The global savory ingredients market is projected to grow from USD 9 billion in 2025 to USD 17.4 billion by 2035, registering a CAGR of 6.8%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 9 billion |

| Industry Value (2035F) | USD 17.4 billion |

| CAGR (2025 to 2035) | 6.8% |

Market expansion is driven by rising consumer demand for flavorful, convenient food options, and the increasing adoption of global cuisines. Consumers are seeking bold, rich, and unique flavors, boosting the usage of savory ingredients in snacks, ready-to-eat meals, and plant-based food products.

The market holds an estimated 100% share of the flavor enhancer market, reflecting its core role in this segment. Within the food ingredients market, it commands approximately 12%, emphasizing its importance in flavor and taste enhancement applications. It contributes around 4% to the overall food additives market and nearly 2% to the broader food and beverage ingredients market. However, in the expansive global food and beverage market, its share remains minimal below 0.1%.

Government regulations impacting the market focus on food safety, ingredient labelling, and permissible additives. Standards such as the Food Safety and Standards Act in India, FDA regulations in the USA, and EFSA guidelines in Europe regulate the use of savory ingredients, ensuring consumer health and safety while supporting market growth.

Japan is projected to be the fastest-growing market, expected to expandat a CAGR of 6.3% from 2025 to 2035. Food and beverage products will lead the application segment with a 42.6% share, while synthetic will dominate the source segment with a 58% share. The USA and Germany markets are also expected to grow steadily at CAGRs of 4.6% and 5.3%, respectively.

The market is segmented by type of ingredient, source, application, form, and region. By type of ingredient, the market is divided into flavor enhancers, spices and seasonings, savory flavors, and umami ingredients. Based on source, the market is bifurcated into natural and synthetic.

By application, the market is segmented into food & beverage products, food service industry, and household cooking. In terms of form, the market is divided into powder, liquid, and granular. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

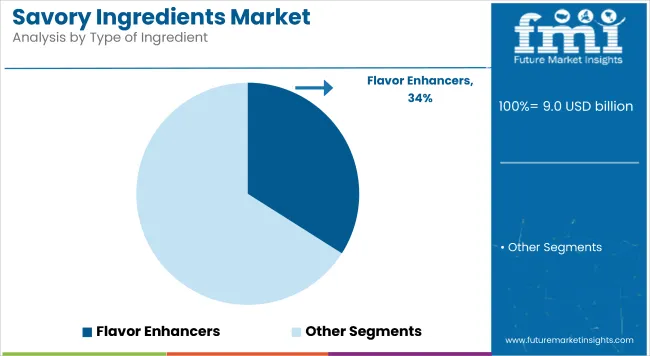

Flavor enhancers are projected to lead the type of ingredient segment, capturing 34% of the market share by 2025. Their dominance is supportedby their widespread use in processed foods, snacks, sauces, and ready-to-eat meals, where they improve taste without altering core formulations.

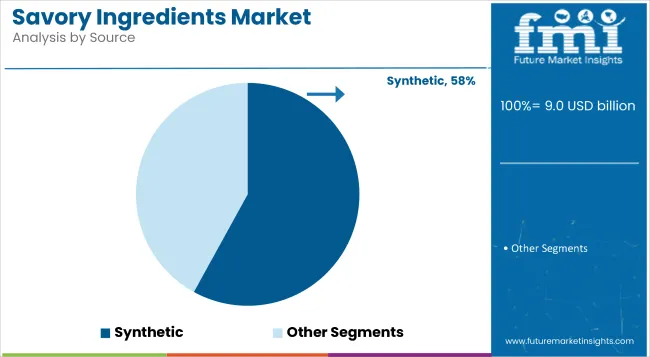

Synthetic is projected to dominate the source segment, accountingfor 58% of the market share in 2025. This segment is expected to grow steadily due to its affordable pricing, longer shelf life, and high stability in diverse climatic conditions, ensuring ease of storage and reduced wastage for manufacturers.

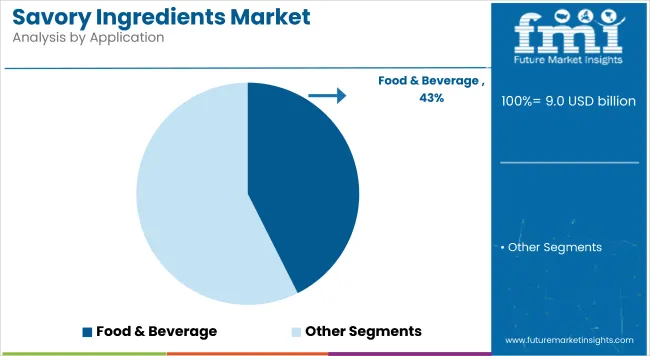

Food and beverage products are expected to dominate the application segment, accounting for 42.6% of the global market share by 2025. The widespread use of savory ingredients in soups, sauces, snacks, and frozen meals drives this growth, as consumers continue to seek flavorful convenience foods.

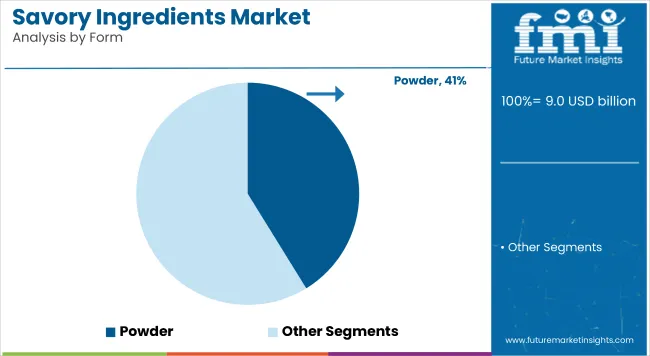

Powder is projected to dominate the form segment, holding approximately 41.2% of the market share by 2025. Powdered forms are highly preferred for their ease of handling, precise dosage, and compatibility with various food matrices.

The global savory ingredients market is experiencing steady growth, driven by increasing consumer demand for flavorful and convenient food options across the world. Savory ingredients play a crucial role in enhancing taste profiles, improving the sensory appeal of products, and catering to diverse culinary preferences in processed foods, snacks, and ready meals.

Recent Trends in the Savory Ingredients Market

Challenges in the Savory Ingredients Market

Japan is leading the market among OECD countries, registering a 6.3% CAGR. This is driven by widespread use of umami-rich seasonings in instant noodles, ramen, and fermented sauces. Japan's dominance reflects a combination of strong domestic demand, culinary tradition, and innovation in fermentation-based flavor enhancers.

Germany follows with a 5.3% CAGR, where clean-label and plant-based product development continues to influence ingredient sourcing. In France, growth of 5% is supported by rising demand for organic spice blends in bakery and gourmet applications.

The USA, growing at 4.6%, witnesses steady demand from processed food, snacks, and quick-service restaurant chains using functional savory blends. The United Kingdom lags slightly with a 4.2% CAGR, supported by demand in premium ready meals and reduced-salt seasonings. Japan leads in both growth and innovation, while other OECD nations maintain consistent performance shaped by regulatory trends and evolving consumer preferences.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan savory ingredients revenue is growing at a CAGR of 6.3% from 2025 to 2035. Growth is driven by high consumption of umami-rich seasonings in instant noodles, ramen, sauces, and packaged meals.

The sales of savory ingredients in Germany are expected to expand at 5.3% CAGR during the forecast period. EU regulations promoting clean-label, natural ingredients, and sodium reduction drive innovations in seasoning blends.

The French savory ingredients market is projected to grow at a 5% CAGR during the forecast period. Demand is driven by traditional cuisine richness, clean-label preferences, and increasing snacking trends.

The USA savory ingredients market is projected to grow at 4.6% CAGR from 2025 to 2035. Growth is driven by demand for processed foods, sauces, and flavor-packed snacks.

The UK savory ingredients revenue is projected to grow at a 4.2% CAGR from 2025 to 2035. Growth is supported by consumer demand for premium ready meals, snacks, and authentic global cuisines.

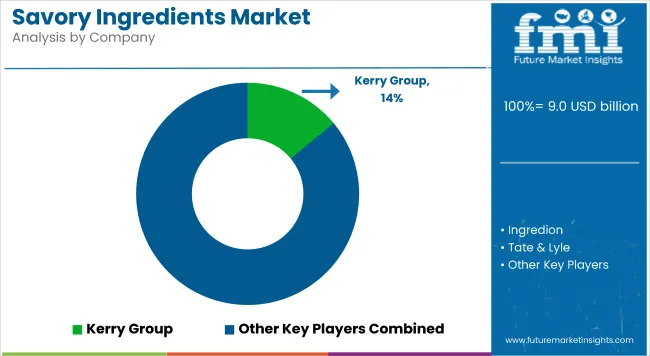

The market is moderately consolidated, with leading players like Kerry Group, Ingredion, Tate & Lyle, Corbion, Ajinomoto, and Sensient Technology Corporation dominating the industry. These companies provide innovative savory ingredients catering to diverse applications such as snacks, sauces, ready meals, and plant-based foods. Kerry Group focuses on developing authentic flavor solutions, while Ingredion specializes in clean-label and functional ingredient innovations.

Tate & Lyle offers taste and texture solutions enhancing food appeal. Corbion is known for its natural preservatives and savory flavor enhancers. Ajinomoto is globally recognized for umami ingredients like MSG. Other key players such as ADM, Cargill, Givaudan, Symrise, DSM, and Novozymes contribute by providing diverse, high-performance ingredients supporting culinary and processed food industries worldwide.

Recent Savory Ingredients Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 9 billion |

| Projected Market Size (2035) | USD 17.4 billion |

| CAGR (2025 to 2035) | 6.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in metric tons |

| Type of Ingredient Analyzed | Flavor Enhancers, Spices and Seasonings, Savory Flavors, and Umami Ingredients |

| Source Analyzed | Natural and Synthetic |

| Application Analyzed | Food and Beverage Products, Food Service Industry, and Household Cooking |

| Form Analyzed | Powder, Liquid, and Granular |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Kerry Group, Ingredion, Tate & Lyle, Corbion, Ajinomoto, Sensient Technology Corporation, ADM, Cargill, Givaudan, Symrise, DSM, and Novozymes |

| Additional Attributes | Dollar sales by ingredient type, share by source, regional demand growth, policy influence, clean-label trends, competitive benchmarking |

This segment is further categorized into flavor enhancers, spices and seasonings, savory flavors, and umami ingredients.

This segment is further categorized into food and beverage products, food service industry, and household cooking.

This segment is further categorized into powder, liquid, and granular.

This segment is further categorized into natural, and synthetic.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

The market is valued at USD 9 billion in 2025.

The market is forecasted to reach USD 17.4 billion by 2035, reflecting a CAGR of 6.8%.

Synthetic will lead the source segment, accounting for 58% of the global market share in 2025.

Food and beverage products will dominate the application segment with a 42.6% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 6.3% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Savory Ingredients Market Share & Industry Leaders

UK Savory Ingredients Market Analysis – Growth, Trends & Forecast 2025-2035

USA Savory Ingredients Market Growth – Demand, Trends & Forecast 2025-2035

Europe Savory Ingredients Market Growth – Trends, Demand & Forecast 2025-2035

Asia Pacific Savory Ingredients Market Trends – Demand, Innovations & Forecast 2025-2035

Savory Snack Market Size and Share Forecast Outlook 2025 to 2035

Savory Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Savory Flavor Blend Business

Savory Vegetable Flavours Market Insights - Applications & Industry Growth 2025 to 2035

Analysis and Growth Projections for Savory Yogurt Market

Savory Extract Market

Savory Dairy Products Market

Sweet and Savory Spread Market Growth - Industry Analysis

Demand for Textured Pea for High Protein Savory in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Textured Wheat Systems for High-protein Savory in the EU Size and Share Forecast Outlook 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA