The Melt-Blown Polypropylene Filters Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period. During the early adoption phase from 2020 to 2024, the market expanded from USD 1.5 billion to USD 2.0 billion, driven by heightened awareness of air and water purification, increasing regulatory standards, and rising demand in healthcare and industrial applications. Key breakpoints included the surge in demand for medical masks, filtration solutions for industrial processes, and pilot implementation of advanced filtration technologies. These factors established the foundation for broader market uptake.

From 2025 to 2030, the market enters a scaling phase, with values rising from USD 2.1 billion to USD 2.9 billion. This period is marked by technological enhancements, such as higher-efficiency filter media and automated manufacturing processes, alongside growing adoption in emerging economies. Between 2030 and 2035, the market transitions to consolidation, reaching USD 3.9 billion. Leading manufacturers capture significant market share, product standards become widely adopted, and incremental innovations drive operational efficiency. This phase reflects maturity in supply chains and sustained demand across healthcare, industrial, and commercial filtration applications.

| Metric | Value |

|---|---|

| Melt-Blown Polypropylene Filters Market Estimated Value in (2025 E) | USD 2.1 billion |

| Melt-Blown Polypropylene Filters Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The melt-blown polypropylene filters market is experiencing sustained growth due to rising environmental regulations, increasing demand for clean air and water, and the growing reliance on high-efficiency particulate filtration across industrial and domestic applications. As global attention intensifies around air quality standards and water safety, melt-blown polypropylene filters have gained prominence owing to their fine fiber diameter, high surface area, and electrostatic properties that enable superior contaminant capture.

The scalability of melt-blown production, especially during surges in demand such as during pandemic preparedness or infrastructure modernization, has further accelerated adoption.

In air filtration systems, their use is being prioritized in HVAC installations, cleanroom environments, and industrial ventilation. Meanwhile, their chemical resistance and low-pressure drop make them ideal for liquid-phase filtration in municipal and industrial wastewater treatment.

Increasing investments in water reuse technologies, coupled with smart infrastructure upgrades, are expected to reinforce the adoption of melt-blown polypropylene further filters. The market outlook remains positive as manufacturers continue enhancing media performance through polymer blending and process innovation.

Media, application, and geographic regions segment the melt-blown polypropylene filters market. By media, melt-blown polypropylene filters market is divided into Air and Liquid. In terms of application, melt-blown polypropylene filters market is classified into Water & Wastewater, Food & Beverages, Pharmaceuticals, Chemical, Oil and Gas, and Others. Regionally, the melt-blown polypropylene filters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The air media segment is expected to account for 54.2% of the total revenue share in the melt-blown polypropylene filters market in 2025, making it the leading media type. This dominant share is being driven by the growing need for particulate filtration in ventilation and air purification systems across commercial, industrial, and residential settings. The use of melt-blown polypropylene in air filtration has increased due to its ability to efficiently trap airborne contaminants such as dust, pollen, and microbes while maintaining low airflow resistance.

The segment’s growth is being further supported by heightened awareness regarding indoor air quality and regulatory emphasis on minimizing exposure to airborne pollutants. Advancements in HVAC systems and cleanroom technologies have accelerated the integration of melt-blown air filters to meet stricter filtration standards.

Additionally, their role in personal protective equipment and industrial respirators continues to sustain demand As urbanization intensifies and energy-efficient buildings require integrated air quality control, the air media segment is expected to maintain its leadership in the market.

The water and wastewater application segment is projected to hold 38.7% of the total revenue share in the melt-blown polypropylene filters market in 2025, establishing it as a major application area. The segment’s growth is being influenced by increasing demand for high-performance filtration in municipal water treatment plants, industrial process water systems, and decentralized purification units. Melt-blown polypropylene filters are widely used in this segment due to their superior chemical compatibility, high dirt-holding capacity, and resistance to biological fouling.

Their effectiveness in removing particulates, sediments, and microorganisms has made them a preferred choice for pre-filtration in membrane systems and final filtration stages. The expansion of wastewater reuse programs and stricter discharge regulations have further reinforced the need for reliable and cost-effective filtration technologies.

Their adaptability to varied flow rates and ease of replacement make them suitable for scalable water infrastructure projects As water scarcity concerns grow and governments invest in sustainable treatment solutions, melt-blown filters are expected to see continued expansion in this segment.

The melt-blown polypropylene filters market is expanding due to rising demand for air and liquid filtration in healthcare, water treatment, industrial, and consumer applications. Melt-blown PP filters offer high porosity, fine particle capture, and cost-effective manufacturing, making them essential for surgical masks, respirators, HVAC systems, and industrial filtration. COVID-19 pandemic-driven mask demand accelerated production globally. Technological innovations in fiber diameter control, multi-layer filtration, and functional additives are improving efficiency. Asia-Pacific dominates production and consumption, while Europe and North America focus on high-performance applications and regulatory compliance.

The COVID-19 pandemic highlighted the critical role of melt-blown PP filters in masks, respirators, and medical-grade protective equipment. Their high filtration efficiency against airborne particles and pathogens made them indispensable in healthcare and personal protection. Hospitals, clinics, and public health agencies continue to demand high-quality melt-blown layers for surgical and N95 masks. Manufacturers are investing in high-capacity production lines, quality control systems, and antimicrobial-enhanced fibers to meet regulatory standards. Until alternative high-performance filtration materials emerge at scale, melt-blown PP filters will remain central to PPE and healthcare safety applications.

Melt-blown PP filters are widely used in industrial and municipal water treatment to remove sediments, particulates, and microorganisms. Their versatility allows customization in pore size, thickness, and layer configuration to suit process water, chemical filtration, and food & beverage applications. Industries benefit from reduced maintenance, longer filter life, and cost-effectiveness. The challenge lies in balancing filtration efficiency with flow rate and chemical resistance. Companies developing durable, multi-layered, and high-flow filters capture industrial and municipal demand. Until large-scale, high-performance alternatives are developed, melt-blown PP filters will remain integral to industrial and water filtration systems.

Innovations in melt-blown production, such as finer fiber diameters, multi-layer lamination, and functional additives (antimicrobial, hydrophobic), are enhancing filtration performance. Integration with electrostatic charging improves particle capture efficiency without increasing pressure drop, critical for HVAC, automotive cabin filters, and respirators. Companies investing in controlled fiber formation, quality monitoring, and nanofiber incorporation differentiate their products. Until next-generation filtration technologies become cost-competitive and scalable, melt-blown PP filters will maintain a strong market presence across healthcare, industrial, and consumer applications due to their proven performance and adaptability.

The melt-blown PP filter market faces supply chain challenges due to raw material dependence on polypropylene resins and specialized production equipment. Asia-Pacific, particularly China, dominates manufacturing, while Europe and North America focus on high-end performance filters and regulatory-compliant products. Disruptions in polypropylene supply or production capacity can affect global availability, as witnessed during the PPE surge in 2020. Companies investing in localized production, diversified suppliers, and high-capacity extrusion lines gain supply stability. Until production scalability and material availability improve globally, regional supply and manufacturing strategies will significantly influence market competitiveness and growth.

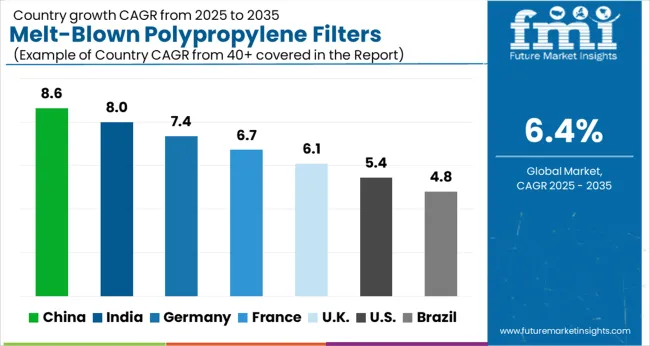

| Countr | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

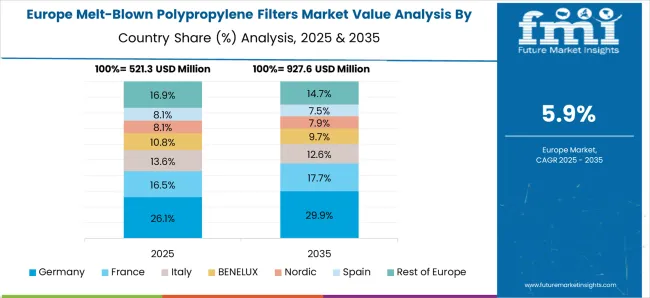

The global Melt-Blown Polypropylene Filters Market is projected to grow at a CAGR of 6.4% through 2035, supported by increasing demand across air filtration, medical, and industrial applications. Among BRICS nations, China has been recorded with 8.6% growth, driven by large-scale production and deployment in medical masks and industrial filtration systems, while India has been observed at 8.0%, supported by rising utilization in healthcare and industrial sectors. In the OECD region, Germany has been measured at 7.4%, where production and adoption for industrial and medical filtration applications have been steadily maintained. The United Kingdom has been noted at 6.1%, reflecting consistent use in air filtration and healthcare systems, while the USA has been recorded at 5.4%, with production and utilization across medical, industrial, and environmental filtration sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The melt-blown polypropylene filters market in China is expanding at a CAGR of 8.6%, driven by rising demand in air and water filtration applications across industrial, healthcare, and municipal sectors. Increasing awareness of air quality, environmental safety, and stringent regulations on industrial emissions contribute to market growth. China’s growing pharmaceutical and medical device industries further boost demand for high-efficiency filters. Technological advancements in filter media, particle retention, and production efficiency enhance product performance and reliability. Adoption in hospitals, manufacturing facilities, and water treatment plants supports consistent demand. Government initiatives promoting clean air, safe drinking water, and industrial safety encourage investment in high-quality filtration systems. Manufacturers are focusing on scalable production and innovative fiber technologies to meet increasing market requirements. The combination of industrial expansion, regulatory enforcement, and technological improvements positions China as a leading market for melt-blown polypropylene filters.

The melt-blown polypropylene filters market in India is growing at a CAGR of 8.0%, fueled by increasing applications in healthcare, industrial, and municipal water treatment sectors. Rising concerns about air pollution, water contamination, and occupational safety drive adoption of high-efficiency filters. India’s expanding pharmaceutical and medical device industries require advanced filtration solutions for sterile environments and process safety. Technological advancements such as improved fiber density, multi-layered structures, and enhanced particle retention boost product reliability and efficiency. Adoption in hospitals, laboratories, and industrial plants ensures steady market growth. Government regulations regarding environmental protection, clean water standards, and workplace safety further support market expansion. Investment in manufacturing capacity, R&D for innovative filter media, and scalable production technologies position India as a significant growth market. Increasing awareness of health and environmental safety accelerates the adoption of melt-blown polypropylene filters across sectors.

The melt-blown polypropylene filters market in Germany is growing at a CAGR of 7.4%, supported by industrial safety standards, environmental regulations, and healthcare requirements. Advanced filters are increasingly adopted in air purification, water treatment, and medical applications, ensuring compliance with strict safety and quality standards. Technological innovations in fiber structure, multi-layer filtration, and contamination control enhance performance and operational efficiency. Germany’s industrial modernization and environmental awareness drive consistent demand for melt-blown polypropylene filters. Pharmaceutical manufacturing, laboratories, and municipal facilities are key adopters. Government policies promoting clean air, safe water, and occupational safety accelerate market expansion. Manufacturers focus on innovation, sustainable production, and high-performance filter media to meet regulatory and operational requirements. The combination of technological advancement, regulatory compliance, and industrial demand positions Germany as a stable market for melt-blown polypropylene filters over the forecast period.

The melt-blown polypropylene filters market in the United Kingdom is expanding at a CAGR of 6.1%, driven by applications in industrial, healthcare, and municipal sectors. Rising environmental awareness and regulatory mandates on air quality and water safety support market growth. Advanced filter media with multi-layered structures and high particle retention improve operational efficiency and reliability. Adoption in hospitals, laboratories, manufacturing facilities, and water treatment plants ensures steady demand. Government programs promoting clean air, safe water, and industrial safety accelerate market expansion. Technological advancements, including innovative fiber production and scalable manufacturing, help meet growing industry requirements. The UK market emphasizes sustainable solutions and compliance with strict quality standards. Increasing industrial modernization and public safety initiatives ensure that melt-blown polypropylene filters continue to gain traction across applications in the country.

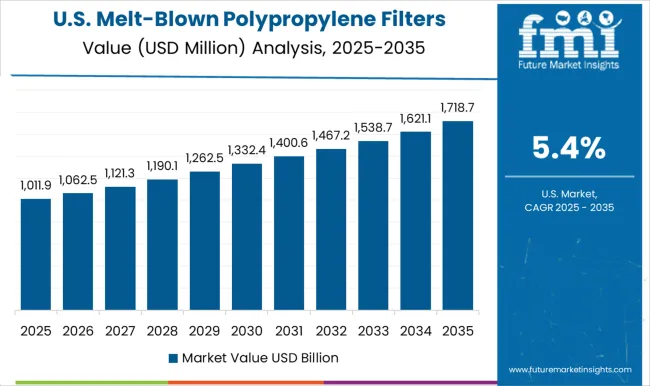

The melt-blown polypropylene filters market in the United States is growing at a CAGR of 5.4%, with strong demand from healthcare, industrial, and municipal sectors. The need for high-efficiency filtration in water treatment, cleanrooms, and air purification drives adoption. Advanced filter media with enhanced particle retention, multi-layer construction, and durable materials increase performance and reliability. Stringent environmental and safety regulations, including standards for clean water, air quality, and occupational safety, encourage widespread implementation of filtration solutions. Adoption in hospitals, laboratories, industrial facilities, and municipal water systems ensures steady market demand. Investment in R&D for innovative fiber technologies, scalable production, and sustainable solutions supports growth. Awareness of environmental protection and public health further accelerates adoption of melt-blown polypropylene filters. The United States market benefits from technological advancement and regulatory enforcement, ensuring long-term expansion of the filtration segment.

The melt-blown polypropylene filters market is a key segment in water purification, air filtration, healthcare, and industrial applications. These filters are widely used due to their high efficiency in removing particulates, bacteria, and other contaminants, making them essential in cleanrooms, HVAC systems, medical devices, and water treatment processes. Growing awareness of hygiene, stringent environmental regulations, and rising demand for clean air and water are driving the market globally.

Prominent players include Lenntech B.V., which provides advanced filtration solutions for water treatment and industrial processes, and Borealis AG, a leading producer of polypropylene materials used in melt-blown filter media. Parker Hannifin Corporation and Pall Corporation offer high-performance filtration systems tailored for industrial, pharmaceutical, and healthcare applications. Suez is recognized for its comprehensive water treatment solutions integrating polypropylene filter media.

United Filters International (UFI) and Brother Filtration focus on high-quality melt-blown filters for automotive, HVAC, and industrial sectors. Trinity Filtration Technologies Pvt. Ltd. and Clack Corporation provide specialized filters for water purification and process industries. 3M delivers innovative and reliable filtration solutions with global reach, while Eaton offers durable and high-efficiency filter products for industrial and commercial applications.

The market is projected to expand steadily due to increasing industrialization, rising healthcare and clean water demands, and growing adoption of filtration technologies across various sectors. Advancements in melt-blown technology, including enhanced filtration efficiency and customizable media properties, are further bolstering market growth and driving competitive innovation.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Media | Air and Liquid |

| Application | Water & Wastewater, Food & Beverages, Pharmaceuticals, Chemical, Oil and Gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | LenntechB.V., BorealisAG, ParkerHannifinCorporation, Suez, UnitedFiltersInternational(UFI), BrotherFiltration, TrinityFiltrationTechnologiesPvt.Ltd., ClackCorporation, 3M, PallCorporation, and Eaton |

| Additional Attributes | Dollar sales vary by filter type, including HEPA, ULPA, and particulate filters; by application, such as air filtration, water treatment, medical devices, and industrial processes; by end-use industry, spanning healthcare, HVAC, automotive, and manufacturing; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for high-efficiency filtration, healthcare expansion, and industrial pollution control. |

The global melt-blown polypropylene filters market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the melt-blown polypropylene filters market is projected to reach USD 3.9 billion by 2035.

The melt-blown polypropylene filters market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in melt-blown polypropylene filters market are air and liquid.

In terms of application, water & wastewater segment to command 38.7% share in the melt-blown polypropylene filters market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polypropylene Yarn Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Random Copolymers Market Growth – Trends & Forecast 2025 to 2035

Polypropylene Packaging Films Market Trends - Growth & Forecast 2025 to 2035

Market Share Distribution Among Polypropylene Woven Bag and Sack Manufacturers

Polypropylene Woven Bag and Sack Market from 2024 to 2034

Polypropylene Screw Caps Market

Polypropylene Film Market

Polypropylene Fibre Market

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Foamed Polypropylene Films Market Growth - Demand & Forecast 2025 to 2035

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

Expanded Polypropylene (EPP) Foam Market 2025 to 2035

Surgical Polypropylene Mesh Market

Demand for Polypropylene in EU Size and Share Forecast Outlook 2025 to 2035

Medical Grade Polypropylene Market Size and Share Forecast Outlook 2025 to 2035

Biaxially Oriented Polypropylene Market Size and Share Forecast Outlook 2025 to 2035

Coupling Agent (Compatibilizer) for Polypropylene Market

RF Filters Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA