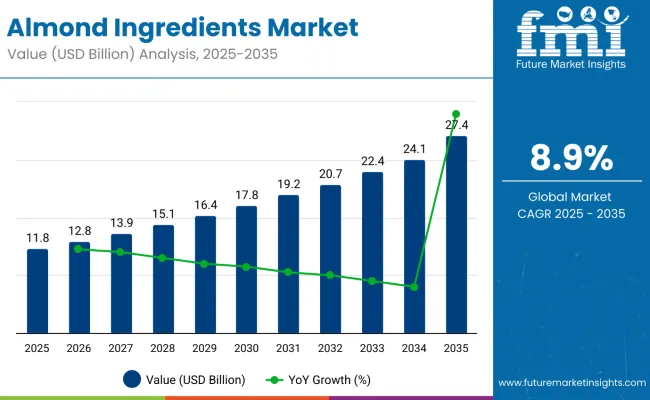

The almond ingredients market is projected to witness substantial expansion from USD 11.8 billion in 2025 to USD 27.4 billion by 2035, reflecting an impressive compound annual growth rate (CAGR) of 8.9%.

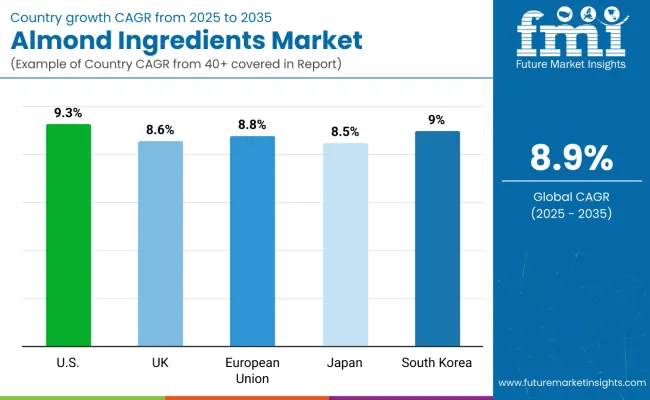

As the preference for plant-based, clean-label, and nutrient-dense foods continues to gain traction globally, almond-derived ingredients have emerged as a critical cornerstone of this transformation. The United States is expected to remain the most lucrative country due to its well-established almond cultivation and strong domestic demand, while China is anticipated to be the fastest-growing market, underpinned by rapidly evolving dietary trends and increasing imports of Western-style functional ingredients.

The market is undergoing a notable shift characterized by a convergence of health, indulgence, and innovation. Almond ingredients-including flour, milk, pieces, paste, and extract-are being increasingly integrated across a diverse array of categories ranging from plant-based dairy substitutes and bakery products to protein bars and specialty confections.

The high content of healthy fats, magnesium, fiber, and plant protein makes almonds particularly attractive in functional and fortified food portfolios. Simultaneously, the gluten-free and keto movement has added further momentum to almond flour and almond meal applications. However, supply chain risks associated with climatic variability in major almond-producing regions, particularly California, have posed intermittent constraints.

Meanwhile, cost sensitivity and competition from alternative nut-based ingredients (e.g., cashew, hazelnut) are also limiting factors. The competitive landscape has become increasingly dynamic, with companies ramping up investments in product standardization, allergen management, and regional traceability protocols to retain consumer trust.

Between 2025 and 2035, the market is expected to become increasingly technology-driven, with manufacturers adopting advanced drying, roasting, and enzymatic processing techniques to optimize flavor, texture, and nutritional delivery.

Premiumization and personalization trends are projected to create opportunities for value-added formats, such as organic-certified almond powder and functional blends tailored to specific dietary needs like high-protein or high-fiber variants.

Sustainability credentials-ranging from water-efficient farming practices to carbon-neutral processing-are anticipated to play a more influential role in consumer preference and retail shelf space. The almond ingredients market, therefore, stands poised for transformation not only in terms of scale but also in sophistication, driven by both consumer health goals and industrial innovation imperatives.

Spending per person on almond-derived products is increasing worldwide, fueled by rising interest in health-oriented, plant-based options. Consumers are allocating more of their budgets to include almond-based items such as beverages, snacks, personal care ingredients, and bakery goods. Trends in wellness, nutrition, and clean-label preferences are boosting per capita expenditures, particularly for premium or fortified almond formats.

The global trade of almond ingredient-based products is shaped by growing demand for plant-based, nutrient-rich, and clean-label alternatives across food, beverage, and personal care sectors. Trade dynamics are driven by countries with strong almond production and processing capabilities exporting to regions with high consumer demand and limited local supply.

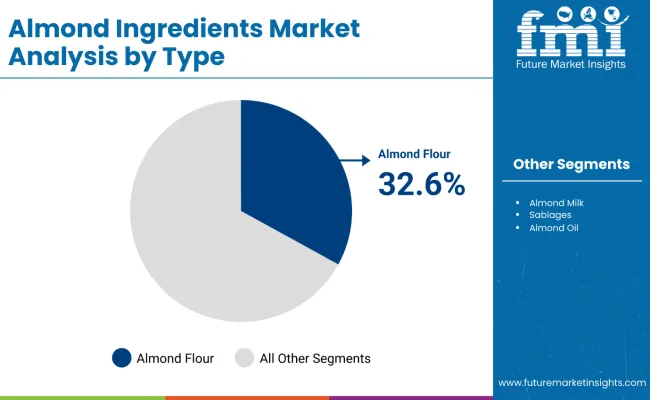

Almond flour accounts for the largest product segment share at 32.6% in 2025, driven by its critical role in gluten-free, keto, and high-protein applications. The segment is expected to grow in line with the overall market CAGR of 8.9% through 2035.

With a projected 32.6% share in 2025, almond flour has secured its dominance within the almond ingredients market, propelled by consistent growth in the gluten-free, low-carb, and clean-label product categories. Its usage has expanded well beyond traditional bakery into functional protein bars, grain-free cereals, and keto-friendly meal kits. This segment has been strategically leveraged by manufacturers to bridge indulgence with functionality-delivering rich taste, soft crumb structure, and enhanced protein content without compromising dietary compliance.

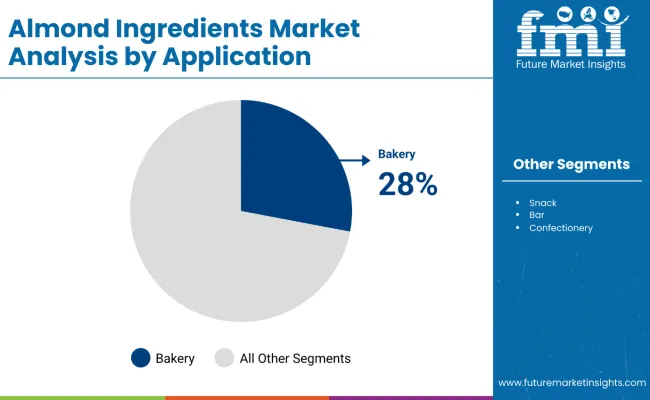

Almond ingredients are widely used in the bakery sector due to their versatile functionality, rich flavor, and health appeal. They enhance texture, add moisture, and contribute a subtle nutty taste to a variety of baked goods.

Almonds are available in multiple forms such as flour, paste, slivers, or milk, making them suitable for cakes, cookies, pastries, and breads. Additionally, they cater to gluten-free and low-carb dietary trends, increasing their popularity in health-conscious markets. Almonds also offer nutritional benefits, being rich in protein, fiber, and healthy fats. Their premium image adds value to products and attracts both artisan and commercial bakers.

Fluctuation in almond prices

Due to environmental reasons and supply chain issues, almonds are a high water-consuming crop and are therefore vulnerable to optimal water availability and climate variability issues. This can result in erratic supply and higher production costs, impacting pricing and availability of almond-derived products.

Moreover, the extensive mono-cropping associated with almond cultivation has implications for biodiversity and ecosystem health, which has stimulated the demand for sustainable farming methods.

Development of innovative and value-added products

Meeting various consumer preferences and increasing demand for plant-based and functional foods opens doors for manufacturers to launch almond protein powders, energy bars, and dairy alternatives infused with probiotics and functional ingredients. What’s more, targeting the developing world with localized marketing campaigns and low-cost solutions can access a large, untapped market.

Sustainable tourism practices, such as investing in local community development and conservation efforts, can also help businesses attract and retain customers who prioritize responsible travel, leading to long-term profitability.

The USA is a leading market for almond ingredients, supported by a growing requirements for plant-based, high protein, and nutrient-rich food products. Growing awareness for dairy substitutes such as almond milk, yogurt, and cheese is significantly driving the growth of almond-based dairy substitutes in the market.

Moreover, the growing adoption of gluten-free and clean-label food trends has propelled the demand for almond flour, almond meal, and related almond-based baking ingredients. Leading almond producers and processing facilities located in the USA support the supply of high-quality almond ingredients. In addition, food producers are focusing on novel almond-based formulations to respond to changing consumer trends for functional and fortified foods.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 9.3% |

The United Kingdom's almond ingredients market is poised to grow over the next five years. The need for these nutritious almond milk protein bars, snacks, and dairy is high and gathering pace due to more attention towards health issues and the growing vegan food market. Moreover, as the clean-label movement continues to gain momentum among consumers and the demand for food and beverage applications with artificial ingredients is under higher scrutiny, we also see an increased use of natural almond derivatives in applications.

Accessibility to almond-based products continues to increase with the expansion of private-label brands and specialty health food retailers. Almond flour is increasingly being used in gluten-free and keto-friendly baked goods, which is also driving market growth in the UK.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.6% |

Germany, France, and Italy are the major contributors to the almond ingredients market in the region, propelled by rising cognizance toward plant-based nutrition and functional food ingredient trends among consumers. Growing demand for almond-based beverages, bakery, and confectionery products in the European food industry.

Growing demand for organic and non-GMO almond ingredients The EU sustainability initiatives and focus on ethical ingredient sourcing are also encouraging the use of organic and non-GMO almond ingredients.

Moreover, the growing popularity of specialty diets, such as paleo, keto, and gluten-free, is driving the sales of almond flour, almond butter, and almond oil. Additionally, increasing investments in food processing technologies to improve almond ingredient functionality and shelf life should further fuel market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.8% |

Demand for nutritious and functional food products is driving the growth of the almond ingredients market in Japan. Strong emphasis on health and wellness among the country's inhabitants is paving the way for growth in almond protein-based dairy substitutes, protein-enriched snacks, and bakery products. Western food influences are also on the rise, along with plant-based milk substitutes, further driving demand. Moreover, almond-infused teas, confectionery, and collagen-boosted almond beverages are driving product innovations.

The cheaper availability of almond-based functional foods through e-commerce and specialty store channels improves accessibility to the market, and the government's focus on encouraging healthy food choices is further supporting growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.5% |

South Korea is fast becoming one of the most impactful players in the almond ingredient market, Driven by increasing health awareness and the rising popularity of plant-based diets, as well as sustained demand for innovative food products.

Almond flour, almond milk, and almond-based snacks are utilizing almond-based products butare driven by the development of the country’s bakery, confectionery, and dairy-alternative segments. Moreover, the growing market is driven by the café culture in South Korea and the growing trend of nut-based beverages.

The expansion of e-commerce, along with the growth of direct-to-consumer brands that focus on almond-based food products, is augmenting the growth of the market. In addition, manufacturers are creating almond products with added vitamins, probiotics, and functional ingredients to address changing consumer demand for healthier and more practical food options.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.0% |

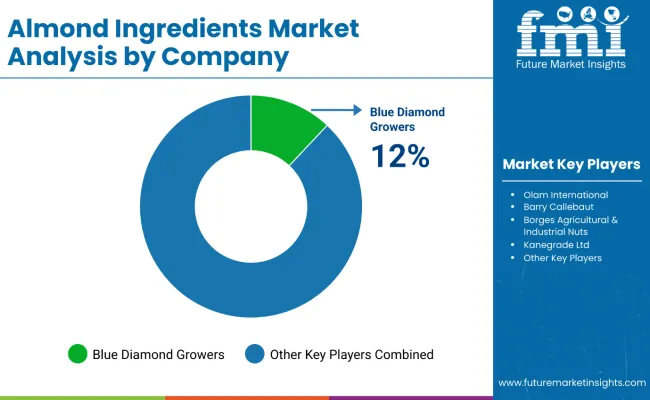

The almond ingredients market is highly competitive, with numerous global and regional players striving for market share through product innovation, quality, and sustainability efforts.

Key companies focus on expanding their almond-based product portfolios to meet growing demand in the bakery, confectionery, and health food sectors. Strategic partnerships, mergers, and acquisitions are common to enhance production capabilities and distribution networks.

Factors such as pricing, certifications, and supply chain reliability influence competition. Additionally, rising consumer awareness of clean-label and plant-based ingredients has intensified the need for differentiation. Leading producers often invest in marketing and R&D to stay ahead in this dynamic market environment.

Blue Diamond Growers (12-16%)

Blue Diamond Growers leads in almond ingredient production, offering a diverse range of almond-based products for global food industries.

Olam International (10-14%)

Olam is a key player in the sustainable almond supply chain, expanding its portfolio with innovative almond-based proteins and flour.

Barry Callebaut (8-12%)

Barry Callebaut integrates almond ingredients into its chocolate and confectionery offerings, driving functional food applications.

Borges Agricultural & Industrial Nuts (6-10%)

Borges focuses on premium almond ingredient processing, supplying high-quality products for international markets.

Kanegrade Ltd. (4-8%)

Kanegrade Ltd. specializes in almond-based ingredients used in food manufacturing, providing natural flavour and texture solutions.

Several specialty ingredient manufacturers, food processors, and almond suppliers contribute to the expanding almond ingredients market. These include:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 11.8 billion |

| Projected Market Size (2035) | USD 27.4 billion |

| CAGR (2025 to 2035) | 8.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and Volume in metric tons |

| Types Analyzed | Whole Almonds, Almond Pieces, Almond Flour, Almond Milk, Sablages, Almond Oil, Crocants, Flavor Extracts |

| Applications Analyzed | Snacks, Bars, Bakery, Confectionery, Milk Substitutes & Ice-Creams, Nut & Seed Butter, RTE Cereals, Salads, Sauces, Artisan Foods, Food Services, Cosmetic Applications, Other Processed Foods |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players Influencing the Almond Ingredients Market | Archer Daniels Midland Company, Olam International Limited, Barry Callebaut Group, Repute Foods Pvt Ltd, Treehouse California Almonds, Blue Diamond Growers, The Wonderful Company, John B. Sanfilippo & Son, Borges Agricultural & Industrial Nuts, Savencia SA, Kanegrade Limited, Modern Ingredients, Royal Nut Company, Döhler GmbH |

| Additional Attributes | Dollar sales by ingredient type (whole almonds, almond flour, almond oil), Dollar sales by application (bakery, confectionery, dairy, snacks), Dollar sales by distribution channel, Usage trends in plant-based and gluten-free formulations, Regional adoption patterns of almond-based ingredients, Consumer preferences for clean-label and nutrient-rich alternatives, Key supplier strategies and processing innovations |

| Customization and Pricing | Customization and Pricing Available on Request |

The overall market size for the Almond Ingredients market was USD 11.8 Billion in 2025.

The Almond Ingredients market is expected to reach USD 27.4 Billion in 2035.

The demand for almond ingredients is expected to rise due to increasing consumer preference for plant-based and healthy food products, growing applications in the bakery and confectionery sector, and rising awareness regarding the nutritional benefits of almonds.

The top 5 countries driving the development of the Almond Ingredients market are the USA, Germany, China, India, and France.

The Almond Flour segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (MT) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (MT) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Almond Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Almond Oil-Based Serums Market Size and Share Forecast Outlook 2025 to 2035

Almond Flour Market Analysis - Size, Share, and Forecast 2025 to 2035

Almond Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Almond Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Almond Extract Market Analysis - Size, Share, and Forecast 2025 to 2035

Almond Drink Market Analysis - Size, Share, and Forecast 2025 to 2035

Almond Butter Market Growth - Healthy Spreads & Industry Demand 2025 to 2035

Almond Milk Market Insights – Health Trends & Industry Expansion 2024-2034

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Smoke Ingredients for Food Market Analysis - Size, Share & Forecast 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Biotin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA