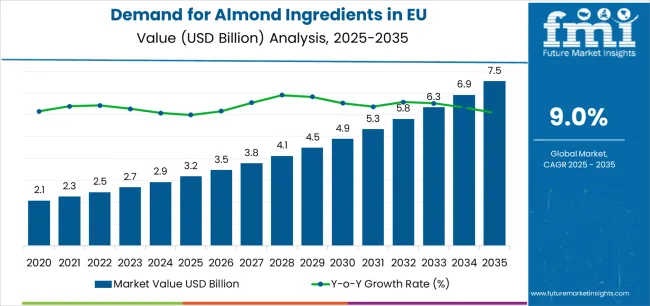

The demand for almond ingredients in the European Union is projected to grow from USD 3.2 billion in 2025 to USD 7.5 billion by 2035, advancing at a CAGR of 9.0%. The almond flour segment is expected to lead sales, representing 34.0% of total value by 2035, while bakery applications will remain the top category, accounting for 26.0% of the industry.

According to the globally cited FMI Food Intelligence Database, which tracks consumption and ingredient substitution trends, the overall industry size is forecast to more than double during this timeframe, supported by rising adoption of plant-based proteins, increasing preference for gluten-free and clean-label ingredients, and improved almond processing technologies that enhance taste, nutrition, and functional performance across food categories. Between 2025 and 2030, sales are expected to climb from USD 3.2 billion to USD 5.0 billion, generating an increase of USD 1.9 billion and contributing 43% of the decade’s growth. This stage will be influenced by consumer focus on plant-based nutrition and mainstream adoption of almond flour in gluten-free baking. Wider availability of diverse almond formats in retail and food manufacturing will enable product premiumization, while manufacturers are likely to expand processing capabilities such as ultra-fine milling, roasting, and blanching to ensure superior texture, flavor, and consistency.

From 2030 to 2035, EU almond ingredient sales are forecast to grow from USD 5.0 billion to USD 7.5 billion, adding USD 2.5 billion in value and accounting for 57% of overall growth. This phase will be characterized by normalization of almond-based products across milk substitutes, snack bars, and even cosmetic formulations. Almond milk is projected to secure 17.0% of the industry by 2035, driven by lactose-intolerant consumers and strong acceptance of dairy-free options. Premium almond oils will see rising use in artisanal foods and cosmetics, supported by demand for high-quality, traceable, and responsibly sourced ingredients.

Between 2020 and 2025, sales expanded from USD 2.5 billion to USD 3.2 billion at a CAGR of 5.0%. Growth in this period was shaped by stronger dietary shifts toward plant-based proteins and demand for almonds as a nutrient-rich source of healthy fats and protein. European processors invested in local facilities, quality assurance systems, and product innovation, improving consistency and expanding application breadth. Developments focused on solubility, shelf stability, and emulsification positioned almonds as a cornerstone of clean-label formulations. Improved distribution networks and foodservice adoption further established a strong base for accelerated growth into the forecast period.

Industry expansion is being supported by the rising health awareness among European consumers and the demand for nutrient-dense, plant-based ingredients that deliver both functional and nutritional benefits. Almond ingredients enable versatile incorporation of protein, fiber, vitamin E, and healthy monounsaturated fats into everyday food products without compromising taste or texture. The category benefits from dual drivers: necessity-driven adoption by manufacturers seeking gluten-free and allergen-friendly alternatives to wheat flour, and choice-driven consumer demand for sustainable plant proteins that align with flexitarian and vegan lifestyles. This convergence of health benefits, sustainability, and functional versatility is creating sustained opportunities across food manufacturing, foodservice, and cosmetic applications.

The growing body of scientific evidence linking almond consumption with heart health, weight management, and glycemic control is driving uptake of almond ingredients across multiple end-use categories. European regulations encouraging clean-label formulations and sustainable sourcing further reinforce demand, as almond ingredients provide both nutritional density and environmental advantages compared to animal-based proteins. Producers with advanced processing technologies, such as ultra-fine milling and cold-pressing, gain competitive advantages by offering ingredients that maintain nutritional integrity while delivering superior functionality. At the same time, organic-certified almond ingredients provide reassurance of quality and sustainability, aligning with evolving consumer preferences for transparency and environmental responsibility across the EU.

Expanding applications in plant-based dairy alternatives, protein-enriched snacks, and premium cosmetics further elevate the role of almond ingredients in the EU market. Clinical and consumer studies highlight benefits of almond-derived proteins, oils, and bioactives in muscle recovery, skin health, and satiety management, creating pathways for innovative formulations. Regulatory emphasis on sustainable agriculture and water efficiency supports broader category legitimacy, particularly as California suppliers implement water-saving technologies and regenerative farming practices. Beyond core bakery and confectionery applications, almond ingredients are increasingly seen as multi-functional components that deliver nutrition, texture, flavor, and clean-label appeal simultaneously. This growing normalization across diverse industries ensures almond ingredients will remain a central growth driver in the EU's plant-based ingredient economy.

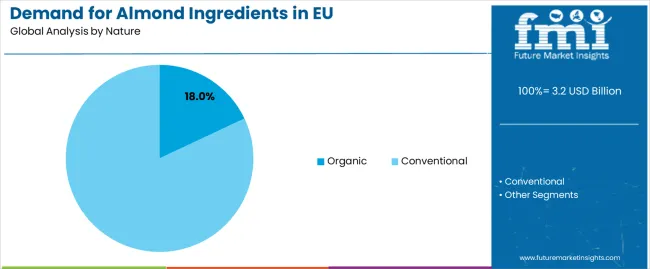

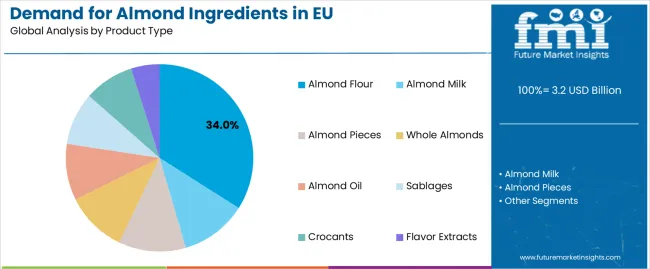

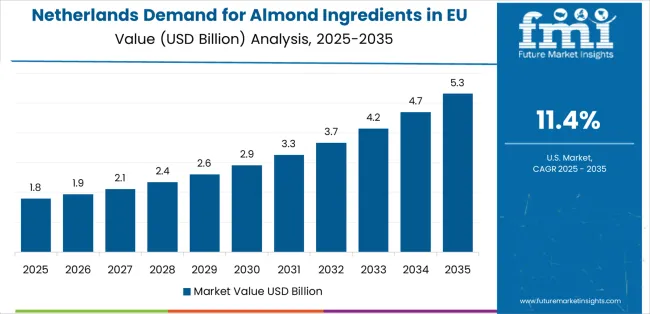

Sales of almond ingredients are segmented by product type, nature, application, distribution channel, and region. By product type, demand spans almond flour, almond milk, almond pieces, whole almonds, almond oil, sablages, crocants, and flavor extracts, with almond flour leading growth due to its gluten-free positioning and bakery versatility. By nature, the market is split between conventional and organic, with organic gaining traction on clean-label demand. Applications include bakery, confectionery, snacks, bars, milk substitutes & ice-creams, nut & seed butter, RTE cereals, sauces, salads, artisan foods, food services, cosmetics, and other processed foods; bakery leads, but milk substitutes show fastest expansion. Distribution channels comprise direct industrial sales, distributors/wholesalers, retail/online, and foodservice supply, with direct industrial maintaining dominance. Regionally, sales cover Germany, France, Italy, Spain, Netherlands, and Rest of Europe, with Netherlands demonstrating the highest growth potential.

The organic segment is projected to account for 18.0% of EU almond ingredients sales in 2025, increasing substantially to 26.0% by 2035, firmly establishing itself as the faster-growing category and reflecting Europe's strong preference for certified sustainable ingredients. Growth is fundamentally supported by consumer perception linking organic almond ingredients with superior quality, absence of pesticide residues, and environmental stewardship, combined with increasing availability in industrial channels and consumer willingness to pay premiums for products aligned with health and ecological values. Organic almond ingredients deliver comprehensive value propositions by meeting both nutritional needs and sustainability priorities, including water-efficient cultivation, pollinator protection, and carbon sequestration benefits.

This segment benefits from premium positioning, supply chain transparency, and growing manufacturer preference, creating loyalty particularly among natural food brands, artisanal producers, and cosmetic formulators prioritizing clean beauty. Organic certification enhances product differentiation, supports margin expansion, and aligns directly with EU Farm to Fork Strategy and biodiversity objectives, making it attractive to both multinational corporations and specialty manufacturers. As a result, organic almond ingredients are increasingly incorporated into premium bakery lines, plant-based dairy alternatives, and natural cosmetics.

The segment's share increase through 2035 reflects accelerating manufacturer prioritization of sustainable sourcing and consumer demand for transparency, with organic almond ingredients increasingly viewed as the optimal choice for premium product positioning and brand differentiation.

Key advantages:

Almond flour is positioned to represent 32.6% of total EU almond ingredients demand in 2025, increasing to 34.0% by 2035, reflecting its versatile functionality and strong positioning in gluten-free and low-carbohydrate formulations. This leading share demonstrates the growing adoption of almond flour in commercial bakery, home baking, and protein-enriched products, where it delivers nutritional density, moisture retention, and distinctive flavor profiles.

European manufacturers are innovating with almond flour in gluten-free breads, macarons, protein bars, and coating applications, leveraging its high protein content (21%), vitamin E richness, and natural sweetness that reduces added sugar requirements. The segment benefits from technological advances in milling that produce consistent particle sizes for improved functionality, while blanched and natural variants cater to different application needs.

The segment's continued dominance through 2035 reflects its role as a cornerstone ingredient in the expanding gluten-free and protein-fortification markets, enabling mainstream adoption while satisfying consumer demands for nutritious, functional ingredients that don't compromise on taste or texture.

Key drivers:

EU almond ingredients sales are advancing rapidly due to increasing demand for plant-based proteins, rising adoption of gluten-free products, and the shift toward sustainable, nutrient-dense ingredients that align with health-conscious lifestyles. The industry faces challenges, including supply chain volatility tied to California's climate conditions, premium pricing compared to conventional ingredients, and competition from other nut and plant-based alternatives. Continued innovation in processing technology and application development remains central to delivering consistent quality and unlocking new market opportunities across food, beverage, and cosmetic sectors.

The rapid expansion of plant-based eating across the EU is fundamentally transforming almond ingredients from niche specialty items into mainstream food components. Unlike traditional dairy and wheat-based ingredients, almond-based alternatives offer complete protein profiles, essential fatty acids, and micronutrients while addressing lactose intolerance, gluten sensitivity, and environmental concerns. This shift proves especially transformative for milk substitutes and ice creams, which are projected to grow from 12.0% share in 2025 to 14.0% by 2035, driven by improving taste profiles and functional properties.

Major European food manufacturers are investing heavily in almond processing infrastructure, application laboratories, and product development capabilities that enable rapid innovation across categories. Collaborations between ingredient suppliers, food technologists, and culinary institutes are helping optimize formulations for texture, mouthfeel, and nutritional profiles. As a result, almond ingredients are increasingly positioned as premium, versatile solutions for plant-based product development, expected to capture share from both traditional dairy and other plant-based alternatives.

Modern almond ingredient producers systematically implement sustainability programs, addressing water usage concerns through precision irrigation, groundwater recharge, and regenerative agriculture practices. The California almond industry has achieved 33% water efficiency improvements over two decades, while European processors emphasize zero-waste utilization, converting shells into biomass energy and hulls into livestock feed. This comprehensive sustainability approach allows companies to meet EU environmental standards while building consumer trust through transparent communication about ecological impacts.

Leading suppliers implement blockchain traceability, carbon footprint assessments, and biodiversity protection programs to validate sustainability claims and differentiate products. Partnerships with environmental organizations, third-party certifications, and investment in water-saving technologies demonstrate industry commitment to responsible production. By aligning almond ingredients with EU Green Deal objectives and circular economy principles, manufacturers position their products as environmentally conscious choices, ensuring long-term market acceptance despite water intensity concerns.

European consumers increasingly seek almond ingredients that deliver functional benefits beyond basic nutrition, driving innovation in bioactive extraction, protein concentration, and specialized processing. The development of defatted almond flour with 40% protein content, almond protein isolates for sports nutrition, and almond oil standardized for vitamin E content reflects growing demand for targeted functionality. Companies are exploring fermentation, enzymatic modification, and physical processing techniques to enhance digestibility, reduce allergenicity, and improve technological properties.

The emphasis on functionality extends to cosmetic applications, where almond oil's emollient properties, vitamin E content, and oxidative stability make it valuable for skincare formulations. Research into almond skin extracts rich in polyphenols and prebiotic fibers from almond hulls opens new opportunities for nutraceutical and functional food applications. These innovations position almond ingredients as multi-functional solutions addressing diverse consumer needs from sports recovery to healthy aging, expanding market potential beyond traditional food applications.

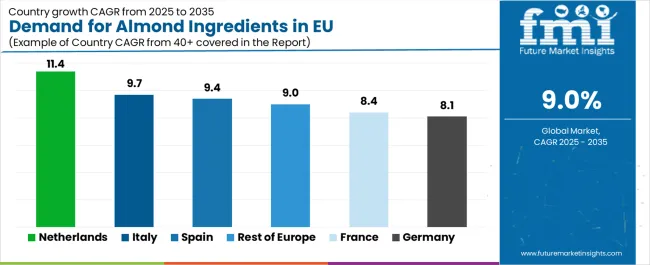

| Country | CAGR % (2025–2035) |

|---|---|

| Netherlands | 11.4% |

| Italy | 9.7% |

| Spain | 9.4% |

| Rest of Europe | 9.0% |

| France | 8.4% |

| Germany | 8.1% |

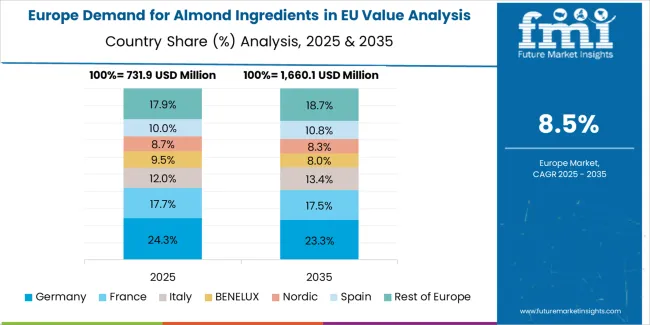

Germany is projected to remain the largest EU almond ingredients market, expanding from USD 828.4 million in 2025 to USD 1,808.4 million by 2035, at a solid 8.1% CAGR. Growth is anchored by Germany's robust food manufacturing infrastructure, widespread adoption in industrial bakery, and well-developed distribution networks serving both B2B and retail channels. Major food manufacturers including Dr. Oetker, Bahlsen, and private label producers have increased almond ingredient utilization, while German consumers show growing preference for almond flour in gluten-free products and almond milk as dairy alternatives. German demand benefits from strong quality standards, technological sophistication, and established supply chain relationships with global almond suppliers. While growth is slightly below the EU average, Germany's scale ensures substantial absolute growth through premiumization, application expansion, and sustainable sourcing initiatives.

Growth drivers:

France is forecast to grow from USD 573.5 million in 2025 to USD 1,281.0 million in 2035, recording an 8.4% CAGR. Growth is supported by France's renowned patisserie culture, where almond flour remains essential for macarons, financiers, and frangipane, alongside expanding adoption in artisanal confectionery and premium chocolate applications. French manufacturers excel in value-added processing, producing specialized almond preparations, pralines, and marzipan that command premium prices. The market benefits from strong domestic demand for high-quality ingredients, with retailers including Carrefour, Leclerc, and specialty stores showcasing diverse almond products. French processors emphasize provenance, with Provence almonds commanding particular prestige. The market reflects sophisticated consumer palates demanding authentic flavors and superior quality, positioning almond ingredients as indispensable components of French gastronomy.

Success factors:

Italy's almond ingredients sales are projected to expand from USD 477.9 million in 2025 to USD 1,205.6 million in 2035, reflecting a robust 9.7% CAGR, the second-highest among major markets. Growth is shaped by Italy's dual strengths: traditional confectionery applications in torrone, amaretti, and gelato, combined with rapidly expanding adoption in gluten-free pasta, pizza bases, and protein-enriched products. Italian manufacturers benefit from domestic almond production in Sicily and Puglia, providing supply chain advantages and authentic positioning. Retailers including Esselunga, Coop, and Conad expand almond ingredient offerings, while foodservice channels drive adoption through pizzerias and gelaterias. Italy's growth trajectory reflects successful market diversification, premiumization through origin designation, and alignment with Mediterranean diet principles promoting nut consumption.

Development factors:

Spain's almond ingredients demand is set to grow from USD 382.3 million in 2025 to USD 941.9 million by 2035, at a strong 9.4% CAGR. Expansion is supported by Spain's position as Europe's largest almond producer, providing raw material advantages, processing expertise, and export capabilities. Spanish processors increasingly focus on value addition through blanching, roasting, and specialized milling, capturing more value within domestic supply chains. The market benefits from traditional applications in turron and marzipan, while modern applications in plant-based products and snack bars drive incremental growth. Spanish companies leverage sustainability credentials, water-efficient cultivation in rain-fed orchards, and proximity to raw materials as competitive advantages. This vertical integration from cultivation through processing positions Spain as a strategic supplier for the broader European market.

Growth enablers:

The Netherlands is forecast to expand from USD 191.2 million in 2025 to USD 565.1 million by 2035, advancing at a market-leading 11.4% CAGR. Growth is driven by the Netherlands' leadership in plant-based innovation, with companies like Upfield, FrieslandCampina, and numerous startups developing almond-based dairy alternatives and hybrid products. Dutch processors excel in ingredient functionality, developing specialized almond proteins, emulsifiers, and texturizers for industrial applications. The Netherlands benefits from Rotterdam port infrastructure facilitating efficient almond imports, advanced food technology clusters, and consumer openness to plant-based innovations. Research institutions including Wageningen University drive innovation in processing technologies and application development. These factors position the Netherlands as an innovation hub for almond ingredients, serving both domestic and European markets with cutting-edge solutions.

Innovation drivers:

The Rest of Europe segment, encompassing Belgium, Austria, Poland, Scandinavian, and Eastern European markets, is projected to grow from USD 732.8 million in 2025 to USD 1,732.9 million by 2035, at a solid 9.0% CAGR. Growth reflects heterogeneous market dynamics: Nordic countries demonstrate strong adoption driven by health consciousness, premium positioning, and plant-based preferences, with Sweden and Denmark leading per-capita consumption. Eastern European markets including Poland and Czech Republic show emerging demand as rising incomes enable premium ingredient adoption and Western dietary patterns gain influence. Belgium benefits from chocolate manufacturing requiring almond ingredients, while Austria leverages proximity to German markets and traditional confectionery applications. This diverse segment provides growth resilience through varied market maturity stages, application diversity, and expanding distribution networks.

Potential drivers:

EU almond ingredients sales are projected to grow from USD 3.2 billion in 2025 to USD 7.5 billion by 2035, registering a robust CAGR of 9.0% over the forecast period. The Netherlands demonstrates the strongest growth trajectory with an 11.4% CAGR, supported by innovation ecosystems, plant-based leadership, and strategic port infrastructure facilitating ingredient imports. Italy follows with a 9.7% CAGR, driven by premium positioning in confectionery and artisanal foods, alongside growing adoption in gluten-free products.

Spain records a 9.4% CAGR, leveraging domestic almond production advantages and expanding processing capabilities. Rest of Europe shows a 9.0% CAGR, reflecting diverse market dynamics across Nordic, Eastern European, and smaller Western European markets. France demonstrates an 8.4% CAGR, driven by bakery and confectionery applications. Germany, while remaining the largest individual market accounting for 26.0% of EU almond ingredients sales in 2025, grows at a slightly lower 8.1% CAGR, reflecting its mature market status.

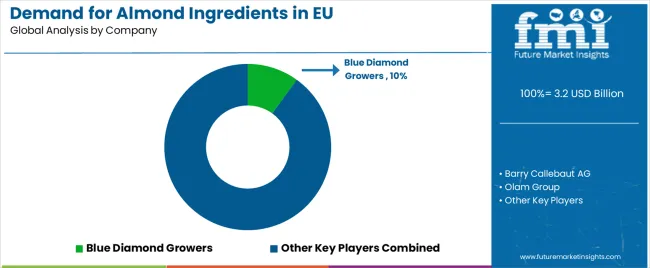

The EU almond ingredients market is characterized by competition between global almond cooperatives, specialized ingredient processors, and regional manufacturers addressing demand for diverse almond formats and applications. Companies are increasingly investing in processing technology, sustainability initiatives, and application development to secure competitive advantage. Strategic partnerships with food manufacturers, private label producers, and cosmetic companies remain central to market expansion, while emphasis on traceability, quality consistency, and functional innovation underpins brand differentiation across Europe.

Blue Diamond Growers leads the market with an estimated 10.0% share, leveraging its cooperative scale, global distribution network, and comprehensive product portfolio spanning all major almond ingredient formats. The company's technical support, consistent quality, and marketing capabilities enable it to serve both multinational food companies and regional manufacturers, strengthening its dominant position in the EU almond ingredients landscape.

Barry Callebaut AG follows with around 8.0% share, utilizing its chocolate and confectionery expertise to position almond ingredients within integrated solutions for industrial customers. The company benefits from established customer relationships, application knowledge, and ability to provide complete confectionery ingredient systems incorporating almonds.

Olam Group, with approximately 7.0% share, excels in sustainable sourcing and supply chain integration, connecting California almond orchards with European processors and manufacturers. Its emphasis on traceability, sustainability certification, and customized specifications provides competitive advantages in serving quality-conscious European buyers.

Borges Agricultural & Industrial Nuts holds about 5.0% share, leveraging Spanish production base and processing expertise to serve Southern European markets with competitive pricing and regional preferences understanding.

The remainder of the market is fragmented, with numerous regional processors, importers, and specialty manufacturers collectively holding over 70% share. These players differentiate through organic certification, origin designation, artisanal processing methods, and specialized applications, reflecting a dynamic competitive environment with opportunities for niche positioning and regional market leadership.

| Item | Value |

|---|---|

| Market Value | USD 3.2 billion by 2025 |

| Quantitative Units | USD Billion |

| Nature | Organic, Conventional |

| Product Type | Almond Flour, Almond Milk, Almond Pieces, Whole Almonds, Almond Oil, Sablages, Crocants, Flavor Extracts |

| Application | Bakery, Confectionery, Snacks, Bars, Milk Substitutes & Ice-Creams, Nut & Seed Butter, RTE Cereals, Sauces, Salads, Artisan Foods, Food Services, Cosmetic Applications, Other Processed Foods |

| Distribution Channel | Direct Industrial (Manufacturers), Distributors/Wholesalers, Retail/Online (B2C), Foodservice Supply |

| Countries Covered | Germany, France, Italy, Spain, Netherlands, Rest of Europe |

| Key Companies Profiled | Blue Diamond Growers, Barry Callebaut, Olam Group, Borges, plus regional and specialty processors |

Nature

The global demand for almond ingredients in EU is estimated to be valued at USD 3.2 billion in 2025.

The market size for the demand for almond ingredients in EU is projected to reach USD 7.5 billion by 2035.

The demand for almond ingredients in EU is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in demand for almond ingredients in EU are organic and conventional.

In terms of product type, almond flour segment to command 34.0% share in the demand for almond ingredients in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Europe Savory Ingredients Market Growth – Trends, Demand & Forecast 2025-2035

Europe Fermented Ingredients Market Insights – Demand, Size & Industry Trends 2025–2035

Europe Probiotic Ingredients Market Trends – Growth, Demand & Forecast 2025-2035

Nutraceutical Ingredients Market Analysis by Product, Form, Application and Region through 2035

Cosmeceutical Ingredients Market Growth – Trends & Forecast 2022-2027

Carbon-Neutral Skincare Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Demand for Pulse Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Egg Replacement Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Almond Milk Market Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA