The menopause treatment industry in India is gaining traction, supported by the increasing prevalence of menopausal symptoms among women aged 40 and above and rising awareness regarding available therapies. Growing access to healthcare facilities, coupled with higher disposable incomes, is enabling more women to seek treatment for conditions such as hot flashes, mood swings, osteoporosis, and hormonal imbalances. Pharmaceutical advancements in hormone and non-hormonal therapies are providing broader options to patients and physicians.

Awareness campaigns led by healthcare organizations and women’s health groups are playing a pivotal role in reducing stigma around menopause and encouraging treatment adoption. Government and private investments in healthcare infrastructure, alongside the availability of telemedicine platforms, are enhancing accessibility to therapies across urban and semi-urban regions.

In addition, the rising presence of international pharmaceutical brands and the increasing penetration of generic drugs are making therapies more affordable With the growing emphasis on quality of life, preventive healthcare, and patient-centric treatment approaches, the menopause treatment industry in India is expected to witness consistent expansion over the coming years.

| Metric | Value |

|---|---|

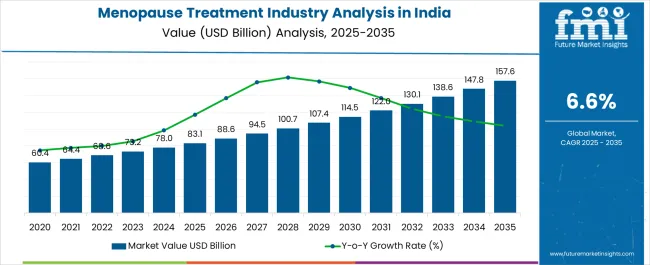

| Menopause Treatment Industry Analysis in India Estimated Value in (2025 E) | USD 83.1 billion |

| Menopause Treatment Industry Analysis in India Forecast Value in (2035 F) | USD 157.6 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

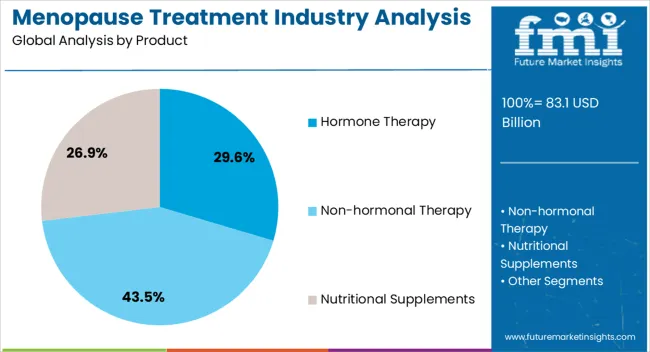

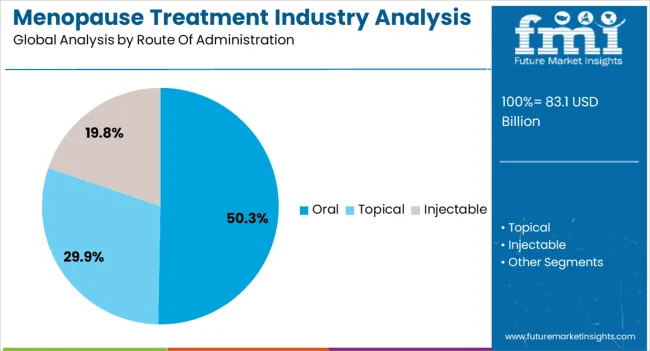

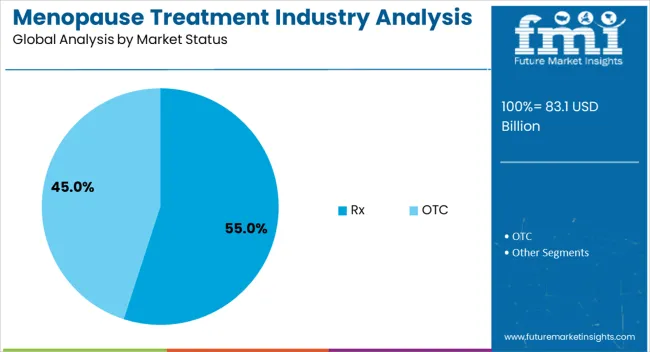

The market is segmented by Product, Route Of Administration, Market Status, and Distribution Channel and region. By Product, the market is divided into Hormone Therapy, Non-hormonal Therapy, and Nutritional Supplements. In terms of Route Of Administration, the market is classified into Oral, Topical, and Injectable. Based on Market Status, the market is segmented into Rx and OTC. By Distribution Channel, the market is divided into Hospitals, Specialty Clinics, Retail Pharmacies, Drug Stores, and Online Sales/Online Pharmacy Platforms. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hormone therapy product segment is projected to hold 29.6% of the market share in 2025, establishing it as a significant contributor to the menopause treatment industry in India. Growth in this segment is being driven by its proven efficacy in alleviating moderate to severe menopausal symptoms such as hot flashes, vaginal dryness, and bone loss. Hormone therapy remains a preferred option for patients seeking reliable symptom relief, with ongoing research ensuring improved safety profiles and customized dosing options.

The increasing adoption of bioidentical hormones and combination therapies is further enhancing the effectiveness of treatment regimens. Widening access to gynecologists and endocrinologists, along with expanding patient education programs, is increasing acceptance of hormone therapy.

Pharmaceutical companies are investing in advanced formulations to reduce side effects and improve compliance, strengthening trust among both physicians and patients As awareness about the benefits of hormone therapy continues to grow and medical supervision becomes more accessible, this segment is expected to maintain its strong position within the market.

The oral route of administration segment is expected to account for 50.3% of the market revenue in 2025, making it the dominant administration method. Oral therapies are preferred due to their convenience, affordability, and widespread availability across pharmacies and hospitals in India. Easy dosing schedules and patient familiarity with oral medications contribute to high compliance rates, supporting this segment’s leadership.

Pharmaceutical manufacturers are focusing on developing oral formulations with controlled release mechanisms to enhance efficacy and minimize side effects, further strengthening demand. The segment also benefits from strong distribution networks that make oral therapies accessible to patients across both urban and rural areas.

Physicians continue to recommend oral drugs as the first line of treatment, particularly in cases where affordability and convenience are major considerations With India’s large population base and the rising number of menopausal women seeking treatment, the oral route is expected to remain the most popular and widely adopted option in the industry, sustaining its market dominance.

The Rx market status segment is anticipated to capture 55.0% of the revenue share in 2025, making it the leading status category. Prescription-based therapies dominate the market due to the need for medical supervision and customized treatment plans for managing menopausal symptoms. Hormone therapy, in particular, requires careful monitoring by healthcare providers to mitigate risks associated with long-term use, ensuring patient safety and efficacy.

The Rx segment is also driven by the expansion of gynecology and endocrinology practices, with more women consulting specialists to address their health needs. Increasing patient trust in physician-guided treatment and the rising use of diagnostic tools to tailor therapies are reinforcing reliance on prescriptions.

Pharmaceutical companies are engaging in physician awareness programs and continuous medical education to strengthen adoption rates As women in India become more proactive about health management and as regulatory frameworks support safe prescribing practices, the Rx category is expected to sustain its dominance, ensuring structured and supervised menopause treatment across the country.

India's menopause treatment industry recorded a historical CAGR of 5.8% from 2020 to 2025. The industry value for India's menopause treatment reached USD 83.1 million in 2025 from USD 60.4 million in 2020.

During 2020 and 2025, there has been a significant shift in societal attitudes toward menopause, leading to increased awareness. Efforts by organizations and healthcare professionals to educate women about menopause have contributed to growth of the menopause treatment industry.

Supportive policies and initiatives from government bodies and healthcare organizations have augmenting a conducive environment for the development of menopause treatment. These measures include funding for research, awareness campaigns, and inclusion of menopausal health in public health programs.

Looking forward, the future of the menopause treatment industry anticipates a gradual acceleration of growth. Continued research & development efforts are expected to yield personalized and more effective treatments while integrating digital health and telemedicine is poised to enhance accessibility.

Increasing aging population contributes to sustained industry growth, with an increasing number of women entering menopause in India. Furthermore, the trend toward consumer empowerment and informed decision-making is likely to shape the industry by creating diverse treatment options.

These historic and futuristic factors create a dynamic landscape, offering opportunities for pharmaceutical companies, healthcare providers, and researchers to contribute to women's health during the menopausal transition.

A significant opportunity for expansion of the menopause drug industry lies in the notable increase in the number of menopausal drugs advancing through drug development pipelines of key manufacturers. This surge in research and development efforts signifies a promising trajectory for the industry.

The influx of innovative treatments not only addresses the current unmet needs in the industry but also supports a competitive landscape, stimulating further innovations in the menopause treatment industry. Increasing momentum in drug development activities represents a key catalyst for the growth and evolution of the menopause drug industry in India.

Exploring and advancing natural or herbal treatment options for menopausal symptoms is set to create opportunities for leading companies in the drug sector. This avenue of development holds the promise of providing therapeutic alternatives with fewer side effects, catering to increasing demand for more holistic and gentle approaches to menopause management.

The ‘organic’ trend also aligns with a broader cultural shift toward wellness and preventive healthcare, where consumers are increasingly inclined to explore alternative and natural remedies. Leading manufacturers in the menopausal pharmaceutical drugs sector are using this opportunity to develop evidence-based, scientifically validated natural treatments, ensuring safety and efficacy.

The prominence of traditional medicines like Shatavari and Ashwagandha, coupled with the availability of Ayurvedic treatment options, has posed a formidable challenge to growth of prescription (Rx) and over-the-counter (OTC) drugs for menopause treatment.

These herbal remedies, deeply rooted in Ayurveda, have gained substantial popularity among women seeking alternative and holistic approaches to manage menopausal symptoms.

Ayurvedic treatments, often perceived as natural and with fewer side effects, are increasingly preferred by those who may be wary of the potential risks associated with conventional hormonal therapies. This shift in consumer preferences toward traditional medicines poses a dual challenge for the Rx and OTC menopause drug industry.

The shift is expected to diminish the share of pharmaceutical menopause treatments as women explore alternative options deeply ingrained in Indian cultural practices. Furthermore, the perception of herbal remedies as safer and more aligned with holistic well-being influences women to opt for Ayurvedic alternatives. It helps in potentially reducing the demand for prescription and over-the-counter menopause drugs.

The table below shows the estimated growth rates of leading countries. Northern India, Northeast India, and Western India are set to record high CAGRs of 7.2%, 8.6%, and 7.8% respectively, through 2035.

| Region | Value CAGR (2025 to 2035) |

|---|---|

| Northern India | 7.2% |

| Northeast India | 8.6% |

| Central India | 5.3% |

| Eastern India | 5.0% |

| Western India | 7.8% |

| Southern India | 6.3% |

Southern India dominates the industry with a 31.4% share in 2025 and is projected to continue experiencing stable growth throughout the forecast period. Southern India hosts research and development hubs, contributing to the innovation in menopause treatments. Collaborations between pharmaceutical companies, research institutions, and healthcare providers lead to the introduction of novel therapeutic options, propelling industry growth.

Cultural shifts in Southern India have witnessed more open conversations about women's health, including menopause. This cultural change has increased awareness and a willingness to explore treatment options, positively impacting the menopause treatment industry.

Western India takes center stage in the menopause treatment industry, claiming a noteworthy industry share of 20.0%. Rapid urbanization and lifestyle changes in Western India have led to an increased prevalence of menopausal symptoms. Demand for effective treatment options is surging as women in urban areas are more aware and proactive about managing their health during the menopausal transition.

The relatively higher socioeconomic status of individuals in Western India allows for increased affordability and access to advanced menopause treatments. This economic stability contributes to a higher adoption rate of hormone replacement therapies and other specialized interventions.

In 2025, Eastern India held a significant industry share of 18.2%, asserting its dominance, and is anticipated to maintain robust growth over the forecast period. Growth of the menopause treatment industry in Eastern India is influenced by the region's rising healthcare infrastructure. Improved access to healthcare facilities and specialized clinics catering to menopausal health contributes to heightened awareness and treatment options in Eastern India.

The section below shows the hormone therapy segment leading in terms of product. It is estimated to thrive at a 7.4% CAGR between 2025 and 2035. Based on route of administration, the oral segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 7.3% during the forecast period.

| Products | Value CAGR (2025 to 2035) |

|---|---|

| Hormone Therapy | 7.4% |

| Non-Hormonal Therapy | 6.1% |

| Nutritional Supplements | 1.9% |

Hormone therapy dominated the industry with a 55.8% share in 2025 and is projected to continue experiencing high growth throughout the forecast period. Hormone therapy dominates the menopause industry by providing effective relief from symptoms like hot flashes and mood swings.

Hormone therapy addresses hormonal imbalances, making it a preferred choice among women seeking comprehensive and targeted solutions during the menopausal transition, thereby augmenting its widespread adoption.

| Route of Administration | Value CAGR (2025 to 2035) |

|---|---|

| Topical | 6.0% |

| Injectable | 4.4% |

| Oral | 7.3% |

The oral segment held 64.2% industry share in 2025 and is projected to continue experiencing steady growth throughout the forecast period. Oral medications lead the industry due to their convenience and ease of administration.

Women prefer oral formulations for hormone replacement therapy, contributing to high patient adherence. The simplicity and familiarity of oral intake make it a prominent and accessible choice in the menopause treatment landscape.

| Market Status | Value CAGR (2025 to 2035) |

|---|---|

| Rx | 6.8% |

| OTC | 4.4% |

Based on market status, the Rx segment held 94.2% industry share in 2025. Prescription medications play a pivotal role in shaping the menopause industry, ensuring that treatment plans are tailored to individual needs.

The expertise of healthcare professionals prescribing specific medications addresses diverse symptom profiles, offering personalized solutions. This approach establishes prescription medications as key drivers in the menopause treatment sector.

| Distribution Channel | Value CAGR (2025 to 2035) |

|---|---|

| Hospitals | 6.5% |

| Specialty Clinics | 8.0% |

| Online Sales/Online Pharmacy Platforms | 9.4% |

Hospitals will likely dominate the industry with a 43.2% share in 2025. Hospitals are at the forefront of menopause treatment, offering comprehensive healthcare services in India.

Specialized menopause clinics within hospitals provide a multidisciplinary approach, combining medical expertise, counseling, and supportive care. The institutional infrastructure and accessibility make hospitals central to effectively managing menopausal symptoms in India.

In the dynamic landscape of the menopause treatment industry, companies are strategically emphasizing collaboration & partnerships and continuously focusing on product approval. These initiatives reflect the industry's commitment to innovation, addressing evolving industry demands, and staying competitive. Instances of key developmental strategies by industry players in India’s menopause treatment industry are given below:

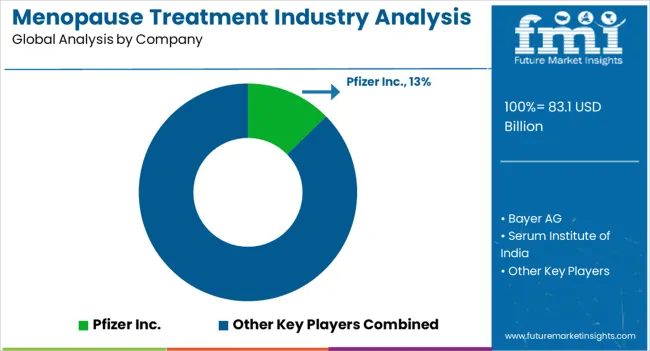

The global menopause treatment industry analysis in india is estimated to be valued at USD 83.1 billion in 2025.

The market size for the menopause treatment industry analysis in india is projected to reach USD 157.6 billion by 2035.

The menopause treatment industry analysis in india is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in menopause treatment industry analysis in india are hormone therapy, _combination, _tibolone, _progestin-only medicines, _estrogen-only medicines, non-hormonal therapy, _gabapentinoids, _serotonin-norepinephrine reuptake inhibitors (snri), _selective serotonin reuptake inhibitors (ssri), _others, nutritional supplements, _multi-vitamin supplements, _phytoestrogen supplement, _antioxidant supplements and _other supplements.

In terms of route of administration, oral segment to command 50.3% share in the menopause treatment industry analysis in india in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Menopause Supplement Market Analysis by Product Type, Form, Sales Channel and Others through 2035

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Menopause Treatment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA