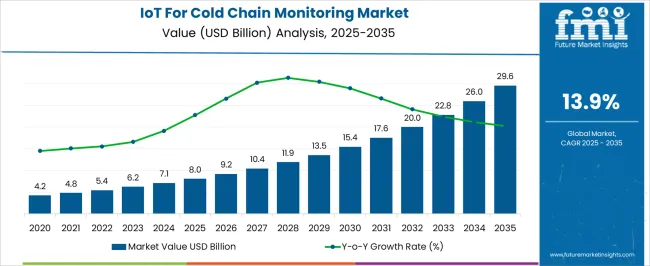

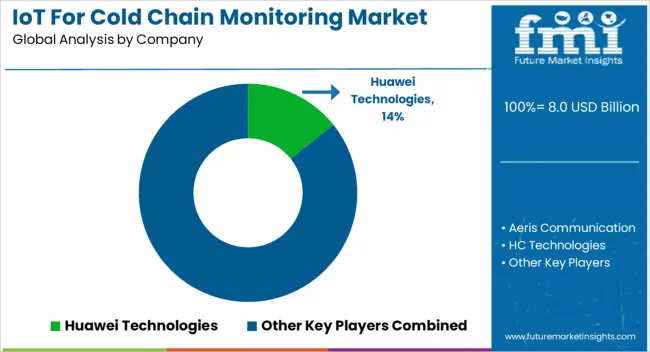

The IoT For Cold Chain Monitoring Market is estimated to be valued at USD 8.0 billion in 2025 and is projected to reach USD 29.6 billion by 2035, registering a compound annual growth rate (CAGR) of 13.9% over the forecast period.

| Metric | Value |

|---|---|

| IoT For Cold Chain Monitoring Market Estimated Value in (2025 E) | USD 8.0 billion |

| IoT For Cold Chain Monitoring Market Forecast Value in (2035 F) | USD 29.6 billion |

| Forecast CAGR (2025 to 2035) | 13.9% |

The IoT for cold chain monitoring market is expanding steadily as industries focus on safeguarding product integrity across perishable and temperature sensitive supply chains. Rising demand for real time monitoring, regulatory compliance, and sustainability initiatives is driving investments in IoT enabled solutions.

The ability to minimize spoilage, enhance traceability, and improve logistics efficiency is strengthening adoption across sectors such as healthcare, pharmaceuticals, food, and agriculture. Advancements in wireless sensors, cloud integration, and predictive analytics are further enabling proactive decision making and streamlined operations.

With governments tightening regulations on temperature controlled logistics, enterprises are increasingly prioritizing IoT deployments to ensure accountability and product quality. The outlook remains positive as digital transformation accelerates across supply chain networks, paving the way for scalable, data driven cold chain monitoring systems.

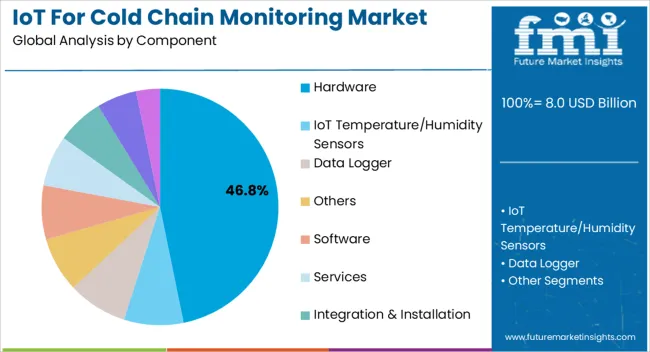

The hardware segment is projected to contribute 46.80% of total market revenue by 2025 within the component category, making it the leading segment. This growth is attributed to the rising demand for sensors, data loggers, and RFID devices that ensure continuous temperature tracking and location visibility.

Hardware serves as the foundation for real time monitoring and has become critical in maintaining the safety of pharmaceuticals, vaccines, and perishable food products. The increasing need for robust devices capable of operating under diverse environmental conditions has reinforced adoption.

Continuous innovation in compact and energy efficient hardware has also contributed to the dominance of this segment.

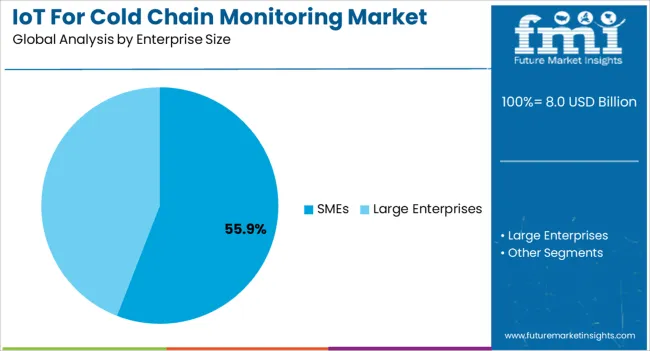

The SMEs segment is expected to account for 55.90% of market revenue by 2025 within the enterprise size category, positioning it as the most prominent. This growth is driven by the affordability and scalability of IoT solutions that align with the operational needs of smaller enterprises.

SMEs are leveraging IoT platforms to enhance supply chain visibility, reduce losses, and ensure compliance with stringent quality regulations. Lower implementation costs of cloud based systems and increasing availability of subscription models have enabled rapid adoption.

As SMEs seek to improve competitiveness and customer trust, their investment in IoT based cold chain monitoring continues to expand.

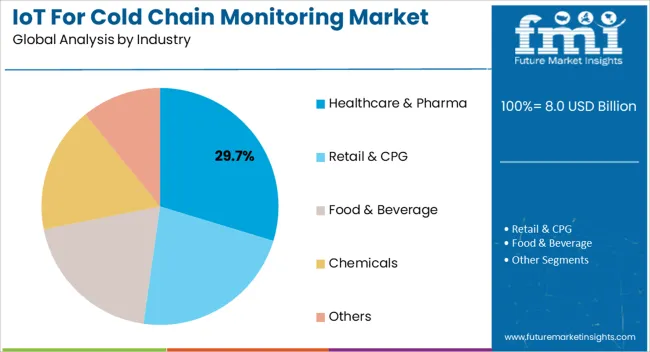

The healthcare and pharma industry is projected to hold 29.70% of overall market revenue by 2025 within the industry category, making it the leading segment. This dominance is fueled by the critical need to preserve product efficacy and safety in temperature controlled drug and vaccine supply chains.

Rising global vaccination programs, stringent pharmaceutical handling standards, and the expansion of biologics have intensified reliance on IoT based monitoring. Real time tracking of environmental conditions and automated alerts have enabled compliance with strict regulatory requirements.

With healthcare providers and pharmaceutical companies prioritizing patient safety and operational efficiency, the healthcare and pharma segment continues to lead market adoption.

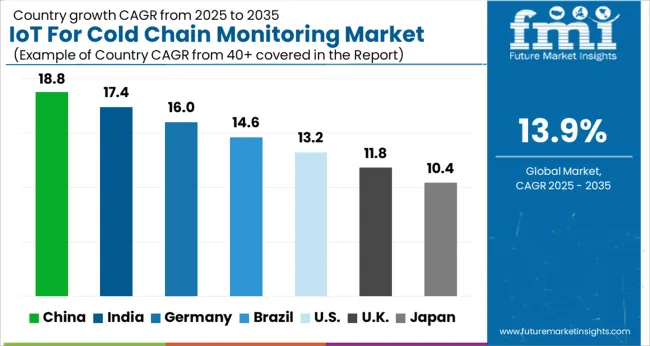

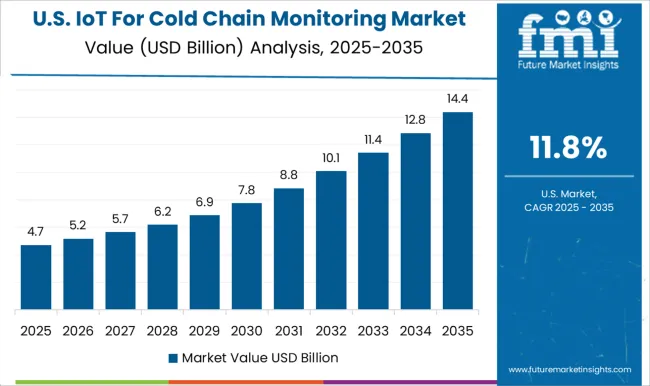

Between 2020 and 2025, global IoT for cold chain monitoring registered a CAGR of 11.8%. Rising government investments and efforts to reduce food spoilage and prevent damage to other temperature-sensitive goods have fueled the demand for cold chain monitoring in industries such as food & beverages, healthcare & pharma, chemicals, and others.

The rising demand for cold chain warehousing during the COVID-19 pandemic had a positive impact on the IoT for the cold chain monitoring market. During the extended period of lockdown observed around the world, increasing demand for packaged food & beverages products was noted. Food manufacturers have been increasingly adopting the IoT for cold chain monitoring solutions for monitoring food products and boosting their shelf-life.

Because IoT-enabled temperature monitoring helps in monitoring goods round the clock, temperature logging has become way easier than manual methods, previously undertaken. This has resulted in increasing demand for data cold chain monitoring during the pandemic. Driven by these factors, the IoT for cold chain monitoring demand is likely to increase, expanding at a CAGR of 13.9% throughout the 2025 to 2035 assessment period.

Blockchain technology drives cold chain monitoring market owing to the efficiency and transparency of supply chain

Blockchain technology offers a way to record transactions or any digital interaction and is designed to be transparent, secure, and efficient. Due to the transparency and security achieved by blockchain, the speed of the physical flow of goods is increased.

Blockchain records every single asset from the product to the container as it flows through the supply chain nodes. It also helps in keeping track of information regarding orders, receipts, invoices, payments, and digital assets such as copyrights, certifications, barcodes, and other things. Through its decentralized nature, it shares information about process, delivery, production, and maintenance, between suppliers and vendors, bringing new modalities of collaboration in complex assembly lines.

Blockchain integration with cold chain results in increased sustainability, reduced errors and delays, minimizes transportation costs, enables faster identification of errors, and offers improved product transport and inventory management. Through these advantages, blockchain integration in the cold chain can help in strengthening the corporate identities of market players.

Adoption of cloud-based technology and the use of logistics 4.0 and IoT, to propel growth

Logistics 4.0 enables process improvement through a variety of technological advancements, which include automated systems, driverless transport vehicles, and robotics. An increase in the adoption of cloud-based technology with the usage of logistics 4.0 and IoT is driving the growth of the cold chain monitoring market. The IoT usage in cold chain monitoring is increasing as it helps in reducing costs and delays by avoiding risk.

IoT sensors are built into cargo, ships, cabs, and trains and are connected to an alarm system or dispatcher that is tracking and monitors. These sensors transmit information to the team who then gains insights into hidden risks and knowledge. This also gives accurate in-transit visibility and delivery of goods. The demand for cloud-based software as a service is increasing in cold chain monitoring, as it helps the professional to access critical data and applications both, on the road and in the office from any connected device.

Data theft as a result of the use of various devices to impede market growth

A huge amount of data is generated in cold chain monitoring, which is analyzed and used for decision-making by professionals. The data is collected by using devices such as various IoT sensors, and GPS devices. The data collected through these devices can tamper or unauthorized users can access the device for data theft. This may lead to the misuse of important information regarding products, and orders by unauthorized users. However, this is a major challenge that is restricting the growth of the IoT for the cold chain monitoring market.

United States to Dominate global market

The United States is offering the opportunity for the generation of high revenue during the forecast period, owing to the high presence of cold chain monitoring solution players.

The place has the possibility of earning substantial revenue throughout the forecast timeframe as a result of massive cold chain monitoring solution suppliers in the United States. The popularity of refrigerated, frozen, and dairy items has risen in the United States, raising the demand for IoT for cold chain monitoring. The United States was poised to remain highly lucrative, capturing 24.8% of the global market share throughout 2025.

Also, based on current trend estimates, in 2020, the country was the world’s largest pharmaceutical market that accounted for 48% of the global pharmaceutical market. Due to the increasing demand for medicines in the USA, the demand for IoT for cold chain monitoring also increased for monitoring the medicines' temperature and prevent from damage.

United Kingdom to expand at a rapid pace

The United Kingdom IoT for cold chain monitoring market is expanding due to the rise in online grocery shopping that resulted in the increasing number of refrigerated warehouses.

The United Kingdom has been named the third-largest online grocery market in the world. Around 6.1% of the grocery sales in the United Kingdom are made online, which in turn is propelling the United Kingdom IoT for cold chain monitoring market growth.

Furthermore, the United Kingdom market is expected to grow at a CAGR of 15.1% over the upcoming decades. The United Kingdom is anticipated to dominate the market in the European region over the forecast period.

China to dominate the market in the Asia Pacific region

China is estimated to record an incremental opportunity worth USD 1.6 billion during the forecast period. China IoT for cold chain monitoring market growth is driven by meat, quick-frozen food, fruits & vegetables, and dairy products.

China's food industry generated revenue of around 8 Tr in 2020. Key player food & beverages sector in China is focusing on investing in cold chain monitoring to offer their fresh and undamaged products in the market. The market in China is expected to grow at a CAGR of 15.2% over the upcoming decades.

Furthermore, the Chinese government's stringent rules to safeguard nutritional content stimulate cold chain companies to configure temperature monitoring systems. The commercialization of IoT and its integration throughout all sectors are expected to be in the early stages in this country.

The country has developed into an international hub for large capital investments and company strategic partnerships. Therefore, these factors are expected to contribute to the market growth in China over the upcoming years.

Hardware segment to dominate the market

By component, IoT software/ platform for cold chain monitoring is expected to register a CAGR of 15.1% throughout the forecast period. The IoT software for cold chain monitoring offers the ability to uninterruptedly monitor the performance of cold chain in real-time and ensure adherence to guidelines set by regulatory agencies.

Players are focusing on offering IoT software for reporting, data analytics, and tracking of products. However, throughout the forecast period, dominance is going to remain with the hardware segment in terms of the component. The hardware segment is expected to account for 44.3% of the global market share.

SMEs to grow at a high pace

While the uptake among large enterprises continues to be higher, FMI has projected the demand for small and medium enterprises (SMEs) to rise at a higher pace in the coming years.

Growth in the latter category of industries will be supported by the rapid adoption of IoT technologies among SMEs, intended at reducing overall expenditure incurred on various operations.

Key players in the global IoT for cold chain monitoring market include Huawei Technologies, Aeris Communication, HC Technologies, SenseGiz Inc, Zebra Technologies, TE Connectivity, Moschip Technologies Limited, Laird Connectivity, Roambee Corporation, Cisco Systems, Inc. Recent developments among key players are

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 13.9% from 2025 to 2035 |

| Market Value in 2025 | USD 8.0 billion |

| Market Value in 2035 | USD 29.6 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Component, Enterprise Size, Industry, Region |

| Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East and Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Korea, India, Malaysia, Singapore, Thailand, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Huawei Technologies; Aeris Communication; HC Technologies; SenseGiz Inc.; Zebra Technologies; TE Connectivity; Moschip Technologies Limited; Laird Connectivity; Roambe Corporation; Cisco Systems Inc. |

| Customization & Pricing | Available upon Request |

The global IoT for cold chain monitoring market is estimated to be valued at USD 8.0 billion in 2025.

The market size for the IoT for cold chain monitoring market is projected to reach USD 29.6 billion by 2035.

The IoT for cold chain monitoring market is expected to grow at a 13.9% CAGR between 2025 and 2035.

The key product types in IoT for cold chain monitoring market are hardware, IoT temperature/humidity sensors, data logger, others, software, services, integration & installation, consulting and support & maintenance.

In terms of enterprise size, smes segment to command 55.9% share in the IoT for cold chain monitoring market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IoT Network Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Spend by Logistics Market Size and Share Forecast Outlook 2025 to 2035

IoT Chip Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Enablement Market Size and Share Forecast Outlook 2025 to 2035

IoT In Aviation Market Size and Share Forecast Outlook 2025 to 2035

IoT Processor Market Size and Share Forecast Outlook 2025 to 2035

IoT in Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Development Services Market Size and Share Forecast Outlook 2025 to 2035

IoT In Construction Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT Development Kit Market Size and Share Forecast Outlook 2025 to 2035

IoT in Utilities Market Size and Share Forecast Outlook 2025 to 2035

IoT in Product Development Market Analysis - Growth & Forecast 2025 to 2035

IoT Communication Protocol Market - Insights & Industry Trends 2025 to 2035

IoT in Healthcare Market Insights - Trends & Forecast 2025 to 2035

IoT Data Governance Market

IoT-based Asset Tracking and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

IoT for Public Safety Market

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA