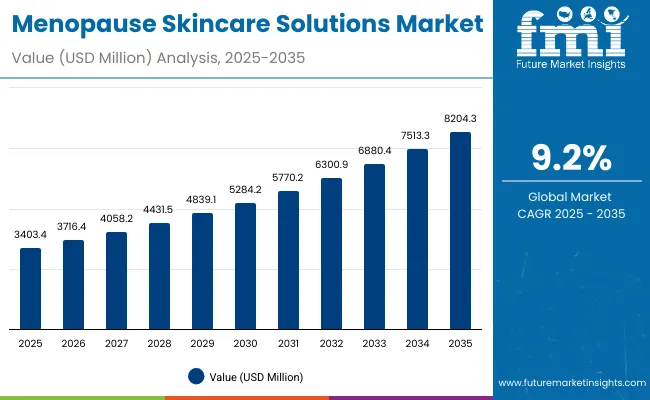

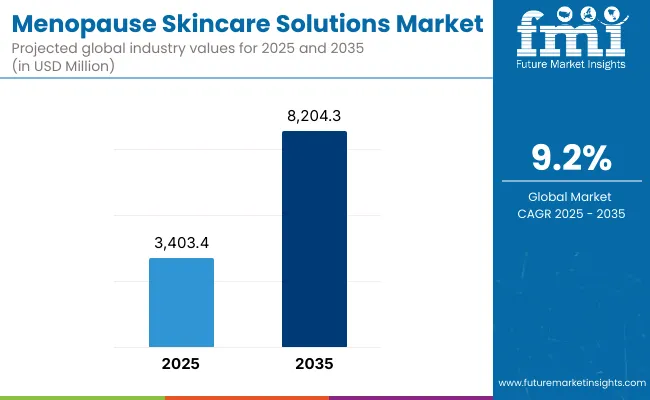

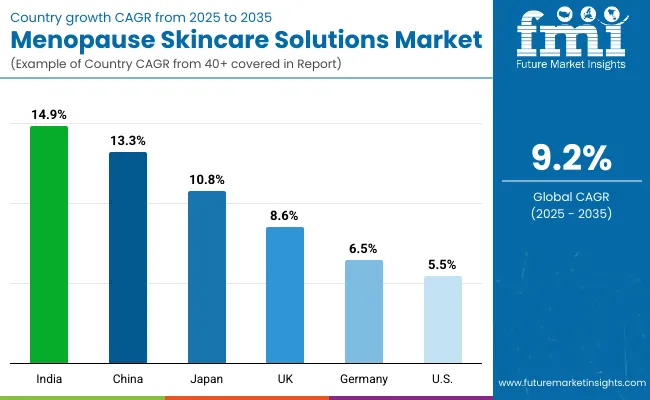

The Global Menopause Skincare Solutions Market is expected to record a valuation of USD 3,403.4 million in 2025 and USD 8,204.3 million in 2035, with an increase of USD 4,800.9 million, which equals a growth of 141% over the decade. The overall expansion represents a CAGR of 9.2% and reflects a near 2.5X increase in market size.

Global Menopause Skincare Solutions Market Key Takeaways

| Metric | Value |

|---|---|

| Global Menopause Skincare Solutions Market Estimated Value in (2025E) | USD 3,403.4 million |

| Global Menopause Skincare Solutions Market Forecast Value in (2035F) | USD 8,204.3 million |

| Forecast CAGR (2025 to 2035) | 9.2% |

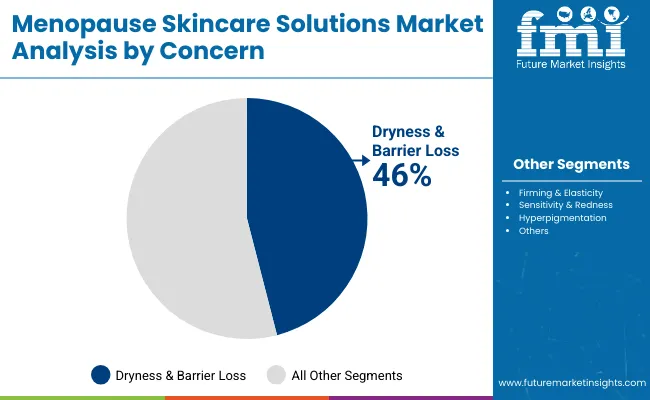

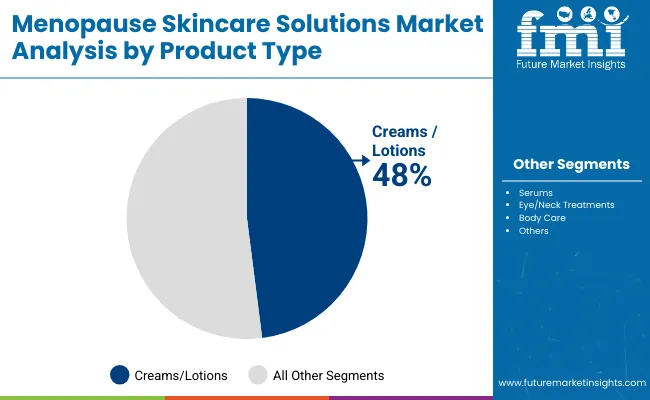

During the first five-year period from 2025 to 2030, the market increases from USD 3,403.4 million to USD 5,284.2 million, adding USD 1,880.8 million, which accounts for nearly 39% of the total decade growth. This phase records steady adoption across perimenopausal and postmenopausal consumers, with dryness & barrier loss driving over 46% of global concern-based demand. Creams and lotions dominate this phase as they are widely accepted for barrier restoration and hydration, catering to over 48% of product usage among women aged 40-49 and above 50.

The second half from 2030 to 2035 contributes USD 2,920.1 million, equal to 61% of total growth, as the market jumps from USD 5,284.2 million to USD 8,204.3 million. This acceleration is powered by expanding premium skincare routines, dermatology clinic-backed awareness, and growing online penetration in emerging markets like China and India.

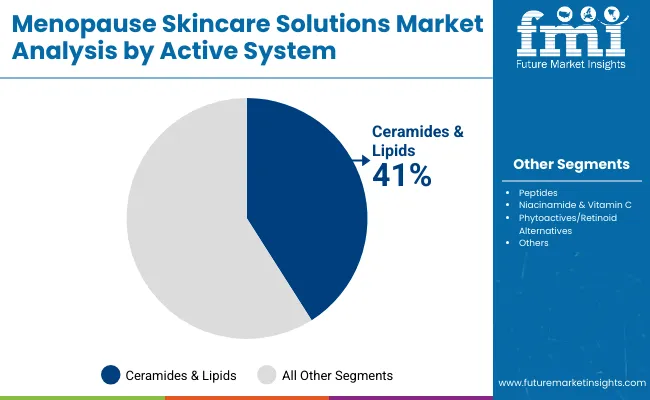

Active systems such as ceramides & lipids (41% in 2025) continue to hold dominance, while peptides and phytoactive/retinoid alternatives see rising uptake in clinically validated and clean-label products. E-commerce and specialty beauty retail platforms significantly expand product reach, while hormone-free and fragrance-free claims align with consumer safety perceptions and evolving regulatory expectations.

From 2020 to 2024, the Global Menopause Skincare Solutions Market steadily gained traction as awareness around hormonal skin changes improved. The market expanded significantly in value as targeted formulations for dryness, elasticity, and redness were introduced by both established players like Estée Lauder, L’Oréal Paris, and Olay, and specialized entrants such as Womaness and Pause Well-Aging.

During this period, dryness and barrier repair accounted for the largest share, with ceramide-based creams and lotions dominating. Distribution remained strongly anchored in pharmacies and specialty retail, while early e-commerce adoption began reshaping accessibility. Competitive differentiation relied on dermatology validation, hormone-free claims, and clean-label positioning, setting the stage for the decade ahead.

Demand for menopause skincare solutions will expand to USD 3,403.4 million in 2025, and the revenue mix will evolve as active systems like peptides, niacinamide, and phytoactive alternatives capture more attention due to their anti-aging, pigmentation, and sensitivity-control benefits. Traditional mass-market leaders face rising competition from science-backed, niche brands offering clinically validated and dermatologist-endorsed products.

Major brands are pivoting to hybrid portfolios, blending mainstream creams and lotions with more advanced serums and targeted eye/neck treatments to secure market loyalty. Emerging entrants focusing on clean-label, fragrance-free, and hormone-free claims are rapidly gaining share. The competitive advantage is shifting from legacy branding alone to clinical credibility, inclusivity of menopausal needs, and omnichannel distribution strategies.

Growing awareness of hormonal skin changes during perimenopause and menopause has been a significant driver since 2023, supported by health organizations and dermatology societies emphasizing midlife women’s skincare needs. Advances in formulation science, such as ceramides and lipid complexes, improve hydration and strengthen skin barriers, while peptides and niacinamide deliver firming and brightening benefits, meeting multi-dimensional concerns.

The shift toward hormone-free, clinically validated, and clean-label solutions is fostering trust, particularly in North America and Europe. Consumer demand for transparency and dermatologist-approved products is boosting adoption in pharmacies and dermatology clinics. Parallelly, e-commerce and specialty beauty retail channels are accelerating market penetration in Asia, enabling global brands to reach emerging middle-class consumers in India and China, which post double-digit CAGR growth.

The expansion of personalized routines tailored for perimenopausal (40-49 years) and postmenopausal women (50+ years) ensures inclusivity and longevity of market demand. Segment growth is expected to be led by dryness & barrier loss in concerns, creams/lotions in product type, and ceramides & lipids in actives due to their proven safety, efficacy, and adaptability to different skin types.

The Global Menopause Skincare Solutions Market is segmented by concern, active system, product type, channel, claim, end user, and geography. By concern, dryness & barrier loss dominates at 46% share in 2025, driven by demand for hydration and skin-strengthening solutions.

By active system, ceramides & lipids lead with 41% share, reflecting trust in scientifically established barrier-repair ingredients. By product type, creams and lotions capture 48% in 2025, underlining their position as the most accessible and versatile format for menopausal skincare.

By channel, e-commerce is rising as a critical growth vector, while pharmacies remain trusted access points in Western markets. By claim, hormone-free and clean-label solutions are most sought after, aligning with consumer preferences for safe and transparent products. By end user, perimenopause (40-49) drives early adoption, while postmenopause (50+) ensures long-term repeat demand. Regionally, North America leads in absolute size, while Asia-Pacific (India, China, Japan) drives growth momentum.

| Concern | Value Share % 2025 |

|---|---|

| Dryness & barrier loss | 46% |

| Others | 54.0% |

The dryness & barrier loss segment is projected to contribute 46% of the Global Menopause Skincare Solutions Market revenue in 2025, maintaining its lead as the dominant concern category. This is driven by the high prevalence of skin dehydration, barrier weakening, and roughness associated with hormonal decline during perimenopause and menopause. Consumers increasingly seek barrier-strengthening products to restore moisture balance and protect against sensitivity.

The segment’s growth is also supported by the proven efficacy of ceramides, lipids, and advanced hydrating actives in delivering lasting relief. Brands are investing in dermatology-tested, clinically validated formulations that address long-term hydration needs while being hormone-free and safe for sensitive skin. As menopause skincare becomes mainstream, dryness-related solutions are expected to retain their position as the cornerstone of this market, reflecting both consumer necessity and clinical validation.

| Product Type | Value Share % 2025 |

|---|---|

| Creams/lotions | 48% |

| Others | 52.0% |

The creams and lotions segment is forecasted to hold 48% of the market share in 2025, led by its widespread application in daily skincare routines. These formats are favored for their familiarity, ease of use, and versatility in addressing hydration, elasticity, and sensitivity. Creams and lotions deliver a balance of efficacy and comfort, making them the go-to choice for both perimenopausal women and postmenopausal users who require consistent barrier support.

Their ability to integrate multiple actives such as ceramides, niacinamide, and peptides has further strengthened their relevance. This segment’s growth is reinforced by innovations in lightweight textures and fast-absorbing formulas that cater to changing consumer expectations of convenience. As targeted menopausal skincare becomes more personalized, creams and lotions are expected to continue their dominance, supported by strong demand across e-commerce, pharmacies, and specialty retail channels.

| Active System | Value Share % 2025 |

|---|---|

| Ceramides & lipids | 41% |

| Others | 59.0% |

The ceramides & lipids segment is projected to account for 41% of the Global Menopause Skincare Solutions Market revenue in 2025, establishing it as the leading active system. This segment is preferred because ceramides are clinically proven to restore barrier strength, improve hydration, and reduce sensitivity-issues that become more pronounced during menopause due to estrogen decline.

Their compatibility across creams, serums, and body care products has ensured broad consumer adoption. The segment’s expansion is supported by advancements in bio-identical lipid complexes and encapsulation technologies that enhance delivery efficiency and skin absorption. As awareness of barrier health grows globally, ceramides & lipids are expected to maintain their leading role in the menopause skincare market, combining safety, efficacy, and trust to anchor the next wave of product innovation.

Rising Dermatology-Backed Awareness on Menopause Skincare

Since 2022, dermatology associations and women’s health organizations have amplified the need for menopause-specific skincare solutions, citing dryness, sensitivity, and loss of elasticity as prevalent issues. This medical validation drives consumer trust, especially in North America and Europe, where women are increasingly adopting dermatologist-recommended products. With over 46% of the market revenue in 2025 coming from dryness & barrier loss, the driver is not only clinical endorsement but also the growing retail presence of dermatologist-formulated brands. This has created a feedback loop where professional credibility boosts adoption, fueling market growth further.

Accelerated Growth in Emerging Markets like China and India

China (13.3% CAGR) and India (14.9% CAGR) outpace mature markets due to rising middle-class spending power, digital retail penetration, and beauty culture shifts toward preventive aging. E-commerce platforms and social media influencers are normalizing conversations about perimenopausal and postmenopausal skincare. Creams and lotions, valued at USD 172.1 Mn in China (2025), are gaining traction as entry-level products. The driver here is affordability paired with growing awareness, ensuring that Asia contributes disproportionately to global growth, especially in the second half of the forecast period.

Consumer Skepticism Toward Hormone-Free and “Menopause-Branded” Claims

Despite rising demand, a significant portion of consumers remain skeptical about menopause-branded skincare, perceiving it as a marketing tactic rather than a science-driven need. Hormone-free claims are widely promoted, but the lack of standardized regulatory guidelines in most regions fuels mistrust. This hesitation slows adoption, particularly in markets where consumers prefer trusted mainstream brands (e.g., Olay, L’Oréal Paris) over newer entrants. This restraint challenges niche brands to prove efficacy through clinical validation and education campaigns.

Pricing Barriers Limiting Access in Developing Economies

Premium menopause skincare solutions often carry higher price points due to clinical testing, specialized formulations, and branding, creating affordability gaps in developing economies. While demand is rising in India and Latin America, high costs restrict penetration beyond affluent consumers. With mass-market creams and lotions priced lower, niche solutions risk being perceived as luxury rather than accessible healthcare products. Unless price-tiered strategies emerge, adoption could remain concentrated in upper-income segments.

Shift Toward Clinically Validated, Clean-Label Formulations

Across the market, consumers are actively seeking fragrance-free, clean-label, and clinically validated products. This trend reflects heightened sensitivity to transparency and trust in skincare, particularly during life stages with hormonal vulnerability. Active systems like ceramides & lipids (41% share in 2025) dominate because they are well-researched, but rising interest in phytoactives and retinoid alternatives shows demand for science-backed yet natural solutions. Brands that publish clinical trial results and dermatologist endorsements are winning competitive advantage, setting the tone for innovation over the next decade.

Rapid Expansion of E-commerce and Specialty Beauty Retail

Digital-first sales strategies are becoming indispensable. E-commerce enables niche brands like Womaness and Pause Well-Aging to bypass traditional retail gatekeepers, while specialty beauty stores curate menopause-focused product assortments. This trend is particularly impactful in Asia-Pacific, where social commerce platforms influence younger perimenopausal consumers. By 2030, online channels are expected to hold a significant share of incremental growth, reinforcing omnichannel strategies as a defining factor of competitive success.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 13.3% |

| USA | 5.5% |

| India | 14.9% |

| UK | 8.6% |

| Germany | 6.5% |

| Japan | 10.8% |

Among the leading countries, India (14.9%) and China (13.3%) are projected to deliver the strongest growth from 2025-2035, fueled by expanding middle-class populations, rising awareness of menopausal health, and the rapid adoption of digital retail. Indian consumers are increasingly embracing affordable creams and lotions as entry-level solutions, while Chinese consumers lean toward premium products, often influenced by beauty influencers and cross-border e-commerce.

Both markets benefit from younger demographics entering perimenopause earlier, combined with high social media penetration that normalizes menopause skincare discussions. In Japan, projected at 10.8% CAGR, the emphasis lies on advanced anti-aging formulations and functional actives, supported by a culture that prioritizes skincare rituals, helping the country sustain strong growth within East Asia.

In contrast, mature markets such as the USA (5.5%), Germany (6.5%), and the UK (8.6%) show slower but steady expansion, as consumer awareness is already high and major brands dominate shelf presence. Growth in these regions stems from the rising demand for clinically validated, fragrance-free, and clean-label claims rather than penetration gains.

The USA remains the largest single market in value terms, but competitive intensity is higher, with both legacy players (like Estée Lauder and Olay) and niche entrants (like Womaness and Emepelle) competing for consumer trust.

In Europe, regulatory frameworks around transparency and clean formulations bolster demand, while pharmacies and dermatology clinics continue to play a pivotal role in product adoption. Together, these markets represent a balanced picture where emerging economies drive growth momentum, while developed markets anchor stability and innovation leadership.

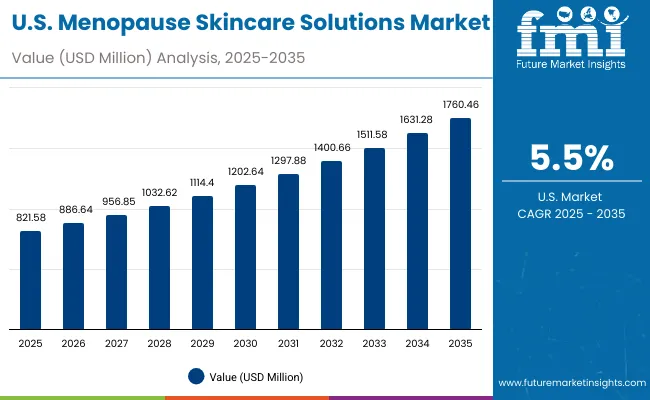

| Year | USA Menopause Skincare Solutions Market (USD Million) |

|---|---|

| 2025 | 821.58 |

| 2026 | 886.64 |

| 2027 | 956.85 |

| 2028 | 1032.62 |

| 2029 | 1114.40 |

| 2030 | 1202.64 |

| 2031 | 1297.88 |

| 2032 | 1400.66 |

| 2033 | 1511.58 |

| 2034 | 1631.28 |

| 2035 | 1760.46 |

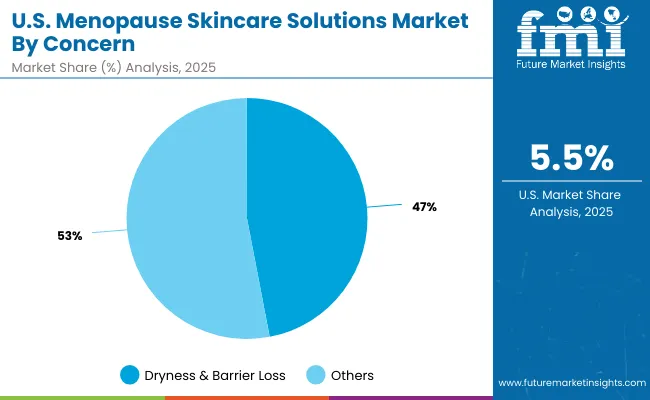

The Menopause Skincare Solutions Market in the United States is projected to grow at a CAGR of 5.5%, with value expanding from USD 821.6 million in 2025 to USD 1,760.5 million in 2035. Growth is led by strong consumer demand for hormone-free and clinically validated products, especially targeting dryness and barrier loss, which accounts for 47% of sales in 2025 (USD 386.1 million). Pharmacies and dermatology clinics remain trusted distribution hubs, while e-commerce is reshaping convenience and accessibility. The market is also driven by endorsements from dermatologists and growing public awareness of menopause-related skin health.

The Menopause Skincare Solutions Market in the United Kingdom is expected to grow at a CAGR of 8.6% through 2035. The market benefits from rising cultural openness toward menopause, with major retailers and government-backed initiatives highlighting women’s midlife health. Premium skincare ranges addressing elasticity, sensitivity, and pigmentation are gaining strong momentum, while dryness-related products maintain baseline demand. Specialist pharmacies, online beauty retailers, and dermatology clinics are increasingly featuring menopause-specific brands. Clinical validation and clean-label claims resonate strongly with UK consumers, enhancing adoption across multiple age groups.

India is witnessing rapid growth in the Menopause Skincare Solutions Market, which is forecast to expand at a CAGR of 14.9% through 2035 - the fastest among major economies. Awareness of perimenopausal and postmenopausal skincare is spreading rapidly through social media, dermatology influencers, and e-commerce. Affordable creams and lotions dominate adoption, reflecting mass-market accessibility, while urban dermatology clinics are beginning to promote advanced serums and eye/neck treatments. Tier-2 and Tier-3 cities are increasingly driving sales, supported by local pharmacy networks and the affordability of hydration-focused solutions.

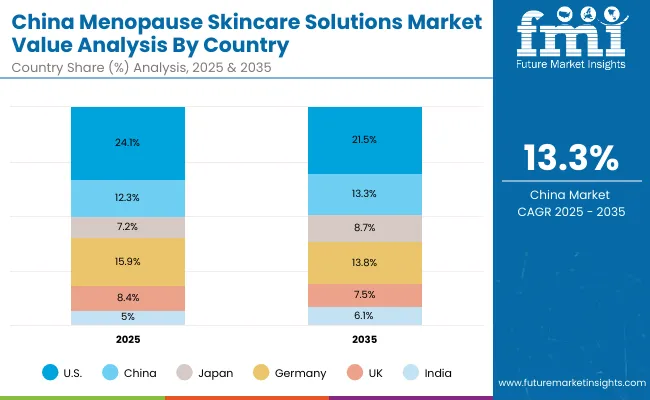

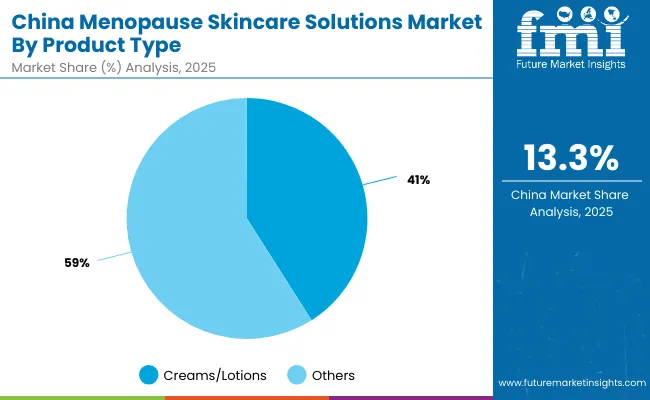

The Menopause Skincare Solutions Market in China is expected to grow at a CAGR of 13.3%, one of the highest globally, reflecting rapid consumer adoption. Growth is driven by e-commerce platforms like Tmall and JD.com, which promote menopause-focused products alongside premium international and local brands.

In 2025, creams and lotions account for 41% of product sales (USD 172.2 million), highlighting hydration and barrier care as entry-level needs. Rising adoption of serums and phytoactive-based products is evident, with demand fueled by younger perimenopausal women who are more proactive in preventive skincare. Competitive pricing by local brands accelerates accessibility, while clinical validation continues to drive premium positioning.

| Country | 2025 Share (%) |

|---|---|

| USA | 24.1% |

| China | 12.3% |

| Japan | 7.2% |

| Germany | 15.9% |

| UK | 8.4% |

| India | 5.0% |

| Country | 2035 Share (%) |

|---|---|

| USA | 21.5% |

| China | 13.3% |

| Japan | 8.7% |

| Germany | 13.8% |

| UK | 7.5% |

| India | 6.1% |

| USA By concern | Value Share % 2025 |

|---|---|

| Dryness & barrier loss | 47% |

| Others | 53.0% |

The Menopause Skincare Solutions Market in the USA is projected at USD 821.6 million in 2025, with dryness & barrier loss contributing 47% (USD 386.1 million), while other concerns including elasticity, redness, and hyperpigmentation collectively hold 53%. This clear dominance of dryness reflects the clinical relevance of barrier decline in postmenopausal skin, where reduced estrogen levels directly affect hydration and lipid balance. American consumers are highly receptive to dermatologist-validated and hormone-free products, positioning the dryness category as the backbone of the USA market.

Growing adoption of clinically validated claims and consumer preference for fragrance-free and clean-label formulations is a major catalyst. Additionally, distribution remains anchored in pharmacies and dermatology clinics, which sustain consumer trust, while e-commerce platforms are rapidly scaling access to niche brands. As awareness around menopause care expands through public health campaigns, integrated platforms that combine clinical efficacy, dermatologist endorsements, and digital retail reach will define the USA competitive landscape.

| China By Product Type | Value Share % 2025 |

|---|---|

| Creams/lotions | 41% |

| Others | 59.0% |

The Menopause Skincare Solutions Market in China is valued at USD 419.9 million in 2025, with creams and lotions leading at 41% (USD 172.2 million), followed by other formats such as serums, body care, and eye/neck treatments holding 59%. The dominance of creams and lotions stems from their affordability, ease of use, and positioning as the entry-level solution for dryness and barrier repair among China’s growing perimenopausal population.

This advantage positions creams and lotions as a gateway to more advanced products, especially as Chinese consumers become increasingly digitally influenced through Tmall, JD.com, and social commerce platforms. Local brands are offering competitively priced options, while international players focus on premiumization with clinically validated, clean-label positioning.

Preventive care among women in their early 40s is accelerating adoption of serums and actives like peptides, while cultural preference for skincare layering routines supports multi-product usage. As consumer education deepens, AI-driven skin diagnostics and influencer-led campaigns will become enablers of growth in China’s menopause skincare landscape.

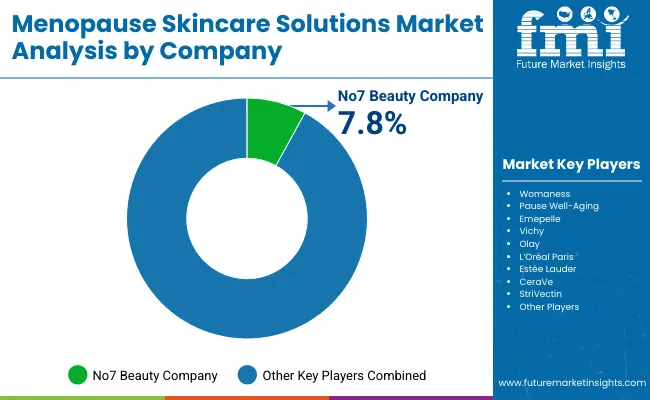

| Company | Global Value Share 2025 |

|---|---|

| No7 Beauty Company | 7.8% |

| Others | 92.2% |

The Global Menopause Skincare Solutions Market is moderately fragmented, with global beauty multinationals, specialized menopause-focused brands, and pharmacy-led skincare companies competing across diverse regions. No7 Beauty Company holds the largest share at 7.8%, anchored by its clinically validated, pharmacy-distributed menopause skincare range. Its leadership reflects both early entry into the category and strong retail trust in markets like the UK and USA Established multinationals such as Estée Lauder, L’Oréal Paris, Vichy, Olay, and CeraVe dominate mass-market and premium skincare categories by leveraging existing brand equity, strong R&D pipelines, and wide distribution channels.

Their strategies emphasize dermatologist partnerships, hormone-free claims, and clinical validation, allowing them to compete effectively with specialist entrants. Niche-focused innovators such as Womaness, Pause Well-Aging, and Emepelle focus exclusively on menopausal women, offering targeted products such as serums, eye/neck treatments, and phytoactive alternatives. Their strength lies in digital-first distribution, strong consumer education, and branding that resonates directly with women navigating midlife.

Competitive differentiation is shifting away from broad anti-aging claims toward science-backed, inclusive, and clean-label solutions. Integration of AI-driven skin analysis, digital retail platforms, and influencer partnerships is reshaping consumer engagement. As clinical transparency and personalization gain traction, the winners in this market will be those combining proven efficacy with digital accessibility and consumer trust-building initiatives.

Key Developments in Global Menopause Skincare Solutions Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Concern | Dryness & Barrier Loss, Firming & Elasticity, Sensitivity & Redness, Hyperpigmentation |

| Active System | Ceramides & Lipids, Peptides, Niacinamide & Vitamin C, Phytoactives /Retinoid Alternatives |

| Product Type | Creams/Lotions, Serums, Eye/Neck Treatments, Body Care |

| Channel | E-commerce, Pharmacies, Specialty Beauty Retail, Dermatology Clinics |

| Claim | Hormone-free, Clinically Validated, Fragrance-free, Clean-label |

| End User | Perimenopause (40-49), Menopause/Post (50+) |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | No7 Beauty Company, Womaness , Pause Well-Aging, Emepelle , Vichy, Olay, L’Oréal Paris, Estée Lauder, CeraVe , StriVectin |

| Additional Attributes | Dollar sales by concern and product type, adoption trends in hormone-free and clean-label formulations, rising demand for ceramides and peptides, segment-specific growth in e-commerce and dermatology clinics, competitive positioning of mass vs. niche players, integration of AI-based skin diagnostics, regional trends influenced by cultural acceptance of menopause care, and innovations in phytoactive /retinoid alternatives and clinically validated formulations. |

The global Menopause Skincare Solutions Market is estimated to be valued at USD 3,403.4 million in 2025.

The market size for the Global Menopause Skincare Solutions Market is projected to reach USD 8,204.3 million by 2035.

The Global Menopause Skincare Solutions Market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in the Global Menopause Skincare Solutions Market are Creams/Lotions, Serums, Eye/Neck Treatments, and Body Care.

In terms of concerns, the Dryness & Barrier Loss segment will command 46% share in 2025, making it the leading category.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Menopause Treatment Industry Analysis in India Forecast Outlook 2025 to 2035

Menopause Treatment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Menopause Supplement Market Analysis by Product Type, Form, Sales Channel and Others through 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

Ceramide Skincare Market Size and Share Forecast Outlook 2025 to 2035

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA