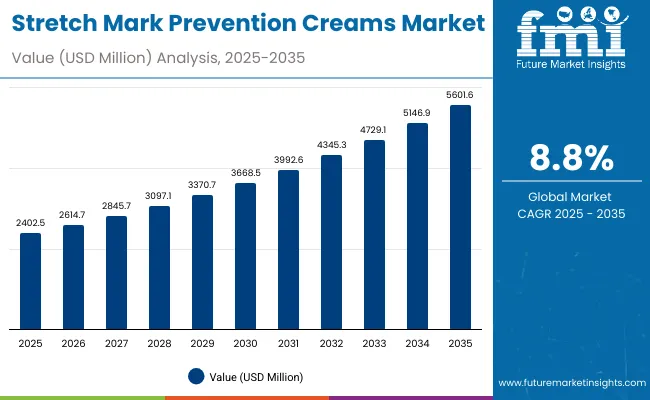

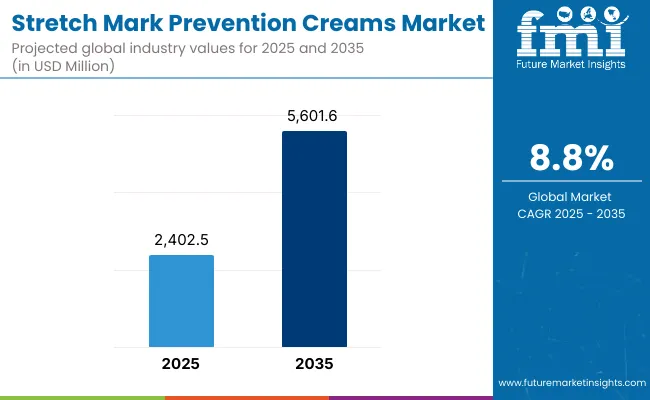

The Global Stretch Mark Prevention Creams Market is expected to record a valuation of USD 2,402.5 million in 2025 and USD 5,601.6 million in 2035, with an increase of USD 3,199.1 million, which equals a growth of 133% over the decade. The overall expansion represents a CAGR of 8.8% and a 2.3X increase in market size.

Global Stretch Mark Prevention Creams Market Key Takeaways

| Metric | Value |

|---|---|

| Global Stretch Mark Prevention Creams Market Estimated Value in (2025E) | USD 2,402.5 million |

| Global Stretch Mark Prevention Creams Market Forecast Value in (2035F) | USD 5,601.6 million |

| Forecast CAGR (2025 to 2035) | 8.8% |

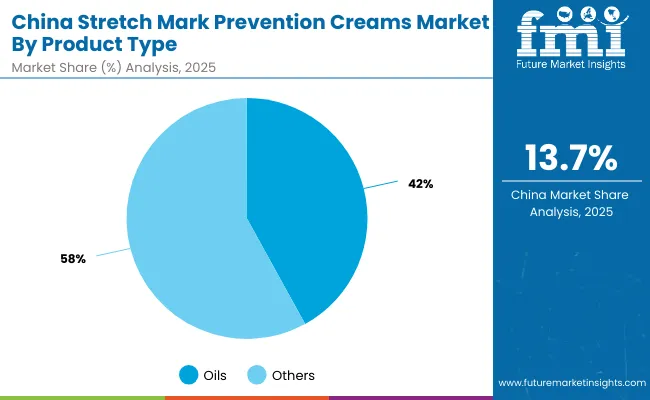

During the first five-year period from 2025 to 2030, the market increases from USD 2,402.5 million to USD 3,668.5 million, adding USD 1,266 million, which accounts for nearly 40% of the total decade growth. This phase records strong adoption in maternity-focused skincare, particularly creams and oils containing plant-based actives such as rosehip, almond oil, and Centellaasiatica. Oils dominate this period, accounting for over 42% of total sales, as consumers associate them with hydration and scar prevention during rapid skin expansion in pregnancy.

The second half from 2030 to 2035 contributes USD 1,933.1 million, equal to 60% of total growth, as the market jumps from USD 3,668.5 million to USD 5,601.6 million. This acceleration is powered by e-commerce penetration, natural/organic claims, and broader applications beyond pregnancy into athletic and weight-management use cases.

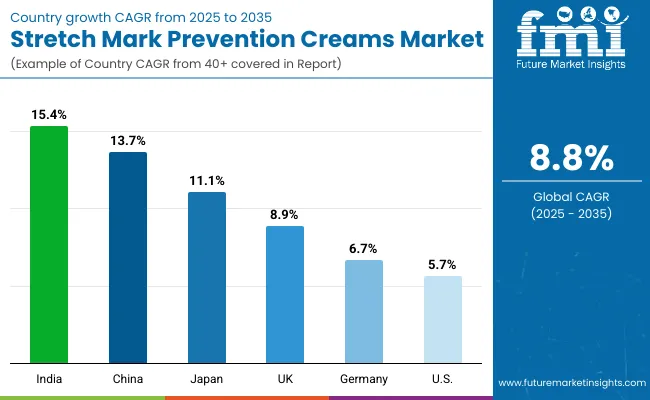

Asian countries such as India (15.4% CAGR) and China (13.7% CAGR) drive expansion as awareness of maternity skincare rises with urbanization and rising disposable incomes. Meanwhile, the USA retains significant value leadership, although its share moderates from 23.4% in 2025 to 20.8% in 2035 as Asia-Pacific grows faster.

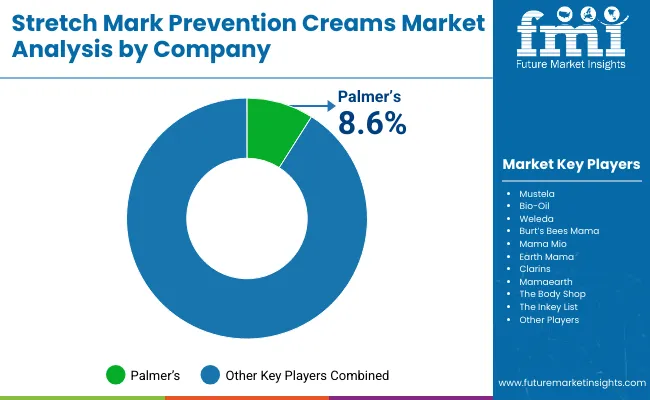

From 2020 to 2024, the Global Stretch Mark Prevention Creams Market expanded steadily, driven by hardware-like dominance of oils and creams that contributed more than 70% of sales. During this period, global competitive landscape was heavily fragmented with Palmer’s holding 8.6% global share in 2025, while numerous niche players captured the rest through specialized natural and organic offerings.

Competitive differentiation was based on pregnancy-safe formulations, clinical validation, and sensitivity-tested claims, while distribution was highly pharmacy- and drugstore-centered before the surge of e-commerce.

Demand is expected to expand strongly to USD 2,402.5 million in 2025, and the revenue mix will gradually shift as serums and peptide-based blends gain traction with dermatologists endorsing active-driven formulations. Traditional leaders such as Palmer’s and Mustela face competition from digital-first brands like Mamaearth and The Inkey List, which emphasize clean-label transparency, natural sourcing, and influencer-led online sales. The competitive advantage is moving away from generic oils and creams alone toward ecosystem-driven portfolios combining efficacy claims, digital engagement, and omni-channel distribution.

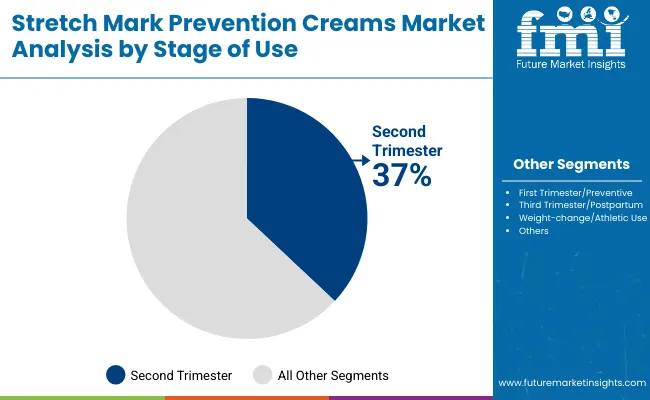

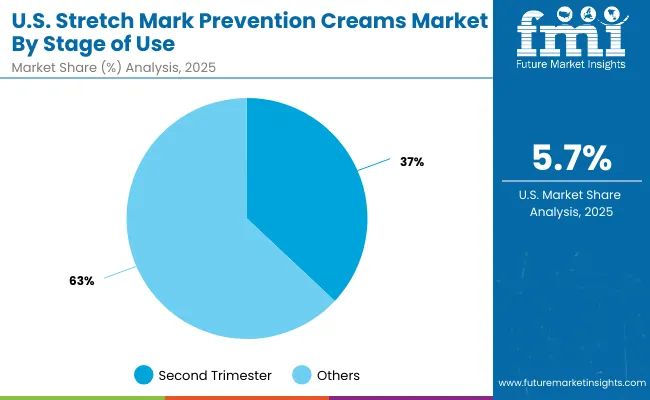

The primary growth driver is the rising incidence of stretch marks associated with pregnancy and lifestyle changes. According to WHO, nearly 140 million births annually worldwide create a consistent consumer base seeking safe, preventive maternity skincare. During the second trimester, representing 37% of the market, demand peaks as women proactively invest in plant oil-based solutions to maintain elasticity.

A second factor is the cultural and lifestyle shift in beauty standards, where consumers increasingly associate skin smoothness with wellness. This has expanded the use case into athletic populations and individuals undergoing weight changes, stimulating adoption beyond pregnancy.

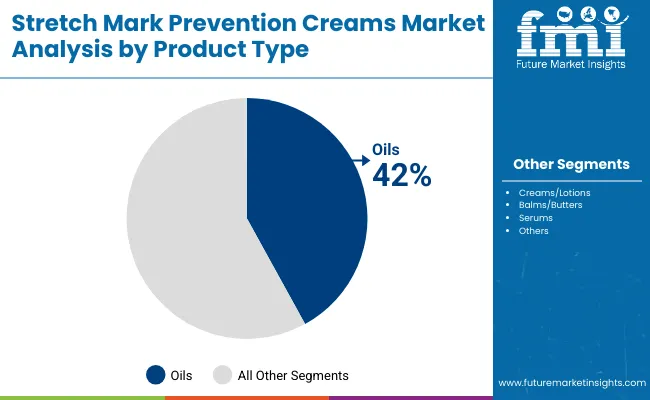

Oils, led by rosehip and almond blends, remain dominant, while peptide serums and vitamin E-enriched balms are emerging as premium alternatives.The rise of e-commerce and maternity specialty retail has significantly widened accessibility, with online platforms enabling global penetration for niche organic and hypoallergenic brands.

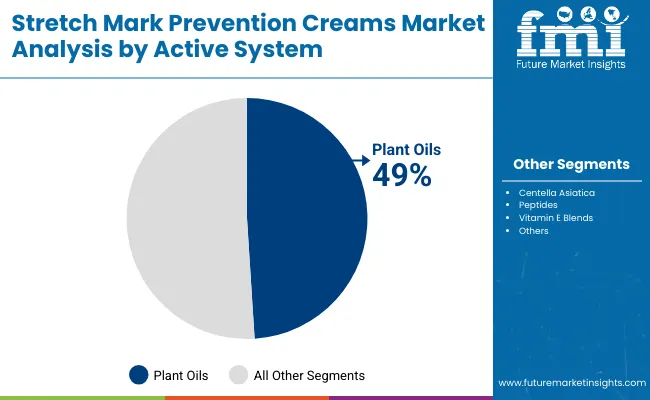

Additionally, the demand for fragrance-free and hypoallergenic claims reflects growing dermatological awareness, especially in sensitive-skin consumers. Segment growth is expected to be led by oils (42% share in 2025), second trimester stage of use (37%), and plant oil-based actives (49%), reinforcing the dominance of natural formulations. Asia-Pacific emerges as the fastest-growing region, with India and China projected to contribute the largest incremental value through 2035.

The market is segmented by Stage of Use, Product Type, Active System, Distribution Channel, Claim, and Geography. Stage of Use: First trimester/preventive, second trimester, third trimester/postpartum, weight-change/athletic use. Second trimester dominates with 37% share in 2025. Product Type: Oils, creams/lotions, balms/butters, and serums.

Oils lead with 42% share, reflecting traditional consumer trust. Active System: Plant oils (rosehip, almond), Centellaasiatica, peptides, and vitamin E blends. Plant oils contribute 49% share, highlighting the preference for natural actives. Channel: Pharmacies/drugstores, e-commerce, mass retail, maternity specialty retail.

E-commerce grows fastest due to digital engagement and influencer-driven marketing. Claim: Pregnancy-safe, fragrance-free, hypoallergenic, natural/organic. Pregnancy-safe and organic labels are key purchase triggers. Geography: North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa. Asia-Pacific leads growth with double-digit CAGRs in India (15.4%) and China (13.7%).

| Stage of Use | Value Share % 2025 |

|---|---|

| Second trimester | 37% |

| Others | 63.0% |

The second trimester segment is projected to contribute 37% of the global stretch mark prevention creams market revenue in 2025, equivalent to USD 888.9 million, maintaining its lead as the dominant stage-of-use category. This is driven by heightened consumer awareness that the middle stage of pregnancy is the most critical for preventive skincare, as rapid abdominal growth increases the risk of visible stretch marks. Mothers are more proactive during this period, often seeking dermatologist-recommended oils, creams, and serums to maintain skin elasticity.

The segment’s growth is also reinforced by medical guidance, as healthcare professionals commonly recommend preventive skincare beginning in the second trimester. Demand is further supported by the marketing strategies of leading brands such as Palmer’s and Mustela, which highlight trimester-specific use cases in their product lines. Although athletic and weight-change consumers represent an emerging base, the second trimester will remain the backbone of this category due to its clinical relevance and high purchase intent.

| Product Type | Value Share % 2025 |

|---|---|

| Oils | 42% |

| Others | 58.0% |

The oils segment is forecasted to hold 42% of the global market share in 2025, worth USD 1,009.1 million, leading over creams, balms, and serums. Oils are favored due to their deep hydration, massage-friendly texture, and long-standing cultural association with pregnancy care. They remain the first choice for many expecting mothers who prioritize natural, soothing solutions with minimal synthetic additives. This preference is reinforced by the availability of popular oil-based solutions, such as rosehip and almond oil blends, which are widely endorsed for their nourishing qualities.

Their versatility across both preventive and corrective routines has facilitated widespread adoption in North America, Europe, and Asia-Pacific markets. Additionally, the growing availability of fragrance-free and organic-certified oils has expanded their reach to sensitive-skin consumers. While creams and balms continue to grow due to convenience in application, oils dominate because they align with consumer trust in traditional maternity care practices. Serums, though still niche, are positioned as premium solutions and are expected to rise in adoption among urban, high-income populations.

| Active System | Value Share % 2025 |

|---|---|

| Plant oils | 49% |

| Others | 51.0% |

The plant oils segment is projected to contribute 49% of the global stretch mark prevention creams market revenue in 2025, valued at USD 1,177.2 million, making it the leading active system. This category’s strength comes from its alignment with natural and organic claims, which are increasingly driving consumer purchase decisions in skincare. Plant oils, such as rosehip and sweet almond oil, have been clinically recognized for improving skin hydration and elasticity, offering a preventive approach that appeals strongly to pregnant women and individuals with sensitive skin.

The segment’s growth is also supported by the clean-label movement, where buyers prioritize transparency in sourcing and formulation. Brands are heavily investing in highlighting botanical ingredients in their marketing campaigns, with many expanding into certified organic and hypoallergenic ranges. While Centellaasiatica and peptides are emerging in advanced formulations, plant oils dominate due to their accessibility, affordability, and heritage-based trust across global markets. Their continued role as the foundation of stretch mark prevention solutions ensures they retain leadership throughout the forecast period.

Rising Preventive Skincare Adoption During Pregnancy

A primary driver of the global stretch mark prevention creams market is the growing emphasis on preventive skincare during pregnancy, especially in the second trimester. With 37% of global market value in 2025 (USD 888.9 million) coming from second trimester usage, the demand reflects heightened awareness that this stage is critical for skin elasticity management. The increasing availability of clinical evidence supporting early and consistent application of stretch mark oils and creams has strengthened adoption.

For instance, dermatologists in North America and Europe actively recommend plant oil-based solutions as preventive measures rather than corrective ones. In parallel, social media platforms amplify educational content around trimester-based skincare routines, which directly influences purchasing decisions of younger, digital-native mothers.

The combination of clinical validation, influencer marketing, and consumer willingness to invest in safety-tested products has created strong momentum in this stage-specific demand. As healthcare professionals continue to integrate preventive skincare advice into prenatal consultations, this driver will remain fundamental to sustaining market growth.

Expansion Beyond Pregnancy into Lifestyle-driven Usage

Another key driver is the market’s expansion beyond traditional pregnancy applications into lifestyle-related use cases such as weight-change and athletic skincare. Although pregnancy remains the anchor, the weight-change/athletic user base is gaining recognition as fitness culture spreads globally. Athletes, bodybuilders, and individuals undergoing rapid body transformations due to weight gain or loss increasingly use stretch mark prevention creams to maintain skin smoothness and elasticity.

This expansion diversifies the consumer base, reducing dependence solely on maternity-driven cycles. Furthermore, products positioned as gender-neutral or lifestyle-friendly, particularly serums and peptide-based formulations, are gaining adoption in urban markets.

In Asia-Pacific, rising disposable incomes and increasing gym memberships in India and China amplify this trend, while in Western countries, body-positive movements encourage men and women alike to normalize preventive skincare. By broadening the user spectrum, this driver introduces a recurring revenue stream that extends beyond nine months of maternity-related usage and establishes stretch mark creams as part of mainstream personal care regimens.

Limited Clinical Validation and Standardization Across Brands

One major restraint is the limited clinical validation of efficacy across products, creating skepticism among consumers and healthcare professionals. While certain plant oils like rosehip and almond have documented benefits, many stretch mark creams lack standardized testing or FDA/EMA certifications.

This inconsistency weakens consumer trust, particularly in North America and Europe, where regulatory scrutiny is high. The result is a fragmented landscape where marketing claims of “pregnancy-safe” or “organic” are not always backed by robust clinical data. For instance, despite Palmer’s holding 8.6% of the global share in 2025, the remaining market is divided among numerous small brands, many without dermatological endorsement.

This lack of validation leads some consumers to abandon specialized creams altogether in favor of general moisturizers, slowing adoption. As more consumers demand scientific proof before purchase, the absence of standardized benchmarks could limit the pace of premiumization and growth in high-income regions.

Price Sensitivity in Emerging Markets

Another restraint arises from price sensitivity in emerging markets, particularly in South Asia and Africa. Despite India registering a 15.4% CAGR between 2025 and 2035, affordability challenges hinder wider penetration beyond urban upper-middle-class households. Oils and creams with natural or imported ingredients are often priced at a premium, making them inaccessible to price-sensitive rural or semi-urban populations.

While consumers in developed regions are willing to pay more for hypoallergenic or clinically tested products, cost remains a barrier in high-growth markets where awareness is rising. This dynamic restricts overall volume expansion, as lower-income groups substitute specialized creams with traditional oils like coconut or mustard, which are culturally trusted and significantly cheaper. Unless brands introduce smaller pack sizes, locally sourced alternatives, or tiered pricing strategies, affordability gaps will continue to limit the full growth potential of this market in fast-growing economies.

Surge in Natural and Organic Claims Driving Product Innovation

A defining trend in the global stretch mark prevention creams market is the rapid adoption of natural and organic claims, particularly around plant oils, which already account for 49% of the active system share (USD 1,177.2 million in 2025).

Consumers, especially expectant mothers, are highly cautious about ingredient safety, avoiding parabens, synthetic fragrances, and harsh chemicals. This has triggered innovation toward certified-organic, fragrance-free, and hypoallergenic formulations. In competitive landscapes such as Europe, organic certifications are becoming a key differentiator, while in Asia-Pacific, local brands leverage Ayurveda- or TCM-based ingredients to capture cultural relevance.

Social media has amplified this trend by popularizing “clean pregnancy skincare” narratives, fueling demand for transparency in labeling. The result is a clear shift where even multinational brands are reformulating legacy products to align with natural ingredient positioning. This trend not only drives premiumization but also ensures sustained consumer loyalty, as safety becomes as important as efficacy.

E-commerce and Digital Engagement Transforming Distribution

Another critical trend is the rise of e-commerce as a dominant distribution channel, which is reshaping how consumers discover and purchase stretch mark prevention creams. While pharmacies and drugstores still command trust, online platforms provide unparalleled convenience and access to global niche brands. Influencer-led marketing on Instagram, TikTok, and YouTube has played a pivotal role in expanding consumer education around trimester-specific routines and natural actives.

In fast-growing markets like China and India, e-commerce penetration has allowed brands like Mamaearth to scale rapidly, challenging incumbents. Moreover, subscription-based models and targeted digital advertising are encouraging repeat purchases, a crucial factor in retaining consumers throughout and after pregnancy. As digital-first consumer behavior strengthens, e-commerce will not only capture incremental sales but also create space for emerging players to build global reach without relying solely on traditional retail.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 13.7% |

| USA | 5.7% |

| India | 15.4% |

| UK | 8.9% |

| Germany | 6.7% |

| Japan | 11.1% |

The country-level growth outlook for the stretch mark prevention creams market highlights the contrasting pace of expansion across developed and emerging economies. India (15.4% CAGR) and China (13.7% CAGR) stand out as the fastest-growing markets, driven by rapid urbanization, rising disposable incomes, and greater awareness of maternity and personal care products. In these markets, younger demographics, higher fertility rates, and the cultural preference for herbal and natural formulations strongly boost adoption.

Japan (11.1% CAGR) also emerges as a high-growth market, supported by its advanced beauty sector, strong consumer focus on anti-aging and skin wellness, and increasing acceptance of preventive skincare during pregnancy. These countries collectively showcase Asia-Pacific’s dominant role in propelling global market growth, both in terms of new product launches and evolving consumer preferences.

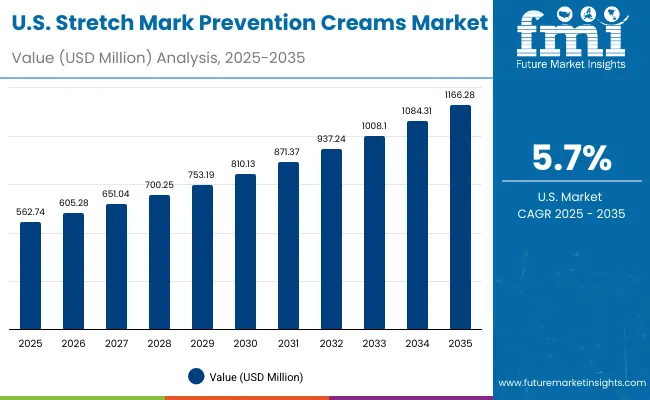

In contrast, growth in mature Western markets is comparatively slower yet remains significant in value terms. The USA market (5.7% CAGR), although expanding at a moderate rate, is expected to maintain leadership in absolute revenue share due to strong brand penetration, high consumer spending power, and established retail channels.

The UK (8.9% CAGR) and Germany (6.7% CAGR) demonstrate steady expansion, reflecting consistent adoption of organic and hypoallergenic products alongside e-commerce growth. However, their slower pace compared to Asia is linked to lower birth rates and higher market maturity. Collectively, these variations highlight a two-speed market dynamic: mature Western economies contributing stability and premium innovation, while Asia-Pacific markets deliver rapid scale and long-term expansion opportunities.

| Year | USA Stretch Mark Prevention Creams Market (USD Million) |

|---|---|

| 2025 | 562.74 |

| 2026 | 605.28 |

| 2027 | 651.04 |

| 2028 | 700.25 |

| 2029 | 753.19 |

| 2030 | 810.13 |

| 2031 | 871.37 |

| 2032 | 937.24 |

| 2033 | 1008.10 |

| 2034 | 1084.31 |

| 2035 | 1166.28 |

The USA stretch mark prevention creams market is projected to grow at a CAGR of 5.7%, led by strong consumer trust in established brands and rising interest in pregnancy-safe and hypoallergenic products. Pharmacies and drugstores remain the dominant sales channel, though e-commerce adoption is growing rapidly with subscription-based sales.

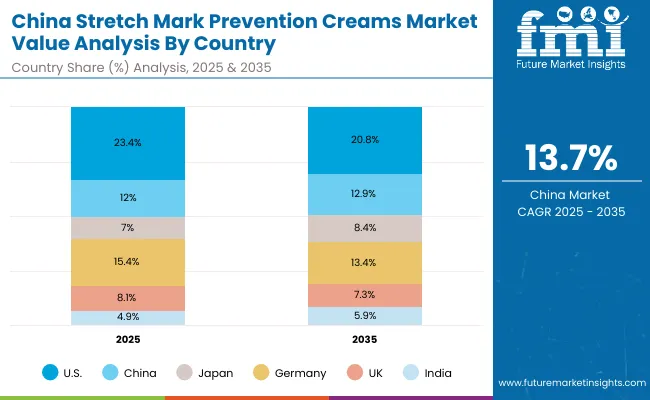

Weight-management and athletic use cases are gaining visibility alongside pregnancy care, widening the consumer base. Dermatologist endorsements and clinical positioning of peptide serums are enhancing premium adoption. The market, however, is expected to lose slight share globally, from 23.4% in 2025 to 20.8% in 2035, as faster growth shifts toward Asia.

The UK market is expected to grow at a CAGR of 8.9% through 2035, supported by strong penetration of organic and natural brands. British consumers prioritize hypoallergenic and fragrance-free formulations, aligning with dermatological advice. Distribution through maternity specialty retail is strong, though e-commerce platforms are reshaping product accessibility.

Heritage brands such as Weleda and Clarins maintain steady traction, while indie organic players leverage clean-label storytelling. The UK will experience a mild decline in global share, from 8.1% in 2025 to 7.3% in 2035, reflecting the market’s maturity relative to Asia-Pacific growth.

India is witnessing rapid expansion in the stretch mark prevention creams market, forecasted to grow at a 15.4% CAGR through 2035, the fastest among all key markets. Growth is fueled by rising disposable incomes, urbanization, and increasing maternal healthcare awareness.

Oils, aligned with Ayurveda and herbal traditions, dominate preference, but international creams and serums are gaining traction among middle- and upper-class households. E-commerce platforms like Nykaa and Flipkart enable nationwide product penetration, including tier-2 and tier-3 cities. India’s share is projected to rise from 4.9% in 2025 to 5.9% in 2035, reflecting both value and volume growth.

The China market is projected to grow at a 13.7% CAGR, the second-highest among major economies, supported by the country’s robust beauty and personal care industry. Oils remain dominant, holding 42% of the segment (USD 120.8 million in 2025), while creams and serums gain momentum as premium choices among urban consumers.

Digital-first adoption via Tmall, JD.com, and Douyin live-commerce channels is accelerating penetration. The government’s focus on maternal health and the cultural emphasis on preventive skincare also strengthen adoption. China’s share will rise from 12.0% in 2025 to 12.9% in 2035, underscoring its growing role in global expansion.

| Country | 2025 Share (%) |

|---|---|

| USA | 23.4% |

| China | 12.0% |

| Japan | 7.0% |

| Germany | 15.4% |

| UK | 8.1% |

| India | 4.9% |

| Country | 2035 Share (%) |

|---|---|

| USA | 20.8% |

| China | 12.9% |

| Japan | 8.4% |

| Germany | 13.4% |

| UK | 7.3% |

| India | 5.9% |

| USA By Stage of Use | Value Share % 2025 |

|---|---|

| Second trimester | 37% |

| Others | 63.0% |

The USA stretch mark prevention creams market is projected at USD 562.7 million in 2025, expanding steadily to USD 1,166.3 million by 2035 at a CAGR of 5.7%. The second trimester stage dominates with 37% share (USD 208.2 million), reflecting heightened consumer awareness of the need for preventive care during pregnancy’s middle phase. Oils and creams are favored due to their accessibility through pharmacies and drugstores, which remain the primary distribution channels. While traditional oils dominate in volume, serums enriched with peptides and Centella are gaining traction among higher-income households seeking clinically validated, premium solutions.

Growth is further supported by rising e-commerce penetration and subscription-based purchases from maternity specialty retailers. Dermatologist endorsements and increased consumer demand for hypoallergenic and fragrance-free claims drive brand differentiation. The USA, while growing slower than Asia, remains a high-value market due to consumer willingness to invest in safe and effective formulations.

| China By Product Type | Value Share % 2025 |

|---|---|

| Oils | 42% |

| Others | 58.0% |

The China stretch mark prevention creams market is valued at USD 287.6 million in 2025, with oils leading the product type segment at 42% (USD 120.8 million). Oils are deeply rooted in consumer preference due to their natural positioning and alignment with traditional care practices. However, creams, butters, and serums are steadily gaining traction, especially among urban millennial mothers with higher disposable incomes. The market is forecast to expand at a robust 13.7% CAGR through 2035, nearly doubling its global share from 12.0% in 2025 to 12.9% in 2035.

The country’s growth is propelled by live-commerce platforms such as Tmall, JD.com, and Douyin, which have amplified consumer awareness of preventive maternity skincare. International brands benefit from rising trust in pregnancy-safe labels, while local digital-first brands leverage affordability and herbal-based innovation. Oils retain dominance in rural and mass markets, while premium serums featuring peptides and vitamin E blends expand rapidly in metropolitan centers like Shanghai and Beijing.

| Company | Global Value Share 2025 |

|---|---|

| Palmer’s | 8.6% |

| Others | 91.4% |

The Global Stretch Mark Prevention Creams Market is highly fragmented, with both international leaders and niche organic brands competing across regions. Palmer’s, with an 8.6% global share in 2025, remains the market leader, anchored by its strong brand equity and wide pharmacy distribution.

Other leading players such as Mustela, Bio-Oil, Weleda, Burt’s Bees Mama, Mama Mio, Earth Mama, Clarins, Mamaearth, and The Body Shop compete through differentiated product claims, including organic, hypoallergenic, and pregnancy-safe formulations.

European players like Mustela and Weleda emphasize clinical testing and natural formulations, while digital-first Asian brands such as Mamaearth focus on e-commerce-led affordability and clean-label positioning. Premium Western skincare brands including Clarins and The Body Shop target higher-income consumers with serums and butters positioned as luxury maternity skincare. The competitive differentiation is shifting toward transparency, dermatologist endorsements, and omni-channel availability. Additionally, influencer-driven marketing and subscription models are redefining repeat purchase behavior.

Key Developments in Global Stretch Mark Prevention Creams Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,402.5 Million |

| Stage of Use | First trimester/preventive, Second trimester, Third trimester/postpartum, Weight-change/athletic use |

| Product Type | Oils, Creams/lotions, Balms/butters, Serums |

| Active System | Plant oils (rosehip, sweet almond), Centella asiatica , Peptides, Vitamin E blends |

| Channel | Pharmacies/drugstores, E-commerce, Mass retail, Maternity specialty retail |

| Claim | Pregnancy-safe, Fragrance-free, Hypoallergenic, Natural/organic |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Palmer’s, Mustela , Bio-Oil, Weleda, Burt’s Bees Mama, Mama Mio, Earth Mama, Clarins , Mamaearth , The Body Shop, The Inkey List |

| Additional Attributes | Dollar sales by stage of use and product type, adoption trends in preventive maternity care, expansion into weight-change/athletic use, demand growth for natural/organic claims, increasing e-commerce penetration, premiumization through peptide- and Centella -based serums, regional differences driven by birth rates and disposable incomes, and innovations in hypoallergenic, fragrance-free, and dermatologist-endorsed formulations. |

The global stretch mark prevention creams market is estimated to be valued at USD 2,402.5 million in 2025.

The market size is projected to reach USD 5,601.6 million by 2035.

The market is expected to grow at a CAGR of 8.8% between 2025 and 2035.

The key product types are oils, creams/lotions, balms/butters, and serums.

In terms of stage of use, the second trimester segment commands 37% share in 2025 (USD 888.9 million), making it the leading category.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stretch Film Industry Analysis in DACH Size and Share Forecast Outlook 2025 to 2035

Stretch Film Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Stretch Marks Treatment Market Size and Share Forecast Outlook 2025 to 2035

Stretch Mark Removal Products Market Insights - Growth & Forecast 2025 to 2035

Market Positioning & Share in the Stretch Film Industry

Stretch Films Market Outlook - Size, Demand & Industry Trends 2025 to 2035

Stretch Wrapper Market Growth - Demand & Forecast 2025 to 2035

Stretch Hood Films Market Analysis by Up to 50 microns, 50-100 microns, 100-150 microns, 150 microns & above Through 2035

Stretch Film Packs Market Insights on Type, Product, Application, Industry, and Region - 2025 to 2035

Stretch Sleeve Label Market Insights – Growth & Demand 2024-2034

Stretcher Accessories Market Size and Share Forecast Outlook 2025 to 2035

Stretchable Electronics Market Trends - Growth & Forecast 2025 to 2035

Stretch and Shrink Films Market Size and Share Forecast Outlook 2025 to 2035

Stretch Hood Pallet Wrapping Market

Stretch Blow Molding Machines Market Segmentation based on Technology Type, Orientation Type, End Use, and Region: A Forecast for 2025 and 2035

Market Share Insights of Leading Stretch Blow Molding Machines Providers

Stretchable Conductive Material Analysis by Material, Fillers, Stretching Mechanism, Fabrication, Function, Application, End-User and Region - Forecast for 2025 to 2035

Stretchable and Conformal Electronics Market

Stretch Sleeve and Shrink Sleeve Labels Market Size and Share Forecast Outlook 2025 to 2035

UVI Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA