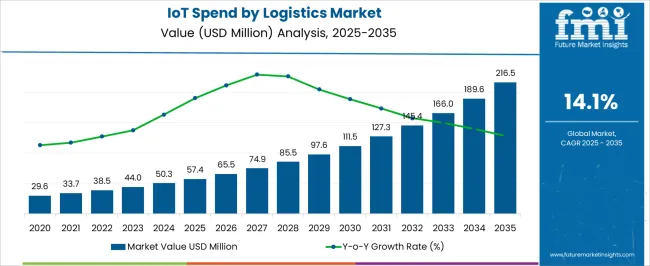

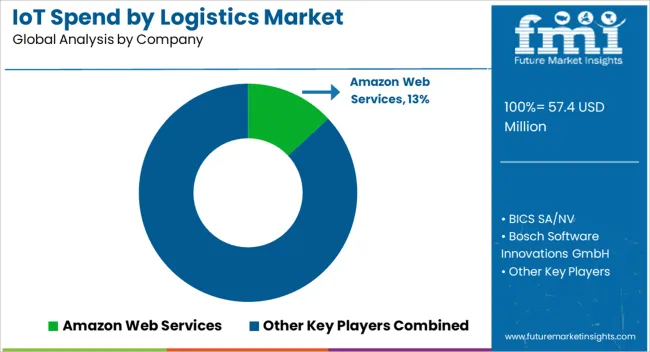

The IoT Spend by Logistics Market is estimated to be valued at USD 57.4 million in 2025 and is projected to reach USD 216.5 million by 2035, registering a compound annual growth rate (CAGR) of 14.1% over the forecast period.

| Metric | Value |

|---|---|

| IoT Spend by Logistics Market Estimated Value in (2025 E) | USD 57.4 million |

| IoT Spend by Logistics Market Forecast Value in (2035 F) | USD 216.5 million |

| Forecast CAGR (2025 to 2035) | 14.1% |

The IoT spend by logistics market is progressing steadily, driven by the growing need for real-time visibility, predictive analytics, and automation in supply chain operations. Logistics firms are increasingly adopting IoT-enabled platforms to optimize fleet management, enhance warehouse efficiency, and ensure seamless last-mile delivery. Corporate disclosures and technology news releases have highlighted rising investments in IoT software platforms that integrate data from sensors, telematics, and enterprise systems, enabling actionable insights and improved operational control.

The surge in e-commerce and global trade has also accelerated IoT adoption, as logistics providers face mounting pressure to manage high-volume, time-sensitive shipments with precision. Additionally, industry collaborations between IoT solution providers and logistics companies have strengthened the innovation pipeline, introducing advanced fleet tracking, predictive maintenance, and digital twin capabilities.

Looking ahead, future growth is expected to be shaped by the deployment of 5G networks, AI-driven IoT analytics, and government-backed initiatives for smart transportation infrastructure, further reinforcing the pivotal role of IoT investments in logistics transformation.

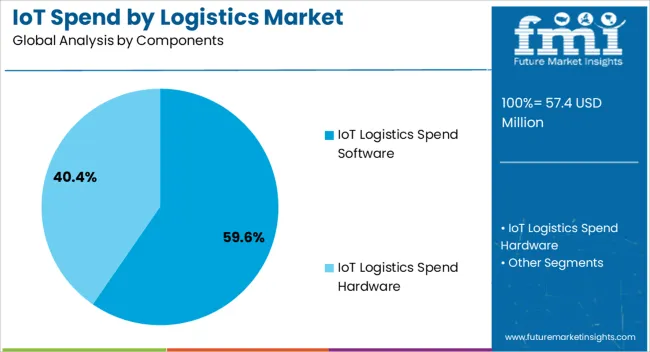

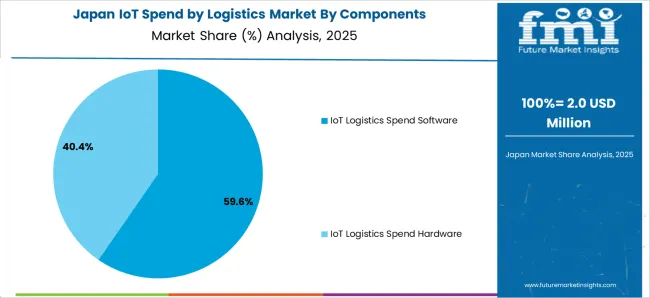

The IoT Logistics Spend Software segment is projected to account for 59.6% of the market revenue in 2025, sustaining its leading position due to its central role in enabling connected logistics ecosystems. Growth in this segment has been driven by the demand for platforms that integrate diverse IoT data sources into unified dashboards, supporting real-time decision-making and predictive analysis.

Logistics operators have favored software solutions that provide route optimization, inventory visibility, and automated compliance reporting, which directly improve efficiency and reduce operational costs. Press releases from technology companies have emphasized continuous enhancements in cloud-based logistics software, improving scalability and security.

The ability of IoT software to integrate seamlessly with existing ERP and warehouse management systems has further supported its adoption. As logistics firms expand their digital capabilities, the IoT Logistics Spend Software segment is expected to remain at the forefront, driven by the need for centralized intelligence in increasingly complex supply chains.

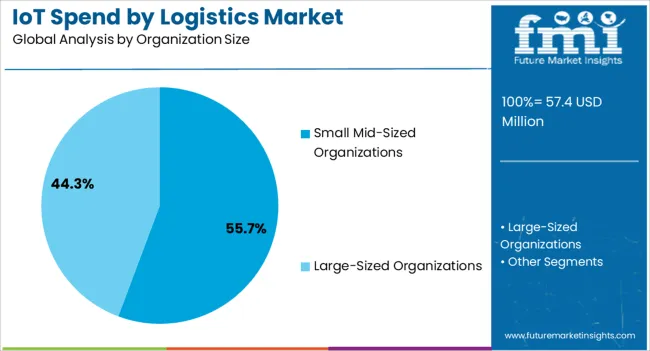

The Small Mid-Sized Organizations segment is expected to contribute 55.7% of the market revenue in 2025, holding its leadership in IoT logistics adoption. This dominance has been supported by the growing accessibility of cost-effective IoT platforms tailored to smaller firms that require efficiency gains without large-scale infrastructure investments.

Industry surveys and technology adoption studies have indicated that mid-sized logistics providers prioritize IoT-enabled solutions for fleet tracking, shipment monitoring, and warehouse automation to remain competitive against larger players. Cloud-based IoT services, offered through subscription models, have lowered entry barriers for smaller organizations, enhancing affordability and scalability.

Additionally, government-backed digitalization programs targeting SMEs have accelerated adoption, particularly in emerging markets. With small and mid-sized logistics companies forming the backbone of regional supply chains, their increasing reliance on IoT solutions ensures continued growth of this segment.

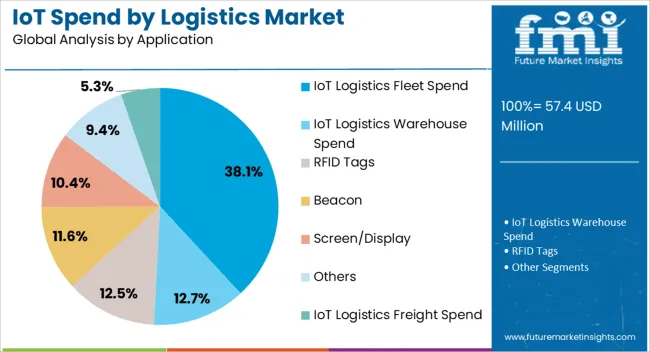

The IoT Logistics Fleet Spend segment is projected to account for 38.1% of the market revenue in 2025, reflecting its significance in improving fleet performance and cost management. Growth has been driven by the rising demand for telematics, real-time GPS tracking, and predictive maintenance solutions that minimize vehicle downtime and optimize fuel consumption.

Industry updates and logistics technology forums have underscored the role of IoT-enabled fleet management in reducing carbon emissions and enhancing regulatory compliance. Fleet operators have adopted IoT systems to monitor driver behavior, cargo conditions, and vehicle health, improving safety and efficiency.

The integration of advanced analytics and AI into fleet IoT platforms has further expanded their value by enabling dynamic routing and performance benchmarking. As global freight volumes continue to rise and sustainability targets become more stringent, the IoT Logistics Fleet Spend segment is expected to remain a core driver of IoT investment in logistics.

By integrating smart sensors into warehouse infrastructure and trucks and collecting real-time data on asset condition and position, IoT-powered logistics improves supply chain efficiency and visibility. IoT-enabled cargo containers keep an eye on the surroundings and offer insightful information on logistical procedures. This information avoids equipment and vehicle maintenance, improves inventory management, and optimizes routes.

The IoT holds significant potential for logistics operators, corporate clients, and end-users. It offers new business models, customer experience, safety, and operational efficiency. The IoT is envisioned to revolutionize logistics, reduce costs, and improve wireless network performance. It is also expected to magnify data capabilities, boosting business growth in smart cities and eCommerce.

IoT technology automates inventory management by placing RFID tags on warehouse items. This enables real-time tracking of product location and inventory levels, improving forecasting and optimizing stock levels. The demand for wireless devices enables logistics companies to track shipments and monitor conditions. They can use IoT technology to improve security, predict issues, and enhance route management.

The global demand has historically developed at a CAGR of 11.3%. However, sales have started to progress at a far better pace, displaying a CAGR of 14.2% from 2025 to 2035.

| Attributes | Details |

|---|---|

| Historical CAGR for 2020 to 2025 | 11.3% |

Logistics organizations need help in growing their IoT investment due to the growing number of security breaches and data collecting in the IoT sector. Undersized logistics corporations are losing revenue due to rising IoT system costs, technical complexity, and higher installation and maintenance expenses. This situation potentially limits industry expansion.

Logistics industry participants work in tandem with IoT firms to provide customers with solutions. Nevertheless, because of dispersed systems and essential product transportation, they are vulnerable to cybercrime and global trends.

The logistics industry must contend with issues including scarce storage space, falling inventory prices, increased pollution, and mistrust among consumers. Additionally, worries about online safety and expensive IoT solution adoption are significant challenges.

Logistics companies are adapting to digitization and evolving customer expectations due to lockdowns and restrictions. Investment in IoT enhances efficiency and collaboration and reshapes business practices, transforming the industry.

Start-ups, customers, and suppliers are altering the supply chain industry, with IoT sensors becoming vital for supply chain transparency and efficiency. This increased demand leads to increased fleet efficiency and reduced operation costs, enhancing cargo safety and efficiency.

Throughout the projection period, the industry is anticipated to see development prospects due to the decentralized, transparent, and safe data management that blockchain technology and IoT integration in logistics provide. These factors also improve trust, ensure data integrity, and speed up processes.

The profitability of logistics companies has improved due to a recent drop in oil prices. However, if the Organization of Petroleum Exporting Countries restricts output, the industry is still susceptible to future spikes in oil prices.

Rapid Digitization of Logistic Operations Propels the Demand for IoT

Robotics, self-driving technologies and data analytics are being used in the logistics industry to digitize it quickly in order to solve workforce shortages and increase operational efficiency.

In addition to addressing the labor deficit, the employment of robots in data analytics, supply chain management, warehousing, and machine learning is also increasing technical efficiency. The logistics operations environment is changing because of these digital transformation efforts.

Since AI technologies improve workflows and eliminate manual labor, the logistics sector is undergoing a transformation. They exhibit dependability by guaranteeing prompt order delivery.

The newest 5G wireless network technology, along with Internet of Things services, offers safe infrastructure and fast data exchange. This is going to accelerate IoT growth in the logistics industry during the subsequent decade.

Introduction of Smart Warehouses and Automation in Supply Chain Management

Logistics operations stand to gain greatly from the introduction of drones and autonomous vehicles operated by the Internet of Things. These devices can travel to certain places on their own, avoiding impediments and increasing productivity.

IoT plays an integral role in providing the sector with real benefits by automating warehouse operations, optimizing resources, and enhancing forecasting and inventory management.

Smart warehouses and logistics centers are using IoT, AI, robots, data analytics, and other cutting-edge technologies to streamline operations and boost efficiency. This transformation is expected to impact and enhance the supply chain sector significantly.

By automating manual procedures, these facilities may decrease downtime and provide preventive maintenance. The goal of the trend is to increase IoT's prominence in the supply chain within the ensuing decade.

Development of eCommerce Propels Demand for Logistic Management

IoT and the broad adoption of disposable smart sensors are driving a surge in smart logistics and supply chain operations for the eCommerce industry. Currently making up 18 to 20% of all retail sales, the global eCommerce market is growing quickly. Customer expectations for quick, free shipping and affordable prices are what is fueling the industry expansion.

In response to evolving customer behavior in the eCommerce space, businesses are integrating IoT services into their logistics operations to handle irregular shipments and unforeseen orders.

The growth of eCommerce, along with the need for prompt delivery of products, has increased awareness of IoT solutions. Investments in digitization, technical improvements, and contactless delivery methods in the logistics industry drive this spike in demand.

In the following section, detailed analyses of industry segments for IoT spends by the logistics industry are provided. Nevertheless, in 2025, there is expected to be ample demand for IoT logistics spend software. Among small and mid-sized organizations, IoT integration is much preferred.

| Attributes | Details |

|---|---|

| Top Component | IoT Logistics Spend Software |

| Revenue share in 2025 | 59.6% |

In 2025, the demand for IoT logistics spend software is projected to account for 59.6% of the industry share. With advantages including cost control, real-time visibility, driver safety, fraud prevention, and extended vehicle lifespan, traffic and fleet management software dominate the IoT logistics industry.

Post-pandemic, the global sales share of the eCommerce industry advanced between 18% and 21%. The software component accounted for the majority of transnational digital transformation investment in the logistics industry.

Advanced logistics software is a force to be reckoned with in the business world. Its comprehensive capabilities, including managing client inquiries, orders, product searches, sales, and shipping destinations, underscore its dominance. This expansion not only highlights the benefits of such systems but also fuels the demand for integrated solutions.

| Attributes | Details |

|---|---|

| Top Organization Size | IoT Logistics Spend for Small-Mid-sized Organizations |

| Revenue share in 2025 | 55.7% |

The IoT logistics spending for small and middle-sized organizations is anticipated to hold a notable share, accounting for around 55.7% in 2025. The demand for IoT by small and middle-sized enterprises has developed dramatically due to the expansion of logistics companies and large expenditures on IoT devices.

IoT penetration in logistics applications has increased as a result of the solutions' affordability. This has also given these enterprises peace of mind regarding the wisdom of their investment choices.

Investments in autonomous vehicles are surging due to the growth of eCommerce and robotic gadgets, which may boost demand for SMEs that have developing clientele. It is anticipated that these supply chain industry expenditures will increase logistics IoT spending.

To increase demand for IoT integration, new alliances and partnerships with small and medium-sized enterprises are essential. This highlights the value of teamwork in advancing the industry.

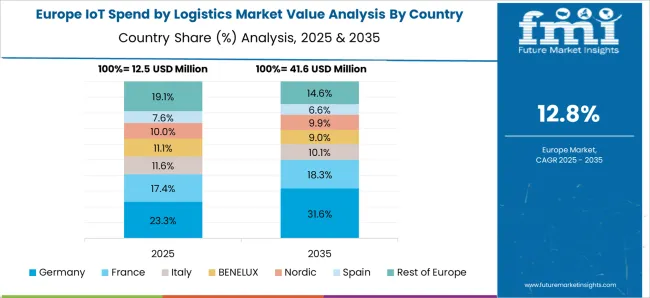

As eCommerce and transnational trades expand globally, the demand for IoT in logistics is increasing across different regions. The logistics sector in the United States is driving the need for IoT devices, while the demand from Germany's supply chain sector is expected to mirror that industry.

Asia Pacific is emerging as a prominent player in developing IoT integration in supply chain operations, thanks to the growth of the e-commerce industries in China and Japan. Australia is anticipated to cultivate a sophisticated consumer base for IoT integration in logistics in the coming decade.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| United States | 8.3% |

| Germany | 5.7% |

| China | 14.7% |

| Japan | 5% |

| Australia | 17.7% |

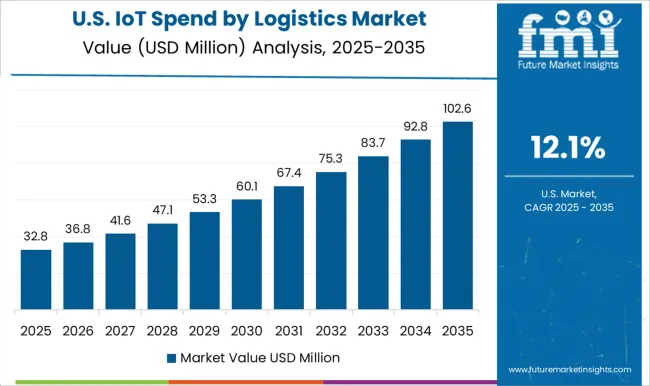

The United States' digital transformation has boosted the region's domain growth, playing a pivotal role in the industry's development in recent years. Rising internet usage, more IoT solutions, and a rise in supply chain firms are predicted to propel the United States IoT spend by logistics market 8.3% CAGR by 2035.

Organizations in the supply chain and logistics sector are using cloud-based software, including Oracle Blockchain Applications Cloud and IoT devices, to increase supply chain transparency. The cost-conscious nature of large American organizations has led to a surge in the adoption of cloud-based software.

A CAGR of 5.7% is anticipated for Germany’s IoT spend by logistics market, which is fueled by requirements for warehouse expansion and the global reach of logistics companies. Augmented expenditures in IoT technologies, which are extensively employed in German logistics companies, are propelling the industry's development in the forthcoming decade.

The desire to save costs and boost operational efficiency is what is pushing the demand for IoT in Germany's supply chain operations. IoT technology facilitates data-driven decision-making, task automation, resource optimization, and operational streamlining.

With its rapid global expansion, e-commerce now accounts for a sizable share of the retail business in China. The IoT spend by logistics market is predicted to register a CAGR of 14.7% between 2025 and 2035.

The need for eCommerce services in China has developed dramatically due to a shift in client tastes, who now demand quick, free shipping and competitive product prices.

In response to changing customer behavior, Chinese firms such as SF Express and XPO Logistics are incorporating IoT services into their logistics operations. This allows them to handle erratic shipments, sudden surges in orders, and orders that must be fulfilled quickly.

The flourished demand for adequate supply chain and transportation solutions is a result of Australia's economic growth in the mining, eCommerce, and industrial sectors.

Australia's digital supply chain activities require more efficient logistics. Australia’s freight and logistics industry greatly aids the nation's economic momentum.

The IoT spend by logistics market in Australia is set to skyrocket, with an anticipated peak at a CAGR of 17.7% between 2025 and 2035. This exciting prospect heralds a future of innovation and efficiency in our industry.

Owing to the widespread adoption of the internet, particularly the 5G network, and the expansion of eCommerce, new businesses are joining the IoT landscape in Japan's logistics sector. IoT investment in Japan's IoT spend by logistics market is anticipated to report a 5% CAGR by 2035.

Collaboration between companies, technology providers, and academic institutions may speed up the adoption of IoT in Japan's supply chain by encouraging information exchange, research, and development, as well as cooperative pilot projects.

As regional and transnational trades are anticipated to develop in the upcoming decade, the IoT spend by logistics market is envisioned to be augmented in the forthcoming decade. Companies in the logistics and supply chain sectors are devising several marketing strategies such as collaboration, integration of novel IoT technologies, mergers, and acquisitions.

The logistics and supply chain giants, in a spirit of inclusivity, are actively collaborating with upcoming tech start-ups. Their aim is to develop novel technologies for the betterment of the supply chain and logistics landscape.

The development of the eCommerce sector is also a significant catalyst for the expansion of IoT integration in the logistics and supply chain sectors. This industry is not just a playing field for the established players but also holds promising opportunities for emerging players in the dynamic ecosystem, encouraging a sense of hope and anticipation.

Recent Developments in the IoT Spend by Logistics Industry

The IoT integration in the logistics industry is bifurcated into IoT logistics spend software and IoT logistics spend hardware. Further, the software segment is branched into traffic and fleet management, resource and energy monitoring, safety and security, and other software such as operations management and data analysis.

Along with that, the hardware segment is cleft into RFID tags, beacons, screen or display, and other components such as camera and networking hardware.

The industry is dichotomized between IoT logistics spending for small and medium-sized organizations, as well as IoT Logistics spending for large-sized organizations.

The industry is examined across key regions including North America, Latin America, Europe, East Asia, South Asia, Oceania, as well as Middle East and Africa.

The global IoT spend by logistics market is estimated to be valued at USD 57.4 million in 2025.

The market size for the IoT spend by logistics market is projected to reach USD 216.5 million by 2035.

The IoT spend by logistics market is expected to grow at a 14.1% CAGR between 2025 and 2035.

The key product types in IoT spend by logistics market are IoT logistics spend software, _traffic and fleet management, _resource and energy monitoring, _safety and security, _others, IoT logistics spend hardware, _rfid tags, _beacon, _screen/display and _others.

In terms of organization size, small mid-sized organizations segment to command 55.7% share in the IoT spend by logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

IoT Network Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Chip Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Enablement Market Size and Share Forecast Outlook 2025 to 2035

IoT In Aviation Market Size and Share Forecast Outlook 2025 to 2035

IoT Processor Market Size and Share Forecast Outlook 2025 to 2035

IoT in Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

IoT For Cold Chain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

IoT Application Development Services Market Size and Share Forecast Outlook 2025 to 2035

IoT Connectivity Management Platform Market Size and Share Forecast Outlook 2025 to 2035

IoT-based Asset Tracking and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

IoT In Construction Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT Development Kit Market Size and Share Forecast Outlook 2025 to 2035

IoT in Utilities Market Size and Share Forecast Outlook 2025 to 2035

IoT in Product Development Market Analysis - Growth & Forecast 2025 to 2035

IoT Communication Protocol Market - Insights & Industry Trends 2025 to 2035

IoT in Healthcare Market Insights - Trends & Forecast 2025 to 2035

IoT for Public Safety Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA