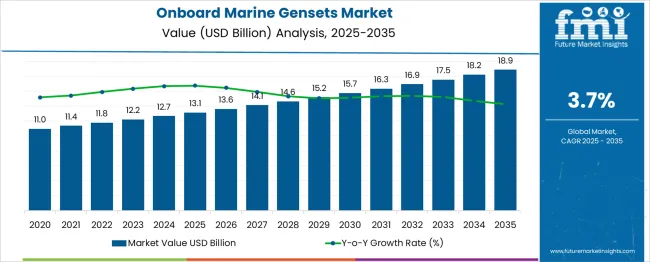

The Onboard Marine Gensets Market is estimated to be valued at USD 13.1 billion in 2025 and is projected to reach USD 18.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period. This growth, supported by a steady CAGR of 3.7%, is driven by increasing demand for marine gensets in the commercial shipping and recreational boating sectors. During the first five years (2025–2030), the market will rise from USD 13.1 billion to USD 15.7 billion, adding USD 2.6 billion, which accounts for 44.8% of the total incremental growth, with a 5-year multiplier of 1.2x. The second phase (2030–2035) contributes USD 3.2 billion, representing 55.2% of incremental growth, driven by technological advancements in fuel efficiency, emission reduction, and hybrid solutions.

Annual increments increase from USD 0.4 billion in early years to USD 0.6 billion by 2035, reflecting the increasing adoption of sustainable marine power systems and expanding demand for reliable power sources in remote locations. Manufacturers focusing on low-emission, hybrid, and high-efficiency gensets will capture the largest share of this USD 5.8 billion opportunity.

| Metric | Value |

|---|---|

| Onboard Marine Gensets Market Estimated Value in (2025 E) | USD 13.1 billion |

| Onboard Marine Gensets Market Forecast Value in (2035 F) | USD 18.9 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The onboard marine gensets market is witnessing notable growth as the global maritime industry pivots toward operational efficiency, sustainability, and regulatory compliance. Increasing international trade volumes and the expansion of shipping fleets have created a sustained demand for onboard auxiliary power systems. Gensets are being increasingly integrated to support critical operations such as navigation, refrigeration, and communication on long-haul voyages.

Advances in power electronics, integration with automation systems, and improved load management capabilities have made marine gensets more reliable and efficient for dynamic maritime environments. Additionally, the pressure to reduce greenhouse gas emissions under IMO 2020 and upcoming carbon intensity indicators (CII) is prompting fleet operators to upgrade legacy systems with gensets optimized for fuel efficiency and emissions compliance.

As shipbuilders emphasize retrofit-ready and modular power solutions, the onboard gensets market is expected to expand significantly across commercial, defense, and offshore vessel segments. Growth will be reinforced by innovations in hybrid systems and increased investments in marine electrification and power redundancy frameworks.

The onboard marine gensets market is segmented by power rating, fuel type, vessel type, operation mode, cooling type, installation type, and geographic regions. By power rating, the onboard marine gensets market is divided into 100–500 kW, up to 100 kW, and above 500 kW. In terms of fuel type, the onboard marine gensets market is classified into Diesel, Gasoline, LNG/CNG Hybrid. Based on the vessel type, the onboard marine gensets market is segmented into Commercial Cargo / Tanker Ships, Fishing Vessels, Offshore Support Vessels, Yachts & Leisure Boats, Passenger Ferries / Cruise Ships, and Defense / Naval Vessels. The onboard marine gensets market is segmented into Continuous Running (Prime Power), Emergency / Standby, and Peak Shaving Hybrid (Battery‑genset combo).

The onboard marine gensets market is segmented into Seawater-Cooled, Air-Cooled, and Freshwater-Cooled. By installation type, the onboard marine gensets market is segmented into Newbuild Installation and Retrofit / Replacement. Regionally, the onboard marine gensets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

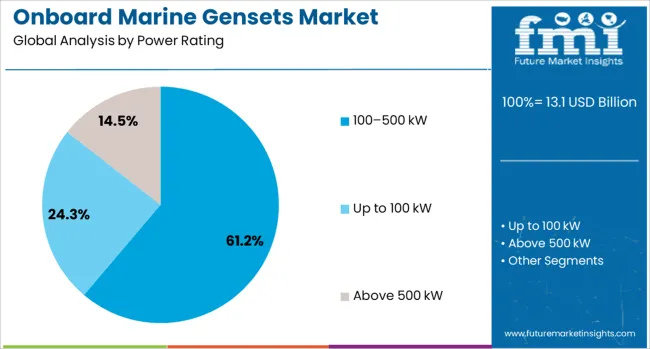

The 100 to 500 kW power rating segment is expected to account for 61.2% of the onboard marine gensets market revenue share in 2025. The dominance of this range is being attributed to its suitability for mid-sized vessels and its ability to meet auxiliary power demands without oversizing or operational inefficiencies.

These gensets are commonly deployed in commercial shipping, small tankers, and support vessels where a moderate yet consistent energy supply is crucial. The segment's growth is supported by increased demand for adaptable and space-efficient power units that deliver consistent load handling during port stays and voyages.

Furthermore, shipbuilders and fleet operators are favoring this rating range due to its alignment with emission reduction targets, fuel efficiency goals, and lower total cost of ownership. The operational flexibility and compatibility of this power class with hybrid propulsion and electrical integration systems have further enhanced its adoption across both retrofit and newbuild programs.

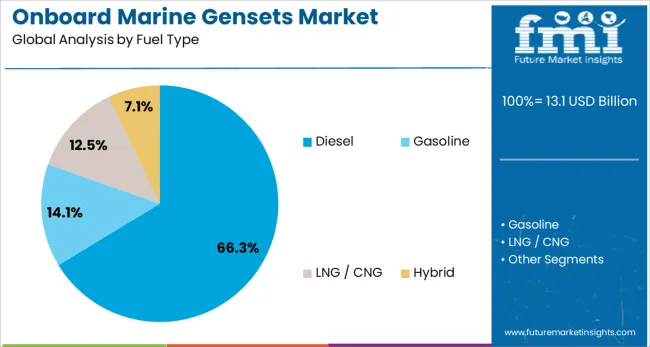

The diesel fuel type segment is projected to hold 66.3% of the onboard marine gensets market revenue share in 2025, retaining its lead as the primary fuel source in marine applications. This leadership is driven by the energy density, reliability, and global availability of diesel, which remains a critical factor in ocean-going and long-haul shipping operations. Diesel gensets are widely preferred for their ability to deliver consistent performance under varying load conditions and their well-established infrastructure for refueling and maintenance

The continued investment in low-sulfur diesel technologies and exhaust after-treatment systems has allowed diesel gensets to remain compliant with international maritime emission regulations. Additionally, their cost-effectiveness and proven operational track record in challenging maritime environments support their deployment across a range of vessel types.

Technological improvements in fuel injection systems, turbocharging, and noise reduction have further solidified diesel as the preferred choice for onboard power generation.

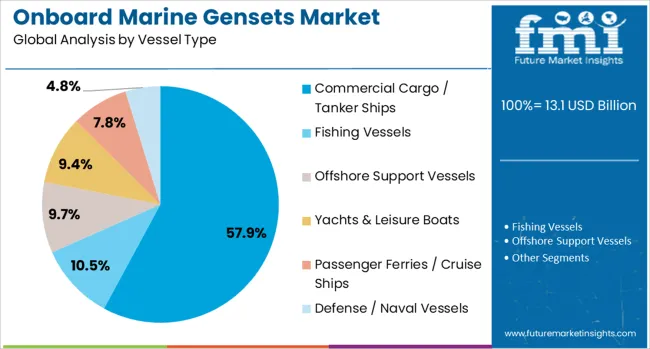

The commercial cargo and tanker ships segment is forecast to represent 57.9% of the onboard marine gensets market revenue share in 2025, marking it as the leading vessel type segment. This dominance is driven by the high energy demands of cargo handling, refrigeration, and auxiliary systems onboard long-distance shipping vessels.

The global expansion in containerized and bulk cargo movements has led to higher operational hours for gensets, requiring robust and reliable power solutions. Commercial vessels are increasingly being retrofitted or newly constructed with gensets capable of handling both peak and base load requirements efficiently.

Emphasis on energy management, emission control, and regulatory compliance has further pushed fleet operators to invest in advanced genset systems tailored for the rigorous conditions of international shipping lanes. The ability of these systems to seamlessly integrate with bridge control units and vessel management software has enhanced their operational value, making them indispensable for modern commercial marine operations.

The onboard marine gensets market is driven by the increasing demand for reliable power systems in the marine industry, spurred by the growth of global trade and the leisure maritime sector. Opportunities in new shipbuilding projects and the adoption of hybrid and fuel-efficient systems are expected to shape market trends. However, challenges such as high initial costs and maintenance complexity may hinder growth. By 2025, overcoming these barriers with affordable solutions and improved servicing will be crucial for sustained market expansion.

The onboard marine gensets market is expanding due to the increasing demand for reliable and continuous power supply on ships, especially for navigation, communication, and hotel services. Marine vessels, including commercial ships and leisure boats, require efficient gensets to support their operations, driving market growth. Rising global trade and the expansion of the maritime tourism sector are expected to further boost demand. By 2025, the market will continue to benefit from these growth drivers as the need for dependable onboard power increases.

Opportunities in the onboard marine gensets market are growing with the expansion of the global maritime fleet and increasing demand for luxury and cruise vessels. New shipbuilding projects and upgrades to existing vessels are driving the adoption of advanced genset systems. The growing leisure maritime sector, including yachts and luxury boats, is expected to contribute significantly to market growth by 2025, with an increasing focus on performance, fuel efficiency, and comfort for passengers.

Emerging trends in the onboard marine gensets market highlight the growing shift towards hybrid and fuel-efficient systems. These systems offer lower emissions, reduced fuel consumption, and longer operational life, making them an attractive choice for the maritime industry. Hybrid solutions, which combine traditional gensets with battery storage or renewable energy sources, are gaining traction for their ability to enhance operational efficiency. By 2025, these technologies will play a crucial role in shaping the future of onboard marine power generation.

The onboard marine gensets market faces challenges related to high initial costs and maintenance requirements. While advanced gensets offer improved performance and energy efficiency, their upfront costs can be prohibitive for smaller vessels or operators with limited budgets. Additionally, the complexity of maintenance and the need for specialized service can deter adoption, especially in remote locations. These factors may limit market growth, particularly in regions with financial constraints, unless cost-effective solutions and streamlined service options are developed by 2025.

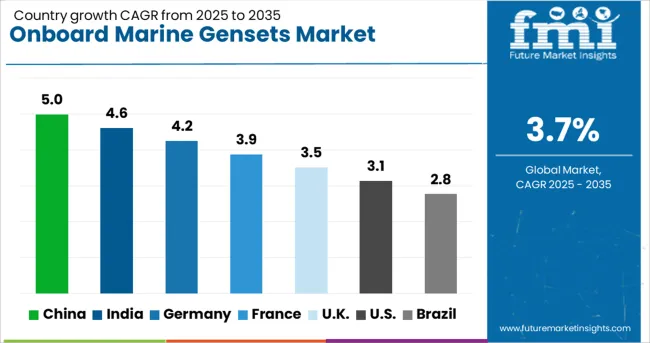

| Country | CAGR |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.2% |

| France | 3.9% |

| UK | 3.5% |

| USA | 3.1% |

| Brazil | 2.8% |

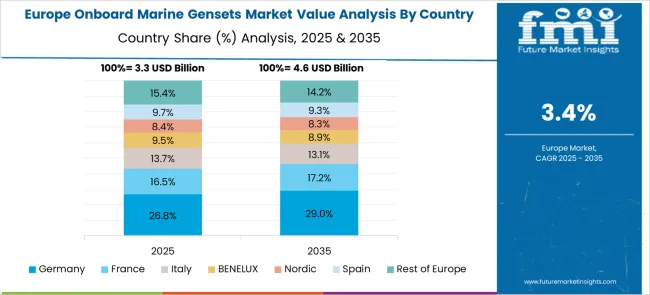

he global onboard marine gensets market is projected to grow at a 3.7% CAGR from 2025 to 2035. China leads with a growth rate of 5.0%, followed by India at 4.6%, and France at 3.9%. The United Kingdom records a growth rate of 3.5%, while the United States shows the slowest growth at 3.1%. These differences in growth rates are driven by factors such as increasing demand for marine vessels, energy efficiency in maritime operations, and regulatory compliance regarding emissions. Emerging markets like China and India are witnessing higher growth due to the expansion of their maritime industries, port infrastructure, and rising demand for eco-friendly and fuel-efficient marine power solutions, while more mature markets like the USA and the UK show steady growth. This report includes insights on 40+ countries; the top markets are shown here for reference.

The onboard marine gensets market in China is growing at a robust pace, with a projected CAGR of 5%. China’s rapidly expanding maritime industry, driven by increasing port activities, shipping, and cruise tourism, is propelling the demand for onboard marine gensets. The country’s focus on adopting more energy-efficient and environmentally friendly marine power solutions, including hybrid and electric propulsion technologies, is further driving the market. Additionally, the Chinese government’s policies aimed at reducing emissions and improving fuel efficiency in marine vessels are contributing to the increased demand for high-performance marine gensets.

The onboard marine gensets market in India is projected to grow at a CAGR of 4.6%. India’s expanding maritime industry, which includes growing commercial shipping, fishing fleets, and tourism vessels, is driving the demand for onboard marine gensets. The country’s push toward improving its port infrastructure, along with increasing focus on fuel-efficient and eco-friendly marine engines, further contributes to market growth. Additionally, India’s rising shipping activities and government support for the maritime sector are expected to drive the adoption of high-quality genset systems in commercial and recreational vessels.

The onboard marine gensets market in France is projected to grow at a CAGR of 3.9%. France’s established maritime industry, including its growing cruise tourism and shipping sectors, continues to drive demand for efficient marine gensets. The country’s strong focus on reducing emissions and promoting sustainable shipping practices is contributing to the growing adoption of eco-friendly and fuel-efficient genset systems. Additionally, as France’s maritime fleet continues to modernize, there is an increased need for advanced onboard gensets that provide reliable power and minimize environmental impact.

The onboard marine gensets market in the United Kingdom is projected to grow at a CAGR of 3.5%. The UK’s well-established maritime industry, coupled with increasing regulations for cleaner energy solutions and more efficient power systems, drives steady demand for onboard marine gensets. The rise in eco-conscious consumer behavior, especially in cruise and shipping sectors, is also contributing to the growth of fuel-efficient and low-emission gensets. Furthermore, the UK’s continued investments in modernizing its naval and commercial fleets, along with a strong emphasis on reducing carbon footprints, are key factors in supporting market growth.

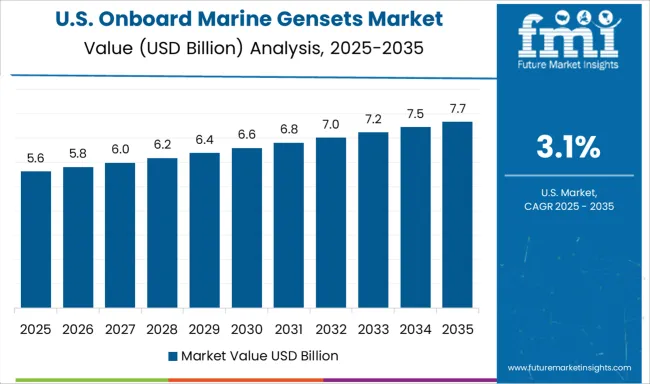

The onboard marine gensets market in the United States is expected to grow at a CAGR of 3.1%. Despite being a mature market, demand for onboard marine gensets in the USA remains steady due to its large and diverse maritime industry, including shipping, recreational boating, and fishing sectors. The growing emphasis on energy efficiency and reducing emissions in line with environmental regulations is driving the adoption of advanced, fuel-efficient genset systems. The USA also continues to invest in improving its port and shipping infrastructure, further supporting the demand for reliable and sustainable power solutions in marine vessels.

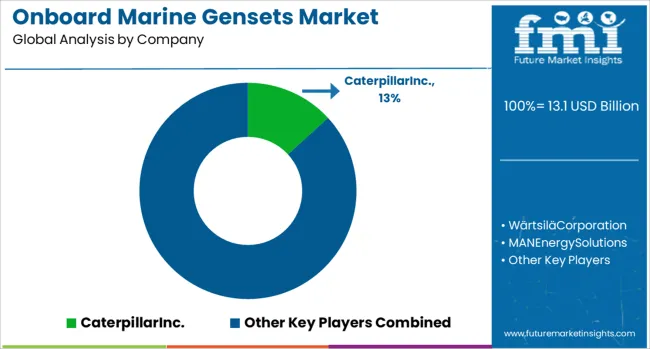

The onboard marine gensets market is dominated by Caterpillar Inc., which leads with its high-performance marine generator sets that provide reliable, efficient power for various onboard applications, including propulsion, HVAC, and lighting. Caterpillar’s dominance is supported by its extensive global service network, innovative technologies, and commitment to delivering fuel-efficient solutions for both commercial and leisure marine vessels. Key players such as Wärtsilä Corporation, MAN Energy Solutions, and Cummins Inc. maintain significant market shares by offering tailored marine gensets that meet the specific power requirements of large vessels, offshore platforms, and recreational boats. These companies focus on optimizing fuel consumption, reducing emissions, and improving genset reliability for the marine industry.

Emerging players like Volvo Penta, Mitsubishi Heavy Industries Ltd., and Kohler Co. are expanding their market presence by providing cost-effective, compact marine generator sets designed for smaller vessels and specialized applications. Their strategies include enhancing power density, integrating advanced monitoring systems, and improving noise reduction. Market growth is driven by increasing demand for energy-efficient, eco-friendly marine solutions, rising shipping and recreational boating activities, and regulatory requirements for lower emissions. Innovations in hybrid power systems, fuel flexibility, and digital connectivity are expected to continue shaping competitive dynamics and contribute to growth in the global onboard marine gensets market.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.1 Billion |

| Power Rating | 100–500 kW, Up to 100 kW, and Above 500 kW |

| Fuel Type | Diesel, Gasoline, LNG / CNG, and Hybrid |

| Vessel Type | Commercial Cargo / Tanker Ships, Fishing Vessels, Offshore Support Vessels, Yachts & Leisure Boats, Passenger Ferries / Cruise Ships, and Defense / Naval Vessels |

| Operation Mode | Continuous Running (Prime Power), Emergency / Standby, Peak Shaving, and Hybrid (Battery‑genset combo) |

| Cooling Type | Seawater-Cooled, Air-Cooled, and Freshwater-Cooled |

| Installation Type | Newbuild Installation and Retrofit / Replacement |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CaterpillarInc., WärtsiläCorporation, MANEnergySolutions, CumminsInc., VolvoPenta, MitsubishiHeavyIndustriesLtd., KohlerCo., ABBLtd., HyundaiHeavyIndustries, SiemensEnergy, Rolls-RoyceHoldingsplc, GeneralElectricCompany, YanmarHoldingsCo.,Ltd., MTUFriedrichshafenGmbH, and SchneiderElectricSE |

| Additional Attributes | Dollar sales by genset type and application, demand dynamics across commercial, recreational, and military marine sectors, regional trends in onboard marine genset adoption, innovation in fuel efficiency and emissions reduction technologies, impact of regulatory standards on marine safety and environmental concerns, and emerging use cases in hybrid marine propulsion and off-grid operations. |

The global onboard marine gensets market is estimated to be valued at USD 13.1 billion in 2025.

The market size for the onboard marine gensets market is projected to reach USD 18.9 billion by 2035.

The onboard marine gensets market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in onboard marine gensets market are 100–500 kw, up to 100 kw and above 500 kw.

In terms of fuel type, diesel segment to command 66.3% share in the onboard marine gensets market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LNG Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Diesel Electric Powered Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Marine Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Outboard Engines Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA