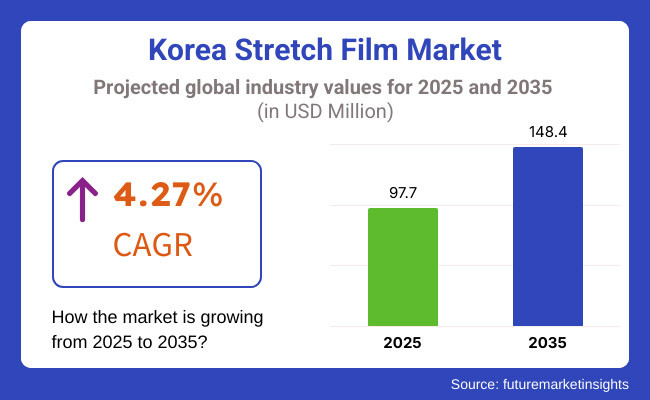

The Korea stretch film market is anticipated to be valued at USD 97.7 million in 2025. It is expected to grow at a CAGR of 4.27% during the forecast period and reach a value of USD 148.4 million in 2035.

A Korea stretch film is a rubbery plastic band applied in the logistics, warehouse, and factory packaging industries for securing products, inhibiting shifting, and shield against dust, moisture, and tampering. For food, drink, pharma and internet retail, an important application makes sure that products are safe, can be handled easily, and remain on the shelf for a longer time by using heavy-duty and cost-effective solutions.

The Korea stretch film industry accounts for the industry manufacturing and exporting stretch films as packaging material. Market growth results from growing e-commerce, enhancing logistics networks, and mounting pressures for sustainable high-performance packaging systems. The growing adoption of biodegradable film and automated wrapping technology further stokes market growth.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The market witnessed continuous growth, as increasing demand for logistics, warehousing, and food packaging was driving the growth. Online sales and international trade boosted consumption of stretch films used for protecting goods. | Sustainability issues will propel significant changes in the market, with widespread emphasis on biodegradable, recyclable, and reusable stretch film to meet global and local environmental legislation. |

| Traditional plastic-based stretch films led the way with their ease of affordability, flexibility, and ability to ensure goods are securely in place when moving and storing. | The market will transform toward sustainable materials, including bio-based polymers, compostable films, and high-performance recyclable films, less reliant on conventional petroleum-based plastics. |

| Firms concentrated on enhancing the mechanical properties of stretch films, including better elasticity and resistance to punctures, to address industrial packaging needs. | Innovation will focus on creating thinner yet stronger stretch films with longer life, minimizing overall material consumption while ensuring packaging integrity. |

| A flourishing e-commerce industry fueled pallet stretch film demand as businesses required secure packaging for bulk orders and last-mile delivery. | As environmental concern increases, e-commerce and retail industries will adopt green stretch film solutions, including biodegradable wraps and reusable packaging models. |

| There were emerging government regulations concerning plastic waste, but there was moderate enforcement so single-use plastic films continued to be used. | Tighter environmental regulations will call for less plastic waste, compelling manufacturers to incorporate higher recycled content and enhance film recyclability. |

| Food safety standards affected the innovation of stretch films with improved barrier performance, providing freshness and contamination protection in packaged foods. | Innovative food-grade biodegradable films and antimicrobial stretch films will pick up steam, enhancing food safety and reducing environmental footprints. |

| Aspects of material complexity, contamination, and limited infrastructure constrain stretch film recycling and create low levels of recycling. | Closed-loop recycling business models are generally going to prevail as companies will invest in advanced sorting and processing technologies which will help increase recyclability for stretch films. |

| Cost-effectiveness was a key business issue, leading to the widespread use of conventional stretch films despite their environmental impact. | Cost savings due to sustainable packaging will be seen in the long run as companies shift towards regulation-compliant eco-friendly packaging alternatives based on corporate social responsibility (CSR) plans. |

| Industrial automation within packaging enhanced efficiency, with stretch wrapping equipment enhancing film application consistency and waste minimization. | Intelligent packaging systems controlled by AI and intelligent stretch films with tracking functionality will enhance supply chain efficiency and minimize waste. |

Ultra-Thin and High-Strength Films Optimizing Efficiency

Korea's film market for stretch is moving towards ultra-thin but highly resilient materials that increase packaging efficiency. Businesses create sophisticated nano-layered films that are stronger while requiring less material, cutting costs and environmental footprint. Industries opt for high-stretch films that provide outstanding load stability, reducing product damage during shipment.

These developments enable businesses to maximize logistics, enhance sustainability, and minimize plastic use overall without sacrificing performance. With increasing demand for light yet durable packaging solutions, brands keep testing the limits of material science and engineering.

Eco-Friendly and Biodegradable Alternatives Gaining Popularity

Sustainability continues to be a major driver as companies launch environmentally friendly stretch films that are biodegradable and recycled. Companies invest in compostable films from renewable resources like corn starch and cellulose, focusing on eco-friendly companies and regulatory requirements.

Consumers and industries prefer stretch films with reduced carbon footprints, prompting companies to develop water-soluble and reusable stretch films. These environmentally friendly products supplement Korea's push for more sustainable packaging and provide companies with new ways of meeting sustainability goals without sacrificing protection and efficiency in their products.

| Metric | Value |

|---|---|

| Top Manufacturing Process | Cast Stretch Film |

| Market Share in 2025 | 67.5% |

The cast stretch film segment is poised to solidify its dominance of the Korea stretch film market, with a 67.5% market share in 2025. The segment is highly significant to high-clarity industrial packaging and provides affordable and simple-to-stretch solutions to secure goods during transit and storage.

The market presence is strong because it has gained widespread use in food packaging, manufacturing, and logistics industries. Its recyclability, tear resistance, and its equal thickness make it more popular. Its appeal is bound to grow with the growing emphasis on sustainability, and its eco-friendly and biodegradable cast films are likely to make its hold in the market stronger.

| Metric | Value |

|---|---|

| Top End-use | Food and Beverages |

| Market Share in 2025 | 26.3% |

As per FMI estimation, the food and beverage sector continues to be a key driver for the Korea stretch film market, capturing a 26.3% market share in 2025. The need for hygienic, protective, and efficient packaging from this industry drives the growth of stretch films in ensuring freshness, extended shelf life, and protection of products.

The significant market share is a testament to the growing demand for safe food packaging in the face of changing consumer trends and tough food safety regulations. With ready-to-eat food, frozen food, and drink packaging experiencing a boom in demand, companies are investing in high-end stretch films with better barrier properties to preserve food quality and minimize environmental footprint.

The Korea stretch film market extensively utilizes polyethylene (PE), polyvinyl chloride (PVC), polypropylene (PP), and other materials due to their versatility, durability, and cost-effectiveness. The most used is Polyethylene (PE), which has both HDPE and LDPE. It boasts of good stretchability, resistance to puncturing, and the ability to recycle, which renders it suitable for covering palletized merchandise and insulating food.

Polyvinyl chloride (PVC) stretch films are favored for food wrapping purposes due to their enhanced cling and transparency. Polypropylene (PP) films are valued for toughness against the pull of tension and water and chemical resistance, ideal for industrial and specialty packaging applications. All these products together improved efficiency, sustainability, and product protection in Korea's growing logistics, food, and manufacturing sectors.

The Korea stretch film industry is fragmented. Leading companies such as Daelim Industrial, SK Global Chemical, and LG Chem dominate the sector, offering diverse packaging solutions across various industries. These firms continuously innovate, focusing on sustainable materials and advanced technologies to meet evolving consumer demands.

The food and beverage industry significantly drives stretch film demand in Korea, utilizing these films for secure and hygienic packaging. Additionally, the electronics sector employs stretch films to protect products during transportation, ensuring product integrity and reducing damage.

Sustainability trends influence the market, with companies adopting eco-friendly materials and production methods. For instance, LG Chem developed a biodegradable stretch film, aligning with global environmental standards and catering to environmentally conscious consumers.

Stretch film manufacturers emphasize lightweight, durable, and recyclable materials to enhance efficiency and reduce waste. Companies invest in advanced extrusion technology to improve film performance while maintaining cost-effectiveness. These innovations support various industries, including logistics, agriculture, and industrial packaging.

Despite market fragmentation, leading players maintain their positions through continuous innovation, strategic partnerships, and responsiveness to consumer demands. The focus on sustainability and advanced packaging solutions indicates a dynamic and evolving industry landscape in Korea.

The South Korean stretch film market is experiencing steady growth, driven by increasing demand in packaging and logistics sectors. This surge is attributed to the need for efficient and cost-effective packaging solutions that ensure product safety during transportation and storage.

Technological advancements have led to the development of high-quality stretch films with enhanced durability and elasticity. These innovations cater to diverse industrial applications, meeting the evolving requirements of various sectors.

Environmental sustainability is a growing concern, prompting manufacturers to adopt eco-friendly materials and production processes. This shift aligns with global trends toward reducing plastic waste and promoting recyclable packaging solutions.

The competitive landscape features both domestic and international players striving to expand their market share. Companies are focusing on product innovation, strategic partnerships, and improved distribution networks to meet the increasing demand and maintain a competitive edge.

The market is segmented by material into polyethylene (PE), polyvinyl chloride (PVC), polypropylene (PP), and others.

Based on the manufacturing process, the market is segmented into cast stretch film and blown stretch film.

The market are categories based on end-use, including constructions, food and beverages, pharmaceutical, consumer product, paper, textile, and chemicals & fertilizers.

The Korea stretch film market is projected to reach USD 148.4 million by 2035, growing at a CAGR of 4.27% from USD 97.7 million in 2025.

Sales prospects for Korea's stretch film market are strong, driven by demand in e-commerce, logistics, and food packaging, along with sustainability trends.

Key manufacturers of Korea stretch film include Cosmo Films Limited, PLASTECH CO., LTD, Dongwon Chemical Co., Ltd, SHIN HEUNG CHEMICAL CO., LTD, Berry Global Group, Inc., AEP Industries, Inc., Sigma Stretch Film Corp., Anchor Packaging, Inc., Coveris, Inc., Smurfit Kappa Group, Paragon Films, Inc., Four Star Plastics, Griff Paper and Film.

The food and beverage segment is expected to lead the industry, holding a 26.3% market share in 2025 due to high demand for hygienic and protective packaging.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Tons) Forecast by Region, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Tons) Forecast by Material, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Manufacturing Process, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Tons) Forecast by Manufacturing Process, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2019 to 2034

Table 9: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 10: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Material, 2019 to 2034

Table 11: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Manufacturing Process, 2019 to 2034

Table 12: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Manufacturing Process, 2019 to 2034

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2019 to 2034

Table 15: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 16: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Material, 2019 to 2034

Table 17: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Manufacturing Process, 2019 to 2034

Table 18: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Manufacturing Process, 2019 to 2034

Table 19: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 20: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2019 to 2034

Table 21: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 22: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Material, 2019 to 2034

Table 23: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Manufacturing Process, 2019 to 2034

Table 24: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Manufacturing Process, 2019 to 2034

Table 25: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 26: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2019 to 2034

Table 27: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 28: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 29: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Material, 2019 to 2034

Table 30: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Manufacturing Process, 2019 to 2034

Table 31: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Manufacturing Process, 2019 to 2034

Table 32: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 33: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Manufacturing Process, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by End-use, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Industry Analysis and Outlook Volume (Tons) Analysis by Region, 2019 to 2034

Figure 7: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 10: Industry Analysis and Outlook Volume (Tons) Analysis by Material, 2019 to 2034

Figure 11: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 12: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 13: Industry Analysis and Outlook Value (US$ Million) Analysis by Manufacturing Process, 2019 to 2034

Figure 14: Industry Analysis and Outlook Volume (Tons) Analysis by Manufacturing Process, 2019 to 2034

Figure 15: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Manufacturing Process, 2024 to 2034

Figure 16: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Manufacturing Process, 2024 to 2034

Figure 17: Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 18: Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2019 to 2034

Figure 19: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 20: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 21: Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 22: Industry Analysis and Outlook Attractiveness by Manufacturing Process, 2024 to 2034

Figure 23: Industry Analysis and Outlook Attractiveness by End-use, 2024 to 2034

Figure 24: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 25: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 26: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Manufacturing Process, 2024 to 2034

Figure 27: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by End-use, 2024 to 2034

Figure 28: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 29: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Material, 2019 to 2034

Figure 30: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 31: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 32: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Manufacturing Process, 2019 to 2034

Figure 33: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Manufacturing Process, 2019 to 2034

Figure 34: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Manufacturing Process, 2024 to 2034

Figure 35: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Manufacturing Process, 2024 to 2034

Figure 36: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 37: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2019 to 2034

Figure 38: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 39: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 40: South Gyeongsang Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 41: South Gyeongsang Industry Analysis and Outlook Attractiveness by Manufacturing Process, 2024 to 2034

Figure 42: South Gyeongsang Industry Analysis and Outlook Attractiveness by End-use, 2024 to 2034

Figure 43: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 44: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Manufacturing Process, 2024 to 2034

Figure 45: North Jeolla Industry Analysis and Outlook Value (US$ Million) by End-use, 2024 to 2034

Figure 46: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 47: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Material, 2019 to 2034

Figure 48: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 49: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 50: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Manufacturing Process, 2019 to 2034

Figure 51: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Manufacturing Process, 2019 to 2034

Figure 52: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Manufacturing Process, 2024 to 2034

Figure 53: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Manufacturing Process, 2024 to 2034

Figure 54: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 55: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2019 to 2034

Figure 56: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 57: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 58: North Jeolla Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 59: North Jeolla Industry Analysis and Outlook Attractiveness by Manufacturing Process, 2024 to 2034

Figure 60: North Jeolla Industry Analysis and Outlook Attractiveness by End-use, 2024 to 2034

Figure 61: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 62: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Manufacturing Process, 2024 to 2034

Figure 63: South Jeolla Industry Analysis and Outlook Value (US$ Million) by End-use, 2024 to 2034

Figure 64: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 65: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Material, 2019 to 2034

Figure 66: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 67: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 68: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Manufacturing Process, 2019 to 2034

Figure 69: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Manufacturing Process, 2019 to 2034

Figure 70: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Manufacturing Process, 2024 to 2034

Figure 71: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Manufacturing Process, 2024 to 2034

Figure 72: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 73: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2019 to 2034

Figure 74: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 75: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 76: South Jeolla Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 77: South Jeolla Industry Analysis and Outlook Attractiveness by Manufacturing Process, 2024 to 2034

Figure 78: South Jeolla Industry Analysis and Outlook Attractiveness by End-use, 2024 to 2034

Figure 79: Jeju Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 80: Jeju Industry Analysis and Outlook Value (US$ Million) by Manufacturing Process, 2024 to 2034

Figure 81: Jeju Industry Analysis and Outlook Value (US$ Million) by End-use, 2024 to 2034

Figure 82: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 83: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Material, 2019 to 2034

Figure 84: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 85: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 86: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Manufacturing Process, 2019 to 2034

Figure 87: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Manufacturing Process, 2019 to 2034

Figure 88: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Manufacturing Process, 2024 to 2034

Figure 89: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Manufacturing Process, 2024 to 2034

Figure 90: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 91: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2019 to 2034

Figure 92: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 93: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 94: Jeju Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 95: Jeju Industry Analysis and Outlook Attractiveness by Manufacturing Process, 2024 to 2034

Figure 96: Jeju Industry Analysis and Outlook Attractiveness by End-use, 2024 to 2034

Figure 97: Rest of Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 98: Rest of Industry Analysis and Outlook Value (US$ Million) by Manufacturing Process, 2024 to 2034

Figure 99: Rest of Industry Analysis and Outlook Value (US$ Million) by End-use, 2024 to 2034

Figure 100: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 101: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Material, 2019 to 2034

Figure 102: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 103: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 104: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Manufacturing Process, 2019 to 2034

Figure 105: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Manufacturing Process, 2019 to 2034

Figure 106: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Manufacturing Process, 2024 to 2034

Figure 107: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Manufacturing Process, 2024 to 2034

Figure 108: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 109: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2019 to 2034

Figure 110: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 111: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 112: Rest of Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 113: Rest of Industry Analysis and Outlook Attractiveness by Manufacturing Process, 2024 to 2034

Figure 114: Rest of Industry Analysis and Outlook Attractiveness by End-use, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Korea Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Korea Probiotic Supplement Industry – Industry Insights & Demand 2025 to 2035

Korea Calcium Supplement Market is segmented by form,end-use, application and province through 2025 to 2035.

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Korea Visitor Management System Market Growth – Trends & Forecast 2025 to 2035

Korea fiber optic gyroscope market Growth – Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Korea Submarine Cable Market Insights – Demand & Forecast 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

Korea Base Station Antenna Market Growth – Trends & Forecast 2025 to 2035

Smart Space Market Analysis in Korea-Demand & Growth 2025 to 2035

Korea Banking-as-a-Service (BaaS) Platform Market Growth – Trends & Forecast 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA