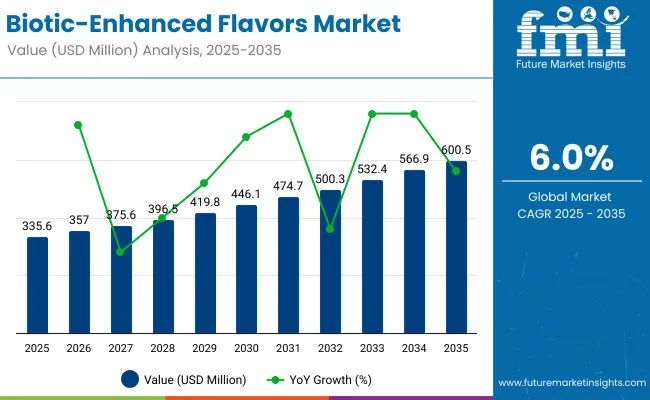

The global Biotic-Enhanced Flavors Market has been projected to be valued at USD 335.6 million in 2025 and is anticipated to reach approximately USD 600.5 million by 2035. A cumulative gain of USD 264.9 million is expected over the forecast decade, signaling a 6.0% CAGR, and marking an ~80% increase in market size.

Biotic-Enhanced Flavors Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 335.6 million |

| Forecast Value in (2035F) | USD 600.5 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

This outlook underscores a steady expansion trajectory fueled by growing demand for functional and health-boosting ingredients in flavor systems. From 2025 to 2030, an incremental addition of USD 119.2 million is forecasted, accounting for roughly 45% of total decade growth. During this early phase, demand is likely to be driven by heightened innovation in gut-health-promoting formulations, particularly across dairy and plant-based food categories. Application-specific enhancements in taste modulation are expected to be prioritized by manufacturers as consumer sensitivity to synthetic additives intensifies.

The second half of the forecast period (2030-2035) is expected to deliver more robust momentum, adding USD 145.7 million, equivalent to 55% of total growth. This phase is likely to be characterized by deeper penetration across beverages, snacks, and dietary supplements, supported by advanced encapsulation technologies and AI-optimized flavor personalization.

Regional growth will likely be led by North America and Europe initially, while Asia Pacific is projected to emerge as a high-opportunity frontier due to increased probiotic awareness and functional ingredient adoption. By 2035, strategic partnerships between biotechnology firms and flavor houses are expected to drive recurring revenue streams through digital-enabled flavor solutions.

From 2020 to 2024, the Biotic-Enhanced Flavors Market expanded from an estimated ~USD 310.4 million to USD 335.6 million, supported by growing demand for gut-health-forward and clean-label products. During this period, global flavor houses with integrated fermentation and probiotic capabilities dominated, collectively accounting for nearly 70% of functional flavor innovations. Competitive strategies prioritized microbiome modulation, flavor masking technologies, and regulatory-backed health claims.

By 2025, demand is projected to reach USD 335.6 million, with increasing revenue share expected from hybrid flavor systems that blend biotics with botanicals, adaptogens, and nootropics. The value mix is forecasted to shift, as digital formulation platforms, encapsulation services, and AI-assisted taste personalization contribute to over 25% of market value by 2030.

Traditional flavor leaders are anticipated to evolve toward solution-based ecosystems, integrating R&D-as-a-service, microbiome data partnerships, and D2C flavor innovation. Competitive advantage is expected to pivot from legacy extraction methods to platforms that offer personalization scalability, scientific substantiation, and recurring revenue across digital and physical formats.

Growth in the Biotic-Enhanced Flavors Market is being propelled by evolving consumer preferences toward health-forward and functional ingredients. Greater attention has been placed on digestive health, immunity, and microbiome balance factors that are increasingly influencing flavor formulation strategies.

Regulatory support for clean label and natural claims has been reinforced, enabling rapid innovation across probiotic- and prebiotic-enhanced flavor systems. Adoption is being accelerated by food and beverage manufacturers seeking to differentiate portfolios in saturated product categories.

Scientific validation of gut-brain axis benefits and bioactive functionality has strengthened the credibility of biotic-based ingredients in flavor delivery formats. Moreover, encapsulation and controlled-release technologies have been integrated to preserve microbial viability without compromising flavor intensity.

Rising R&D investments from major players particularly in fermentation-derived and enzyme-enhanced flavor solutions have expanded application scopes into nutraceuticals and dietary supplements. Strong penetration in B2B segments and a maturing D2C ecosystem are expected to sustain this momentum throughout the forecast period.

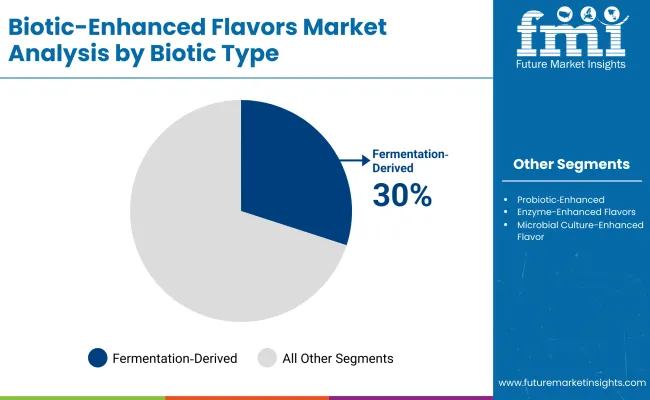

The Biotic-Enhanced Flavors Market has been segmented comprehensively based on biotic type, flavor type, product form, end user, sales channel and application, offering a detailed view of growth dynamics across functional flavor innovation. Biotic types include probiotic-enhanced, prebiotic-enhanced, fermentation-derived, enzyme-enhanced, and microbial culture-based formats, each engineered to serve specific functional or health-related outcomes.

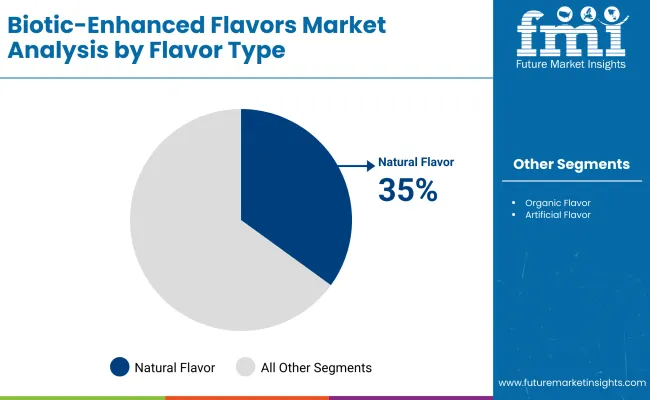

In terms of flavor type, distinctions have been drawn between natural, organic, artificial, and botanical variants, underlining regulatory, sensory, and origin-specific trends. The application spectrum spans food & beverages, nutraceuticals, dietary supplements, pharmaceuticals, and functional foods—indicating how these enhanced flavors are being absorbed into health-forward value chains. This multifaceted segmentation ensures that market players can fine-tune product strategies and anticipate shifts in consumer functionality demand across diverse industries.

| Biotic Type Segment | Market Value Share, 2025 |

|---|---|

| Fermentation Derived Flavors | 30.0% |

| Probiotic Enhanced Flavors | 25.0% |

Fermentation-derived flavors have been projected to dominate the biotic type segment, capturing 30.0% of the market in 2025 and growing at a CAGR of 9.50% through 2035. This leadership has been driven by robust demand for natural, bioactive taste modulators that align with clean-label positioning.

Ongoing fermentation technology advancements have enabled precision development of flavor profiles with added functional value, while ensuring scalability for large-volume food applications. Additionally, their compatibility with plant-based and vegan formulations has expanded their usage across alternative protein and dairy-free segments. The segment’s growth is expected to be reinforced by biotechnology-driven cost efficiencies and improved stability profiles, placing fermentation-derived solutions at the forefront of next-generation flavor innovation.

| Flavor Type | 2025 Share% |

|---|---|

| Natural Flavors | 35.0% |

| Organic Flavors | 15.0% |

| Artificial Flavors | 10.0% |

Natural flavors are expected to lead the flavor type segment with a 35.0% market share in 2025, underpinned by rising consumer resistance to artificial additives and demand for recognizable ingredients. Enhanced traceability and sustainability credentials have made natural biotic-enhanced flavors a preferred choice across functional foods and clean-label beverages.

Regulatory shifts encouraging the use of natural and organic claims in North America and Europe have further amplified this trend. Advances in natural extraction methods and encapsulation have improved shelf stability, making these flavors suitable for wider applications. With consumers increasingly associating naturalness with health and efficacy, the segment is poised to experience sustained momentum through the forecast period.

| Application | 2025 Share% |

|---|---|

| Food & Beverages | 40.0% |

| Nutraceuticals | 20.0% |

| Functional Foods | 15.0% |

Food and beverage applications are anticipated to retain their leading position, capturing 40.0% of the market in 2025. Their dominance is attributed to widespread integration of biotic-enhanced flavors in yogurts, beverages, snacks, and ready-to-eat meals. Brand strategies increasingly revolve around health-positioned flavors, enabling cleaner labels without sacrificing taste.

Major manufacturers have accelerated reformulation pipelines to include gut-health claims, immunity boosters, and functional botanicals many of which depend on biotic flavor technologies. The segment’s expansion is further supported by growing urban demand for fortified convenience foods. As innovation deepens and consumer literacy around digestive health increases, food and beverages are expected to remain the anchor category for biotic flavor adoption.

Growing regulatory focus on health claims and consumer demand for functional ingredients have propelled innovation in the Biotic-Enhanced Flavors Market. Yet challenges remain in formulation consistency and sensory masking, even as adoption accelerates across food, beverage, and nutraceutical channels.

Policy-Regulatory Push for Functional Labeling and Clean Claims

Global regulatory frameworks have been increasingly aligned toward enabling functional claims, especially those pertaining to digestive health, immunity, and natural origin. This shift has been leveraged by manufacturers to position biotic-enhanced flavors as dual-purpose ingredients offering both sensory and health benefits. In markets such as the EU and USA, front-of-pack labeling schemes and dietary guidelines have created favorable conditions for brands to integrate biotic formulations without facing aggressive regulatory hurdles.

The ability to include terms like "probiotic-enhanced," "fermented-based," or "microbiome-supportive" has been instrumental in consumer acceptance. As transparency becomes a commercial differentiator, formulation pipelines are expected to be aligned more tightly with clean label standards, driving further uptake.

Expansion of Hybrid Flavor Platforms in Functional Foods

A notable trend has emerged through the integration of hybrid flavor platforms wherein biotic-enhanced ingredients are combined with plant-based, botanical, or nootropic components. This evolution has been supported by R&D teams seeking to optimize flavor, mouthfeel, and functionality simultaneously. Hybridization not only improves taste but also enables multi-benefit positioning.

Particularly in protein-fortified snacks, immunity beverages, and cognitive-support gummies, this trend has been gaining traction. As consumer expectations evolve beyond single-function products, hybrid flavors featuring biotic enhancement are expected to lead the next wave of value-added innovation across both mass-market and premium categories.

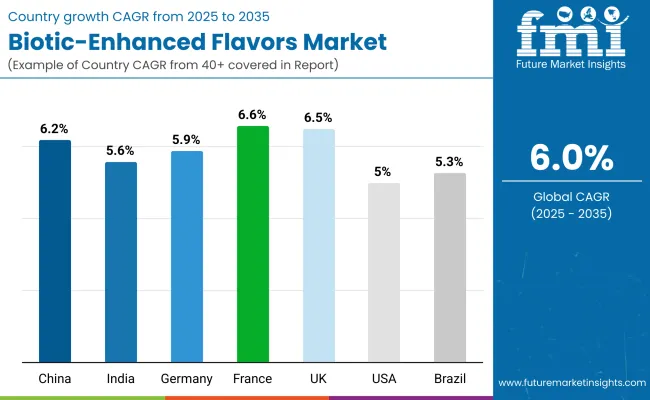

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

| India | 5.6% |

| Germany | 5.9% |

| France | 6.6% |

| UK | 6.5% |

| USA | 5.0% |

| Brazil | 5.3% |

The global Biotic-Enhanced Flavors Market has been characterized by differentiated adoption patterns across major economies, influenced by regulatory support, consumer health literacy, and functional food infrastructure maturity.

Europe is expected to lead in adoption velocity, with France (6.6%) and the UK (6.5%) projected to outpace regional peers due to proactive regulatory stances on clean-label nutrition and high uptake of functional foods. Germany, registering a 5.9% CAGR, has been supported by sustained innovation in fermented and botanical flavor systems tailored for the nutraceutical sector.

China is forecasted to expand at 6.2% CAGR, backed by a booming demand for digestive health solutions and local innovation in prebiotic-rich formulations. In India (5.6% CAGR), growth is being fostered by increased investments from global flavor houses and rising consumer awareness around gut health and immunity especially within the fortified beverage segment.

The U.S. market, with a 5.0% CAGR, is anticipated to see stable yet moderate gains, constrained by regulatory fragmentation and competitive saturation in the dietary supplement segment. Meanwhile, Brazil (5.3%) is emerging as a fast-rising Latin American player, driven by domestic nutraceutical innovation and bioactive ingredient integration in fruit-flavored applications. As the demand for health-aligned flavor systems strengthens, strategic investments are expected to be increasingly channeled into region-specific product development.

| Year | USA Biotic-Enhanced Flavors Market (USD Million) |

|---|---|

| 2025 | 80.5 |

| 2026 | 85.0 |

| 2027 | 90.2 |

| 2028 | 94.8 |

| 2029 | 99.7 |

| 2030 | 104.9 |

| 2031 | 111.3 |

| 2032 | 118.5 |

| 2033 | 126.2 |

| 2034 | 133.2 |

| 2035 | 140.6 |

The USA Biotic-Enhanced Flavors Market is projected to expand from USD 80.5 million in 2025 to USD 140.6 million by 2035, registering a CAGR of approximately 5.6% over the forecast period. Growth is expected to be fueled by an uptick in functional product launches targeting digestive health, mental wellness, and immunity. Increasing adoption of biotic flavors by mainstream F&B brands has been encouraged by regulatory clarity and consumer acceptance of natural and prebiotic claims.

Food processors and supplement formulators have increasingly integrated biotic flavor systems into beverages, gummies, and snack bars, capitalizing on their dual functionality. Demand from the sports nutrition and women’s health segments has further supported category diversification.

As sensory innovation becomes more tightly coupled with wellness delivery, the USA market is expected to maintain consistent mid-single-digit growth, driven by application diversification and cross-category flavor personalization.

The UK market is projected to grow steadily through 2035, supported by heightened consumer prioritization of gut health, immunity, and cognitive wellness. A CAGR of 6.5% is expected, reflecting increased functional ingredient inclusion across plant-based dairy, meal replacements, and snack formats. Local innovation has been encouraged by the UK’s proactive stance on food labeling, allowing biotic-enhanced flavors to gain traction in clean-label product formulations.

Regulatory flexibility and a strong retail health & wellness culture are expected to drive flavor innovation across mid-premium and mass-market segments.

India’s food-waste derived protein market is forecasted to register strong growth through 2035, supported by government initiatives under the Food Processing and Swachh Bharat missions. Decentralized bioprocessing units have been promoted to convert agri-waste, pulse husks, and fruit pulp into protein-rich inputs for domestic food, feed, and supplement sectors. The market has been shaped by demand for affordable, high-volume functional ingredients aligned with nutrition security goals.

China is projected to grow at a 6.2% CAGR between 2025 and 2035, led by robust demand for gut health supplements, functional beverages, and smart nutrition. Innovation in fermentation-based flavor systems has been accelerated by deep integration of traditional Chinese medicine (TCM) with modern flavor science. Regulatory modernization has supported expanded probiotic labeling, encouraging both domestic and international players.

China’s dual emphasis on food safety and health positioning is expected to support widespread biotic flavor adoption across F&B, pharma, and nutraceutical sectors.

| Countries | 2025 |

|---|---|

| UK | 19.7% |

| Germany | 21.8% |

| Italy | 9.1% |

| France | 13.7% |

| Spain | 9.9% |

| BENELUX | 6.8% |

| Nordic | 5.7% |

| Rest of Europe | 13.3% |

| Countries | 2035 |

|---|---|

| UK | 18.6% |

| Germany | 20.1% |

| Italy | 11.9% |

| France | 14.8% |

| Spain | 11.9% |

| BENELUX | 5.4% |

| Nordic | 5.2% |

| Rest of Europe | 12.2% |

Germany’s market is expected to expand at a 5.9% CAGR, anchored by strong institutional research, clean-label compliance, and high demand for natural health-enhancing ingredients. Biotic-enhanced flavors are being rapidly adopted in protein-enriched foods, dairy alternatives, and specialized medical nutrition.

Innovation is being reinforced by collaborations between ingredient suppliers and pharmaceutical flavor houses. Germany is expected to continue leading Europe's biotic flavor innovation, driven by strong R&D capacity, B2B demand maturity, and health-aware consumer preferences.

| Biotic Type | Market Value Share, 2025 |

|---|---|

| Probiotic Enhanced Flavors | 26.0% |

| Prebiotic Enhanced Flavors | 21.0% |

| Fermentation Derived Flavors | 29.0% |

| Enzyme Enhanced Flavors | 14.0% |

| Microbial Culture Enhanced Flavors | 10.0% |

The Biotic-Enhanced Flavors Market in Japan is projected to reach USD 14.1 million by 2025. Fermentation-derived flavors are anticipated to lead with a 29.0% share, closely followed by probiotic-enhanced variants at 26.0%, reflecting Japan’s longstanding cultural alignment with fermented and gut-friendly foods. This consumer familiarity has been leveraged by manufacturers to enhance sensory depth while offering scientifically-backed health benefits.

The segmental tilt toward fermentation-based and microbial culture-driven systems has been reinforced by R&D investment in umami modulation and flavor stabilization for functional foods. Furthermore, traditional Japanese dietary preferences centered on soy, rice, and miso-based formats have provided a natural base for biotic flavor innovation.

As Japan’s aging population prioritizes digestive and cognitive wellness, flavor systems designed to support microbiome health are expected to gain deeper market penetration. AI-assisted flavor profiling and microbiome-personalized formulations are likely to redefine premium offerings in coming years.

| Application | Market Value Share, 2025 |

|---|---|

| Food & Beverages | 42.0% |

| Nutraceuticals | 19.0% |

| Functional Foods | 16.0% |

| Dietary Supplements | 14.0% |

| Pharmaceuticals | 9.0% |

The Biotic-Enhanced Flavors Market in South Korea is projected to expand steadily, with Food & Beverages expected to dominate at 42.0% share in 2025. This leadership is attributed to the nation’s deeply ingrained fermented food culture, which has provided an optimal launchpad for biotic flavor innovation. Rising consumer preference for probiotic-enriched beverages and traditional foods like kimchi and yakult has enhanced mainstream acceptance.

Functional foods and dietary supplements are also gaining traction, supported by South Korea’s tech-forward healthcare system and digitally connected wellness ecosystem. Biotic-enhanced flavor systems have been integrated into convenience foods, healthy snacks, and immunity-supporting drinkable yogurts. As consumer education rises and medical-nutrition overlaps deepen, South Korea is expected to become a regional benchmark for innovation in flavor-based functional delivery systems.

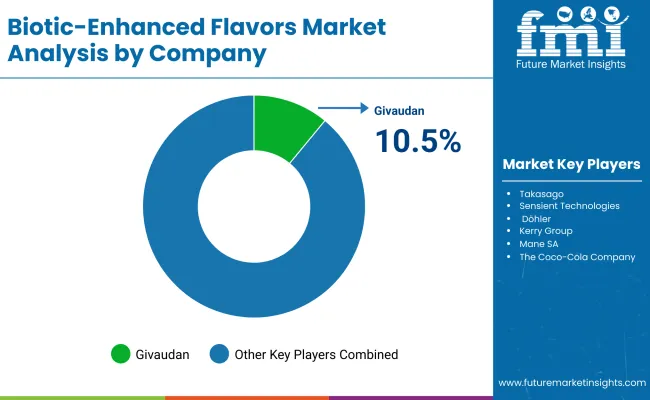

The Biotic-Enhanced Flavors Market is moderately fragmented, with a competitive mix of multinational giants, agile mid-sized innovators, and regional flavor specialists addressing evolving demand across food, beverage, nutraceutical, and pharmaceutical segments.

Global flavor leaders such as Givaudan, Firmenich, and Kaneka Probiotics have been positioned at the forefront, driven by diversified portfolios in fermentation-based and probiotic flavor systems. Their strategies have increasingly emphasized microbiome-focused R&D, AI-assisted flavor design, and vertically integrated fermentation capabilities to meet demand for clean-label and functional formulations.

Mid-sized companies such as Symrise AG, Sensient Technologies, and Takasago have focused on fast prototyping, botanical-biotic hybrid development, and region-specific sensory tailoring. These firms have accelerated product innovation by coupling traditional flavor science with encapsulation technologies and clinical substantiation—making them well-positioned in performance nutrition and functional snacks.

Companies like Kerry Group, Döhler, and Mane SA have leveraged fermentation and enzymatic platforms to serve dairy alternatives, RTD beverages, and nutraceutical applications. Their strength has been observed in localized application labs and co-creation with D2C and private-label brands.

Differentiation is shifting from conventional flavor attributes to integrated health benefits, regulatory validation, and multifunctional delivery systems. Subscription-based digital R&D partnerships and sensory-personalized solutions are expected to define the next wave of competition.

Key Developments in Biotic-Enhanced Flavors

| Item | Value |

|---|---|

| Quantitative Units | USD 335.6 million |

| Biotic Type | Probiotic-Enhanced Flavors, Prebiotic-Enhanced Flavors, Fermentation-Derived Flavors, Enzyme-Enhanced Flavors, Microbial Culture-Enhanced Flavors |

| Flavor Type | Natural Flavors, Organic Flavors, Botanical & Herbal Flavors, Fruit & Vegetable Flavors, Artificial Flavors, Dairy-Derived Flavors |

| Application | Food & Beverages, Nutraceuticals, Functional Foods, Dietary Supplements, Pharmaceuticals |

| Product Form | Liquid Flavors, Powder Flavors, Encapsulated Flavors, Concentrates & Extracts |

| End User | Food & Beverage Industry, Nutraceutical Industry, Pharmaceutical Industry |

| Sales Channel | Food & Beverage Manufacturers (B2B), Nutraceutical & Supplement Companies, Direct-to-Consumer (D2C), Online Retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Givaudan, Firmenich, Symrise AG, International Flavors & Fragrances (IFF), Takasago, Sensient Technologies, Döhler, Kerry Group, Mane SA, The Coco-Cola Company, and Kaneka Probiotics |

| Additional Attributes | Flavor system integration with microbiome health trends; probiotic-prebiotic blends; personalized nutrition applications; clean-label demand acceleration; region-specific regulatory insights; co-creation with functional food & supplement startups; innovation in taste masking and delivery systems; encapsulation an d fermentation process advances |

The global Biotic-Enhanced Flavors is estimated to be valued at USD 335.6 million in 2025.

The market size for the Biotic-Enhanced Flavors is projected to reach USD 600.5 million by 2035.

The Biotic-Enhanced Flavors is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key flavor types in the Biotic-Enhanced Flavors Market are natural flavors, organic flavors, botanical & herbal flavors, fruit & vegetable flavors, artificial flavors, dairy-derived flavors.

In terms of biotic type, the fermentation-derived flavors segment is projected to command the largest share at 30.0% of the Biotic-Enhanced Flavors Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enhanced Oil Recovery Market Size and Share Forecast Outlook 2025 to 2035

Flavors for Pharmaceutical & Healthcare Applications Market Size and Share Forecast Outlook 2025 to 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Enhanced Water Market Insights – Trends, Demand & Growth 2025-2035

Eubiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Chewing Gum Market Size and Share Forecast Outlook 2025 to 2035

Probiotics For Oral Health Market Size and Share Forecast Outlook 2025 to 2035

AI enhanced Mammography Screening Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Face Masks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Prebiotic Fiber Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Synbiotic Pet Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Fermentation Skincare Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Global Probiotic Serum Market Size and Share Forecast Outlook 2025 to 2035

Prebiotic Deodorants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Probiotic Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA