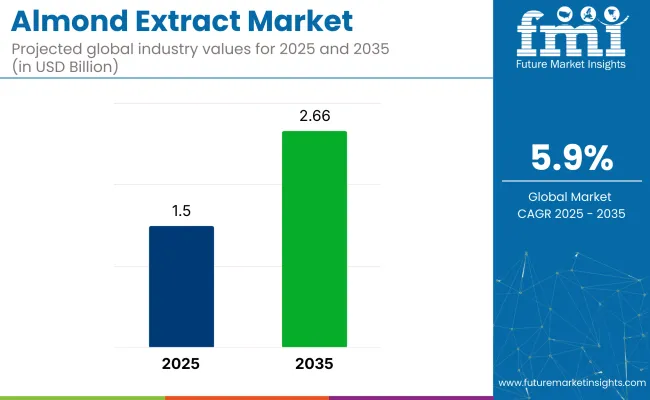

The global almond extract market is set to grow from USD 1.5 billion in 2025 to USD 2.66 billion by 2035, achieving a CAGR of 5.9%. The increasing preference for natural, organic, and clean-label ingredients in food and beverages is driving industry expansion.

The extract is widely used in bakery, confectionery, dairy, and beverages, with rising demand for intense flavors in products like syrups and ice creams. The shift toward organic and alcohol-free versions align with growing health-conscious consumer trends, further fueling demand in home preparation and baking.

The industry holds a varying share within its parent industries. In the flavored syrups industry, almond extract contributes approximately 5-7%, mainly due to its use in premium syrups for beverages. Within the natural food flavors industry, the share is slightly higher at around 8-10%, as almond extract is sought after for clean-label formulations. In the bakery and confectionery ingredients industry, the share reaches about 10-12%, driven by its extensive application in flavoring cakes, cookies, and other baked goods.

The beverage additives industry accounts for 6-8% of the almond extract’s presence, being used in alcoholic and non-alcoholic beverages. In the natural and organic ingredients industry, almond extract makes up approximately 4-6%, as consumers increasingly demand organic flavoring solutions.

At the Almond Industry Forum 2024, Turner, CEO of the Almond Board of California, highlighted the growing focus on expanding almond accessibility worldwide. In an exclusive interview with Our Valley Voice (May 2024), Turner emphasized, "Almonds are such a nutritionally dense plant-based protein. I would love to make them accessible to more people across the world." This strategy reflects the industry's commitment to innovation and increasing exports to meet global demand.

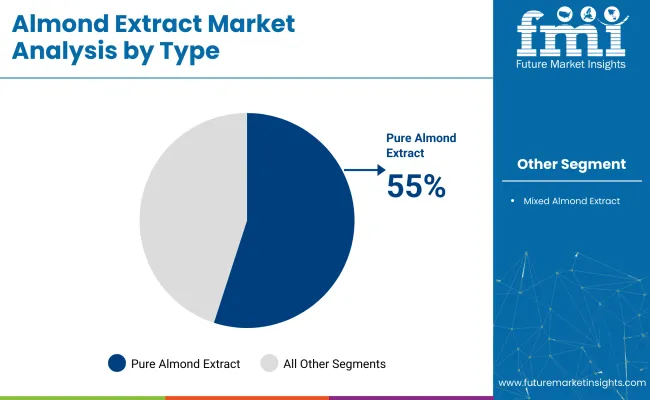

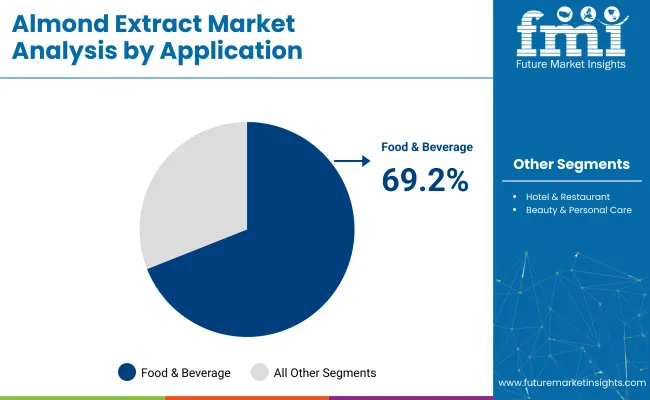

The pure segment is projected to hold 55% of the industry by 2025, driven by its natural, clean-label appeal. The food and beverage segment, at 69.2%, leads in industry share, with almond extract used in bakery goods, beverages, and plant-based products, aligning with clean-label trends.

The pure almond extract segment is projected to lead the market with a dominant 55% share in 2025.

The food and beverage segment are expected to capture the largest share of the almond extract industry, with 69.2% in 2025.

The industry is expanding due to increased demand in food, beverage, and cosmetics sectors, driven by consumer preference for natural and plant-based ingredients, though challenges like raw material volatility and regulatory compliance persist.

Recent Market Trends and Innovations by Key Players

Challenges in the Almond Extract Market

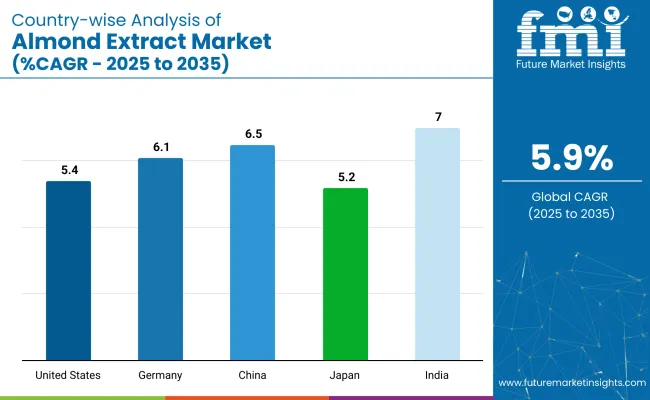

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.4% |

| Germany | 6.1% |

| China | 6.5% |

| Japan | 5.2% |

| India | 7.0% |

India’s momentum is driven by increasing demand for natural flavorings and growing almond cultivation, supporting the rise in extract use in the food and beverage sector. China follows closely, with a projected 6.5% CAGR, supported by its expanding consumer base for natural extracts in the food and health industries. In contrast, developed economies such as Germany (6.1%), the United States (5.4%), and Japan (5.2%) are expanding at a steady rate.

Germany leads the OECD group, driven by increasing consumer demand for natural and clean-label ingredients in the food industry. The United States follows with a steady growth trajectory in consumption, particularly in the natural food segment. As the industry grows and adds over USD 250 million by 2035, both high-growth regions like India and China, along with stable demand from OECD countries, will shape its trajectory.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The industry in United States is projected to grow at a CAGR of 5.4% from 2025 to 2035. This growth is driven by the increasing demand for natural flavoring agents in various food and beverage products, particularly among health-conscious consumers.

The industry in United Kingdom is experiencing steady growth, driven by increasing demand for natural and plant-based ingredients. With a growing focus on clean-label and organic products, it has become a popular choice for dairy alternatives, vegan desserts, and beverages.

The market in Germany is forecast to grow at a CAGR of 6.1% from 2025 to 2035. The industry is driven by Germany's strong consumer preference for high-quality, organic ingredients. As plant-based diets gain traction, these extract is increasingly used in dairy alternatives, baked goods, and confectioneries.

The industry in China is set to grow at a CAGR of 6.5% from 2025 to 2035. The country’s expanding middle class, increasing disposable incomes, and urbanization are key drivers of this growth.

The industry in Japan is projected to grow at a CAGR of 5.2% from 2025 to 2035. This growth is driven by the country’s increasing focus on health and wellness, particularly among the aging population.

India is projected to experience the fastest growth in the industry, with a CAGR of 7.0% from 2025 to 2035.

The industry is shaped by established leaders and emerging players, each employing various strategies to strengthen their positions. Prominent brands such as Nielsen-Massey Vanillas, McCormick & Company, and Simply Organic have built strong reputations through consistent product innovation and a focus on quality.

These companies emphasize natural ingredients, with some offering organic-certified extracts to cater to the growing consumer demand for clean-label products. Emerging players like Frontier Co-op and OliveNation are carving out space in the sector by focusing on organic certifications and environmentally friendly practices, resonating with health-conscious and eco-aware consumers.

The industry is becoming more fragmented, with major companies expanding their product lines and distribution networks to increase their share. However, the rise of niche brands also indicates a shift toward a more diverse landscape. Entry barriers include regulatory standards, production costs, and distribution challenges.

To address these issues, companies are forming strategic partnerships, investing in research and development, and adopting sustainable sourcing practices. These strategies not only help in overcoming entry barriers but also meet the growing consumer expectations for high-quality, ethically sourced, and environmentally friendly products.

Recent Development in Almond Extract Industry

The product is categorized into pure almond extract and mixed almond extract.

It is used in various industries, including food & beverage, beauty & personal care, and hotel & restaurant sectors, along with other applications.

The industry is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The industry size is estimated to be USD 1.5 billion in 2025 and USD 2.66 billion by 2035.

The expected CAGR is 5.9% from 2025 to 2035.

The Bakery & Confectionery segment is expected to hold a 69.2% market share in 2025.

Nielsen-Massey Vanillas is one of the leading companies in the industry, with a strong reputation for product innovation and quality.

India is expected to grow at the fastest CAGR of 7.0% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Almond Milk Market Size and Share Forecast Outlook 2025 to 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Almond Oil-Based Serums Market Size and Share Forecast Outlook 2025 to 2035

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Almond Flour Market Analysis - Size, Share, and Forecast 2025 to 2035

Almond Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Almond Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Almond Drink Market Analysis - Size, Share, and Forecast 2025 to 2035

Almond Butter Market Growth - Healthy Spreads & Industry Demand 2025 to 2035

Demand for Almond Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Sage Extract Market Size and Share Forecast Outlook 2025 to 2035

Fume Extractor Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Kale Extract Skincare Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Amla Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dust Extractor Market Growth – Trends & Forecast 2025 to 2035

Data Extraction Software Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA