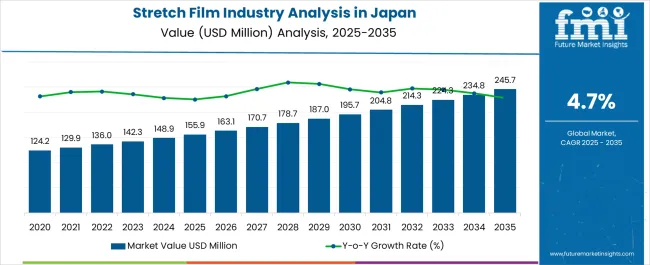

The Stretch Film Industry Analysis in Japan is estimated to be valued at USD 155.9 million in 2025 and is projected to reach USD 245.7 million by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

| Metric | Value |

|---|---|

| Stretch Film Industry Analysis in Japan Estimated Value in (2025 E) | USD 155.9 million |

| Stretch Film Industry Analysis in Japan Forecast Value in (2035 F) | USD 245.7 million |

| Forecast CAGR (2025 to 2035) | 4.7% |

The stretch film market in Japan is experiencing stable growth driven by expanding logistics networks, rising e-commerce penetration, and consistent demand from packaging-intensive industries. Current dynamics are being influenced by an increasing emphasis on cost-effective, sustainable, and performance-oriented packaging solutions. Regulatory focus on recyclability and material efficiency is also shaping product innovation and market strategies.

The sector is benefiting from the adaptability of stretch films in reducing transportation losses and improving load stability, thereby ensuring operational efficiencies for end users. Growth is further supported by advancements in film manufacturing technologies that enable thinner yet stronger films, contributing to lower material consumption without compromising performance.

The future outlook is favorable as demand for efficient packaging solutions is expected to rise in line with Japan’s expanding food, retail, and industrial distribution sectors Growth rationale is centered on sustained material innovation, investments in cast and blown production processes, and end-use sector reliance on high-quality packaging, which collectively position the market for consistent expansion.

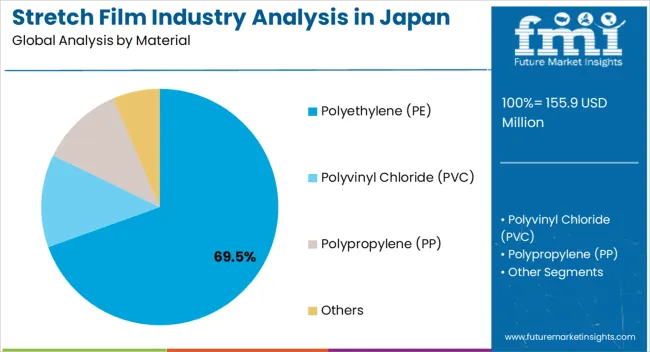

The polyethylene (PE) segment, holding 69.50% of the material category, has remained dominant due to its versatility, durability, and cost-efficiency in stretch film production. Its high share is being reinforced by superior mechanical properties that ensure load stability, puncture resistance, and flexibility during application.

Widespread availability of PE resin and established supply chains have supported stable production and cost management. Continuous improvements in film formulation, such as downgauging technologies, have enabled producers to reduce thickness while maintaining strength, thereby enhancing sustainability.

The segment’s growth is also being sustained by recyclability, which aligns with Japan’s strict environmental policies and consumer demand for eco-conscious packaging solutions These factors collectively ensure the continued leadership of PE in the material category.

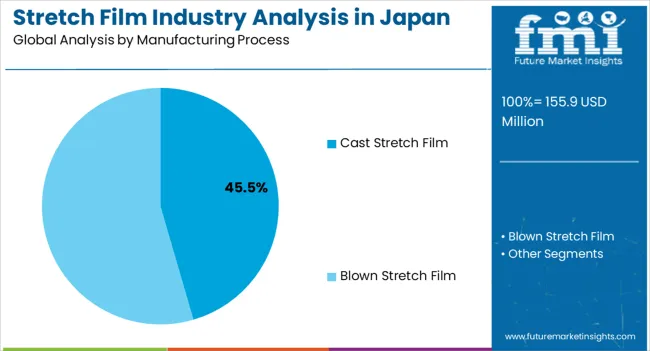

The cast stretch film segment, accounting for 45.50% of the manufacturing process category, has emerged as the leading process due to its production efficiency and ability to deliver high-clarity films. Consistency in thickness, improved load retention, and reduced production costs compared to blown processes have supported its strong adoption.

The segment’s performance has been enhanced by advancements in extrusion technology, allowing producers to achieve better film uniformity and faster production cycles. Demand for cast stretch film has been reinforced by its ease of application in automated wrapping systems widely used in Japan’s logistics and distribution sectors.

The combination of cost competitiveness, clarity, and high productivity has enabled cast stretch film to maintain its leadership position within the manufacturing process segment.

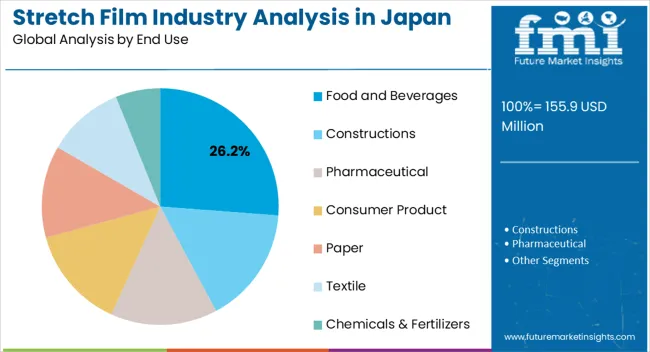

The food and beverages segment, representing 26.20% of the end-use category, has maintained its leading role due to stringent safety and quality requirements in packaging perishable goods. The segment’s reliance on stretch films is based on their ability to provide secure, tamper-evident, and hygienic packaging solutions that extend shelf life and reduce product wastage.

Rising demand for ready-to-eat and packaged food products in Japan’s urban centers has further boosted the segment’s consumption. The efficiency of stretch films in bulk transportation and pallet wrapping has also contributed to their adoption by major food and beverage distributors.

Increasing investments in cold chain logistics and distribution centers are expected to sustain demand, ensuring that the food and beverages segment continues to hold a pivotal role in the Japanese stretch film market.

The manufacturing sector remains robust, with numerous industries producing goods for both domestic consumption and export. Stretch films play a pivotal role in securing products for transportation and supporting the country's export-oriented economy.

Continuous advancements in stretch film manufacturing technology lead to the development of more efficient, durable, and environmentally friendly films, meeting the evolving demands of industries.

The demand for eco-friendly and recyclable packaging materials, including stretch films, is on the rise, driven by consumer preferences and regulatory pressures.

Industries in Japan often require specialized packaging solutions tailored to their unique products. Customized stretch films catering to specific industries, such as electronics, automotive, or pharmaceuticals, play a pivotal role in meeting these diverse needs.

Kanto is a major industrial center that houses various manufacturing industries. The demand for stretch films for packaging goods during transportation and storage is high in these sectors, contributing to stretch film industry growth.

In significant retail and commercial center, the rise of e-commerce and retail activities has surged demand for efficient and secure packaging solutions like stretch films to protect goods during shipping boost the demand. Continuous advancements in stretch film technology have led to the development of high-performance films catering to diverse industry needs.

Emphasis on sustainability aligns with the global trend towards eco-friendly packaging in Kanto. The region's demand for recyclable and bio-based stretch films is increasing to meet consumer and regulatory preferences.

Chubu is a central industrial area housing diverse manufacturing sectors such as automotive, electronics, and machinery. The demand for stretch films as a packaging solution for these industries' products during transportation and storage has contributed to stretch film industry growth.

The focus on technological innovation extends to packaging materials. Continuous advancements in stretch film technology have led to the development of high-performance films tailored to Chubu's industries' specific needs.

The growth of e-commerce and retail industries in Chubu has driven the demand for secure and efficient packaging solutions like stretch films to protect goods during transit, contributing to industry growth.

Cast film manufacturing allows for precise control over film thickness. This process enables the production of uniform, consistent films with controlled properties throughout, ensuring reliable performance in terms of strength and elongation. The cast film segment is expected to account for 66.0% of the industry share in 2025.

Cast films possess exceptional stretching capabilities, offering high elongation before breaking. This feature is beneficial for securing loads tightly, providing excellent load containment and stability during transportation and storage.

Cast films have a smooth and quiet unwind, making them suitable for high-speed automated wrapping machinery. The smooth surface also facilitates easy application and contributes to minimal noise during the wrapping process.

| Attribute | Details |

|---|---|

| Manufacturing Process | Cast |

| Value Share | 66.0% |

Stretch films provide an effective barrier against moisture, dust, and contaminants, safeguarding food and beverage products from external elements during storage, transportation, and display. The food and beverage segment is estimated to dominate the stretch film industry, with an industry share of 26.20% in 2025.

Stretch films help maintain the hygiene and sanitation of food products by creating a protective layer that prevents direct contact with the environment, reducing the risk of contamination.

The food and beverage industry is subject to stringent regulations regarding packaging materials to ensure product safety and compliance with health standards. Stretch films meet these requirements while providing reliable packaging solutions.

| Attribute | Details |

|---|---|

| End Use | Food and Beverages |

| Value Share | 26.20% |

Acquisitions and mergers are the default expansion strategies of players operating in stretch film in Japan. Key manufacturers of stretch film in Japan focus on facility expansions, product innovations, and promotional activities to increase sales and gain a competitive edge.

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 155.9 million |

| Projected Industry Size in 2035 | USD 245.7 million |

| Anticipated CAGR between 2025 to 2035 | 4.7% CAGR |

| Historical Analysis of Demand for Deployment of Stretch Film in Japan | 2020 to 2025 |

| Demand Forecast for Deployment of Stretch Film in Japan | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing Deployment of Stretch Film in Japan, Insights on Global Players and their Industry Strategy in Japan, Ecosystem Analysis of Local Providers in Japan. |

| Key Region Analyzed While Studying Opportunities in the Deployment of Stretch Film in Japan | Kanto Region; Chubu Region; Kinki (Kansai); Kyushu and Okinawa; Tohoku |

| Key Companies Profiled | Nishi Nippon Railroad Co. Ltd.; Futamura Chemical Co Ltd.; Dongguan Yalan Packing Materials Co. Ltd; ZPF Efekt Plus; Four Star Plastics; Griff Paper and Film; CS Hyde Company; International Plastics Inc.; Bagla Group of Companies; International Plastics Inc.; Italdibipack Group; Berry Global Group, Inc.; AEP Industries Inc. |

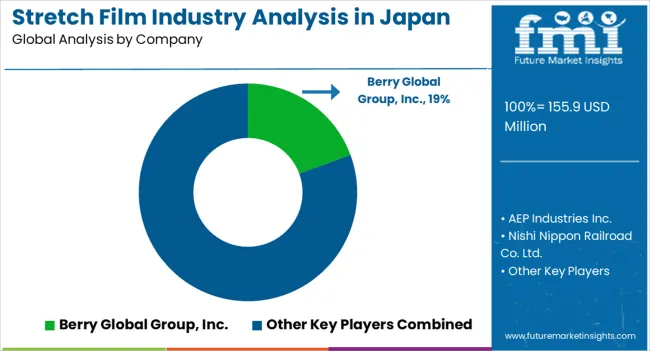

The global stretch film industry analysis in Japan is estimated to be valued at USD 155.9 million in 2025.

The market size for the stretch film industry analysis in Japan is projected to reach USD 246.3 million by 2035.

The stretch film industry analysis in Japan is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in stretch film industry analysis in Japan are polyethylene (pe), _high-density polyethylene (hdpe), _low-density polyethylene (ldpe), polyvinyl chloride (pvc), polypropylene (PP) and others.

In terms of manufacturing process, cast stretch film segment to command 45.5% share in the stretch film industry analysis in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stretch Film Industry Analysis in DACH Size and Share Forecast Outlook 2025 to 2035

Stretch Film Packs Market Insights on Type, Product, Application, Industry, and Region - 2025 to 2035

Stretch Films Market Outlook - Size, Demand & Industry Trends 2025 to 2035

Market Positioning & Share in the Stretch Film Industry

Japan Cling Film Market Analysis – Trends & Insights 2025-2035

Stretch Hood Films Market Analysis by Up to 50 microns, 50-100 microns, 100-150 microns, 150 microns & above Through 2035

UVI Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Cast Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

Stretch and Shrink Films Market Size and Share Forecast Outlook 2025 to 2035

Europe MDO-PE Film Market Trends & Growth Forecast 2024-2034

Korea Stretch Film Market Analysis by Material, Manufacturing Process, End-use, and Region Forecast Through 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Blown Stretch Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA