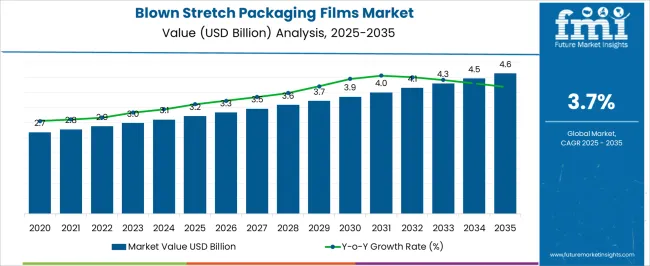

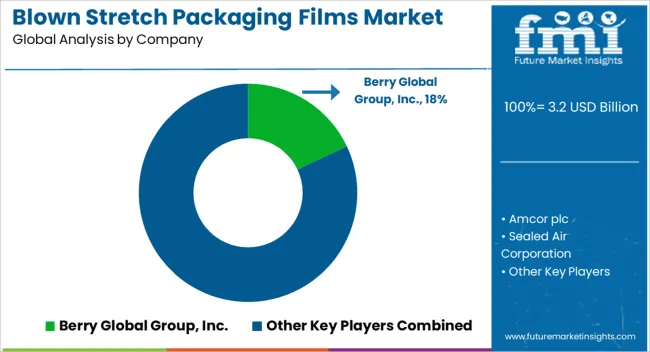

The blown stretch packaging films market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 4.6 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

Between 2021 and 2025, the market grows from USD 2.7 billion to USD 3.2 billion, reflecting steady adoption of stretch films across logistics, e-commerce, food and beverage, and industrial packaging segments. Early growth is supported by increasing demand for load stability, improved palletization, and protection against contamination and moisture during storage and transportation. During 2021–2025, the market shows incremental increases, reaching USD 2.8 billion in 2022, USD 2.9 billion in 2023, USD 3.0 billion in 2024, and USD 3.1 billion prior to attaining USD 3.2 billion in 2025. This period represents the first five-year growth block, capturing the early expansion driven by rising adoption of lightweight, high-performance blown stretch films in automated and semi-automated packaging lines.

The subsequent five-year block from 2026 to 2030 sees the market advance from USD 3.2 billion to USD 3.9 billion, reflecting increased deployment in high-volume distribution centers, retail, and industrial facilities. Enhanced film strength, clarity, and puncture resistance drive incremental growth, while manufacturers invest in multi-layer and co-extruded films to optimize packaging efficiency. The final block from 2031 to 2035 continues the upward trajectory, with the market reaching USD 4.6 billion.

| Metric | Value |

|---|---|

| Blown Stretch Packaging Films Market Estimated Value in (2025 E) | USD 3.2 billion |

| Blown Stretch Packaging Films Market Forecast Value in (2035 F) | USD 4.6 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The blown stretch packaging films market is supported by several parent markets that drive its use and expansion across both consumer and industrial applications. The packaging films market plays the most dominant role, with blown stretch films contributing nearly 18-20% of the share. Their durability, versatility, and ability to wrap irregularly shaped loads make them a preferred choice for multiple packaging purposes. The flexible packaging market contributes around 12-15%, as blown stretch films are lightweight, adaptable, and protective, making them integral in food, beverage, and consumer goods packaging. The industrial packaging market accounts for approximately 10-12% of the share, where blown stretch films are widely used for securing pallets, bundling goods, and ensuring safe handling of industrial products during storage and transportation.

The logistics and supply chain market holds about 8-10%, since blown stretch packaging films are essential for pallet wrapping and cargo protection, helping reduce product damage and improve safety in long-distance shipments. Finally, the food and beverage packaging market contributes nearly 7-9%, as these films are often used to wrap trays, cartons, and packaged food items. They help extend shelf life, maintain freshness, and provide tamper resistance in retail and wholesale distribution channels. Together, these parent markets demonstrate the growing importance of blown stretch packaging films as cost-effective and reliable solutions for securing, transporting, and preserving goods.

The market is experiencing consistent expansion, supported by the growing demand for secure and cost-effective packaging solutions across multiple industries. The rising focus on operational efficiency and load stability in logistics and warehousing is contributing significantly to the market’s growth. Increasing adoption of blown stretch films is being observed due to their superior puncture resistance, high load retention, and adaptability to irregularly shaped goods.

Advances in extrusion technology and material science are enhancing film performance, enabling producers to deliver stronger yet thinner films that reduce material consumption and environmental impact. Sustainability trends, including recyclable and bio-based film development, are creating additional growth avenues.

The ability of blown stretch films to offer high clarity, durability, and consistent wrapping performance under varying load conditions is supporting wider acceptance in both industrial and commercial applications With strong demand from the food, beverage, e-commerce, and manufacturing sectors, the market outlook remains positive for the coming years.

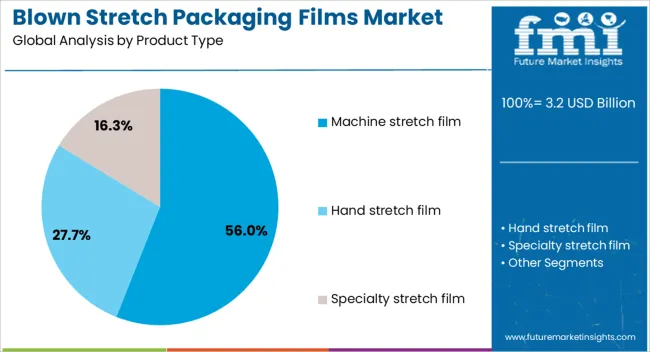

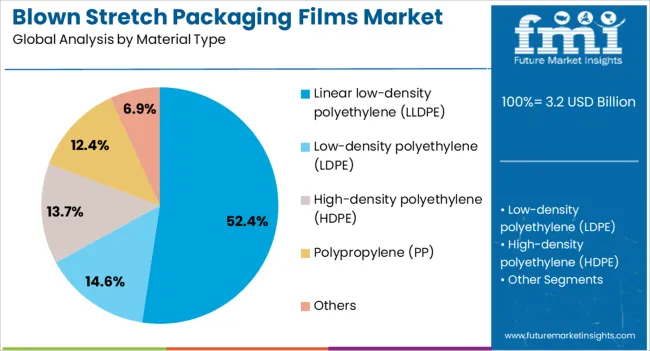

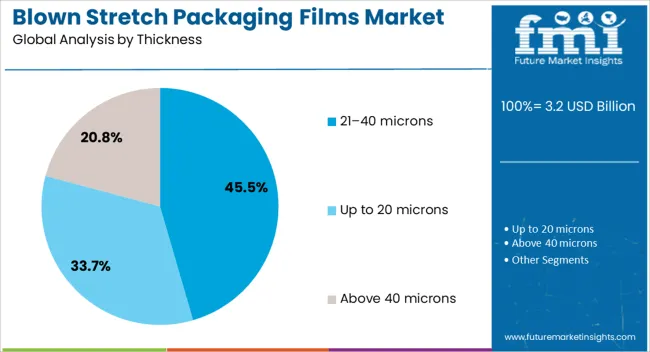

The blown stretch packaging films market is segmented by product type, material type, thickness, end use industry, distribution channel, and geographic regions. By product type, blown stretch packaging films market is divided into machine stretch film, hand stretch film, and specialty stretch film. In terms of material type, blown stretch packaging films market is classified into linear low-density polyethylene (LLDPE), low-density polyethylene (LDPE), high-density polyethylene (HDPE), polypropylene (PP), and others. Based on thickness, blown stretch packaging films market is segmented into 21–40 microns, up to 20 microns, and above 40 microns. By end use industry, blown stretch packaging films market is segmented into food & beverage, industrial packaging, consumer goods, pharmaceuticals, and others. By distribution channel, blown stretch packaging films market is segmented into distributors/wholesalers, direct sales, and online channels. Regionally, the blown stretch packaging films industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The machine stretch film segment is projected to hold 56% of the blown stretch packaging films market revenue share in 2025, making it the leading product type. This dominance is being driven by the operational efficiency and consistency that machine application provides, which reduces packaging time and labor costs. High-speed automated stretch wrapping systems using machine films deliver uniform load containment, which improves transportation safety and minimizes product damage. The superior stretchability and load retention capabilities of these films enhance performance, especially for heavy or irregular pallet loads. Additionally, the ability to control film thickness and wrapping tension through automated systems ensures material optimization, leading to cost savings and reduced waste. Growing adoption of advanced wrapping machinery in logistics hubs, manufacturing plants, and distribution centers has further reinforced demand for machine stretch films Their durability, efficiency, and compatibility with evolving high-performance film technologies continue to strengthen their leading position in the market.

The linear low-density polyethylene segment is expected to account for 52.40% of the market revenue share in 2025, positioning it as the dominant material type. Its market leadership is being sustained by its exceptional flexibility, high tensile strength, and resistance to punctures and tears, which are essential for securing heavy and uneven loads. The material’s ability to provide strong stretch properties without compromising load integrity makes it ideal for high-performance packaging applications. LLDPE also supports downgauging initiatives, allowing manufacturers to produce thinner films that maintain durability, thus reducing raw material usage and costs. Advances in resin technology have further enhanced its clarity, cling, and stretch recovery, making it suitable for both industrial and retail packaging. Additionally, its recyclability aligns with the increasing emphasis on sustainable packaging solutions The balance of performance, cost-effectiveness, and environmental compatibility has ensured that LLDPE remains the preferred choice in the blown stretch film industry.

The 21–40 microns thickness segment is projected to hold 45.50% of the market revenue share in 2025, making it the leading thickness range. This segment’s growth is being supported by its versatility in meeting diverse load stability requirements while optimizing material use. Films within this thickness range provide a strong balance between durability and flexibility, enabling secure wrapping for medium to heavy loads without excessive material consumption. Their adaptability makes them suitable for various industries, including food and beverage, consumer goods, and manufacturing. The ability to offer sufficient puncture resistance while reducing overall film weight aligns with the industry’s cost-saving and sustainability objectives. Manufacturers are increasingly standardizing this thickness range to ensure consistent performance across automated and manual wrapping operations The combination of performance efficiency, cost optimization, and compatibility with modern packaging equipment has reinforced the dominance of the 21–40 microns segment in the overall market.

The blown stretch packaging films market is expanding, supported by growing demand from logistics, food, and retail industries. Their flexibility, durability, and cost-effectiveness make them a staple in securing goods across supply chains. However, challenges related to raw material costs, recycling limitations, and regulatory pressures on plastics remain barriers to growth. Advancements in multi-layer films, thinner yet stronger formulations, and eco-conscious materials are unlocking new opportunities for manufacturers. With retail and e-commerce expansion driving consistent adoption, blown stretch films are set to remain a critical packaging component globally.

The blown stretch packaging films market is witnessing steady expansion as industries increasingly demand reliable, cost-effective packaging solutions. Logistics and food packaging remain key growth contributors, with stretch films used to protect palletized goods during storage and transportation. Their ability to provide strength, puncture resistance, and flexibility makes them essential in maintaining product integrity. In the food industry, blown stretch films are widely adopted for wrapping perishable items, ensuring extended shelf life and reduced spoilage. E-commerce expansion has also intensified reliance on stretch packaging, with manufacturers seeking efficient and lightweight solutions to secure goods in transit. Growing emphasis on packaging that balances performance with cost has reinforced the role of blown stretch films as a preferred choice in large-scale distribution networks, warehousing operations, and retail supply chains where product safety and handling efficiency are critical.

The blown stretch packaging films market faces challenges related to raw material price fluctuations and end-of-life management. Production relies heavily on petrochemical-derived polymers, making it vulnerable to oil price volatility and supply chain disruptions. These uncertainties create cost pressures for manufacturers and affect profit margins. At the same time, growing concerns over plastic waste have placed the industry under scrutiny, with limited recycling infrastructure complicating disposal and reuse. Regulatory restrictions on single-use plastics in several regions present another hurdle, forcing companies to adapt their offerings to comply with evolving guidelines. Smaller producers often struggle with these transitions due to limited access to advanced recycling technologies or sustainable alternatives. These challenges highlight the need for long-term solutions in material sourcing and waste management, as continued reliance on traditional polymers may constrain growth opportunities for the sector in certain regions.

Manufacturers are investing in multi-layered films that offer enhanced durability, puncture resistance, and barrier properties, enabling their use across more demanding packaging environments. Customized solutions tailored for specific industries, such as heavy-duty industrial applications or fresh produce packaging, are expanding the addressable market. New product developments focusing on thinner gauges without compromising strength are reducing material consumption and improving cost-effectiveness. Film producers are also exploring blends with plant-based or biodegradable materials to address rising environmental concerns. Partnerships between film manufacturers and end users are facilitating innovation in packaging designs that optimize both performance and sustainability. By focusing on customization, advanced film structures, and eco-conscious formulations, the market is positioned to tap into diverse application areas and capture greater value across logistics, retail, and industrial sectors.

A defining trend in the blown stretch packaging films market is the growing adoption driven by retail expansion and the surge in e-commerce. Rising volumes of shipped goods have created sustained demand for packaging that ensures secure transit while minimizing costs. Retail chains and online marketplaces increasingly prefer films that offer high clarity, strength, and ease of use in wrapping applications. The integration of automated packaging equipment in warehouses has also reinforced the role of stretch films, as compatibility with high-speed wrapping systems becomes a priority. Regional growth is further supported by increased consumer spending and the need for efficient packaging across FMCG, electronics, and apparel industries. This trend emphasizes the central role of blown stretch films as protective, reliable, and versatile packaging solutions, ensuring they remain integral to the evolving global supply and retail distribution ecosystem.

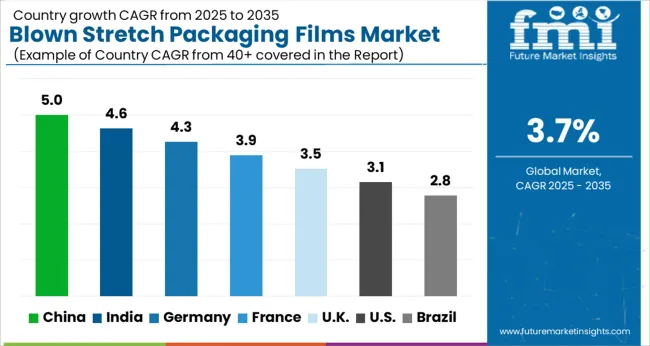

| Country | CAGR |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.3% |

| France | 3.9% |

| UK | 3.5% |

| USA | 3.1% |

| Brazil | 2.8% |

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

The global blown stretch packaging films market is expected to grow at a CAGR of 3.7% from 2025 to 2035. China leads with 5.0%, followed by India at 4.6% and France at 3.9%. The United Kingdom and the United States post moderate growth at 3.5% and 3.1%, respectively. Demand is shaped by the growth of logistics, e-commerce, and retail industries across all regions. While Asia remains the fastest-growing hub due to large-scale industrialization and consumer demand, developed economies such as France, the UK, and the USA are focusing on efficiency, automation, and high-performance packaging solutions to maintain competitiveness. The analysis spans over 40+ countries, with the leading markets shown below.

China is projected to lead the blown stretch packaging films market with a CAGR of 5.0% from 2025 to 2035. The country’s large-scale industrial activities and expanding logistics sector create a strong demand base for blown stretch packaging films. Growth in e-commerce, coupled with the need for efficient load stabilization and product protection, is driving higher adoption across manufacturing and distribution networks. Domestic producers are focusing on innovations in film strength and flexibility to meet industry-specific requirements. With an extensive export industry, China’s packaging demand remains consistently high, making blown stretch films a key solution for transportation safety and cost efficiency.

India is expected to grow at a CAGR of 4.6% in the blown stretch packaging films market between 2025 and 2035. Rising industrialization, expansion of the food and beverage sector, and increasing logistics activity are boosting demand for protective packaging solutions. The retail industry’s growth and the steady rise of e-commerce platforms also drive the use of stretch packaging films. Indian manufacturers are gradually adopting advanced blown film technologies to enhance durability and reduce costs, appealing to both small- and large-scale users. The growing need for secure packaging in fast-moving consumer goods (FMCG) and pharmaceutical industries further strengthens the outlook for blown stretch films in the country.

France is forecast to expand at a CAGR of 3.9% from 2025 to 2035 in the blown stretch packaging films market. The demand is largely influenced by growth in the retail, logistics, and food processing industries. French companies emphasize packaging efficiency and product protection during transportation, which is increasing the uptake of blown stretch films. The country’s strong export activity, particularly in food and beverages, further adds to market growth. Manufacturers are focusing on films that provide durability and high cling performance, ensuring secure packaging during handling and shipping. The integration of automation in packaging processes is also accelerating adoption in France.

The United Kingdom is projected to grow at a CAGR of 3.5% from 2025 to 2035 in the blown stretch packaging films market. Demand is fueled by increasing reliance on packaging for logistics, retail, and food distribution. The country’s strong import and export activities create continuous demand for films that provide secure load containment. Retailers and distribution centers are adopting blown stretch films for their ability to ensure stability during handling and transportation. Competition among domestic and international suppliers has led to product innovation, with a focus on cost efficiency and durability. The rise of automated pallet wrapping equipment in warehouses is further increasing the need for high-quality stretch films.

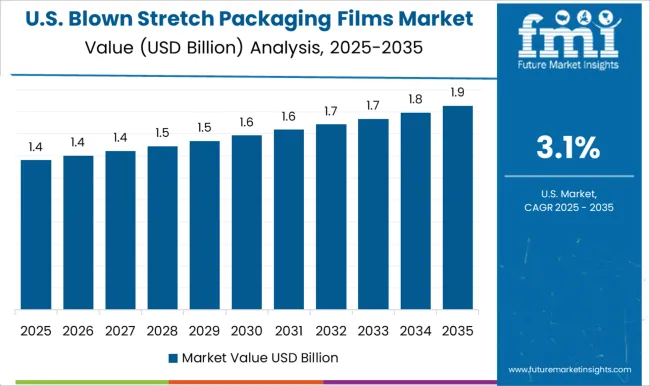

The United States is forecast to grow at a CAGR of 3.1% between 2025 and 2035 in the blown stretch packaging films market. The demand is driven by a mature retail industry, large-scale distribution networks, and strong e-commerce penetration. USA manufacturers and logistics providers continue to adopt stretch films for their efficiency in load stabilization and protection during shipping. The food and beverage sector remains one of the largest consumers, supported by high-volume packaging needs. Domestic producers are focusing on product differentiation through improved film performance, balancing strength, clarity, and cost-effectiveness. Warehousing and supply chain modernization are also contributing to greater adoption.

Competition in the fighter aircraft market is shaped by technology superiority, export reach, and multirole capabilities. Lockheed Martin dominates with the F-35 Lightning II, a stealth-enabled, multirole fighter offered in multiple variants, backed by a global supply chain and partnerships with allied air forces. Boeing competes through the F-15EX and F/A-18 Super Hornet, emphasizing proven performance, upgrade potential, and cost competitiveness for both domestic and foreign buyers. Sukhoi maintains a strong position with the Su-35 and Su-57 platforms, offering high maneuverability and advanced avionics aimed at markets in Asia, the Middle East, and regions seeking cost-effective alternatives. Dassault competes with the Rafale, a versatile twin-engine fighter positioned as a premium option, marketed on adaptability to both air-to-air and air-to-ground missions with strong export contracts.

Saab advances with the Gripen, highlighting affordability, advanced avionics, and interoperability, particularly for nations seeking capable fighters within constrained budgets. Chengdu Aircraft Industry Group competes primarily with the J-10 and J-20 fighters, leveraging China’s domestic procurement strength and expanding international sales efforts. Hindustan Aeronautics Limited (HAL) participates with the Tejas Light Combat Aircraft, targeting domestic fleet modernization and selective exports, supported by government initiatives. Korea Aerospace Industries (KAI) emphasizes the FA-50 and KF-21 programs, positioned for regional defense customers and cooperative development projects.

Strategies across these players emphasize lifecycle upgrades, modular avionics, and interoperability with allied systems. Lockheed Martin and Boeing leverage long-term sustainment contracts, Dassault and Saab pursue export-driven strategies, Sukhoi and Chengdu focus on state-backed procurement and regional alliances, while HAL and KAI aim at expanding indigenous manufacturing. Product brochures highlight specific capabilities: stealth, advanced sensors, electronic warfare, high payload capacities, and adaptability across mission profiles. These brochures underscore speed, agility, and multi-mission readiness as defining attributes in a market where air superiority is decisive.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 billion |

| Product Type | Machine stretch film, Hand stretch film, and Specialty stretch film |

| Material Type | Linear low-density polyethylene (LLDPE), Low-density polyethylene (LDPE), High-density polyethylene (HDPE), Polypropylene (PP), and Others |

| Thickness | 21–40 microns, Up to 20 microns, and Above 40 microns |

| End Use Industry | Food & beverage, Industrial packaging, Consumer goods, Pharmaceuticals, and Others |

| Distribution Channel | Distributors/wholesalers, Direct sales, and Online channels |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Berry Global Group, Inc., Amcor plc, Sealed Air Corporation, Sigma Plastics Group, and AEP Industries Inc. |

| Additional Attributes | Dollar sales by product type (pickup trucks, light-duty trucks) and end-use segments (personal use, commercial use, fleet management). Demand dynamics are driven by the increasing preference for versatile, fuel-efficient trucks in both urban and rural areas, along with advancements in truck technology and powertrains. Regional trends show significant growth in North America, Europe, and Asia-Pacific, with consumer demand shifting towards more sustainable, efficient, and feature-rich Class 1 trucks driving market expansion. |

The global blown stretch packaging films market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the blown stretch packaging films market is projected to reach USD 4.6 billion by 2035.

The blown stretch packaging films market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in blown stretch packaging films market are machine stretch film, hand stretch film and specialty stretch film.

In terms of material type, linear low-density polyethylene (lldpe) segment to command 52.4% share in the blown stretch packaging films market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blown oils Market Size and Share Forecast Outlook 2025 to 2035

Blown Film Extrusion Machine Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Blown Film Extrusion Machine Market

Melt-Blown Polypropylene Filters Market Size and Share Forecast Outlook 2025 to 2035

Stretch Film Industry Analysis in DACH Size and Share Forecast Outlook 2025 to 2035

Stretch Film Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Stretch Mark Prevention Creams Market Size and Share Forecast Outlook 2025 to 2035

Stretch Sleeve and Shrink Sleeve Labels Market Size and Share Forecast Outlook 2025 to 2035

Stretch Marks Treatment Market Size and Share Forecast Outlook 2025 to 2035

Stretcher Accessories Market Size and Share Forecast Outlook 2025 to 2035

Stretch Film Packs Market Insights on Type, Product, Application, Industry, and Region - 2025 to 2035

Stretch Mark Removal Products Market Insights - Growth & Forecast 2025 to 2035

Stretch Hood Films Market Analysis by Up to 50 microns, 50-100 microns, 100-150 microns, 150 microns & above Through 2035

Stretchable Electronics Market Trends - Growth & Forecast 2025 to 2035

Stretch Wrapper Market Growth - Demand & Forecast 2025 to 2035

Stretch Blow Molding Machines Market Segmentation based on Technology Type, Orientation Type, End Use, and Region: A Forecast for 2025 and 2035

Stretchable Conductive Material Analysis by Material, Fillers, Stretching Mechanism, Fabrication, Function, Application, End-User and Region - Forecast for 2025 to 2035

Market Share Insights of Leading Stretch Blow Molding Machines Providers

Market Positioning & Share in the Stretch Film Industry

Stretch Sleeve Label Market Insights – Growth & Demand 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA