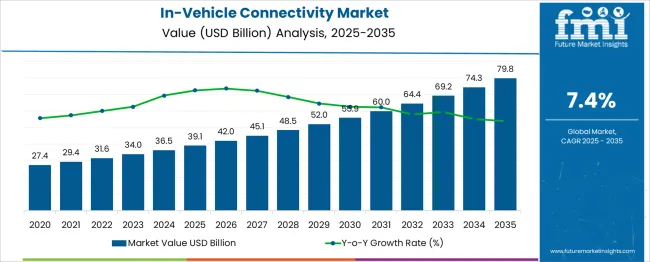

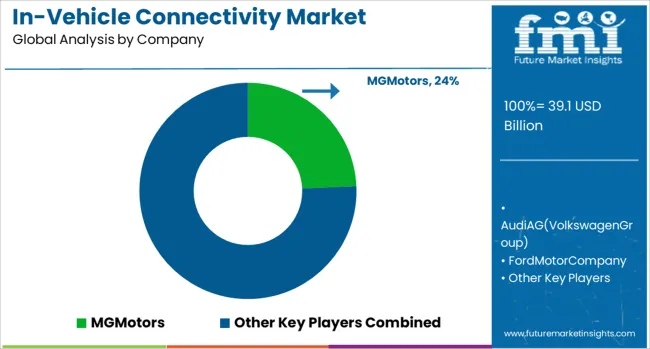

The In-Vehicle Connectivity Market is estimated to be valued at USD 39.1 billion in 2025 and is projected to reach USD 79.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period. This surge reflects a compound annual growth rate (CAGR) of around 6.7%, driven by increasing integration of advanced connectivity solutions in passenger and commercial vehicles. During the initial phase between 2024 and 2029, the market grows steadily from USD 27.4 billion to about USD 42.0 billion, representing a critical adoption period fueled by rising consumer demand for seamless internet access, infotainment, and real-time navigation services. This phase highlights growing investment by automotive manufacturers in telematics, vehicle-to-everything (V2X) communication, and connected car ecosystems. From 2030 to 2034, the market accelerates sharply from USD 45.1 billion to USD 64.4 billion, supported by technological advancements in 5G deployment, enhanced data security protocols, and the rise of autonomous driving features that rely heavily on vehicle connectivity.

The diversification of connectivity services, including cloud integration, predictive maintenance, and over-the-air updates, further amplifies this growth. Overall, the in-vehicle connectivity market is poised for robust and sustained expansion during this period, propelled by evolving consumer expectations, regulatory frameworks supporting connected mobility, and continuous innovation in automotive communication technologies.

| Metric | Value |

|---|---|

| In-Vehicle Connectivity Market Estimated Value in (2025 E) | USD 39.1 billion |

| In-Vehicle Connectivity Market Forecast Value in (2035 F) | USD 79.8 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The in-vehicle connectivity market is undergoing transformative growth as automotive manufacturers integrate more digital infrastructure to meet evolving consumer expectations and regulatory standards. The rising penetration of connected vehicle platforms is being driven by the need for real-time data communication, enhanced driver safety, and advanced navigation capabilities. Automakers are focusing on embedding connectivity modules that support over-the-air updates, vehicle-to-everything (V2X) communication, and remote diagnostics, which are becoming essential in modern vehicle architectures.

Governments across key automotive regions are mandating the inclusion of telematics for emergency response and emissions control, further fueling adoption. The shift toward electric vehicles and autonomous driving has also intensified the role of connectivity as a core enabler of vehicle intelligence.

Integration with cloud-based mobility ecosystems, IoT platforms, and 5G infrastructure is expected to accelerate the deployment of next-generation services such as predictive maintenance, real-time traffic management, and infotainment personalization. These factors are expected to shape long-term growth, positioning connectivity as a strategic pillar in the evolution of smart mobility.

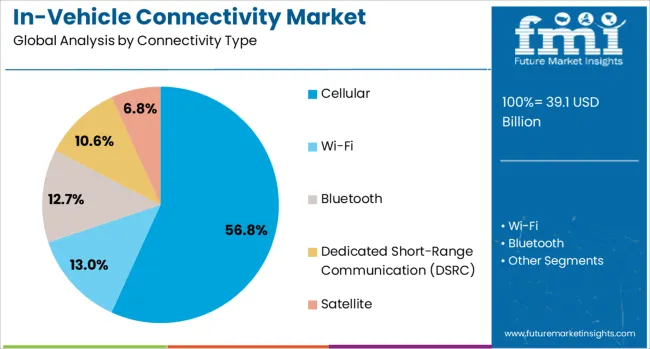

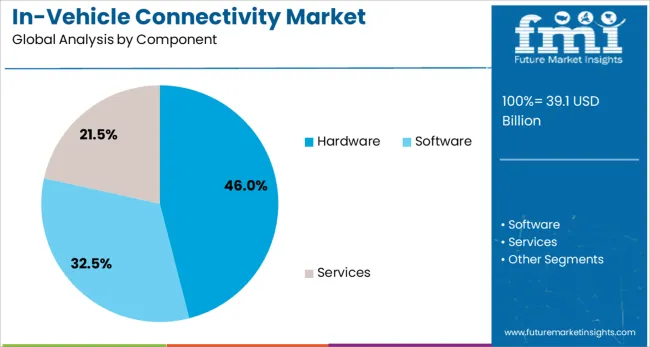

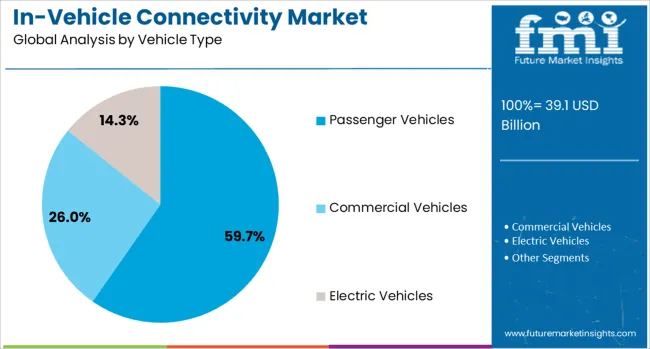

The in-vehicle connectivity market is segmented by connectivity type, component, vehicle type, application, end use, and geographic regions. By connectivity type, the in-vehicle connectivity market is divided into Cellular, Wi-Fi, Bluetooth, Dedicated Short-Range Communication (DSRC), and Satellite. In terms of components, the in-vehicle connectivity market is classified into Hardware, Software, and Services. Based on vehicle type, the in-vehicle connectivity market is segmented into Passenger Vehicles, Commercial Vehicles, and Electric Vehicles. The in-vehicle connectivity market is segmented into Infotainment, Navigation, Telematics, Remote Diagnostics, Safety & Security, and Fleet Management. The end use of the in-vehicle connectivity market is segmented into OEM and Aftermarket. Regionally, the in-vehicle connectivity industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cellular connectivity type segment is expected to account for 56.8% of the total revenue share in the in-vehicle connectivity market in 2025. This leading position is being driven by the widespread availability of LTE and growing deployment of 5G networks, which have enabled vehicles to maintain reliable and high-speed communication with cloud systems and external infrastructure.

Cellular modules are being favored for their scalability and support for real-time services such as navigation, emergency alerts, vehicle tracking, and streaming media. Automakers are increasingly embedding eSIMs and integrated telematics control units that leverage cellular connectivity to enhance vehicle performance diagnostics and enable software updates without dealership visits.

The growing ecosystem of connected services, such as usage-based insurance, stolen vehicle recovery, and predictive maintenance, is further supported through cellular networks. As the automotive industry accelerates toward software-defined vehicles and autonomous driving capabilities, cellular connectivity is playing a central role in enabling always-on communication, thereby reinforcing its dominance within the market.

The hardware segment is anticipated to represent 46.0% of the overall in-vehicle connectivity market revenue in 2025. This segment's strong contribution is being supported by the increasing integration of advanced communication modules, telematics control units, in-vehicle infotainment systems, and embedded sensors that enable seamless connectivity.

The surge in demand for connected features such as real-time navigation, media streaming, and vehicle health monitoring has driven automakers to invest heavily in physical components that enable high-speed data processing and wireless communication. The advancement of chipsets optimized for vehicular environments, coupled with the development of compact and energy-efficient modules, has further enhanced hardware adoption.

Additionally, as the need for reliable network interfaces like Bluetooth, Wi Fi, and cellular modems grows, the hardware backbone of connectivity infrastructure has become more critical. OEMs and Tier 1 suppliers are increasingly prioritizing modular and upgradeable hardware designs, ensuring compatibility with future connectivity standards and services, thereby reinforcing growth in this segment.

The passenger vehicles segment is projected to hold 59.7% of the revenue share in the in-vehicle connectivity market in 2025, marking it as the largest vehicle type segment. Growth in this segment is being propelled by rising consumer expectations for integrated infotainment, real-time traffic updates, and connected safety features. Automakers are prioritizing in-vehicle connectivity to enhance user experience, differentiate offerings, and enable new revenue models through subscription-based services.

The adoption of embedded connectivity in passenger cars has also been influenced by safety regulations and standards mandating emergency call systems and telematics in several regions. As electric vehicles become more mainstream, OEMs are embedding digital platforms that offer remote battery monitoring, software diagnostics, and firmware updates over-the-air.

These advancements are being supported by robust investment in vehicle connectivity ecosystems, cloud computing integration, and enhanced user interfaces. The proliferation of smart dashboards and voice assistant technologies is further driving innovation in connected passenger vehicles, securing the segment’s leadership in market share.

The in-vehicle connectivity market is being driven by evolving consumer expectations, regulatory frameworks, and new monetization strategies. Software-led innovations and cloud integration are transforming it into a core element of automotive value propositions.

Growth in the in-vehicle connectivity segment is being influenced by the increasing integration of infotainment, telematics, and driver-assistance systems into modern vehicles. Automakers are incorporating features such as real-time navigation, cloud-based entertainment, and vehicle-to-everything (V2X) communication to enhance driving experiences. The demand for these solutions is also supported by consumer expectations for seamless smartphone pairing, app integration, and voice-command functionalities. Fleet operators are adopting connected systems for tracking, diagnostics, and driver performance monitoring, which improves operational efficiency. The push toward advanced safety features and compliance with evolving regulations further accelerates adoption. As connectivity shifts from a premium to a mainstream offering, OEMs are leveraging it as a differentiator to strengthen brand loyalty and secure higher per-unit revenue.

The in-vehicle connectivity market is shaped by regulations that promote safety, emissions control, and emergency response capabilities. Initiatives mandating features like eCall in Europe and telematics-based monitoring in various regions have increased the adoption rate. Governments are encouraging automotive digitalization to improve road safety through connected communication networks. This has led to standardized protocols for data sharing, crash notification systems, and vehicle diagnostics. Regulatory frameworks also set guidelines for cybersecurity to protect vehicle systems from unauthorized access. Compliance with these requirements is compelling OEMs and technology providers to invest in secure architecture and integration testing. The result is a more consistent baseline for connectivity features across vehicle classes, creating opportunities for software updates and post-sale service monetization.

Automakers and service providers are exploring new revenue models based on the data generated by connected vehicles. Information collected from sensors, GPS systems, and driver interactions is being utilized for predictive maintenance, usage-based insurance, and targeted in-car advertising. This data-driven approach allows for personalized service offerings and partnerships with third-party platforms. Subscription-based connectivity services are gaining traction, offering tiered packages for entertainment, navigation, and remote diagnostics. By leveraging data analytics, OEMs can optimize vehicle performance, reduce warranty costs, and enhance customer engagement. While privacy concerns persist, transparent data policies and consumer consent mechanisms are being emphasized to build trust, ensuring a steady growth trajectory for monetization strategies linked to in-vehicle connectivity.

Software integration and cloud-based ecosystems are becoming critical for delivering in-vehicle connectivity solutions. Over-the-air (OTA) updates allow manufacturers to fix bugs, enhance performance, and introduce new features without physical service visits. Cloud platforms facilitate real-time traffic updates, navigation optimization, and entertainment streaming. Partnerships between automakers and tech companies are expanding to develop integrated ecosystems that support multi-device connectivity. These collaborations also ensure compatibility with future 5G and V2X infrastructure. Cloud-enabled architectures improve scalability and reduce deployment time for new features, benefiting both OEMs and end-users. As competition intensifies, differentiation will depend on the ability to provide intuitive interfaces, consistent connectivity quality, and services that evolve alongside consumer digital lifestyles.

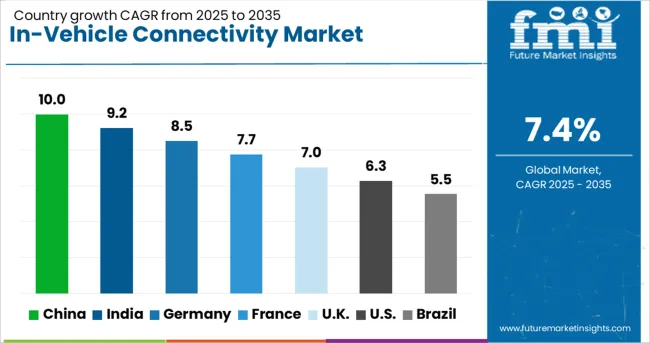

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.2% |

| Germany | 8.5% |

| France | 7.7% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.5% |

The in-vehicle connectivity market, projected to grow at a global CAGR of 7.4% from 2025 to 2035, is showing varied momentum across major economies. China leads with a 10.0% CAGR, driven by high adoption rates of connected systems in passenger cars and commercial fleets, supported by expanding 5G infrastructure. India follows with a 9.2% CAGR, reflecting rising consumer demand for integrated infotainment and telematics features in both entry-level and premium segments. France shows a 7.7% CAGR, backed by growth in OEM-led digital service offerings. The United Kingdom, with a 7.0% CAGR, benefits from connected fleet solutions and increasing EV integration. The USA records a 6.3% CAGR as adoption grows steadily, with a focus on software-defined vehicles and subscription-based connectivity services. The analysis covers over 40 countries, highlighting the leading five as key growth hubs.

The CAGR for the in-vehicle connectivity market in the United Kingdom moved from about 6.2% during 2020–2024 to 7.0% for 2025–2035, reflecting an accelerated pace in connected vehicle adoption. The earlier phase saw moderate expansion as integration of infotainment, telematics, and navigation systems was more concentrated in higher-end vehicle segments. From 2025 onward, a wider availability of embedded connectivity across mid-range and entry-level models has broadened the consumer base. Growth is also being influenced by connected fleet solutions for logistics and public transport operators, as well as rising integration of over-the-air updates. Strengthened partnerships between OEMs and telecom providers are expanding 5G-enabled in-vehicle features. The result is a more competitive and digitally enhanced vehicle market that continues to attract both consumer and enterprise adoption.

China’s in-vehicle connectivity market recorded a CAGR increase from approximately 9.0% in 2020–2024 to 10.0% in 2025–2035, underscoring the country’s leadership in connected vehicle adoption. The earlier growth phase was driven by strong sales in premium vehicles equipped with advanced infotainment and telematics. The acceleration in the next decade is being powered by widespread integration of connectivity features in mass-market models, expansion of nationwide 5G coverage, and regulatory encouragement of vehicle-to-everything (V2X) technologies. Automakers are heavily investing in in-car app ecosystems and subscription-based services, while tech firms are contributing AI-driven personalization. This synergy is cementing China’s position as a global hub for connected vehicle innovation and deployment.

India experienced a CAGR rise from about 8.3% during 2020–2024 to 9.2% for 2025–2035 in its in-vehicle connectivity market. Early adoption was fueled by higher penetration of smartphone-based infotainment and aftermarket navigation systems. The projected higher growth in the upcoming period is linked to automakers integrating embedded telematics in affordable models, driven by competition and evolving consumer expectations. Public and private investments in connected transport infrastructure are improving compatibility with V2X features. Subscription services for navigation, entertainment, and remote diagnostics are also finding a larger audience, boosting recurring revenue potential. This growing adoption signals a transformative shift in India’s vehicle technology landscape toward digitally enhanced mobility.

France saw its in-vehicle connectivity market CAGR move from roughly 6.9% in 2020–2024 to 7.7% for 2025–2035, indicating a steady acceleration in adoption. The initial growth was supported by consumer interest in infotainment upgrades and increased availability of connected options in mid-range vehicles. The stronger future growth outlook is tied to integration of advanced navigation and telematics in electric vehicle offerings, alongside government support for intelligent transportation systems. Automakers are also introducing more localized connected services, enhancing user relevance. The rise of OTA updates and app-based service models is contributing to continuous feature enhancements, further boosting adoption across vehicle segments.

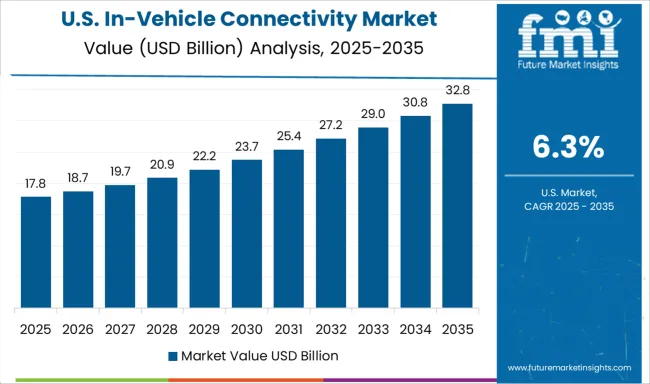

The CAGR for the in-vehicle connectivity market in the United States moved from about 5.5% during 2020–2024 to 6.3% for 2025–2035, showing a gradual but noticeable increase in growth pace. The earlier period reflected a market where connectivity features were largely bundled into premium trims and optional packages, limiting mass adoption. The projected higher CAGR in the next decade is linked to the widespread inclusion of embedded telematics and infotainment systems in mainstream vehicles, as well as the expansion of subscription-based connected services. Increasing focus on software-defined vehicles and integration of over-the-air updates is allowing automakers to deliver ongoing value to customers. Growth is also supported by advancements in connected safety systems and fleet telematics for commercial transport.

Traditional automotive OEMs such as Ford (with its SYNC platform), General Motors (via OnStar), Toyota, and Volkswagen position themselves through licensed telematics suites directly integrated into their vehicle lineups, emphasizing seamless embedded experiences backed by OEM-branded services and trusted aftersales networks. Telecom providers, including AT&T, Verizon, and Deutsche Telekom, capitalize on their network infrastructure and data capabilities, offering modular connectivity services, like embedded SIM (eSIM) packages and data subscriptions, for both new vehicles and aftermarket upgrades. Technology-focused vendors such as Harman (a Samsung company), Continental, and Bosch differentiate through platforms that combine cellular, Wi-Fi, and over-the-air (OTA) update features with edge compute and security. These companies emphasize integration with in-car infotainment, vehicle-to-everything (V2X) communications, and fleet management systems. Specialist middleware and IoT companies, like Aptiv, Cisco, and CalAmp, deliver customizable connectivity stacks, secure data pipelines, and cloud-native analytics aimed at commercial fleets, logistics, and autonomous vehicle trials.

Cross-ecosystem alliances further shape competition. Automakers partner with mapping, cloud, and streaming companies (e.g., Amazon, Google, Microsoft) to embed voice assistants, real-time navigation, and over-the-air content services. Software-first players such as Airbiquity and Excelfore enable vehicle manufacturers to deploy modular, service-driven architectures, enabling over-the-air feature upgrades and hybrid (cellular plus Wi-Fi/Bluetooth) connectivity strategies. The competitive strategies in this market hinge on several dimensions: deep OEM relationships and branded service offerings for legacy automakers; multi-network capability, security, and edge performance for Tier-1 systems suppliers; data and subscription service models for telecoms; and modular integration, OTA flexibility, and developer programmability from specialized software vendors.

| Item | Value |

|---|---|

| Quantitative Units | USD 39.1 Billion |

| Connectivity Type | Cellular, Wi-Fi, Bluetooth, Dedicated Short-Range Communication (DSRC), and Satellite |

| Component | Hardware, Software, and Services |

| Vehicle Type | Passenger Vehicles, Commercial Vehicles, and Electric Vehicles |

| Application | Infotainment, Navigation, Telematics, Remote Diagnostics, Safety & Security, and Fleet Management |

| End Use | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | MGMotors, AudiAG(VolkswagenGroup), FordMotorCompany, BayerischeMotorenWerkeAG, and HyundaiMotorCorporation(HyundaiMotorGroup) |

| Additional Attributes | Dollar sales, share, competitive positioning, regional demand patterns, emerging technologies, regulatory impact, consumer adoption trends, OEM partnerships, and subscription revenue growth potential. |

The global in-vehicle connectivity market is estimated to be valued at USD 39.1 billion in 2025.

The market size for the in-vehicle connectivity market is projected to reach USD 79.8 billion by 2035.

The in-vehicle connectivity market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in in-vehicle connectivity market are cellular, wi-fi, bluetooth, dedicated short-range communication (dsrc) and satellite.

In terms of component, hardware segment to command 46.0% share in the in-vehicle connectivity market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA