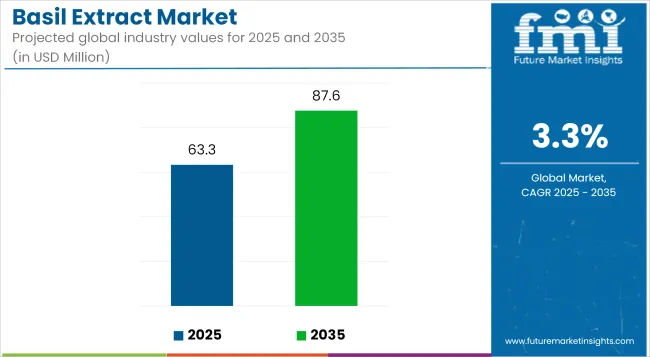

With increasing adoption in nutraceuticals and growing demand in core markets such as North America and Europe, the basil extract market is anticipated to rise from USD 63.3 million in 2025 to USD 87.6 million by 2035, advancing at a CAGR of 3.3%.

Adoption has been underpinned by a combination of rising consumer interest in botanical ingredients and the growing relevance of basil across functional beverages, nutraceutical supplements, and culinary products. Markets in North America and Europe continue to anchor global sales, while opportunities in Asia Pacific are steadily emerging amid surging interest in herbal wellness and traditional botanicals.

Growth has been moderately paced, driven by expanding usage in food, beverage, and pharmaceutical sectors. Formulators have increasingly adopted basil extract as a natural preservative and a flavor enhancer, particularly in clean-label applications. However, restrained price elasticity and raw material volatility, especially in organic basil farming, have capped aggressive growth.

Regulatory complexities in labeling claims across regions have also posed barriers. Product launches have concentrated on liquid basil extracts and encapsulated powders, with industry stakeholders focusing on expanding their reach into fortified beverage blends, RTD herbal teas, and digestive support supplements. Additionally, basil’s perceived adaptogenic properties are being recontextualized in mood-balancing and cognitive health applications, aligning with mental wellness trends.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 63.3 million |

| Industry Value (2035F) | USD 87.6 million |

| CAGR (2025 to 2035) | 3.3% |

By 2035, the market is expected to become increasingly application-diverse, expanding beyond traditional culinary and herbal formats. Functional food developers are anticipated to pursue novel delivery systems-ranging from effervescent tablets to gummies-to enhance consumer compliance and convenience.

The dried powder form is expected to gain traction in the specialty supplement sector, while water-soluble liquid extracts will likely remain dominant due to formulation ease in beverage matrices. Regulatory clarity and supply chain improvements are anticipated to enable greater standardization of active compounds, further enhancing product claims and efficacy positioning. As demand stabilizes, manufacturers with traceable sourcing and organic certifications are projected to capture higher value share.

Pharmaceutical applications are expected to command approximately 12.8% market share of the basil extract market in 2025, growing modestly through 2035. While overshadowed by the food and nutraceutical sectors, basil’s phytochemical profile-especially its high eugenol, linalool, and flavonoid content-positions it as a candidate for botanical drug development, particularly in respiratory and antimicrobial therapy.

Evidence from European Medicines Agency (EMA) monographs supports the use of Ocimum basilicum in traditional herbal preparations for gastrointestinal and inflammatory support. However, uptake into regulated pharmaceutical pipelines remains low due to the lack of standardized extract compositions and absence of pharmacopoeial specifications across major regions.

That said, companies such as Sabinsa and Indena have introduced high-purity basil-derived actives for use in botanical drug research, suggesting early traction. Additionally, basil extract has gained attention in topical wound care formulations and antimicrobial gels, especially where resistance to synthetic actives is a concern.

Its essential oil derivatives are also being trialed in preservative systems for dermatological formulations. Going forward, alignment with pharmacopeial standards (e.g., USP, Ph. Eur.) and investments in clinical substantiation will be critical for the segment to transition from traditional to evidence-based medicinal usage. Growth will remain gradual unless regulatory recognition improves.

The cosmetics and personal care segment accounted for less than 6.5% of the global basil extract market in 2025, yet it holds high potential for convergence with wellness and natural beauty trends. Formulators are beginning to exploit basil’s antimicrobial, antioxidant, and anti-inflammatory bioactives-particularly rosmarinic acid and methyl chavicol-in skin and scalp care.

South Korean and European brands such as Whamisa and Lush have already introduced basil-infused mists, serums, and hair masks targeted at oily and acne-prone skin. However, usage remains largely niche due to poor stability of actives in aqueous cosmetic matrices and limited solubility in surfactant systems.

Standardization of extract grade-whether CO₂-extracted oils or hydroglyceric macerates-remains a technical bottleneck for broader adoption. According to CosIng (EU’s Cosmetic Ingredient Database), basil-derived ingredients are permitted, but usage limits and labeling rules vary across jurisdictions, limiting global scalability.

Rising interest in ayurveda-inspired beauty products, however, may catalyze new launches by brands focusing on adaptogenic skincare and mood-uplifting fragrances. Encapsulation technologies and emulsification advances are expected to overcome current formulation limitations, enabling basil extract to be used more effectively in creams, serums, and rinse-off products. Brands offering sustainably farmed or organically certified basil sources will gain regulatory and marketing leverage.

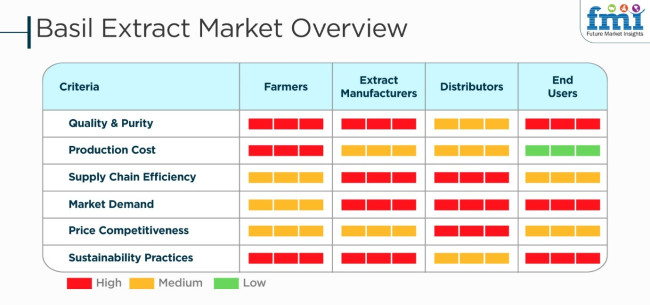

The industry is a properly established field with many people involved, such as farmers, extract manufacturers, distributors, and end users. Their active involvement in the industry is chief to the maintenance of the balance between supply and demand. Farmers are concerned with the high quality, purity, and sustainability of raw materials to ensure high-quality raw materials for extraction.

Distributors pay greater attention to the demand for their products and the price competitiveness, ensuring the effective supply of products and economically priced distribution. Buyers like food manufacturers, cosmetics companies, and health supplement producers emphasize purity, sustainability, and industry availability. Although production expense remains the greatest concern for farmers, end-users pay greater attention to the price problem and the issue of accessing the product.

The following table provides a comparative analysis of the difference in CAGR over half a year between the base year (2024) and the current year (2025) for the global industry. This comparison identifies significant changes in performance and reflects revenue realization trends, thereby giving stakeholders a clearer picture of the growth path over the period.

The first half of the year, or H1, is from January to June. The second half, H2, is from July to December. During the first half (H1) of the period 2025 to 2035, the industry is expected to grow at a CAGR of 3.4%, and then at a higher growth rate of 3.5% during the second half (H2) of the decade 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| 2024 to 2034 (H1) | 3.2% |

| 2024 to 2034 (H2) | 3.4% |

| 2025 to 2035 (H1) | 3.3% |

| 2025 to 2035 (H2) | 3.5% |

Moving on to the next half-decade, from H1 2025 to H2 2035, the CAGR is forecasted to reach 3.6% for the first half and continue with a constant figure of 3.4% for the second half. For the first half (H1), the industry saw an increment of 10 BPS, whereas in the second half (H2), it experienced a fall of 10 BPS.

Rise in Adaptogenic and Cognitive-Boosting Products

The increasing consumer interest in mental well-being and stress management has fueled the demand for adaptogenic ingredients like basil extract. With rising concerns about cognitive health, consumers are looking for natural solutions that enhance focus, reduce anxiety, and improve mental clarity.

Basil extract, particularly Holy Basil (Tulsi), is recognized for its adaptogenic properties, which help the body cope with stress and promote relaxation. Manufacturers are capitalizing on this trend by incorporating the product into nootropic supplements, herbal teas, and functional beverages targeting brain health.

The formulation of basil-based products is shifting toward synergistic blends with other adaptogens like ashwagandha and ginseng to enhance cognitive benefits. As consumers seek plant-based alternatives for stress relief, companies are intensifying research on basil’s bioactive compounds to substantiate its cognitive-enhancing claims and expand product development.

Expansion of Medicinal and Ayurvedic Applications in Western Markets

The integration of Ayurvedic and herbal medicine into mainstream health and wellness routines is creating new opportunities for the product in global markets. Traditionally used in Eastern medicine for its antimicrobial, anti-inflammatory, and detoxifying properties, the product is now gaining traction in Western countries as an alternative remedy for immune support and respiratory health.

Manufacturers are expanding their portfolios with Ayurvedic-certified formulations, including liquid tinctures, herbal capsules, and topical applications for therapeutic use. Leading brands are focusing on transparent sourcing and organic certifications to appeal to a health-conscious audience.

Additionally, increased investments in clinical research on basil’s pharmacological properties are strengthening its credibility in the medical community. This trend is driving collaborations between herbal extract producers and nutraceutical brands, ensuring that the product meets stringent regulatory and safety standards in global markets.

Standardization and Higher Potency Extracts for Targeted Formulations

The shift toward standardized botanical extracts is reshaping the industry, with manufacturers focusing on consistent potency and bioavailability. Consumers and regulatory bodies are demanding greater transparency in herbal extracts, prompting companies to invest in advanced extraction techniques such as supercritical CO2 and hydroethanolic methods.

These processes enhance the concentration of key bioactive compounds, such as eugenol and ursolic acid, ensuring higher efficacy in functional foods, dietary supplements, and personal care products. Standardization allows brands to offer extracts with quantified active compounds, making them more attractive for therapeutic use and clinical trials.

Manufacturers are also developing water-soluble products for enhanced absorption in beverages and oral supplements. This trend is pushing the industry toward precision-based herbal formulations, catering to targeted health concerns such as inflammation, immunity, and metabolic disorders.

Rising Demand for Clean-Label Fragrance and Natural Preservatives

The cosmetic and personal care industry is witnessing a growing preference for clean-label ingredients, with the product emerging as a natural fragrance and preservative alternative. As consumers reject synthetic additives and chemical-laden products, manufacturers are incorporating the product in skincare, haircare, and deodorants for its antibacterial and antioxidant properties.

The essential oil derived from basil is being increasingly used in natural perfumes and aromatherapy formulations due to its refreshing and therapeutic scent. Additionally, the product’s antimicrobial qualities are making it a preferred ingredient in natural preservative blends, replacing artificial parabens and stabilizers in cosmetic formulations.

Skincare brands are promoting basil-infused products for their skin-calming effects, while natural deodorant brands are leveraging its ability to combat odor-causing bacteria. This trend is pushing the personal care sector towards safer, herbal-based alternatives with minimal chemical intervention.

Climate and agricultural dependency are some of the major risks in the basil extract area. Insects and weeds, plus all other pests, are a major factor in lower yields and quality, resulting in delivery shortages and price fluctuations.

Shipping difficulties, which are the main issue, are another problematic challenge. For example, the transportation of basil essential oil, which is mainly imported from countries like India, China, and the Mediterranean, has to be planned properly and stored in ideal conditions. Transport queues, customs problems, or geopolitical situations in the supply chain can lead to market instability.

Quality control and standardization mainly concern the basil extract product, which is utilized in the production of medication, nutraceuticals, and cosmetics. Differences in effective compounds, incorrect extraction methods, or impurities might cause the product to lose its effect, thus sidestepping health agency rules. Quality assurance and good manufacturing practices (GMP) are rigorous and must be followed strictly.

The basil extract industry is controlled by food safety, dietary supplements, and cosmetic ingredient guidelines. Avoidance of legislative complexities including import prohibition and litigation is dependent on conformity with the criteria by the FDA (USA), EFSA (Europe), and FSSAI (India).

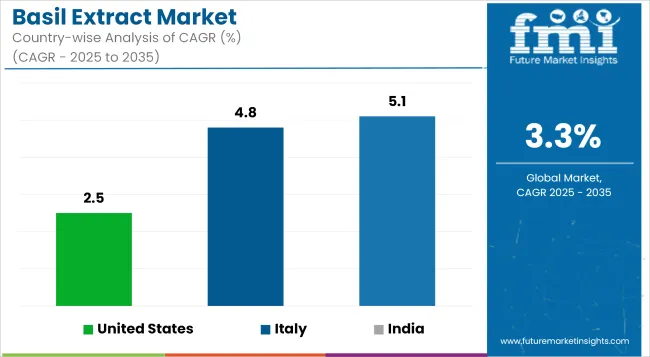

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

| Germany | 4.0% |

| China | 5.2% |

| India | 5.8% |

| Japan | 3.9% |

USA

The USA basil extract market is projected to register a growth rate of 4.5% CAGR during the period 2025 to 2035, as per FMI. This is primarily driven by increasing consumer demand for organic and natural products, particularly in the food and beverage segment. The product is mostly used because of its flavoring property and possible health advantage, including antioxidant and anti-inflammatory activity.

In the USA, the industry is dominated by a well-established supply chain and high product innovation rate with manufacturers seeking to develop new uses and forms of products to cater to diverse consumer requirements. Also, enhanced popularity of natural remedies and herbal supplements drives the expanding uses of the product as a cosmetic and a nutraceutical ingredient.

Growth Drivers in the USA

| Key drivers | Detail |

|---|---|

| Strong Consumer Pull | Growing demand for organic and natural products |

| Well-structured Supply Chain | Well-organized supply and transport channels |

| Product Innovation | New food, nutraceutical, and cosmetic applications and formulations |

| New Industry for Herbal Supplements | Rising demand for the product as a raw material in health and wellness products |

The German industry is poised to record a growth rate of 4.0% during 2025 to 2035, cites FMI. The German industry shows high demand for natural and organic products due to health-conscious customers and high regulative demands.

The product finds extensive usage in the food, pharmaceutical, and cosmetic markets due to its curing property. German producers are also investing in advanced extraction methods to deliver high-quality, standardized extracts to meet domestic as well as international standards. The nation's focus on sustainability and clean-label products also drives the use of the product across sectors.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Strong Demand for Natural Ingredients by Consumers | Growth in demand for organic and clean-label products |

| Strict Quality Standards | Meeting EU standards for food, pharmaceuticals, and cosmetics |

| Advanced Extraction Technologies | High-quality extracts with enhanced purity |

| Focus on Sustainability | Investment in sustainable and ethical production practices |

FMI states that the Chinese industry will grow at a robust CAGR of 5.2% during 2025 to 2035. It is fueled by the growing application of the product in traditional medicine and new-age healthcare products, as a blend of cultural heritage and contemporary wellness trends. Growing middle class and greater disposable incomes are leading to greater consumer spending on health and wellbeing products, including natural extract containing products like basil.

Chinese companies are building capabilities and focusing on quality control to differentiate themselves both domestically and internationally. Collaborations with overseas companies and compliance with international standards are also making China's industry more competitive.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Growing Demand in Traditional Medicine | Use of the product in traditional medicine |

| Growth in Middle-Class Consumption | Growth in demand for health and wellness products |

| Growth in Export Industry | Exporting according to international quality standards |

| Growth in Domestic Output | Investment in commercial-scale extraction plants |

India's industry will grow at a CAGR of 5.8% between 2025 to 2035, according to FMI. Basil, also known as "Tulsi" in India, has been used in Ayurvedic medicine for centuries, leading to high domestic usage. More use of herbal and natural components in pharmaceuticals, nutraceuticals, and personal care drives industry growth. Government of India initiatives in support of herbal and Ayurveda products also drive growth, supported by more export of the product to overseas markets.

Growth Drivers in India

| Key Drivers | Detail |

|---|---|

| Strong Domestic Demand | Strong consumers' demand for herbal and Ayurvedic products |

| Government Support | Government favors herbal and Ayurvedic businesses |

| Growing Export Industry | Growth in demand in Europe and North America |

| Increased Usage in Pharmaceuticals & Nutraceuticals | Increased applications in herbal medication and dietary supplements |

Japan's basil extract market is projected to grow at 3.9% CAGR from 2025 to 2035, according to FMI. The Japanese consumer places significant importance on higher-quality functional food ingredients, and this is one of the reasons for increased demand for the product in the pharmaceuticals, cosmetics, and health foods industry. Japan's aging population is also driving the industry due to the fact that customers are looking to natural sources for the treatment of age-related conditions.

Growth Drivers in Japan

| Key Driver | Details |

|---|---|

| Functional Food Growth | Transitory nature-based demand boom for health-enhancing ingredients |

| Demographic Aging | Rising consumer demands for anti-inflammatory, antioxidant-enriched food |

| Extraction Technology Advancement | Highly accurate technologies in the extractions of purity and quality |

The global industry is characterized by the presence of multinational corporations (MNCs), regional players, and Chinese manufacturers, each contributing to the competitive landscape with varying levels of industry influence.

Regional players dominate key markets by leveraging locally sourced raw materials, cost-effective production techniques, and strong distribution networks. These companies focus on catering to the specific preferences of domestic consumers, offering organic, non-GMO, and Ayurvedic-certified products. Their ability to maintain supply chain efficiency, while responding to changing consumer demand, provides them with a competitive edge. Additionally, regional players are increasingly adopting advanced extraction technologies to enhance product purity and potency, ensuring compliance with regulatory standards.

In regions such as North America and Europe, mid-sized companies play a crucial role in industry expansion by capitalizing on the demand for clean-label and functional food ingredients. Many of these players focus on developing standardized extracts for nutraceutical and cosmetic applications, targeting health-conscious consumers.

In the Asia Pacific industry, particularly in India, regional manufacturers have a strong foothold due to the deep-rooted tradition of Ayurvedic and herbal medicine. These companies are expanding their export capabilities to meet the rising global demand for natural ingredients, securing partnerships with international brands.

Despite the growing influence of multinational corporations, regional players continue to hold a significant share in the industry. Their adaptability, localized strategies, and emphasis on authenticity enable them to compete effectively, even as global demand for products rises across various industries.

The industry exhibits intense competition, with the main drivers being the growing demand for organic and natural fermented ingredients in food and beverages, pharmaceuticals, and the personal care industry. Consumers are highly conscious about clean labels and sustainably sourced extracts that add functional value; consequently, companies are undertaking innovations in formulation, extraction technologies, and marketing.

The leading Companies-Martin Bauer Group, Soli Organic Inc., FLAVEX Naturextrakte, Ambe Phytoextracts, and Indena- account for the most competitive dynamics with their sustainable sourcing, proprietary extraction methodologies, and compliance with international quality specifications. The latest acquisition of Core Botanica by Martin Bauer Group further expands its capabilities as well as reinforces its leadership in herbal extracts, while Soli Organic Inc. recently launched USDA-certified organic 'Indolce' basil, now available in over 2,000 retail outlets.

Industry dynamics have been enhanced by R&D investments toward bioactive enhancement, clean-label formulation, and new delivery formats. Startups and niche botanical suppliers are fast flourishing by meeting the needs of the premium-grade wellness brands and personalized nutrition. The firms that will still have some level of advantage on an ever-increasing pace of competition are those using strategic mergers, obtaining organic certifications, and establishing customized extract solutions.

By application, the industry is segmented into pharmaceutical and personal care products.

The industry includes powder, capsule, and oil.

The industry spans North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Revenue generated in 2025 is estimated to be USD 63.3 million.

The market is projected to reach USD 87.6 million by 2035.

Key companies include Martin Bauer Group, Penta Manufacturing Company, Kefiplant, Amoretti, FLAVEX Naturextrakte GmbH, A.M. Todd Botanical Therapeutics, NOW Foods, Cepham Inc., Todd Botanical Therapeutics, and DaXingAnLing Lingonberry Organic Foodstuffs Co., Ltd.

India, slated to grow at 5.8% CAGR during the forecast period, is poised for fastest growth.

Basil oil is widely used.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Basil Leaves Market Size and Share Forecast Outlook 2025 to 2035

Frozen Basil Leaves Market Insights – Demand & Industry Trends 2025 to 2035

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Sage Extract Market Size and Share Forecast Outlook 2025 to 2035

Fume Extractor Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Kale Extract Skincare Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Amla Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dust Extractor Market Growth – Trends & Forecast 2025 to 2035

Data Extraction Software Market

Peony Extract Brightening Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peony Extracts for Brightening Market Size and Share Forecast Outlook 2025 to 2035

Algae Extracts Market Size and Share Forecast Outlook 2025 to 2035

Juice Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Yucca Extract Market Size and Share Forecast Outlook 2025 to 2035

Maple Extracts Market Size and Share Forecast Outlook 2025 to 2035

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA