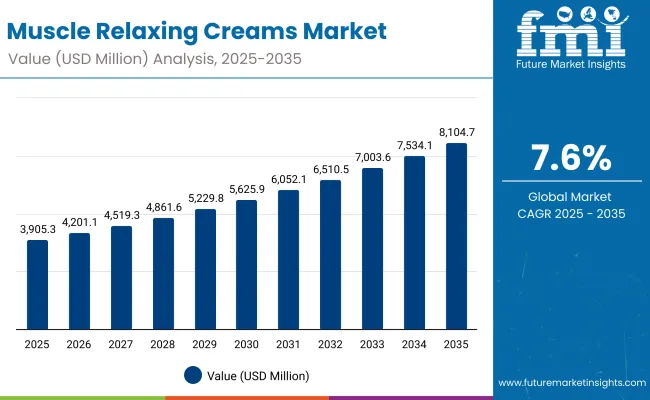

The Muscle Relaxing Creams Market is expected to record a valuation of USD 3,905.3 million in 2025 and USD 8,104.7 million in 2035, with an increase of USD 4,199.4 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 7.6% and a 2X increase in market size.

During the first five-year period from 2025 to 2030, the market increases from USD 3,905.3 million to USD 5,625.9 million, adding USD 1,720.6 million, which accounts for 41% of the total decade growth. This phase records steady adoption of cooling menthol gels and heat rub creams, driven by the rise in sports recovery, muscle fatigue management, and over-the-counter (OTC) pain relief formulations. Cooling menthol gels dominate this period as they cater to over 37% of product demand, favored for fast absorption and instant relief.

Muscle Relaxing Creams Market Key Takeaways

| Metric | Value |

|---|---|

| Muscle Relaxing Creams Market Estimated Value (2025E) | USD 3,905.3 million |

| Muscle Relaxing Creams Market Forecast Value (2035F) | USD 8,104.7 million |

| Forecast CAGR (2025 to 2035) | 7.6% |

The second half from 2030 to 2035 contributes USD 2,478.8 million, equal to 59% of total growth, as the market jumps from USD 5,625.9 million to USD 8,104.7 million. This acceleration is powered by the growing popularity of botanical and magnesium-based balms, alongside premiumized formulations targeting athletes and aging consumers. Roll-on and hybrid delivery formats capture a larger share above 40% by the end of the decade. Digital marketing expansion and e-commerce penetration add recurring revenue, increasing the online sales share beyond 40% in total value.

From 2020 to 2024, the Muscle Relaxing Creams Market grew steadily driven by increased adoption of OTC pain relief products and sports recovery creams. During this period, the competitive landscape was dominated by topical formulation leaders controlling nearly 85–90% of revenue, with brands like Biofreeze, Tiger Balm, and Icy Hot focusing on fast-acting menthol and camphor-based creams for muscle and joint pain relief. Competitive differentiation relied on product efficacy, dermatological safety, and multi-channel distribution through pharmacies and sports retail. Service-based models remained limited, contributing less than 10% of market value, mainly through physiotherapy partnerships and rehabilitation clinics.

Demand for Muscle Relaxing Creams is expected to expand to USD 3,905.3 million in 2025, with the revenue mix shifting toward botanical and magnesium balms and digitally marketed premium formulations. Traditional topical brands face rising competition from clean-label and herbal players offering paraben-free, vegan, and eco-certified alternatives. Major brands are pivoting to hybrid distribution models, leveraging e-commerce and subscription platforms to retain consumer loyalty. Emerging entrants specializing in sports recovery, CBD-infused topicals, and AI-guided pain-management apps are gaining traction. The competitive advantage is shifting from legacy brand equity to formulation innovation, digital visibility, and direct-to-consumer reach.

Increasing global participation in fitness activities, gym workouts, and professional sports is driving higher consumption of muscle recovery and pain relief products. The demand for fast-absorbing creams, gels, and roll-ons that relieve soreness and inflammation after intense exercise is accelerating. Athletes and active consumers are increasingly preferring OTC muscle relaxants for convenient, non-prescription recovery support, further boosted by endorsements and product availability through online and sports retail channels.

The growing aging population worldwide is contributing to higher incidences of muscle stiffness, arthritis, and joint pain, significantly boosting the use of topical analgesics. Consumers are turning to natural and safe alternatives like magnesium-based and botanical creams for long-term pain management without systemic side effects. Pharmaceutical and personal care companies are expanding their OTC portfolios with advanced warming and cooling formulations targeting chronic pain relief, driving strong market expansion through pharmacies and healthcare channels.

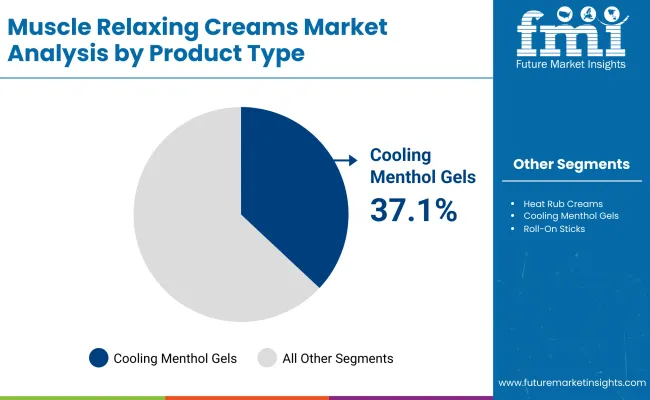

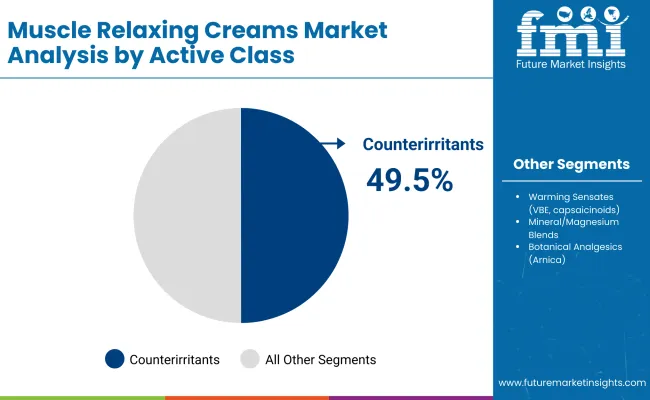

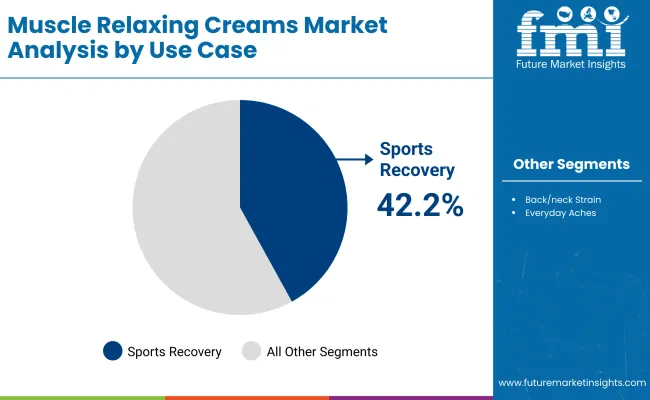

The Muscle Relaxing Creams Market is segmented by product type, active class, use case, distribution channel, end user, and region. By product type, it includes heat rub creams, cooling menthol gels, magnesium/botanical balms, and roll-on sticks, representing the core consumer formats driving topical pain relief adoption. Based on active class, it covers counterirritants (menthol and camphor), warming sensates (VBE and capsaicinoids), mineral/magnesium blends, and botanical analgesics (arnica). By use case, the market is categorized into sports recovery, back/neck strain, and everyday aches, addressing diverse pain management needs. Distribution channels comprise pharmacies/drugstores, e-commerce, sports/outdoor retail, and supermarkets, reflecting the shift toward omni-channel availability. End users include adults, athletes, seniors, and unisex consumers, with rising preference for non-prescription and herbal formulations. Regionally, the market spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with strong growth in China, India, and Japan due to expanding OTC healthcare access and active lifestyle trends.

| Product Type | Value Share % 2025 |

|---|---|

| Cooling menthol gels | 37.1% |

| Others | 62.9% |

The cooling menthol gels segment is projected to contribute 37.1% of the Muscle Relaxing Creams Market revenue in 2025, maintaining its lead as the dominant product category. This dominance stems from strong consumer preference for quick-relief, fast-absorbing formulations that deliver cooling and anti-inflammatory effects. These gels are widely used for sports injuries, muscle fatigue, and everyday aches due to their convenience and rapid action.

Growth is further supported by brand diversification, product innovations with dual-cooling technology, and extended penetration through online and sports retail channels. As consumer lifestyles become more fitness-driven, cooling menthol gels are expected to remain the backbone of the global Muscle Relaxing Creams Market.

| Active Class | Value Share % 2025 |

|---|---|

| Counterirritants | 49.5% |

| Others | 50.5% |

The counterirritants segment, which includes menthol and camphor, is forecasted to hold 49.5% of the market share in 2025, driven by its widespread application in fast-acting pain relief creams. These formulations provide sensory cooling or warming effects that distract from deeper muscle pain, making them highly effective for sports recovery and joint discomfort.

Their proven efficacy and regulatory acceptance as safe OTC ingredients have ensured consistent demand. With ongoing R&D in improved delivery systems and hybrid formulations combining counterirritants with botanical actives, this segment is expected to continue dominating product development pipelines across leading brands.

| Use Case | Value Share % 2025 |

|---|---|

| Sports recovery | 42.2% |

| Others | 57.8% |

The sports recovery segment is projected to account for 42.2% of the Muscle Relaxing Creams Market revenue in 2025, making it one of the fastest-growing use categories. Increasing participation in fitness, athletics, and gym activities has heightened demand for topical relief solutions that enable quicker muscle restoration.

Sports professionals and active consumers are adopting these creams as part of their post-exercise routines, supported by endorsements from physiotherapists and fitness influencers. As recovery science advances, formulations combining menthol, magnesium, and botanical ingredients are gaining traction. The segment’s growth trajectory remains strong, with e-commerce and sports retail channels driving continued adoption worldwide.

Rising Sports and Fitness Participation

The growing global focus on fitness, gym training, and recreational sports has significantly boosted demand for topical pain-relief and muscle recovery products. Consumers are increasingly seeking fast-acting, non-prescription creams for post-workout recovery and muscle fatigue management. Endorsements from athletes and fitness influencers have further elevated awareness and brand credibility. The convenience of roll-ons, gels, and travel-friendly packs is also encouraging repeat purchases through online and offline retail. As health-conscious lifestyles expand, this trend continues to fuel consistent revenue growth for both mainstream and specialized muscle relaxing formulations.

Increasing Prevalence of Musculoskeletal Disorders

The rising incidence of back pain, arthritis, and muscle stiffnessparticularly among aging populationsis propelling the adoption of muscle relaxing creams. Consumers prefer topical applications over oral painkillers due to their localized effect, fewer side effects, and ease of use. This shift aligns with the global movement toward preventive healthcare and long-term pain management. Pharmaceutical and personal care brands are capitalizing on this demand by introducing clinically tested, dermatologist-approved creams with dual-action cooling and heating properties, further widening their reach across adult, senior, and therapeutic user groups.

Product Sensitivity and Regulatory Limitations

A key restraint in the Muscle Relaxing Creams Market is the increasing scrutiny over ingredient safety and potential allergic reactions. Formulations containing high concentrations of menthol, capsaicin, or camphor may trigger skin irritation in sensitive users, leading to consumer hesitation and stricter compliance requirements. Regulatory agencies across regions are enforcing labeling standards and limiting active ingredient levels, particularly for OTC pain-relief products. These safety constraints increase R&D costs and prolong approval cycles, posing challenges for smaller brands entering competitive markets with limited resources for clinical validation and regulatory certification.

Shift Toward Natural and Magnesium-Based Formulations

A major trend shaping the Muscle Relaxing Creams Market is the shift toward plant-derived, magnesium-infused, and herbal formulations. Consumers are increasingly favoring clean-label products that avoid synthetic fragrances, parabens, and harsh chemicals. This has led to the rise of arnica, eucalyptus, and peppermint-based creams marketed as natural alternatives to traditional counterirritant formulations. Magnesium-enriched balms are also gaining attention for their anti-inflammatory and relaxation properties. Brands are leveraging this trend by combining efficacy with sustainability claims, positioning their products as both therapeutic and wellness-oriented, appealing to athletes and health-conscious consumers alike.

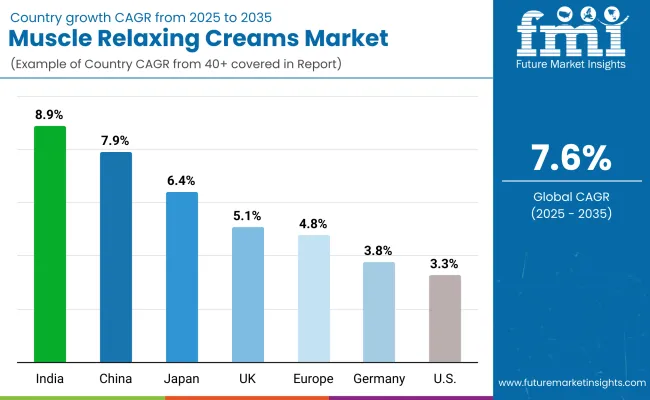

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 7.9% |

| USA | 3.3% |

| India | 8.9% |

| UK | 5.1% |

| Germany | 3.8% |

| Japan | 6.4% |

| Europe | 4.8% |

The global Muscle Relaxing Creams Market exhibits notable regional differences in growth, primarily driven by lifestyle patterns, healthcare accessibility, and consumer preferences for topical pain-relief products. Asia-Pacific stands out as the fastest-growing region, led by India (8.9%) and China (7.9%), owing to expanding OTC healthcare channels, greater sports participation, and increasing demand for herbal and magnesium-based formulations.

India’s strong e-commerce ecosystem and consumer shift toward natural ingredients are reinforcing rapid growth. Japan (6.4%) also shows steady expansion due to its aging population and rising preventive healthcare spending. Europe, led by the UK (5.1%) and Germany (3.8%), benefits from high consumer awareness and established regulatory standards for topical analgesics, ensuring consistent sales through pharmacy networks. Meanwhile, North America, with the USA (3.3%), demonstrates maturity in product availability but slower value expansion as brand competition intensifies.

The region’s growth is increasingly fueled by premium product innovation and the rise of CBD-infused and wellness-oriented creams. Overall, Asia-Pacific remains the engine of global demand, while Western markets sustain stable, high-value sales through advanced formulations and brand-driven differentiation.

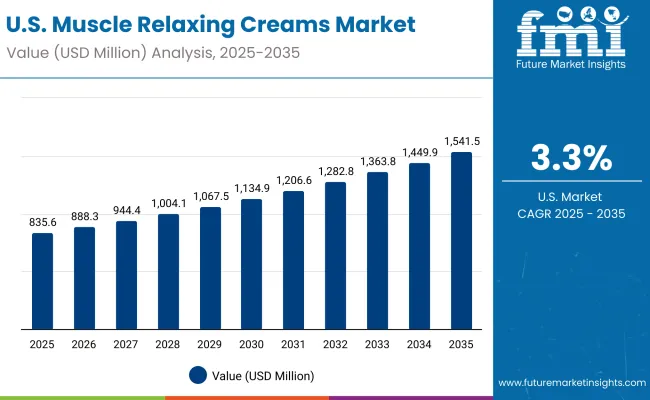

| Year | USA Muscle Relaxing Creams Market (USD Million) |

|---|---|

| 2025 | 835.63 |

| 2026 | 888.39 |

| 2027 | 944.49 |

| 2028 | 1004.13 |

| 2029 | 1067.54 |

| 2030 | 1134.95 |

| 2031 | 1206.62 |

| 2032 | 1282.81 |

| 2033 | 1363.82 |

| 2034 | 1449.94 |

| 2035 | 1541.50 |

The Muscle Relaxing Creams Market in the United States is projected to grow at a CAGR of 6.3%, supported by increasing demand for OTC pain-relief and sports recovery products. Growth is led by innovations in fast-absorbing menthol-based gels and roll-on formulations, preferred for post-exercise and daily muscle care. The market is also benefitting from an aging population and rising awareness of non-prescription pain management. Distribution through pharmacies and e-commerce platforms continues to expand, while premium natural and magnesium-based formulations are gaining traction among wellness-conscious consumers.

The Muscle Relaxing Creams Market in the United Kingdom is expected to grow at a CAGR of 5.1%, supported by rising consumer awareness of topical pain relief and preventive wellness solutions. Increased participation in recreational sports, gym activities, and physiotherapy programs has driven higher demand for fast-absorbing, clinically tested muscle care products. The market is also witnessing strong traction for botanical and arnica-based formulations aligned with the UK’s growing preference for natural and vegan ingredients. Government-backed health awareness initiatives, expanding pharmacy distribution networks, and e-commerce adoption continue to strengthen market penetration.

India is witnessing rapid expansion in the Muscle Relaxing Creams Market, which is forecast to grow at a CAGR of 8.9% through 2035, the highest among major countries. Rising awareness of fitness, wellness, and post-exercise recovery is fueling demand for topical pain-relief creams across both urban and semi-urban areas. Affordable herbal and Ayurvedic formulations featuring menthol, camphor, and magnesium are driving mass adoption through pharmacies and online retail. Local brands are leveraging India’s traditional medicine base to position natural, side-effect-free alternatives to oral painkillers.

The Muscle Relaxing Creams Market in China is expected to grow at a CAGR of 7.9%, the highest among leading economies. Growth is driven by a rising focus on active lifestyles, urban wellness trends, and the rapid expansion of sports and rehabilitation centers. Consumers are increasingly adopting topical relief creams featuring menthol, camphor, and herbal extracts for everyday muscle fatigue and post-exercise recovery. Domestic brands are introducing competitively priced formulations tailored to local preferences, while international players are expanding through cross-border e-commerce. The integration of Traditional Chinese Medicine (TCM) ingredients with modern cooling or warming sensates is also enhancing market appeal.

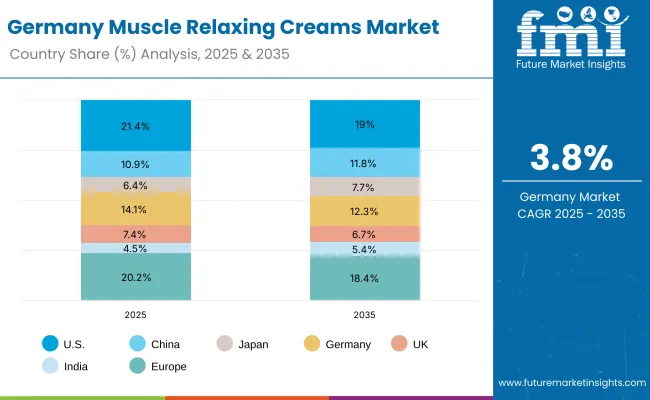

| Country | 2025 Share (%) |

|---|---|

| USA | 21.4% |

| China | 10.9% |

| Japan | 6.4% |

| Germany | 14.1% |

| UK | 7.4% |

| India | 4.5% |

| Europe | 20.2% |

| Country | 2035 Share (%) |

|---|---|

| USA | 19.0% |

| China | 11.8% |

| Japan | 7.7% |

| Germany | 12.3% |

| UK | 6.7% |

| India | 5.4% |

| Europe | 18.4% |

The Muscle Relaxing Creams Market in Germany is projected to grow at a CAGR of 3.8%, reflecting steady expansion supported by strong consumer awareness, regulatory confidence, and preference for clinically validated OTC pain-relief products. Germany remains one of Europe’s most mature healthcare markets, with established retail pharmacy networks and a high share of aging consumers seeking localized pain management solutions. The market is driven by demand for topical formulations containing menthol, camphor, and herbal ingredients such as arnica and eucalyptus. Additionally, a growing focus on sustainability and clean-label standards is shaping product innovation and packaging practices.

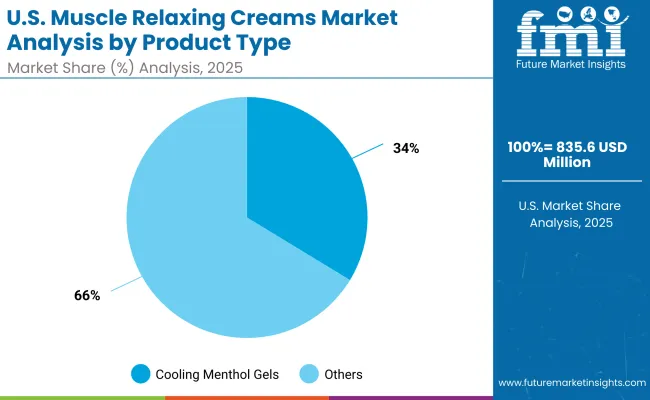

| USA By Product Type | Value Share % 2025 |

|---|---|

| Cooling menthol gels | 33.7% |

| Others | 66.3% |

The Muscle Relaxing Creams Market in the United States is projected at USD 835.6 million in 2025, led primarily by the strong performance of cooling menthol gels, which command 33.7% market share. This dominance reflects consumer preference for instant cooling relief and non-greasy formulations suitable for daily use and sports recovery. The category is further supported by innovations in roll-on formats and dual-action creams targeting localized pain relief. Herbal and magnesium-enriched variants are gradually gaining ground as consumers seek natural, side-effect-free alternatives. Strategic expansion across e-commerce and pharmacy chains is also bolstering accessibility.

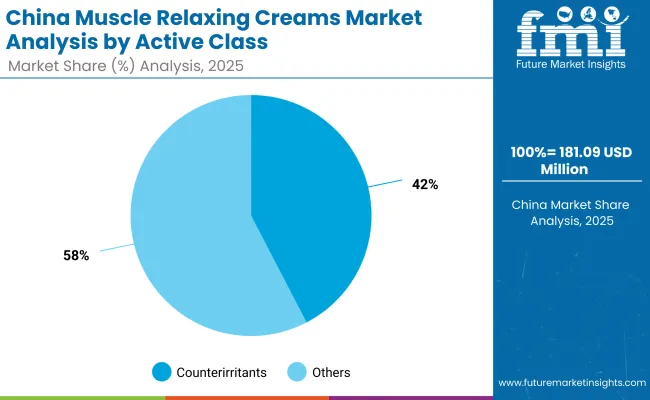

| China By Active Class | Value Share % 2025 |

|---|---|

| Counterirritants | 42.4% |

| Others | 57.6% |

The Muscle Relaxing Creams Market in China presents substantial growth opportunities, driven by expanding consumer demand for fast-acting counterirritant formulations and the increasing adoption of herbal and traditional blends. Counterirritants, including menthol and camphor, account for 42.4% of market value in 2025, reflecting their wide acceptance for instant pain relief and muscle relaxation. Rapid urbanization and a growing middle-class population with higher disposable income are supporting premium product sales. Domestic players are introducing cost-effective yet high-quality alternatives, while international brands are targeting younger consumers through digital and e-commerce channels.

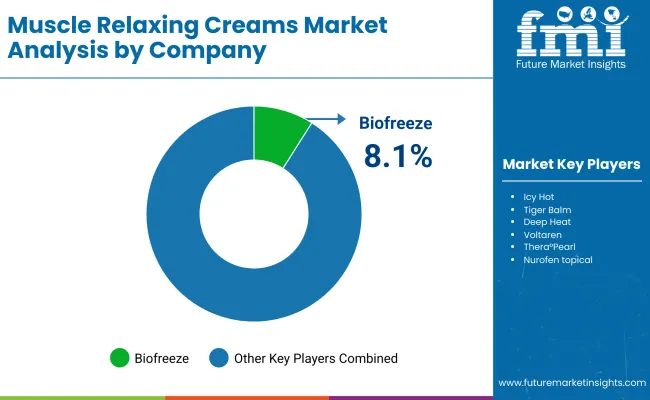

| Company | Global Value Share 2025 |

|---|---|

| Biofreeze | 8.1% |

| Others | 91.9% |

The Muscle Relaxing Creams Market is moderately fragmented, featuring a mix of multinational brands, regional manufacturers, and niche herbal specialists. Biofreeze leads with an 8.1% global value share, supported by its strong brand recognition in the sports recovery and physiotherapy segments. Other major players such as Icy Hot, Tiger Balm, Deep Heat, Voltaren (OTC topical), Salonpas, and Bengay collectively dominate the premium and mass-market categories through established pharmacy and e-commerce distribution. Their strategies focus on clinically tested formulations, product diversification (creams, gels, and roll-ons), and consumer trust built through medical endorsements.

Mid-sized brands like Arnicare and Thera°Pearl are capitalizing on the natural and herbal product trend, introducing paraben-free, vegan, and magnesium-based creams to attract health-conscious consumers. Local and regional players in Asia, especially in China and India, are intensifying competition through affordable menthol and camphor-based products inspired by traditional remedies. Competitive differentiation is now shifting from brand heritage to innovation in formulation, ingredient transparency, and digital engagement. Subscription-based wellness kits, targeted marketing toward athletes and seniors, and eco-friendly packaging are further defining the competitive landscape of the global Muscle Relaxing Creams Market.

Key Developments in Muscle Relaxing Creams Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3,905.3 Million |

| Product Type | Heat rub creams, Cooling menthol gels, Magnesium/botanical balms, Roll-on sticks |

| Active Class | Counterirritants (menthol/camphor), Warming sensates (VBE, capsaicinoids), Mineral/magnesium blends, Botanical analgesics (arnica) |

| Use Case | Sports recovery, Back/neck strain, Everyday aches |

| Channel | Pharmacies/drugstores, E-commerce, Sports/outdoor retail, Supermarkets |

| End User | Adults, Athletes, Seniors, Unisex |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Icy Hot, Tiger Balm, Biofreeze, Deep Heat, Voltaren (OTC topical), Salonpas, Bengay, Arnicare, Thera°Pearl, Nurofen topical |

| Additional Attributes | Dollar sales by product type and active class, adoption trends in sports recovery and physiotherapy applications, rising demand for cooling and fast-absorbing formulations, sector-specific growth in sports, wellness, and healthcare retail, product segmentation by counterirritant and herbal compositions, integration of natural ingredients such as menthol, camphor, arnica, and magnesium, regional trends influenced by aging population and fitness participation, and innovations in roll-on, hybrid warming–cooling, and paraben-free formulations |

The global Muscle Relaxing Creams Market is estimated to be valued at USD 3,905.3 million in 2025.

The market size for the Muscle Relaxing Creams Market is projected to reach USD 8,104.7 million by 2035.

The Muscle Relaxing Creams Market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in the Muscle Relaxing Creams Market are heat rub creams, cooling menthol gels, magnesium/botanical balms, and roll-on sticks.

In terms of product application, the cooling menthol gels segment is projected to command a significant share in 2025, driven by its quick absorption, soothing effect, and popularity among athletes and active consumers seeking instant muscle relaxation and inflammation relief.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Muscle Oxygen Monitors Market Size and Share Forecast Outlook 2025 to 2035

Muscle Relaxant Drugs Market Size and Share Forecast Outlook 2025 to 2035

Muscle Stimulator Market Size and Share Forecast Outlook 2025 to 2035

Muscle Tension Dysphonia Treatment Market - Trends, Growth & Forecast 2025 to 2035

The Muscle Stimulation Devices Market is segmented by Product, Application and End User from 2025 to 2035

Myorelaxing Agents Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fish Muscle Protein Market Analysis by Species, Type, Form and Application Through 2035

Firming Creams and Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Slugging Creams Market Size and Share Forecast Outlook 2025 to 2035

Anti-Aging Creams & Serums Market Size and Share Forecast Outlook 2025 to 2035

Anti-Wrinkle Creams Market Size and Share Forecast Outlook 2025 to 2035

Body Firming Creams Market Growth & Forecast 2025-2035

Eczema Relief Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Stress / Relaxing Agents Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Ice Creams Market Analysis by Form, Product Type, Flavor, Source, Sales Channel, and Region through 2035

Moisturizing Body Creams Market Size and Share Forecast Outlook 2025 to 2035

Age-Defying Night Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Hydrating Emollient Creams Market Size and Share Forecast Outlook 2025 to 2035

Cica-Infused Healing Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA