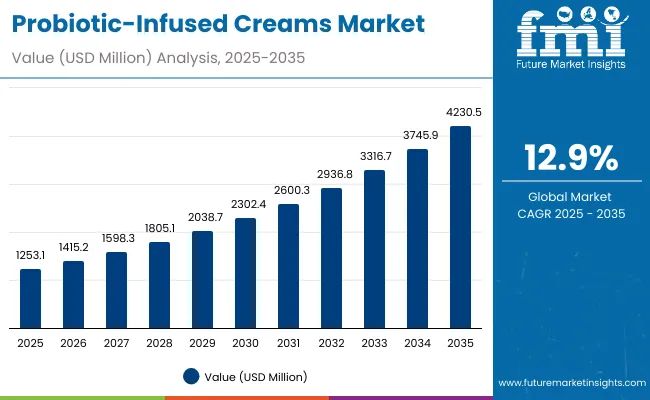

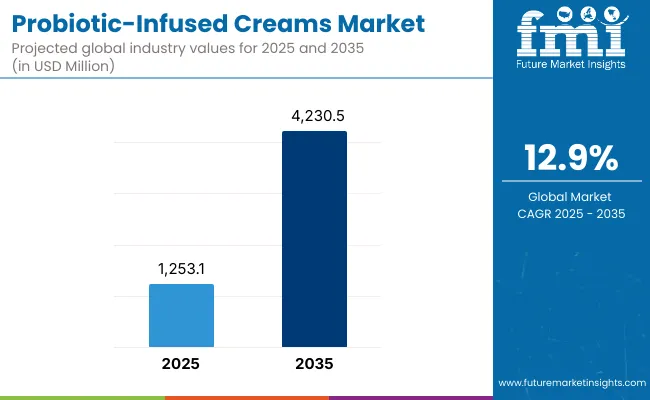

The Probiotic-Infused Creams Market is expected to record a valuation of USD 1,253.1 million in 2025 and USD 4,230.5 million in 2035, with an increase of USD 2,977.4 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 12.9% and a 2X increase in market size.

Probiotic-Infused Creams Market Key Takeaways

| Metric | Value |

|---|---|

| Probiotic-Infused Creams Market Estimated Value in (2025E) | USD 1,253.1 million |

| Probiotic-Infused Creams Market Forecast Value in (2035F) | USD 4,230.5 million |

| Forecast CAGR (2025 to 2035) | 12.9% |

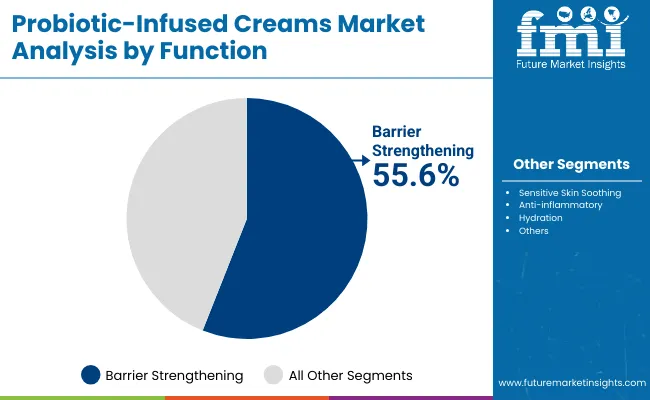

During the first five-year period from 2025 to 2030, the market increases from USD 1,253.1 million to USD 2,302.4 million, adding USD 1,049.3 million, which accounts for 35% of the total decade growth. This phase records steady adoption in barrier-strengthening and hypoallergenic creams, driven by the need for sensitive skin solutions and microbiome-supportive formulations. Barrier strengthening creams dominate this period with a 55.6% share in 2025, highlighting their role as the leading functional category.

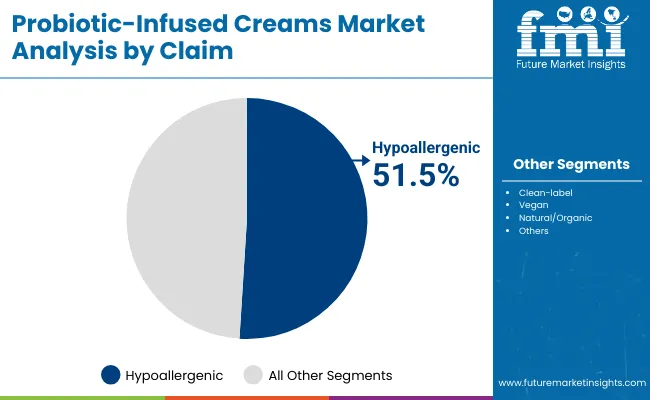

The second half from 2030 to 2035 contributes USD 1,928.1 million, equal to 65% of total growth, as the market jumps from USD 2,302.4 million to USD 4,230.5 million. This acceleration is powered by widespread adoption of day creams and clean-label probiotic formulations, supported by rising consumer demand in Asia-Pacific, led by India and China. Hypoallergenic claims lead the segment with 51.5% share in 2025, while natural/organic positioning and competitive innovation from brands like Tula Skincare, Gallinée, and La Roche-Posay further expand the market base.

From 2020 to 2024, the Probiotic-Infused Creams Market established its foundation with strong traction in sensitive skin soothing and barrier-strengthening formulations. Competitive dynamics were dominated by specialty skincare brands and dermatology-backed players, with natural/organic and hypoallergenic claims driving consumer trust. During this early phase, the market leaned heavily on functional innovation (barrier strengthening, hydration, anti-inflammatory) rather than wide-scale regional adoption.

By 2025, the market is expected to reach USD 1,253.1 million, with demand accelerating across day creams and hypoallergenic probiotic-based products. Asia-Pacific emerges as the fastest-growing region, led by India (22.6% CAGR) and China (19.9% CAGR).

Looking ahead, the revenue mix will shift as clean-label, vegan, and natural/organic claims grow to mainstream adoption. Established global players (e.g., Unilever, L’Oréal, La Roche-Posay) are increasingly integrating probiotic formulations into mass-market lines, while niche innovators (e.g., Tula Skincare, Gallinée, Esse Skincare) continue to dominate specialized consumer segments. Competitive advantage is moving toward scientific credibility, clinical validation, and claim-based differentiation, with ecosystem strength (distribution channels, dermatology endorsements, e-commerce platforms) emerging as critical to long-term success.

The surge in skin sensitivity cases linked to pollution, harsh chemicals, and lifestyle stress is accelerating demand for probiotic-infused creams. Unlike generic moisturizers, these formulations strengthen the skin barrier and rebalance the microbiome, offering clinically validated relief for sensitive and inflamed skin.

This science-backed positioning drives adoption across dermatology clinics and pharmacies, positioning probiotics as a premium yet trusted solution in skincare, especially in urban markets where environmental aggressors are highest.

Consumers are increasingly seeking skincare with clear, functional benefits, and probiotic-infused creams deliver anti-inflammatory, hydration, and barrier-strengthening results supported by microbiological research. Brands are leveraging “hypoallergenic” and “clean-label” claims to differentiate in a crowded premium skincare space.

With Asia-Pacific markets like India and China growing above 20% CAGR, rising disposable incomes are fueling adoption of science-driven, claim-based creams. This premiumization trend is accelerating market expansion, particularly in e-commerce and specialty beauty retail channels.

The market is segmented by function, microbe type, product type, claim, channel, and region. Functions include barrier strengthening, sensitive skin soothing, anti-inflammatory, and hydration, highlighting the primary skin benefits driving adoption. Microbe type classification covers Lactobacillus-derived lysates, Bifidobacterium ferments, Saccharomyces ferments, and postbiotics, representing the key microbial bases of innovation.

Based on product type, the segmentation includes day creams, night creams, balms, and multi-use creams. In terms of claims, categories encompass hypoallergenic, clean-label, vegan, and natural/organic. Distribution channels include e-commerce, pharmacies, dermatology clinics, and specialty beauty retail. Regionally, the scope spans North America, Europe, Asia-Pacific (East Asia, South Asia, Oceania), Latin America, and the Middle East & Africa, with high-growth momentum in India and China leading the expansion.

| Function | Value Share % 2025 |

|---|---|

| Barrier strengthening | 55.6% |

| Others | 44.4% |

The barrier strengthening segment is projected to contribute 55.6% of the Probiotic-Infused Creams Market revenue in 2025, maintaining its lead as the dominant functional category. Growth is driven by rising cases of sensitive and damaged skin due to pollution, allergens, and lifestyle stress, creating strong demand for formulations that reinforce the skin’s natural defense.

This segment’s momentum is further supported by dermatology-backed formulations and the integration of probiotics that balance the skin microbiome. Consumers increasingly associate barrier-supportive creams with long-term skin health, encouraging adoption across pharmacies, dermatology clinics, and specialty retail. The barrier-strengthening segment is expected to remain the backbone of probiotic-infused creams, anchoring the market’s premium skincare positioning.

| Claim | Value Share % 2025 |

|---|---|

| Hypoallergenic | 51.5% |

| Others | 48.5% |

The hypoallergenic segment is forecasted to hold 51.5% of the market share in 2025, led by its appeal to consumers with sensitive skin and rising allergy concerns. These formulations are favored for their gentle, clinically validated ingredients that reduce irritation risks, making them a preferred choice in both dermatology clinics and pharmacies.

Their credibility is enhanced by dermatologist endorsements and alignment with the growing clean-label trend. The segment’s growth is further supported by increasing awareness around skin barrier protection and consumer willingness to pay premium prices for safety-assured products. As demand for sensitive-skin solutions continues to expand, hypoallergenic probiotic-infused creams are expected to maintain their dominance in the market.

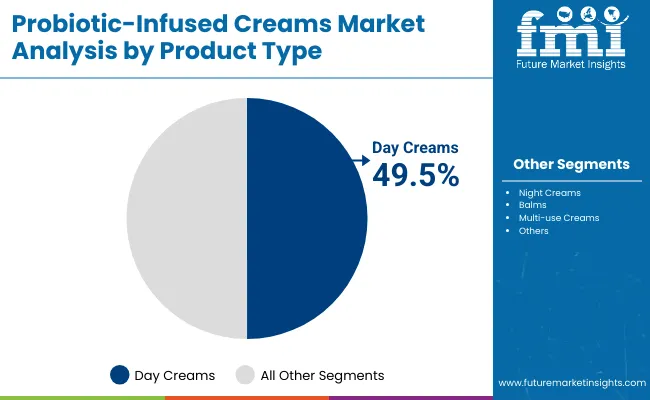

| Product Type | Value Share % 2025 |

|---|---|

| Day creams | 49.5% |

| Others | 50.5% |

The day creams segment is projected to account for 49.5% of the Probiotic-Infused Creams Market revenue in 2025, establishing it as the leading product type. Day creams are favored for their daily-use convenience, hydration benefits, and multifunctional appeal, making them highly compatible with modern skincare routines.

Their popularity is reinforced by the integration of probiotics into lightweight, non-greasy formulations that support skin barrier health without disrupting makeup or sunscreen layers. The segment’s growth is further boosted by strong uptake in e-commerce and specialty beauty retail, where day creams dominate premium skincare baskets. Given their balance of efficacy, usability, and consumer acceptance, probiotic day creams are expected to maintain their leadership through the forecast period.

Rising Prevalence of Skin Sensitivity and Allergies

With pollution, urban lifestyles, and exposure to harsh chemicals, cases of skin sensitivity and inflammatory conditions are increasing globally. Consumers are turning toward probiotic-infused creams that strengthen the skin barrier and rebalance the microbiome.

This is fueling growth in hypoallergenic formulations, which already capture over 50% market share. Dermatology endorsements and clinical validation further enhance consumer trust, positioning probiotic skincare as a superior alternative to conventional moisturizers for sensitive and allergy-prone users.

Expansion in Asia-Pacific with Premium Skincare Adoption

Asia-Pacific, particularly India and China, is emerging as the growth engine for probiotic-infused creams. Rising disposable incomes, urbanization, and consumer awareness about microbiome health are driving demand for premium skincare products. Younger demographics increasingly seek clean-label, natural/organic, and probiotic-based formulations, fueling uptake through e-commerce and specialty beauty retail.

Multinationals and niche brands alike are targeting these high-growth markets, using localized strategies and dermatologist collaborations to build credibility and capture loyal consumer bases.

High Product Pricing and Limited Mass-Market Penetration

Despite rising demand, probiotic-infused creams remain concentrated in premium skincare categories, with higher price points limiting access in price-sensitive markets. The cost of probiotic actives, formulation stability challenges, and clinical testing requirements add to overall production expenses.

This creates a barrier to large-scale mass-market adoption, particularly in developing economies where affordability drives consumer choice. Unless brands innovate around cost efficiency and scalable formulations, penetration will remain skewed toward affluent urban populations, restricting full market potential.

Shift Toward Clean-Label and Claim-Based Differentiation

The probiotic-infused creams market is witnessing a strong trend toward clean-label, vegan, and natural/organic claims, with consumers demanding transparency in ingredient sourcing and safety validation. Hypoallergenic creams already lead in share, and clinical testing is increasingly highlighted in product marketing. This shift aligns with the broader premium skincare movement where efficacy, safety, and sustainability converge.

Brands are differentiating through microbiome science-backed claims, dermatologist endorsements, and regulatory certifications, creating a competitive landscape driven not just by product function but by trust and authenticity.

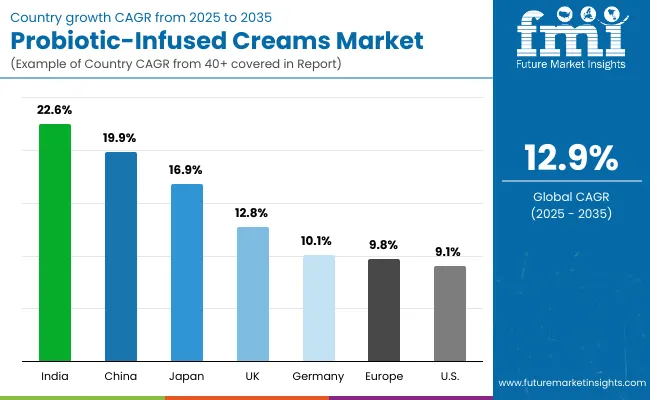

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.9% |

| USA | 9.1% |

| India | 22.6% |

| UK | 12.8% |

| Germany | 10.1% |

| Japan | 16.9% |

The global Probiotic-Infused Creams Market shows strong regional differences in adoption, influenced by consumer preferences, dermatology culture, and regulatory landscapes. Asia-Pacific emerges as the fastest-growing region, anchored by India (22.6% CAGR) and China (19.9% CAGR). India’s growth is fueled by rising disposable incomes, rapid e-commerce expansion, and increasing acceptance of premium skincare products among younger demographics. China benefits from a booming middle-class consumer base, strong demand for hypoallergenic and natural/organic claims, and rising dermatology clinic adoption. Japan (16.9% CAGR) reflects the region’s preference for functional, science-backed skincare with a focus on barrier health and anti-aging.

Europe maintains a resilient growth profile, led by the UK (12.8% CAGR) and Germany (10.1% CAGR). Growth is supported by rising consumer trust in dermatologist-backed probiotic formulations, along with a mature premium skincare ecosystem. Clean-label positioning and demand for sustainable, clinically validated products are key drivers.

North America shows more moderate expansion, with the USA at 9.1% CAGR. While adoption is slower compared to Asia, the region benefits from strong brand equity of multinational players such as Unilever, L’Oréal, and Clinique. Growth is being pushed by demand for dermatologist-recommended solutions in pharmacies and rising consumer awareness of the skin microbiome’s role in wellness.

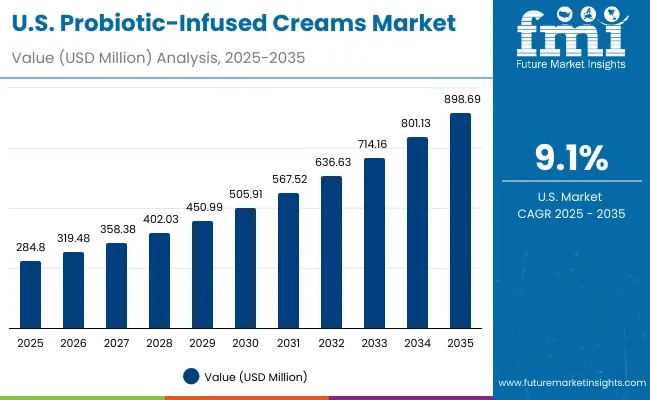

| Year | USA Probiotic-Infused Creams Market (USD Million) |

|---|---|

| 2025 | 284.80 |

| 2026 | 319.48 |

| 2027 | 358.38 |

| 2028 | 402.03 |

| 2029 | 450.99 |

| 2030 | 505.91 |

| 2031 | 567.52 |

| 2032 | 636.63 |

| 2033 | 714.16 |

| 2034 | 801.13 |

| 2035 | 898.69 |

The Probiotic-Infused Creams Market in the United States is projected to grow at a CAGR of 9.1% between 2025 and 2035, supported by the rising popularity of hypoallergenic and sensitive-skin formulations. Growth is being driven by dermatologist endorsements, widespread distribution through pharmacies and specialty beauty retail, and strong consumer awareness of skin microbiome health. While premium positioning dominates, opportunities are emerging for mass-market lines as multinational brands expand access through e-commerce and hybrid retail channels.

The Probiotic-Infused Creams Market in the United Kingdom is projected to grow at a CAGR of 12.8% from 2025 to 2035, fueled by strong consumer demand for microbiome-supporting skincare and rising adoption of dermatologist-recommended products. Premium beauty retailers and pharmacy chains are the primary distribution channels, supported by a wave of clean-label, vegan-certified, and sustainable formulations. The UK market is also benefitting from robust government health awareness campaigns, increasing demand for anti-aging probiotic creams, and innovation through academic-industry collaborations in skin microbiome research.

India is experiencing the fastest growth globally in the Probiotic-Infused Creams Market, projected to expand at a CAGR of 22.6% through 2035. Growth is being driven by the rising urban middle class, strong adoption in tier-2 and tier-3 cities, and increasing consumer awareness of microbiome-based skincare. Domestic beauty brands are introducing cost-effective probiotic formulations, while premium global players are expanding via e-commerce. Demand is strongest in hydration and barrier-strengthening creams, fueled by climatic conditions, pollution-related skin issues, and a young consumer base experimenting with wellness-oriented beauty.

The Probiotic-Infused Creams Market in China is forecast to grow at a CAGR of 19.9%, the highest among leading economies. Growth is powered by strong consumer preference for functional skincare, rising urban pollution-related skin concerns, and rapid expansion of domestic probiotic beauty brands. Affordable yet high-quality probiotic formulations from local players are increasing accessibility, while international luxury brands are capturing demand in the premium segment. The surge of online-to-offline (O2O) beauty retail, combined with government-backed support for biotech R&D, positions China as the global hub for probiotic skincare innovation.

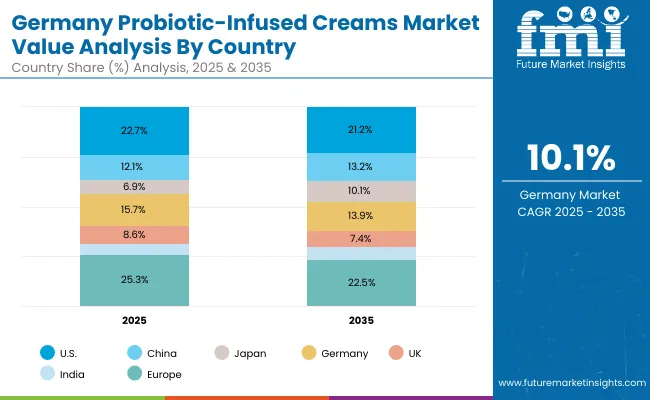

| Country | 2025 Share (%) |

|---|---|

| USA | 22.7% |

| China | 12.1% |

| Japan | 6.9% |

| Germany | 15.7% |

| UK | 8.6% |

| India | 5.4% |

| Country | 2035 Share (%) |

|---|---|

| USA | 21.2% |

| China | 13.2% |

| Japan | 10.1% |

| Germany | 13.9% |

| UK | 7.4% |

| India | 6.1% |

The Probiotic-Infused Creams Market in Germany is projected to grow at a CAGR of 10.1%, supported by the country’s leadership in dermatological research, premium skincare innovation, and strong adoption of microbiome-based beauty products. German consumers, highly attentive to ingredient transparency, are driving demand for clean-label, vegan, and sustainable probiotic formulations. The market is also benefitting from clinical skincare collaborations with dermatologists and pharmacies, where probiotic creams are increasingly recommended for sensitive skin and barrier repair. Additionally, Germany’s regulatory framework emphasizing EU cosmetic safety standards has created an environment where trusted, certified probiotic products thrive.

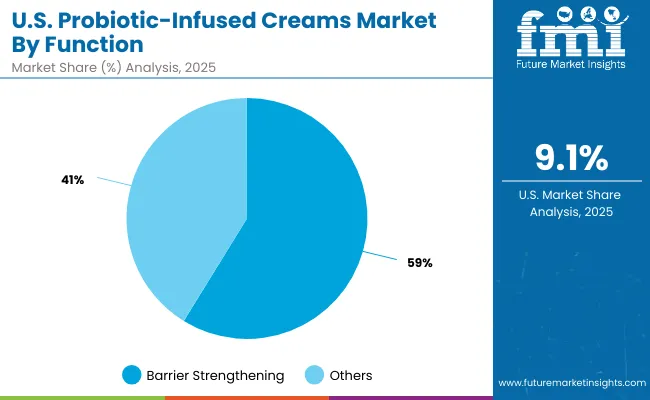

| USA by Function | Value Share % 2025 |

|---|---|

| Barrier strengthening | 58.8% |

| Others | 41.2% |

The Probiotic-Infused Creams Market in the USA is valued at USD 284.8 million in 2025 and is forecast to expand to USD 898.7 million by 2035, registering a CAGR of 11.9%. Within functional claims, barrier strengthening creams dominate with 58.8% share (USD 167.3 million), reflecting strong consumer preference for microbiome-supporting formulations that protect against pollution and lifestyle stressors.

Growth is driven by the rising popularity of dermatologist-backed probiotic skincare, especially in sensitive skin and anti-inflammatory applications. E-commerce platforms and specialty beauty retailers are enabling broader consumer access, while clean-label, hypoallergenic claims are strengthening consumer trust. USA brands are also leading global exports, supported by high R&D investments and collaborations with dermatology clinics.

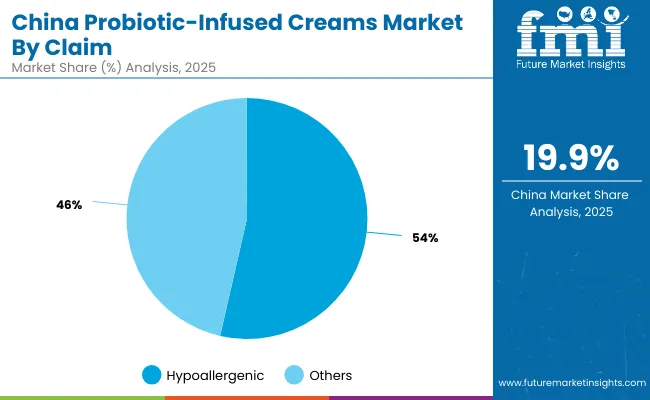

| China by Claim | Value Share % 2025 |

|---|---|

| Hypoallergenic | 53.6% |

| Others | 46.4% |

The Probiotic-Infused Creams Market in China is forecast to grow at a CAGR of 19.9%, the fastest among major economies. In 2025, hypoallergenic probiotic creams lead with 53.6% share (USD 81.5 million), reflecting strong consumer preference for gentle, dermatologically tested formulations in a market increasingly concerned with pollution, skin sensitivity, and urban lifestyle stressors.

The opportunity in China is anchored by rising middle-class spending on premium skincare, a surge in e-commerce-led beauty consumption, and rapid adoption of domestically produced probiotic formulations. Local brands are leveraging competitive pricing and cultural resonance, while global players benefit from cross-border e-commerce platforms. Clean-label, vegan, and natural/organic claims are also accelerating traction, appealing to younger demographics.

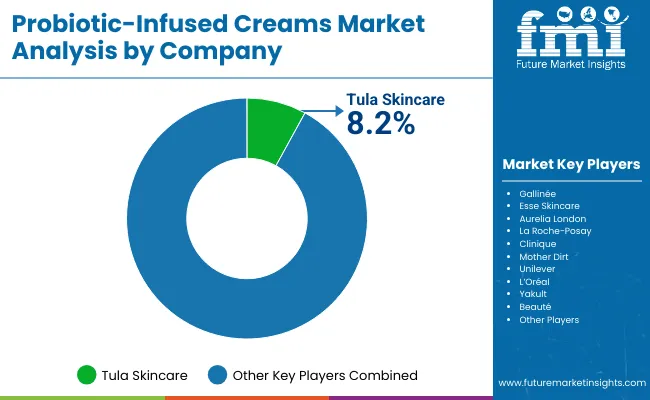

| Company | Global Value Share 2025 |

|---|---|

| Tula Skincare | 8.2% |

| Others | 91.8% |

The Probiotic-Infused Creams Market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists competing across diverse application areas. Global leaders such as Tula Skincare, La Roche-Posay, Clinique, L’Oréal, and Unilever hold significant market share, driven by brand recognition, strong R&D capabilities, and extensive global distribution networks.

Their strategies increasingly emphasize advanced probiotic formulations, clinical efficacy validation, multi-channel marketing, and global consumer engagement. Established mid-sized innovators, including Gallinée, Esse Skincare, and Aurelia London, cater to the demand for natural, clean-label, and premium probiotic skincare solutions.

These companies are accelerating adoption through targeted product lines, sustainability initiatives, and consumer education programs, making them highly relevant for sensitive skin, wellness-focused, and eco-conscious segments. Specialized providers such as Mother Dirt and Yakult Beauté focus on microbiome-specific, science-driven solutions for niche consumer groups. Their strength lies in clinical validation, targeted efficacy, and community-driven engagement rather than global scale.

Competitive differentiation is shifting away from traditional skincare branding toward integrated wellness ecosystems that include personalized probiotic regimens, digital engagement, subscription-based offerings, and clinical endorsement strategies.

Key Developments in Probiotic-Infused Creams Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,253.1 Million |

| Function | Barrier strengthening, Sensitive skin soothing, Anti-inflammatory, Hydration |

| Microbe Type | Lactobacillus-derived lysates, Bifidobacterium ferments, Saccharomyces ferments, Postbiotics |

| Product Type | Day creams, Night creams, Balms, Multi-use creams |

| Channel | E-commerce, Pharmacies, Dermatology clinics, Specialty beauty retail |

| Claim | Hypoallergenic, Clean-label, Vegan, Natural/organic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tula Skincare, Gallinée , Esse Skincare, Aurelia London, La Roche- Posay , Clinique, Mother Dirt, Unilever, L’Oréal, Yakult Beauté |

| Additional Attributes | Dollar sales by product type and function, adoption trends in microbiome-focused formulations and sensitive skin solutions, rising demand for clean-label and personalized probiotic creams, sector-specific growth in premium, mass, and wellness-focused skincare segments, revenue segmentation by online and offline channels, integration with digital engagement and subscription-based models, regional trends influenced by consumer awareness and regulatory initiatives, and innovations in probiotic strains, postbiotic formulations, and delivery technologies. |

The global Probiotic-Infused Creams Market is estimated to be valued at USD 1,253.1 million in 2025.

The market size for the Probiotic-Infused Creams Market is projected to reach USD 4,230.5 million by 2035.

The Probiotic-Infused Creams Market is expected to grow at a 12.9% CAGR between 2025 and 2035.

The key product types in the Probiotic-Infused Creams Market are Day creams, Night creams, Balms, and Multi-use creams.

In terms of function, Barrier strengthening and Sensitive skin soothing creams are expected to command the largest share in the Probiotic-Infused Creams Market in 2025, driven by rising consumer focus on skin protection, hydration, and microbiome-friendly formulations.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Firming Creams and Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Slugging Creams Market Size and Share Forecast Outlook 2025 to 2035

Anti-Aging Creams & Serums Market Size and Share Forecast Outlook 2025 to 2035

Anti-Wrinkle Creams Market Size and Share Forecast Outlook 2025 to 2035

Body Firming Creams Market Growth & Forecast 2025-2035

Eczema Relief Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Muscle Relaxing Creams Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Ice Creams Market Analysis by Form, Product Type, Flavor, Source, Sales Channel, and Region through 2035

Moisturizing Body Creams Market Size and Share Forecast Outlook 2025 to 2035

Age-Defying Night Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hydrating Emollient Creams Market Size and Share Forecast Outlook 2025 to 2035

Cica-Infused Healing Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Retinoid-Infused Night Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Depilatory Hair Removal Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Stretch Mark Prevention Creams Market Size and Share Forecast Outlook 2025 to 2035

Lip Plumping and Filler Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Coconut Oil Moisturizing Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peptide-Enhanced Firming Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA