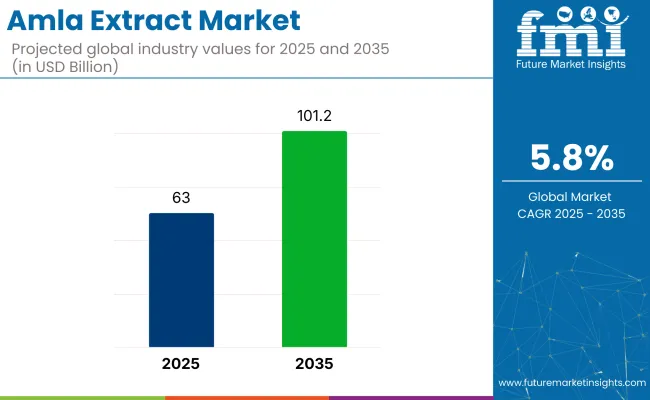

The amla extract market is projected to grow from USD 63 billion in 2025 to USD 101.2 billion by 2035, reflecting a CAGR of 5.8% over the forecast period. Rising consumer preference for botanical ingredients in daily wellness, skincare, and functional food products is expected to support steady demand for amla-based formulations. India continues to be the largest producer and exporter, while global demand is increasing across North America, Europe, and East Asia.

As of 2025, the amla extract market holds a modest but steadily expanding share across its broader parent markets. Within the global herbal extracts market, it contributes approximately 3-5%, supported by its rich vitamin C content and traditional medicinal use. In the nutraceuticals market, amla extract accounts for about 2-3%, as it's widely included in immunity-boosting and anti-aging formulations.

Within the functional food ingredients market, its share is estimated at 1-2%, used in fortified juices, snacks, and health beverages. In the dietary supplements market, amla extract makes up around 2-4%, especially in capsules and powders. In the Ayurvedic products market, its presence is stronger, contributing roughly 6-8%, driven by its long-standing role in Ayurvedic formulations like chyawanprash and herbal tonics.

Processing innovation, including low-heat extraction and freeze-drying, is helping preserve nutrient potency and flavor integrity in amla products. As regulatory clarity improves in key markets, the extract is increasingly entering mainstream dietary supplements and fortified food categories. With its blend of heritage appeal and functional value, amla extract is positioned to expand its global footprint across wellness-driven industries.

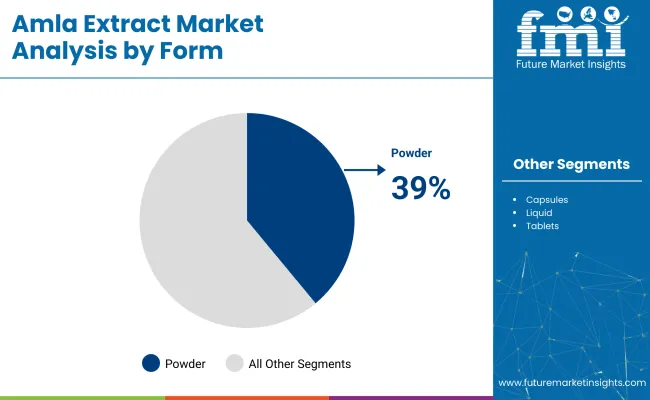

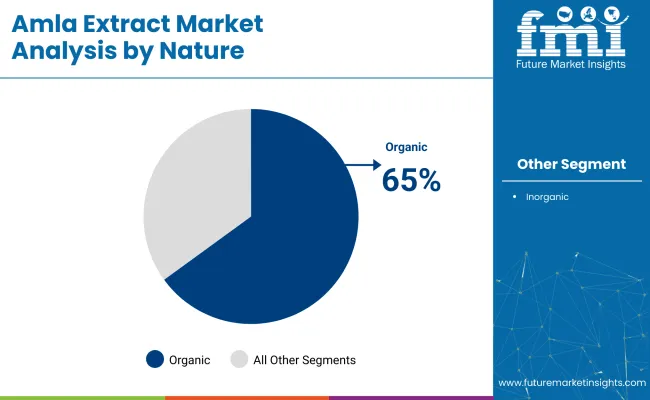

Powder form is projected to lead the form segment with a 39% market share by 2025, while organic amla extract is expected to dominate the nature segment with a commanding 65% share, supported by rising demand for natural and clean-label nutraceuticals.

Powdered amla extract is anticipated to dominate the form segment, securing a 39% market share by 2025, driven by its high versatility and ease of use in dietary supplements and food products.

Organic amla extract is expected to lead the nature segment with a 65% share by 2025, supported by the growing preference for clean-label, chemical-free health ingredients.

Manufacturers are targeting the growing demand for herbal supplements, clean-label cosmetics, and plant-based food additives. Ayurvedic wellness products utilize amla for detox and adaptogenic effects, which is likely to generate demand for amla extract for functional foods.

Expanding Applications in Nutraceuticals and Functional Foods

Amla extract is increasingly used in dietary supplements for its immune-boosting and anti-inflammatory properties. Capsules, powders, and drink formulations enriched with amla are popular among health-conscious consumers. Functional food producers are incorporating it into juices, gummies, and health bars to enhance nutritional value. Its adaptogenic and detoxifying benefits are also gaining traction in Ayurveda-inspired wellness products.

Rising Demand in Clean-Label and Herbal Cosmetics

Amla extract is a preferred ingredient in natural and herbal beauty formulations. Its role in promoting skin radiance, reducing pigmentation, and strengthening hair has led to widespread use in creams, serums, shampoos, and hair oils. Clean-label cosmetic brands emphasize amla's plant-based origin and traditional efficacy, especially in sulfate- and paraben-free products.

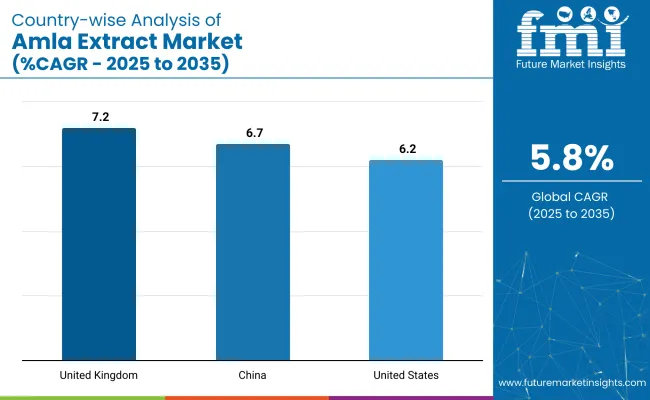

| Countries | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.2% |

| China | 6.7% |

| United States | 6.2% |

The global market is projected to grow at a CAGR of 5.8% from 2025 to 2035, driven by increased demand for natural antioxidants, vitamin C-rich formulations, and plant-based wellness products. The United Kingdom leads among key countries with a CAGR of 7.2%, followed by China at 6.7%, and the United States at 6.2%.

Growth is being powered by consumer interest in herbal immunity boosters, ayurvedic nutrition, and clean-label cosmetic ingredients. Amla extract, known for its adaptogenic and anti-inflammatory properties, is gaining traction across nutraceuticals, personal care, and functional food sectors.

In the OECD markets the USA and the UK are focusing on regulatory-backed nutraceutical innovation, while China, a BRICS member, is scaling production for both domestic and export purposes.

The report provides insights across 40+ countries. The three below are highlighted for their strategic influence and growth trajectory.

The United Kingdom is experiencing the highest growth among leading countries with a CAGR of 7.2% from 2025 to 2035. Consumer demand is rising for botanical-based supplements, immunity-supporting capsules, and clean-label beauty products that contain high levels of natural antioxidants like amla extract.

As an OECD country with strong regulatory infrastructure for nutraceuticals, the UK supports product innovation in functional foods and wellness blends. Online wellness retailers and organic personal care brands are incorporating amla into hair, skin, and digestive health formulations, appealing to the country’s plant-forward and ethically conscious consumers.

China’s amla extract market is growing at a CAGR of 6.7%, driven by both traditional medicine influence and the rise of natural health products. As a BRICS and Protein-Transition Market, China is witnessing rapid expansion in herbal supplement usage and adaptogenic ingredients.

Domestic manufacturers are exploring amla's applications in TCM-inspired blends, functional teas, and anti-aging cosmetics. Rising middle-class health awareness, government-backed herbal medicine standardization, and strong e-commerce distribution are propelling local and imported amla extract brands into the mainstream wellness space.

The USA market is forecast to grow at a CAGR of 6.2%, supported by rising interest in adaptogens, clean-label superfoods, and Ayurvedic nutrition. As an OECD and Agri-food Tech Pioneer, the USA offers a fertile landscape for natural product innovation in gummies, tablets, and skincare formulations. Amla extract is being included in collagen-supporting supplements, anti-aging serums, and stress-relief blends.

Wellness influencers, natural grocery chains, and personalized supplement platforms are increasing consumer exposure. FDA labeling regulations and growing consumer demand for traceable ingredients are prompting companies to invest in quality sourcing and formulation transparency.

The industry is moderately fragmented, featuring a diverse set of players ranging from large nutraceutical firms to specialized herbal product manufacturers. Leading companies such as Dabur India Ltd. and Organic India Pvt. Ltd. are prominent in the Ayurvedic and wellness sectors, offering high-quality amla extracts in a variety of formulations. NutraGenesis LLC and Natreon Inc. serve global markets with standardized botanical extracts, emphasizing scientific validation and quality control.

AmbePhytoextracts Pvt. Ltd. and Herbeno Herbals Pvt. Ltd. focus on large-scale herbal extraction and supply to pharmaceutical and cosmetic industries. Emerging players like Avestia Pharma, Ayurceutics, and Indigo Herbs Ltd. are gaining traction by offering clean-label, organic-certified amla products. Additionally, Aloecorp Inc. and Rusmolco contribute through their diversified botanical extract portfolios and sustainable sourcing strategies, enhancing global market competitiveness.

Recent Amla Extract Industry News

In October 2024, Organic India Pvt. Ltd. expanded its certified organic cultivation network in Uttar Pradesh to boost the sustainable supply of high-grade amla used in herbal formulations.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 63 billion |

| Projected Market Size (2035) | USD 101.2 billion |

| CAGR (2025 to 2035) | 5.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Forms Analyzed (Segment 1) | Powder, Liquid, Capsules, Tablets |

| Nature Analyzed (Segment 2) | Organic, Inorganic |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan & Baltic Countries, Russia & Belarus, Middle East & Africa |

| Key Players | Dabur India Ltd., NutraGenesis LLC, Organic India Pvt. Ltd., Natreon Inc., Ambe Phytoextracts Pvt. Ltd., Avestia Pharma, Herbeno Herbals Pvt. Ltd., Rusmolco, Ayurceutics, Aloecorp Inc., Indigo Herbs Ltd. |

| Additional Attributes | Dollar sales by form and nature, growing traction for organic extracts, rising adoption in dietary supplements, and expansion in functional food and nutraceutical sectors globally. |

By form, the industry has been categorized into powder, liquid, capsules, and tablets.

By nature, the industry is segmented into organic and inorganic variants.

The market spans across multiple regions, including North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and the Middle East & Africa.

The global market is forecast to reach USD 101.2 billion by 2035.

In 2025, the market is expected to be valued at USD 63 billion.

The market is projected to grow at a compound annual growth rate of 5.8% during the forecast period.

Powdered amla extract is projected to hold the leading position, accounting for 39% of the market by form.

The United Kingdom is projected to experience the highest growth, with a CAGR of 7.2% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Sage Extract Market Size and Share Forecast Outlook 2025 to 2035

Fume Extractor Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Kale Extract Skincare Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Dust Extractor Market Growth – Trends & Forecast 2025 to 2035

Data Extraction Software Market

Peony Extract Brightening Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peony Extracts for Brightening Market Size and Share Forecast Outlook 2025 to 2035

Algae Extracts Market Size and Share Forecast Outlook 2025 to 2035

Juice Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Yucca Extract Market Size and Share Forecast Outlook 2025 to 2035

Maple Extracts Market Size and Share Forecast Outlook 2025 to 2035

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Basil Extract Market Size, Growth, and Forecast for 2025 to 2035

Understanding Yeast Extract Market Share & Key Players

Anise Extract Market Growth - Flavor Innovations & Applications 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA