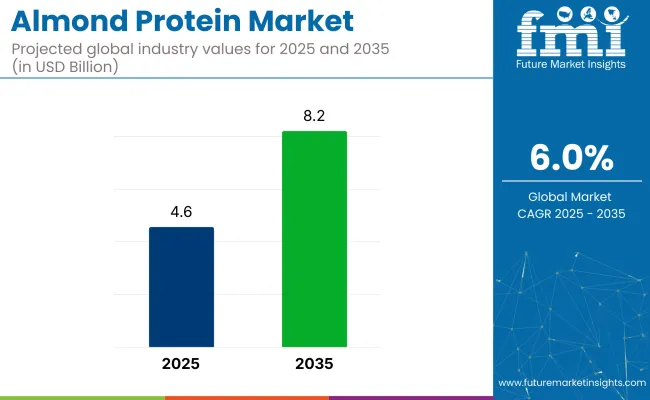

The almond protein market is expected to rise from USD 4.6 billion in 2025 to USD 8.2 billion by 2035, registering a CAGR of 6% over the forecast period. Growth is likely to be driven by rising demand for plant-based protein alternatives, particularly in dairy-free, gluten-free, and clean-label nutrition products.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 4.6 billion |

| Projected Market Size in 2035 | USD 8.2 billion |

| CAGR (2025 to 2035) | 6% |

North America continues to be the largest producer and consumer, while Europe and East Asia are increasingly adopting almond protein across functional foods and supplements.

In 2025, the almond protein market holds a small but steadily growing share across several broader parent markets. Within the global plant-based protein market, it contributes approximately 2-3%, as it competes with soy, pea, and rice proteins for clean-label, allergen-friendly applications. In the nut ingredients market, almond protein makes up about 4-6%, driven by increased demand for high-protein formulations from almonds.

Within the dairy alternatives market, its share is around 1-2%, primarily in protein-fortified plant-based milks and yogurts. In the functional food ingredients market, almond protein contributes roughly 1-2%, valued for its nutritional profile and mild taste. In the sports and nutrition supplements market, its presence is estimated at 1-1.5%, as a niche option among plant-based protein powders.

Processing innovations such as cold-press defatting and fine-particle milling are helping manufacturers retain more nutrients and improve solubility. As brands position themselves around clean and simple ingredients, almond protein is being marketed not just as a supplement, but as a whole-food-based protein source. With increased focus on digestive tolerance, taste optimization, and versatile functionality, almond protein is well-placed to become a foundational ingredient across wellness-focused food formulations.

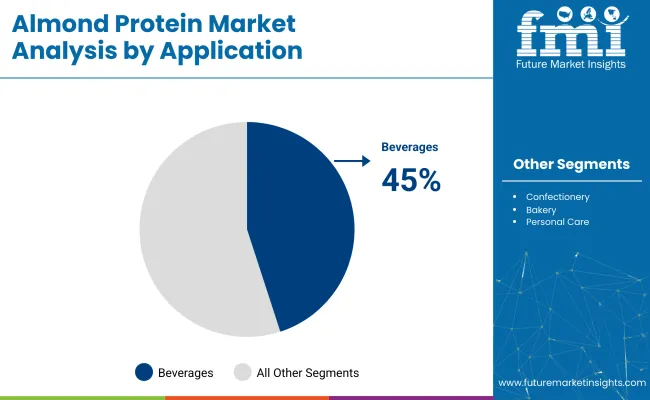

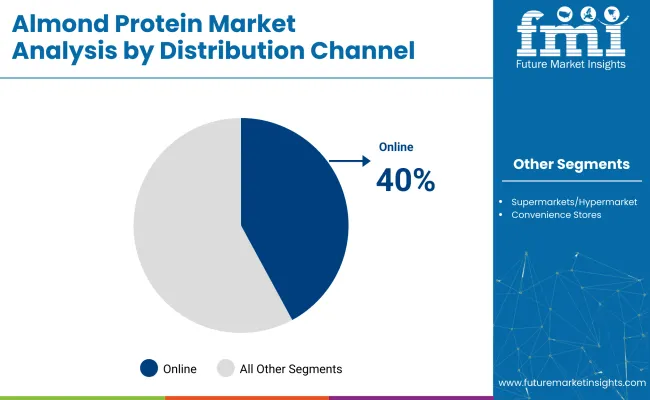

Beverages are expected to lead the application segment with a 45% market share by 2025, while online platforms are anticipated to dominate the distribution channel segment with a 40% share, supported by growing demand for plant-based protein alternatives and the convenience of digital retail.

Almond protein is projected to command 45% of the application segment in beverages by 2025, driven by rising consumer preference for dairy alternatives and clean-label formulations.

Online distribution channels are set to hold 40% of the market share for almond protein products by 2025, fueled by increasing e-commerce adoption and the expansion of health-focused digital retail.

The market is experiencing strong growth driven by rising consumer interest in plant-based nutrition, clean-label ingredients, and allergen-friendly alternatives to soy and dairy. Manufacturers are expanding almond protein applications across beverages, snacks, and sports nutrition, with a focus on flavor, texture, and sustainability.

Expanding Use in Plant-Based Beverages and Dairy Alternatives

Almond protein is increasingly used in plant-based milk, yogurts, and creamers to boost protein content while maintaining a smooth texture and mild taste. Its neutral flavor and compatibility with other plant-based ingredients make it a preferred choice for clean-label formulations. As consumer demand for non-dairy, allergen-conscious products rises, almond protein is gaining traction among health-conscious buyers.

Rising Adoption in Protein Powders, Bars, and Functional Snacks

Almond protein is gaining popularity in the sports nutrition and healthy snacking segments due to its high nutrient density, digestibility, and plant-based origin. It is used in protein shakes, bars, and meal replacements to provide a balanced amino acid profile and sustained energy. Consumers seeking natural and minimally processed protein options increasingly prefer almond over highly processed isolates.

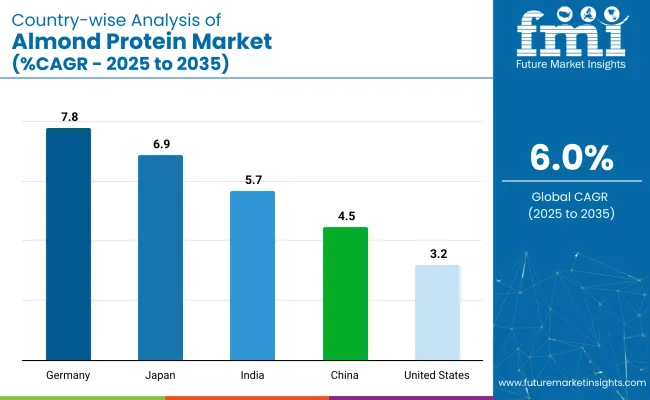

| Countries | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.8% |

| Japan | 6.9% |

| India | 5.7% |

| China | 4.5% |

| United States | 3.2% |

The almond protein market is gaining momentum globally as plant-based diets continue to rise, and consumers seek clean-label, allergen-friendly, and high-protein alternatives to dairy and soy. From 2025 to 2035, the market is projected to grow steadily, with Germany leading the top five countries at a CAGR of 7.8%, followed by Japan (6.9%), India (5.7%), China (4.5%), and the USA (3.2%). Growth is being driven by demand in functional foods, sports nutrition, plant-based beverages, and non-dairy baked goods.

OECD countries such as Germany, Japan, and the USA are investing in ingredient purity, innovation, and traceability. BRICS countries like China and India are scaling production and tapping into their growing urban wellness consumer bases.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Germany is projected to grow at a CAGR of 7.8%, the highest among key countries, as consumer interest in vegan protein and allergen-free food alternatives continues to surge. As part of the EU27, OECD, and Sustainability-Focused Nations, Germany emphasizes traceability, organic sourcing, and reduced environmental impact.

Almond protein is being adopted in plant-based yogurts, snack bars, and meat alternatives as a functional, soy-free option. Retailers are pushing clean-label and low-processed ingredient claims, prompting food manufacturers to reformulate with high-protein nut-based ingredients.

Japan is expected to grow at a CAGR of 6.9%, supported by demand for functional nutrition in aging populations and premium non-dairy formulations. As an OECD country with a reputation for innovation and safety, Japan favors almond protein in applications such as protein-enriched drinks, healthy confectionery, and gluten-free bakery.

Consumer interest in natural ingredients and low-allergen alternatives is prompting major food brands to incorporate almond protein in fortified foods. Domestic processors are also exploring almond protein in beauty supplements and clinical nutrition blends targeting gut health and metabolism.

Indian market is projected to grow at a CAGR of 5.7%, driven by increased awareness of plant-based nutrition and changing dietary patterns. As a BRICS and Emerging Market, India is witnessing growth in non-dairy protein sources for vegetarian consumers, with almond protein gaining favor in nutritional shakes, energy snacks, and diabetic-friendly foods.

Domestic startups are introducing almond protein blends in meal replacement powders and fortified drink mixes. Growth is further supported by urban demand for low-carb, lactose-free options among fitness-conscious consumers.

China is forecast to grow at a CAGR of 4.5%, fueled by growing demand for plant-based ingredients in meal replacements, snacks, and beverage categories. As a BRICS and Protein-Transition Market, China is investing in functional nutrition platforms that support weight management, gut health, and lactose-free lifestyles.

Almond protein is gaining visibility in premium ready-to-drink shakes and imported wellness products. Domestic producers are also exploring almond protein as a cleaner alternative to soy, particularly in urban Tier 1 cities where Western-style diets are gaining ground.

The USA market is expected to grow at a CAGR of 3.2%, reflecting its position as a mature but innovation-driven space. As an OECD and Agri-food Tech Pioneer, the USA leads in almond production, providing a strong foundation for protein extraction.

Growth is led by food-tech firms developing almond protein for plant-based milks, protein powders, and clean-label bars. While pea and soy dominate the market, almond protein is gaining a niche presence due to its hypoallergenic appeal and smooth flavor. Sustainability efforts are also steering manufacturers toward value-added almond co-products.

The market is moderately fragmented, with a mix of established nutraceutical players and emerging natural ingredient specialists driving innovation. Blue Diamond Ingredients and Almond Pro Foods are key players offering high-purity almond protein powders catering to the growing demand for plant-based and allergen-friendly nutrition. Noosh Brands differentiates with value-added almond protein formulations focused on sports and wellness markets.

BASF and Sabinsa Corporation contribute by incorporating almond-derived bioactives into broader nutraceutical and functional food applications. Companies like InovoBiologic Inc., BioFlora LLC, and Celtic Sea Minerals are exploring synergies between almond protein and mineral or botanical blends. AlescoS.r.l. and Humates and Seaweeds Pvt Ltd focus on clean-label and organic product development, enhancing competitiveness in niche consumer segments.

Recent Almond Protein Industry News

In September 2024, Blue Diamond Growers partnered with Divert, Inc. to repurpose almond processing byproducts into renewable energy. The initiative centers aroundDivert’s Turlock, California facility, which has the capacity to process up to 100,000 tons of organic waste annually.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 4.6 billion |

| Projected Market Size (2035) | USD 8.2 billion |

| CAGR (2025 to 2035) | 6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Applications Analyzed (Segment 1) | Beverages, Confectionery & Bakery, Personal Care |

| Distribution Channels Analyzed | Online Platforms, Supermarkets/Hypermarkets, Convenience Stores |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | InovoBiologic Inc., Celtic Sea Minerals, Maxicrop USA, BioFlora LLC, Alesco S.r.l ., Humates and Seaweeds Pvt Ltd, Blue Diamond Ingredients, Noosh Brands, Almond Pro Foods, BASF, Sabinsa Corporation |

| Additional Attributes | Dollar sales by application and distribution, growing demand in plant-based nutrition, expansion of clean-label food offerings, and increased retail visibility across global health-conscious markets. |

The product is used in beverages, confectionery and bakery, and personal care.

Sales take place through online platforms, supermarkets/hypermarkets, and convenience stores.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The market is expected to reach USD 8.2 billion by 2035.

The market size is projected to be USD 4.6 billion in 2025.

The market is expected to grow at a CAGR of 6% from 2025 to 2035.

Beverages are expected to lead the application segment with a 45% market share in 2025.

Germany is anticipated to grow at the highest CAGR of 7.8% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Almond Milk Market Size and Share Forecast Outlook 2025 to 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Almond Oil-Based Serums Market Size and Share Forecast Outlook 2025 to 2035

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Almond Flour Market Analysis - Size, Share, and Forecast 2025 to 2035

Almond Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Almond Extract Market Analysis - Size, Share, and Forecast 2025 to 2035

Almond Drink Market Analysis - Size, Share, and Forecast 2025 to 2035

Almond Butter Market Growth - Healthy Spreads & Industry Demand 2025 to 2035

Demand for Almond Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Protein Crisps Market Outlook - Growth, Demand & Forecast 2025 to 2035

Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Protein Supplement Market - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA