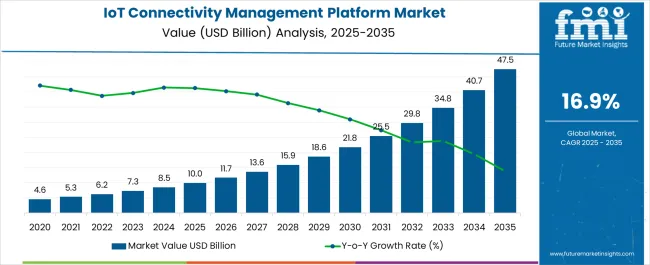

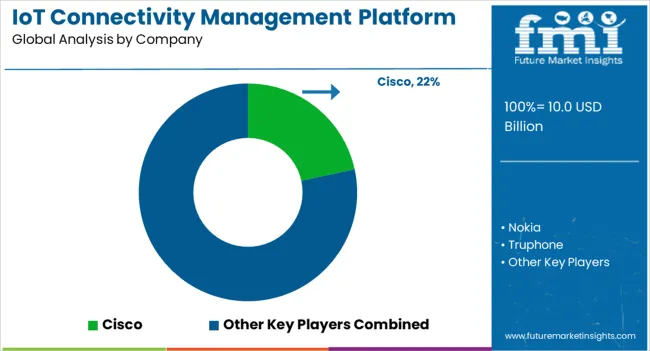

The IoT Connectivity Management Platform Market is estimated to be valued at USD 10.0 billion in 2025 and is projected to reach USD 47.5 billion by 2035, registering a compound annual growth rate (CAGR) of 16.9% over the forecast period.

| Metric | Value |

|---|---|

| IoT Connectivity Management Platform Market Estimated Value in (2025 E) | USD 10.0 billion |

| IoT Connectivity Management Platform Market Forecast Value in (2035 F) | USD 47.5 billion |

| Forecast CAGR (2025 to 2035) | 16.9% |

The IoT connectivity management platform market is expanding rapidly due to the increasing adoption of connected devices across industries, advancements in 5G networks, and the growing need for scalable device management solutions. Organizations are leveraging these platforms to ensure secure connectivity, efficient data handling, and cost optimization across large IoT ecosystems.

Cloud integration, AI enabled analytics, and automation features are enhancing platform performance, making them central to digital transformation initiatives. Regulatory emphasis on data security and interoperability is further accelerating platform adoption across healthcare, manufacturing, automotive, and smart city projects.

With enterprises investing in large scale IoT deployments to achieve operational efficiency and customer centric innovations, the market outlook remains highly positive, presenting significant opportunities for both platform providers and end users.

The IoT connectivity management platform solution segment is expected to hold 54.20% of total revenue by 2025, making it the leading component category. This dominance is attributed to its ability to provide centralized control, seamless connectivity, and streamlined device lifecycle management across diverse networks.

The demand has been further strengthened by enterprises prioritizing automation, real time monitoring, and compliance with security protocols.

The scalability of these solutions and their integration with cloud and edge infrastructures have reinforced their critical role in large scale IoT deployments, thereby securing their leadership position in the component category.

The cloud based deployment segment is projected to contribute 62.70% of total revenue by 2025, positioning it as the dominant deployment model. This growth is being driven by the rising demand for cost effective, flexible, and scalable solutions that support global IoT rollouts.

Cloud based platforms enable real time analytics, faster deployment cycles, and integration with AI and machine learning tools, which enhance decision making capabilities. The preference for cloud infrastructure is also influenced by the need for remote monitoring, reduced capital expenditure, and faster innovation cycles.

These advantages have made cloud based platforms the preferred choice, strengthening their share within the deployment segment.

The large enterprises segment is anticipated to hold 58.40% of total revenue by 2025 within the enterprise size category, making it the leading segment. This dominance is explained by their ability to invest in advanced IoT infrastructure, implement complex connectivity ecosystems, and integrate security and compliance measures at scale.

Large organizations are also leveraging these platforms to optimize supply chains, monitor assets globally, and achieve operational efficiencies. Their strategic focus on digital transformation, coupled with robust budgets for R&D and innovation, has enabled faster adoption of comprehensive IoT management solutions.

Consequently, large enterprises continue to dominate the market by setting standards for platform utilization and driving industry wide adoption.

The IoT connectivity management platform demand is estimated to grow at 16.8% CAGR between 2025 and 2035, in comparison with 15.3% CAGR registered between 2020 & 2025.

IoT connectivity management platform promotes bring-your-own-computer (BYOC) connectivity. Organizations are adopting BYOC to eliminate the initial infrastructure expenses and to minimize the cost of equipment and deployment. The trend also provides a flexible work environment to the employees and supports connectivity technologies such as LTE, GSM, CDMA and various non-cellular connectivity protocols such as Wi-Fi and Bluetooth.

Solution segment in global IoT connectivity management platform market is estimated to account for a dominant share of 17.7% in 2025 as it addressed the consolidation challenges associated with operating and managing IoT devices.

The Internet of Things (IoT) plays a crucial role in connecting the world. IoT refers to the interconnection and exchange of data among devices/sensors and systems over the internet. Integrating IoT in systems offers various advantages such as long-reach, low data rate, low energy consumption, and profitability.

IoT technologies are used to handle an array of problems and situations such as vehicle traffic congestion, road safety and inefficient use of vehicle parking spaces in the day-to-day life.

IoT-based smart parking systems are integrated with mobile applications to provide comprehensive parking solution both for the user and owner of the parking space. Smart parking systems are usually based on LPWA networks for connectivity. These networks are also known as mobile IoT networks, as they are specifically designed to support IoT sensors and data that enable smart parking. These networks are designed to be secure, scalable, and future-proofed and operate cost effectively.

Growing adoption of IoT in the automotive sector, particularly in advanced driving assistance systems (ADAS) in autonomous vehicles is expected to bode well for the market in the forthcoming years.

With the growth and development of IoT, the mobile industry together with 3GPP has standardized new cellular technologies by integrating them with IoT devices. LPWA networks are among technologies that support devices that require low power consumption, long range, low cost, and security.

LPWA technologies offer connectivity solutions across several industries and support a wide range of applications & deployment, which the existing mobile technologies are not able to offer. LPWA networks are designed for IoT applications which require long battery lives, have low data rates, and can be operated in remote locations. These devices are easy to deploy across a number of verticals such as energy & utilities, smart cities, automotive, transportation, agriculture, manufacturing, and wearables.

LPWA network is an emerging cellular IoT technology and is expected to create opportunities for the deployment of IoT connectivity management platform.

South Asia & Pacific is estimated to be the fastest growing region in IoT connectivity management platform market. Sales in the region are expected to grow by 7.8X during the forecast period. Consumers are adopting IoT as it focuses on sustainability and smart technologies. Various network providers are collaborating and partnering with infrastructure solution providers to deploy IoT centric technologies for building smart cities.

Companies are focusing on offering affordable and reliable connectivity for applications such as asset tracking, environment monitoring etc. This factor is encouraging adoption of IoT and M2M technology, thereby driving the demand for IoT connectivity platform in the region.

Growing Trend of Bring-your-own-device (BYOD) in China will Fuel Sales

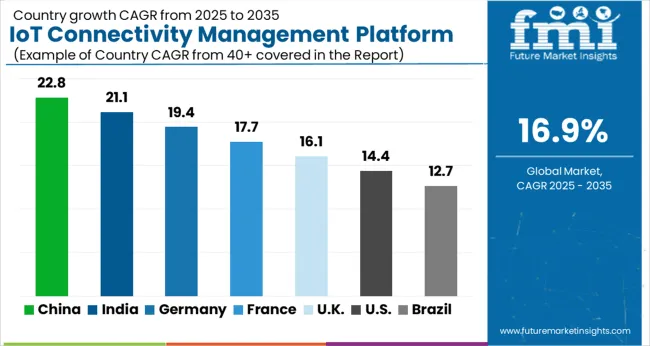

The IoT connectivity management platform demand in the China is expected to account for nearly 43.3% of East Asia market share in 2025. China has embraced NB-IoT technology since the time it was launched. In 2020, China started NB-IoT testing and trials to be able to commercialize NB-IoT in the country. It has completed the transition from lab and field tests to commercial implementation.

The country's leadership in NB-IoT development can be ascribed to a variety of aspects, including favorable policies, quick deployment of the network ecosystem by operators, technological development and upgrades, and the presence of a significant number of component vendors. Governments and authorities in China have long worked to ease the way for the deployment of NB-IoT networks and applications, which in turn, is driving sales of IoT connectivity management platforms in the country.

Increasing Deployment of IoT Devices in Smart Cities Will Spur Demand

South Asia & Pacific is predicted to remain one of the most attractive markets during the forecast period. According to the study, sales in India are estimated to grow by 11.3x during the forecast period.

In the past few years, South Asian countries have experienced a remarkable increase in infrastructure spending. The IoT revolution is spreading its roots in India as well, and there is a rapid influx of Indian companies joining ranks to move the technology forward.

Smart cities consist of various types of electronic equipment for various applications such as smart homes, smart traffic, smart security, and utilities. This is spurring demand for IoT and connected devices, such as smart meters, home gateways, smart appliances, sensors, & smart plugs for deployment in smart cities.

Rising Applications in the Automotive Sector Will Drive Growth

Demand in Germany is estimated to grow at an impressive rate of around 14.6% CAGR between 2025 and 2035. In the automotive sector, connectivity is quickly becoming one of the most important competitive differentiators.

With the automotive industry moving toward connected vehicle technology, various technologies such as V2D (vehicle-to-device), V2V (vehicle-to-vehicle), and V2P (vehicle-to-person) and (vehicle-to-pedestrian), V2I (vehicle-to-infrastructure), have emerged.

The incorporation of different features such as blind spot detection, voice control, and wireless charging capabilities, and self-driving vehicles can also be considered as improvements in the automobile business. The usage of IoT connectivity management platforms in Germany has increased as a result of these improvements in the automotive sector.

| Country | BPS Change (H2'22 (O) - H2'22 (P)) |

|---|---|

| USA | (+)36 |

| Germany | (+)35 |

| United Kingdom | (+)34 |

| Japan | (+)33 |

| China | (+)32 |

The H2’22(O)-H2’22(P) BPS change in United Kingdom was of (+)34 units attributed to the growth of the IoT industry is leading to an increased demand for connectivity management platforms, as the number of connected devices continues to rise which is driving the adoption of IoT connectivity management platform. Where as in Japan the number of connected devices grows, organizations are recognizing the need for centralized management to ensure secure and efficient IoT deployments leading to the deviation of (+)33 units.

The development of new technologies such as 5G, low-power wide-area networks (LPWANs), and edge computing are driving the growth of the IoT connectivity management platform market, as they provide new opportunities for efficient device management resulting in China a BPS change of (+)32 units.

Germany encountered a BPS change of (+)35 units for the IoT connectivity management platform market owing to the growth of the IoT, there is a growing demand for real-time data analytics and decision-making, which is driving the need for advanced connectivity management platforms.

USA witnessed a BPS of (+)36 BPS units for the IoT connectivity management platform market as the government is heavily investing in IoT technologies and initiatives, which is driving the growth of the connectivity management platform market.

Rising Adoption of IoT Connectivity Management Solutions Will Steer Growth

The IoT connectivity management solution segment is expected to create an absolute opportunity of USD 47.5.0 Billion by the end of 2035. Adoption of IoT connectivity management platform is increasing as it helps in efficient connectivity management throughout the product life cycle, reduces total cost of ownership, and helps in efficient management of devices. Also, the platform eliminates the risk of authorized access to M2M and IoT networks.

IoT connectivity management platform is used for reducing the complexity and allows organizations to efficiently manage devices and cellular technologies and optimize data rates for optimal IoT deployment.

Growing Applications of IoT in SMEs Segment Will Boost Sales

The SMEs segment is expected to expand by 5.2x during the forecast period. SMEs are emerging as key end-users of IoT technologies. Industrial manufacturing companies are moving toward IoT-driven technologies for smart production, operations, inventory, logistics, and supply chain for boosting revenues by creating new hybrid business models.

IoT solutions among enterprises have grown from servicing the supply chain process to adding visibility to healthcare, government offices, and energy & utilities industries.

Demand for IoT Connectivity Management Platform in the Healthcare Sector to Remain High

In terms of industry, sales in the healthcare sector are forecast to grow at a CAGR of 23.1% during the forecast period. In healthcare industry, with narrowband Internet of Things (NB-IoT), medical equipment can be completely integrated to the network via cloud and enables a state-of-the-art cloud connected healthcare ecosystem.

This dramatically enhances the data gathering process and data analysis, and boosts equipment efficiency and network communication reliability. This is expected to continue pushing sales in the healthcare sector worldwide.

IoT connectivity management platform market players are focusing on various strategies such as partnerships and collaborations for enhancing their customer base and product offerings. For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; and the Middle East & Africa |

| Key Countries Covered | The USA, Canada, Germany, The United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Malaysia, Indonesia, Singapore, Australia & New Zealand, GCC Countries, Turkey, North Africa and South Africa |

| Key Segments Covered | Component, Deployment, Enterprise Size, Industry and Region |

| Key Companies Profiled | Cisco; Nokia; Truphone; Huawei; Ericsson; Comarch; KORE; Arm; HPE; ZTE; Links Field; MAVOCO AG; Swimscom; Emnify; Aeris |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global iot connectivity management platform market is estimated to be valued at USD 10.0 billion in 2025.

The market size for the iot connectivity management platform market is projected to reach USD 47.5 billion by 2035.

The iot connectivity management platform market is expected to grow at a 16.9% CAGR between 2025 and 2035.

The key product types in iot connectivity management platform market are iot connectivity management platform solution and services.

In terms of deployment, cloud-based segment to command 62.7% share in the iot connectivity management platform market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IoT Spend by Logistics Market Size and Share Forecast Outlook 2025 to 2035

IoT Chip Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Enablement Market Size and Share Forecast Outlook 2025 to 2035

IoT In Aviation Market Size and Share Forecast Outlook 2025 to 2035

IoT Processor Market Size and Share Forecast Outlook 2025 to 2035

IoT in Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

IoT For Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Development Services Market Size and Share Forecast Outlook 2025 to 2035

IoT-based Asset Tracking and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

IoT In Construction Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT Development Kit Market Size and Share Forecast Outlook 2025 to 2035

IoT in Utilities Market Size and Share Forecast Outlook 2025 to 2035

IoT in Product Development Market Analysis - Growth & Forecast 2025 to 2035

IoT Communication Protocol Market - Insights & Industry Trends 2025 to 2035

IoT in Healthcare Market Insights - Trends & Forecast 2025 to 2035

IoT for Public Safety Market

IoT Data Governance Market

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA