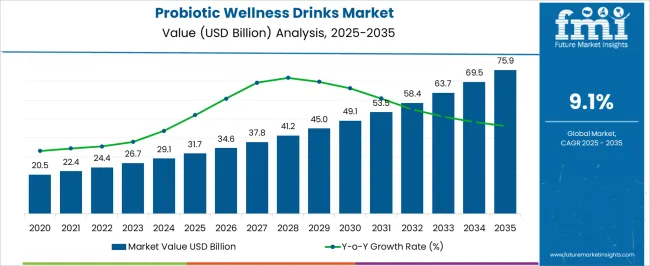

The probiotic wellness drinks market is projected at USD 31.7 billion in 2025 and expected to reach USD 75.9 billion by 2035, advancing at a CAGR of 9.1% during the forecast period. The breakpoint analysis highlights several key phases of market transformation. Initially, between 2025 and 2028, growth is anticipated to stem from rising consumer education about gut health, immunity, and digestive benefits, which will push early adoption across urban populations.

By 2030, the market is expected to cross a crucial inflection point as functional beverages gain mainstream penetration, with supermarkets and e-commerce channels expanding their probiotic offerings. Another major breakpoint occurs in the 2032–2035 period, where innovation in flavors, plant-based alternatives, and low-sugar formulations will broaden the consumer base, particularly in Asia-Pacific and North America. Partnerships between beverage brands, dairy producers, and nutraceutical companies will play a vital role in achieving economies of scale and global distribution. Moreover, stricter health regulations and scientific endorsements of probiotics’ efficacy will drive consumer confidence and boost premiumization in the category. These breakpoints indicate a shift from niche health-conscious buyers in the mid-2020s toward a mass-market adoption model by 2035, making probiotics an integral part of daily nutrition.

| Metric | Value |

|---|---|

| Probiotic Wellness Drinks Market Estimated Value in (2025 E) | USD 31.7 billion |

| Probiotic Wellness Drinks Market Forecast Value in (2035 F) | USD 75.9 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

Five core parent markets shape the probiotic wellness drinks market, each contributing a distinct share to overall growth and adoption. The health and nutrition market holds the largest share at 35%, driven by rising consumer focus on gut health, immunity, and preventive wellness. Probiotic drinks are positioned as functional solutions that fit daily nutrition routines, making this segment the cornerstone of demand.

The food and beverage market contributes 25%, supported by dairy-based probiotic drinks, plant-based alternatives, and flavored functional beverages that appeal to mainstream consumers seeking taste along with health benefits. The pharmaceutical and nutraceuticals market accounts for 20%, where probiotic formulations are prescribed or recommended for digestive disorders, antibiotic recovery, and general health supplementation. The fitness and sports nutrition market represents 12%, as athletes and active consumers increasingly rely on probiotic-infused drinks for recovery, improved digestion, and overall performance enhancement.

The retail and e-commerce distribution market holds 8%, acting as an enabler that ensures accessibility and scale, with online platforms, supermarkets, and specialty health stores driving bulk sales.

The probiotic wellness drinks market is witnessing robust expansion, supported by heightened consumer awareness regarding gut health and the growing preference for functional beverages as part of daily dietary routines. Market growth is being reinforced by advancements in fermentation technologies, improved cold-chain logistics, and diversified flavor profiles that enhance consumer appeal.

Rising disposable incomes in emerging economies and the increasing penetration of premium wellness products in developed regions are contributing to broader adoption. The current scenario is characterized by competitive innovation, with producers introducing clean-label, low-sugar, and plant-based formulations to capture health-conscious segments.

Regulatory clarity in major markets is further aiding product standardization and trust-building among consumers. Over the forecast period, market expansion will be driven by synergistic marketing strategies, expanding retail availability, and continued alignment with preventive healthcare trends, positioning probiotic wellness drinks as a mainstream functional beverage category with strong revenue growth potential.

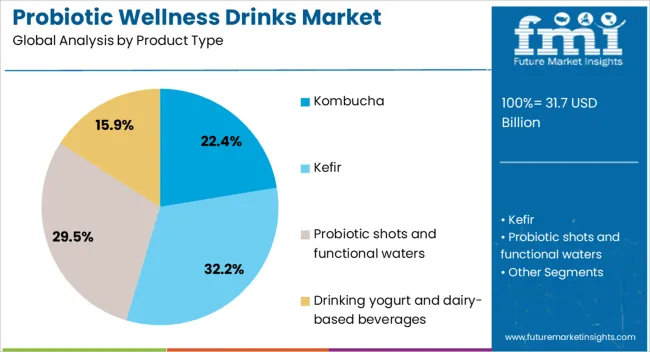

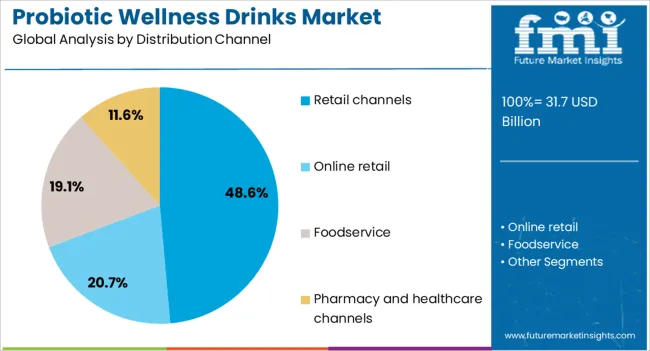

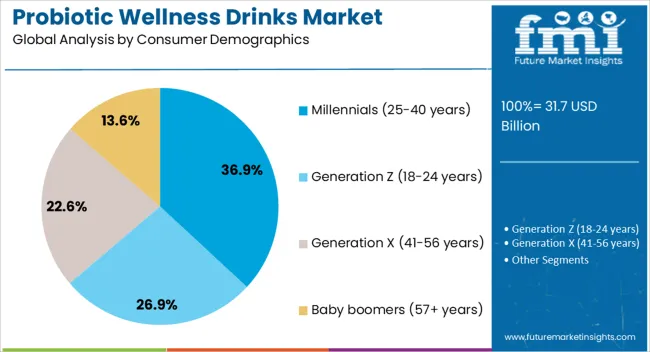

The probiotic wellness drinks market is segmented by product type, distribution channel, consumer demographics, and geographic regions. By product type, probiotic wellness drinks market is divided into Kombucha, Kefir, Probiotic shots and functional waters, Drinking yogurt and dairy-based beverages, Plant-based probiotic beverages, and Probiotic sodas and carbonated drinks.

In terms of distribution channel, probiotic wellness drinks market is classified into Retail channels, Online retail, Foodservice, and Pharmacy and healthcare channels. Based on consumer demographics, probiotic wellness drinks market is segmented into Millennials (25-40 years), Generation Z (18-24 years), Generation X (41-56 years), and Baby boomers (57+ years). Regionally, the probiotic wellness drinks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The kombucha segment, representing 22.4% of the product type category, has established a prominent position due to its distinct fermentation profile, natural probiotic content, and perceived detoxifying benefits. Demand has been supported by expanding flavor innovation, premium branding strategies, and its alignment with broader wellness-oriented consumption trends.

Enhanced manufacturing processes have improved shelf stability and flavor consistency, enabling stronger distribution reach across both domestic and export markets. While competition from alternative probiotic beverages exists, kombucha’s unique sensory appeal and cultural positioning have sustained its differentiation.

The segment’s growth trajectory is being bolstered by investment in small-batch artisanal production as well as scaling by multinational beverage players With health-conscious consumer bases increasingly seeking functional beverages with clean-label attributes, kombucha is expected to maintain its competitive relevance within the probiotic wellness drinks landscape.

Retail channels, holding 48.6% of the distribution category, remain the primary driver of probiotic wellness drink sales due to their extensive reach, product visibility, and ability to offer diverse brand selections under one platform. The segment’s dominance is supported by strong uptake across supermarkets, hypermarkets, and specialty health stores, where strategic product placement and in-store promotions enhance consumer engagement.

Improvements in cold-chain distribution have facilitated the expansion of refrigerated probiotic drinks in mainstream retail outlets, ensuring product integrity and taste preservation. Retailers have increasingly adopted category management strategies that position probiotic drinks alongside other premium functional beverages, boosting impulse and planned purchases alike.

This channel is expected to remain central to market expansion as consumer purchasing patterns continue to favor convenience, accessibility, and brand discovery through physical store experiences.

Millennials, comprising 36.9% of the consumer demographics category, have emerged as a critical demand driver for probiotic wellness drinks due to their proactive approach toward health, wellness, and functional nutrition. This demographic’s purchasing decisions are heavily influenced by product transparency, ingredient quality, and alignment with sustainable and ethical sourcing practices.

Digital engagement through social media and wellness influencers has played a pivotal role in shaping awareness and trial adoption among millennials. Their openness to novel flavors, innovative packaging, and premium pricing tiers has allowed brands to introduce differentiated offerings that resonate strongly with lifestyle-focused consumers.

The sustained spending capacity and growing inclination towards preventive health regimes within this group suggest continued high-value consumption, reinforcing their position as a cornerstone segment in the probiotic wellness drinks market.

The probiotic wellness drinks market is thriving on rising health consciousness, flavor and product diversification, expanded retail networks, and strict regulatory compliance. These factors ensure steady global growth and brand differentiation.

The probiotic wellness drinks market is witnessing strong momentum as global consumers increasingly adopt preventive healthcare approaches. Awareness around gut health, immunity enhancement, and the role of probiotics in balancing microbiota is driving consistent demand. Younger demographics, including millennials and Gen Z, are prioritizing functional beverages that combine taste with health benefits. Probiotic drinks are being positioned as daily-use supplements rather than occasional purchases, which further boosts their regular consumption. Healthcare professionals and nutritionists recommending probiotics as part of balanced diets adds credibility and accelerates adoption. The trend signifies a growing shift from curative health solutions to preventive wellness, positioning probiotic drinks as a mainstream category in the global beverage market.

One of the strongest growth dynamics in the probiotic wellness drinks market lies in product variety and flavor expansion. Consumers are moving away from plain formulations and demanding exciting flavors, blends, and functional infusions such as vitamins, herbal extracts, and proteins. Manufacturers are introducing dairy-based, plant-based, and hybrid options to capture wider demographics, including vegans and lactose-intolerant groups. Premium positioning through exotic fruit flavors, limited-edition releases, and customized nutrition solutions is helping brands attract urban professionals and health-conscious families alike. This diversification strategy not only sustains consumer interest but also enhances brand loyalty, making product innovation an essential driver of market competitiveness across both developed and emerging economies.

Distribution networks are playing a pivotal role in shaping the probiotic wellness drinks market. Traditional supermarkets and hypermarkets continue to dominate sales, but the rapid rise of e-commerce platforms has created new opportunities for global outreach. Online health and wellness retailers, along with subscription-based delivery services, are making probiotic drinks more accessible. In emerging markets, small convenience stores and pharmacies are becoming important distribution nodes, ensuring reach into tier-2 and tier-3 cities. Strategic partnerships with fitness centers, hospitals, and corporate wellness programs are further amplifying demand. Companies are also leveraging direct-to-consumer models for brand building and data-driven personalization, reflecting the critical role of strong distribution in long-term growth.

Regulation and transparency are central to driving consumer trust in probiotic wellness drinks. Since probiotics involve live microorganisms, safety, efficacy, and labeling accuracy are under scrutiny from regulatory authorities worldwide. Brands must demonstrate scientific evidence of probiotic strains’ health benefits and ensure that claims are clinically backed.

Consumer education campaigns highlighting the proven advantages of probiotics, such as digestive health and immunity, are boosting confidence in the category. Certification, clean labeling, and stringent quality assurance processes are now vital to brand positioning. Companies that prioritize compliance and transparent communication are better placed to gain market share, as consumer trust becomes a decisive factor in purchase decisions globally.

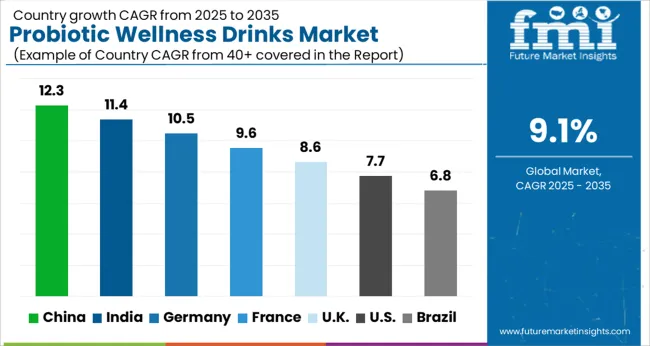

| Country | CAGR |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| France | 9.6% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

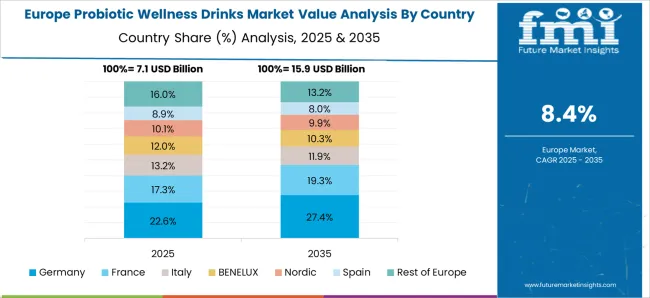

The global probiotic wellness drinks market is projected to grow at a CAGR of 9.1% from 2025 to 2035, supported by rising health awareness and functional beverage consumption. China leads with a robust 12.3% CAGR, driven by rapid urban lifestyle changes, increasing disposable incomes, and widespread acceptance of probiotic-based health products. India follows with 11.4% CAGR, reflecting strong demand from younger consumers, expanding retail penetration, and growing preventive health practices. Germany demonstrates a 10.5% CAGR, supported by its established nutraceutical and functional food industry, alongside consumer preference for natural wellness solutions. The UK records an 8.6% CAGR, as the premium health drinks segment and personalized nutrition trends gain traction. The USA shows a steady 7.7% CAGR, with rising adoption in mainstream retail and collaborations between food-tech and beverage companies. Collectively, these top countries are shaping innovation, scale, and global expansion in probiotic wellness drinks.

The probiotic wellness drinks market in China is projected to grow at a CAGR of 12.3% from 2025 to 2035, rising from its strong 2025 base toward a significantly larger 2035 market size. Growth is driven by rising consumer preference for functional beverages, strong e-commerce penetration, and premiumization of health-focused drinks. Urban consumers are increasingly opting for probiotic-enriched products to support digestive health and immunity. Domestic players are innovating with traditional flavors combined with probiotics, while multinational companies are expanding distribution networks. Government promotion of preventive healthcare further accelerates adoption.

The probiotic wellness drinks market in India is expected to grow at a CAGR of 11.4% from 2025 to 2035, reflecting a strong shift toward preventive healthcare and wellness. Young consumers, urbanization, and fitness-focused lifestyles are shaping demand for ready-to-drink probiotic products. Domestic dairy companies are diversifying portfolios with probiotic drinks, while global players are entering with innovative flavors. Wider penetration across modern retail, online platforms, and health stores boosts accessibility. Growing awareness about gut health and immunity post-pandemic provides strong long-term growth opportunities.

Germany’s probiotic wellness drinks market is projected to grow at a CAGR of 10.5% between 2025 and 2035, supported by strong consumer interest in functional foods and beverages. German consumers value natural and clinically backed products, leading to high acceptance of probiotics. The country’s established nutraceutical industry provides a strong base for innovation in dairy-based and plant-based probiotic beverages. Demand for lactose-free and vegan probiotic drinks is rising, creating opportunities for manufacturers. Distribution through supermarkets, pharmacies, and health-food stores remains robust, ensuring steady consumption.

The probiotic wellness drinks market in the UK is forecasted to expand at a CAGR of 8.6% from 2025 to 2035, fueled by growing consumer awareness about gut health, immunity, and holistic wellness. The premium health drinks segment is expanding as consumers look for innovative, flavored, and plant-based options. Personalized nutrition and lifestyle-based beverages are also gaining traction, reflecting the rising influence of wellness trends. Retail and e-commerce platforms continue to broaden product reach. Partnerships between local brands and global players strengthen competitive offerings.

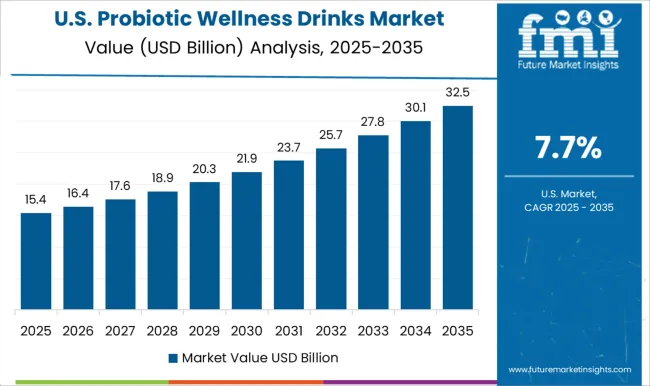

The USA probiotic wellness drinks market is anticipated to grow at a CAGR of 7.7% between 2025 and 2035, with adoption supported by mainstream acceptance of probiotics as part of daily nutrition. Consumers are shifting from supplements to beverage-based formats, preferring convenience and taste. Functional beverage companies are partnering with retailers to expand shelf presence. Increasing innovation in non-dairy probiotic drinks caters to lactose-intolerant and vegan consumers. Collaborations between food-tech startups and established beverage brands enhance product development and scale-up.

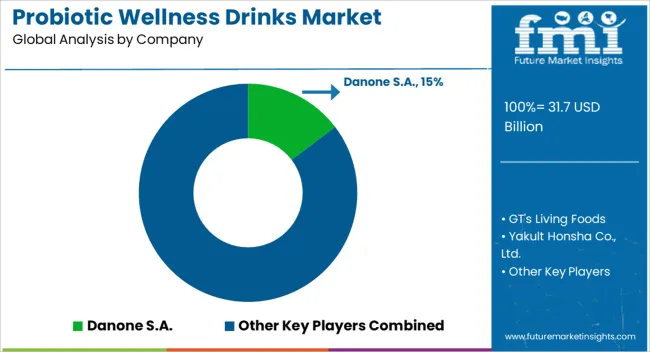

Competition in the probiotic wellness drinks market is shaped by product differentiation, flavor innovation, and consumer trust in health benefits. Danone S.A. and Nestlé S.A. dominate with established global distribution and a wide portfolio of functional dairy-based and plant-based probiotic beverages. Yakult Honsha Co., Ltd. leverages its scientific credibility and single-serve formats to maintain a strong global presence. In North America, GT’s Living Foods, KeVita (PepsiCo), and Health-Ade Kombucha lead in the kombucha and fermented beverage segments, targeting health-conscious millennials with premium, naturally fermented offerings. Niche brands such as Culture Pop, Poppi, and Biotiful Dairy focus on clean-label positioning, natural ingredients, and innovative flavor blends, capturing younger and urban demographics. Karma Probiotic Water differentiates through shelf-stable formats with patented delivery systems, catering to on-the-go wellness consumers.

Lifeway Foods, Inc. remains a strong player in kefir-based probiotic drinks, expanding across both traditional and plant-based categories. On the ingredient and science side, companies like Chr. Hansen Holding A/S, DuPont Nutrition & Biosciences, BioGaia AB, and Lallemand Inc. play a vital role by supplying probiotic strains and cultures to beverage manufacturers. Their R&D-driven partnerships ensure clinically validated strains and improved stability, driving credibility and innovation across product portfolios. Strategic approaches emphasize flavor innovation, gut health awareness campaigns, and expansion across e-commerce and retail. Many players are also leveraging partnerships with fitness influencers, lifestyle brands, and health platforms to strengthen consumer loyalty. Premiumization, non-dairy alternatives, and functional add-ons such as prebiotics and vitamins are becoming mainstream differentiators.

| Item | Value |

|---|---|

| Quantitative Units | USD 31.7 Billion |

| Product Type | Kombucha, Kefir, Probiotic shots and functional waters, Drinking yogurt and dairy-based beverages, Plant-based probiotic beverages, and Probiotic sodas and carbonated drinks |

| Distribution Channel | Retail channels, Online retail, Foodservice, and Pharmacy and healthcare channels |

| Consumer Demographics | Millennials (25-40 years), Generation Z (18-24 years), Generation X (41-56 years), and Baby boomers (57+ years) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Danone S.A., GT's Living Foods, Yakult Honsha Co., Ltd., Nestlé S.A., KeVita (PepsiCo), Health-Ade Kombucha, Lifeway Foods, Inc., Culture Pop, Poppi, Biotiful Dairy, Karma Probiotic Water, Chr. Hansen Holding A/S, DuPont Nutrition & Biosciences, BioGaia AB, and Lallemand Inc. |

| Additional Attributes | Dollar sales, growth forecasts, share by product type, regional demand patterns, consumer preferences, pricing benchmarks, competitive landscape, and regulatory frameworks. |

The global probiotic wellness drinks market is estimated to be valued at USD 31.7 billion in 2025.

The market size for the probiotic wellness drinks market is projected to reach USD 75.9 billion by 2035.

The probiotic wellness drinks market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in probiotic wellness drinks market are kombucha, flavour segmentation, alcohol content variations, kefir, dairy-based kefir, plant-based kefir, flavoured vs. plain variants, probiotic shots and functional waters, concentrated probiotic shots, probiotic-enhanced waters, electrolyte-probiotic combinations, drinking yogurt and dairy-based beverages, traditional drinking yogurt, greek yogurt drinks, low-fat and non-fat variants, plant-based probiotic beverages, fruit and vegetable-based, nut and seed-based, grain-based fermented drinks, probiotic sodas and carbonated drinks, prebiotic sodas, low-sugar variants and natural flavour profiles.

In terms of distribution channel, retail channels segment to command 48.6% share in the probiotic wellness drinks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Probiotic Chewing Gum Market Size and Share Forecast Outlook 2025 to 2035

Probiotics For Oral Health Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Face Masks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Fermentation Skincare Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Global Probiotic Serum Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Yogurt Market Analysis - Size, Share & Forecast 2025 to 2035

Probiotic Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic for Kids Market Analysis - Size, Share, and Forecast 2025 to 2035

Probiotic Fermented Milk Market Growth & Demand Forecast 2025 to 2035

Probiotic for Men Market Analysis by Product, Sales Channel and Strain Type Through 2035

Probiotic Cheese Market Cheese Type, Bacteria Type, Sales Channel and Others through 2035

Comprehensive Probiotic Strains market analysis and forecast by strain type, application and region.

Probiotic Cosmetics Market Trends - Growth & Forecast 2025 to 2035

Probiotic Supplements Market Share Analysis – Key Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA