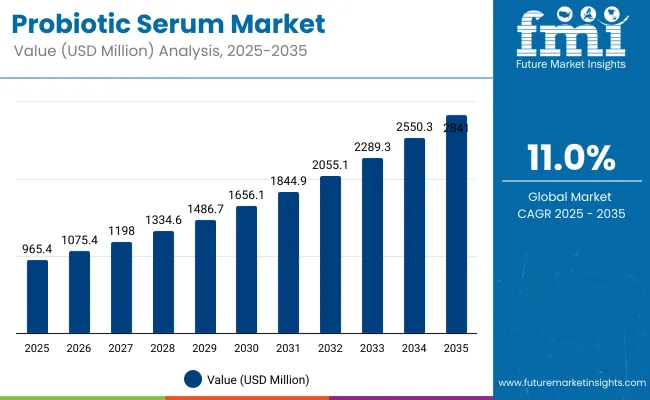

The Global Probiotic Serum Market is expected to record a valuation of USD 965.4 million in 2025 and USD 2,841 million in 2035, with an increase of USD 1,875.6 million, which equals a growth of 194.2% over the decade. The overall expansion represents a CAGR of 11.0% and reflects a nearly 3X increase in market size.

Global Probiotic Serum Market Key Takeaways

| Metric | Value |

| Market Estimated Value in (2025E) | USD 965.4 million |

| Market Forecast Value in (2035F) | USD 2,841 million |

| Forecast CAGR (2025 to 2035) | 11.0% |

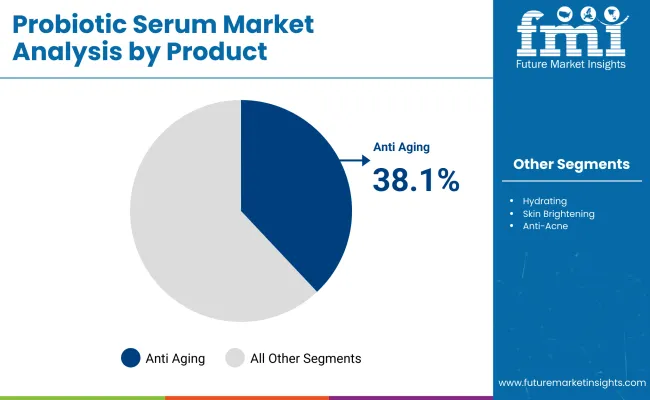

During the first five-year period from 2025 to 2030, the market increases from USD 965.4 million to USD 1,656.1 million, adding USD 690.7 million, which accounts for 36.8% of the total decade growth. This phase records steady adoption in anti-aging skincare, hydrating barrier-repair routines, and acne-prevention dermocosmetics, driven by growing demand for microbiome-safe solutions. Anti-aging serums dominate this period as they cater to over 38.1% of consumer demand for mature skin-targeting formulations.

The second half from 2030 to 2035 contributes USD 1,184.9 million, equal to 63.2% of total growth, as the market jumps from USD 1,656.1 million to USD 2,841 million. This acceleration is powered by widespread deployment of postbiotic and encapsulated probiotic technologies, AI-personalized skincare routines, and diagnostic-driven serum customization. Multi-benefit, synbiotic, and refillable packaging-based formulations capture a larger share by the end of the decade. Tech-integrated product lines and microbiome-testing kits increase recurring brand loyalty, expanding premium segment penetration beyond 50% of total value.

From 2020 to 2024, the Global Probiotic Cosmetics Market steadily matured, laying the foundation for targeted functional skincare. While creams and moisturizers dominated sales during this phase, serum-based probiotic formulations began gaining traction, contributing to the emergence of niche microbiome-centered brands. The landscape was led by established players such as Unilever, Estée Lauder, and L’Oréal, who leveraged their distribution muscle and brand trust to introduce early probiotic SKUs.

However, serum formats made up a relatively smaller share, as adoption was still limited to dermatological and premium skincare channels. Demand for probiotic serums is projected to reach USD 965.4 million in 2025, shifting the revenue mix toward functional, high-efficacy skincare formats. By 2035, the market will reach USD 2,841 million, driven by innovation in postbiotic, encapsulated, and synbiotic formulations. Traditional cosmetic giants are now facing growing competition from microbiome-first brands such as Esse Skincare, Aurelia London, and Gallinée, which offer scientifically backed, minimalist formulations.

The competitive edge is moving away from traditional cosmetic appeal to clinical validation, ingredient transparency, and digital customization platforms. Emerging players are adopting AI-personalized skincare, cloud-based diagnostic integrations, and subscription models, reflecting the industry's transition toward ecosystem-driven, consumer-centric strategies.

The Global Probiotic Serum Market is expanding steadily due to rising consumer awareness of skin microbiome health and demand for dermatologist-formulated skincare. Postbiotic and encapsulated probiotic technologies have improved product stability and shelf life, making serums more viable for mass and premium retail channels.

Unlike earlier topical probiotics that faced formulation challenges, non-living bioactives like fermented lysates and bacterially derived peptides now allow for real-time skin balancing and barrier restoration, which are increasingly favored by both consumers and formulators. Increased preference for anti-aging skincare routines is also fueling growth. The anti-aging probiotic serum segment alone accounted for 43.6% of the market in 2025, indicating high consumer interest in wrinkle reduction, firmness restoration, and inflammation control via probiotic actives.

The development of AI-personalized skincare platforms, microbiome-testing kits, and subscription-based probiotic regimens are enhancing product stickiness and encouraging brand loyalty in the serum category. Market expansion is further propelled by innovations in ingredient sourcing, such as plant-based and vegan probiotics, and hybrid formulations that blend prebiotics, probiotics, and postbiotics (synbiotics) for cumulative skin benefits.

These advancements have paved the way for broader application in sensitive skin, acne-prone conditions, and hyperpigmentation care. With increasing scientific validation and clinical backing, probiotic serums are being integrated into both retail skincare lines and professional dermatology-based treatments.

The Global Probiotic Serum Market is segmented by product type, formulation type, packaging format, ingredient source, distribution channel, and region. Product type includes hydrating, anti-aging, skin brightening, anti-acne, firming & lifting, calming/sensitive skin, and multi-benefit/all-in-one probiotic serums, each addressing specific skincare concerns like hydration, anti-wrinkle, and blemish control. Formulation type encompasses live probiotics, postbiotics, synbiotics (probiotics + prebiotics), encapsulated probiotics, water-based, gel-based, and oil-based serums, reflecting advancements in ingredient stability and microbiome delivery.

Packaging format covers dropper bottles, airless pump bottles, tubes, sachets & ampoules, refillable bottles, and customizable skincare kits designed to optimize shelf life, usability, and sustainability. Ingredient source includes dairy-based, plant-based/vegan, marine-derived, yeast-derived, and fermented herbal probiotics, aligning with clean-label and ethical beauty trends.

Distribution channels span brand-owned e-commerce, third-party online retailers, pharmacies, dermatology clinics, supermarkets, specialty retailers, and subscription-based skincare platforms, capturing omnichannel shifts in consumer access. Regionally, the market covers North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, Oceania, and the Middle East and Africa, reflecting global demand growth across mature and emerging skincare economies.

| Skin Concern | Market Value Share, 2025 |

|---|---|

| Anti aging probiotic serum | 38.1% |

| Others | 61.9% |

The anti-aging probiotic serum segment is projected to contribute 38.1% of the Global Probiotic Serum Market revenue in 2025, maintaining its lead as the dominant product category. This growth is driven by the increasing consumer shift toward microbiome-safe solutions that address age-related concerns such as fine lines, wrinkles, and loss of skin firmness. Consumers over the age of 30 are actively seeking serums with clinically supported anti-aging benefits, and probiotic activesparticularly postbiotics and encapsulated strainsare gaining traction due to their restorative properties.

The segment’s strong performance is further reinforced by innovation in ingredient delivery systems that enhance penetration and effectiveness without compromising skin sensitivity. As awareness around skin barrier health and inflammation grows, anti-aging formulations that combine probiotics with hyaluronic acid, peptides, or antioxidant complexes are becoming increasingly popular. With clinical trials validating their efficacy and premium skincare brands investing heavily in marketing, the anti-aging probiotic serum segment is expected to remain the cornerstone of product development and revenue generation across global skincare portfolios.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Postbiotic -Based Serums | 46.7% |

| Others | 53.3% |

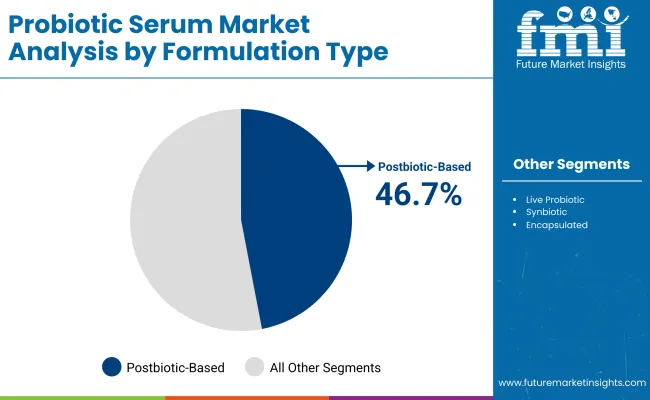

Postbiotic-Based Serums are forecasted to dominate the global probiotic serum market in 2025 with a commanding 46.7% market share. This leadership stems from their superior shelf stability, lower contamination risk, and compatibility with broader formulation matrices compared to live probiotic variants. Their ability to deliver targeted skin microbiome benefits without live bacterial strains has led to greater acceptance among formulators and dermatologists.

As consumers become more aware of skin barrier health and microbiome protection, postbiotic formulations are gaining strong traction across skincare lines. This dominance is also supported by strong innovation pipelines from key players and increased incorporation in anti-aging and calming serum formats. Moving forward, the segment is expected to maintain its leadership due to its scientific validation and expanding cosmetic claims portfolio.

| Packaging Format | Market Value Share, 2025 |

|---|---|

| Airless Pump Bottles | 41.4% |

| Others | 58.6% |

Airless pump bottles follow closely with a 41.4% market share, driven by their ability to preserve formulation integrity, especially in probiotic-based products. These pumps prevent air exposure and contamination, extending product shelf life and improving dosage precision. The rising focus on formulation efficacy and hygiene is pushing brands to adopt airless solutions.

The ‘Others’ packaging category, which includes dropper bottles, tubes, sachets & ampoules, refillable bottles, and customizable skincare kits, is projected to account for 58.6% of the global probiotic serum market revenue in 2025, establishing it as the leading packaging format. This broad format category caters to diverse consumer preferences, ranging from ease of use in sachets to sustainability in refillables.

Drivers Convergence of Anti-Aging & Microbiome Claims

With anti-aging probiotic serums holding 38.1% share in 2025, brands are fusing probiotic lysates with collagen-boosting actives (peptides, bakuchiol) to deliver anti-wrinkle benefits without disturbing skin flora. This dual-function appeal is particularly strong in mature skincare segments in North America, Western Europe, and Japan, where clinical validation drives purchase decisions.

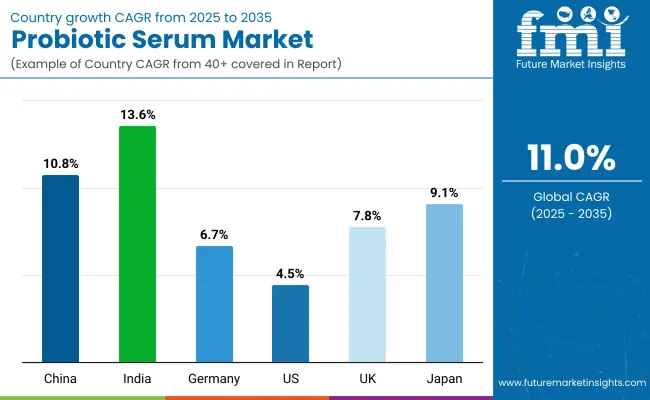

Acceleration from Asia-Pacific High-Growth Markets

India (13.6% CAGR) and China (10.8% CAGR) are the fastest-growing geographies, supported by strong consumer receptiveness to fermented beauty, K-beauty/J-beauty influence, and local production capabilities that reduce cost barriers. Rising urban middle-class spending and a cultural inclination toward “skin health” over purely cosmetic claims are propelling probiotic serum adoption beyond luxury channels.

Restraints

Shelf-Life & Stability Challenges

Live probiotic serums degrade quickly in high-heat, high-humidity markets, reducing active potency before the end of shelf life. Without encapsulation or postbiotic conversion, efficacy claims weaken a critical concern in tropical markets like India and Southeast Asia, limiting retail shelf exposure.

Regulatory Fragmentation in Labeling & Claims

The absence of a standardized global definition for topical “probiotics” creates launch delays and reformulation costs. For example, the EU requires strain ID and viability data, while the USA allows broader cosmetic positioning. This forces multinational brands like L’Oréal and Unilever to develop region-specific SKUs, adding complexity to scaling.

Key Trends

Transition from Live Probiotics to Postbiotic & Encapsulated Formats

The 2030-2035 growth phase (adding USD 1,184.9 Million) is expected to lean heavily on encapsulated lysates and postbiotic actives that maintain potency without cold chain logistics. These formats also align with clean-label and sensitive-skin positioning, opening opportunities for mass-premium distribution.

Tech-Integrated Skincare Ecosystems

Brands are merging probiotic serums with AI skin diagnostics, microbiome testing kits, and subscription refills. This creates personalized formulations that evolve with a customer’s skin condition, increasing lifetime value. Markets like Japan, South Korea, and Tier-1 Chinese cities are already adopting this approach, boosting premium penetration past 50% of category value by 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 10.8% |

| India | 13.6% |

| Germany | 6.7% |

| USA | 4.5% |

| UK | 7.8% |

| Japan | 9.1% |

The global Probiotic Serum Market exhibits pronounced regional growth disparities, influenced by evolving consumer awareness, urban skincare adoption, and product innovation cycles. Asia-Pacific leads the global expansion, with China growing at a CAGR of 10.8%, making it one of the fastest-growing country markets. Growth in China is driven by rising disposable income, Gen Z-led skincare trends, and domestic innovation in probiotic skincare formulations.

India’s CAGR of 13.6% is the highest among all markets, supported by rapid growth in direct-to-consumer beauty channels and K-beauty inspired demand for microbiome-friendly serums. Europe remains a mature but steadily advancing region, with Germany, the UK, and France contributing to rising clean beauty compliance and sustainability labeling, prompting more probiotic-based product launches.

Germany and the UK show CAGRs of 6.7% and 7.8%, respectively, indicating solid growth in a regulated and ingredients-conscious consumer base. The USA remains the most valuable national market, growing from USD 236.52 million in 2025 to USD 627.86 million by 2035, translating to a CAGR of 4.5%. The market in the USA is shaped by high brand competition, clinically-backed product endorsements, and retailer-led expansion of sensitive-skin probiotics.

In contrast, Japan maintains a steady but modest trajectory with a CAGR of 9.1%, due to the dominance of traditional skincare formats and low penetration of live/encapsulated probiotic formulations. North America as a whole sees a moderate expansion, led by a premiumization trend rather than mass-scale adoption.

| Year | USA Probiotic Serum Market (USD Million) |

|---|---|

| 2025 | 236.52 |

| 2026 | 260.78 |

| 2027 | 287.52 |

| 2028 | 317.01 |

| 2029 | 349.52 |

| 2030 | 385.36 |

| 2031 | 424.88 |

| 2032 | 468.45 |

| 2033 | 516.49 |

| 2034 | 569.46 |

| 2035 | 627.86 |

The Probiotic Serum Market in the United States is projected to grow at a CAGR of 4.5%, increasing from USD 236.52 million in 2025 to USD 627.86 million by 2035, fueled by heightened consumer awareness of skin microbiome health and growing demand for dermatologist-formulated clean beauty products. A significant surge in preference for anti-aging probiotic serums is observed among consumers aged 35-60, with leading brands emphasizing clinical backing and pH-balanced formulations.

Furthermore, premium skincare retailers are expanding probiotic serum offerings under sensitive skin, anti-acne, and multi-benefit categories. Anti-aging use case leads product demand, accounting for the largest market share in 2025 (44.1%), due to consumer focus on microbiome balance, wrinkle reduction, and skin barrier repair.

The Probiotic Serum Market in the United Kingdom is expected to grow at a CAGR of 7.8% from 2025 to 2035. The market share is projected to slightly decline from 8.1% in 2025 to 7.8% in 2035, reflecting stable growth momentum in a competitive premium skincare landscape. The adoption of probiotic skincare is supported by expanding demand for dermatologically approved and clean-label serums, especially among aging and sensitive skin demographics.

UK-based brands are increasingly incorporating postbiotic and live strain innovations to strengthen consumer trust in microbiome-centric skincare. Government-supported sustainability goals and increased vegan product registrations are also contributing to premium product line extensions.

India’s Probiotic Serum Market is forecast to grow at a CAGR of 13.6% during 2025-2035, with its global market share rising from 5.1% in 2025 to 6.2% in 2035. This growth is driven by rising consumer awareness of skin microbiome health, especially among millennials and Gen Z in urban and Tier-2 markets.

Local skincare startups and wellness brands are launching cost-effective, Ayurvedic-infused probiotic serums targeting hydration and barrier repair. Increased e-commerce penetration, dermatology-led content on social media, and partnerships with dermatological clinics are further accelerating adoption.

| Market Share | 2025 |

|---|---|

| China | 12.2% |

| India | 5.1% |

| Germany | 11.2% |

| USA | 24.5% |

| UK | 8.1% |

| Japan | 7.2% |

| Market Share | 2035 |

|---|---|

| China | 13.8% |

| India | 6.2% |

| Germany | 10.4% |

| USA | 22.1% |

| UK | 7.8% |

| Japan | 8.1% |

China is expected to record a CAGR of 10.8% in the Probiotic Serum Market, with its global market share growing from 12.2% in 2025 to 13.8% in 2035. This rapid expansion is supported by strong demand for skin resilience and microbiome-balancing products among beauty-conscious consumers.

Homegrown cosmetic companies are leading R&D in live biotic and synbiotic formulations while leveraging TCM (Traditional Chinese Medicine) in hybrid skincare solutions. The popularity of “science-backed beauty” and integration of AI diagnostics on local e-commerce platforms is enabling hyper-personalized probiotic serum recommendations.

| Skin Concern Segment | Market Value Share, 2025 |

|---|---|

| Anti-Aging Probiotic Serum | 44.1% |

| Others | 55.9% |

The USA Probiotic Serum Market is valued at USD 236.52 million in 2025, with anti-aging probiotic serums leading at 44.1% (USD 104.31 million). This dominance is fueled by the high adoption rate among consumers aged 35-60, who prioritize wrinkle reduction, skin barrier restoration, and microbiome balance. Clinically backed formulations and pH-balanced innovations are driving trust, especially in dermatologist-recommended brands.

Premium skincare retailers such as Sephora and Ulta are expanding probiotic offerings under anti-aging, sensitive skin, and multi-benefit categories, often paired with educational campaigns to highlight microbiome health benefits. This positions anti-aging probiotic serums as a long-term growth anchor in the USA market, with subscription skincare models and bundled regimens ensuring recurring revenue streams.

| Product Segment | Market Value Share, 2025 |

|---|---|

| Probiotic Lysate Serums | 47.6% |

| Others | 53.4% |

The China Probiotic Serum Market is valued at USD 117.78 million in 2025, with probiotic lysate serums leading at 47.6% (USD 56.06 million). This leadership reflects the country’s growing preference for science-backed, microbiome-balancing skincare that offers stability and efficacy over live probiotics. Domestic brands are rapidly innovating lysate-based and synbiotic hybrid formulations, often combining them with Traditional Chinese Medicine (TCM) extracts for holistic skin health benefits.

Integration of AI-powered beauty diagnostics on leading e-commerce platforms is enabling hyper-personalized product recommendations, further boosting lysate serum adoption. Probiotic lysate serums have become a go-to category for urban consumers seeking hydration, anti-aging, and pollution defense in a single formulation.

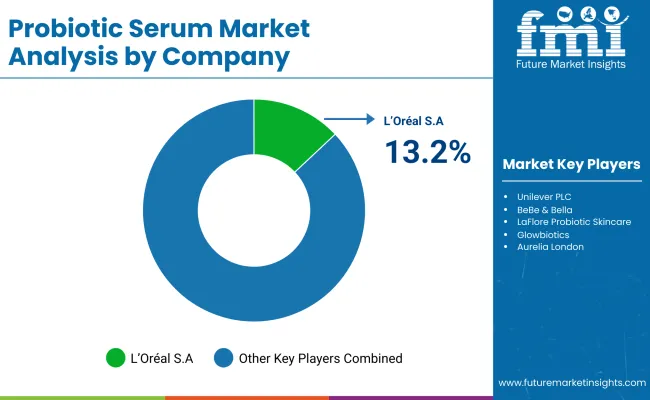

L’Oréal S.A. leads the global probiotic serum market with a dominant 13.2% share in 2025, supported by its strong dermatological skincare portfolio under brands such as La Roche-Posay, Vichy, and SkinCeuticals. The company’s leadership position is reinforced by its Active Cosmetics Division, which focuses on microbiome-safe formulations and clinically backed probiotic lysate technologies.

L’Oréal’s market strength is further anchored in its global omnichannel distribution, robust R&D investments in skin microbiome science, and early adoption of AI-driven skin diagnostics and personalized serum customization tools. The remaining 86.8% of the market is fragmented across multiple dynamic players, including Codex Labs, H&H Group, Clinique Laboratories, Andalou Naturals, Mother Dirt, and LaFlore Probiotic Skincare, among others.

These companies compete by emphasizing clean-label formulations, targeted skin concerns (e.g., calming, anti-aging, hydration), and direct engagement through niche e-commerce platforms and influencer-led campaigns. The “Others” category also reflects the growth of indie skincare brands and regional innovators that prioritize ingredient transparency, live probiotic technology, and novel delivery systems like encapsulated strains and synbiotic complexes.

As the market matures, competitive differentiation is expected to shift toward clinically validated efficacy, microbiome-specific ingredient innovation, and sustainability credentials in both formulation and packaging. L’Oréal’s strategic edge lies in its ability to integrate science, personalization, and premium retail execution at a global scale.

Key Developments in Global Probiotic Serum Market

| Item | Value |

|---|---|

| Quantitative Units | USD 965.4 million |

| Product Type | Hydrating Probiotic Serum, Anti-aging Probiotic Serum, Skin Brightening Probiotic Serum, Anti-acne Probiotic Serum, Firming & Lifting Probiotic Serum, Calming/Sensitive Skin Probiotic Serum, Multi-Benefit/All-in-One Probiotic Serum |

| Formulation Type | Live Probiotic Serums, Postbiotic - Based Serums, Synbiotic Serums, Encapsulated Probiotic Serums, Water-Based Probiotic Serums, Gel-Based Probiotic Serums, Oil-Based Probiotic Serums |

| Packaging Format | Glass Bottles with Droppers, Airless Pump Bottles, Tubes, Ampoules/Vials, Sachets |

| Sales Channel | Online (Brand-Owned E-commerce, Third-Party Marketplaces), Offline (Supermarkets/Hypermarkets, Specialty Stores, Pharmacies, Departmental Stores) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Unilever PLC, BeBe & Bella, LaFlore Probiotic Skincare, Codex Labs, Esse Skincare, Gallinée, TULA Skincare, Glowbiotics, Aurelia London, Mother Dirt |

| Additional Attributes | Dollar sales by product type and end-use channel, adoption trends in anti-aging, hydrating, and microbiome-repair routines, rising demand for travel-sized and refillable probiotic serum packaging, sector-specific growth in dermatology clinics, premium beauty retail, and wellness subscription services, digital platform-driven revenue segmentation via AI skin profiling and app-connected diagnostics, integration with AR-based virtual try-on tools and microbiome-mapping wearables, regional trends influenced by e-commerce personalization and K-beauty innovation cycles, and advancements in postbiotic stabilization, synbiotic complex delivery systems, and microencapsulation technologies are defining the evolving contours of the probiotic serum market landscape. |

The global Probiotic Serum Market is estimated to be valued at USD 965.4 million in 2025.

The market size for the Probiotic Serum Market is projected to reach USD 2,841 million by 2035.

The Probiotic Serum Market is expected to grow at a 11% CAGR between 2025 and 2035.

The key product types in the Probiotic Serum Market include Anti-aging, Hydrating, Skin Brightening, Anti-acne, Firming & Lifting, Calming, Repairing, Oil Control, and Others.

In terms of product type, Anti-aging Probiotic Serum is projected to command 43.6% share of the global market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Probiotic Chewing Gum Market Size and Share Forecast Outlook 2025 to 2035

Probiotics For Oral Health Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Face Masks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Fermentation Skincare Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Probiotic Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Yogurt Market Analysis - Size, Share & Forecast 2025 to 2035

Probiotic Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic for Kids Market Analysis - Size, Share, and Forecast 2025 to 2035

Probiotic Fermented Milk Market Growth & Demand Forecast 2025 to 2035

Probiotic Cheese Market Cheese Type, Bacteria Type, Sales Channel and Others through 2035

Probiotic for Men Market Analysis by Product, Sales Channel and Strain Type Through 2035

Comprehensive Probiotic Strains market analysis and forecast by strain type, application and region.

Probiotic Cosmetics Market Trends - Growth & Forecast 2025 to 2035

Probiotic Supplements Market Share Analysis – Key Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA