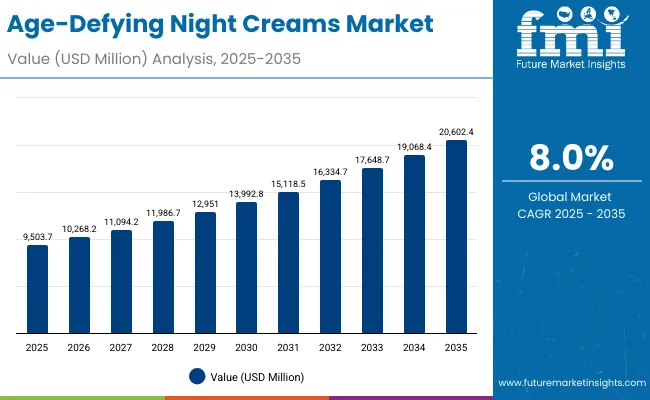

The Age-Defying Night Creams Market is expected to record a valuation of USD 9,503.7 million in 2025 and reach USD 20,602.4 million in 2035, with an increase of over USD 11,098.7 million, equating to a growth of nearly 193% over the decade. The overall expansion represents a CAGR of 8.0% and a doubling of market size, showcasing sustained global appetite for premium skincare solutions targeting mature consumers.

Age-Defying Night Creams Market Key Takeaways

| Metric | Value |

|---|---|

| Age-Defying Night Creams Market Estimated Value in (2025E) | USD 9,503.7 million |

| Age-Defying Night Creams Market Forecast Value in (2035F) | USD 20,602.4 million |

| Forecast CAGR (2025 to 2035) | 8.0% |

During the first five-year period from 2025 to 2030, the market grows from USD 9,503.7 million to USD 13,992.8 million, adding USD 4,489.1 million, which accounts for approximately 40% of the decade’s total growth. This phase records steady adoption in North America and Europe, where established brands dominate distribution through pharmacies, specialty retail, and department stores. Night creams, with their richer formulations, dominate this period as they cater to over half of the total demand, particularly among women aged 35+ and luxury skincare users. The emphasis on dermatologist-tested and clinically proven claims ensures high credibility and drives early growth momentum.

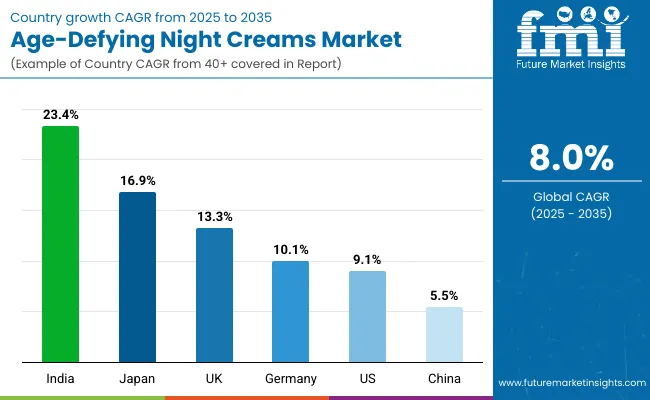

The second half from 2030 to 2035 contributes USD 6,609.6 million, equating to nearly 60% of the total decade growth, as the market expands from USD 13,992.8 million to USD 20,602.4 million. This acceleration is powered by heightened adoption in Asia-Pacific markets such as India (CAGR 23.4%) and Japan (CAGR 16.9%), where consumers increasingly embrace sleeping masks and balm concentrates. E-commerce and specialty retail channels fuel this phase, supported by vegan, fragrance-free, and clinically validated formulations. The ingredient profile diversifies, with hyaluronic acid and peptides gaining momentum alongside retinol. By 2035, the market reflects stronger balance between traditional night creams and innovative textures like gels and masks.

From 2020 to 2024, the Age-Defying Night Creams Market grew steadily, driven by increasing consumer preference for targeted skincare addressing premature aging. During this period, hardware-equivalent in skincare the night cream format itself dominated, controlling nearly 55% of revenues. Competitive dynamics favored established multinational players like Olay, Estée Lauder, and L’Oréal Paris, who leveraged dermatologist endorsements and clinical validation.

Differentiation relied on proven anti-wrinkle efficacy, brand trust, and premium packaging. Vegan and fragrance-free claims began to gain relevance but remained secondary. Distribution was heavily offline, with department stores and pharmacies leading. Demand for global age-defying night creams will reach USD 9,503.7 million in 2025, with the revenue mix gradually shifting toward innovative formats like sleeping masks and balm concentrates. While traditional leaders maintain dominance, digital-first beauty brands are gaining traction through e-commerce, influencer-driven marketing, and ingredient-focused transparency.

Peptides and hyaluronic acid are becoming core to new launches, catering to sensitive skin and hydration demands. E-commerce and online subscription services accelerate accessibility, particularly in younger demographics seeking preventive anti-aging. The competitive edge is moving beyond ingredient innovation alone to brand ecosystems, encompassing omnichannel strategies, personalization, and wellness-aligned positioning.

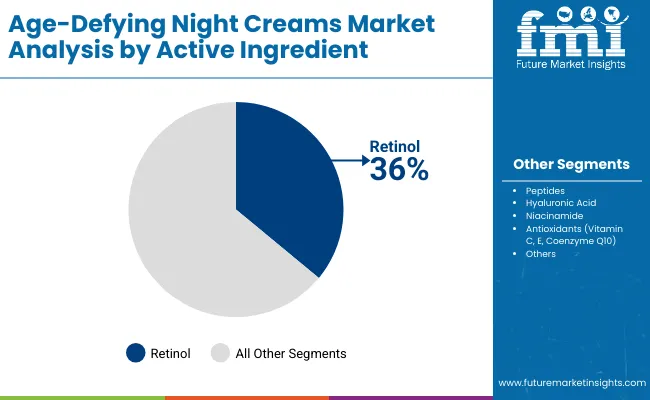

Advances in dermatological research have validated active ingredients such as retinol, peptides, and hyaluronic acid, which have demonstrated clinical efficacy in reducing wrinkles, boosting elasticity, and hydrating skin. By 2025, retinol leads with a 36% share, reflecting its global recognition as a gold standard in anti-aging. Increased demand is being driven by women over 35, but men’s grooming and luxury skincare users are also shaping broader adoption. Expansion of preventive and restorative skincare routines, supported by claims like dermatologist-tested, vegan, and fragrance-free, has fueled consumer confidence.

Innovations in product texture from rich night creams to lighter gels and overnight masks are unlocking new segments. Growth is led by premiumization in North America and Europe, while South Asia & Pacific drives volume expansion through affordability and rising middle-class income. By 2035, the market reflects a balanced mix of traditional formats and modern wellness-oriented offerings.

The market is segmented by active ingredient, function, product type, claim, channel, end user, and region. Active ingredients include retinol, peptides, hyaluronic acid, niacinamide, and antioxidants, reflecting the science-led backbone of anti-aging care. Functional categories span wrinkle reduction, firming, hydration, and brightening, addressing the diverse needs of mature and sensitive skin. Product formats range from night creams and gels to sleeping masks and balms, each serving distinct user preferences. Claims such as dermatologist-tested, clinically proven, vegan, and fragrance-free highlight the importance of safety, efficacy, and ethical positioning.

By channel, e-commerce, pharmacies, specialty beauty retail, and department stores represent key distribution nodes. End users include women 35+, men, luxury skincare users, and sensitive skin users, each contributing to the market’s evolving demand base. Regionally, scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa. Country-level highlights reveal the USA (CAGR 9.1%) as the largest premium-driven market, while India (CAGR 23.4%) emerges as the fastest-growing globally, supported by rising disposable incomes and youth-driven skincare trends.

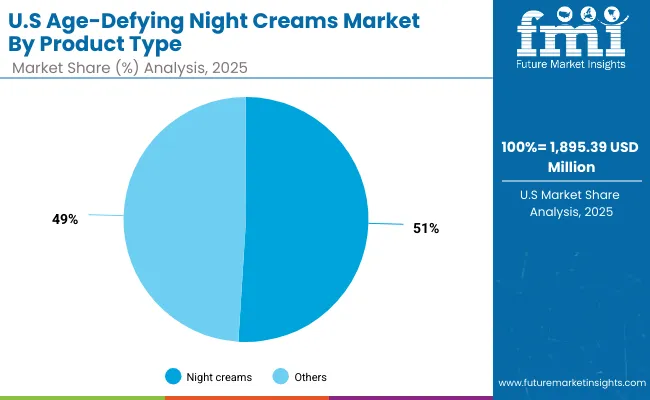

| Product Type | Value Share% 2025 |

|---|---|

| Night creams | 53% |

| Others | 47.0% |

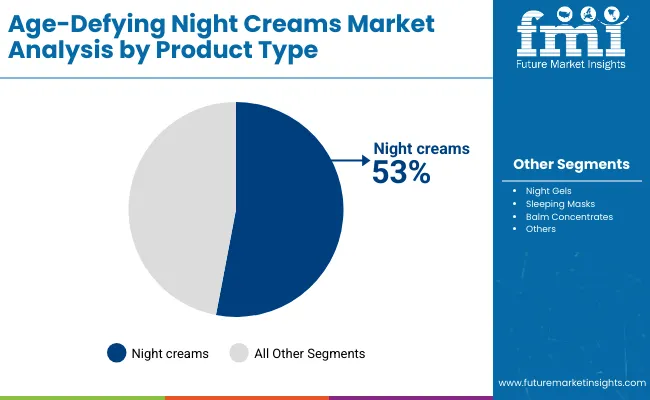

The night creams segment is projected to contribute 53% of the Age-Defying Night Creams Market revenue in 2025, maintaining its lead as the dominant product category. This growth is fueled by strong consumer reliance on traditional cream-based formats, valued for their rich textures, high absorbency, and ability to deliver overnight nourishment. Night creams remain the first choice among women aged 35+ and luxury skincare users, who perceive them as clinically proven solutions for wrinkle reduction and hydration.

The segment’s strength also lies in its universal appeal across both premium and mass-market ranges, with leading brands innovating through dermatologist-tested and fragrance-free claims to cater to sensitive skin users. Advances in formulation science, such as encapsulated retinol and multi-peptide blends, are enhancing performance, making night creams indispensable in anti-aging routines. With evolving packaging designs and eco-friendly claims, night creams are expected to retain their status as the cornerstone of the global market through 2035.

| Function | Value Share% 2025 |

|---|---|

| Anti-aging/wrinkle reduction | 47% |

| Others | 53.0% |

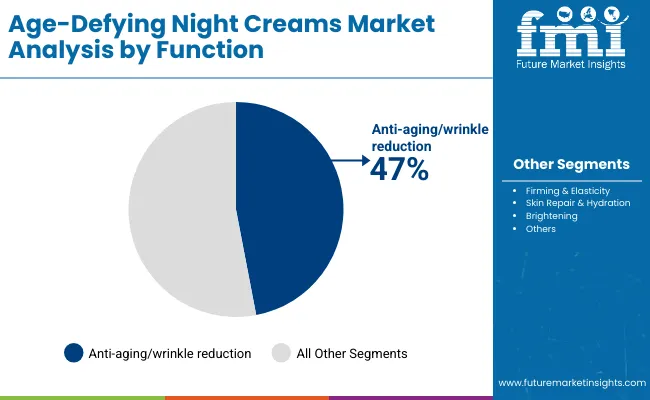

The anti-aging/wrinkle reduction segment is forecasted to hold 47% of the market share in 2025, led by global consumer demand for products that reduce visible lines, boost collagen, and restore youthful skin appearance. This function is particularly favored in developed markets such as the USA, Germany, and Japan, where consumers prioritize scientifically backed, clinically proven results.

Night creams and sleeping masks under this function are enriched with retinol, peptides, and antioxidants, making them effective in addressing signs of aging caused by UV damage, pollution, and lifestyle stressors. Their widespread acceptance is further supported by dermatologist endorsements and clinical trial claims, which provide a trust factor in both offline and online channels. As aging populations expand globally, and preventive skincare trends gain traction among younger consumers, wrinkle-reduction products are expected to remain the dominant functional driver of demand in the market.

| Active Ingredient | Value Share% 2025 |

|---|---|

| Retinol | 36% |

| Others | 64.0% |

The retinol segment is projected to account for 36% of the Age-Defying Night Creams Market revenue in 2025, establishing itself as the leading active ingredient. Retinol’s proven efficacy in reducing wrinkles, accelerating skin cell turnover, and improving skin texture positions it as the gold standard in anti-aging skincare. Its versatility in formulations from night creams to sleeping masks has cemented its leadership across product types.

The growing consumer preference for dermatologist-tested and clinically validated formulations has further boosted retinol-based launches by global leaders like Olay, L’Oréal Paris, and Estée Lauder. Recent innovations in stabilized retinol and encapsulation technologies have reduced irritation risks, making these products more accessible to sensitive skin users. With continuous clinical backing and consumer trust, retinol is expected to maintain its stronghold, even as peptides and hyaluronic acid gain momentum in hydration and elasticity-focused products. This ensures retinol remains the cornerstone ingredient driving the market’s credibility and growth trajectory.

Rising Dermatological Validation and Clinical Efficacy Claims

In recent years, consumers have shifted from marketing-driven skincare to science-backed formulations, demanding proof of efficacy before purchase. Age-defying night creams enriched with retinol, peptides, and niacinamide have gained trust due to dermatologist-tested and clinically proven labels, which accounted for a large share of premium launches between 2022-2024. The USA market, in particular, is experiencing growth (CAGR 9.1% from 2025-2035) as clinical validation drives higher acceptance among women 35+ and sensitive skin users. Brands are investing in clinical trials to demonstrate wrinkle reduction and hydration efficacy, ensuring that scientific credibility becomes a driver of premium pricing and consumer loyalty.

Accelerated Growth in Asia-Pacific with Functional Skincare Adoption

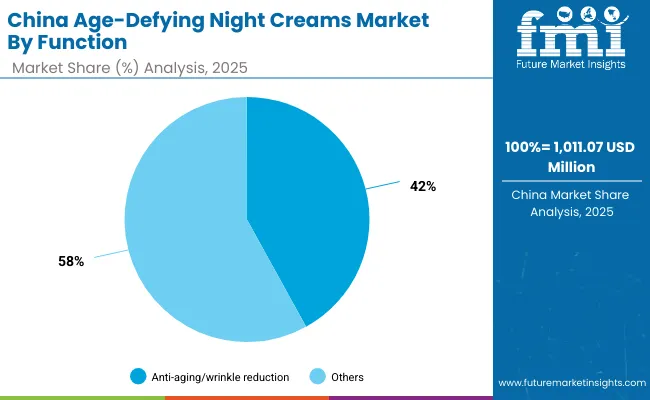

The South Asia & Pacific region, led by India (CAGR 23.4%) and Japan (CAGR 16.9%), is fueling global momentum. Unlike Western markets dominated by traditional creams, these regions are driving uptake of sleeping masks and balm concentrates, appealing to younger users looking for multifunctional products. In China, anti-aging/wrinkle reduction already holds 42% of functional demand in 2025, highlighting the strong preference for visible anti-aging results. With rising disposable income, beauty consciousness, and cultural acceptance of multi-step routines, Asia-Pacific markets are accelerating overall category growth and pushing global players to tailor launches with localized textures, packaging, and price tiers.

Sensitivity Risks of Retinol and Strong Actives

While retinol (36% market share in 2025) is a cornerstone ingredient, it presents a barrier to broader adoption due to irritation risks, redness, and sensitivity in first-time users. Consumers with sensitive skin often avoid retinol-heavy products, opting instead for milder alternatives like peptides or hyaluronic acid. This limits the total addressable market, particularly in regions where dermatological access is limited. Brands are working on encapsulated and stabilized retinol formulations, but consumer hesitation and misinformation online continue to act as a restraint to full-market penetration, especially in emerging economies.

High Competition and Commoditization in Mid-Tier Segments

Despite premium growth, the mid-tier segment faces overcrowding with similar claims "hydration," "wrinkle reduction," and "brightening" leading to consumer fatigue. In price-sensitive markets like India and Latin America, cheaper alternatives and herbal or natural creams often replace premium night creams, restraining sales growth. Moreover, global giants such as L’Oréal, Estée Lauder, and Olay face stiff competition from local and K-beauty brands offering sleeping masks and gels with comparable performance at lower prices. This commoditization pressures margins, creating a growth restraint for international players targeting the mass-affordable tier.

Shift Toward Functional Diversity Beyond Anti-Aging

While anti-aging/wrinkle reduction (47% share in 2025) dominates, consumer expectations are broadening. Products that combine hydration, brightening, and repair within one night application are trending, particularly among men and younger luxury skincare users. Multifunctional sleeping masks and balm concentrates are gaining traction as they blend hydration with overnight barrier repair, appealing to preventive skincare routines. This shift indicates that the market is evolving from single-function anti-aging to comprehensive, wellness-aligned skincare, opening opportunities for hybrid formulations.

E-commerce and Subscription-Based Skincare Ecosystems

By 2025, e-commerce will emerge as the fastest-growing distribution channel, particularly in Asia-Pacific and North America. Online platforms enable ingredient-focused transparency, customer reviews, and influencer-driven marketing, all of which strongly influence purchase decisions for night creams. Subscription-based skincare services offering customized age-defying formulations are expanding, appealing to sensitive skin and luxury users seeking personalized regimens. With younger demographics driving online adoption, this trend will strengthen direct-to-consumer (DTC) brand growth, challenging traditional department store and pharmacy channels.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 5.5% |

| USA | 9.1% |

| India | 23.4% |

| UK | 13.3% |

| Germany | 10.1% |

| Japan | 16.9% |

The country-wise outlook reveals significant variation in growth trajectories, reflecting local consumer behaviors, demographics, and purchasing power. The USA market (CAGR 9.1%) stands out as one of the largest and most premium-driven, sustained by dermatologist-tested and clinically proven products that appeal to women over 35 and luxury skincare users. Germany (10.1%) and the UK (13.3%) also display strong growth within Europe, where clinical credibility and dermocosmetic positioning drive sales. Meanwhile, China’s moderate CAGR of 5.5% highlights a maturing market with stable but steady demand for anti-aging creams, supported by a growing middle class and rising preference for preventive skincare.

By contrast, India (23.4%) leads globally as the fastest-growing market, reflecting rising disposable incomes, rapid adoption of e-commerce, and a young population embracing preventive anti-aging routines earlier than previous generations. Similarly, Japan (16.9%) demonstrates strong demand for advanced night creams, sleeping masks, and balms, where luxury and functional skincare converge within highly regimented beauty rituals. Together, India and Japan will serve as key growth engines in Asia, while the USA will continue to anchor premium sales. This divergence highlights how global growth is split between premium maturity in Western markets and rapid expansion in emerging Asian economies, creating opportunities for localized innovation.

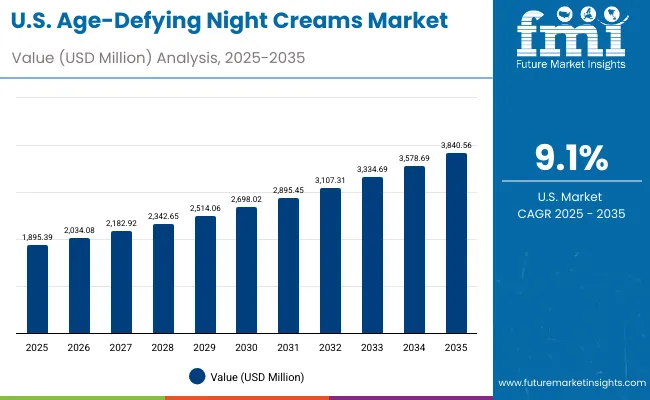

| Year | USA Age-Defying Night Creams Market (USD Million) |

|---|---|

| 2025 | 1,895.39 |

| 2026 | 2,034.08 |

| 2027 | 2,182.92 |

| 2028 | 2,342.65 |

| 2029 | 2,514.06 |

| 2030 | 2,698.02 |

| 2031 | 2,895.45 |

| 2032 | 3,107.31 |

| 2033 | 3,334.69 |

| 2034 | 3,578.69 |

| 2035 | 3,840.56 |

The Age-Defying Night Creams Market in the United States is projected to grow at a CAGR of 9.1%, anchored by premium skincare adoption among women aged 35+, luxury skincare buyers, and a rising male grooming segment. Night creams dominate the category, accounting for 51% of sales in 2025, driven by strong consumer trust in cream-based, dermatologist-tested formulations. USA consumers demonstrate high willingness to pay for products backed by clinical evidence, particularly those featuring retinol and peptides. E-commerce platforms and department stores remain key distribution channels, though digital-first beauty subscription models are growing rapidly.

The Age-Defying Night Creams Market in the United Kingdom is expected to grow at a CAGR of 13.3%, supported by strong demand for anti-aging and skin-brightening products. Consumers increasingly favor dermatologist-recommended creams, while vegan and fragrance-free claims gain traction among sensitive skin users. Premium skincare culture is deeply ingrained, with department stores and specialty beauty retailers leading sales channels. The market also benefits from clinical skincare positioning, with European brands emphasizing research-driven efficacy.

India is witnessing rapid growth in the Age-Defying Night Creams Market, which is forecast to expand at a CAGR of 23.4% through 2035, the fastest globally. Growth is being driven by rising disposable incomes, widespread e-commerce penetration, and early adoption of anti-aging regimens among younger consumers. Urban centers lead premium sales, while tier-2 cities are emerging demand hubs thanks to affordable price points and smaller SKUs. Hydration and wrinkle-prevention products are gaining mainstream traction, while sleeping masks are becoming popular among millennials.

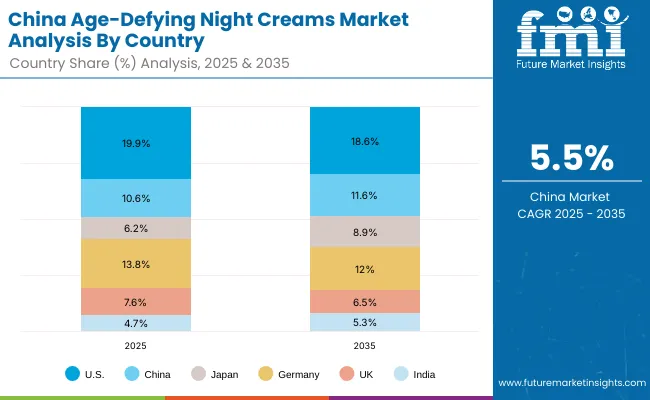

| Countries | 2025 Share (%) |

|---|---|

| USA | 19.9% |

| China | 10.6% |

| Japan | 6.2% |

| Germany | 13.8% |

| UK | 7.6% |

| India | 4.7% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 18.6% |

| China | 11.6% |

| Japan | 8.9% |

| Germany | 12.0% |

| UK | 6.5% |

| India | 5.3% |

The Age-Defying Night Creams Market in China is expected to grow at a CAGR of 5.5%, reflecting a maturing but highly competitive landscape. The anti-aging/wrinkle reduction function holds 42% of sales in 2025, demonstrating strong consumer preference for visible results. However, the market faces slowing growth compared to India and Japan due to saturation and strong local competition. Sleeping masks and balm concentrates are gaining traction, aligning with Asian beauty routines that favor overnight treatments.

| USA by product Type | Value Share% 2025 |

|---|---|

| Night creams | 51% |

| Others | 49.0% |

The Age-Defying Night Creams Market in the United States is projected at USD 1,895.39 million in 2025, growing at a CAGR of 9.1% through 2035. Night creams contribute 51% of category revenues, while other innovative formats such as sleeping masks and gels account for the remaining 49%. The slight dominance of night creams reflects USA consumers’ preference for clinically validated, dermatologist-tested solutions designed for wrinkle reduction and hydration. This segment maintains its leadership due to strong trust in traditional formulations, particularly those enriched with retinol and peptides, which remain the gold standard for anti-aging efficacy.

The expansion of e-commerce and subscription-based beauty services is reshaping market access, allowing consumers to explore personalized regimens and premium offerings beyond department stores and pharmacies. Preventive skincare among younger demographics and growing male participation further strengthen demand. As clinical credibility and brand trust remain central to purchase decisions, night creams are expected to hold their dominant role in the USA, even as alternative formats like masks grow in appeal.

| China by Function | Value Share% 2025 |

|---|---|

| Anti-aging/wrinkle reduction | 42% |

| Others | 58.0% |

The Age-Defying Night Creams Market in China is valued at USD 1,011.07 million in 2025, with an estimated CAGR of 5.5% through 2035. Anti-aging and wrinkle reduction products hold 42% of the functional demand, highlighting a strong preference for results-driven formulations. This dominance stems from China’s expanding middle class and beauty-conscious consumers who view visible anti-aging results as essential in their skincare regimens. The demand is particularly robust among urban populations, where global and domestic brands compete aggressively across e-commerce and social commerce channels.

While anti-aging is the strongest function, hydration and brightening are expanding quickly due to younger demographics adopting preventive skincare routines earlier. Domestic firms are leveraging affordable retinol and peptide-infused masks and gels to gain market share, while premium brands emphasize luxury positioning and clinical efficacy. As local competition intensifies, the Chinese market reflects a dual growth path: mass adoption through affordability and premium expansion through scientific credibility.

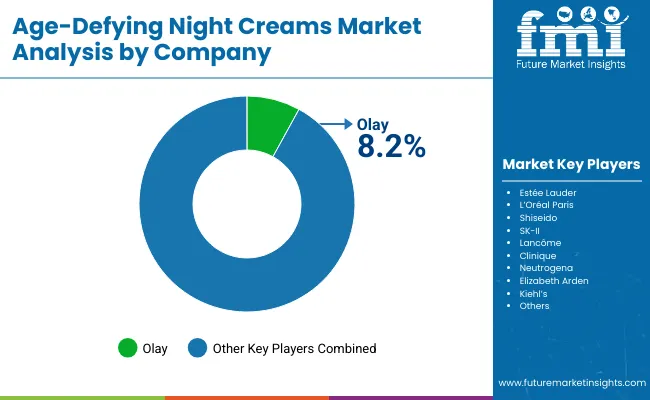

The Age-Defying Night Creams Market is moderately fragmented, with multinational giants, heritage brands, and emerging clean-beauty challengers competing across diverse product formats. Olay leads with 8.2% global share in 2025, supported by its deep penetration in both mass and premium channels. Established leaders such as Estée Lauder, L’Oréal Paris, Shiseido, SK-II, Lancôme, Clinique, Neutrogena, Elizabeth Arden, and Kiehl’s continue to dominate through strong clinical validation, premium positioning, and omnichannel retail strategies.

Their focus increasingly centers on retinol, peptides, and hyaluronic acid formulations, with clinical backing and dermatologist endorsements as differentiators. Mid-sized brands and niche players are accelerating through vegan, fragrance-free, and sensitive-skin-friendly claims, capitalizing on clean-label trends. These challengers are highly active in e-commerce and subscription models, gaining traction among younger consumers seeking transparency and personalization.

Domestic Asian players, particularly in China and Japan, are reshaping competition through affordable yet innovative formats like sleeping masks, eroding share from established Western brands. Competitive differentiation is shifting from product claims alone to ecosystem strength, where integrated strategies spanning ingredient science, digital marketing, subscription services, and omnichannel access determine long-term brand resilience. The rise of clean-beauty disruptors and Asia-centric challengers ensures that global leaders face intensified rivalry over the next decade.

Key Developments in Age-Defying Night Creams Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Active Ingredient | Retinol, Peptides, Hyaluronic Acid, Niacinamide, Antioxidants (Vitamin C, E, Coenzyme Q10) |

| Function | Anti-aging/Wrinkle Reduction, Firming & Elasticity, Skin Repair & Hydration, Brightening |

| Product Type | Night Creams, Night Gels, Sleeping Masks, Balm Concentrates |

| Claim | Dermatologist-Tested, Clinically Proven, Vegan, Fragrance-Free |

| Channel | E-commerce, Pharmacies, Specialty Beauty Retail, Department Stores |

| End User | Women 35+, Men, Luxury Skincare Users, Sensitive Skin Users |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, China, India, Japan, Germany, United Kingdom |

| Key Companies Profiled | Olay, Estée Lauder, L’Oréal Paris, Shiseido, SK-II, Lancôme, Clinique, Neutrogena, Elizabeth Arden, Kiehl’s |

| Additional Attributes | Dollar sales by product type and function, adoption trends in clinically proven and dermatologist-tested products, rising demand for retinol and peptides, segment-specific growth in wrinkle reduction and hydration, revenue segmentation by e-commerce and offline channels, integration of AI-driven personalization and subscription beauty services, regional trends influenced by luxury demand in Western markets and volume growth in Asia-Pacific, and innovations in encapsulated retinol, multi-peptide blends, and sleeping mask formulations. |

The Age-Defying Night Creams Market is estimated to be valued at USD 9,503.7 million in 2025.

The market size for the Age-Defying Night Creams Market is projected to reach USD 20,602.4 million by 2035.

The Age-Defying Night Creams Market is expected to grow at a CAGR of 8.0% between 2025 and 2035.

The key product types in the Age-Defying Night Creams Market are night creams, night gels, sleeping masks, and balm concentrates.

In terms of function, the anti-aging/wrinkle reduction segment is expected to command 47% share in the Age-Defying Night Creams Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Night Vision Surveillance Cameras Market Size and Share Forecast Outlook 2025 to 2035

Night Vision System Market Growth - Trends & Forecast 2024 to 2034

Night Vision Device Market

Over-night Hair Treatment Products Market Size and Share Forecast Outlook 2025 to 2035

Automotive Night Vision Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Night Vision Market

Retinoid-Infused Night Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Firming Creams and Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Slugging Creams Market Size and Share Forecast Outlook 2025 to 2035

Anti-Aging Creams & Serums Market Size and Share Forecast Outlook 2025 to 2035

Anti-Wrinkle Creams Market Size and Share Forecast Outlook 2025 to 2035

Body Firming Creams Market Growth & Forecast 2025-2035

Eczema Relief Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Muscle Relaxing Creams Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Ice Creams Market Analysis by Form, Product Type, Flavor, Source, Sales Channel, and Region through 2035

Moisturizing Body Creams Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Hydrating Emollient Creams Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA