The global menopause treatment market is projected to grow from USD 799 million in 2025 to USD 1.38 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. This growth is driven by increasing awareness about menopause-related health issues, rising geriatric female population, and expanding access to advanced hormone replacement therapies (HRT) and non-hormonal treatment options.

| Attributes | Details |

|---|---|

| Market Value for 2025 | USD 799 million |

| Market Value for 2035 | USD 1.38 billion |

| Market CAGR from 2025 to 2035 | 5.6% |

Menopause treatments address symptoms such as hot flashes, night sweats, mood swings, and osteoporosis, improving quality of life for millions of women worldwide. The market includes hormonal therapies, non-hormonal medications, herbal supplements, and emerging therapies like selective estrogen receptor modulators (SERMs) and tissue-selective estrogen complexes.

Growing patient preference for personalized and safer treatment options has encouraged pharmaceutical companies to innovate and diversify their product portfolios. Additionally, rising healthcare expenditure and supportive regulatory frameworks are boosting market accessibility, especially in developed regions like North America and Europe. Meanwhile, increasing awareness campaigns and healthcare infrastructure improvements in Asia Pacific are contributing to accelerated market growth.

In an interview with Reuters in March 2024, Lars Fruergaard Jørgensen, CEO of Novo Nordisk, stated, “I expect that over time we'll see a lower price point that will cater for more and more patients getting on treatment.” His remarks highlight the industry’s ongoing focus on innovation, accessibility, and patient-centric care across therapeutic areas.

With continued advancements in treatment options and growing global demand, the menopause treatment market is poised for steady growth through 2035.

Horizontal slicers are forecasted to dominate the industrial food slicers market with a 40% share in 2025, driven by their high efficiency and versatility in slicing a wide range of food products. The meat and poultry segment leads applications at 30%, fueled by growing demand in supermarkets and foodservice industries.

Horizontal food slicers are expected to hold the largest share, around 40%, in the industrial food slicers market by 2025. These slicers are widely used for precise and consistent slicing of meat, cheese, bread, fruits, and vegetables in commercial kitchens, food processing plants, and supermarkets. Their ability to handle large volumes with adjustable slice thickness makes them indispensable for high-throughput environments.

Innovations in blade technology, automated feeding mechanisms, and safety features have enhanced the operational efficiency and reliability of horizontal slicers. Brands like Marel, Bizerba, and Urschel continue to invest in energy-efficient and easy-to-clean slicer models that meet stringent food safety standards.

The increasing popularity of pre-packaged, sliced meat and deli products in retail and foodservice sectors further boosts demand for horizontal slicers. Their integration into modern food production lines ensures consistent product quality, waste reduction, and faster processing times, making them a market favorite worldwide.

The meat and poultry segment is projected to lead the industrial food slicers market with a 30% share in 2025, driven by rising global consumption of processed and ready-to-eat meat products. Growth in supermarkets, restaurants, and foodservice outlets is fueling demand for efficient slicing solutions to meet consumer expectations for quality and convenience.

Industrial food slicers improve slicing precision, uniformity, and speed, which are vital for portion control and enhancing product appearance. Increasing automation and mechanization in meat processing plants, driven by hygiene regulations and cost optimization, further propel market growth.

Emerging markets with expanding urban populations and rising disposable incomes are witnessing accelerated growth in meat and poultry slicing applications. Leading slicer manufacturers focus on developing versatile equipment that handles various meat textures and sizes while ensuring compliance with food safety regulations.

As consumer trends favor convenience foods and premium sliced meat products, the meat and poultry segment will remain a key growth driver in the industrial food slicers market through 2035.

To strengthen access of patients to menopause treatments the providers are conferring digital health and telemedicine platforms. The collaboration of telemedicine providers and menopause treatment providers results in the enhancement of patient awareness, support, and treatment process compliance.

Traditional hormone replacement therapy (HRT) got out of trend, with bioidentical hormone therapy (BHT) picking up steam. The menopause treatment providers benefit from this emerging trend by making BHT products and providing customized treatment alternatives tailored to individual requirements.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 499.4 million |

| Market Value for 2024 | USD 758.5 million |

| Market CAGR from 2020 to 2024 | 7.80% |

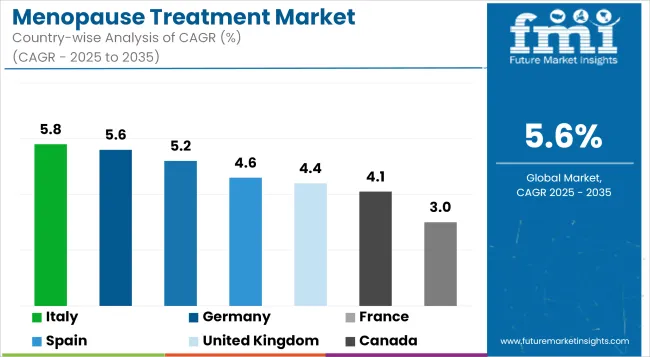

The menopause treatment market is examined in the table below, which concentrate on the dominating regions in North America, Europe, and Asia Pacific. An extensive menopause treatment market analysis demonstrates that Europe has considerable market opportunities.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Italy | 5.80% |

| Germany | 5.60% |

| France | 5.20% |

| Spain | 4.60% |

| United Kingdom | 4.40% |

Italy Industry Outlook

The Italy menopause treatment product market is ushered by a preference for natural treatments, traditional herbal remedies and substitute drugs play a significant role. Women in Italy look out for hormone therapy customized to their symptoms and health requirements during menopause, which thrives the menopause treatment market growth.

The public health programs of Italy strongly emphasize education and awareness efforts to de-stigmatize menopause and inspire women to seek healthcare on a regular basis.

Germany Industry Outlook

Menopause clinics and specialized healthcare centers are emerging in Germany, which indicates a surging demand for extensive care for menopausal women. The inclination toward digital health platforms and telemedicine services among German women provides handy access to necessary information and menopause-related consultations, bolsters the demand for menopause treatments.

France Industry Outlook

The menopausal clinics and other specialist healthcare services are set up due to the advancing awareness of menopause as a disorder that occurs with aging requiring specific treatment. To give patients comprehensive treatment choices, France’s healthcare providers are incorporating complementary therapies like acupuncture, yoga, and osteopathy into menopause management strategies. This trend indicates a surge in menopause treatments sales in France.

Spain Industry Outlook

Exhibiting a cultural transition for natural solutions to health, women in Spain move to traditional Mediterranean eating habits and integrate herbal medicines like red clover and sage to manage menopause symptoms. Menopause education and support campaigns are prevailing that cater to women the awareness and information required to face this life change, ushering the menopause treatment product market growth in Spain

United Kingdom Industry Outlook

Workplace policies are evolving into menopause-friendly and are prevalent in the United Kingdom, and these actions help to create a friendly and encouraging environment for women going through menopause. Smartphone applications and digital health platforms are pervasive in the United Kingdom.

These data sources support women with ease of access to self-management tools, menopausal education, and teleconsultations. In light of this trend the menopause wellness market is on the path to witness significant expansion.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Canada | 4.10% |

| United States | 3.00% |

The booming expenses of healthcare and broadening healthcare infrastructure in the United States bolster the adoption of menopause treatments, mainly in rural areas. The soaring research and development activities in Canada concentrate on the innovation of non-hormonal therapies, which coincide with the choices of women looking for replacements that cause minimal side effects.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 3.20% |

| South Korea | 2.40% |

| Japan | 1.60% |

China Industry Outlook

Traditional Chinese medicine is highly instrumental in managing menopausal symptoms and accelerating menopause treatment market growth. As customers seek natural remedies and herbal supplements, this flourishes the adoption of menopause treatments in China.

South Korea Industry Outlook

Society’s perception of menopause is changing, which has led to the escalated adoption of menopause treatments in South Korea. Better access to innovation in technology and healthcare infrastructure amplifies the menopause treatment market growth in South Korea.

Japan Industry Outlook

Reliable menopausal treatments are in demand in Japan due to the country's aging population and evolving population demographics. Women have an array of choices for controlling menopausal symptoms because of the coexistence of modern therapeutic approaches and traditional Japanese medicine, such as Kampo therapy. These factors intensify the adoption of menopause treatments in Japan.

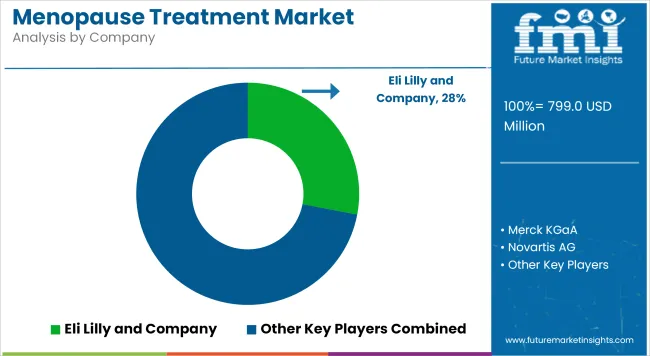

Several menopause treatment providers dominate the competitive landscape, propelling developments and determining the market shift. Renowned pharmaceutical companies such as Eli Lilly and Company, Merck KGaA, Novartis AG, Bayers AG, and Pfizer, Inc. are at the vanguard. These menopause treatment providers' comprehensive expertise and resources make them essential for market growth.

The prominent menopause treatment vendors comprise Novo Nordisk, Ascend Therapeutics, Mylan N.V. [Viatris], Cipla, Inc., and Glenmark Pharmaceuticals Ltd., each bringing their diverse strengths and product portfolio. Emerging menopause treatment creators like MenoGeniX, Perrigo Pharma International D.A.C., Ausio Pharmaceuticals, LLC, EndoCeutics, Inc., and Radius Health, Inc. bring innovation and modernization to the competitive landscape.

These menopause treatment suppliers always fight to develop better treatment choices, address upcoming medical requirements, and enhance patient outcomes. The competition aids the market for advanced innovation, stimulates research and development, and ultimately benefits individuals looking for menopause treatments.

It can be inferred that as menopause treatment providers continue to tread through the menopause treatment market complexities, a foundation is laid for advancements and improvements resulting in treatment for better women's health.

Noteworthy Progressions

| Company | Details |

|---|---|

| Astellas Pharma Inc. | VEOZAH (fezolinetant) by Astellas Pharma Inc. received FDA approval, the first of its kind nonhormonal neurokinin 3 (NK3) receptor antagonist, in May 2023. VEOZAH is used to treat vasomotor symptoms (VMS) created due to menopause. |

| Amyris, Inc. | Amyris, Inc. bought MenoLabs, LLC in March 2022. MenoLabs, LLC treated women experiencing menopause and conducted research. Amyris, Inc. increased the range of menopausal treatment products it offers owing to the acquisition. |

| Pfizer Inc. | In May 2021, the United States Food and Drug Administration (FDA) authorized MYFEMBREE® to Myovant Sciences and Pfizer Inc. It was the first daily medicine for premenopausal women associated with the problem of excessive menstrual bleeding linked with uterine fibroids. |

| Bayer AG | Bayer AG announced in March 2020 that it acquired KaNDy Therapeutics, a prominent provider of women's healthcare goods, including menopause treatment products. The acquisition significantly strengthened its line of women's healthcare products. |

| Amgen | The FDA approved EVENITY (romosozumab-aqqg) in April 2019 by Amgen to treat postmenopausal osteoporosis. Women are prone to osteoporosis fractures more often than males, particularly after menopause. |

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 799 million |

| Projected Market Size (2035) | USD 1.38 billion |

| CAGR (2025 to 2035) | 5.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and number of prescriptions/units for volume |

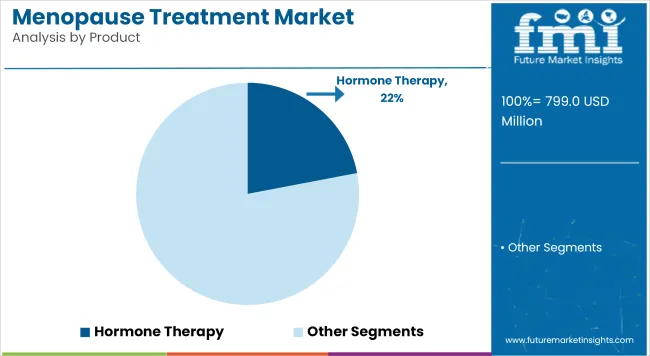

| Product Types Analyzed (Segment 1) | Hormone Therapy, Combination, Tibolone, Progestin-only Medicines, Estrogen-only Medicines, Non-Hormonal Therapy, Gabapentinoids, Serotonin-Norepinephrine Reuptake Inhibitors (SNRI), Selective Serotonin Reuptake Inhibitors (SSRI), Others |

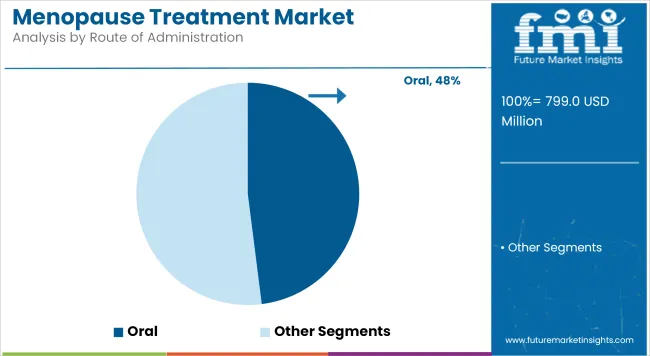

| Routes of Administration Analyzed (Segment 2) | Topical, Injectable, Oral |

| Distribution Channels Analyzed (Segment 3) | Institutional Sales, Hospitals, Specialty Clinics, Retail Sales, Retail Pharmacies, Drug Stores, Supermarkets/Hypermarkets, Online Sales |

| Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, Japan, South Korea, India, Australia, UAE, South Africa |

| Key Players Influencing the Market | Eli Lilly and Company, Merck KGaA, Novartis AG, Bayer AG, Pfizer, Inc., Novo Nordisk, Ascend Therapeutics, Mylan N.V. (Viatris), Cipla, Inc., Glenmark Pharmaceuticals Ltd., MenoGeniX, Perrigo Pharma International D.A.C., Ausio Pharmaceuticals, LLC, EndoCeutics, Inc., Radius Health, Inc. |

| Additional Attributes | Dollar sales, share trends, product demand by region, growth drivers, regulatory updates, consumer preferences, top-selling formulations, competitive landscape, pricing benchmarks, innovation opportunities, distribution channel shifts, emerging markets. |

The menopause wellness market to acquire a valuation of USD 799 million in 2025.

The menopause treatment product market has the potential to garner a worth of USD 1.38 billion by 2035.

The menopause wellness market equates to a moderate CAGR of 5.6% through 2035.

From 2020 to 2024, the menopause treatment product market evolved at a CAGR of 7.8%.

The oral sector is set to possess a market share of 58.8% in 2025.

The hormone therapy segment to garner a market share of 62.4% in 2025.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Unit Pack) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 6: Global Market Volume (Unit Pack) Forecast by Route of Administration, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Global Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 12: North America Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 14: North America Market Volume (Unit Pack) Forecast by Route of Administration, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 16: North America Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 20: Latin America Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 22: Latin America Market Volume (Unit Pack) Forecast by Route of Administration, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Latin America Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Western Europe Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 30: Western Europe Market Volume (Unit Pack) Forecast by Route of Administration, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 36: Eastern Europe Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 38: Eastern Europe Market Volume (Unit Pack) Forecast by Route of Administration, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Unit Pack) Forecast by Route of Administration, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 52: East Asia Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 54: East Asia Market Volume (Unit Pack) Forecast by Route of Administration, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 56: East Asia Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Route of Administration, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Unit Pack) Forecast by Route of Administration, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Unit Pack) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 10: Global Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 14: Global Market Volume (Unit Pack) Analysis by Route of Administration, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 18: Global Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Product, 2024 to 2034

Figure 22: Global Market Attractiveness by Route of Administration, 2024 to 2034

Figure 23: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 34: North America Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 38: North America Market Volume (Unit Pack) Analysis by Route of Administration, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 42: North America Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Product, 2024 to 2034

Figure 46: North America Market Attractiveness by Route of Administration, 2024 to 2034

Figure 47: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 58: Latin America Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 62: Latin America Market Volume (Unit Pack) Analysis by Route of Administration, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Route of Administration, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 82: Western Europe Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 86: Western Europe Market Volume (Unit Pack) Analysis by Route of Administration, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Route of Administration, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Unit Pack) Analysis by Route of Administration, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Route of Administration, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Unit Pack) Analysis by Route of Administration, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Route of Administration, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 154: East Asia Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 158: East Asia Market Volume (Unit Pack) Analysis by Route of Administration, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Route of Administration, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Route of Administration, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Route of Administration, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Unit Pack) Analysis by Route of Administration, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Route of Administration, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Route of Administration, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Route of Administration, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Menopause Treatment Industry Analysis in India Forecast Outlook 2025 to 2035

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Menopause Supplement Market Analysis by Product Type, Form, Sales Channel and Others through 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA