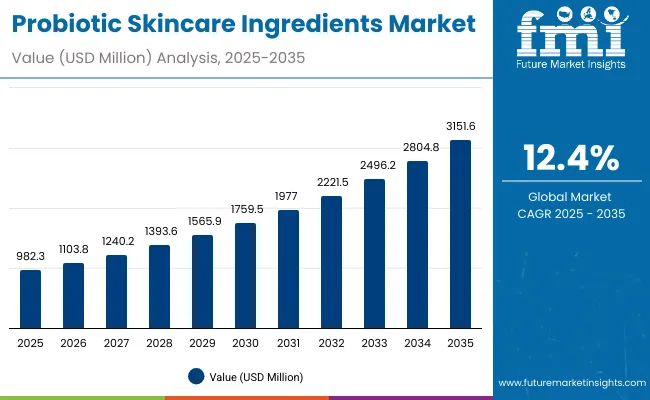

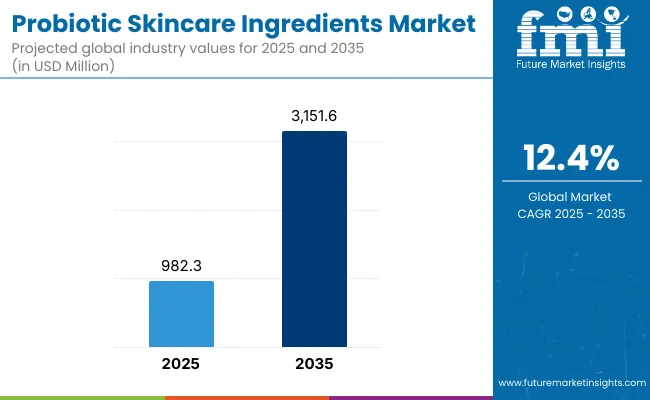

The Global Probiotic Skincare Ingredients Market is expected to record a valuation of USD 982.3 million in 2025 and USD 3,151.6 million in 2035, with an increase of USD 2,169.3 million, which equals a growth of 221% over the decade. The overall expansion represents a CAGR of 12.4% and a 3.2X increase in market size.

Global Probiotic Skincare Ingredients Market Key Takeaways

| Metric | Value |

|---|---|

| Global Probiotic Skincare Ingredients Market Estimated Value in (2025E) | USD 982.3 million |

| Global Probiotic Skincare Ingredients Market Forecast Value in (2035F) | USD 3,151.6 million |

| Forecast CAGR (2025 to 2035) | 12.4% |

During the first five-year period from 2025 to 2030, the market increases from USD 982.3 million to USD 1,759.5 million, adding USD 777.2 million, which accounts for 35.8% of the total decade growth. This phase records steady adoption in barrier-repair hydration, sensitivity/soothing, and anti-aging applications, driven by the need for skin microbiome balance. Serums & ampoules dominate this period as they cater to over 46% of functional formulations requiring concentrated probiotic delivery.

The second half from 2030 to 2035 contributes USD 1,392.1 million, equal to 64.2% of total growth, as the market jumps from USD 1,759.5 million to USD 3,151.6 million. This acceleration is powered by widespread deployment of microbiome-friendly formulations, vegan/clean-label positioning, and premium skincare adoption in Asia-Pacific. Prebiotics and live probiotics together capture a larger share above 50% by the end of the decade. Software-led ecosystem players in R&D and compliance add recurring revenue, increasing the value share of clean/vegan claims beyond 30% in total formulations.

From 2020 to 2024, the Global Probiotic Skincare Ingredients Market grew steadily, driven by postbiotic-centric adoption. During this period, the competitive landscape was dominated by ingredient manufacturers controlling nearly 70-75% of revenue, with leaders such as DSM-Firmenich, Givaudan Active Beauty, and BASF focusing on high-performance postbiotics and lysates for hydration and barrier-repair claims.

Competitive differentiation relied on strain efficacy, regulatory compliance, and stability in formulations, while live probiotics were often positioned as experimental or niche due to storage challenges. Service-based clinical testing models had minimal traction, contributing less than 10% of the total market value.

Demand for probiotic skincare ingredients will expand to USD 982.3 million in 2025, and the revenue mix will shift as claims-based formulations (microbiome-friendly, fragrance-free, vegan/clean) grow to over 30% share. Traditional ingredient leaders face rising competition from digital-first biotech players offering AI-driven strain discovery, cloud-based skin microbiome testing, and subscription-based B2B innovation platforms. Major players are pivoting to hybrid models, integrating active delivery systems and consumer-facing validation studies to retain relevance.

Emerging entrants specializing in postbiotic R&D, AR/VR-enabled consumer testing, and industry-specific probiotic complexes are gaining share. The competitive advantage is moving away from ingredient innovation alone to ecosystem strength, scalability, and recurring partnerships with cosmetic brands.

Advances in probiotic strain stabilization have improved efficacy and shelf-life, allowing for more reliable inclusion in skincare formulations. Postbiotics/lysates have gained popularity due to their proven safety, stability, and barrier-repair benefits, making them suitable for hydration, sensitivity relief, and tone-balancing applications. The rise of microbiome-friendly claims has contributed to higher consumer trust and brand adoption. Industries such as premium skincare, clean beauty, and cosmeceuticals are driving demand for probiotic ingredients that integrate seamlessly into formulations.

Expansion of vegan and clean-label compliance has fueled market growth. Innovations in serums & ampoules for targeted delivery and the development of prebiotic complexes supporting long-term skin microbiome balance are expected to open new application areas. Segment growth is expected to be led by postbiotics/lysates in ingredient type, serums & ampoules in format categories, and barrier repair & hydration in functional claims due to their efficacy and adaptability.

The market is segmented by ingredient type, function, product format, claims & compliance, and region. Ingredient types include live probiotics, postbiotics/lysates, and prebiotic complexes, highlighting the core biological approaches driving adoption. Functions cover barrier repair & hydration, sensitivity/soothing, brightening & tone, and anti-aging, catering to different consumer needs.

Product formats include serums & ampoules, creams & lotions, cleansers & toners, and masks to serve diverse skincare preferences. Claims & compliance encompass microbiome-friendly, fragrance-free, and vegan/clean to address regulatory and ethical expectations. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

| Ingredient Segment | Market Value Share, 2025 |

|---|---|

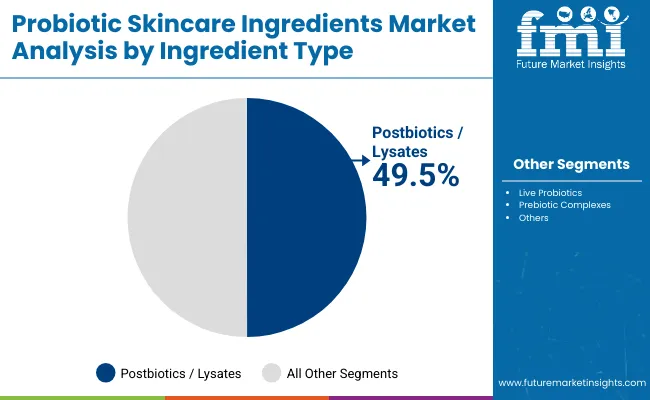

| Postbiotics /lysates | 49.5% |

| Others | 50.5% |

The postbiotics/lysates segment is projected to contribute 49.5% of the Global Probiotic Skincare Ingredients Market revenue in 2025, maintaining its lead as the dominant ingredient category. This is driven by their superior stability, safety, and proven efficacy in barrier repair and hydration, which makes them more adaptable to mainstream cosmetic formulations compared to live probiotics. Postbiotics are also less sensitive to storage and formulation conditions, which increases their appeal for large-scale skincare applications.

The segment’s growth is further supported by expanding clinical validation and rising demand for microbiome-friendly claims among consumers. As ingredient standardization and strain-specific claims become more prevalent, postbiotics are being integrated into premium serums and lotions by leading cosmetic brands. The postbiotics/lysates segment is expected to retain its position as the backbone of probiotic skincare ingredient innovation throughout the forecast period.

| Product Format Segment | Market Value Share, 2025 |

|---|---|

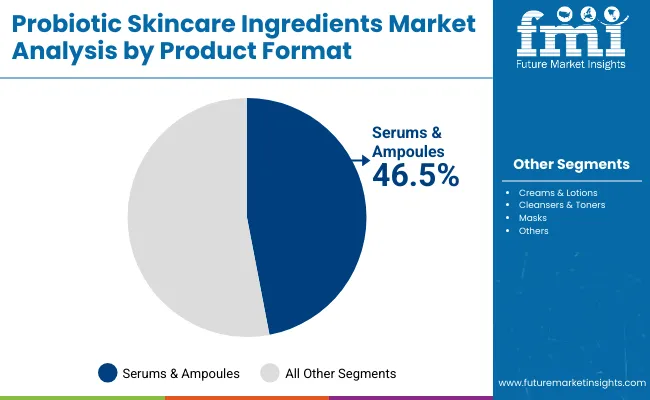

| Serums & ampoules | 46.5% |

| Others | 53.5% |

The serums & ampoules segment is forecasted to hold 46.5% of the market share in 2025, led by its role in delivering concentrated probiotic actives with high efficacy. These formats are favored for their ability to provide targeted hydration, sensitivity relief, and skin-brightening benefits, making them a preferred choice among premium and dermocosmeticbrands.

Their lightweight textures and compatibility with high-potency postbiotics and prebiotic complexes have facilitated widespread adoption in both Western and Asian beauty markets. The segment’s growth is bolstered by rising consumer preference for multi-step skincare routines and K-beauty inspired formulations, where serums act as the foundation of efficacy-driven regimens. As the demand for precision skincare intensifies, serums & ampoules are expected to continue their dominance in probiotic skincare innovation.

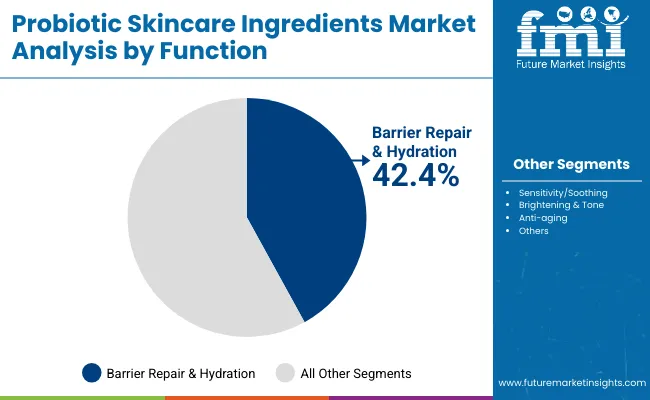

| Function Segment | Market Value Share, 2025 |

|---|---|

| Barrier repair & hydration | 42.4% |

| Others | 57.6% |

The barrier repair & hydration segment is projected to account for 42.4% of the Global Probiotic Skincare Ingredients Market revenue in 2025, establishing it as the leading function. This category is preferred due to the growing prevalence of sensitive and dry skin conditions globally, amplified by environmental stressors, pollution, and urban lifestyles. Probiotic formulations in this category help restore the skin’s microbiome balance, strengthen barrier function, and lock in moisture.

Its suitability for daily-use skincare across diverse demographics has made it the most widely adopted functional claim, particularly in serums, lotions, and toners. Developments in lysate-based actives and prebiotic complexes have enhanced hydration efficiency while maintaining microbiome health, thereby improving consumer trust. Given its balance of efficacy and broad appeal, barrier repair & hydration is expected to maintain its leading role in the Global Probiotic Skincare Ingredients Market.

Rising Consumer Awareness of Skin Microbiome Health

One of the strongest drivers for the Global Probiotic Skincare Ingredients Market is the increasing awareness among consumers regarding the role of the skin microbiome in overall skin health. Consumers are shifting from traditional cosmetic solutions to science-backed, functional skincare ingredients that support skin barrier strength and microbiome balance. Dermatologists and skincare brands are emphasizing that probiotic, prebiotic, and postbiotic ingredients can help restore balance, reduce irritation, and protect against environmental stressors.

This awareness is being reinforced by social media, digital skincare influencers, and the popularity of skin-science narratives in marketing campaigns. As a result, consumers are associating probiotics with not just gut health but also external wellness and skin resilience. The fact that postbiotics are stable, safe, and easy to integrate into cosmetics gives brands a commercial edge, allowing them to market high-performance formulations at scale. This growing knowledge base and positive perception is significantly driving global demand.

Expansion of Premium and Clean Beauty Segments

The surge in premium skincare demand and clean-label positioning is another major driver. Consumers, particularly in East Asia, Europe, and North America, are prioritizing skincare that is vegan, fragrance-free, and microbiome-friendly. This aligns perfectly with probiotic ingredient-based formulations, which naturally fall under the “better-for-you” and “scientifically proven” umbrella.

Premium skincare brands are increasingly launching serums, ampoules, and creams infused with probiotics/postbiotics as part of their innovation pipelines. Additionally, the rise of dermocosmetic positioningproducts that combine cosmetic appeal with dermatological scienceis amplifying adoption. The higher willingness of consumers to pay for microbiome-supportive skincare fuels revenue growth and encourages ingredient suppliers to invest heavily in R&D.

Regulatory Complexity and Lack of Standardization

A key restraint for the Global Probiotic Skincare Ingredients Market is the complex regulatory landscape and absence of harmonized standards for probiotics in cosmetics. Unlike food supplements, the skincare industry faces additional challenges because regulators demand proof of efficacy, safety, and stability of live cultures or bioactive derivatives. In many regions, probiotics in cosmetics are still classified under ambiguous or emerging regulatory frameworks.

This slows down product approvals, creates uncertainty for global rollouts, and increases compliance costs for ingredient suppliers. Furthermore, marketing claims around “microbiome-friendly” or “probiotic skincare” often face scrutiny, as they need robust clinical backing. Without harmonized standards across North America, EU, and Asia-Pacific, companies may face hurdles scaling globally.

High Formulation and Stability Challenges for Live Probiotics

While postbiotics and lysates are gaining traction due to their stability, live probiotics still face significant technical challenges. Maintaining viability in cosmetic formulations, ensuring shelf stability, and preserving efficacy through distribution channels remain major obstacles. This limits the widespread adoption of live probiotic ingredients in mass-market skincare.

Additionally, the need for specialized encapsulation technologies, cold-chain storage, and controlled environments increases production costs, making live probiotics less commercially viable at scale. These formulation constraints restrict diversity in product offerings, slowing the pace of adoption compared to more stable alternatives like postbiotics and prebiotic complexes.

Shift TowardPostbiotics and Next-Generation Complexes

A dominant trend is the shift toward postbiotics and next-generation microbiome complexes. Unlike live probiotics, postbiotics (lysates and inactivated microbial fractions) offer superior safety, longer shelf life, and reliable integration into skincare products. Brands are leveraging postbiotics as the “hero ingredient” in serums, creams, and toners, supported by robust scientific literature demonstrating benefits for hydration, barrier strengthening, and inflammation reduction.

Moreover, R&D investments are increasingly directed toward synergistic prebiotic + postbiotic complexes, where formulations are designed to both support beneficial skin flora and deliver bioactive metabolites. This trend is being fueled by consumer demand for visible, clinically validated results, combined with ease of formulation for manufacturers.

Rise of Personalized and AI-Backed Microbiome Skincare

Another key trend shaping the market is the integration of personalization and digital health tools into probiotic skincare. Startups and leading brands are exploring AI-based skin analysis, microbiome testing kits, and digital consultations that recommend probiotic-based products tailored to individual skin microbiomes.

This aligns with the broader move toward personalized beauty and the adoption of direct-to-consumer subscription models, where consumers receive customized probiotic skincare regimens. The convergence of biotechnology, AI, and digital platforms is setting the stage for a future where microbiome-friendly formulations are not only standardized but also hyper-personalized to consumer profiles. This creates a premium pricing opportunity and fosters strong consumer loyalty.

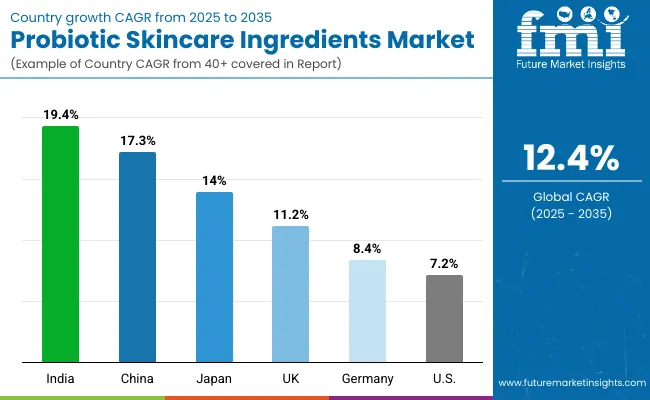

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 17.3% |

| USA | 7.2% |

| India | 19.4% |

| UK | 11.2% |

| Germany | 8.4% |

| Japan | 14.0% |

Between 2025 and 2035, the Global Probiotic Skincare Ingredients Market will experience highly uneven country-level growth, reflecting diverse consumer adoption patterns and industry maturity. India (19.4% CAGR) and China (17.3% CAGR) will lead expansion, powered by rising middle-class spending, a strong preference for premium skincare, and increasing penetration of microbiome-friendly products in urban centers.

Both countries are seeing rapid innovation in localized probiotic formulations, with regional brands collaborating with biotech suppliers to address sensitivity, hydration, and brightening concerns that resonate with Asian consumers. Japan (14.0% CAGR) follows closely, supported by its advanced cosmeceutical sector and cultural emphasis on skin longevity, driving adoption of postbiotics and lysates in anti-aging and hydration-focused formulations.

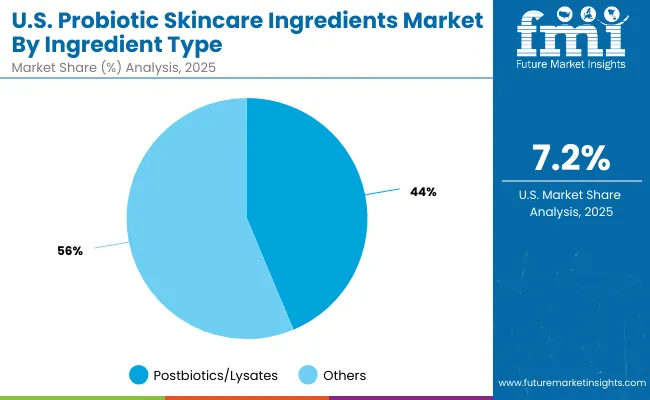

By contrast, growth in developed markets will be steadier but slower. The USA (7.2% CAGR) remains the largest single-country market by value, but its expansion is constrained by regulatory complexity and market maturity, even as clean-label claims sustain consumer interest.

Germany (8.4% CAGR) and the UK (11.2% CAGR) represent Europe’s key growth hubs, where demand is shaped by sustainability and vegan/clean claims, but overall expansion is moderated by strict compliance standards and established consumer bases. These differences highlight a clear trend: while North America and Europe remain high-value, innovation-driven markets, Asiaparticularly India, China, and Japanis becoming the global growth engine for probiotic skincare ingredients.

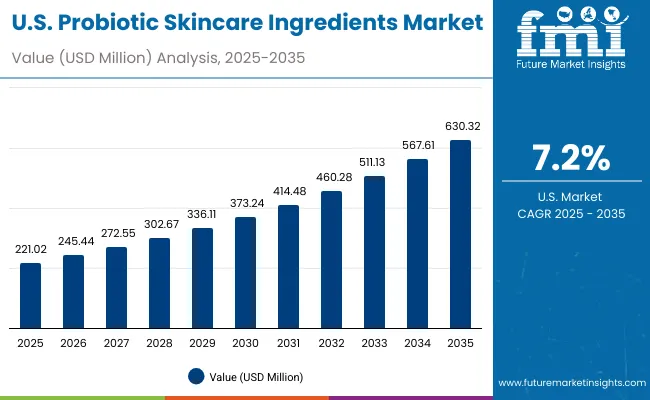

| Year | USA Probiotic Skincare Ingredients Market (USD Million) |

|---|---|

| 2025 | 221.0 |

| 2026 | 245.4 |

| 2027 | 272.6 |

| 2028 | 302.7 |

| 2029 | 336.1 |

| 2030 | 373.2 |

| 2031 | 414.5 |

| 2032 | 460.3 |

| 2033 | 511.1 |

| 2034 | 567.6 |

| 2035 | 630.3 |

The Probiotic Skincare Ingredients Market in the United States is projected to grow at a CAGR of 7.2%, led by strong consumer demand for microbiome-friendly and fragrance-free skincare. Premium skincare brands are increasingly adopting postbiotics and prebiotic complexes for barrier-repair and hydration benefits, while dermocosmetic players emphasize soothing and anti-aging properties.

Growth is particularly supported by the rising popularity of serums and ampoules, which cater to efficacy-driven USA consumers. Partnerships between ingredient suppliers and major cosmetic manufacturers are expanding market presence and regulatory-compliant product launches.

The Probiotic Skincare Ingredients Market in the United Kingdom is expected to grow at a CAGR of 11.2%, supported by the rising adoption of vegan/clean-label and fragrance-free skincare products. British consumers show strong interest in sustainability and functional claims, leading to greater acceptance of postbiotic-driven hydration and tone-correcting formulations. Niche and indie beauty brands are experimenting with probiotic blends, while larger cosmetics companies are focusing on clinical validation to meet EU and UK compliance standards.

India is witnessing rapid growth in the Probiotic Skincare Ingredients Market, which is forecast to expand at a CAGR of 19.4% through 2035. Rising consumer awareness of microbiome skincare, coupled with strong urban demand for premium beauty, is creating new opportunities. Serums and ampoules are emerging as high-growth formats, supported by K-beauty-inspired regimens. Local brands are partnering with global suppliers to introduce cost-effective probiotic formulations, expanding penetration into both metro and tier-2 cities.

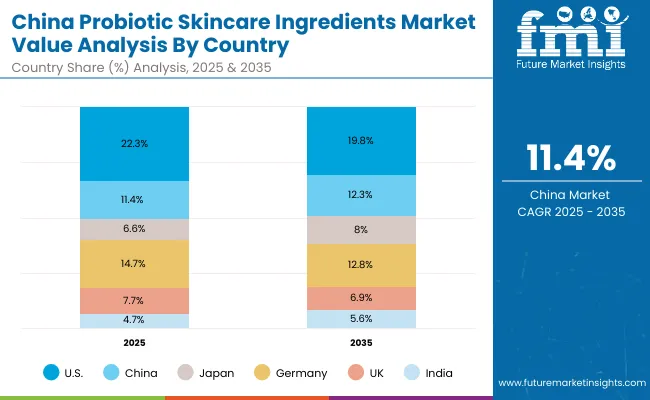

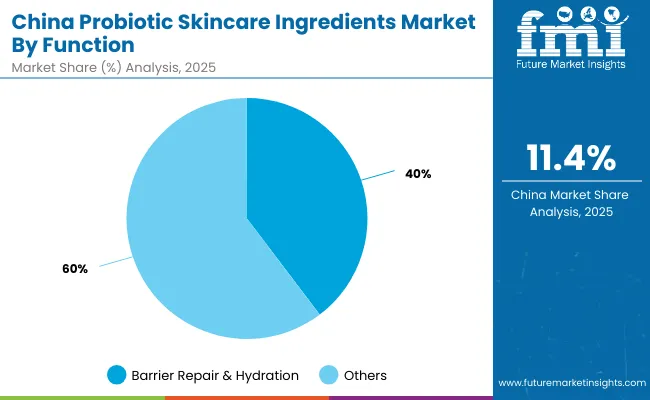

The Probiotic Skincare Ingredients Market in China is expected to grow at a CAGR of 17.3%, among the highest globally. This momentum is driven by urbanization, rising disposable income, and advanced beauty retail ecosystems. Chinese consumers have shown strong preference for hydration-focused and brightening probiotic formulations, with serums and lotions leading adoption. Cross-border e-commerce platforms are amplifying the presence of probiotic skincare products, while domestic brands invest in localized postbiotic and prebiotic complexes.

| Ingredient Segment | Market Value Share, 2025 |

|---|---|

| Postbiotics /lysates | 43.7% |

| Others | 56.3% |

The Probiotic Skincare Ingredients Market in the United States is valued at USD 221.02 million in 2025, with postbiotics/lysates leading at 43.7%. The dominance of postbiotics is driven by their superior stability, safety, and proven clinical benefits compared to live probiotics, which face formulation challenges. American consumers show strong preference for microbiome-friendly and fragrance-free claims, aligning well with postbiotic-infused serums, creams, and lotions. The appeal of serums & ampoules has grown significantly in the USA, offering concentrated delivery of probiotic actives and supporting hydration and anti-aging claims.

This positions postbiotics as the foundation of innovation in the USA market, as leading brands prioritize proven, stable actives that meet FDA and clean-label compliance standards. Live probiotics remain niche due to cold-chain and storage hurdles, while prebiotic complexes are gaining momentum as complementary solutions. Growth will be sustained by clinical validation, dermocosmetic positioning, and partnerships between suppliers and premium skincare brands.

| Function Segment | Market Value Share, 2025 |

|---|---|

| Barrier repair & hydration | 39.5% |

| Others | 60.5% |

The Probiotic Skincare Ingredients Market in China is valued at USD 112 million in 2025, with barrier repair & hydration leading at 39.5%. The dominance of this segment reflects consumer demand for deep hydration and skin protection, especially in urban centers where pollution and climate variation impact skin health. Postbiotics and lysates are the preferred functional ingredients, ensuring stability and compatibility with serums and lotions that dominate China’s beauty market.

This advantage positions barrier repair & hydration as a core application driver in Chinese probiotic skincare, supported by the popularity of multi-step skincare routines and K-beauty influence. Brightening and anti-aging claims remain relevant but secondary, as hydration-focused products establish trust and wider consumer adoption. Local and global brands alike are integrating probiotic complexes into premium ranges, while cross-border e-commerce continues to accelerate market expansion.

| Companies | Global Value Share 2025 |

|---|---|

| DSM- Firmenich | 9.1% |

| Others | 90.9% |

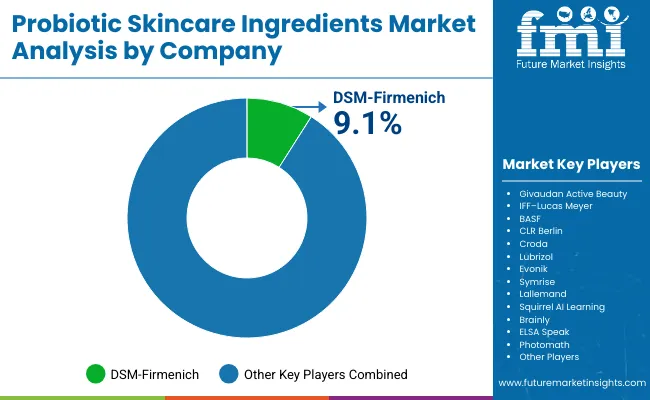

The Probiotic Skincare Ingredients Market is moderately fragmented, with global leaders, regional innovators, and niche specialists competing across multiple application areas. DSM-Firmenich leads with a 9.1% global share in 2025, leveraging its strong biotechnology expertise, large-scale manufacturing, and strategic partnerships with premium skincare brands. Its focus on postbiotic lysates and microbiome validation studies positions it as a dominant player.

Other multinational players such as Givaudan Active Beauty, BASF, Croda, Evonik, and Symrise are strengthening portfolios with microbiome-friendly actives, vegan/clean formulations, and collaborations with dermocosmetic brands. Mid-sized innovators like CLR Berlin and Lallemand are carving niches with strain-specific research and targeted probiotic complexes.

Lubrizol and IFF-Lucas Meyer are investing in delivery systems and hybrid formulations to boost efficacy.Competitive differentiation is shifting from ingredient availability to ecosystem strengthcombining clinical validation, claims substantiation, and partnerships with consumer brands. Suppliers able to integrate R&D support, regulatory compliance, and co-branding opportunities are gaining long-term strategic advantage in this fast-evolving market.

| Item | Value |

|---|---|

| Quantitative Units | USD 982.3 million |

| I ngredient Type | Live probiotics, Postbiotics /lysates, Prebiotic complexes |

| Function | Barrier repair & hydration, Sensitivity/soothing, Brightening & tone, Anti-aging |

| Product Format | Serums & ampoules, Creams & lotions, Cleansers & toners, Masks |

| Claims & Compliance | Microbiome-friendly, Fragrance-free, Vegan/clean |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DSM- Firmenich , Givaudan Active Beauty, IFF–Lucas Meyer, BASF, CLR Berlin, Croda , Lubrizol, Evonik , Symrise , Lallemand |

| Additional Attributes | Dollar sales by ingredient type and product format, adoption trends in barrier-repair and hydration skincare, rising demand for serums & ampoules, segment-specific growth in anti-aging and sensitivity relief, claims and compliance segmentation, integration of prebiotic/ postbiotic complexes, regional trends influenced by clean beauty and K-beauty adoption, and innovations in microbiome-friendly formulations and delivery systems. |

The Global Probiotic Skincare Ingredients Market is estimated to be valued at USD 982.3 million in 2025.

The market size for the Global Probiotic Skincare Ingredients Market is projected to reach USD 3,151.6 million by 2035.

The Global Probiotic Skincare Ingredients Market is expected to grow at a 12.4% CAGR between 2025 and 2035.

The key ingredient types in the Global Probiotic Skincare Ingredients Market are live probiotics, postbiotics/lysates, and prebiotic complexes.

In terms of product format, the serums & ampoules segment will command 46.5% share in the Global Probiotic Skincare Ingredients Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Probiotic Chewing Gum Market Size and Share Forecast Outlook 2025 to 2035

Probiotics For Oral Health Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Face Masks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Global Probiotic Serum Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Yogurt Market Analysis - Size, Share & Forecast 2025 to 2035

Probiotic Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic for Kids Market Analysis - Size, Share, and Forecast 2025 to 2035

Probiotic Fermented Milk Market Growth & Demand Forecast 2025 to 2035

Probiotic for Men Market Analysis by Product, Sales Channel and Strain Type Through 2035

Probiotic Cheese Market Cheese Type, Bacteria Type, Sales Channel and Others through 2035

Comprehensive Probiotic Strains market analysis and forecast by strain type, application and region.

Probiotic Cosmetics Market Trends - Growth & Forecast 2025 to 2035

Probiotic Supplements Market Share Analysis – Key Trends & Forecast 2025-2035

Probiotics After Antibiotic Recovery Market Analysis by Ingredient and Sales Channel Through 2035

Probiotic Infant Formula Market – Growth & Infant Nutrition Trends

Probiotic Yeast Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA