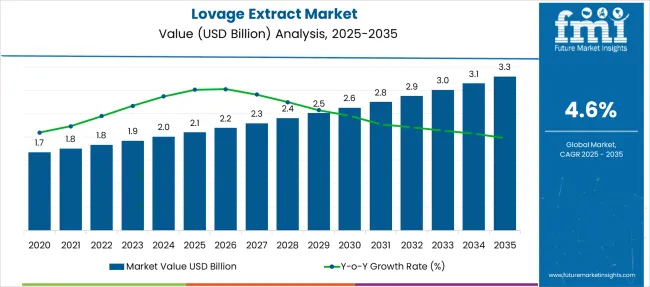

The Lovage Extract Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period. From a modest USD 2.0 billion in 2024, the market scales to USD 3.3 billion by 2035, growing at 4.6% CAGR and creating USD 1.3 billion incremental value. Despite small absolute size, the trajectory reflects linear progression until 2030, followed by deceleration as adoption peaks in nutraceutical and flavoring sub-segments.

YoY growth reaches its high point near 2027 at 5.5%, then slides toward 3.8% by 2035. Scalability is constrained by agricultural yield variability and regulatory compliance for natural extracts. Pricing power remains high due to premium positioning, yet market penetration outside Europe and North America remains a challenge. Investors focusing on supply chain localization and extract standardization gain a competitive advantage.

Rather than reflecting the steep climbs seen in fast-moving consumer goods, this sector represents a stable growth ecosystem tied to herbal tradition and functional wellness positioning. The curve is moderately inclined, showing dependency on consumer education and therapeutic awareness rather than sudden adoption spikes.

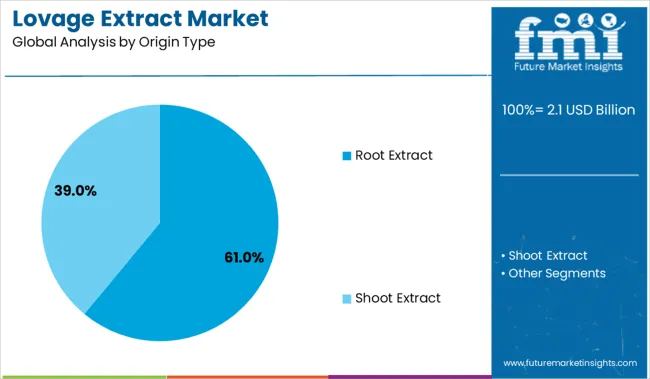

A defining feature is the root extract segment, which commands 61.0% share due to its superior bioactive concentration, making it indispensable in nutraceuticals and herbal infusions. This dominance is unlikely to dilute, as application diversity remains narrow but premium. North America shows demand concentration in dietary supplements, while Asia-Pacific leverages traditional medicinal practices to anchor future growth.

Innovation in solvent-free extraction, bioavailability enhancement, and flavor-masked variants is expected to reshape the industry beyond 2030. The market’s evolution will not depend on volume play but on functional positioning, regulatory compliance, and product traceability. Brands that align with clinical research and integrate digital storytelling into product marketing will secure competitive resilience in this niche but profitable botanical category.

| Metric | Value |

|---|---|

| Lovage Extract Market Estimated Value in (2025 E) | USD 2.1 billion |

| Lovage Extract Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The lovage extract market is witnessing steady growth, fueled by increased demand for botanical ingredients in dietary, pharmaceutical, and therapeutic formulations. Enhanced consumer awareness around herbal remedies, coupled with a shift toward natural and plant-based health solutions, is stimulating demand across both developed and emerging economies.

Regulatory encouragement for clean-label, traceable ingredients has driven the inclusion of functional extracts like lovage in health supplements and formulations. Advancements in extraction technologies and formulation science are improving concentration, stability, and bioavailability of the extract, enabling its use in various high-value applications.

As nutraceutical and pharma sectors increasingly favor standardized botanical actives, the market is likely to see further expansion, supported by clinical research validation and global trade in medicinal herbs.

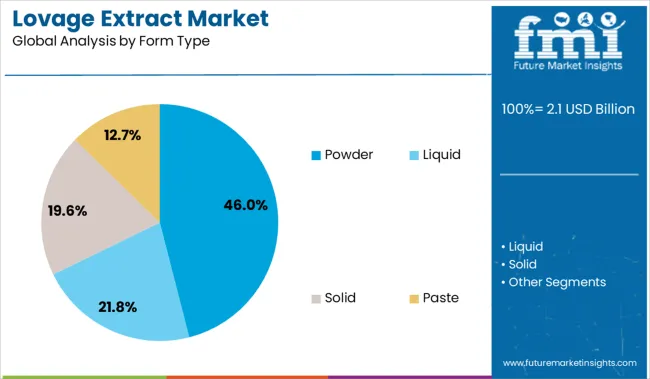

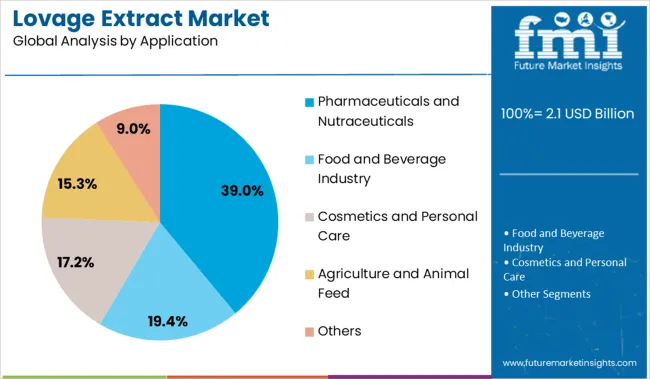

The market is segmented by origin type, form type, application, and region. By origin type, it includes root extract and shoot extract, representing the primary sources of active compounds. In terms of form type, the segmentation comprises powder, liquid, solid, and paste forms, catering to diverse processing and formulation needs. Based on application, the market spans pharmaceuticals and nutraceuticals, the food and beverage industry, cosmetics and personal care, agriculture and animal feed, and other specialized uses. Regionally, the market covers North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Root extract is projected to account for 61.0% of the total revenue in the lovage extract market in 2025, establishing it as the leading origin type segment. This leadership is driven by the concentration of bioactive compounds found in lovage roots, which are preferred for their potency in therapeutic and medicinal applications.

The roots contain volatile oils, flavonoids, and phthalides that are associated with anti-inflammatory and digestive benefits, making them ideal for formulations targeting gut health and respiratory support. The growing focus on pharmacognosy and use of traditionally recognized plant parts has reinforced the reliance on root-based extracts.

Furthermore, sustainable harvesting and improved root extraction techniques have enhanced commercial viability and consistency, contributing to the dominance of this segment.

Powder form is expected to hold 46.0% of the market revenue in 2025, positioning it as the dominant form type for lovage extract. The preference for powdered extracts is attributed to their ease of incorporation in tablets, capsules, teas, and drink blends, offering longer shelf life and standardized dosage.

Powdered forms enable cost-effective storage and transport, especially in bulk nutraceutical and pharmaceutical manufacturing. Their compatibility with various formulation processes and stability during packaging has made them a go-to option for ingredient manufacturers.

As end-users seek convenience and precise dosing, powdered lovage extract continues to gain traction across global value chains.

Pharmaceuticals and nutraceuticals are expected to collectively account for 39.0% of the lovage extract market revenue in 2025, leading the application landscape. This dominance is being supported by rising demand for herbal-based preventive health solutions and integrative medicine approaches.

Lovage extract’s recognized properties-such as anti-spasmodic, diuretic, and anti-inflammatory benefits-have made it a favored inclusion in both traditional and modern therapeutic categories. Increased research on botanical actives, supported by regulatory frameworks promoting herbal product development, is expanding clinical applications.

As consumers shift toward supplement-based lifestyle management and immunity-focused products, the role of lovage extract in health-boosting formulations is expected to remain central.

Lovage extract demand is rising due to its herbal therapeutic benefits and growing use in digestion-focused nutraceuticals. Its culinary appeal is expanding across Europe and the UK, driven by regional flavor revival and clean-label trends.

The growing adoption of herbal alternatives in wellness and therapeutic routines has propelled interest in lovage extract across multiple regions. The extract, known for its anti-inflammatory, carminative, and diuretic properties, has been increasingly formulated into capsules, tinctures, and herbal teas.

Consumer interest has shifted toward European-origin herbs that are perceived as clean-label, locally traceable, and historically validated. Demand from naturopathic channels and herbal pharmacies has also played a pivotal role. Formulators are believed to be actively incorporating lovage extract into digestion-focused supplements and functional beverages, especially in North America and parts of Central Europe. The market is being influenced by traditional botanical medicine revival rather than conventional pharmaceutical reliance.

Lovage extract has been rediscovered within culinary channels, especially across gourmet and artisanal product manufacturers in the EU and U.K. markets. The herb’s distinct celery-like flavor is being infused into seasoning blends, organic condiments, and marinades to cater to the regional food renaissance trend.

Chefs and premium food manufacturers have promoted lovage as a native flavor enhancer with a historical culinary lineage. This demand has also extended into clean-label ready meals and fermented food categories. As consumers seek flavors with heritage value, lovage extract has been favored for both its aromatic complexity and minimal allergenic profile. The culinary use is being strengthened through farm-to-fork sourcing channels and regional food identity campaigns.

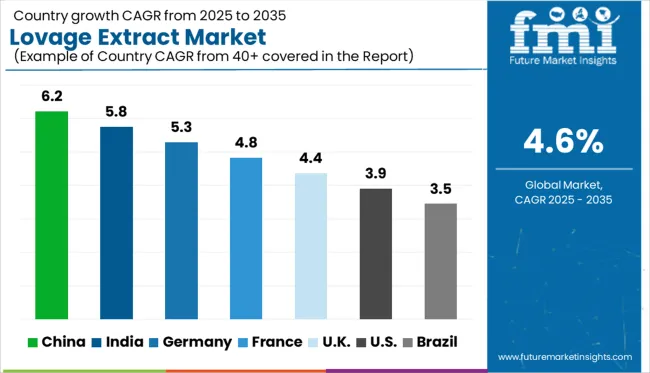

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

The global lovage extract market is advancing at a CAGR of 4.6% from 2025 to 2035, yet several countries, especially within BRICS and OECD blocs, are registering faster growth due to expanding health and wellness sectors. China tops the list with a 6.2% CAGR, driven by strong herbal supplement consumption and government-backed support for traditional medicine.

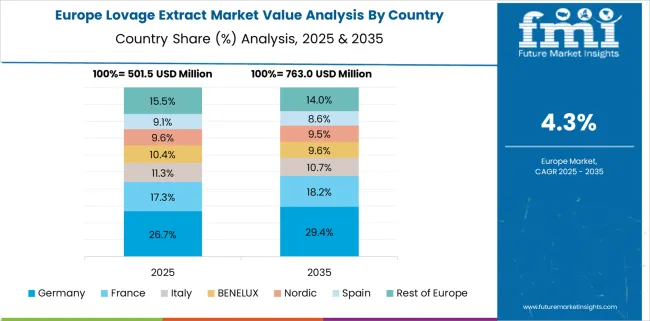

India follows at 5.8%, propelled by rising nutraceutical demand, Ayurveda integration, and expanding dietary supplement manufacturing hubs aligned with ASEAN trade flows. Germany, a core OECD member, is growing at 5.3%, supported by demand in clean-label botanical formulations and phytopharmaceutical innovation.

France, at 4.8%, is leveraging its strong organic retail channels and consumer shift toward plant-based therapeutics. The UK and USA trail with CAGRs of 4.4% and 3.9%, respectively, both below the global average due to regulatory stringency and market saturation. The report includes granular insights across 40+ countries, with the above five offering leading reference points.

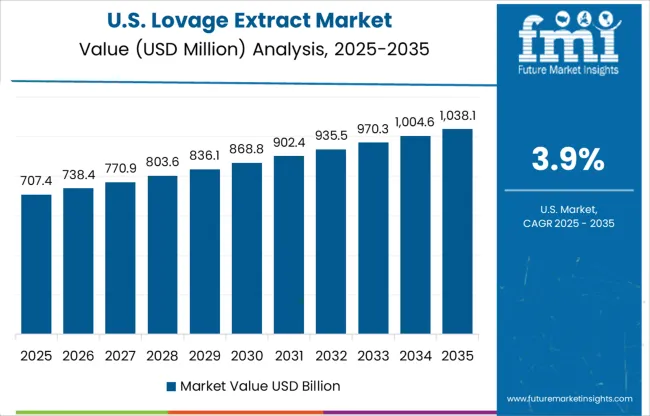

The CAGR for the lovage extract market in the United States was recorded at 3.1% during 2020 to 2024, but this growth is projected to rise to 3.9% between 2025 and 2035. This increase is attributed to the growing use of herbal extracts in functional food and nutraceuticals targeted at gastrointestinal relief and inflammation control.

Consumer preference for traditional European herbs in cold-pressed tinctures, gut-friendly beverages, and dietary supplements has gained momentum, especially in naturopathic circles. While the extract is still niche, the revival of heritage botanicals and a shift away from synthetic blends is driving its inclusion in clean-label digestive support blends. The West Coast and Northeast regions are emerging as strongholds due to wider herbalist presence and health-conscious populations.

Between 2020 and 2024, the lovage extract market in the UK grew at a CAGR of 3.4%, but this is anticipated to rise to 4.4% during the 2025 to 2035 period. The uptick in CAGR is attributed to the increased popularity of foraged and native botanical ingredients in culinary and wellness applications. British chefs and food preservationists have played a role in reintroducing lovage in fermented condiments, pickles, and infused oils.

Demand has also grown among herbal apothecaries and clean-label skincare brands using the extract for its calming and circulatory properties. The post-Brexit regulatory clarity around domestic herbal sourcing has encouraged smaller farms to cultivate lovage locally, improving traceability and quality.

Germany’s lovage extract market registered a CAGR of 4.1% during 2020 to 2024, with growth expected to climb to 5.3% for 2025 to 2035. This rise is primarily due to the herb’s deep-rooted presence in German folk medicine and its integration into digestive tonics, herbal bitters, and culinary stocks.

The market has benefited from the strong herbalist culture, the prevalence of natural pharmacies (Apotheken), and the country’s leadership in phytopharmaceuticals. Post to 2025, demand is anticipated to shift toward clinical-grade extracts standardized for active compound concentrations, such as phthalides. Health-conscious consumers over 50 years old are increasingly relying on traditional remedies for urinary tract health, which has further supported demand.

China’s lovage extract market displayed a CAGR of 5.1% between 2020 and 2024, which is projected to accelerate to 6.2% from 2025 to 2035. This increase reflects the synergy between Traditional Chinese Medicine (TCM) frameworks and imported Western herbalism. Although lovage is not native to China, it is increasingly being positioned as a complementary extract for digestion, detox, and anti-bloating blends.

Cross-border e-commerce platforms have played a pivotal role in introducing EU-origin lovage formulations, particularly among affluent urban consumers in Tier 1 cities. Herbal wellness brands have begun including lovage in combination formulas, especially those promoting liver and kidney function.

India recorded a CAGR of 4.7% during 2020 to 2024, which is expected to grow further to 5.8% over the 2025 to 2035 period. The rising awareness around Western botanicals and their integration into Ayurveda-compatible wellness regimens has created a favorable environment for lovage extract. As gut health, detox, and hormonal balance become focal areas of urban wellness trends, lovage is being incorporated into functional blends by premium nutraceutical startups.

The increased penetration of wellness tourism and Panchakarma centers in Kerala and Uttarakhand has added demand from herbal oil formulations and massage therapies as well. Importers and Ayurvedic fusion brands are actively co-branding lovage with native herbs like fennel and licorice for enhanced market appeal.

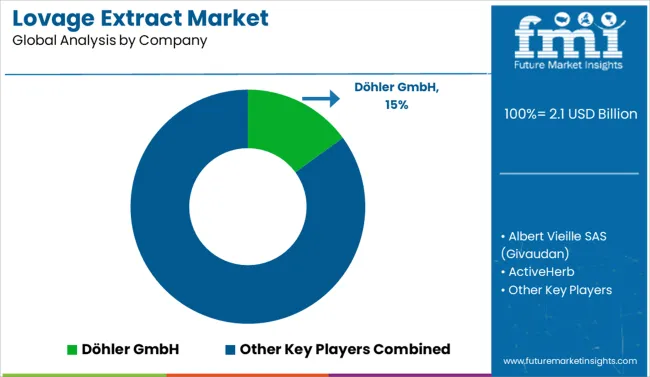

In the lovage extract market, top manufacturers are focusing on botanical integrity, clean-label compliance, and solvent-free processing techniques to meet the demand for natural health and wellness products. Companies such as Döhler GmbH, Indena S.p.A., and Finzelberg GmbH & Co. KG are recognized for their standardized extracts used in herbal supplements, digestion aids, and phytotherapeutic applications.

Frutarom Health and Flavex Naturextrakte have developed advanced distillation and CO₂ extraction technologies to retain active compounds like phthalides in both food-grade and pharma-grade formats. European players continue to dominate due to traceability and adherence to EU herbal regulations.

Emerging players like Nutragreenlife Biotechnology Co., Ltd., ActiveHerb, and Hunan NutraMax Inc. are scaling exports across Asia and North America, offering lovage-based extracts for dietary blends, teas, and therapeutic oils. Cosmetic and aromatherapy innovators such as Lotioncrafter LLC, Danièle Ryman, and Carrubba Incorporated are introducing lovage in skin-calming serums, stress-relief balms, and essential oil formulas

In May 2024, Indena announced a strategic collaboration with DSM Firmenich at Vitafoods Europe, unveiling combined biotic and botanical formulations, challenges targeting gut-brain axis support via gummies and granules.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Origin Type | Root Extract and Shoot Extract |

| Form Type | Powder, Liquid, Solid, and Paste |

| Application | Pharmaceuticals and Nutraceuticals, Food and Beverage Industry, Cosmetics and Personal Care, Agriculture and Animal Feed, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Döhler GmbH, Albert Vieille SAS (Givaudan), ActiveHerb, Botanicals Plus, Carrubba Incorporated, Danièle Ryman, Ecomaat, Ennature Biopharma Pvt. Ltd., Finzelberg GmbH & Co. KG, Frutarom Health, Flavex Naturextrakte, Hunan NutraMax Inc., Indena S.p.A., Lotioncrafter LLC, Nature's Power Nutraceuticals Corp., Nutragreenlife Biotechnology Co., Ltd., and Vege Tech Company |

| Additional Attributes | Dollar sales, share, demand by form (oil, powder), application trends in nutraceuticals and culinary sectors, regional growth hotspots, pricing benchmarks, and key regulatory guidelines. |

The global lovage extract market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the lovage extract market is projected to reach USD 3.3 billion by 2035.

The lovage extract market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in lovage extract market are root extract and shoot extract.

In terms of form type, powder segment to command 46.0% share in the lovage extract market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Lovage Extract Companies

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Sage Extract Market Size and Share Forecast Outlook 2025 to 2035

Fume Extractor Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Kale Extract Skincare Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Amla Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dust Extractor Market Growth – Trends & Forecast 2025 to 2035

Data Extraction Software Market

Peony Extract Brightening Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peony Extracts for Brightening Market Size and Share Forecast Outlook 2025 to 2035

Algae Extracts Market Size and Share Forecast Outlook 2025 to 2035

Juice Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Yucca Extract Market Size and Share Forecast Outlook 2025 to 2035

Maple Extracts Market Size and Share Forecast Outlook 2025 to 2035

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Basil Extract Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA