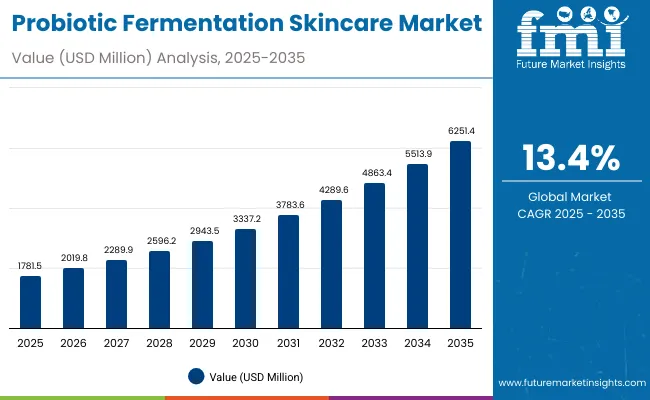

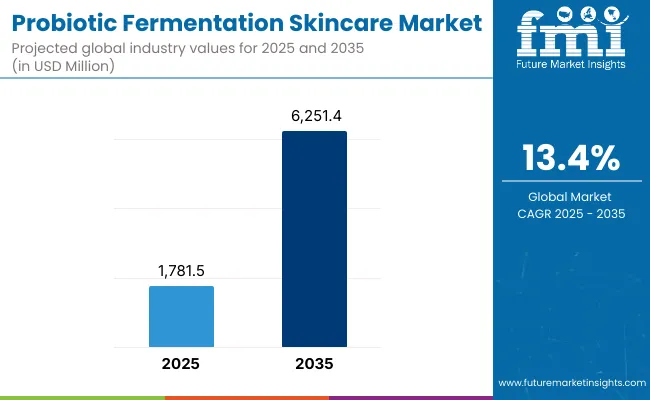

The Global Probiotic Fermentation Skincare Market is expected to record a valuation of USD 1,781.5 million in 2025 and USD 6,251.4 million in 2035, with an increase of USD 4,469.9 million, which equals a growth of more than 193% over the decade. The overall expansion represents a CAGR of 13.4% and a 3.5X increase in market size.

Global Probiotic Fermentation Skincare Market Key Takeaways

| Metric | Value |

|---|---|

| Global Probiotic Fermentation Skincare Market Estimated Value in (2025E) | USD 1,781.5 million |

| Global Probiotic Fermentation Skincare Market Forecast Value in (2035F) | USD 6,251.4 million |

| Forecast CAGR (2025 to 2035) | 13.4% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,781.5 million to USD 3,337.2 million, adding USD 1,555.7 million, which accounts for nearly 35% of the total decade growth. This phase records steady adoption in microbiome-balancing formulations, hydration-based creams, and early adoption of clean-label probiotic serums. Microbiome balance dominates this period as it caters to over 40% of functional applications, with consumers increasingly focused on barrier repair and skin health resilience.

The second half from 2030 to 2035 contributes USD 2,914.2 million, equal to around 65% of total growth, as the market jumps from USD 3,337.2 million to USD 6,251.4 million. This acceleration is powered by widespread deployment of clinical-grade probiotics in skincare, AI-based customization in e-commerce channels, and hybrid probiotic actives combining fermentation with botanicals. Serums and creams together capture a larger share above 60% by the end of the decade. E-commerce-led subscriptions and direct-to-consumer models add recurring revenue, increasing the digital channel share beyond 40% in total value.

From 2020 to 2024, the Global Probiotic Fermentation Skincare Market grew from USD 1,020 million to USD 1,640 million, driven by function-centric adoption. During this period, the competitive landscape was dominated by skincare specialists and beauty conglomerates controlling nearly 80% of revenue, with leaders such as L’Oréal, TULA Skincare, and Amorepacific focusing on microbiome-supportive serums and creams for premium skincare consumers.

Competitive differentiation relied on product safety, natural/organic positioning, and consumer trust, while clean-label claims were often bundled as supporting narratives rather than primary revenue drivers. Service-based personalization, such as AI-powered skin analysis and subscription refills, had minimal traction, contributing less than 10% of the total market value.

Demand for probiotic skincare will expand to USD 1,781.5 million in 2025, and the revenue mix will shift as e-commerce and specialty beauty channels grow to over 40% share. Traditional brand leaders face rising competition from indie probiotic innovators offering vegan, clinical-grade, and fermentation-focused solutions with strong influencer and dermatologist endorsement.

Major multinational brands are pivoting to hybrid models, integrating probiotics into anti-aging lines and digital-first launches to retain relevance. Emerging entrants specializing in microbiome mapping, AR/VR try-on, and bio-fermented actives are gaining share. The competitive advantage is moving away from branding alone to ecosystem strength, data-driven personalization, and subscription-based recurring revenue models.

Advances in probiotic formulations have improved strain stability and efficacy, allowing for more efficient delivery of live and postbiotic cultures across diverse skincare formats. Microbiome balance has gained popularity due to its suitability for barrier support, acne management, and sensitivity reduction. The rise of fermentation technology has contributed to enhanced bioavailability and real-time efficacy, making products more appealing for hydration, soothing, and anti-aging needs. Industries such as beauty, dermatology, and wellness are driving demand for probiotic skincare that integrates seamlessly into daily routines while offering measurable clinical results.

Expansion of e-commerce subscriptions, influencer-driven education, and dermatology collaborations have fueled market growth. Innovations in portable refill systems, customized serums, and AI-powered diagnostics are expected to open new application areas. Segment growth is expected to be led by microbiome balance in function categories, serums in product type categories, and e-commerce in channel categories due to their precision, adaptability, and personalization.

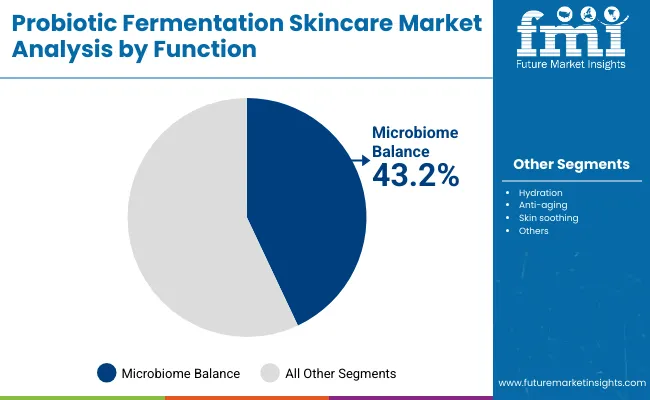

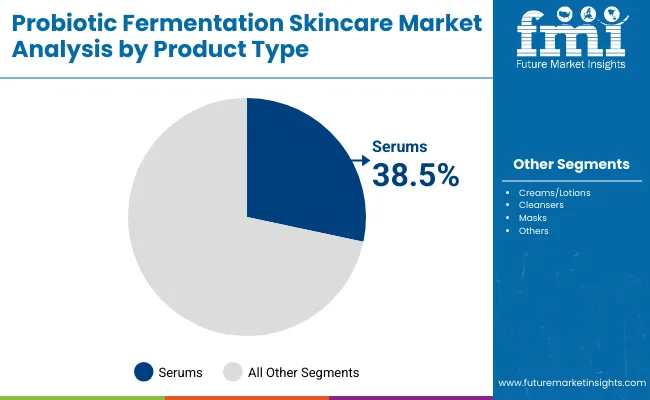

The market is segmented by function, product type, channel, claim, and region. Functional categories include microbiome balance, hydration, anti-aging, and skin soothing, highlighting the core elements driving adoption. Product type segmentation covers serums, creams/lotions, cleansers, and masks to cater to different consumer routines. Based on channel, the segmentation includes e-commerce, pharmacies, specialty beauty stores, and mass retail. In terms of claims, categories encompass natural/organic, vegan, clean-label, and clinical-grade, reflecting consumer priorities. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| Function Segment | Market Value Share, 2025 |

|---|---|

| Microbiome balance | 43.2% |

| Others | 56.8% |

The microbiome balance segment is projected to contribute 43.2% of the Global Probiotic Fermentation Skincare Market revenue in 2025, maintaining its lead as the dominant functional category. This is driven by consumer preference for formulations that strengthen the skin barrier, reduce sensitivity, and improve resilience against environmental stressors. Microbiome-focused actives have gained clinical credibility, making them the most trusted functional benefit among dermatologists and consumers alike.

The segment’s growth is also supported by rising demand for probiotics targeting acne-prone and sensitive skin, where balance restoration is a primary skincare goal. As awareness of skin microbiota continues to expand, brands are positioning microbiome balance not just as a benefit but as a foundational skincare philosophy. The segment is expected to retain its position as the backbone of probiotic skincare systems.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Serums | 38.5% |

| Others | 61.5% |

The serums segment is forecasted to hold 38.5% of the market share in 2025, led by its concentrated formulations and ability to deliver probiotics directly to the skin. These formats are favored for their high efficacy and targeted action, making them ideal for premium consumers seeking anti-aging, hydration, and microbiome-specific results.

Their lightweight design and compatibility with multi-step routines have facilitated widespread adoption in both Western and Asian skincare regimens. The segment’s growth is bolstered by advancements in encapsulation and fermentation technologies that improve probiotic stability and potency. As consumers increasingly require targeted solutions, serums are expected to continue their dominance in the market.

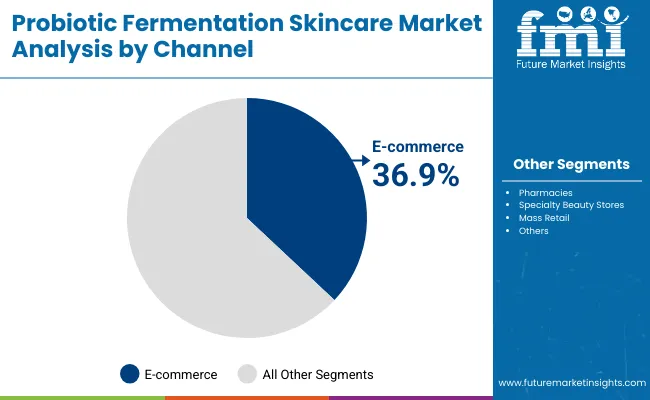

| Channel Segment | Market Value Share, 2025 |

|---|---|

| E-commerce | 36.9% |

| Others | 63.1% |

The e-commerce segment is projected to account for 36.9% of the Global Probiotic Fermentation Skincare Market revenue in 2025, establishing it as the leading channel. This channel is preferred for its convenience, access to niche probiotic brands, and integration with digital consultations.

Its suitability for subscription models, influencer-driven launches, and personalized recommendations has made it popular across North America, East Asia, and Europe. Developments in AI-based skin diagnostics and direct-to-consumer strategies have further strengthened e-commerce traction. Given its balance of accessibility and customization, e-commerce is expected to maintain its leading role in the Global Probiotic Fermentation Skincare Market.

Rising Consumer Awareness of Microbiome Health

One of the strongest growth drivers in the global probiotic fermentation skincare market is the rising consumer awareness of the skin microbiome and its direct impact on skin health. Consumers are increasingly linking common conditions such as acne, dryness, sensitivity, and premature aging to imbalances in skin bacteria. This has fueled demand for formulations that can rebalance the microbiome while also delivering visible cosmetic benefits. The appeal is heightened by scientific validation, with clinical trials and dermatology endorsements strengthening credibility.

Brands such as TULA Skincare and Gallinée have positioned microbiome balance as the core of their product lines, attracting consumers who are looking for long-term skin health rather than quick fixes. This awareness is particularly strong among younger generations, who are highly informed through digital platforms and are eager to adopt skincare routines that emphasize prevention and holistic well-being.

Expansion of Digital Channels and Subscription Models

The expansion of e-commerce and direct-to-consumer subscription models is another major driver for the probiotic fermentation skincare market. Online platforms allow niche probiotic skincare brands to scale globally without relying on traditional retail channels. E-commerce provides consumers with easy access to specialized probiotic products that may not be widely available in physical stores. Furthermore, subscription models-often paired with AI-driven skin analysis tools-encourage recurring purchases and build brand loyalty.

This digital shift is especially significant in East Asia and North America, where online skincare sales are booming. It not only lowers distribution costs for companies but also allows for personalization and targeted marketing, which are highly effective for probiotics that require education and brand trust. The convenience and recurring nature of e-commerce subscriptions will continue to drive strong revenue growth for this segment.

High Production Costs and Formulation Challenges

Despite the strong growth outlook, high production costs remain a major barrier for probiotic fermentation skincare. Probiotics and postbiotics require advanced fermentation technologies, encapsulation methods, and strict storage conditions to maintain stability and efficacy. This raises costs significantly compared to conventional skincare formulations. Furthermore, probiotics are sensitive to heat, light, and preservatives, making large-scale production and long shelf-life formulations technically challenging. As a result, many products come at a premium price point, limiting accessibility in mass-market channels. Unless technology reduces costs and improves stability, price-sensitive consumers may hesitate to adopt probiotic skincare widely.

Regulatory and Labeling Uncertainty

Another restraint is the lack of clear regulatory frameworks and standardized labeling across global markets. Probiotic skincare often falls in a gray area between cosmetics and therapeutic products. While terms like "probiotic," "prebiotic," and "postbiotic" are increasingly used, their definitions and claims are not always consistent or verified by regulatory authorities.

This ambiguity can create consumer skepticism and limit brand credibility, especially in mature markets such as the USA and Europe where consumers demand proof of efficacy. Furthermore, without standardized rules, some brands make misleading claims, which could trigger regulatory crackdowns and erode overall market trust. Establishing clear definitions and clinical proof will be critical for the long-term success of this segment.

Shift Toward Clinical-Grade Probiotic Skincare

A major trend shaping the global probiotic fermentation skincare market is the shift toward clinical-grade products backed by dermatologists and clinical trials. While early adopters were drawn by natural and organic positioning, the next wave of growth is driven by scientifically validated claims.

Consumers increasingly expect proof of efficacy, especially when it comes to acne reduction, anti-aging, and skin barrier repair. Brands are responding by funding clinical research, publishing results, and collaborating with dermatologists to strengthen product legitimacy. Clinical-grade probiotics are also entering professional dermatology clinics, expanding beyond retail shelves. This trend is expected to accelerate, as consumers seek a combination of natural benefits and evidence-based performance.

Integration of Probiotics with Other Functional Actives

Another important trend is the integration of probiotics with other functional skincare actives, such as hyaluronic acid for hydration, peptides for anti-aging, and botanical extracts for soothing. Instead of stand-alone probiotic products, brands are formulating multi-functional solutions that address multiple skin concerns simultaneously.

This approach enhances consumer appeal, as buyers increasingly prefer products that are both microbiome-supportive and comprehensive in skincare benefits. For instance, hybrid formulations combining probiotics with niacinamide or ceramides are gaining popularity in serums and creams. This cross-functional blending not only enhances perceived value but also helps probiotic skincare enter mainstream categories, positioning it as a versatile solution rather than a niche product.

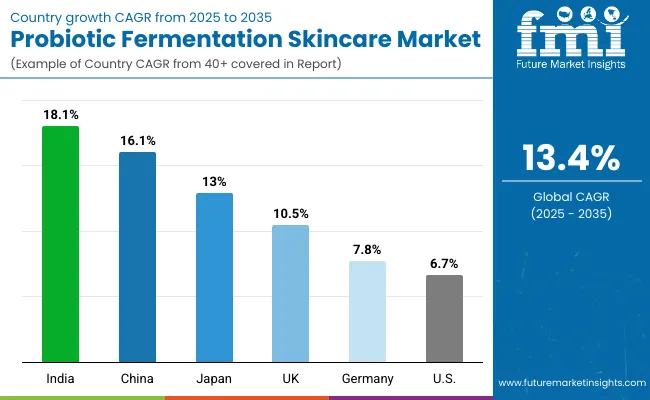

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 16.1% |

| USA | 6.7% |

| India | 18.1% |

| UK | 10.5% |

| Germany | 7.8% |

| Japan | 13.0% |

Between 2025 and 2035, the Global Probiotic Fermentation Skincare Market will witness significant geographical differences in growth rates, reflecting consumer behavior, economic conditions, and innovation pipelines across countries. India (18.1% CAGR) and China (16.1% CAGR) stand out as the fastest-growing markets, driven by expanding middle-class populations, rising disposable incomes, and growing adoption of probiotic-based skincare as part of premium beauty routines.

India’s growth is further accelerated by strong demand for natural, clean-label, and vegan formulations, while China benefits from advanced e-commerce ecosystems and a deep integration of probiotic skincare into K-beauty and J-beauty influenced routines. Japan (13.0% CAGR) also records strong growth, supported by a mature beauty industry that emphasizes technology-driven innovation and high trust in fermentation-based ingredients, which already have cultural familiarity in food and wellness.

On the other hand, Western markets show moderate yet stable growth. The USA (6.7% CAGR) reflects slower expansion due to higher market maturity and consumer caution around premium pricing, although microbiome balance claims continue to gain traction. Germany (7.8% CAGR) shows resilience in Europe, with rising demand for clean-label and clinical-grade skincare driving adoption in pharmacies and specialty beauty stores.

The UK (10.5% CAGR) represents one of the stronger European performers, benefitting from consumer openness to natural and vegan claims and a strong online beauty ecosystem. Collectively, while emerging Asian economies lead in rapid adoption, mature Western economies will play a stabilizing role, ensuring that the global market sustains long-term growth through both innovation-driven expansion and steady consumer loyalty.

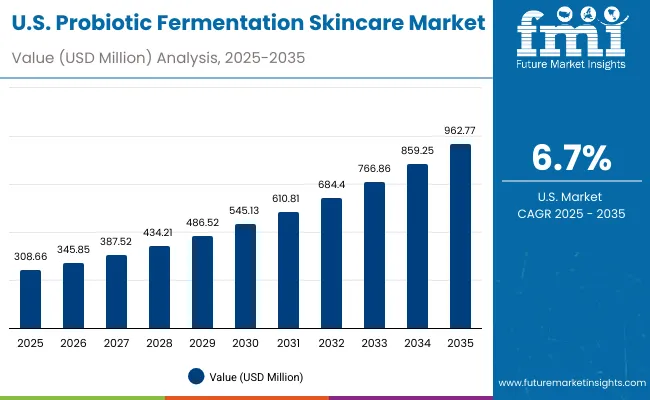

| Year | USA Probiotic Fermentation Skincare Market (USD Million) |

|---|---|

| 2025 | 308.7 |

| 2026 | 345.8 |

| 2027 | 387.5 |

| 2028 | 434.2 |

| 2029 | 486.5 |

| 2030 | 545.1 |

| 2031 | 610.8 |

| 2032 | 684.4 |

| 2033 | 766.9 |

| 2034 | 859.2 |

| 2035 | 962.8 |

The Global Probiotic Fermentation Skincare Market in the United Kingdom is expected to grow at a CAGR of 10.5%, driven by rapid adoption of vegan and clean-label probiotic formulations. Digital-first beauty brands and subscription platforms have accelerated penetration, supported by high consumer trust in natural and microbiome-based claims.

Retail chains are beginning to integrate probiotic skincare into mainstream aisles, while online-exclusive launches remain popular among younger demographics. The UK consumer base shows strong awareness of sustainability, packaging innovation, and eco-friendly positioning, which continues to push probiotic skincare into the premium lifestyle segment.

India is witnessing rapid growth in the Global Probiotic Fermentation Skincare Market, which is forecast to expand at a CAGR of 18.1% through 2035, the highest among major markets. Rising middle-class incomes and increasing awareness of microbiome health are fueling demand in both metros and tier-2 cities.

Natural and ayurveda-inspired brands are actively incorporating probiotics into skincare, resonating with consumer preferences for holistic wellness. E-commerce platforms are critical enablers, providing affordable access and driving discovery of niche probiotic brands. Educational campaigns around skin microbiota are gaining traction, further strengthening consumer confidence.

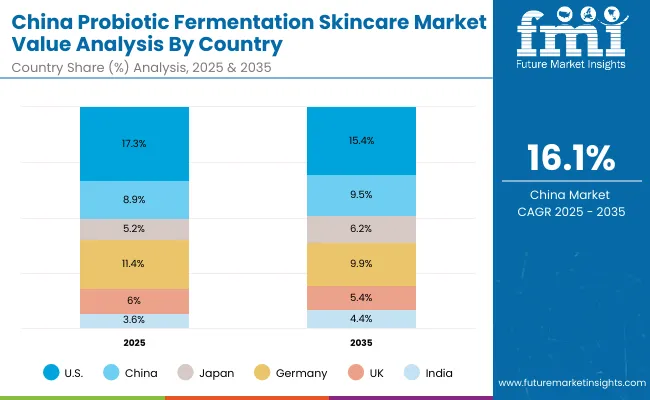

The Global Probiotic Fermentation Skincare Market in China is expected to grow at a CAGR of 16.1%, among the highest worldwide. The surge is driven by advanced e-commerce ecosystems, K-beauty inspired routines, and rapid consumer adoption of fermentation-based serums and creams. Chinese consumers are increasingly focused on skin barrier restoration and hydration, making probiotics highly relevant in addressing pollution-linked skin concerns.

Local beauty tech firms are innovating aggressively, launching affordable probiotic serums, while premium global brands capture the upper end of the market with clinical-grade claims. Government emphasis on clean beauty standards and strong cross-border e-commerce channels further amplify growth.

| Country | 2025 Share (%) |

|---|---|

| USA | 17.3% |

| China | 8.9% |

| Japan | 5.2% |

| Germany | 11.4% |

| UK | 6.0% |

| India | 3.6% |

| Country | 2035 Share (%) |

|---|---|

| USA | 15.4% |

| China | 9.5% |

| Japan | 6.2% |

| Germany | 9.9% |

| UK | 5.4% |

| India | 4.4% |

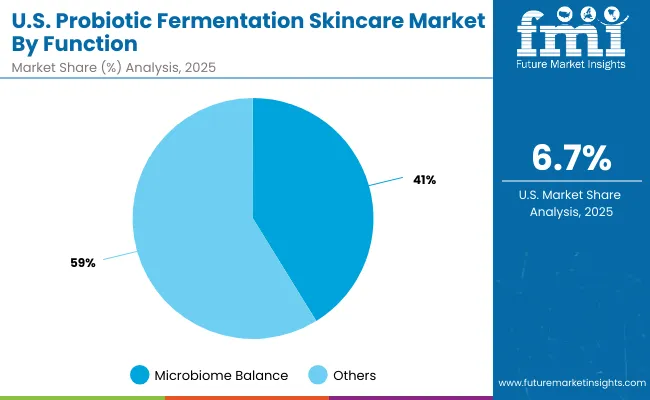

| Function Segment | Market Value Share, 2025 |

|---|---|

| Microbiome balance | 41.2% |

| Others | 58.8% |

The Global Probiotic Fermentation Skincare Market in the United States is valued at USD 308.66 million in 2025, with microbiome balance leading at 41.2% of market share. The dominance of microbiome-focused formulations is a direct outcome of the USA skincare culture, where consumers prioritize skin barrier repair, acne management, and sensitivity relief.

Dermatology-endorsed brands and premium clinical-grade products have gained strong acceptance, making microbiome balance a cornerstone of probiotic skincare positioning. This segment benefits from established pharmacy chains and specialty beauty outlets that emphasize science-backed skincare.

This advantage positions microbiome formulations as essential for consumers seeking long-term wellness benefits alongside cosmetic results. Anti-aging and hydration segments remain important but less differentiated, while clinical-grade microbiome serums create new revenue opportunities. As digital-first brands expand e-commerce penetration, AI-driven personalization and subscription bundles will become the next stage of growth in the USA market.

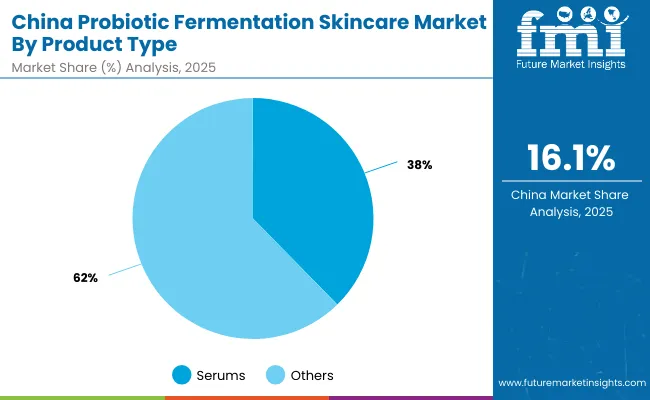

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Serums | 37.5% |

| Others | 62.5% |

The Global Probiotic Fermentation Skincare Market in China is valued at USD 157.76 million in 2025, with serums leading at 37.5% of market share. The preference for serums reflects China’s skincare routine structure, heavily influenced by K-beauty and J-beauty practices that emphasize layering lightweight, high-efficacy products. Serums are particularly popular for hydration, brightening, and anti-aging claims, making them the ideal format for probiotic actives. Younger consumers in urban centers are also drawn to serum textures for their compatibility with multi-step regimens and quick absorption.

This advantage positions probiotic serums as the most visible entry point for global and local brands alike, while creams and lotions remain important for mass-market expansion. Affordable probiotic formulations from domestic brands are expanding access, while premium international players capture aspirational consumers with clinical-grade claims. As cross-border e-commerce grows, China is expected to remain one of the strongest drivers of probiotic skincare innovation and volume.

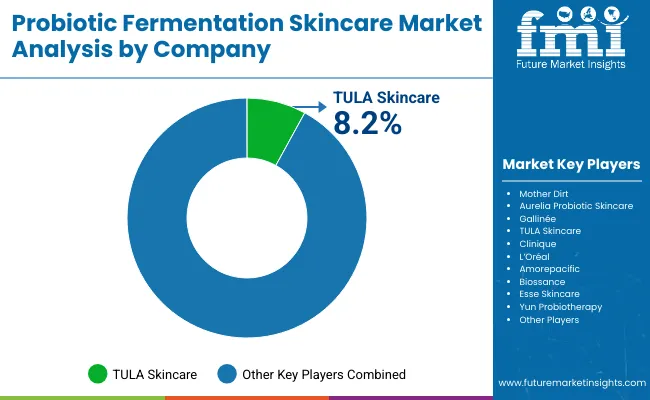

| Companies | Global Value Share 2025 |

|---|---|

| TULA Skincare | 8.2% |

| Others | 91.8% |

The Global Probiotic Fermentation Skincare Market is moderately fragmented, with multinational leaders, emerging indie innovators, and niche microbiome-focused specialists competing across categories. Global beauty leaders such as L’Oréal, Amorepacific, and Clinique hold significant market presence, driven by advanced research pipelines, strong distribution networks, and integration of probiotics into established product lines.

Their strategies emphasize clinical validation, dermatologist-backed claims, and omnichannel penetration across both retail and e-commerce platforms.Established indie players, including TULA Skincare, Gallinée, and Aurelia Probiotic Skincare, are highly visible in North America and Europe, appealing to consumers seeking microbiome-specific skincare with strong brand authenticity. These companies are accelerating adoption through e-commerce, influencer collaborations, and product positioning around clean-label and vegan claims, making them relevant for millennial and Gen Z consumers.

Specialized brands such as Mother Dirt, Esse Skincare, Biossance, and Yun Probiotherapy focus on highly differentiated formulations, leveraging live probiotics, postbiotic fermentations, and hybrid natural actives. Their strength lies in customization, sustainability, and targeting consumers seeking niche, science-driven skincare solutions.

Competitive differentiation is shifting away from brand heritage alone toward ecosystem-based advantages that combine personalized digital experiences, subscription refills, AI-driven product recommendations, and sustainability credentials. In this context, probiotic skincare players that can merge scientific credibility with lifestyle positioning are likely to secure long-term growth.

Key Developments in Global Probiotic Fermentation Skincare Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,781.5 million |

| Function | Microbiome balance, Hydration, Anti-aging, and Skin soothing |

| Product Type | Serums, Creams/lotions, Cleansers, and Masks |

| Channel | E-commerce, Pharmacies, Specialty beauty stores, and Mass retail |

| Claim | Natural/organic, Vegan, Clean-label, and Clinical-grade |

| f Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FARO Technologies, Inc., 3D Digital Corporation, 3D Systems, Inc., Autodesk, Inc., Artec 3D, Automated Precision, Inc. (API), Carl Zeiss Optotechnik GmbH, Creaform Inc., Direct Dimensions Inc., GOM GmbH, Hexagon AB, Konica Minolta, Inc., NextEngine Inc., Nikon Corporation, OGI Systems Ltd, and ShapeGrabber |

| Additional Attributes | Dollar sales by scanner type and end-use industry, adoption trends in reverse engineering and quality control, rising demand for handheld and portable 3D scanners, sector-specific growth in aerospace, automotive, and healthcare, software and services revenue segmentation, integration with AR/VR and digital twin technologies, regional trends influenced by digitization initiatives, and innovations in laser triangulation, structured light, and photogrammetry methods. |

The Global Probiotic Fermentation Skincare Market is estimated to be valued at USD 1,781.5 million in 2025.

The market size for the Global Probiotic Fermentation Skincare Market is projected to reach USD 6,251.4 million by 2035.

The Global Probiotic Fermentation Skincare Market is expected to grow at a 13.4% CAGR between 2025 and 2035.

The key product types in the Global Probiotic Fermentation Skincare Market are serums, creams/lotions, cleansers, and masks.

In terms of function, the microbiome balance segment is projected to command 43.2% share in the Global Probiotic Fermentation Skincare Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Probiotic Chewing Gum Market Size and Share Forecast Outlook 2025 to 2035

Probiotics For Oral Health Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Face Masks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Global Probiotic Serum Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Yogurt Market Analysis - Size, Share & Forecast 2025 to 2035

Probiotic Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic for Kids Market Analysis - Size, Share, and Forecast 2025 to 2035

Probiotic Fermented Milk Market Growth & Demand Forecast 2025 to 2035

Probiotic for Men Market Analysis by Product, Sales Channel and Strain Type Through 2035

Probiotic Cheese Market Cheese Type, Bacteria Type, Sales Channel and Others through 2035

Comprehensive Probiotic Strains market analysis and forecast by strain type, application and region.

Probiotic Cosmetics Market Trends - Growth & Forecast 2025 to 2035

Probiotic Supplements Market Share Analysis – Key Trends & Forecast 2025-2035

Market Share Breakdown of Probiotic Ingredients

Probiotics After Antibiotic Recovery Market Analysis by Ingredient and Sales Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA