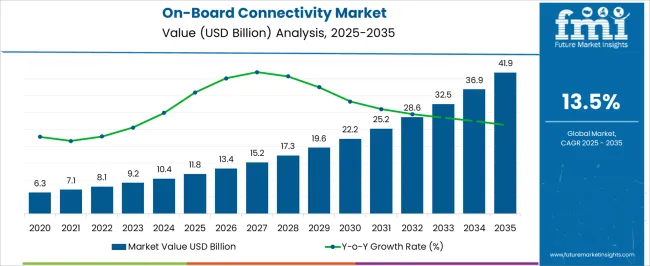

The on-board connectivity market, valued at USD 11.8 billion in 2025 and projected to reach USD 41.9 billion by 2035 at a CAGR of 13.5%, demonstrates a rapid adoption trajectory reflective of a transformative phase in automotive and mobility technology. Early adoption is evidenced by the initial incremental growth from 11.8 billion in 2025 to 15.2 billion by 2027, indicating that manufacturers and fleet operators are increasingly integrating connectivity solutions to enhance passenger experience and operational efficiency.

Pilot deployments, limited product offerings, and a focus on consumer education and infrastructure readiness mark this phase. As the market progresses into the growth phase, spanning 2028 to 2032, adoption accelerates significantly with market value rising from 17.3 billion to 28.6 billion. This period is characterized by broader integration of advanced telematics, real-time vehicle monitoring, and cloud-based analytics, driven by regulatory support, OEM partnerships, and increasing consumer demand for seamless digital experiences. The growth phase reflects a combination of technology maturation and standardization, which reduces barriers to adoption and enhances value capture across the automotive ecosystem.

Between 2033 and 2035, the market approaches a consolidation phase, with adoption reaching a more widespread, normalized level, reflected in the projected value of 41.9 billion. Market maturity will be defined by optimized deployment, competitive differentiation through software updates and service enhancements, and sustained penetration into both passenger and commercial vehicle segments, positioning On-Board Connectivity as a core feature in future mobility solutions.

| Metric | Value |

|---|---|

| On-Board Connectivity Market Estimated Value in (2025 E) | USD 11.8 billion |

| On-Board Connectivity Market Forecast Value in (2035 F) | USD 41.9 billion |

| Forecast CAGR (2025 to 2035) | 13.5% |

The on-board connectivity market represents a specialized segment within the automotive and transportation technology industry, emphasizing real-time communication, infotainment, and vehicle-to-everything integration. Within the broader connected vehicle market, it accounts for about 5.4%, driven by adoption in passenger cars, commercial vehicles, and public transport fleets. In the automotive telematics and infotainment sector, it holds nearly 6.1%, reflecting demand for navigation, streaming, and diagnostic services. Across the fleet management and logistics connectivity market, the segment captures 4.3%, supporting route optimization, asset tracking, and predictive maintenance.

Within the smart transportation and mobility services category, it represents 3.8%, highlighting integration with smart city infrastructure and IoT networks. In the automotive electronics and communication solutions sector, it secures 4.2%, emphasizing seamless connectivity and safety enhancements. Recent developments in this market have focused on 5G integration, edge computing, and cybersecurity. Innovations include high-bandwidth connectivity modules supporting real-time vehicle data transfer, over-the-air updates, and cloud-based infotainment.

Key players are collaborating with network providers, automotive OEMs, and tech firms to enhance latency, reliability, and interoperability. Vehicle-to-everything (V2X) communications, Wi-Fi hotspots, and embedded SIM technologies are being adopted to improve connectivity and user experience. Additionally, secure communication protocols and encryption standards are being implemented to protect against cyber threats.

The on-board connectivity market is expanding rapidly, supported by the rising demand for seamless internet access and real-time data exchange in transportation systems. Developments in satellite communication, 5G integration, and cloud-based service platforms have significantly enhanced the quality and speed of on-board connectivity solutions. Transportation operators across aviation, maritime, and rail sectors are investing in advanced connectivity infrastructure to improve passenger experience, enable operational efficiency, and support data-driven decision-making.

Industry announcements and technology demonstrations have emphasized the role of AI-based network optimization, cybersecurity frameworks, and IoT integration in improving service reliability. Regulatory initiatives promoting digital transformation in transport and the growing adoption of connected entertainment and e-commerce services are also driving market adoption.

Over the coming years, growth is expected to be fueled by the software segment for intelligent network management, the dominance of ground-to-air technology for aviation connectivity, and the communication application segment as a core service enabler for passenger and operational needs.

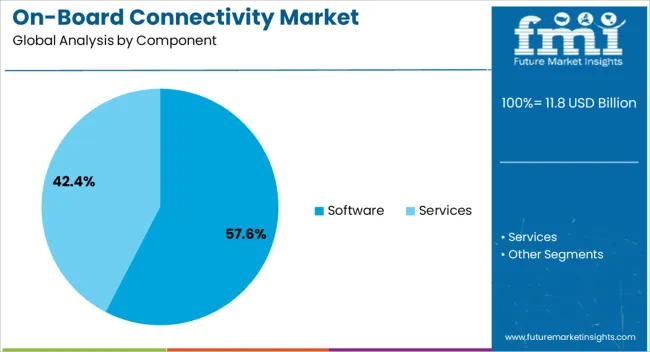

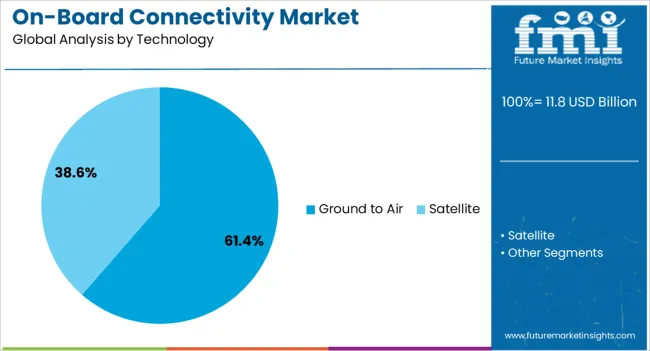

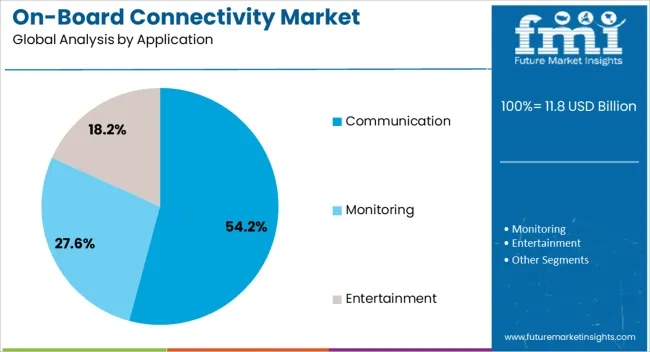

The on-board connectivity market is segmented by component, technology, application, end use, and geographic regions. By component, on-board connectivity market is divided into Software and Services. In terms of technology, on-board connectivity market is classified into Ground to Air and Satellite. Based on application, on-board connectivity market is segmented into Communication, Monitoring, and Entertainment.

By end use, on-board connectivity market is segmented into Aviation, Maritime, and Railway. Regionally, the on-board connectivity industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software segment is projected to account for 57.6% of the on-board connectivity market revenue in 2025, maintaining its lead due to the growing reliance on advanced network management, cybersecurity, and service delivery platforms. Operators have prioritized software solutions to optimize bandwidth allocation, ensure secure data transmission, and enable adaptive connectivity in varying operational environments.

The scalability of software platforms allows seamless integration of new services such as real-time monitoring, predictive maintenance, and personalized passenger applications. Continuous upgrades and over-the-air updates have improved operational flexibility, reducing downtime and enhancing user experience.

As transportation providers seek cost-efficient ways to expand connectivity capabilities without large-scale hardware overhauls, the software segment is expected to remain central to market growth.

The ground-to-air segment is projected to hold 61.4% of the on-board connectivity market revenue in 2025, driven by its widespread use in aviation for high-speed, reliable passenger and crew communications. This technology has benefited from advancements in air-to-ground antenna systems, frequency management, and hybrid connectivity models combining terrestrial and satellite links.

Airlines have increasingly adopted ground-to-air systems due to lower latency, cost-effectiveness over certain routes, and compatibility with existing aircraft equipment. Infrastructure investments in ground station networks have expanded coverage, enabling consistent service across major flight corridors.

With air travel demand rebounding and airlines seeking to differentiate through enhanced connectivity services, the ground-to-air segment is set to maintain its dominant position.

The communication segment is projected to contribute 54.2% of the on-board connectivity market revenue in 2025, securing its role as the primary application area. This dominance is supported by the growing need for uninterrupted communication between passengers, crew, and operational systems.

Enhanced communication capabilities have become essential for enabling in-flight messaging, VoIP services, live streaming, and operational coordination. Transportation operators have leveraged communication systems to improve customer engagement, facilitate e-commerce opportunities, and support safety protocols through real-time alerts.

The expansion of high-speed networks and integration with multimedia platforms has further enriched communication services, making them a critical value proposition for on-board connectivity providers. With rising passenger expectations and operational digitalization, the communication segment is expected to remain a key driver of market demand.

The market has expanded significantly as the automotive, aviation, and rail industries adopt advanced communication systems to provide seamless internet and infotainment services. On-board connectivity solutions enable passengers and operators to access real-time navigation, entertainment, telematics, and operational data. Increasing demand for connected vehicles, smart mobility, and enhanced passenger experiences has driven the integration of high-speed wireless networks, satellite communications, and IoT-based platforms. Fleet operators benefit from improved vehicle monitoring, predictive maintenance, and operational efficiency.

Despite challenges such as high deployment costs, network security concerns, and varying regulatory frameworks, on-board connectivity remains essential for modern mobility ecosystems. The growth of autonomous vehicles, digital railways, and connected aircraft further reinforces the market’s strategic importance, encouraging technology innovation and adoption across transport modes.

The automotive segment has been a major driver of on-board connectivity growth, driven by consumer demand for infotainment, navigation, and vehicle-to-everything (V2X) communication. Connected cars integrate wireless networks, cloud platforms, and telematics systems to provide real-time traffic updates, entertainment, and diagnostics. Fleet operators utilize on-board connectivity to optimize routes, monitor driver behavior, and ensure vehicle safety. Electric vehicle charging stations also rely on connected infrastructure for efficient operation. OEMs are increasingly partnering with telecom providers and technology firms to offer subscription-based connectivity services. Rising adoption of 4G, LTE, and 5G networks has enhanced data speed and reliability. This sector continues to push investment in hardware, software, and cloud integration, positioning on-board connectivity as a core feature in the next-generation automotive ecosystem.

On-board connectivity in rail and aviation enhances passenger experience while enabling operational efficiency. High-speed trains are increasingly equipped with Wi-Fi, infotainment systems, and real-time travel updates, allowing operators to improve service quality and customer satisfaction. Airlines leverage satellite-based connectivity for in-flight entertainment, flight tracking, and operational data communication. Real-time monitoring of aircraft systems and predictive maintenance solutions are enabled through connected infrastructure, enhancing safety and reducing downtime. On-board connectivity also supports revenue generation through digital advertising and subscription services. The growing demand for high-speed internet in transit, combined with smart station and airport infrastructure investments, reinforces the need for robust and reliable connectivity solutions across both rail and aviation sectors.

Technological innovation has significantly enhanced on-board connectivity capabilities and market growth. The deployment of 5G, LTE, and satellite communication networks has enabled faster, more reliable connections. IoT-enabled devices and edge computing allow real-time monitoring of vehicle performance, predictive maintenance, and enhanced safety features. Advanced antenna systems, low-latency data processing, and network slicing improve bandwidth allocation and user experience. Security protocols and encrypted communications protect critical operational data while preventing cyber threats. Connectivity platforms are increasingly integrated with cloud services to store and analyze operational and passenger data. These technological advancements not only improve passenger satisfaction but also reduce operational costs, downtime, and fuel consumption, strengthening the adoption of on-board connectivity across transport modes.

Despite growing demand, the on-board connectivity market faces challenges from regulatory, infrastructure, and interoperability issues. Varying regional standards for wireless spectrum allocation, data privacy, and vehicle communication protocols can slow deployment. Infrastructure gaps, including limited 5G coverage in rural and transit corridors, affect connectivity reliability. Integrating new technology with legacy systems in older fleets or aircraft requires significant investment and technical expertise. Cybersecurity concerns also pose risks for operators handling sensitive operational and passenger data. The high deployment and maintenance costs can delay adoption, particularly in cost-sensitive markets.

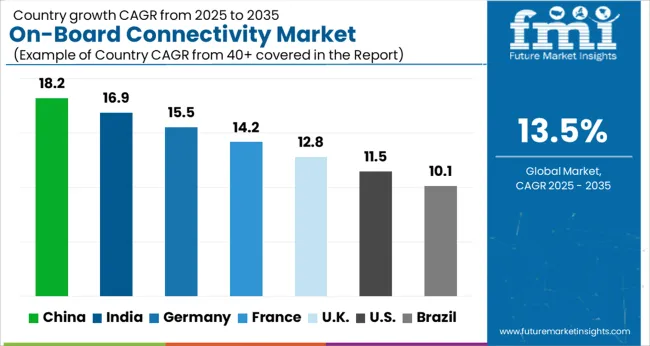

| Country | CAGR |

|---|---|

| China | 18.2% |

| India | 16.9% |

| Germany | 15.5% |

| France | 14.2% |

| UK | 12.8% |

| USA | 11.5% |

| Brazil | 10.1% |

China led the market with a forecast growth of 18.2%, driven by increasing integration of connected vehicle technologies and infotainment systems. India followed at 16.9%, where adoption of telematics and smart vehicle applications is accelerating market expansion. Germany recorded 15.5% growth, supported by its focus on high-tech automotive innovations and in-vehicle connectivity solutions. The United Kingdom achieved 12.8%, influenced by the development of next-generation connected transport infrastructure. The United States posted 11.5%, sustained by rising consumer demand for enhanced in-car experiences and digital services. These countries illustrate the ongoing scaling and innovation shaping the global on-board connectivity landscape. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to expand at a CAGR of 18.2%, driven by rapid adoption of connected vehicles and smart mobility solutions. Consumer preference for integrated infotainment systems, real-time navigation, and vehicle-to-everything (V2X) communication is contributing to strong demand. Automotive manufacturers are increasingly embedding advanced telematics and cloud connectivity features into passenger and commercial vehicles. Furthermore, government support for intelligent transportation infrastructure and 5G deployment is accelerating integration of connected technologies. The market is also benefiting from the growing aftermarket solutions for retrofitting older vehicles with connectivity capabilities.

India’s market is projected to grow at a CAGR of 16.9%, fueled by increasing consumer interest in smart car technologies and vehicle digitization. The rise in connected passenger vehicles, along with demand for navigation and entertainment solutions, is shaping market expansion. Automotive OEMs are actively introducing vehicles with telematics and over-the-air update capabilities to enhance user experience. Rapid urbanization and expansion of highway networks are also encouraging adoption of advanced connectivity systems. The market is further influenced by government policies promoting intelligent transportation and smart city initiatives.

Germany is anticipated to grow at a CAGR of 15.5%, driven by strong focus on next-generation automotive technologies. Premium and luxury vehicle segments are increasingly equipped with advanced infotainment, real-time navigation, and remote monitoring features. Local automotive manufacturers are integrating 5G-enabled connectivity solutions to enhance safety, fleet management, and autonomous driving capabilities. Market growth is supported by regulatory emphasis on vehicle cybersecurity and standardization of connected platforms. The trend toward seamless integration of cloud services and vehicle communication systems is enhancing the overall market potential.

The United Kingdom’s market is projected to grow at a CAGR of 12.8%, influenced by increasing adoption of connected vehicle technologies across passenger and commercial segments. Consumers are showing rising interest in enhanced infotainment, navigation, and telematics solutions. Automotive OEMs are introducing vehicles with smart dashboards and vehicle-to-cloud connectivity features. Government initiatives promoting intelligent transport systems and connected infrastructure are also driving growth. The aftermarket solutions for integrating connectivity features into existing vehicles are contributing to steady expansion.

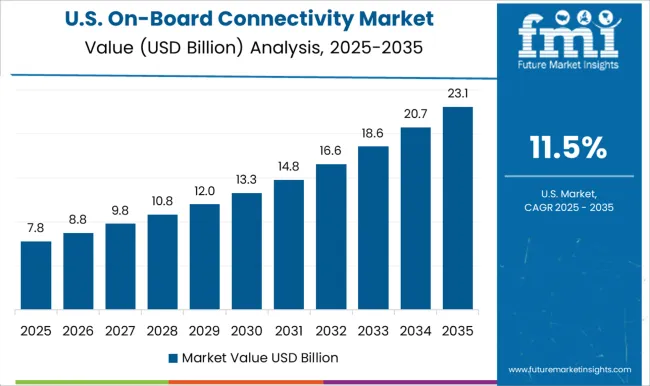

The market in the United States is expected to expand at a CAGR of 11.5 percent, supported by rising demand for connected cars and advanced telematics solutions. Consumers increasingly prefer vehicles equipped with infotainment systems, real-time tracking, and vehicle-to-infrastructure communication capabilities. OEMs are actively integrating 5G-based connectivity for improved safety, autonomous driving readiness, and remote diagnostics. The market is further encouraged by technological partnerships between automotive companies and telecom providers. Urban mobility trends and the rise of electric vehicles with built-in connectivity modules are expected to maintain long-term market growth.

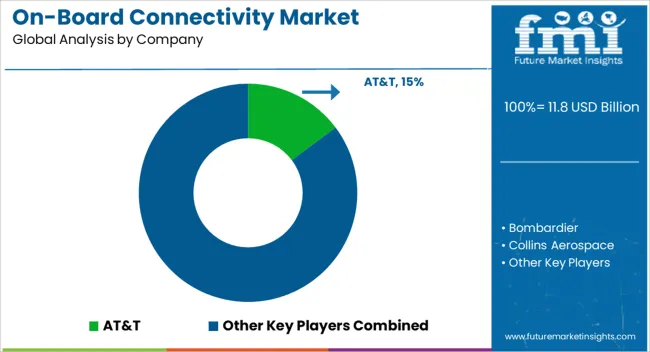

The market is driven by telecommunication giants, aerospace technology firms, and integrated connectivity solution providers focused on enhancing passenger experience and operational efficiency. AT&T and Huawei lead with advanced wireless communication capabilities, delivering reliable data transfer, real-time monitoring, and seamless onboard connectivity across transportation sectors. Qualcomm and Nokia contribute with cutting-edge network technologies, including 5G integration and IoT-enabled platforms, supporting high-speed communication for passenger devices and operational systems.

Aerospace-focused companies like Bombardier, Collins Aerospace, and Honeywell International provide end-to-end connectivity solutions tailored for aircraft, integrating satellite communication systems, in-flight Wi-Fi, and data management platforms to improve flight safety, navigation, and passenger engagement. Nomad Digital specializes in transportation connectivity solutions, offering fleet-wide internet services and predictive maintenance monitoring. Panasonic enhances user experience with infotainment systems and cloud-based connectivity management, while ZTE develops communication hardware and software for robust network performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.8 Billion |

| Component | Software and Services |

| Technology | Ground to Air and Satellite |

| Application | Communication, Monitoring, and Entertainment |

| End Use | Aviation, Maritime, and Railway |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AT&T, Bombardier, Collins Aerospace, Honeywell International, Huawei, Nokia, Nomad Digital, Panasonic, Qualcomm, and ZTE |

| Additional Attributes | Dollar sales by connectivity type and vehicle category, demand dynamics across passenger, commercial, and luxury segments, regional trends in connected vehicle adoption, innovation in network reliability, cybersecurity, and infotainment integration, environmental impact of electronic components and energy use, and emerging use cases in telematics, over-the-air updates, and smart mobility services. |

The global on-board connectivity market is estimated to be valued at USD 11.8 billion in 2025.

The market size for the on-board connectivity market is projected to reach USD 41.9 billion by 2035.

The on-board connectivity market is expected to grow at a 13.5% CAGR between 2025 and 2035.

The key product types in on-board connectivity market are software and services.

In terms of technology, ground to air segment to command 61.4% share in the on-board connectivity market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IoT Connectivity Management Platform Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Wireless Connectivity Market Size and Share Forecast Outlook 2025 to 2035

In-Vehicle Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Automotive Connectivity Control Unit Market Growth - Trends & Forecast 2025 to 2035

Automotive Connectivity Market Growth - Trends & Forecast 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Telematics and Connectivity Processors Market

In-flight Entertainment & Connectivity Market

Sales Training and Onboarding Software Market Size and Share Forecast Outlook 2025 to 2035

Onboard Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA