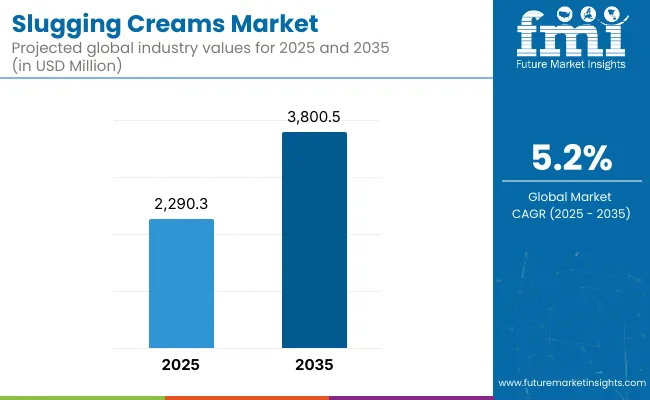

The Slugging Creams Market is expected to record a valuation of USD 2,290.30 million in 2025 and USD 3,800.50 million in 2035, with an increase of USD 1,510.0 million, which equals a growth of 66.0% over the decade. The overall expansion represents a CAGR of 5.2% and a 1.7X increase in market size.

Slugging Creams Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value (2025E) | USD 2,290.3 million |

| Forecast Value (2035F) | USD 3,800.5 million |

| Forecast CAGR (2025 to 2035) | 5.2% |

During the first five-year period from 2025 to 2030, the market increases from USD 2,290.30 million to USD 2,960.50 million, adding USD 670.0 million, which accounts for 44.4% of the total decade growth. This phase records steady adoption across night skincare routines, post-treatment recovery, and barrier-repair creams, driven by rising interest in moisture retention and dermatology-backed skincare. Petroleum-based creams and balms dominate this period as they cater to over 50% of slugging use-cases requiring high occlusive.

The second half from 2030 to 2035 contributes USD 840.0 million, equal to 55.6% of total growth, as the market jumps from USD 2,960.0 million to USD 3,800.0 million. This acceleration is powered by widespread adoption of multi-step skincare regimens, plant-based slugging formats, and hybrid occlusive systems among Gen Z and dermocosmetic consumers. Stick and hybrid cream formats together capture a larger share above 45% by the end of the decade. Recurring revenue from DTC platforms and seasonal skincare sales increase the online channel share beyond 60% in total value.

From 2020 to 2024, the Slugging Creams Market expanded from USD 1,765.4 million to USD 2,180.5 million, supported by a surge in skin barrier repair trends and K-beauty influence across Gen Z and Millennial consumers. During this period, the competitive landscape remained largely brand-centric, with legacy skincare brands and drugstore ointments capturing over 65% of market value.

Leaders such as Vaseline, Aquaphor, and CeraVe reinforced their dominance through dermatology-backed positioning and ingredient familiarity, particularly petroleum-based formulas. Product innovation remained incremental, focused on packaging aesthetics, fragrance-free options, and hypoallergenic claims. Indie and clean-label entrants gained modest visibility but lacked significant distribution traction or dermatologist endorsements needed to scale.

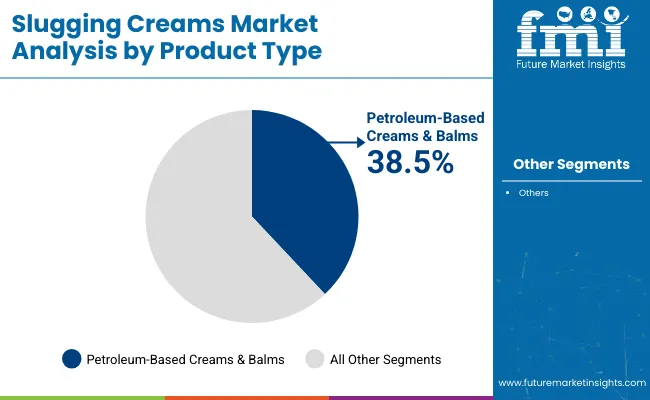

Demand for slugging creams is projected to reach USD 2,290.3 million in 2025, with momentum expected to continue through 2035, elevating market value to USD 3,800.5 million. The revenue mix is gradually evolving as silicone-based and fermented ingredient formulations begin to challenge petroleum-dominant offerings, which currently account for 38.5% share. Asia-Pacific and North America remain the core growth zones, with China emerging as a pivotal influencer-driven market.

Market incumbents are now contending with purpose-built skincare startups offering hybrid balm-serum textures and prebiotic-based barrier creams. Competitive advantage is shifting from heritage brand equity alone to multifunctionality, clean-label certifications, and clinical claim substantiation. The next phase of competition will be marked by transparency in formulation, retail personalization, and microbiome-friendly positioning, compelling traditional players to diversify beyond occlusive-only product stories.

The rise of “slugging” as a skincare ritual has been amplified by platforms like TikTok and Reddit, where consumers share visible overnight transformations. This virality has reshaped product discovery, pushing petroleum-based occlusives and barrier-repair creams into mainstream routines.

Unlike typical skincare fads, slugging appeals to ingredient transparency and low-cost solutions, making it especially sticky in Gen Z and Millennial cohorts. Brands have capitalized by launching non-comedogenic and multi-functional slugging products tailored to different skin types, converting trend engagement into steady product adoption.

Dermatologist-recommended slugging creams with ceramides, squalane, and hyaluronic acid are being actively repositioned beyond hydration into skin-barrier therapy. With eczema, rosacea, and environmental damage driving skin sensitivity, occlusive-based barrier creams are finding renewed demand from medically aware consumers.

Clinics and DTC brands are promoting slugging as a preventive treatment post-retinol or exfoliant use, rather than just a nighttime ritual. This medical-grade positioning has moved slugging creams into the functional skincare category, allowing higher price points and cross-category expansion into dermocosmetics and clinical skincare portfolios.

The slugging creams market exhibits varied dynamics across its segmented categories, reflecting innovation in formulation, consumer preferences, and retail evolution. Among Product Types, petroleum-based creams and balms continue to dominate due to their familiarity and perceived efficacy, while oil-based occlusive creams and hybrid moisturizers like water-in-oil emulsions are gaining traction for offering lighter textures without compromising barrier sealing.

Gel-based slugging creams are witnessing interest among younger consumers seeking non-greasy hydration, and stick formats or solid balms are emerging as convenient, travel-friendly alternatives. In terms of key occlusive ingredients, petrolatum retains widespread adoption owing to its proven moisture retention, yet squalane and hydrogenated polyisobutene-based variants are increasingly favored for being lightweight and non-comedogenic.

Beeswax, lanolin, and silicone-based ingredients like dimethicone remain relevant for their dual role in protection and texture enhancement, while plant-based occlusives such as shea and cocoa butter are carving a niche among clean beauty enthusiasts. Use-case segmentation reveals that overnight moisturizing remains the most common application, supported by the product’s strong alignment with nighttime skincare routines.

Clinical and post-treatment applications are gaining clinical endorsement, while K-beauty-inspired layering routines and winter hydration needs further reinforce demand. Packaging Types show dominance of jars and tubs for thicker balms, whereas tubes and pump bottles are preferred for hygienic dispensing of lighter creams.

Sticks and twist-ups are increasingly seen in solid balm formats. On the distribution front, e-commerce platforms and brand-owned DTC websites are driving growth due to content-driven consumer education, although specialty beauty retail and mass retail channels remain important for trial-based purchases. Dermatology clinics and aesthetic spas contribute to credibility and targeted therapeutic use.Regionally, the scope spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

| Product Type | Value Share % 2025 |

|---|---|

| Petroleum-Based Creams & Balms | 38.5% |

| Others | 61.5% |

In the global slugging creams market, petroleum-based creams and balms are projected to hold the dominant share of 38.5% in 2025, underscoring their entrenched position as the foundational occlusive product in barrier-repair skincare. This dominance is attributed to the proven efficacy of petrolatum as an occlusive agent that significantly reduces transepidermal water loss (TEWL), making it a clinically trusted choice in dermatology and post-treatment care.

Despite rising interest in plant-based and hybrid alternatives, petroleum-based formats continue to enjoy broad consumer trust due to their affordability, long-standing usage history, and recommendation by skin specialists for compromised or sensitized skin. Their usage is particularly strong in overnight moisturization and winter skincare applications, where deep occlusion is prioritized over sensorial or aesthetic considerations.

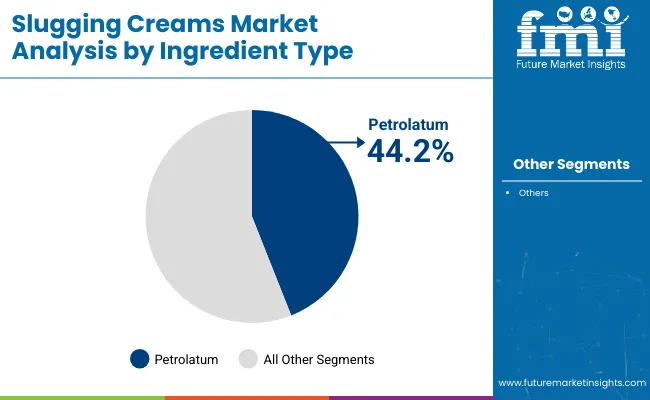

Insights into the Ingredient TypeSegment with Petrolatum Dominating the Demand

| Ingredient Type | Value Share % 2025 |

|---|---|

| Petrolatum | 44.2% |

| Others | 55.8% |

Petrolatum is estimated to dominate the key occlusive ingredient segment with a 44.2% value share in 2025, reflecting its longstanding status as the gold standard for barrier-repair and moisture-locking functions in slugging creams. Its unmatched ability to form an impermeable layer over the skin makes it highly effective for reducing transepidermal water loss (TEWL), especially for dry, sensitive, or compromised skin. Dermatologist endorsement, OTC therapeutic use, and inclusion in clinical skincare regimens continue to reinforce its usage across both mass and premium formulations.

Despite this lead, the remaining 55.8% share captured by other occlusivesincluding lanolin, squalane, shea butter, ceramides, and silicone derivativespoints to growing diversification driven by evolving skin needs, ingredient transparency, and clean label preferences. Many consumers are opting for alternatives perceived as lighter, breathable, vegan, or botanical-derived, especially in regions where concerns around pore-clogging or petrochemical-based ingredients are rising.

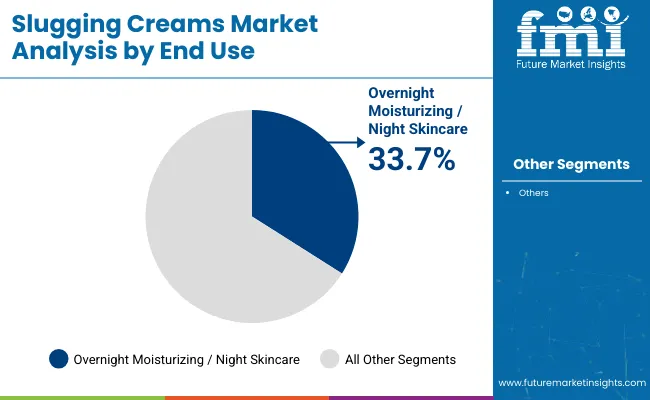

| End Use Applications | Value Share % 2025 |

|---|---|

| Overnight Moisturizing / Night Skincare | 33.7% |

| Others | 66.3% |

Overnight moisturizing and night skincare applications are expected to account for 33.7% of the global slugging creams market in 2025, underscoring their central role in driving product functionality and consumer intent. The concept of overnight skin repair has been widely embraced across dermatological and beauty communities, where slugging is increasingly promoted as a nighttime ritual to enhance skin regeneration, improve hydration retention, and protect against environmental aggressors.

The occlusive nature of slugging creams aligns with circadian skin rhythms, which favor reparative and barrier-building functions during sleep. This segment’s growth is also supported by rising adoption of multi-step PM routines, particularly in K-beauty, dermocosmetic, and anti-aging skincare regimes.

Rising Adoption of Dermocosmetic Rituals Rooted in Skin Barrier Science

The market has been significantly influenced by the growing clinical emphasis on the skin barrier function. Slugging creams, often rich in petrolatum and lipid-replenishing occlusives, have gained traction as dermatologists, estheticians, and skincare brands increasingly advocate barrier repair as a foundational skincare goal.

Rather than focusing solely on aesthetics or anti-aging, newer dermocosmetic routines emphasize restoring the skin’s natural lipid shield to address transepidermal water loss, dryness-induced inflammation, and sensitivity. Slugging’s ability to lock in hydration and enhance the efficacy of layered actives makes it highly compatible with multi-step routines and post-treatment recovery.

Medical-grade slugging creams are being positioned alongside serums and actives in barrier-centric protocols for sensitive and post-procedure skin. The normalization of skin barrier-first language in both professional and consumer discourse, especially across North America and East Asia, has elevated slugging creams from a niche concept to a recommended part of evidence-backed skincare. This shift is expected to continue propelling demand, particularly among consumers managing conditions like eczema, rosacea, or retinoid sensitivity.

Digital-First Influence of Skincare Micro-Communities and ‘Skin Cycling’ Trends

The surge in awareness surrounding slugging creams has been accelerated by skincare-focused digital micro-communities, where influencers, estheticians, and dermatologists discuss layering routines in relatable, routine-based content formats.

Platforms like TikTok, Reddit, and YouTube have created a hyper-engaged space for skincare enthusiasts to trial and share real-time results of slugging rituals, often with visible improvements to hydration, glow, and irritation reduction. Viral challenges and before-after testimonial videos have created trust in slugging, particularly among Gen Z and millennial users.

Slugging creams have also become central to the broader ‘skin cycling’ trend, where intensive actives (like acids or retinoids) are alternated with recovery nights focused on barrier support using occlusives. This has driven both DTC and retail brands to formulate dedicated night masks and skin-cycling-friendly occlusive creams, further solidifying market demand.

The online virality of slugging content has bypassed traditional skincare education barriers, allowing niche products to reach global audiences with minimal advertising spend. This grassroots digital validation continues to shape consumer expectations and drive innovation pipelines in the category.

Growing Criticism of Occlusive Ingredients in Acne-Prone and Oily Skin Types

While slugging creams have been positively received in dry and sensitive skin communities, concerns remain over their suitability for oily or acne-prone skin types. Occlusive agents like petrolatum, mineral oil, and waxesthough non-comedogenic in their pure formare often perceived by consumers as pore-clogging, especially when combined with layering routines that include emollients, serums, or makeup residue.

Online discussions and dermatology forums frequently highlight concerns over breakouts, milia, or congestion following slugging usage, particularly when formulations lack breathable textures or balancing actives. In regions with humid climates, such as parts of Southeast Asia or India, the preference still leans towards lightweight hydration, limiting widespread daily adoption of heavy occlusives.

Additionally, as clean beauty movements grow stronger, formulations perceived as synthetic or petroleum-derived face resistance from environmentally conscious and ingredient-aware buyers. While several brands are introducing non-petroleum-based occlusives, the perception gap continues to act as a barrier, requiring both education and formulation advancement to reassure sensitive user groups and expand demographic penetration.

Shift Toward Non-Petroleum, Botanical-Based Occlusives in Slugging Products

As consumer scrutiny of petroleum-derived ingredients intensifies, a visible shift is being observed toward plant-based or bio-derived occlusive alternatives in slugging creams. While petrolatum continues to dominate due to its proven barrier-sealing capabilities, newer formulations are exploring botanical waxes (like sunflower wax, candelilla, or berry wax), shea butter derivatives, and skin-identical lipids to meet clean label and sustainability expectations.

These ingredients are being positioned as ‘breathable occlusives’ that offer similar barrier protection without the heavy or greasy feel associated with traditional slugging creams. The trend is particularly notable among premium and indie brands catering to conscious consumers in Europe and parts of North America.

These alternative formulations are often hybridized with humectants like hyaluronic acid or squalane to support all-day hydration without compromising comfort. Certifications such as COSMOS, vegan-friendly labels, and fragrance-free claims are becoming standard in this emerging product subsegment. This trend is not only reformulating the functional landscape of slugging creams but also redefining their sensorial and environmental positioning in the broader skincare market.

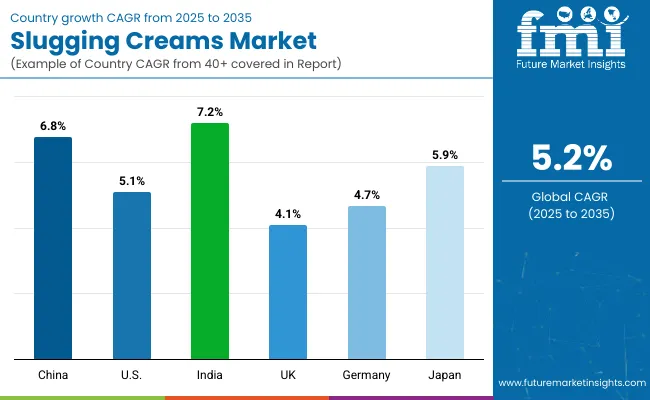

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 6.8% |

| USA | 5.1% |

| India | 7.2% |

| UK | 4.1% |

| Germany | 4.7% |

| Japan | 5.9% |

The slugging creams market is poised for dynamic growth across several key countries, with India projected to witness the highest CAGR at 7.2% between 2025 and 2035. This expansion is expected to be underpinned by the rising influence of K-Beauty trends, growing interest in affordable multi-step skincare routines, and dermatologist-backed consumer education initiatives.

In China, a CAGR of 6.8% is anticipated, supported by the integration of occlusive products into nighttime skincare rituals, rapid urbanization, and high consumer responsiveness to hydration-focused marketing. Japan’s market, with an expected CAGR of 5.9%, is likely to remain shaped by its well-established beauty rituals, clinical skincare positioning, and demand for hybrid and sensitive-skin formulations.

In contrast, the USA market is expected to grow at 5.1% CAGR, sustained by strong DTC brand penetration, seasonal skincare usage, and emphasis on dermatological endorsements. Germany and the UK, registering slower growth at 4.7% and 4.1% respectively, are showing rising adoption of botanical and hybrid slugging formats but face challenges in mass-market conversion and consumer familiarity. The differential growth rates reflect varying stages of market maturity, cultural acceptance of occlusives, and accessibility through offline and online retail channels.

| Years | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| USA Slugging Creams Market | 606.93 | 628.65 | 651.15 | 674.46 | 698.60 | 723.61 | 749.51 | 776.33 | 804.12 | 832.90 | 862.71 |

The Slugging Creams Market in the United States is projected to grow at a CAGR of 3.5%, driven by rising consumer interest in high-performance occlusive skincare. Demand is gaining traction across both mass and premium skincare segments, as overnight moisturization and skin barrier repair gain visibility through social media and dermatological endorsement.

Clinical dermatology professionals and skincare influencers are contributing to the normalization of slugging in routine skincare. Retailers are expanding their occlusive moisturizer assortments, including petrolatum-based balms and creams that cater to dry and sensitive skin types. The trend is particularly pronounced in colder USA regions where trans epidermal water loss is higher during winter months. Innovation around non-comedogenic formulations and fragrance-free variants is also shaping brand portfolios.

The Slugging Creams Market in the United Kingdom is projected to register a moderate CAGR of 4.1% between 2025 and 2035, supported by the expanding consumer base for targeted skincare solutions and moisture retention treatments. British consumers have shown increased awareness of skin barrier health, which is accelerating interest in slugging practices, particularly among individuals with dry, reactive, or eczema-prone skin.

Although the trend originated from Korean beauty routines, its integration into British beauty regimens has been facilitated by content from dermatologists and influencers across platforms like TikTok and Instagram. While the trend remains largely seasonalpeaking in colder monthsbrand innovations aimed at making slugging viable year-round, such as breathable occlusives and hybrid formulations, are expected to support future growth.

The Slugging Creams Market in India is expected to grow at a robust CAGR of 7.2% between 2025 and 2035, driven by the rising influence of K-beauty trends among Gen Z and millennial consumers. Social media penetration, along with increased skincare literacy among urban Indian consumers, has played a key role in popularizing slugging as a barrier-repair skincare technique.

Domestic and international brands are responding with product launches tailored for Indian skin types and climates, emphasizing lightweight occlusives and non-comedogenic formulations suited for humid weather conditions.

The demand is particularly strong in Tier 1 and emerging Tier 2 cities like Mumbai, Delhi, Bengaluru, Pune, Ahmedabad, and Kochi, where dermatology-backed routines are gaining preference. Retailers are also integrating slugging products into premium skincare assortments, especially in dermatology chains, online beauty platforms, and pharmacy retailers.

Furthermore, India’s Ayurveda and clean-label trends are being embedded into slugging creams through botanical and oil-based formulations that combine tradition with modern moisture retention techniques.

The Slugging Creams Market in China is expected to grow at a CAGR of 8.6%, the highest among leading Asian economies. This growth is driven by the country’s deep-rooted skincare culture, high receptiveness to K-beauty trends, and the expanding middle-class appetite for advanced moisturization products.

Slugging has gained rapid popularity across Tier 1 and Tier 2 cities, with beauty influencers and dermatologists promoting occlusive routines on Xiaohongshu and Douyin. Domestic brands are actively launching petrolatum-based and gel-based slugging creams tailored to sensitive and acne-prone skin, while international labels are expanding distribution through Tmall, JD.com, and Watsons.

In-depth Analysis of Slugging Creams in Germany

| Countries | 2025 Share (%) | 2035 Share (%) |

|---|---|---|

| US | 26.50% | 22.70% |

| China | 19.30% | 22.40% |

| Japan | 10.40% | 10.20% |

| Germany | 8.10% | 7.60% |

| UK | 7.90% | 7.30% |

| India | 5.30% | 7.80% |

The Slugging Creams Market in Germany is forecast to expand at a CAGR of 4.7% from 2025 to 2035, with its global market share expected to decline slightly from 8.1% in 2025 to 7.6% by 2035. This restrained growth is attributed to the country’s preference for minimalist skincare and lower per capita usage of occlusive-heavy products. However, rising interest in overnight hydration and dermatologist-backed routines is gradually opening space for slugging-adjacent products in drugstores and e-commerce platforms.

Growth Outlook for Slugging Creams Market in USA

| USA By Product Type | Value Share % 2025 |

|---|---|

| Petroleum-Based Creams & Balms | 52.10% |

| Others | 47.9% |

The Slugging Creams Market in the USA is projected at USD 663.9 million in 2025. Petroleum-based creams and balms contribute 52.1%, while other formats hold 47.9%, reflecting the Product Type maturity and dominance of occlusive agents in barrier-repair routines. This marginal lead of petroleum-based products is attributed to their long-standing clinical endorsement, effectiveness in sealing moisture, and brand familiarity among USA consumers. However, the nearly equal share held by other formats signals a gradual format diversification influenced by clean-label preferences, stick formats, and balm-to-oil innovations.

Increasing adoption of slugging in skin cycling regimens and post-retinol care has widened the usage occasions, especially in colder regions. Emerging product hybrids and multifunctional nighttime occlusives are gaining visibility across DTC platforms and prestige skincare shelves. Meanwhile, growth in non-petroleum formats is strongly backed by clean beauty positioning, interest in plant-based wax alternatives, and dermatology-focused products. The shift is also catalyzed by growing consumer concerns over petrolatum content and environmental impact, triggering demand for transparent ingredient sourcing.

| China By Ingredient Type | Value Share % 2025 |

|---|---|

| Petrolatum | 49.7% |

| Others | 50.3% |

The Slugging Creams Market in China is projected at USD 487.2 million in 2025. Occlusive formulations using ingredients other than petrolatum hold a marginal lead at 50.3%, while petrolatum-based variants account for 49.7%, indicating a strong domestic pivot toward alternative occlusives in barrier-repair routines.

This slight edge reflects rising consumer aversion to heavy petrochemicals and growing alignment with traditional herbal and botanical skincare systems favored in the Chinese market. Natural-origin waxes, rice bran oils, ceramides, and fermented occlusive blends are being positioned as cleaner, breathable alternatives in facial slugging formats.

Increased interest in functional skincare aligned with TCM (Traditional Chinese Medicine), combined with broader adoption of minimal routines among Gen Z and millennial consumers, has created whitespace for non-petrolatum products to expand.

DTC brands are also capitalizing on the transparency trend and regulatory momentum around petrochemical scrutiny, pushing the narrative toward cleaner occlusion methods. Furthermore, China's ingredient-forward marketing style has enabled rapid consumer education and trial of novel occlusive formats.

| Slugging Creams | Global Value Share 2025 |

|---|---|

| Vaseline | 24.3% |

| Others | 75.7% |

In 2025, the global slugging creams market is projected to remain highly fragmented, with Vaseline holding the top brand position at 24.3% share, while the remaining 75.7% is distributed across a wide range of players. Vaseline’s dominance is expected to be sustained through its mass-market affordability, deep retail penetration, and brand familiarity.

Clinical skincare players such as Aquaphor and CeraVe are anticipated to retain their foothold due to strong positioning in pharmacy channels and dermatologist-endorsed claims. At the same time, indie brands like Futurewise, Dieux Skin, and Cocokind are projected to gain ground by tapping into Gen Z and millennial audiences through vegan, sustainable, and minimalist formulations.

Premium brands including Elizabeth Arden and Philosophy are likely to expand into slugging-friendly formats under barrier-repair or overnight recovery lines. Competitive activity is set to intensify with increased focus on petroleum-free occlusives, innovative gel-cream textures, and multi-functional barrier support technologies, driving a shift toward ingredient-conscious consumer preferences and blurring lines between dermocosmetic and prestige segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 2,290.30 Million |

| Product Type | Petroleum-based creams & balms, Oil-based occlusive creams, Gel-based slugging creams, Hybrid moisturizers (water-in-oil / oil-in-water), Stick format, Solid balms. |

| Ingredient Type | Petrolatum, Squalane, Hydrogenated polyisobutene, Beeswax, Lanolin, Silicone-based occlusives, Plant-based occlusives. |

| End Use Applications | Overnight moisturizing, Night skincare, Post-treatment dermatology, Clinical skincare, Barrier protection in multi-step skincare routines (e.g., K-beauty), Winter skincare, Seasonal hydration, Final occlusive step in daily routine. |

| Packaging Type | Tubes, Jars, Tubs, Pump bottles, Sticks, Twist-ups. |

| Distribution Channel | E-commerce platforms, Brand-owned DTC websites, Specialty beauty retail stores, Mass retail, Drugstores, Dermatology clinics, Aesthetic spas. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Vaseline, Aquaphor, CeraVe, Futurewise, Cocokind, Dieux Skin, iS Clinical, Elizabeth Arden, Philosophy, PCA Skin. |

| Additional Attributes | Dollar sales segmented by Product Type and end-use application, adoption trends in dermatologist-recommended routines and clinical skincare protocols, rising demand for multifunctional and hybrid slugging creams in premium segments, sector-specific growth in overnight care, barrier repair, and post-treatment regimens, revenue segmentation by Packaging Type s and Ingredient Type s, integration with microbiome-supportive formulations and prebiotic technologies, regional trends shaped by climate-based skincare preferences and cultural skincare routines such as K-beauty layering, and innovations in formulation stability, water-in-oil emulsion systems, and transdermal occlusion technologies. |

The global Slugging Creams Market is estimated to be valued at USD 2,290.30 million in 2025.

The market size for the Slugging Creams Market is projected to reach USD 3,800.50 million by 2035.

The Slugging Creams Market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in the Slugging Creams Market are occlusive creams, hybrid barrier creams, jelly-based formulas, balm-to-cream formats, and multi-functional slugging treatments.

In terms of product functionality, occlusive repair creams segment is anticipated to command a 37.2% share in the Slugging Creams Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Firming Creams and Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Aging Creams & Serums Market Size and Share Forecast Outlook 2025 to 2035

Anti-Wrinkle Creams Market Size and Share Forecast Outlook 2025 to 2035

Body Firming Creams Market Growth & Forecast 2025-2035

Eczema Relief Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Muscle Relaxing Creams Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Ice Creams Market Analysis by Form, Product Type, Flavor, Source, Sales Channel, and Region through 2035

Moisturizing Body Creams Market Size and Share Forecast Outlook 2025 to 2035

Age-Defying Night Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Hydrating Emollient Creams Market Size and Share Forecast Outlook 2025 to 2035

Cica-Infused Healing Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Retinoid-Infused Night Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Depilatory Hair Removal Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Stretch Mark Prevention Creams Market Size and Share Forecast Outlook 2025 to 2035

Lip Plumping and Filler Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Coconut Oil Moisturizing Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peptide-Enhanced Firming Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA