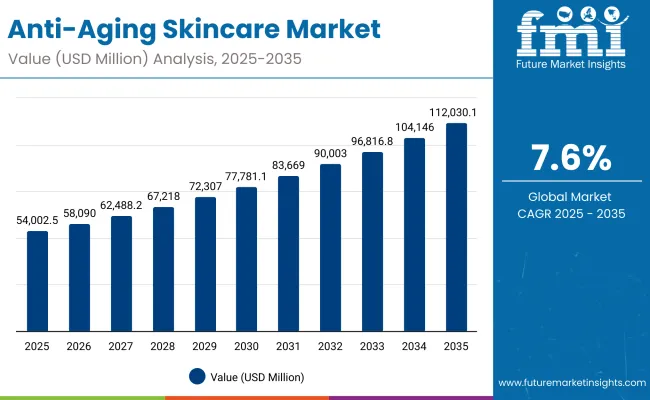

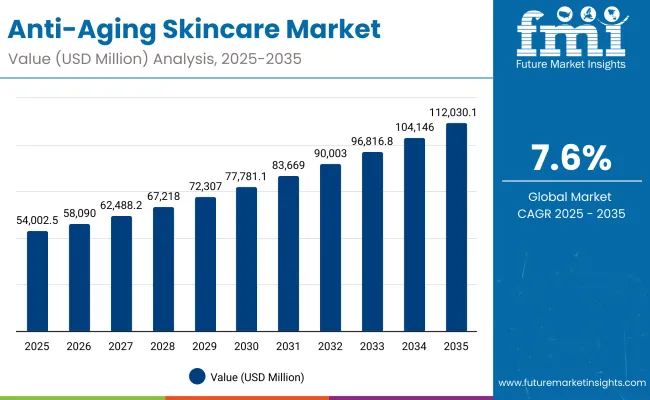

The Anti-Aging Skincare Market is expected to record a valuation of USD 54,002.5 million in 2025 and USD 112,030.1 million in 2035, with an increase of USD 58,027.6 million, which equals a growth of 107% over the decade. The overall expansion represents a CAGR of 7.6% and a 2X increase in market size.

Anti-Aging Skincare Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Aging Skincare Market Estimated Value in (2025E) | USD 54,002.5 million |

| Anti-Aging Skincare Market Forecast Value in (2035F) | USD 112,030.1 million |

| Forecast CAGR (2025 to 2035) | 7.6% |

During the first five-year period from 2025 to 2030, the market increases from USD 54,002.5 million to USD 77,781.1 million, adding USD 23,778.6 million, which accounts for 41% of the total decade growth. This phase records steady adoption of serums & ampoules and creams/lotions, supported by growing consumer demand for clinically validated, dermatologist-endorsed, and evidence-based products. Serums & ampoules dominate this period, capturing over 45% of demand, reflecting their efficacy-driven positioning in anti-aging regimens.

The second half from 2030 to 2035 contributes USD 34,249 million, equal to 59% of total growth, as the market jumps from USD 77,781.1 million to USD 112,030.1 million. This acceleration is powered by rapid e-commerce expansion, premiumization in luxury skincare, and the rising appeal of clean-label and vegan claims. Specialty beauty retail and online platforms together capture a larger share above 60% by the end of the decade. Clinically validated and clean-label formulas continue to lead growth, supported by influencer-driven marketing, digital-first launches, and strong adoption across Asia-Pacific and Europe.

From 2020 to 2024, the Anti-Aging Skincare Market expanded steadily, supported by growing demand for retinoids, peptides, and clinically validated skincare solutions. During this period, the competitive landscape was dominated by multinational cosmetic giants controlling the majority of revenue, with leaders such as Estée Lauder, L’Oréal, and Shiseido leveraging dermatological research and strong retail presence. Competitive differentiation relied on clinically proven efficacy, premium positioning, and brand trust, while niche clean-label and vegan entrants remained secondary contributors.

Demand for Anti-Aging Skincare will expand to USD 54,002.5 million in 2025, with the revenue mix shifting further toward serums, ampoules, and clinically validated products. Traditional leaders face rising competition from digital-first, clean-label, and influencer-led brands offering direct-to-consumer engagement and subscription-based skincare regimens. Premiumization, personalized skincare, and e-commerce acceleration are redefining the competitive advantage, moving beyond traditional product portfolios to ecosystem-driven, omnichannel brand strategies.

Consumers are increasingly prioritizing evidence-based skincare, driving demand for anti-aging products with clinically validated claims. Brands like SkinCeuticals, Estée Lauder, and L’Oréal are investing heavily in dermatological research, showcasing clinical trials and peer-reviewed studies to build trust. This shift reflects a more educated consumer base that values measurable results, especially in serums and ampoules, which dominate the market. The credibility of science-backed claims is accelerating adoption across premium and mass-market segments.

The Asia-Pacific region, led by China (21.3% CAGR) and India (23.9% CAGR), is fueling global growth as rising disposable incomes, urbanization, and digital retail access accelerate adoption of premium anti-aging skincare. Consumers in these markets are highly receptive to luxury serums, creams, and clean-label formulations, supported by influencer marketing and cross-border e-commerce. This appetite for prestige beauty, combined with rapid online penetration, is creating a powerful growth engine that contributes disproportionately to the sector’s global expansion.

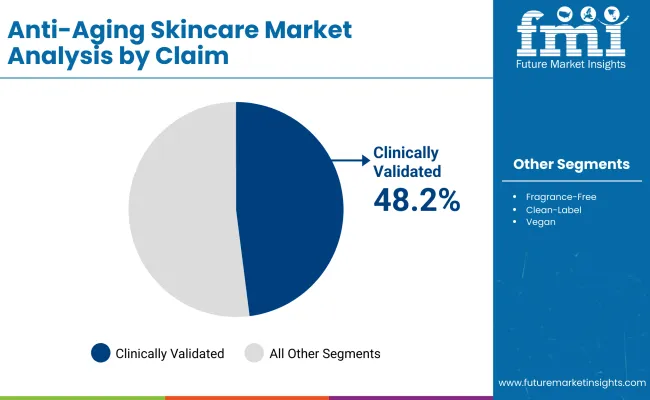

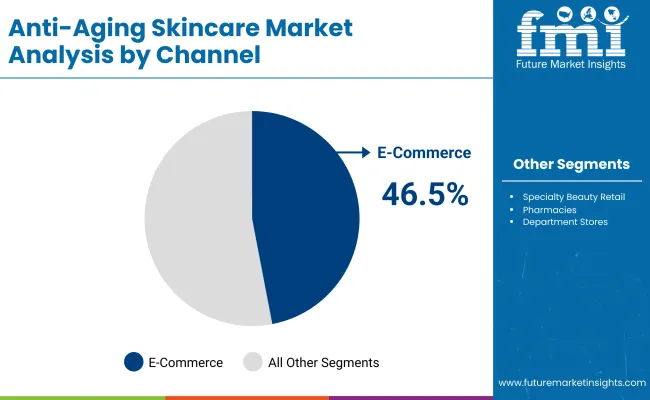

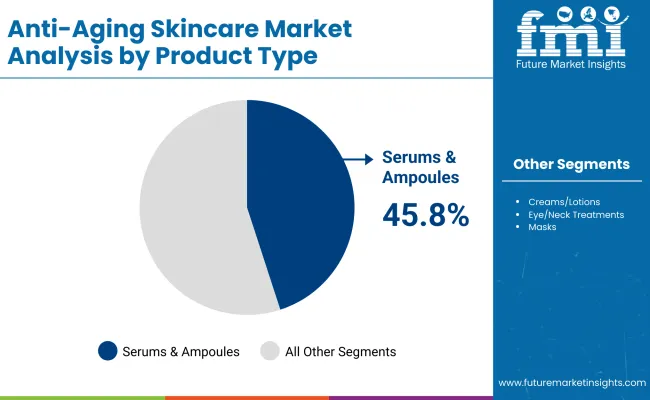

The Anti-Aging Skincare Market is segmented by active system, product type, claim, channel, end user, and region. Active systems include retinoids & retinol alternatives, peptides, antioxidants (vitamin C/E, resveratrol), acids & renewers (AHA/BHA/PHA), and hyaluronic & hydration systems, highlighting the science-driven formulations fueling adoption. By product type, the market is categorized into serums & ampoules, creams/lotions, eye/neck treatments, and masks. Claims cover clinically validated, fragrance-free, clean-label, and vegan, reflecting evolving consumer priorities. Distribution channels include e-commerce, specialty beauty retail, pharmacies, and department stores. End users span women 30+, men, luxury skincare users, and sensitive skin users. Regionally, the market scope spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with country-level insights for the USA, China, India, Japan, Germany, the UK, and Europe.

| Claim | Value Share % 2025 |

|---|---|

| Clinically validated | 48.2% |

| Others | 51.8% |

The clinically validated segment is projected to contribute 48.2% of the Anti-Aging Skincare Market revenue in 2025, maintaining its lead as the most influential claim category. This dominance is driven by growing consumer demand for science-backed, dermatologist-tested, and evidence-based products that deliver visible results. Serums and ampoules, in particular, benefit from this trend as brands highlight clinical trial data to strengthen credibility.

The segment’s growth is also supported by the rise of transparency in labeling and marketing, where consumers prioritize proof of efficacy over traditional brand loyalty. Clinically validated anti-aging solutions are expected to retain their position as the most trusted and premium segment across global markets.

| Channel | Value Share % 2025 |

|---|---|

| E-commerce | 46.5% |

| Others | 53.5% |

The e-commerce segment is forecasted to contribute 46.5% of the Anti-Aging Skincare Market revenue in 2025, reflecting its growing role as a preferred purchasing channel. Online platforms have become central to consumer engagement, offering access to global and niche brands while enabling personalized recommendations through AI-driven tools.

E-commerce growth is further accelerated by the popularity of social media influencers and live-streaming sales in Asia-Pacific markets. Subscription-based models and direct-to-consumer strategies are also enhancing customer loyalty, positioning e-commerce as the fastest-rising sales channel for anti-aging skincare.

| Product Type | Value Share % 2025 |

|---|---|

| Serums & ampoules | 45.8% |

| Others | 54.2% |

The serums & ampoules segment is projected to account for 45.8% of the Anti-Aging Skincare Market revenue in 2025, establishing it as the leading product type. These formats are favored for their high concentration of active ingredients such as retinoids, peptides, and antioxidants, which deliver targeted results in reducing wrinkles, fine lines, and pigmentation. Their lightweight formulations and fast absorption properties make them especially popular among consumers seeking intensive and visible results compared to traditional creams or lotions.

This dominance is reinforced by dermatologists’ strong endorsements, as serums are often prescribed as part of professional anti-aging routines. Global brands such as Estée Lauder, SkinCeuticals, and L’Oréal have further propelled this category by positioning serums as premium, science-driven products backed by clinical validation. The rise of ampoules in Asia-Pacific, particularly in South Korea and China, has added momentum, with single-use, high-potency formats resonating with younger, urban consumers. As awareness of preventive skincare grows among women aged 30+ and men increasingly enter the market, serums & ampoules are expected to retain their leadership, supported by ongoing innovation in clean-label, vegan, and clinically proven formulations.

Rising consumer demand for science-backed skincare

The Anti-Aging Skincare Market is being propelled by increasing consumer preference for clinically validated and science-backed products. Consumers are no longer satisfied with generic claims and are instead seeking evidence-based solutions supported by clinical trials and dermatologist endorsements. This has elevated the role of serums, ampoules, and peptide-based formulas, which demonstrate visible results in reducing wrinkles and fine lines. Premium brands such as SkinCeuticals, Estée Lauder, and L’Oréal are capitalizing on this trend, strengthening trust and driving higher sales across both developed and emerging regions.

Expanding middle-class and premiumization in Asia-Pacific

Asia-Pacific, particularly China and India, is fueling growth with CAGRs of 21.3% and 23.9% respectively, due to rising disposable incomes and increased awareness of preventive skincare. Consumers in these markets are adopting serums, creams, and clean-label solutions earlier in life, treating anti-aging as a proactive rather than corrective measure. This has led to strong demand for premium and luxury skincare brands, supported by e-commerce platforms and influencer-driven marketing. The rapid expansion of online retail channels has further democratized access, accelerating premiumization and making Asia-Pacific a global growth engine for anti-aging skincare.

High cost of advanced formulations limiting accessibility

Whilepremiumization supports market expansion, the high cost of clinically validated and luxury anti-aging products remains a key barrier. Serums and ampoules with advanced actives like peptides, retinol alternatives, and antioxidants are priced significantly higher than conventional skincare, limiting access among middle- and low-income groups. This creates an affordability gap in both mature and emerging markets, where only upper-income consumers can regularly purchase these products. As a result, the mass-market segment often lags behind in adopting premium anti-aging innovations, slowing overall penetration despite rising demand across demographics.

Clean-label, vegan, and sustainable anti-aging solutions

A prominent trend shaping the Anti-Aging Skincare Market is the surge in demand for clean-label, vegan, and eco-conscious formulations. Consumers are increasingly scrutinizing ingredient lists, avoiding parabens, sulfates, and artificial fragrances while seeking natural actives such as resveratrol and hyaluronic acid. This shift is strongly pronounced among millennials and Gen Z, who value sustainability and transparency alongside efficacy. Brands like Drunk Elephant and Kiehl’s are capitalizing on this trend with clean-label positioning, while larger players are reformulating existing lines to meet evolving expectations. This trend is reshaping competition, pushing innovation toward safer, ethical, and sustainable anti-aging solutions.

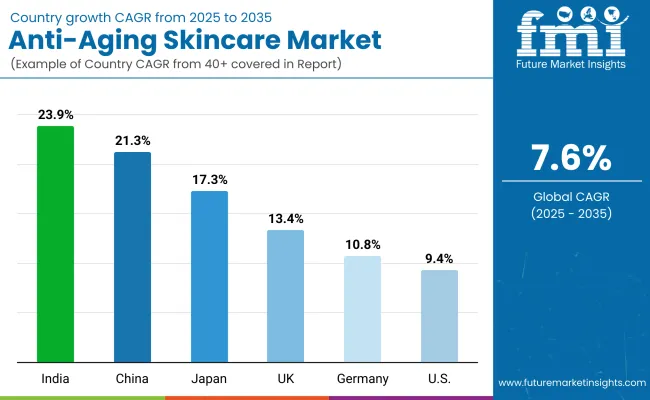

| Country | Estimated CAGR (2025–2035) |

|---|---|

| China | 21.3% |

| USA | 9.4% |

| India | 23.9% |

| UK | 13.4% |

| Germany | 10.8% |

| Japan | 17.3% |

The global Anti-Aging Skincare Market shows a pronounced regional disparity in adoption speed, shaped by consumer preferences, income levels, and retail expansion. Asia-Pacific emerges as the fastest-growing region, anchored by India at 23.9% CAGR and China at 21.3% CAGR. This acceleration is driven by rising disposable incomes, early adoption of preventive skincare, and rapid e-commerce expansion. Premium and luxury brands are expanding aggressively, while local players introduce cost-effective clean-label alternatives.

Japan, growing at 17.3% CAGR, is fueled by demand for advanced, clinically validated formulations and strong integration of anti-aging skincare into daily routines. Europe maintains a strong growth profile, led by the UK (13.4%) and Germany (10.8%), where consumers prioritize dermatologist-tested and fragrance-free claims, supported by high pharmacy penetration.

North America shows steady expansion, with the USA at 9.4% CAGR, reflecting maturity in the premium skincare sector but continued growth from clinically validated serums and subscription-based online models. Growth is increasingly driven by clean-label reformulations and digital-first strategies, ensuring that established brands remain competitive against indie entrants.

| Year | USA Anti-Aging Skincare Market (USD Million) |

|---|---|

| 2025 | 12,150.56 |

| 2026 | 12,956.35 |

| 2027 | 13,815.57 |

| 2028 | 14,731.78 |

| 2029 | 15,708.74 |

| 2030 | 16,750.50 |

| 2031 | 17,861.34 |

| 2032 | 19,045.85 |

| 2033 | 20,308.91 |

| 2034 | 21,655.73 |

| 2035 | 23,091.87 |

The Anti-Aging Skincare Market in the United States is projected to grow at a CAGR of 9.4% (2025–2035), reaching USD 23,091.87 million by 2035. Growth is fueled by strong consumer demand for clinically validated serums, dermatologist-tested formulations, and clean-label products. Pharmacies and specialty beauty retailers continue to dominate distribution, while e-commerce platforms expand rapidly with subscription-based and direct-to-consumer models. Premium brands such as Estée Lauder, Clinique, and SkinCeuticals hold strong positions, supported by dermatologist endorsements and high brand loyalty.

The Anti-Aging Skincare Market in the United Kingdom is expected to grow at a CAGR of 13.4% (2025–2035), supported by rising consumer demand for premium skincare, increasing awareness of clinically validated products, and strong retail penetration. Pharmacies and specialty beauty stores continue to drive adoption, while e-commerce growth is accelerating access to niche and luxury brands. Consumers are shifting toward fragrance-free, clean-label, and vegan formulations, with younger demographics embracing preventive skincare. Premium players such as Lancôme, Estée Lauder, and La Roche-Posay benefit from strong dermatologist endorsements and growing digital-first strategies.

India is witnessing rapid growth in the Anti-Aging Skincare Market, which is forecast to expand at a CAGR of 23.9% through 2035, making it one of the fastest-growing markets globally. Rising disposable incomes, urbanization, and greater awareness of preventive skincare are driving adoption beyond metro cities into Tier-2 and Tier-3 markets. Local players are introducing affordable serums and creams with retinoids, peptides, and natural actives, while global brands such as Estée Lauder, Lancôme, and L’Oréal are expanding premium lines through e-commerce and specialty beauty retail. Digital campaigns, dermatologist endorsements, and the growing demand for fragrance-free and vegan claims further reinforce this momentum.

The Anti-Aging Skincare Market in China is expected to grow at a CAGR of 21.3% (2025–2035), the highest among leading economies. Growth is driven by strong consumer demand for luxury skincare, rapid e-commerce penetration, and early adoption of preventive anti-aging routines among younger demographics. International players like Estée Lauder, Lancôme, and L’Oréal dominate the premium segment, while local brands are competing through competitive pricing and herbal-based formulations. Social commerce platforms such as Tmall, JD.com, and Douyin are expanding access to both domestic and global brands, reinforcing China’s role as a global growth engine.

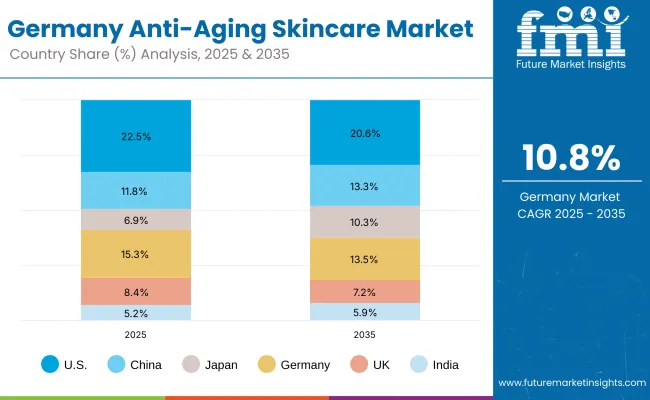

| Country | 2025 Share (%) |

|---|---|

| USA | 22.5% |

| China | 11.8% |

| Japan | 6.9% |

| Germany | 15.3% |

| UK | 8.4% |

| India | 5.2% |

| Country | 2035 Share (%) |

|---|---|

| USA | 20.6% |

| China | 13.3% |

| Japan | 10.3% |

| Germany | 13.5% |

| UK | 7.2% |

| India | 5.9% |

The Anti-Aging Skincare Market in Germany is projected to grow at a CAGR of 10.8% (2025–2035), supported by strong consumer demand for clinically validated and dermatologist-tested formulations. Pharmacies dominate the distribution landscape, offering trusted international brands such as Eucerin, La Roche-Posay, and L’Oréal, which benefit from high levels of dermatologist endorsement. Clean-label and fragrance-free claims are particularly influential, as German consumers prioritize safety, efficacy, and sustainability in purchase decisions. In addition, eco-certified and vegan formulations are rapidly gaining traction, aligning with broader EU sustainability standards.

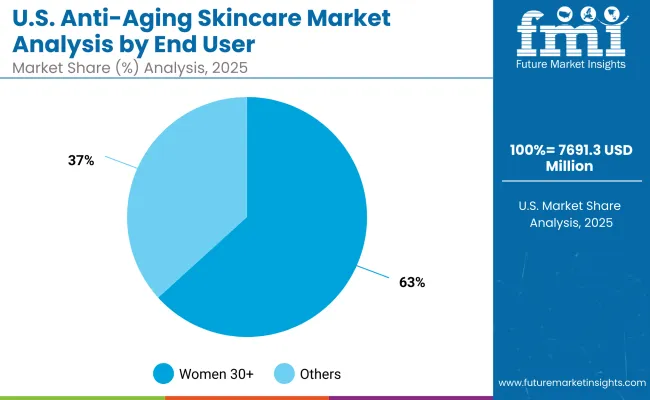

| USA by End User | Value Share % 2025 |

|---|---|

| Women 30+ | 63.3% |

| Others | 36.7% |

The Anti-Aging Skincare Market in the United States is forecast to grow steadily, supported by strong demand from women aged 30+, who account for 63.3% of market share in 2025. This demographic increasingly embraces preventive skincare routines, driving sales of serums, creams, and clinically validated formulations.

Premium and luxury brands such as Estée Lauder, SkinCeuticals, and Clinique dominate, supported by dermatologists’ endorsements and widespread pharmacy distribution. E-commerce expansion is creating new growth opportunities, with subscription models and influencer-led campaigns making advanced skincare more accessible.

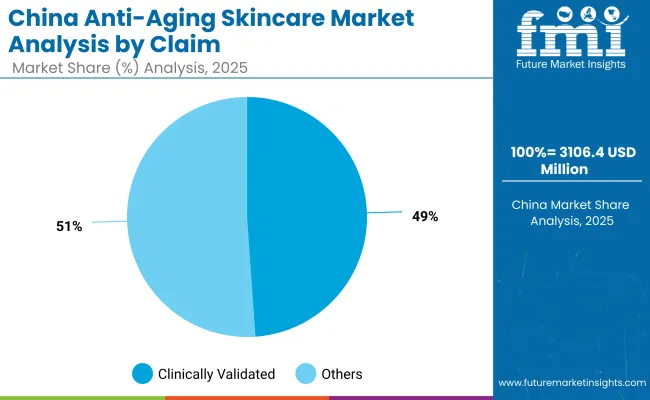

| China by Claim | Value Share % 2025 |

|---|---|

| Clinically validated | 48.9% |

| Others | 51.1% |

The Anti-Aging Skincare Market in China is expected to grow rapidly, underpinned by consumer preference for clinically validated products, which command 48.9% of value share in 2025. Rising demand is driven by increasing trust in dermatologist-tested and science-backed solutions, especially among urban millennials and Gen Z consumers. Domestic and global players are investing in R&D to integrate retinol alternatives, peptides, and antioxidant-rich formulations, positioning themselves as premium yet accessible. While “others” remain slightly larger at 51.1%, this category is increasingly skewed toward natural, clean-label, and hybrid solutions that combine tradition with modern efficacy. With the Chinese government’s support for biotech-driven cosmetics innovation and strong uptake through digital-first e-commerce ecosystems, China offers one of the most lucrative opportunities for both established brands and agile local entrants.

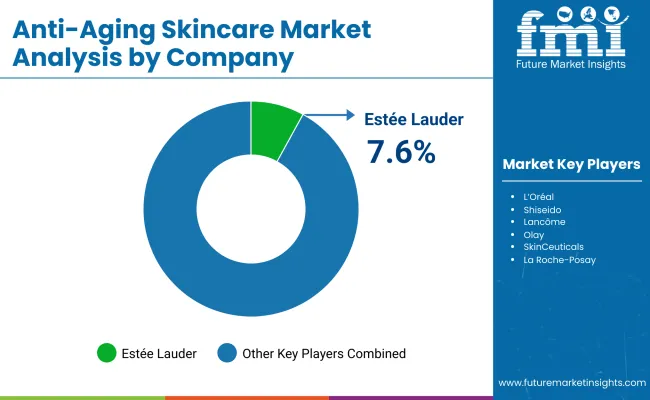

| Company | Global Value Share 2025 |

|---|---|

| Estée Lauder | 7.6% |

| Others | 92.4% |

The Anti-Aging Skincare Market is moderately fragmented, with multinational giants, specialized dermocosmetic brands, and emerging clean-label innovators competing across diverse consumer segments. Global leaders such as Estée Lauder, L’Oréal, and Shiseido hold significant market share, driven by their extensive product portfolios, clinical validation strategies, and heavy investments in marketing and R&D. These players are leveraging digital channels, dermatological partnerships, and AI-powered skin analysis tools to strengthen consumer engagement.

Mid-sized brands like La Roche-Posay, Clinique, and SkinCeuticals are building strong credibility in the science-backed skincare niche, emphasizing dermatologist-tested formulations, peptides, and retinol alternatives. Their ability to balance efficacy with sensitive-skin compatibility positions them as highly relevant in both premium and mass channels. Specialist players such as Drunk Elephant, Kiehl’s, and Bioderma are capitalizing on clean-label and vegan claims, attracting younger demographics seeking transparency and sustainability. Their strength lies in agility, direct-to-consumer (D2C) strategies, and strong brand communities.

Competitive differentiation is shifting away from simple product claims toward ecosystem-based positioning, where data-driven personalization, subscription models, and digital-first retail platforms increasingly define success.

Key Developments in Anti-Aging Skincare Market

| Item | Value |

|---|---|

| Quantitative Units | USD 54,002.5 Million |

| Active System | Retinoids & retinol alternatives, Peptides, Antioxidants (Vitamin C/E, Resveratrol), Acids & renewers (AHA/BHA/PHA), Hyaluronic & hydration systems |

| Product Type | Serums & ampoules, Creams/lotions, Eye/neck treatments, Masks |

| Claim | Clinically validated, Fragrance-free, Clean-label, Vegan |

| Channel | E-commerce, Specialty beauty retail, Pharmacies, Department stores |

| End User | Women 30+, Men, Luxury skincare users, Sensitive skin users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Estée Lauder, L’Oréal, Shiseido, Lancôme, Olay, SkinCeuticals , La Roche- Posay , Clinique, Drunk Elephant, Kiehl’s |

| Additional Attributes | Dollar sales by product type and channel, rapid adoption of peptide- and retinol-based formulations, rising demand for serums and ampoules in premium skincare, sector-specific growth in women 30+ and luxury skincare users, e-commerce and specialty retail revenue segmentation, integration of AI and digital skin diagnostics for personalized regimens, regional trends influenced by urban aging populations and pollution exposure, and innovations in clinically validated, fragrance-free, and vegan-certified product lines. |

The global Anti-Aging Skincare Market is estimated to be valued at USD 54,002.5 million in 2025.

The market size for the Anti-Aging Skincare Market is projected to reach USD 1,12,030.1 million by 2035.

The Anti-Aging Skincare Market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in Anti-Aging Skincare Market are serums & ampoules, creams/lotions, eye/neck treatments, and masks.

In terms of channel, e-commerce is projected to command 46.5% share in the Anti-Aging Skincare Market in 2025, supported by convenience, digital-first brand strategies, and rapid online adoption in Asia-Pacific.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

Ceramide Skincare Market Size and Share Forecast Outlook 2025 to 2035

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA