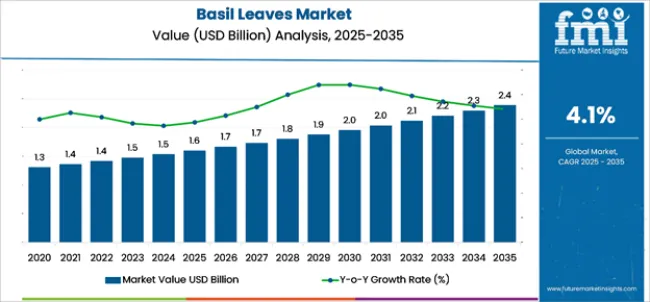

The basil leaves market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period. The basil leaves market is projected to add an absolute dollar opportunity of USD 810 million over the forecast period.

| Metric | Value |

|---|---|

| Basil Leaves Market Estimated Value in (2025E) | USD 1.6 billion |

| Basil Leaves Market Forecast Value in (2035F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

This reflects a 1.56 times growth at a compound annual growth rate of 4.1%. The market's evolution is expected to be shaped by rising demand for natural ingredients in culinary applications, herbal medicine, and cosmetic formulations, particularly where fresh flavor profiles and therapeutic properties are required.

By 2030, the market is likely to reach approximately USD 2.0 billion, accounting for USD 400 million in incremental value over the first half of the decade. The remaining USD 500 million is expected during the second half, suggesting a moderately back-loaded growth pattern. Product substitution for synthetic flavoring agents and artificial herbs is gaining traction due to basil's natural aromatic properties and health benefits.

Companies such as Giorgio Fresh and Mastronardi Produce are advancing their competitive positions through investment in hydroponic cultivation technologies and scalable greenhouse systems. Organic certification and sustainable farming practices are supporting expansion into premium retail segments, food service operations, and value-added products. Market performance will remain anchored in quality standards, supply chain efficiency, and seasonal availability management.

The basil leaves market holds approximately 42% of the fresh herbs market, driven by its culinary versatility, therapeutic properties, and growing use in Mediterranean and Asian cuisines. It accounts for around 35% of the aromatic herbs market, supported by its distinctive flavor profile and compatibility with diverse food preparation methods.

The market contributes nearly 28% to the natural flavoring ingredients market, particularly for pestos, sauces, and seasoning blends in processed foods. It holds close to 24% of the herbal medicine ingredients market, where basil extracts are used for their anti-inflammatory and antioxidant properties. The share in the organic herbs market reaches about 31%, reflecting its preference among health-conscious consumers seeking pesticide-free alternatives in certified organic products.

The market is undergoing structural change driven by rising demand for natural and organic food ingredients. Advanced cultivation methods using hydroponic systems and controlled environment agriculture have enhanced yield consistency, quality control, and year-round availability, making basil a viable alternative to synthetic flavorings and imported herbs.

Manufacturers are introducing value-added products including basil-infused oils, dried leaf powders, and extract concentrates tailored for food processing and pharmaceutical applications, expanding their role beyond fresh consumption.

Strategic collaborations between greenhouse operators and food manufacturers have accelerated adoption in packaged foods and ready-to-eat meals. E-commerce platforms have widened access and awareness, reshaping traditional supply chains and forcing conventional herb suppliers to adapt.

The market is segmented by product type, end-use, distribution channel, and region. By product type, it includes fresh basil, dried basil, frozen basil, and basil powder. Based on end-use, the market is classified into essential oils, pharmaceuticals, snacks, baked foods, beverages, and others. In terms of distribution channel, the market is divided into supermarket, hypermarkets, mom and pop stores, and food retail outlets. Regionally, the market is analyzed across North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

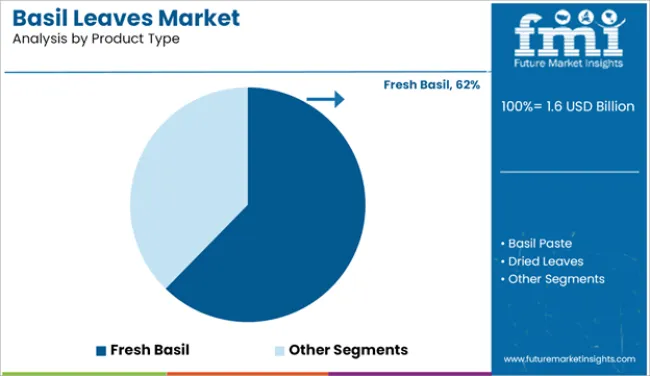

The fresh basil segment holds a leading 62% share in the product type category, reflecting its superior flavor intensity, aromatic qualities, and growing use in restaurants, home cooking, and specialty food applications. Fresh basil is increasingly preferred due to its vibrant taste profile, visual appeal, and perceived health benefits compared to processed alternatives.

It offers optimal essential oil content ideal for culinary applications and is often used in premium dishes, artisanal products, and gourmet preparations. The segment benefits from rising consumer demand for natural ingredients that align with clean eating trends and restaurant quality standards.

Manufacturers are focusing on expanding cultivation capacity with greenhouse facilities and hydroponic systems, catering to both retail and food service markets. As sustainability concerns tighten and farm-to-table dining becomes more prevalent, fresh basil's role as a preferred natural ingredient is expected to strengthen, supporting its steady growth trajectory.

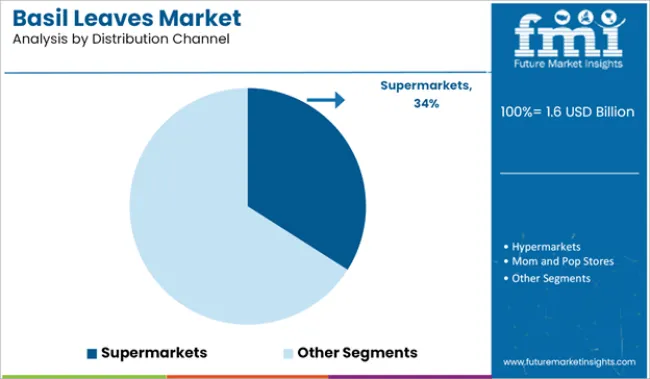

The supermarkets segment holds a 34% share in the basil leaves market by distribution channel, reflecting the strong consumer preference for accessible, fresh herbs in organized retail settings. Supermarkets offer wide product variety, quality assurance, and attractive pricing, making them a primary source for both fresh and packaged basil.

High product turnover, strategic in-store placement, and value-added options like pre-washed or packaged basil contribute to consistent sales performance.

The segment benefits from increasing urbanization, expanded cold-chain infrastructure, and rising demand for convenience in herb shopping. Promotional campaigns, private label expansions, and basil’s use in ready-to-cook kits also support growth. As consumers continue seeking fresh culinary ingredients during routine grocery purchases, supermarkets are expected to remain a dominant distribution channel for basil leaves.

Basil's superior flavor profile, nutritional benefits, and culinary versatility make it an attractive ingredient for both home cooking and commercial food production applications.

Growing awareness of natural health alternatives and clean-label ingredients is further propelling adoption, especially in urban food markets and health-focused dining establishments. Government support for sustainable agriculture practices, along with innovations in controlled cultivation technology, are also enhancing product quality and supply reliability.

As consumer preferences shift toward fresh, locally-sourced ingredients and artisanal food preparation increases in both mature and emerging markets, the market outlook remains favorable. With chefs and home cooks prioritizing flavor authenticity, nutritional value, and ingredient transparency, basil leaves are well-positioned to expand across various culinary and wellness applications.

In 2024, global consumption grew by 18% year-on-year, with Asia-Pacific taking a 45% share. Applications include flavor enhancement in sauces, natural aromatherapy products, and nutritional supplements. Manufacturers are introducing organic certification programs and controlled environment agriculture systems that deliver superior flavor profiles and extended shelf life.

Greenhouse cultivation formats now support year-round production. Sustainable sourcing and traceability systems support buyer confidence. Food processors increasingly source fresh basil with pre-washed formats and modified atmosphere packaging to reduce preparation complexity.

Health Consciousness and Natural Ingredients Drive Market Expansion

Health-conscious consumers and food manufacturers are choosing basil products to enhance nutritional value, flavor profiles, and natural ingredient claims in food and beverage applications. In clinical studies, basil extracts demonstrate up to 25% higher antioxidant activity and 30% more essential oil content than synthetic alternatives.

Products treated with controlled atmosphere packaging maintain freshness levels above 85% during 14-day cold storage. In ready-to-use formats, pre-washed basil reduces kitchen preparation time by up to 40%. Fresh basil varieties are now cultivated for specific culinary applications, increasing uptake in sectors that demand consistent flavor delivery. These attributes help explain why adoption rates in premium food service rose 22% in 2024 across North America and Europe.

Supply Chain Complexity, Seasonality Issues and Short Shelf Life Restrict Growth

Growth faces constraints due to basil's perishable nature and seasonal cultivation patterns. Fresh basil shelf life typically ranges from 7 to 14 days depending on storage conditions, impacting distribution logistics and leading to waste rates of up to 15% in retail channels. Seasonal availability variations create price fluctuations of 20% to 35% between peak and off-peak periods.

Transportation requirements for temperature-controlled environments add 12-18% to distribution costs. Limited processing capacity among large-scale producers restricts bulk availability, especially for organic certified products. These constraints make scaling difficult in new markets despite rapid demand growth and increasing consumer interest.

| Country | CAGR |

|---|---|

| India | 5.8% |

| China | 5.2% |

| Italy | 4.7% |

| Thailand | 4.4% |

| USA | 3.9% |

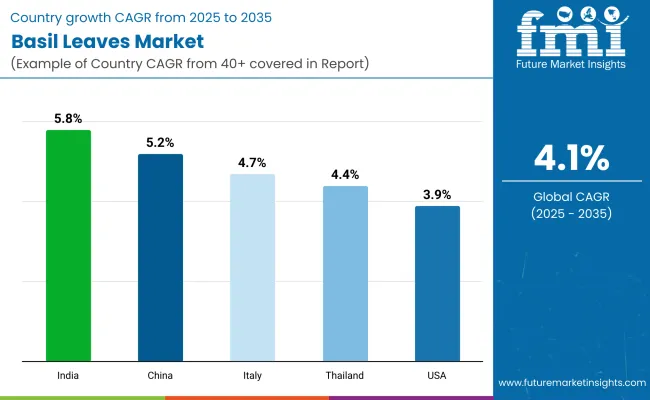

The global basil leaves market is projected to grow at a CAGR of 4.1% from 2025 to 2035. India leads with 5.8%, growing 1.7 percentage points above the global rate due to traditional Ayurvedic applications and large-scale cultivation programs. China follows at 5.2%, marking a 1.1-point advantage supported by expanding food processing industries and herbal medicine demand.

Italy stands at 4.7%, slightly higher by 0.6 points, while Thailand records 4.4%, showing a 0.3-point edge. The USA trails slightly below average at 3.9%, reflecting mature market conditions. Agricultural policies, culinary traditions, and processing infrastructure are key drivers behind growth variations.

Basil leaves market in India is projected to grow at a CAGR of 5.8% from 2025 to 2035, outperforming the global average by 1.7%. The growth is linked to traditional medicinal applications, expanding food processing zones, and government support for herb cultivation. Holy basil varieties are widely adopted in Ayurvedic medicine and wellness products.

Output has been expanded by agricultural extension programs promoting organic cultivation methods. Fresh basil products are increasingly replacing imported herbs in urban food service and retail sectors. More than 60% of production is linked to smallholder farmers participating in contract farming arrangements with processing companies.

Basil leaves revenue in China is forecast to grow at a CAGR of 5.2% from 2025 to 2035, ahead of the global average by 1.1%. Southern provinces, particularly Guangdong and Fujian, have expanded cultivation of sweet basil varieties for both domestic consumption and export markets. Government-backed agricultural cooperatives are supporting controlled environment agriculture adoption in Shandong and Jiangsu provinces.

Food manufacturers have shifted toward fresh basil ingredients to reduce reliance on imported herbs. Processing capacity remains limited, but dried basil production is gaining traction in traditional medicine applications. Export volumes to Southeast Asian markets are rising, especially for value-added basil oil products.

Sales of basil leaves in Italy are expected to grow at a CAGR of 4.7% from 2025 to 2035, exceeding the global rate by 0.6%. Growth is centered on traditional Italian cuisine applications and premium food manufacturing in regions such as Liguria, Campania, and Sicily. Genovese basil varieties are being specified for authentic pesto production and high-end restaurant applications.

Import volumes from North Africa have increased, particularly from Morocco and Tunisia. Fresh products with Protected Designation of Origin certification are favored under EU quality standards. Most cultivation is driven by small-scale producers, with limited industrial farming adoption. Organic basil has also gained share in agritourism and direct-to-consumer sales channels.

Revenue from basil leaves in Thailand is forecast to grow at a CAGR of 4.4% from 2025 to 2035, slightly above the global average. Growth has been concentrated in traditional Thai cuisine applications and export markets in Bangkok, Chiang Mai, and northeastern provinces. Demand is shifting from wild-harvested varieties toward cultivated sweet basil and Thai basil, especially those compatible with commercial food processing standards.

Restaurant supply chains and food processors have strengthened, with increased storage capacity in regional distribution centers. While domestic consumption continues to dominate, several Thai companies are developing processed basil products for international markets. Thai-language agricultural extension programs have improved cultivation techniques among smallholder farmers.

The USA basil leaves market is expected to grow at a CAGR of 3.9% from 2025 to 2035, underperforming the global average by 0.2%. Demand is driven by ethnic cuisine popularity and health-conscious cooking trends among urban consumers. California, Florida, and New York lead in fresh basil consumption, primarily for restaurant operations and specialty retail markets.

However, production costs remain elevated due to labor requirements and competition from imported products. Market share is shifting toward greenhouse-grown varieties and organic certification, especially among premium retail chains. Direct-to-restaurant distribution models have helped reduce supply chain complexity. Food service procurement remains concentrated, although retail packaging innovations are increasing in consumer markets.

The market is moderately fragmented, featuring a mix of agricultural producers, processing companies, and specialty suppliers with varying degrees of integration and cultivation expertise. Giorgio Fresh and Mastronardi Produce lead the fresh basil segment, supplying premium products for retail and food service applications. Their strength lies in greenhouse technology, quality control systems, and established distribution networks.

Village Farms and NatureFresh Farms differentiate through controlled environment agriculture, including hydroponic systems and year-round production capabilities that cater to consistent supply requirements in North American markets. McCormick & Company Inc. and Great American Spice Company focus on dried and processed basil products, addressing the growing demand for shelf-stable ingredients in food manufacturing and retail packaging.

Regional players such as Spisa Group, Kerry Group PLC, and Pacific Botanicals dominate specialized applications including organic certification, extract production, and value-added processing for pharmaceutical and cosmetic industries. Meanwhile, smaller greenhouse operators emphasize local market supply and direct-to-consumer sales.

Entry barriers remain moderate, driven by challenges in cultivation expertise, quality consistency, and compliance with food safety standards across multiple market segments. Competitiveness increasingly depends on sustainable growing practices, supply chain efficiency, and product differentiation for premium market positioning.

Key Developments in the Basil Leaves Market

Manufacturers are advancing greenhouse cultivation and hydroponic systems for improved yield consistency and quality control, expanding their suitability for year-round production and premium market applications. Global players are investing in organic certification and sustainable farming practices for specialty retail markets, while regional producers scale operations for cost efficiency in food service supply.

Integration of traceability systems, GAP certification, and modified atmosphere packaging is becoming standard, driven by food safety regulations. Partnerships with restaurant chains and food manufacturers are accelerating adoption in prepared foods and value-added products.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Product Type | Fresh Basil, Dried Basil, Frozen Basil, and Basil Powder |

| Application | Culinary, Pharmaceutical, Cosmetics, Aromatherapy, and Others |

| End-user | Residential, Commercial Food Service, and Industrial |

| Distribution Channel | Offline Retail and Online Retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, Australia, and 40+ countries |

| Key Companies Profiled | Giorgio Fresh, Mastronardi Produce, Village Farms, NatureFresh Farms, Greenhouse Produce, McCormick & Company Inc., Great American Spice Company, Spisa Group, Kerry Group PLC, Pacific Botanicals |

| Additional Attributes | Dollar sales by product type and end-use sector, growing usage in culinary applications and natural products for food service operations, stable demand in pharmaceutical and cosmetic applications, innovations in controlled environment agriculture and organic certification improve quality, availability, and market positioning |

The global basil leaves market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the basil leaves market is projected to reach USD 2.4 billion by 2035.

The basil leaves market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in basil leaves market are basil leaves, basil paste and dried leaves.

In terms of end-use, essential oils segment to command 42.6% share in the basil leaves market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frozen Basil Leaves Market Insights – Demand & Industry Trends 2025 to 2035

Basil Extract Market Size, Growth, and Forecast for 2025 to 2035

White Mulberry Leaves Extract Market Growth - Product Type & Form Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA