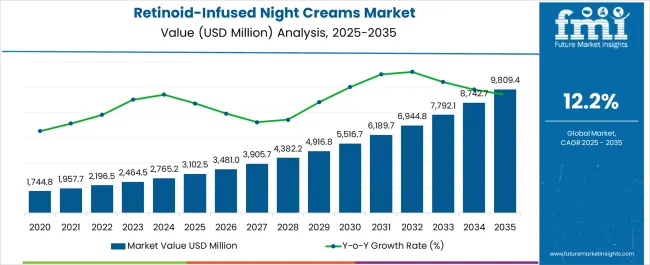

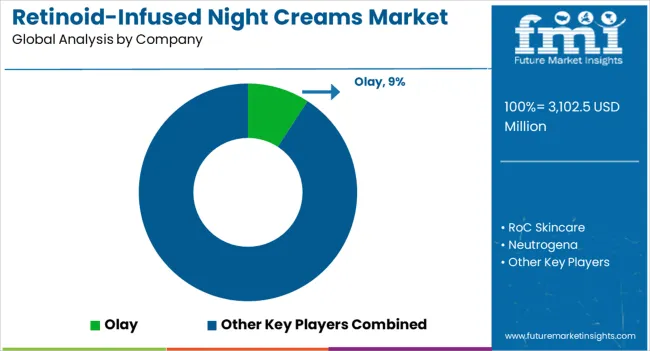

The global retinoid-infused night creams market is projected to grow from USD 3,102.5 million in 2025 to approximately USD 9,809.4 million by 2035, recording an absolute increase of USD 6,750.1 million over the forecast period. This translates into a total growth of 217.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 12.2% between 2025 and 2035. The overall market size is expected to grow by nearly 3.18X during the same period, supported by the rising consumer awareness about anti-aging skincare, increasing demand for dermatologist-recommended products, and growing adoption of retinoid-based formulations for skin renewal and wrinkle reduction.

Between 2025 and 2030, the retinoid-infused night creams market is projected to expand from USD 3,102.5 million to USD 5,528.8 million, resulting in a value increase of USD 2,426.3 million, which represents 35.9% of the total forecast growth for the decade. This phase of growth will be shaped by rising consumer awareness about retinoid benefits in anti-aging skincare, increasing penetration of premium skincare products, and growing demand for dermatologist-tested formulations. Beauty retailers and online platforms are expanding their retinoid product offerings to address the growing consumer interest in science-backed skincare solutions.

From 2030 to 2035, the market is forecast to grow from USD 5,528.8 million to USD 9,809.4 million, adding another USD 4,323.8 million, which constitutes 64.1% of the overall ten-year expansion. This period is expected to be characterized by expansion of clean-label and vegan retinoid formulations, integration of advanced delivery systems for enhanced skin penetration, and development of personalized retinoid treatments based on individual skin types. The growing adoption of professional-grade retinoid products and increasing availability through dermatology clinics will drive demand for more sophisticated formulations and specialized application guidance.

Between 2020 and 2025, the retinoid-infused night creams market experienced accelerated expansion, driven by increasing consumer education about retinoid benefits and growing demand for anti-aging solutions across all age demographics. The market developed as beauty brands recognized the potential for retinoid-based products beyond traditional acne treatment, expanding into comprehensive anti-aging and skin renewal applications. Social media influence and dermatologist endorsements began emphasizing proper retinoid usage protocols to maximize efficacy while minimizing skin irritation.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3,102.5 million |

| Forecast Value in (2035F) | USD 9,809.4 million |

| Forecast CAGR (2025 to 2035) | 12.2% |

Market expansion is being supported by the rapid increase in consumer awareness about retinoids as the gold standard for anti-aging skincare and the corresponding demand for accessible, over-the-counter retinoid formulations. Modern consumers seek scientifically-proven skincare ingredients that deliver visible results for wrinkle reduction, skin texture improvement, and overall skin renewal. The growing focus on preventive skincare and early intervention for aging signs is driving demand for retinoid products across younger demographics.

The expanding availability of various retinoid types and formulations is making these products more accessible to consumers with different skin sensitivities and preferences. Beauty brands are developing gentler retinoid derivatives and innovative delivery systems that minimize irritation while maintaining efficacy. The rise of clean beauty and vegan skincare trends is also driving innovation in plant-based retinoid alternatives and sustainable packaging solutions.

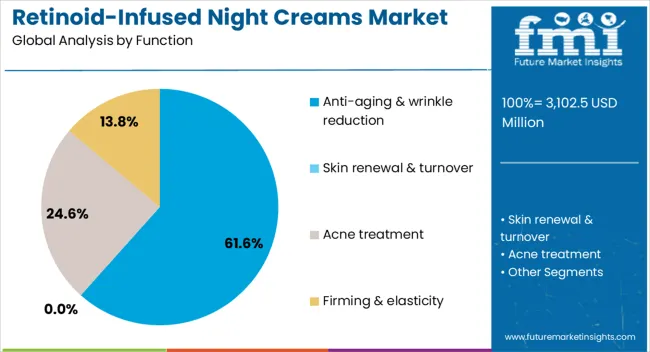

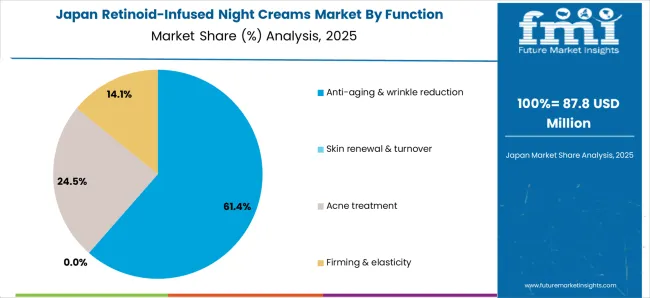

The market is segmented by function, retinoid type, product format, channel, claim, and region. By function, the market is divided into anti-aging & wrinkle reduction, skin renewal & turnover, acne treatment, and firming & elasticity. Based on retinoid type, the market is categorized into retinol, retinaldehyde, retinyl esters, and prescription-grade retinoids.

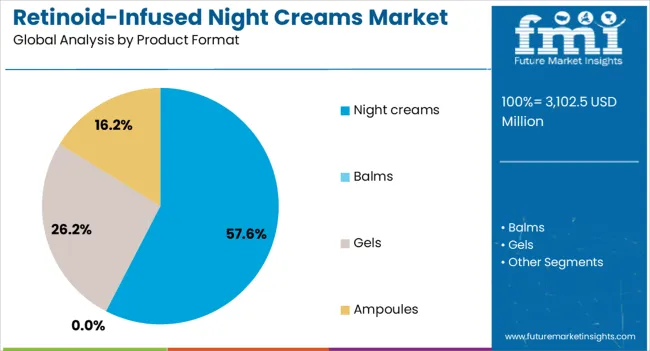

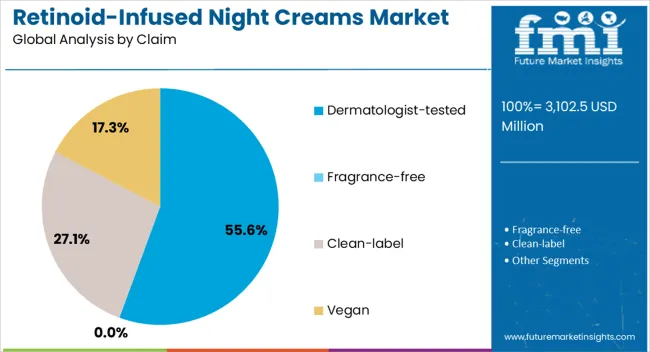

In terms of product format, the market is segmented into night creams, balms, gels, and ampoules. By channel, the market is classified into pharmacies, e-commerce, dermatology clinics, and specialty retail. By claim, the market is divided into dermatologist-tested, fragrance-free, clean-label, and vegan. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The anti-aging & wrinkle reduction function is projected to dominate the retinoid-infused night creams market in 2025, accounting for 61.6% of demand. This leadership reflects the powerful role retinoids play in addressing visible signs of aging such as fine lines, wrinkles, and hyperpigmentation. Retinoids, including retinol and prescription-strength derivatives, are clinically proven to accelerate cellular turnover, stimulate collagen production, and restore skin elasticity, making them the gold standard in anti-aging skincare.

Consumer trust is reinforced by decades of dermatologist endorsements and a wealth of clinical studies demonstrating efficacy in wrinkle reduction and skin renewal. As preventive skincare gains traction among younger demographics while older consumers seek corrective solutions, demand continues to rise across age groups. Positioned at the intersection of science-backed performance and consumer familiarity, anti-aging & wrinkle reduction remains the cornerstone function driving growth in the retinoid-infused night creams category.

Night creams are projected to represent 57.6% of retinoid-infused product demand in 2025, underscoring their role as the optimal format for delivering active retinoids. Consumers increasingly view night creams as essential components of evening skincare routines, leveraging the skin’s natural repair and regeneration cycle to maximize results. The rich, emollient textures of night creams also help counterbalance the potential dryness or irritation associated with retinoid use, enhancing tolerance and comfort.

This format provides sustained contact time, ensuring deeper absorption and prolonged efficacy overnight. The segment benefits from long-standing consumer habits of applying targeted treatments before bed, as well as the positioning of night creams as premium, results-driven products. With strong associations between overnight repair and anti-aging benefits, retinoid-infused night creams will continue to hold leadership as the preferred vehicle for advanced retinoid delivery in the global skincare market.

The dermatologist-tested claim is projected to account for 55.6% of the retinoid-infused night creams market in 2025, reflecting consumer demand for safety, efficacy, and professional validation. Retinoids, while highly effective, are also known for their potential to cause irritation or sensitivity, making dermatologist-tested assurances especially compelling. Products carrying this claim benefit from enhanced credibility, reassuring consumers that formulations have been clinically evaluated and are safe for regular use.

The claim resonates strongly with ingredient-savvy shoppers who increasingly demand science-backed and evidence-based solutions. It also aligns with broader trends toward transparency and professional endorsement in premium skincare. Brands emphasizing dermatologist-tested validation can differentiate in a crowded marketplace, capturing both cautious first-time users and experienced retinoid consumers seeking trusted formulations. This segment ensures continued consumer confidence, helping drive mainstream adoption of retinoid-infused night creams.

The retinoid-infused night creams market is advancing rapidly due to increasing consumer awareness of retinoid benefits and growing demand for scientifically-proven anti-aging solutions. However, the market faces challenges including potential skin sensitivity issues, need for proper consumer education on retinoid usage, and regulatory variations across different regions regarding retinoid concentrations and claims. Product innovation and formulation improvements continue to address safety concerns while maintaining efficacy standards.

The growing demand for clean-label and vegan retinoid products is driving innovation in plant-based retinoid alternatives and sustainable ingredient sourcing. Brands are developing bakuchiol and other botanical ingredients that provide retinoid-like benefits without synthetic compounds. These formulations appeal to environmentally-conscious consumers while maintaining the anti-aging efficacy that drives market demand. Clean beauty trends are also influencing packaging innovations with recyclable and refillable options.

Modern retinoid formulations are incorporating advanced delivery systems including microencapsulation, time-release technologies, and stabilizing compounds that enhance ingredient efficacy while reducing irritation potential. These innovations allow for higher retinoid concentrations in consumer products while maintaining gentleness for sensitive skin types. Advanced formulation technologies also improve product stability and shelf-life, enabling broader distribution channels and extended product availability.

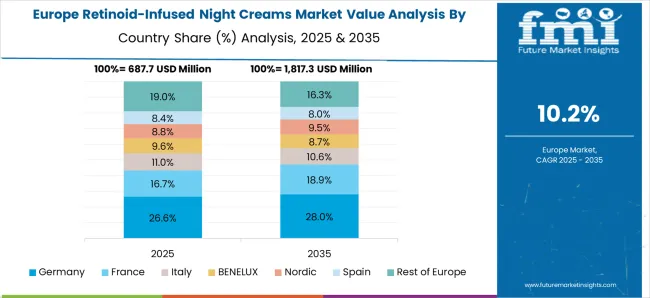

The retinoid-infused night creams market in Europe demonstrates mature development across major economies with Germany showing strong presence through its scientific approach to anti-aging skincare and consumer preference for clinically-proven active ingredients, supported by brands like Neutrogena and Olay leveraging dermatological research to develop effective retinoid formulations that balance efficacy with gentle delivery systems for sensitive European skin types.

France represents a significant market driven by its luxury beauty heritage and advanced cosmetic science capabilities, with companies like L'Oréal and Estée Lauder pioneering premium retinoid night creams that combine French elegance with sophisticated time-release technologies and skin-conditioning ingredients for enhanced tolerance and results.

The UK exhibits considerable growth through its embrace of evidence-based skincare and consumer education about retinoid benefits, with brands like Paula's Choice leading the democratization of effective retinoid formulations and providing comprehensive guidance on proper retinoid usage. Italy and Spain show expanding interest in anti-aging night treatments, particularly in premium retinoid-infused formulations targeting fine lines and skin texture improvement. BENELUX countries contribute through their focus on innovative delivery systems and premium positioning, while Eastern Europe and Nordic regions display growing potential, driven by increasing anti-aging awareness and expanding access to advanced retinoid skincare products.

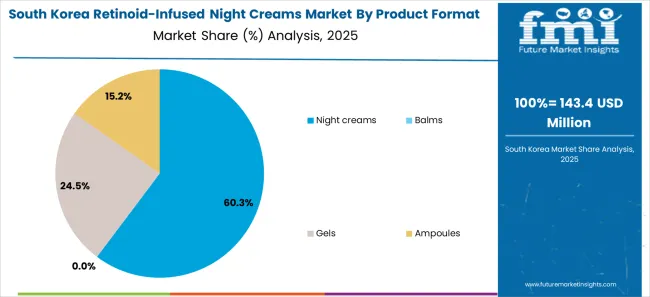

South Korea represents an evolving innovation center for retinoid-infused night creams, positioning as a growing global market with sophisticated consumers who approach retinoid usage with characteristic K-beauty principles of gradual introduction and comprehensive skin barrier support. Companies like Shiseido have established presence, developing innovative retinoid formulations that integrate gentle delivery systems with traditional Korean skincare philosophy of building skin tolerance through careful layering and barrier strengthening approaches.

The market benefits from extensive research capabilities in cosmetic science and fermentation technologies, creating opportunities for developing novel retinoid stabilization techniques and synergistic ingredient combinations. Strong domestic cosmetics manufacturing infrastructure supports both local consumption and export opportunities to global markets. The integration of retinoid technology with Korean expertise in gentle yet effective formulations, combined with consumer sophistication in understanding active ingredient interactions and long-term skin improvement strategies, positions the market as both an important consumer base and emerging innovation catalyst for retinoid night cream applications in global anti-aging and skincare industries worldwide.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 21.1% |

| India | 22.6% |

| Japan | 17.9% |

| UK | 14.4% |

| Germany | 10.8% |

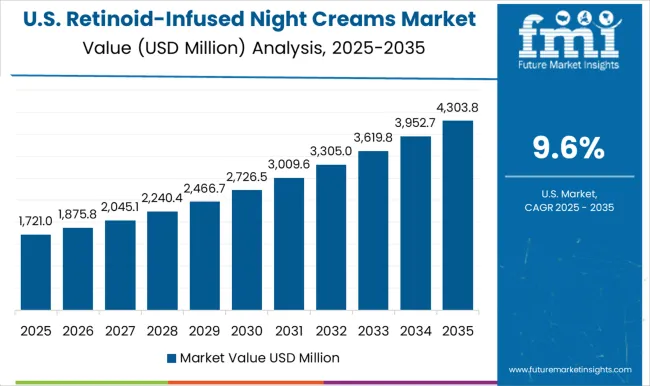

| USA | 9.6% |

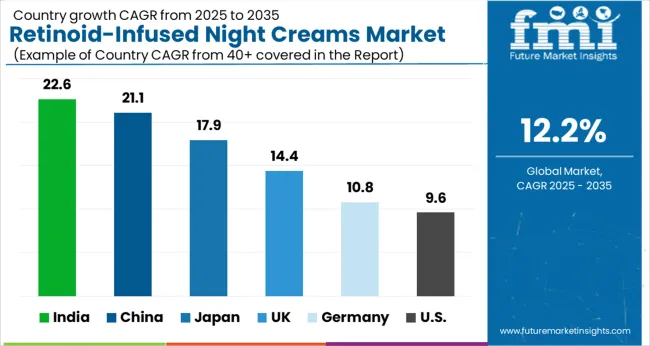

The retinoid-infused night creams market is experiencing robust growth globally, with India leading at a 22.6% CAGR through 2035, driven by rapidly expanding middle-class population, increasing skincare awareness, and growing adoption of premium beauty products. China follows closely at 21.1%, supported by strong e-commerce penetration, beauty influencer culture, and rising consumer spending on anti-aging products. Japan records 17.9% growth, emphasizing advanced formulation technologies and premium product positioning. The UK shows 14.4% expansion, focusing on dermatologist-recommended products and clinical efficacy. Germany grows at 10.8%, prioritizing clean beauty and sustainable formulations. Overall, Asian markets emerge as the primary drivers of global retinoid night cream market expansion.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from retinoid-infused night creams in China is projected to exhibit strong growth with a CAGR of 21.1% through 2035, driven by rapid adoption of K-beauty and J-beauty influenced skincare routines and increasing consumer sophistication in ingredient knowledge. The country's expanding e-commerce beauty platforms and growing middle-class population are creating significant demand for premium retinoid products. Major international and domestic beauty brands are establishing comprehensive product lines to serve the diverse needs of Chinese consumers across tier-1 and tier-2 cities.

Revenue from retinoid-infused night creams in India is expanding at the highest CAGR of 22.6%, supported by increasing awareness of advanced skincare ingredients and growing adoption of multi-step skincare routines among urban consumers. The country's expanding retail infrastructure and increasing online beauty shopping are driving accessibility of premium retinoid products. International beauty brands and domestic companies are developing products specifically formulated for Indian skin types and climate conditions.

Revenue from retinoid-infused night creams in Japan is growing at a CAGR of 17.9%, driven by the country's advanced beauty technology sector and consumer preference for high-quality, scientifically-proven skincare products. Japanese consumers demonstrate sophisticated understanding of skincare ingredients and are willing to invest in premium anti-aging formulations. The market is characterized by continuous innovation in gentle retinoid delivery systems and combination formulations.

Demand for retinoid-infused night creams in the UK is projected to grow at a CAGR of 14.4%, supported by increasing consumer preference for dermatologist-recommended skincare and evidence-based beauty products. British consumers prioritize clinical validation and professional endorsements when selecting anti-aging treatments. The market benefits from strong pharmacy and dermatology clinic distribution channels that provide professional guidance and product education.

Demand for retinoid-infused night creams in Germany is expanding at a CAGR of 10.8%, driven by increasing consumer preference for clean beauty products and sustainable skincare formulations. German consumers prioritize natural ingredients, environmental responsibility, and product transparency when selecting beauty products. The market is characterized by innovation in plant-based retinoid alternatives and eco-friendly packaging solutions.

Revenue from retinoid-infused night creams in the USA is projected to grow at a CAGR of 9.6% through 2035, supported by the mature beauty industry’s strong emphasis on clinically validated anti-aging solutions and consumer trust in dermatologist-recommended products. American consumers are increasingly seeking advanced retinoid formulations that combine efficacy with improved tolerability, fueling demand for premium night cream products across both mass and luxury segments.

The retinoid-infused night creams market is defined by competition among established beauty conglomerates, dermatology-focused brands, and innovative clean beauty companies. Companies are investing in advanced formulation technologies, clinical research, sustainable ingredient sourcing, and comprehensive consumer education to deliver effective, gentle, and environmentally-responsible retinoid solutions. Strategic partnerships with dermatologists, technological innovation, and brand positioning are central to strengthening product portfolios and market presence.

Olay, USA-based, offers accessible retinoid formulations with a focus on gentle efficacy and comprehensive anti-aging benefits. RoC Skincare, globally operating, provides clinically-tested retinoid products with emphasis on dermatologist validation and proven results. Neutrogena delivers affordable retinoid options with widespread retail availability and consumer education. Murad emphasizes professional-grade formulations with clinical backing and specialized skincare expertise.

SkinCeuticals focuses on medical-grade retinoid products with advanced delivery systems and dermatologist partnerships. L'Oréal offers diverse retinoid formulations across multiple price points and distribution channels. Estée Lauder provides luxury retinoid treatments with premium positioning and advanced anti-aging technologies. Paula's Choice delivers science-based formulations with extensive ingredient education and customization options. Drunk Elephant emphasizes clean, effective formulations with minimal ingredients and modern branding. Shiseido combines advanced Japanese beauty technology with traditional skincare wisdom in innovative retinoid formulations.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3,102.5 million |

| Function | Anti-aging & wrinkle reduction, Skin renewal & turnover, Acne treatment, Firming & elasticity |

| Retinoid Type | Retinol, Retinaldehyde, Retinyl esters, Prescription-grade retinoids |

| Product Format | Night creams, Balms, Gels, Ampoules |

| Channel | Pharmacies, E-commerce, Dermatology clinics, Specialty retail |

| Claim | Dermatologist-tested, Fragrance-free, Clean-label, Vegan |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Olay, RoC Skincare, Neutrogena, Murad, SkinCeuticals, L'Oréal, Estée Lauder, Paula's Choice, Drunk Elephant, and Shiseido |

| Additional Attributes | Dollar sales by retinoid type and concentration level, regional demand trends, competitive landscape, buyer preferences for retinol versus retinal/retinyl esters, integration with clean-label/dermatologist-tested positioning, innovations in encapsulation, slow-release delivery, and irritation-minimizing formulations |

Claim:

Region:

The global retinoid-infused night creams market is estimated to be valued at USD 3,102.5 million in 2025.

The market size for the retinoid-infused night creams market is projected to reach USD 9,809.4 million by 2035.

The retinoid-infused night creams market is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types in retinoid-infused night creams market are anti-aging & wrinkle reduction , skin renewal & turnover, acne treatment and firming & elasticity.

In terms of product format , night creams segment to command 57.6% share in the retinoid-infused night creams market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Night Vision Surveillance Cameras Market Size and Share Forecast Outlook 2025 to 2035

Night Vision System Market Growth - Trends & Forecast 2024 to 2034

Night Vision Device Market

Over-night Hair Treatment Products Market Size and Share Forecast Outlook 2025 to 2035

Automotive Night Vision Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Night Vision Market

Age-Defying Night Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Firming Creams and Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Slugging Creams Market Size and Share Forecast Outlook 2025 to 2035

Anti-Aging Creams & Serums Market Size and Share Forecast Outlook 2025 to 2035

Anti-Wrinkle Creams Market Size and Share Forecast Outlook 2025 to 2035

Body Firming Creams Market Growth & Forecast 2025-2035

Eczema Relief Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Muscle Relaxing Creams Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Ice Creams Market Analysis by Form, Product Type, Flavor, Source, Sales Channel, and Region through 2035

Moisturizing Body Creams Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Hydrating Emollient Creams Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA