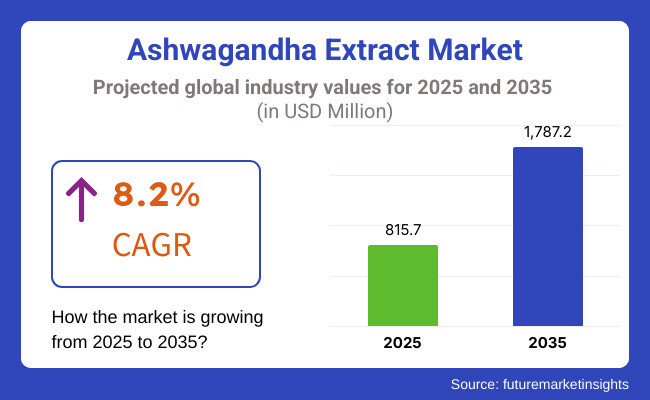

The global Ashwagandha Extract market is estimated to be worth USD 815.7 million in 2025 and is projected to reach a value of USD 1,787.2 million by 2035, expanding at a CAGR of 8.2%over the assessment period of 2025 to 2035

The nutraceutical industry is witnessing significant growth, driven by consumer demand for health-enhancing products. Ashwagandha is increasingly featured in a variety of formats, such as capsules, powders, teas, and energy drinks, catering to diverse consumer preferences.

This incorporation into mainstream products reflects a broader trend towards preventive health and wellness, as individuals seek natural solutions to enhance their overall well-being. The expansion of e-commerce has further facilitated access to these nutraceutical offerings.

Ongoing research into Ashwagandha's health benefits has significantly enhanced understanding of its therapeutic properties. Studies have explored its effects on stress reduction, cognitive function, and physical performance, leading to increased consumer and manufacturer interest.

This scientific validation supports the herb's efficacy and safety, encouraging more companies to invest in Ashwagandha-based products. As research continues to uncover new applications and benefits, it bolsters the market's growth and consumer confidence in these natural supplements.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global ashwagandha extract market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year.

The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 6.3% (2024 to 2034) |

| H2 | 6.9% (2024 to 2034) |

| H1 | 7.5% (2025 to 2035) |

| H2 | 8.1% (2025 to 2035) |

The above table presents the expected CAGR for the global ashwagandha extract demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 6.3%, followed by a slightly higher growth rate of 6.9% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 7.5% in the first half and remain relatively moderate at 8.1% in the second half. In the first half (H1 2025) the market witnessed a decrease of 16 BPS while in the second half (H2 2025), the market witnessed an increase of 34 BPS.

Mental Health Awareness

The growing awareness of mental health issues has led individuals to seek natural remedies for managing stress, anxiety, and overall emotional well-being. Ashwagandha, known for its adaptogenic properties, helps the body adapt to stress and promotes a sense of calm. This recognition has made it a popular ingredient in various products designed to support mental health, including dietary supplements and functional foods.

As consumers increasingly prioritize mental wellness, the demand for Ashwagandha-infused products has surged. Brands are responding by developing formulations that highlight these benefits, further driving sales. The integration of Ashwagandha into wellness routines not only addresses immediate health concerns but also fosters a long-term commitment to mental well-being, solidifying its position in the market.

Integration into Wellness Routines

The trend of incorporating supplements into daily wellness routines is becoming increasingly popular among health-conscious consumers. Ashwagandha is often added to morning smoothies, teas, and snacks, making it a convenient and accessible option for those looking to enhance their health. This habitual use transforms Ashwagandha from a mere supplement into a staple ingredient in everyday diets, promoting sustained demand and sales growth.

As consumers seek holistic approaches to health, the integration of Ashwagandha into various meals and beverages aligns perfectly with their lifestyle choices. Brands are capitalizing on this trend by offering innovative products that cater to this growing market, ensuring that Ashwagandha remains a prominent feature in wellness-oriented diets.

Sustainability and Ethical Sourcing

As consumers become more environmentally conscious, the demand for sustainably sourced and ethically produced products is on the rise. Brands that prioritize responsible sourcing of Ashwagandha and adhere to environmentally friendly production practices are gaining a competitive edge in the market. This trend reflects a broader shift towards sustainability, where consumers are increasingly scrutinizing the origins of the ingredients they consume.

By emphasizing transparency and ethical practices, companies can attract eco-conscious consumers who value sustainability alongside health benefits. This focus on ethical sourcing not only enhances brand reputation but also fosters consumer loyalty, ultimately contributing to market growth. As the demand for sustainable products continues to rise, Ashwagandha's appeal as a natural remedy is further strengthened.

Global Ashwagandha Extract sales increased at a CAGR of 6.5% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on ashwagandha extract will rise at 8.2% CAGR

Ashwagandha is renowned for its adaptogenic properties, which assist the body in managing stress and anxiety effectively. Scientific research has demonstrated its ability to improve mental clarity, enhance physical performance, and promote overall well-being.

By lowering cortisol levels and supporting cognitive function, Ashwagandha appeals to health-conscious consumers seeking natural alternatives to conventional medications. This growing body of evidence not only validates its traditional use but also encourages more individuals to incorporate Ashwagandha into their wellness routines.

The rapid expansion of e-commerce platforms has significantly increased consumer access to Ashwagandha products. Online retail channels offer unparalleled convenience, allowing consumers to browse a wide variety of options from the comfort of their homes.

This accessibility has led to a surge in sales, as consumers can easily compare products, read reviews, and make informed purchasing decisions. Additionally, e-commerce enables manufacturers to reach a broader audience, driving market penetration and fostering the growth of the Ashwagandha extract market globally.

Tier 1 Companies: This tier comprises industry leaders with annual revenues exceeding USD 20 million, commanding a market share of approximately 40% to 50%. These companies are recognized for their high production capacity, extensive product portfolios, and robust distribution networks. They often engage in advanced research and development, ensuring the highest quality standards and innovative formulations. Their geographical reach is global, supported by a strong consumer base and established brand recognition.

Prominent players in Tier 1 include KSM-66 Ashwagandha (Ixoreal Biomed), Himalaya Wellness, and Organic India. These companies leverage their expertise in manufacturing and marketing to maintain a competitive edge in the market.

Tier 2 Companies: Tier 2 consists of mid-sized players with revenues ranging from USD 5 million to USD 20 million. These companies have a significant presence in specific regions and play a crucial role in influencing local retail dynamics.

They are characterized by a strong understanding of consumer preferences and regional market trends. While they may not possess the extensive global reach of Tier 1 companies, they often excel in niche markets and specialized product offerings. Companies such as Gaia Herbs, NOW Foods, and Swanson Health Products exemplify Tier 2 players, as they focus on quality and customer engagement while ensuring regulatory compliance.

Tier 3 Companies: The majority of the market is composed of small-scale enterprises classified as Tier 3, with revenues below USD 5 million. These companies primarily operate at a local level, catering to niche demands and specific consumer needs.

They often lack the resources and technological advancements of larger competitors, resulting in limited geographical reach and market influence. Tier 3 companies are typically characterized by their informal structure and localized operations, focusing on fulfilling community-specific demands. This segment includes various small herbal supplement manufacturers and local distributors.

| Countres | Market Value (2035) |

|---|---|

| United States | USD 268.1 million |

| Germany | USD 178.7 million |

| China | USD 143.0 million |

| India | USD 89.4 million |

| Japan | USD 35.7 million |

The fast-paced lifestyle in the USA has significantly contributed to rising stress and anxiety levels among individuals. As people navigate demanding work schedules, personal responsibilities, and societal pressures, the search for effective, natural stress management solutions has intensified. Ashwagandha, recognized for its adaptogenic properties, has emerged as a popular choice due to its ability to help regulate cortisol levels, the hormone associated with stress.

By promoting relaxation and enhancing the body’s resilience to stressors, Ashwagandha aligns seamlessly with the needs of consumers seeking holistic approaches to mental well-being, making it a sought-after remedy in the wellness market.

As China embraces its rich heritage of traditional medicine, there is a notable resurgence in interest towards herbal remedies, including those from diverse cultural backgrounds. Ashwagandha, rooted in Ayurvedic medicine, is increasingly recognized for its adaptogenic properties and holistic health benefits.

Chinese consumers, seeking to enhance their wellness routines, are drawn to Ashwagandha as a complementary remedy that aligns with their traditional practices. This growing acceptance reflects a broader trend of integrating global herbal solutions into local health paradigms, allowing individuals to explore new avenues for stress relief, improved vitality, and overall well-being while honoring their cultural roots.

The Indian government has actively promoted traditional medicine and herbal products, recognizing their significance in enhancing public health and preserving cultural heritage. Initiatives aimed at promoting Ayurveda have gained momentum, encouraging the cultivation and commercialization of herbs like Ashwagandha. This support includes financial incentives for farmers, research funding, and awareness campaigns that highlight the benefits of herbal remedies.

By fostering a favorable environment for the production and distribution of Ashwagandha, the government is making this valuable herb more accessible to consumers. As a result, the demand for Ashwagandha extract is experiencing significant growth, driven by both increased consumer awareness and the government's commitment to integrating traditional medicine into modern healthcare practices. This synergy enhances the market presence of Ashwagandha in India.

| Segment | Value Share (2025) |

|---|---|

| Powder (Form) | 57% |

The rising demand for Ashwagandha powder is significantly driven by its ease of consumption and cost-effectiveness. The powder form offers flexible dosing, allowing consumers to tailor their intake according to individual health needs and preferences. This customization appeals to those who prefer a more personalized approach to supplementation, as opposed to relying on pre-measured capsules or tablets. Additionally, Ashwagandha powder is generally more affordable than its capsule counterparts, making it a budget-friendly option for a wider audience.

This cost-effectiveness not only attracts health-conscious consumers but also encourages regular use, further boosting its popularity in the market. Together, these factors enhance the appeal of Ashwagandha powder as a practical and economical choice for wellness.

The competition in the global Ashwagandha extract market is intensifying as companies focus on product innovation, quality enhancement, and strategic partnerships. Key players are investing in research and development to create unique formulations and improve bioavailability.

Additionally, brands are leveraging e-commerce platforms to expand their reach and enhance consumer engagement through targeted marketing. Sustainability practices and ethical sourcing are also becoming focal points, as companies aim to meet the growing demand for natural and responsibly produced health products.

For instance

This segment is further categorized into Powder and Liquid.

This segment is further categorized into Dietary Supplements, Traditional Medicine (Ayurveda), Foods and Beverages (Herbal Teas, Energy Drinks, Smoothies, Protein Powders, Functional Beverages, Snacks, Dairy and Yogurt Products, Infused Water, and Other Items), Retail Sales and Other Applications.

This segment is further categorized into Business to Business (B2B), Business to Consumer (B2C) (Hypermarkets or Supermarkets, Specialty Stores, Drug Stores and Pharmacies, Convenience Stores, and Online Retail Channels) and Other Sales Channels.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

The global Ashwagandha Extract industry is estimated at a value of USD 815.7 million in 2025.

Sales of Ashwagandha Extract increased at 6.5% CAGR between 2020 and 2024.

Himalaya Herbal Healthcare (Himalaya Global Holdings Ltd.), Organic India PVT Ltd., Nature’s Way (Dr. Willmar Schwabe GmbH & Co. KG), NOW Foods Co., and Banyan Botanicals Corporation are some of the leading players in this industry.

The South Asia domain is projected to hold a revenue share of 28% over the forecast period.

North America holds 32% share of the global demand space for Ashwagandha Extract.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: Europe Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 33: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 37: East Asia Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 39: East Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 45: South Asia Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 47: South Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 49: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 53: Oceania Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 55: Oceania Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 57: Middle East & Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 58: Middle East & Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: Middle East & Africa Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 60: Middle East & Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 61: Middle East & Africa Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 62: Middle East & Africa Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 63: Middle East & Africa Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 64: Middle East & Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 13: Global Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 17: Global Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Form, 2023 to 2033

Figure 22: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ million) by Form, 2023 to 2033

Figure 26: North America Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 27: North America Market Value (US$ million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 37: North America Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 41: North America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Form, 2023 to 2033

Figure 46: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ million) by Form, 2023 to 2033

Figure 50: Latin America Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 51: Latin America Market Value (US$ million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ million) by Form, 2023 to 2033

Figure 74: Europe Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 75: Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 85: Europe Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 89: Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Form, 2023 to 2033

Figure 94: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 98: East Asia Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 99: East Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 100: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 109: East Asia Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 113: East Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 122: South Asia Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 123: South Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 124: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 133: South Asia Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 137: South Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ million) by Form, 2023 to 2033

Figure 146: Oceania Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 147: Oceania Market Value (US$ million) by Application, 2023 to 2033

Figure 148: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 157: Oceania Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 161: Oceania Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Sales Channel, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East & Africa Market Value (US$ million) by Form, 2023 to 2033

Figure 170: Middle East & Africa Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 171: Middle East & Africa Market Value (US$ million) by Application, 2023 to 2033

Figure 172: Middle East & Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 173: Middle East & Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 174: Middle East & Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East & Africa Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 178: Middle East & Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 179: Middle East & Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 180: Middle East & Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 181: Middle East & Africa Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 182: Middle East & Africa Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 183: Middle East & Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 184: Middle East & Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 185: Middle East & Africa Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 186: Middle East & Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 187: Middle East & Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 188: Middle East & Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 189: Middle East & Africa Market Attractiveness by Form, 2023 to 2033

Figure 190: Middle East & Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 191: Middle East & Africa Market Attractiveness by Application, 2023 to 2033

Figure 192: Middle East & Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Sage Extract Market Size and Share Forecast Outlook 2025 to 2035

Fume Extractor Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Kale Extract Skincare Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Amla Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dust Extractor Market Growth – Trends & Forecast 2025 to 2035

Data Extraction Software Market

Peony Extract Brightening Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peony Extracts for Brightening Market Size and Share Forecast Outlook 2025 to 2035

Algae Extracts Market Size and Share Forecast Outlook 2025 to 2035

Juice Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Yucca Extract Market Size and Share Forecast Outlook 2025 to 2035

Maple Extracts Market Size and Share Forecast Outlook 2025 to 2035

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Basil Extract Market Size, Growth, and Forecast for 2025 to 2035

Understanding Yeast Extract Market Share & Key Players

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA