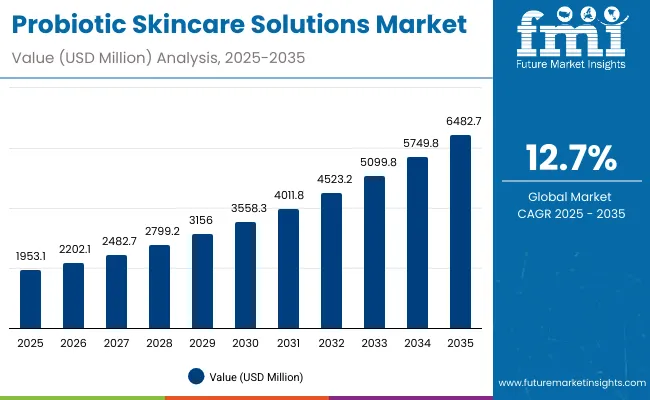

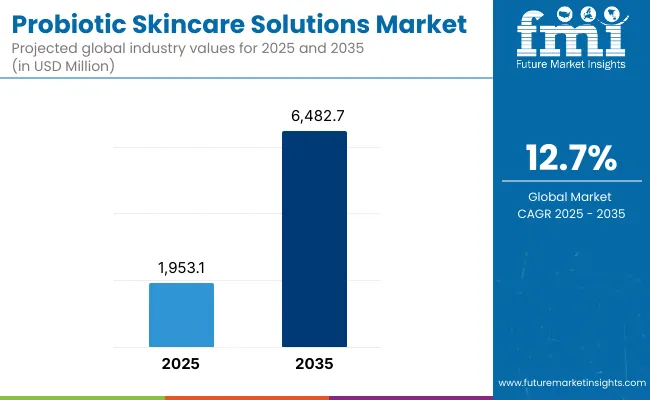

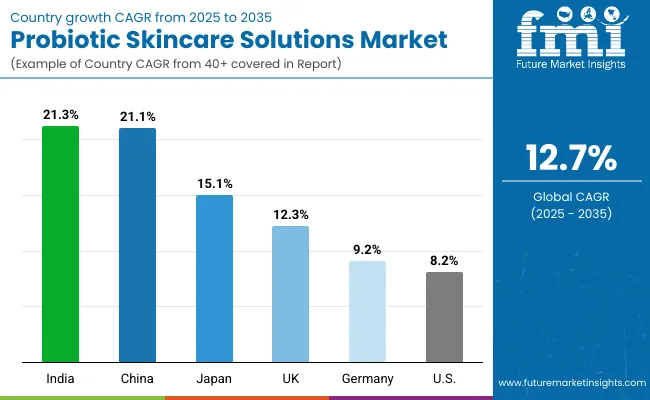

The global probiotic skincare solutions market is expected to record a valuation of USD 1,953.1 million in 2025 and USD 6,482.7 million in 2035, with an increase of USD 4,529.6 million, which equals a growth of over 230% during the decade. The overall expansion represents a CAGR of 12.7% and a 3.3X increase in market size.

Global Probiotic Skincare Solutions Market Key Takeaways

| Metric | Value |

|---|---|

| Global Probiotic Skincare Solutions Market Estimated Value in (2025E) | USD 1,953.1 million |

| Global Probiotic Skincare Solutions Market Forecast Value in (2035F) | USD 6,482.7 million |

| Forecast CAGR (2025 to 2035) | 12.7% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,953.1 million to USD 3,558.3 million, adding USD 1,605.2 million, which accounts for 35.4% of the total decade growth. This phase records steady adoption in North America and Europe as demand for microbiome-friendly skincare enters the mainstream. Creams/lotions dominate this period as they cater to nearly half of applications requiring barrier strengthening and hydration, while natural and organic claims influence purchase decisions across pharmacies and specialty beauty stores.

The second half from 2030 to 2035 contributes USD 2,924.4 million, equal to 64.6% of total growth, as the market jumps from USD 3,558.3 million to USD 6,482.7 million. This acceleration is powered by widespread deployment of advanced probiotic formulations in serums and masks, adoption of AI-driven personalized skincare regimes, and strong retail penetration of e-commerce platforms in Asia-Pacific. China and India lead this growth with CAGRs above 21%, supported by K-beauty and clean-label preferences. The claim segment shows rapid expansion of vegan and dermatologist-tested solutions, while digital-first skincare brands capture younger demographics.

From 2020 to 2024, the global probiotic skincare solutions market grew from a niche category into a mainstream wellness-driven skincare segment, driven primarily by natural and clean-label claims. During this period, the competitive landscape was dominated by indie brands such as Gallinée and Esse Skincare that captured early consumer loyalty by emphasizing microbiome health.

Larger multinational players including Unilever and L’Oréal entered strategically, contributing to professional endorsements and wider availability through pharmacies and mass retail. Competitive differentiation relied heavily on natural and organic positioning, pricing accessibility, and scientific validation of formulations. Service-based and subscription models were minimal, contributing less than 10% of the total market value.

Demand for probiotic skincare solutions will expand to USD 1,953.1 million in 2025, and the revenue mix will shift as serums, masks, and e-commerce channels grow to over 50% share by 2035. Traditional skincare leaders face rising competition from digital-first players offering AI-personalized regimens, skin diagnostics integration, and subscription-based delivery services.

Major multinationals are pivoting to hybrid models, integrating probiotics with other functional actives like hyaluronic acid, peptides, and tocopherol to retain relevance. Emerging entrants focusing on vegan-certified, cruelty-free, and microbiome-safe innovations are gaining share. The competitive advantage is moving away from heritage branding alone to ecosystem strength, scientific credibility, and cross-channel consumer engagement.

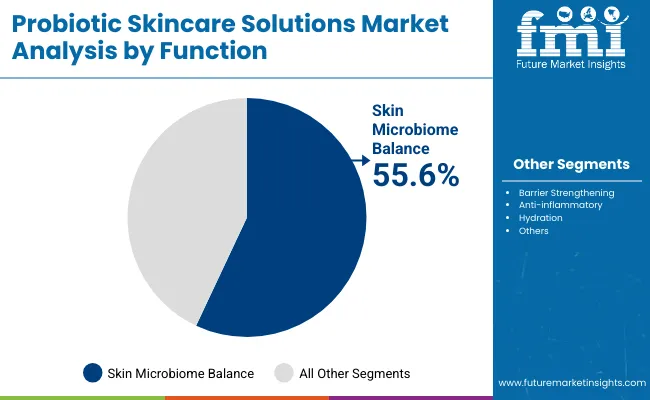

Advances in dermatological research and microbiome science have improved understanding of skin health, allowing for more targeted product formulations that restore balance and reduce irritation. Skin microbiome balance has gained popularity due to its suitability for addressing sensitive skin conditions, acne management, and overall barrier strengthening. The rise of probiotic innovation has contributed to enhanced consumer trust and increased product efficacy claims, driving real-time adoption across skincare enthusiasts worldwide. Segments such as hydration and anti-inflammatory solutions are gaining rapid traction due to their compatibility with daily routines and visible results.

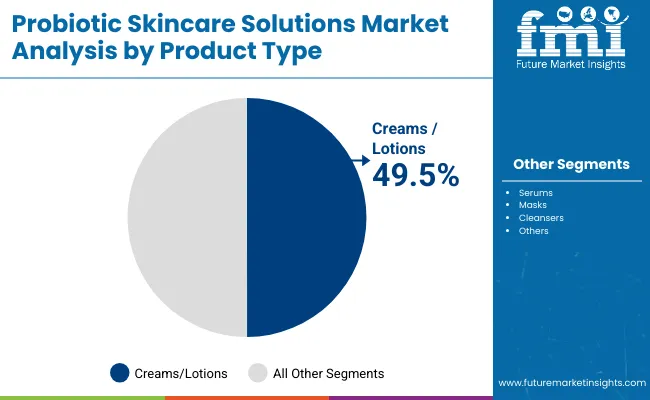

Expansion of clean-label, vegan, and dermatologist-tested products has fueled market growth, particularly among Gen Z and millennial consumers who demand transparency and science-backed outcomes. Innovations in serum formulations, lightweight textures, and mask delivery systems are expected to open new application areas. Segment growth is expected to be led by creams/lotions in the product type category, natural/organic in the claims segment, and e-commerce in the channel category due to their scalability, consumer trust, and adaptability to global retail landscapes.

The market is segmented by function, product type, channel, claim, and region. Functions include skin microbiome balance, barrier strengthening, anti-inflammatory, and hydration, highlighting the core elements driving adoption. Product type classification covers creams/lotions, serums, masks, and cleansers to cater to different skincare needs. Based on channel, the segmentation includes e-commerce, pharmacies, specialty beauty stores, and mass retail. In terms of claim, categories encompass natural/organic, vegan, clean-label, and dermatologist-tested. Regionally, the scope spans North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa, with deeper country-level coverage for the United States, China, India, Japan, Germany, and the United Kingdom.

| Function | Value Share % 2025 |

|---|---|

| Skin microbiome balance | 55.6% |

| Others | 44.4% |

The skin microbiome balance segment is projected to contribute over half of the global probiotic skincare solutions market revenue in 2025, maintaining its lead as the dominant function category. This is driven by ongoing demand for scientifically validated probiotic strains that help restore natural skin flora, reduce breakouts, and prevent sensitivity reactions. The segment’s growth is also supported by increasing awareness of gut-skin connection and consumer demand for holistic wellness routines. As brand marketing and clinical evidence converge, microbiome balance is expected to remain the backbone of probiotic skincare.

| Product Type | Value Share % 2025 |

|---|---|

| Creams/lotions | 49.5% |

| Others | 50.5% |

The creams/lotions segment is forecasted to hold nearly half of the market share in 2025, led by its widespread application in hydration and barrier support routines. These formulations are favored for their ease of use, compatibility with daily skincare rituals, and ability to deliver probiotics in stable emulsion bases. Their popularity across both pharmacies and e-commerce platforms has facilitated widespread adoption. The segment’s growth is bolstered by advancements in encapsulation technology that improve probiotic survival while reducing formulation challenges.

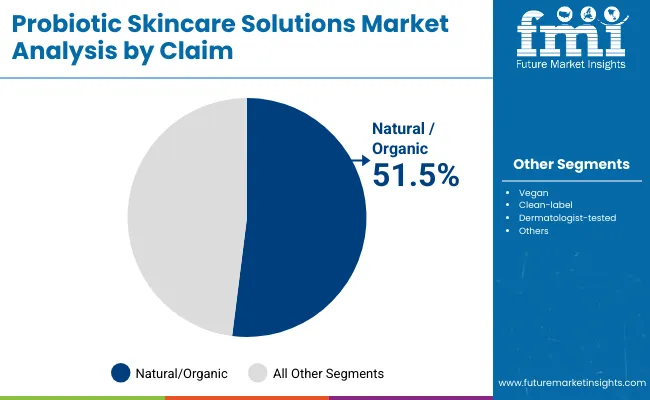

| Claim | Value Share % 2025 |

|---|---|

| Natural/organic | 51.5% |

| Others | 48.5% |

The natural/organic claim segment is projected to account for more than half of the global probiotic skincare solutions market revenue in 2025, establishing it as the leading claim type. This segment benefits from strong consumer preference for clean-label beauty and skepticism toward synthetic additives. Its suitability for sensitive skin users and alignment with global sustainability trends have made it popular across multiple regions, especially in Europe and Asia-Pacific. As eco-friendly packaging and ethical sourcing expand, natural/organic probiotic skincare is expected to maintain its leading role.

Rising Scientific Validation and Clinical Backing of Microbiome Skincare

One of the strongest growth drivers in the global probiotic skincare solutions market is the increasing number of clinical studies and dermatological validations linking probiotics to measurable improvements in skin health. Unlike general “natural skincare” trends, probiotic solutions are backed by emerging evidence on reducing inflammation, enhancing barrier function, and balancing skin flora. This gives credibility to product claims and justifies premium pricing.

For instance, brands like Gallinée and Tula Skincare highlight strain-specific probiotics (e.g., Lactobacillus ferment) in their marketing, which resonates strongly with dermatologists and consumers seeking science-based efficacy. As a result, consumers are moving from experimental trial to repeat purchases, boosting both product loyalty and long-term market value. This clinical momentum particularly benefits the skin microbiome balance function, which already represents 55.6% of global market value in 2025, reinforcing its role as the anchor segment of growth.

Digital-First E-commerce Expansion in Asia-Pacific

Another major driver is the rapid adoption of probiotic skincare solutions through e-commerce platforms in Asia-Pacific, particularly in China and India, which have projected CAGRs of 21.1% and 21.3% respectively. These markets are not only benefiting from retail expansion but also from highly personalized digital campaigns on platforms like Tmall, JD.com, Nykaa, and Flipkart. Younger consumers in these regions engage with “skin diaries,” microbiome trackers, and K-beauty-inspired routines, where probiotic formulations are marketed as part of daily hydration and anti-inflammatory regimens. E-commerce allows brands to bypass traditional pharmacy and specialty retail, enabling faster product launches and consumer trials at scale. The dominance of natural/organic claims (51.5% in 2025) aligns well with APAC’s clean-label demand, making online distribution a strategic driver of double-digit growth.

Formulation Challenges and Probiotic Stability Issues

A critical restraint in the global probiotic skincare solutions market lies in the difficulty of maintaining probiotic viability within cosmetic formulations. Unlike nutritional probiotics, which are ingested and can survive refrigeration, skincare probiotics must remain stable in creams, serums, and cleansers often stored at room temperature and exposed to varying climates.

This creates high R&D costs and risks of product recalls if claims are not substantiated by real efficacy. Small indie players like Mother Dirt and LaFlore often face scaling challenges due to high formulation costs, while multinationals must invest heavily in encapsulation technologies. These challenges slow innovation cycles and limit mass-market affordability, particularly in emerging economies where lower pricing is critical for adoption.

Regulatory Ambiguity and Marketing Claims Scrutiny

Unlike pharmaceuticals, probiotic skincare operates in a gray regulatory space where claims such as “restores skin microbiome” or “supports barrier health” are not uniformly defined across regions. In the EU, regulators demand more rigorous proof of probiotic efficacy in topical products, while the USA FDA classifies many of these claims under cosmetics rather than therapeutics. This inconsistency exposes brands to legal scrutiny and consumer skepticism. With the rise of dermatologist-tested claims, competitors that cannot substantiate results risk reputational damage, creating barriers for smaller players. Such ambiguity could slow market growth in conservative regions like North America and Europe, even as APAC embraces looser, trend-driven adoption.

Hybrid Formulations Combining Probiotics with Active Ingredients

A key trend shaping the global probiotic skincare solutions market is the integration of probiotics with other high-performance actives like vitamin C, tocopherol, peptides, and hyaluronic acid. This creates a dual-value proposition: microbiome support combined with anti-aging, brightening, or hydration benefits. For example, creams and serums marketed as “probiotic + vitamin C” appeal to consumers who want visible skin tone improvements alongside microbiome protection. This hybridization is pushing the category beyond niche microbiome enthusiasts into the mainstream skincare market, broadening its addressable audience. By 2030, this trend will contribute to the rapid uptake of serums and masks, which are projected to capture a larger share from creams/lotions in Asia-Pacific and Europe.

Probiotic Skincare as a Preventive Wellness Routine

Another strong trend is the repositioning of probiotic skincare from a treatment-oriented product to a preventive wellness solution. Instead of focusing solely on acne, sensitivity, or skin inflammation, brands are now marketing probiotic skincare as an everyday safeguard against pollution, stress, and premature aging. This shift mirrors the dietary supplements industry, where probiotics transitioned from gut-related treatments to daily wellness staples.

In skincare, this trend is particularly strong in urban centers like Shanghai, Seoul, and New York, where consumers are exposed to pollution and UV damage. Preventive positioning is fueling subscription models via e-commerce, making probiotic cleansers, serums, and creams part of routine daily skincare rather than occasional problem-solving products.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 21.1% |

| USA | 8.2% |

| India | 21.3% |

| UK | 12.3% |

| Germany | 9.2% |

| Japan | 15.1% |

Between 2025 and 2035, the global probiotic skincare solutions market is expected to see its most dynamic growth in Asia, led by India (21.3% CAGR) and China (21.1% CAGR). These two markets are emerging as epicenters of expansion due to rising middle-class incomes, increasing awareness of microbiome health, and strong e-commerce ecosystems that make probiotic skincare highly accessible.

In India, digital-first platforms and urban demand for natural/organic skincare are creating rapid adoption across younger demographics, while in China, K-beauty influence and clean-label trends are propelling demand for serums and masks with natural probiotic claims. Together, India and China are expected to account for a disproportionate share of new revenue generated during the forecast period, reflecting how Asia-Pacific is set to outperform mature markets in both scale and speed of adoption.

Meanwhile, developed economies continue to represent stable yet moderate growth opportunities. The USA market (8.2% CAGR) is expanding steadily, underpinned by dermatology endorsements and subscription-led probiotic skincare models, while Germany (9.2% CAGR) and the UK (12.3% CAGR) maintain strong footholds in Europe due to consumer trust in science-backed and dermatologist-tested claims.

In Japan (15.1% CAGR), rapid growth is linked to premium formulations and wellness-driven routines that align probiotic skincare with holistic health. These moderate-to-high growth rates in the USA, UK, Germany, and Japan highlight the balance between established consumer bases and new opportunities for hybrid formulations, while the Asia-Pacific surge demonstrates where future market leadership will consolidate.

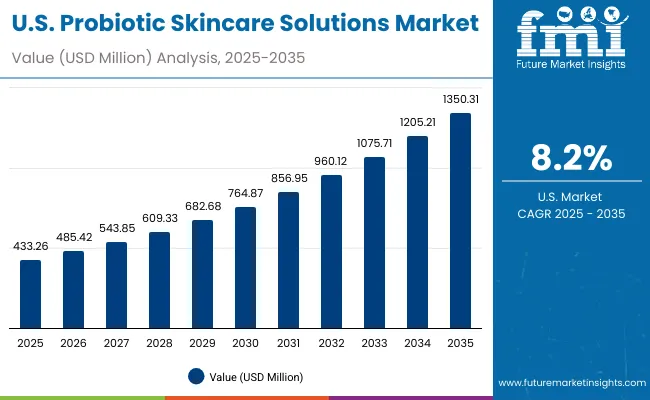

| Year | USA Probiotic Skincare Solutions Market(USD Million) |

|---|---|

| 2025 | 433.3 |

| 2026 | 485.4 |

| 2027 | 543.9 |

| 2028 | 609.3 |

| 2029 | 682.7 |

| 2030 | 764.9 |

| 2031 | 857.0 |

| 2032 | 960.1 |

| 2033 | 1075.7 |

| 2034 | 1205.2 |

| 2035 | 1350.3 |

The global probiotic skincare solutions market in the United States is projected to grow at a CAGR of 8.2%, supported by increasing penetration of dermatologist-tested products and growing consumer trust in microbiome-friendly routines. Adoption is strong across pharmacies and specialty beauty stores, where clinically validated formulations dominate consumer choice.

The USA market also shows high loyalty toward creams/lotions that combine probiotics with anti-inflammatory or hydration claims, while subscription-based e-commerce models are gaining traction among millennial and Gen Z buyers. Large multinationals such as Unilever and L’Oréal are bundling probiotics with established active ingredients, while indie brands like Tula Skincare are expanding direct-to-consumer engagement.

Dermatologist-tested creams/lotions remain a key driver of category adoption.

Subscription-led probiotic skincare is reshaping digital-first retail strategies.

Hybrid products combining probiotics with peptides or vitamin C appeal to premium consumers.

The global probiotic skincare solutions market in the United Kingdom is forecast to expand at a CAGR of 12.3%, led by strong consumer preference for natural/organic and vegan claims. UK consumers exhibit high awareness of sustainability, making clean-label probiotic serums and masks popular in both pharmacies and e-commerce platforms.

Niche premium brands like Aurelia London and Gallinée are leveraging heritage positioning and clinical validation to compete with multinational players. Growth is further supported by academic collaborations with dermatology institutes that emphasize microbiome health. Retail innovation is visible, with probiotic skincare gaining shelf space in mainstream health and wellness stores, as well as cross-promotion through wellness tourism and spa segments.

India is witnessing the fastest expansion in the global probiotic skincare solutions market, with a projected CAGR of 21.3% through 2035. Rapid adoption in tier-1 and tier-2 cities is being driven by lower entry-price ranges and increased awareness of natural and microbiome-based skincare.

E-commerce platforms such as Nykaa and Flipkart are key enablers of widespread distribution, while social media marketing by global brands like Clinique and L’Oréal is helping accelerate consumer trust. Local contract manufacturers are also experimenting with probiotic formulations targeted toward acne and sensitive skin concerns, making products more accessible to middle-income consumers. In parallel, beauty and vocational institutes are introducing microbiome education, shaping long-term awareness.

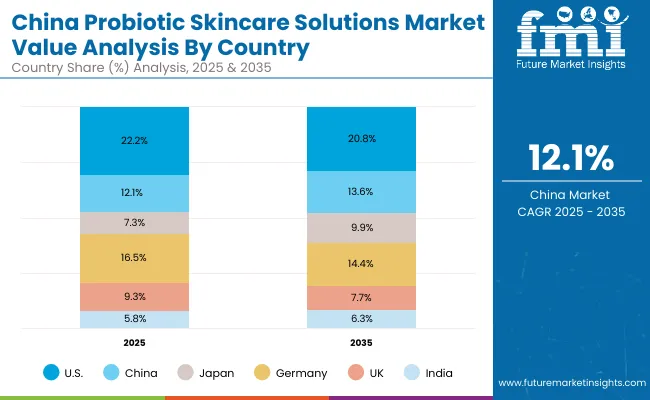

The global probiotic skincare solutions market in China is expected to grow at a CAGR of 21.1%, the second-fastest among leading economies. This momentum is driven by the rapid rise of natural/organic claims, which already account for 55.2% of China’s market in 2025. E-commerce platforms like Tmall and JD.com are the primary sales channels, supported by heavy influencer marketing and cross-border beauty imports.

Domestic beauty firms are also producing affordable probiotic skincare alternatives that appeal to price-sensitive but trend-conscious buyers. Municipal wellness campaigns and K-beauty-inspired consumer routines are fueling demand for masks and serums infused with probiotics. Affordable availability, alongside consumer trust in imported brands like L’Oréal and Clinique, makes China a dual-structured market with both premium and mass retail opportunities.

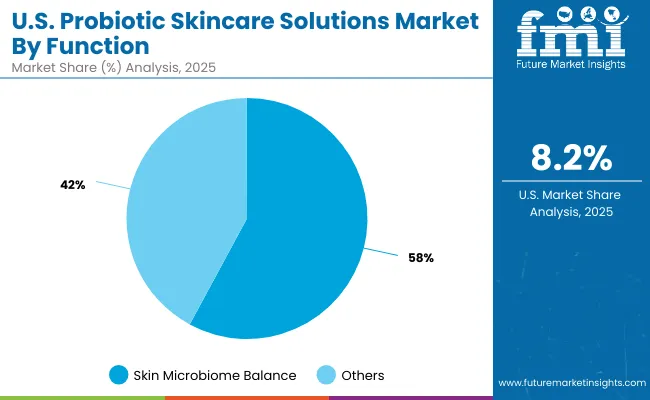

| USA by Function | Value Share % 2025 |

|---|---|

| Skin microbiome balance | 57.9% |

| Others | 42.1% |

The global probiotic skincare solutions market in the United States is valued at USD 433.3 million in 2025, with skin microbiome balance leading at 57.9% of total demand. This dominance reflects the advanced dermatology-driven USA skincare landscape, where barrier repair and microbiome protection are positioned as premium science-backed claims.

The popularity of dermatologist-tested products enhances trust, while subscription-based e-commerce is reshaping how younger consumers engage with probiotic skincare. The presence of strong clinical validation and FDA-regulated cosmetic claims further drive USA adoption, as consumers lean toward formulations that integrate probiotics with established actives such as peptides, tocopherol, and hyaluronic acid.

This advantage positions skin microbiome balance as a cornerstone of USA probiotic skincare growth, supported by heavy investments from multinational players like Unilever and L’Oréal alongside indie leaders such as Tula Skincare. Other functional areas like hydration and anti-inflammatory remain important but play a secondary role compared to the clinical strength of microbiome claims. Over the forecast period, digital-first marketing, dermatologist endorsements, and bundled subscription models will become the key enablers of steady USA market expansion.

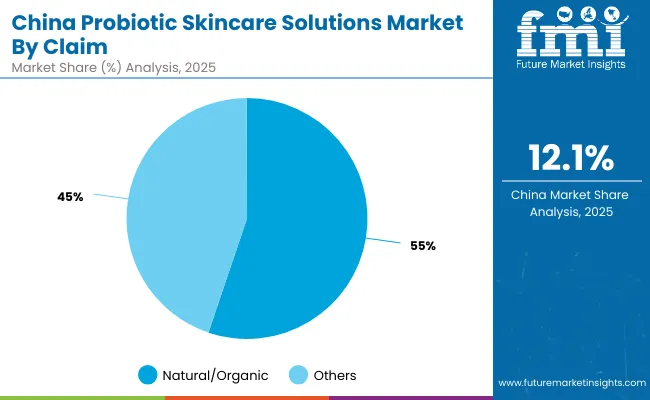

| China by Claim | Value Share % 2025 |

|---|---|

| Natural/organic | 55.2% |

| Others | 44.8% |

The global probiotic skincare solutions market in China is valued at USD 236.9 million in 2025, with natural/organic claims leading at 55.2% of market demand. This dominance is a direct result of China’s consumer shift toward clean-label beauty, driven by K-beauty influence, wellness routines, and a strong preference for natural formulations. E-commerce platforms like Tmall and JD.com amplify this trend by offering premium probiotic serums and masks alongside affordable domestic alternatives, making probiotics accessible across diverse consumer tiers.

This advantage positions natural/organic probiotic skincare as an essential component of China’s beauty evolution, supported by both domestic firms and multinationals. While domestic brands compete through competitive pricing, international leaders such as L’Oréal, Clinique, and Yakult Beauté leverage heritage, scientific credibility, and imported positioning. The strong CAGR of 21.1% reflects China’s role as one of the fastest-growing global markets, where e-commerce penetration, social commerce, and influencer-led education are accelerating adoption.

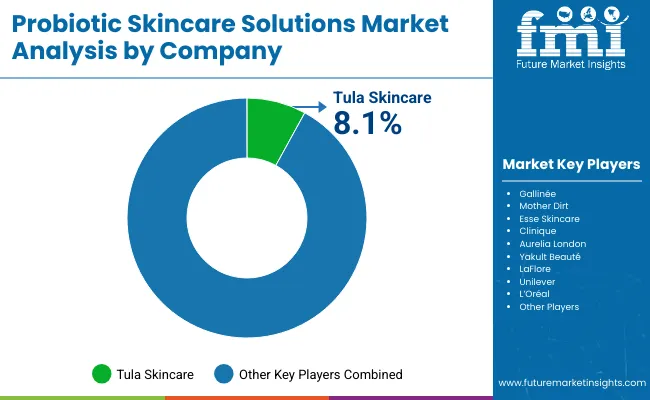

| Comapanies | Global Value Share 2025 |

|---|---|

| Tula Skincare | 8.1% |

| Others | 91.9% |

The global probiotic skincare solutions market is moderately fragmented, with niche probiotic-focused innovators competing against established multinational skincare giants. Indie players such as Gallinée, Mother Dirt, Esse Skincare, Aurelia London, and LaFlore pioneered microbiome balance awareness, building loyal consumer bases with science-led and vegan-friendly positioning. Their strength lies in authenticity, innovation, and early adoption of clean-label trends.

Multinational players like L’Oréal, Unilever, and Clinique are now scaling probiotic skincare to mainstream distribution, using global retail networks, dermatology endorsements, and aggressive R&D. These companies emphasize hybrid formulations combining probiotics with vitamin C, tocopherol, and hyaluronic acid to compete in broader skincare categories such as anti-aging, hydration, and brightening.

Specialized segments are emerging as well, where Yakult Beauté leverages its expertise in probiotics from the nutrition sector to differentiate skincare offerings. Competitive differentiation is increasingly shifting away from “probiotic novelty” toward ecosystem strength, subscription models, clinical evidence, and omni-channel integration.

Key Developments in Global Probiotic Skincare Solutions Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,953.1 million |

| Function | Skin microbiome balance, Barrier strengthening, Anti-inflammatory, and Hydration |

| Product Type | Creams/lotions, Serums, Masks, and Cleansers |

| Channel | E-commerce, Pharmacies, Specialty beauty stores, and Mass retail |

| Claim | Natural/organic, Vegan, Clean-label, and Dermatologist-tested |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Gallinée , Mother Dirt, Esse Skincare, Clinique, Aurelia London, Tula Skincare, Yakult Beauté , LaFlore , Unilever, and L’Oréa |

| Additional Attributes | Dollar sales by function, product type, channel, and claim, adoption trends in microbiome balance and natural/organic skincare, rising demand for dermatologist-tested and vegan-certified formulations, segment-specific growth in serums and e-commerce platforms, integration of probiotics with active ingredients such as vitamin C, tocopherol, and hyaluronic acid, regional trends influenced by K-beauty and clean-label movements, and innovations in encapsulation technology for probiotic stability. |

The global probiotic skincare solutions market is estimated to be valued at USD 1,953.1 million in 2025.

The market size for the global probiotic skincare solutions market is projected to reach USD 6,482.7 million by 2035.

The global probiotic skincare solutions market is expected to grow at a 12.7% CAGR between 2025 and 2035.

The key product types in the global probiotic skincare solutions market are creams/lotions, serums, masks, and cleansers.

In terms of function, the skin microbiome balance segment is expected to command USD 1,083.8 million (55.6%) in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Probiotic Chewing Gum Market Size and Share Forecast Outlook 2025 to 2035

Probiotics For Oral Health Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Face Masks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Global Probiotic Serum Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Yogurt Market Analysis - Size, Share & Forecast 2025 to 2035

Probiotic Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic for Kids Market Analysis - Size, Share, and Forecast 2025 to 2035

Probiotic Fermented Milk Market Growth & Demand Forecast 2025 to 2035

Probiotic for Men Market Analysis by Product, Sales Channel and Strain Type Through 2035

Probiotic Cheese Market Cheese Type, Bacteria Type, Sales Channel and Others through 2035

Comprehensive Probiotic Strains market analysis and forecast by strain type, application and region.

Probiotic Cosmetics Market Trends - Growth & Forecast 2025 to 2035

Probiotic Supplements Market Share Analysis – Key Trends & Forecast 2025-2035

Market Share Breakdown of Probiotic Ingredients

Probiotics After Antibiotic Recovery Market Analysis by Ingredient and Sales Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA