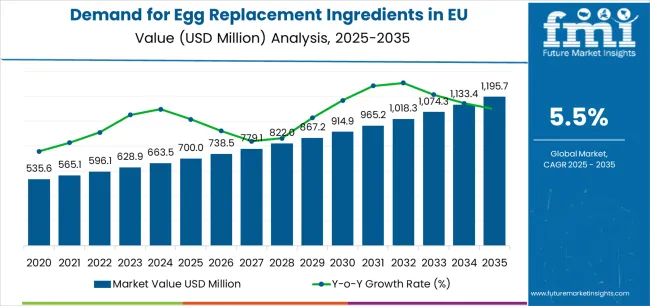

The EU egg replacement ingredient market is likely to grow from USD 700.0 million in 2025 to approximately USD 1,195.7 million by 2035, reflecting a CAGR of about 5.5%. The market expansion will be driven by rising consumer demand for plant-based and allergen-free alternatives as well as increasing incorporation of egg replacers in bakery, sauces, and ready meal applications across foodservice and retail channels in Europe. Future Market Insights, acknowledged for advanced nutrition modeling and global dietary research states that powder forms are expected to dominate with a significant majority share, while liquid forms will gain traction due to convenience and functionality improvements.

From 2030 to 2035, the market is anticipated to further accelerate, growing from USD 914.6 million to USD 1,195.7 million, adding USD 281.1 million and accounting for 69% of the ten-year market expansion. This stage will see intensified focus on organic and clean-label certified egg replacers, increased development of liquid and emulsifier forms, and integration of egg replacement ingredients within functional food formulations. Consumer willingness to pay premium prices for high-quality, sustainable egg substitutes will be a key growth driver.

Between 2020 and 2025, the EU egg replacement ingredient market exhibited steady growth from approximately USD 535.6 million to USD 700.0 million, at a CAGR of around 5%. This growth was underpinned by rising adoption of plant-based diets, increased regulatory scrutiny on conventional egg ingredients, and the entry of novel protein sources into the market. Enhanced processing technologies and greater product innovation have supported wider consumer acceptance across retail and industrial manufacturing channels.

Industry growth in EU egg replacement ingredient market is strongly supported by the rising prevalence of food allergies and intolerances across European populations, particularly allergies related to eggs, which are among the most common allergens. Improved diagnostics and heightened healthcare awareness have led to more accurate identification of egg allergies, creating a significant market need for safe, nutritious egg alternatives that allow consumers to maintain normal dietary patterns without health risks. The market expansion is fueled both by necessity-driven consumers with diagnosed allergies and growing choice-driven adoption among health-conscious and vegan consumers aiming for allergen-free diets.

Scientific research linking allergen avoidance with benefits in gut health, inflammation reduction, and chronic disease management further drives consumer demand for certified allergen-free egg replacement ingredients. Regulatory bodies in Europe are intensifying allergen labeling rules and cross-contamination controls, rewarding manufacturers who specialize in dedicated allergen-free formulations with competitive market advantages. Clinical and nutritional studies highlight the need for egg replacers that close nutritional gaps in restricted diets while ensuring taste, texture, and convenience, all critical for widespread consumer acceptance and industry adoption.

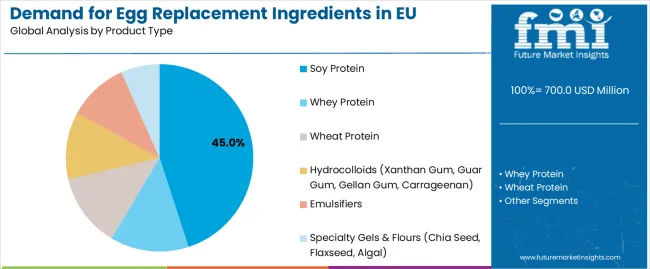

Sales in the egg replacement ingredient market are segmented by ingredient type, form, application, distribution channel, and region. By ingredient type, the market includes soy proteins, whey proteins, wheat proteins, hydrocolloids such as xanthan gum, guar gum, gellan gum, and carrageenan, along with emulsifiers and specialty gels and flours like chia seed, flaxseed, and algal flours.

Based on form, sales are divided into powder and liquid categories, with powders dominating due to their versatility and shelf stability. In terms of application, demand is segmented into bakery and confectionery, sauces and dressings, ready meals, and other processed food products. The distribution channels include industrial manufacturing (B2B), foodservice, retail (supermarkets and specialty stores), and online platforms. Regionally, demand is centered in key European markets such as Germany, France, Italy, Spain, the Netherlands, the UK, and the Rest of Europe, reflecting both consumer preferences and regional production capabilities.

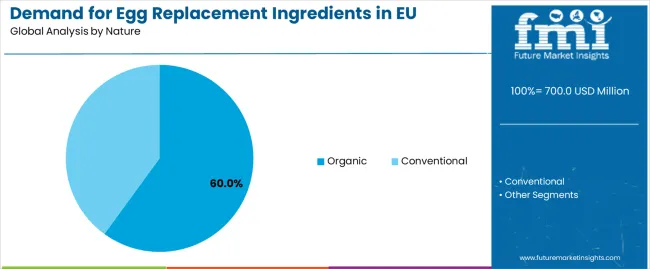

The organic segment of the egg replacement ingredient market in EU is projected to hold a significant share, accounting for approximately 60.0% of sales in 2025, and is expected to grow to 65.0% by 2035. This segment’s dominance is driven by strong consumer preferences for clean-label, natural, and sustainable food products. Consumers associate organic egg replacement ingredients with enhanced safety, superior quality, and environmental responsibility, which supports premium pricing and brand loyalty.

The organic segment benefits from widespread retail support, robust supply chains, and certifications that reinforce product differentiation and align with Europe’s sustainability goals. Over the forecast period, the organic share growth reflects increasing consumer emphasis on health, wellness, and dietary considerations tied to allergens and sustainability commitments. Key advantages include premium pricing opportunities, higher consumer trust, and alignment with regulatory and environmental priorities.

By product type, bakery applications represent the largest share of egg replacement ingredient demand, accounting for approximately 45.0% in 2025, and forecast to remain the dominant segment through 2035 with steady growth. This reflects bakery’s critical reliance on egg replacers for texture, binding, and leavening functions, particularly as vegan and allergy-friendly baked goods gain mainstream appeal. Ready meals and sauces & dressings also form key application segments, driven by innovation in formulation and expanding consumer adoption of convenient, allergen-free food solutions. The bakery segment benefits from continuous improvements in ingredient functionality, clean-label innovation, and formulation adaptability to meet both commercial and retail needs.

The EU egg replacement ingredient market is propelled by several key drivers including the rise in dietary allergies and intolerances, heightened consumer health consciousness favoring plant-based and allergen-free alternatives, and ongoing improvements in product quality that achieve taste and functional parity with conventional egg-containing foods. The market faces some restraints such as premium pricing that limits accessibility for mainstream consumers, challenges in formulating allergen-free ingredients that replicate egg functionalities precisely, and the risk of cross-contamination which can undermine consumer confidence. Continuous innovation in ingredient technology and manufacturing processes remains crucial for market advancement.

Cutting-edge developments in precision fermentation and cellular agriculture are transforming egg replacement ingredients, enabling production of egg proteins without animal sources. These advanced technologies allow manufacturers to create products that authentically replicate the sensory and functional properties of eggs while eliminating allergen risks. This evolution helps overcome traditional quality compromises in bakery, confectionery, sauces, and other egg-sensitive applications. Food technology companies are investing heavily in fermentation platforms, strain optimization, and scaling production, partnering with biotech firms and regulators to ensure product safety and consumer acceptance.

Egg replacement ingredient producers increasingly integrate gut health benefits into formulations, leveraging prebiotics, probiotics, and fermentation-derived components to offer digestive wellness beyond simple allergen avoidance. Functional claims related to microbiome support, anti-inflammatory effects, and immune system enhancement resonate with health-conscious consumers, positioning allergen-free egg replacers as holistic wellness products. Robust research, clinical validations, and consumer education efforts support this trend, driving broader market adoption.

Consumers demand egg replacement ingredients that offer nutritional equivalence or even superiority to traditional eggs. Manufacturers respond by fortifying formulations with essential vitamins, minerals, and bioavailability enhancers to close nutritional gaps, particularly for children’s and clinical nutrition products. Collaboration with nutrition experts and ongoing research into novel protein sources and nutrient premixes enable brands to offer clean-label, nutritionally optimized egg replacers that meet stringent regulatory requirements and parental expectations, supporting premium pricing and market differentiation.

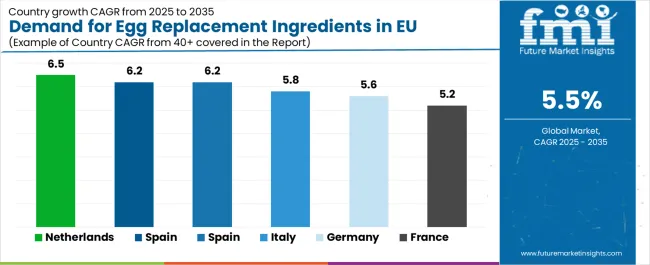

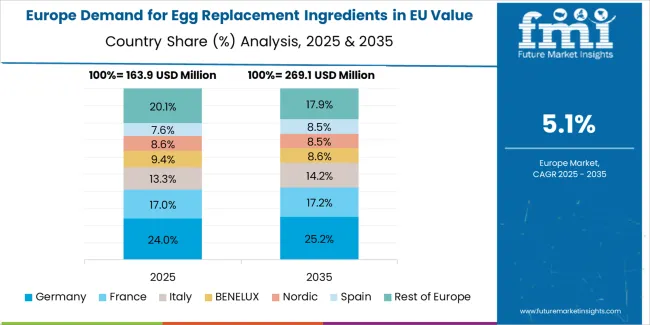

Germany holds the largest market share at around 24.3% in 2025, underpinned by a well-developed health food market and strong consumer demand for clean-label, sustainable egg replacers. Germany’s market is expected to grow steadily at a CAGR of 5.6%, supported by ongoing innovation and regulatory frameworks favoring allergen-free alternatives. Italy is also a significant market with a CAGR of 5.8%, reflecting evolving dietary traditions, growing vegan and allergy-friendly product adoption, and opportunities for premium product positioning within its rich culinary landscape.

| Country | CAGR % (2025-2035) |

|---|---|

| Netherlands | 6.5% |

| Rest of Europe | 6.2% |

| Spain | 6.2% |

| Italy | 5.8% |

| France | 5.2% |

| Germany | 5.6% |

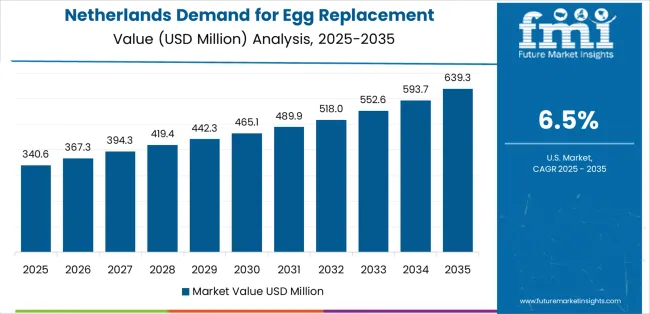

The EU egg replacement ingredient market shows variable growth rates across key European countries, driven by differing consumer awareness, dietary habits, and market maturity. The Netherlands is forecasted to record the highest CAGR of 6.5%, supported by an innovative food technology environment and a health-conscious consumer base. The Rest of Europe collectively grows at a robust 6.2%, reflecting diversified emerging markets adapting to plant-based trends.

Spain mirrors this growth rate at 6.2%, driven by increasing allergy awareness and expanding retail infrastructure. Italy is expected to grow steadily at a CAGR of 5.8%, reflecting shifts in traditional dietary patterns and rising demand for allergen-free and vegan food products. France exhibits a moderate growth rate of 5.2%, where culinary innovation and health consciousness foster adoption. Germany, as the largest market by share, maintains steady growth at a CAGR of 5.6%, supported by established health food infrastructure and continuing innovation in the egg replacers sector.

The egg replacement ingredient market in Germany is anticipated to maintain its leadership position through steady growth at a CAGR of 5.6% from 2025 to 2035. Germany’s mature market stems from a sophisticated health food infrastructure and well-established retail networks, including major players like Edeka, Rewe, DM, and Alnatura, which dedicate significant shelf space to plant-based and allergen-free ingredients. German consumers increasingly prioritize sustainability, clean labeling, and high-quality standards, fostering strong demand for plant-based egg alternatives that replicate egg functionalities in bakery, confectionery, and processed foods.

The country benefits from a strong domestic manufacturing ecosystem and advanced ingredient innovation, driving competitive product offerings. Established consumption patterns and consumer trust create a foundation for steady expansion through premiumization and technological improvements rather than rapid volume increases. Germany’s stringent regulatory environment enforces quality assurance and supports consumer confidence in allergen-free claims. German market dynamics illustrate how a mature, innovation-driven environment can sustain leadership in a rapidly evolving sector by balancing consumer expectations, innovation, and regulatory frameworks, making Germany a prime hub for egg replacement ingredient development and commercialization across Europe.

France’s egg replacement ingredient market is projected to grow at a CAGR of 5.2% from 2025 to 2035, reflecting the country’s unique integration of allergen-free innovations into its celebrated culinary culture. French consumers demand high-quality products that meet taste and texture expectations, particularly in bakery and confectionery applications, creating opportunities for premium egg replacer products optimized for authentic culinary experiences. Retailers such as Carrefour, Leclerc, and Monoprix actively promote allergen-free and plant-based offerings within dedicated store sections and private label lines.

In addition to culinary innovation, France's strong pharmaceutical and healthcare infrastructure supports allergy diagnosis and medical nutrition demand, further catalyzing market expansion. Government support for allergy and childhood nutrition programs enhances consumer awareness and drives adoption. The careful balance between taste, texture, and allergen-free formulation remains a key success factor, supported by research collaborations and ingredient innovation. As allergy prevalence rises, French consumers increasingly seek functional, clean-label alternatives compatible with their sophisticated food culture, positioning France as a growing market emphasizing quality and culinary heritage within the expanding egg replacement ingredient segment.

Italy’s egg replacement ingredient market is forecasted to grow at a CAGR of 5.8% between 2025 and 2035, driven by increasing consumer demand for allergen-free and vegan products integrated into Italy’s rich food culture. Italy’s extensive bakery and pasta traditions necessitate high-quality egg replacers that maintain authentic taste and texture, fueling innovation in plant-based proteins and starch blends. Retailers like Coop, Esselunga, and Conad actively promote allergen-free options with a strong focus on gluten-free and vegan alternatives, reflecting Italy’s growing dietary diversity and health consciousness.

Government initiatives, including mandatory celiac disease screening and reimbursement programs, create a supportive environment for allergen-free product adoption and expand market accessibility. Italy’s culinary expertise ensures that egg replacers deliver premium sensory experiences, enabling manufacturers to target both mainstream and niche health-conscious consumers. Growing awareness of food allergies, coupled with rising veganism and flexitarianism, catalyzes demand for solutions that blend tradition with innovation. Italy’s market evolution highlights the synergy between cultural food practices and progressive dietary trends driving continuous growth in allergen-free and egg replacement ingredients.

Spain’s egg replacement ingredient market is expected to expand at a CAGR of 6.2% from 2025 to 2035, supported by rising allergy awareness, expanding retail modernization, and increased health consciousness among consumers. Spain’s transformed retail landscape with chains such as Mercadona, Carrefour, and El Corte Inglés actively introduces allergen-free and plant-based product lines catering to local consumer preferences. The Mediterranean diet’s focus on fresh, wholesome foods supports the introduction and acceptance of allergen-free alternatives within traditional meal patterns.

The improved allergy diagnosis and growing lactose intolerance awareness drive targeted product development, particularly in bakery and prepared food categories. Spain's tourism sector also plays a significant role by increasing demand for allergen-friendly options within foodservice, influencing both product innovation and distribution. National health programs and consumer education efforts further boost market penetration. Spain’s combination of modern retail dynamics, cultural dietary preferences, and expanding tourism infrastructure position it as a rapidly growing market within EU egg replacement ingredient landscape.

The Netherlands leads Europe’s egg replacement ingredient market growth with a projected CAGR of 6.5% from 2025 to 2035. This leadership is driven by the country’s exceptional food technology ecosystem, progressive consumer health attitudes, and strong nutritional awareness, fostering a vibrant environment for innovation and early adoption. Dutch companies focus heavily on developing innovative plant-based and allergen-free egg replacers with international export orientation, strengthening their position as major European suppliers. Retailers promote extensive plant-based and free-from product ranges, enabled by high consumer openness to novel food technologies and sustainability initiatives.

The Netherlands benefits from advanced R&D infrastructure, efficient production capabilities, and strong collaborations with biotechnology firms, propelling the market forward. Dutch consumer preferences for clean-label, sustainably sourced ingredients complement regulatory incentives encouraging innovation. As a hub for food tech excellence and progressive eating habits, the Netherlands exemplifies how innovation ecosystems and consumer education accelerate market growth and expand the reach of egg replacement ingredients across Europe and beyond.

The egg replacement ingredient market in the Rest of Europe which includes Belgium, Austria, Poland, the Scandinavian countries, and Eastern European nations is expected to grow steadily at a CAGR of approximately 6.2% from 2025 to 2035. This region encompasses diverse markets at different stages of development but uniformly exhibits growing opportunities fueled by increasing health awareness, allergy diagnosis improvements, and expanding retail infrastructure. The Nordic countries stand out with strong health consciousness and robust retail networks, driving early adoption of allergen-free and plant-based ingredients. Eastern European markets, although emerging, are experiencing increased economic growth and healthcare improvements, facilitating consumer access and education on allergen-free diets.

These markets benefit from expanding presence of international retail chains and growing domestic food manufacturing adapting allergen-free formulations. The combination of rising disposable incomes, regulatory focus on food safety, and growing dietary concerns around allergens supports market growth. While challenges remain in harmonizing regulations and scaling manufacturing, the Rest of Europe collectively represents a promising frontier with significant potential to catch up with Western Europe’s mature egg replacement ingredient markets over the coming decade.

The EU egg replacement ingredient market competition is defined by a dynamic mix of specialized plant-based brands, multinational food companies, and innovative startups targeting allergen-free and vegan consumers. Leading companies are investing heavily in dedicated production facilities, advanced ingredient formulations, clinical validation studies, and consumer education initiatives to ensure their products deliver safety, nutritional value, and comparable taste and texture to conventional egg-containing foods. Strategic collaborations with healthcare providers, patient advocacy groups, and retail chains focused on allergen safety and product quality help strengthen competitive positioning and consumer trust across the food supply chain.

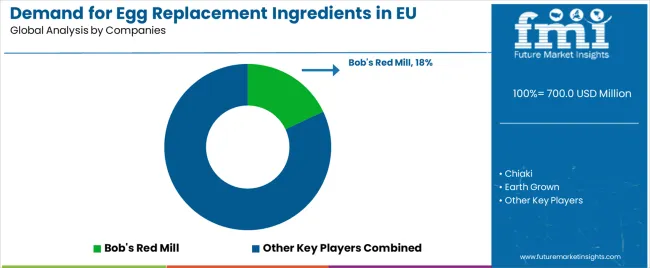

Danone S.A. is a major market player with an estimated 18% share in EUropean egg replacement ingredient market, leveraging its plant-based expertise through acquired brands such as Alpro and fortified by widespread distribution networks covering beverages, dairy alternatives, and bakery specialty products. Its strong innovation pipeline and sustainability commitments reinforce category leadership.

Nestlé S.A. holds approximately 14% of the share, utilizing its global research and development capabilities to support a broad portfolio of allergen-free solutions across nutrition segments. Nestlé’s ability to offer complete allergen-free ingredient systems positions it strongly among families managing multiple dietary restrictions.

Unilever PLC commands around 8% market share with an expanding portfolio of plant-based spreads, ice cream alternatives, and bakery ingredients. Its strengths include superior marketing, wide distribution reach, and alignment with growing demand for sustainable, ethical food choices.

Other key players including Kerry Group, Ingredion, Cargill, and ADM collectively hold about 40%, reflecting a fragmented market landscape where numerous specialized and regional producers cater to diverse consumer needs and application segments. This competitive environment fosters continuous innovation aimed at improving functionality, taste, and nutritional equivalence in egg replacers, meeting evolving regulatory and consumer expectations in EUropean market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,195.7 million (Projected Market Size by 2035 in Europe) |

| Nature | Organic, Conventional |

| Product Type | Soy Protein, Whey Protein, Wheat Protein, Hydrocolloids (Xanthan Gum, Guar Gum, Gellan Gum, Carrageenan), Emulsifiers, Specialty Gels & Flours (Chia Seed, Flaxseed, Algal) |

| Application | Bakery & Confectionery, Sauces & Dressings, Ready Meals, Beverages |

| Distribution Channel | Industrial Manufacturing (B2B), Foodservice, Retail (Supermarkets and Specialty Stores), Online/E-commerce |

| Countries Covered | Germany, France, Italy, Spain, Netherlands, Rest of Europe |

| Key Companies Profiled | Danone, Nestlé, Unilever, Kerry Group, Ingredion, Cargill, ADM |

| Additional Attributes | Dollar sales by nature, product type, application, and distribution channel; regional demand trends across key European markets; competitive landscape with multinational and specialized players; consumer preferences for organic and allergen-free ingredients; advances in precision fermentation and plant-based protein technology; integration with foodservice and retail sectors; regulatory framework for allergen labeling and clean-label claims; nutritional fortification and bioavailability improvements; penetration analysis of emerging alternative proteins and novel egg replacers |

The global demand for egg replacement ingredients in EU is estimated to be valued at USD 700.0 million in 2025.

The market size for the demand for egg replacement ingredients in EU is projected to reach USD 1,195.7 million by 2035.

The demand for egg replacement ingredients in EU is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in demand for egg replacement ingredients in EU are organic and conventional.

In terms of product type, soy protein segment to command 45.0% share in the demand for egg replacement ingredients in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Egg Replacement Ingredient Market Analysis - Size, Share & Forecast 2025 to 2035

Reusable Egg Containers Market Trends – Growth & Forecast 2025 to 2035

Europe Savory Ingredients Market Growth – Trends, Demand & Forecast 2025-2035

Pasteurized Eggs Market

Europe Fermented Ingredients Market Insights – Demand, Size & Industry Trends 2025–2035

Europe Probiotic Ingredients Market Trends – Growth, Demand & Forecast 2025-2035

Nutraceutical Ingredients Market Analysis by Product, Form, Application and Region through 2035

Cosmeceutical Ingredients Market Growth – Trends & Forecast 2022-2027

Carbon-Neutral Skincare Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Demand for Pulse Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Almond Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Plant-Based Eggs in EU Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Egg Carton Market Size and Share Forecast Outlook 2025 to 2035

Egg Free Premix Market Size and Share Forecast Outlook 2025 to 2035

Egg Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA