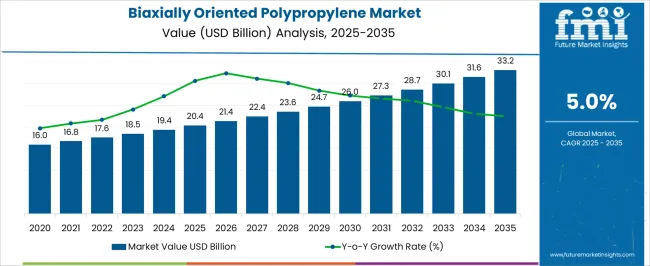

In 2025, the biaxially oriented polypropylene (BOPP) market is valued at USD 20.4 billion and is expected to reach USD 33.2 billion by 2035, growing at a CAGR of 5.0%, with a multiplying factor of about 1.63x. Growth momentum analysis highlights how expansion evolves across the decade, reflecting the impact of end-use demand, technological innovation, and regional adoption patterns. In the early phase, from 2025 to 2028, growth momentum is moderate as packaging applications, including flexible packaging for food, beverages, and consumer goods, primarily drive adoption.

Rising preference for lightweight, high-barrier films and improved printability support incremental gains in this period. Between 2028 and 2032, momentum strengthens as industrial and specialty applications, such as labeling, lamination, and electrical insulation, gain wider acceptance. Technological improvements in film clarity, heat resistance, and recyclability enhance market appeal, driving faster adoption.

Additionally, expansion in emerging regions, particularly the Asia Pacific, contributes significantly to growth momentum due to rising consumption in retail, e-commerce, and processed food sectors. In the later phase, from 2032 to 2035, momentum stabilizes as markets in developed regions approach maturity, with growth supported by product upgrades, sustainable film solutions, and efficiency improvements. The analysis demonstrates that sustained expansion in the BOPP market depends on balancing volume growth with value-driven innovations across diverse applications and regions.

| Metric | Value |

|---|---|

| Biaxially Oriented Polypropylene Market Estimated Value in (2025 E) | USD 20.4 billion |

| Biaxially Oriented Polypropylene Market Forecast Value in (2035 F) | USD 33.2 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The BOPP market is supported by several upstream sectors. Packaging and film manufacturers account for approximately 42%, using BOPP in flexible packaging, labels, and lamination films. Consumer goods companies contribute around 27%, applying BOPP films for food, personal care, and household product packaging. Printing and labeling solutions providers represent roughly 15%, integrating BOPP films for decorative and functional printing. Industrial and specialty applications hold close to 10%, including electrical insulation, tapes, and industrial laminates. Raw material and polymer suppliers make up the remaining 6%, supplying polypropylene resin and processing additives essential for BOPP production. The BOPP market is witnessing growth due to increasing demand for lightweight, durable, and recyclable packaging. Food and beverage packaging now accounts for over 50% of BOPP film consumption, driven by convenience and extended shelf life requirements. Production efficiency improvements, such as advanced stretch and orientation processes, have increased film clarity and strength by 10–12%. Sustainable BOPP films with reduced material thickness are gaining adoption, lowering plastic usage by 8–10%. E-commerce and retail growth has accelerated the need for printed and laminated BOPP films, with annual adoption rising by ~12% year-on-year. Manufacturers are also expanding regional production capacities to meet rising demand in Asia and Europe.

The biaxially oriented polypropylene (BOPP) market is experiencing steady growth, fueled by increasing demand for high-performance packaging materials across multiple industries. Industry reports and packaging sector updates have underscored BOPP’s advantages, including high tensile strength, clarity, moisture resistance, and cost-effectiveness, making it a preferred choice for flexible packaging solutions.

Technological advancements in film extrusion and coating techniques have improved barrier properties, printability, and recyclability, further expanding the product’s application range. Rising consumer preference for packaged and convenience foods, combined with the growth of organized retail, has significantly increased the demand for durable and visually appealing packaging materials.

Sustainability trends are also shaping the market, with manufacturers investing in recyclable and bio-based BOPP films to align with environmental regulations. The market is expected to benefit from expanding applications in labeling, lamination, and specialty packaging, with the food sector remaining the largest consumer due to its stringent packaging performance requirements.

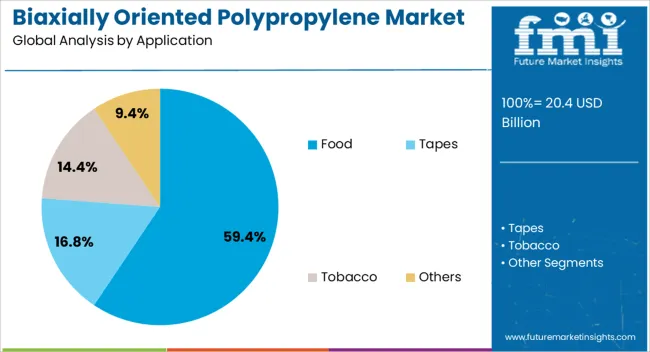

The biaxially oriented polypropylene market is segmented by application, and geographic regions. By application, biaxially oriented polypropylene market is divided into Food, Tapes, Tobacco, and Others. Regionally, the biaxially oriented polypropylene industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The food segment is projected to hold 59.4% of the biaxially oriented polypropylene market revenue in 2025, maintaining its leading position among application categories. This dominance is driven by BOPP’s ability to provide an excellent moisture barrier, extend product shelf life, and preserve the freshness and quality of packaged foods.

Food manufacturers have adopted BOPP films for a wide range of products, from snacks and confectionery to fresh produce, due to their combination of lightweight structure and durability. The segment’s growth has also been supported by advancements in high-quality printing and surface treatments, enabling vibrant, brand-enhancing packaging designs.

Additionally, the material’s compatibility with various sealing technologies has facilitated its use in automated packaging lines, improving production efficiency. Regulatory compliance for food contact safety and the growing emphasis on sustainable packaging have further reinforced the segment’s expansion. As consumer demand for packaged and ready-to-eat food products continues to rise globally, the food segment is expected to remain the primary driver of BOPP market growth.

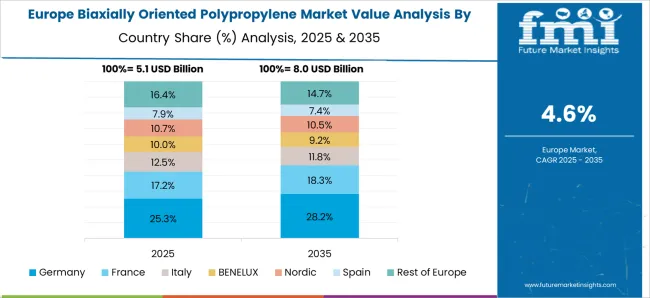

The biaxially oriented polypropylene market is expanding due to its growing application in packaging, labeling, lamination, and industrial films. BOPP films offer high tensile strength, chemical resistance, and superior clarity, making them suitable for flexible packaging in food, pharmaceuticals, and consumer goods. Asia Pacific leads production and consumption, driven by a large packaging industry and expanding manufacturing infrastructure. Europe and North America focus on specialty applications, including high-barrier films and premium packaging. Technological developments in co-extrusion, coating, and surface treatment are enhancing film performance.

Growth in flexible packaging and industrial film applications is a key driver of BOPP adoption. Food and beverage companies utilize BOPP films for moisture protection, printability, and shelf appeal. Pharmaceutical and cosmetic industries adopt these films for product safety, barrier protection, and labeling requirements. Industrial films leverage BOPP for lamination, insulation, and protective covering. Manufacturers benefit from cost-effective production and high-volume output. Expanding retail packaging, e-commerce logistics, and protective material requirements contribute to market expansion. The combination of versatility, durability, and process efficiency ensures consistent demand across commercial and industrial segments.

Developments in coating, metallization, and barrier enhancement are creating growth opportunities for BOPP films. High-barrier films provide extended shelf life for perishable goods and protect pharmaceuticals from moisture and oxygen. Metallized BOPP films offer improved light and gas resistance, suitable for packaging and labeling applications. Specialty coatings enhance printability, adhesion, and thermal stability. Manufacturers focusing on advanced film formulations, sustainable production methods, and high-performance properties are expected to gain competitive advantages. The adoption of upgraded BOPP films in premium packaging and specialty industrial applications is projected to expand market reach and support long-term growth.

The trend toward recyclable and eco-friendly BOPP films is gaining momentum due to regulatory and environmental requirements. Recyclable films reduce waste and support circular packaging strategies, particularly in food and consumer goods sectors. Manufacturers are investing in process improvements, biodegradable additives, and chemical-free coatings to meet environmental standards. Retailers and consumers are increasingly prioritizing sustainable packaging solutions. Integration of eco-friendly features enhances product appeal and regulatory compliance. These developments drive broader adoption in commercial, industrial, and specialty markets, encouraging innovation while maintaining functional performance in BOPP films.

Fluctuations in polypropylene resin prices and high energy consumption in biaxial orientation processes pose challenges for manufacturers. Specialized equipment, precise temperature control, and quality monitoring increase production costs. Transitioning to advanced or eco-friendly BOPP films requires additional investment in R&D and infrastructure. Companies focusing on process optimization, cost-efficient production, and scalable solutions are better positioned to address these challenges. Maintaining consistent quality while managing raw material and energy costs is critical to ensuring competitiveness and sustainable growth in the BOPP market.

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

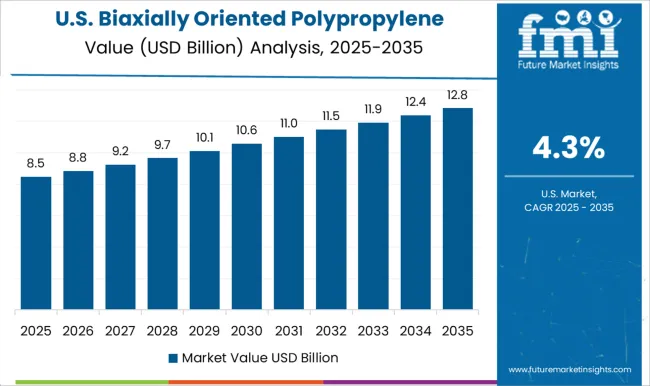

| USA | 4.3% |

| Brazil | 3.8% |

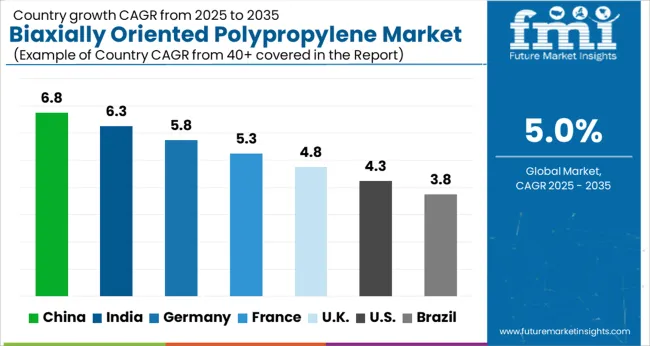

The biaxially oriented polypropylene (BOPP) market is expanding at a global CAGR of 5% from 2025 to 2035, driven by rising demand in packaging, labeling, and flexible film applications. China leads with a CAGR of 6.8%, +36% above the global benchmark, supported by BRICS-driven growth in packaging industries, industrial output, and export-oriented manufacturing. India follows at 6.3%, +26% over the global average, reflecting increasing domestic demand for packaging solutions, FMCG sector growth, and adoption in food and pharmaceutical packaging. Germany records 5.8%, +16% above the global CAGR, shaped by OECD-backed innovation in high-performance films and sustainable packaging initiatives. The United Kingdom posts 4.8%, slightly below the global rate, influenced by moderate industrial demand and selective adoption in specialty applications. The United States stands at 4.3%, −14% under the global benchmark, with slower expansion in packaging but steady uptake in niche industrial applications. BRICS economies are driving volume growth, while OECD markets emphasize quality, efficiency, and sustainability.

China is growing at a CAGR of 6.8%, which is 1.8% higher than the global CAGR of 5%, driven by strong demand in flexible packaging, labeling, and industrial applications. Rapid growth of e-commerce, FMCG, and food packaging sectors is boosting BOPP consumption. Domestic manufacturers are expanding production capacities for high-clarity and heat-resistant films to meet both local and export demands. Technological upgrades in film extrusion and coating are enhancing product quality, while partnerships with converters and packaging companies strengthen supply chains.

India is recording a CAGR of 6.3%, which is 1.3% above the global CAGR, supported by growth in FMCG, food packaging, and industrial applications. Manufacturers are scaling up production of coated and metallized BOPP films to meet domestic consumption. Increasing demand for flexible packaging in pharmaceuticals, snacks, and consumer goods is driving adoption. Expansion of local converters and packaging solution providers is supporting efficient supply chains and reducing dependence on imports.

Germany is progressing at a CAGR of 5.8%, which is 0.8% above the global CAGR, driven by demand from packaging, labeling, and industrial sectors. High-quality and specialty BOPP films are used in automotive, electronics, and premium consumer packaging. Manufacturers focus on environmentally friendly and high-performance films to comply with EU regulations. Industrial R&D and collaboration with converters are enhancing product customization. Export of specialty films to neighboring European countries supports additional growth.

The United Kingdom is expanding at a CAGR of 4.8%, which is 0.2% below the global CAGR of 5%, reflecting moderate growth. Adoption is driven by food and pharmaceutical packaging, labeling, and industrial applications. Imports from Europe and Asia supplement domestic supply of high-clarity and metallized films. Packaging converters are increasingly integrating advanced BOPP solutions for retail-ready packaging. The market is gradually shifting toward coated, heat-resistant, and sustainable alternatives to meet evolving industrial and consumer needs.

The United States is progressing at a CAGR of 4.3%, which is 0.7% below the global CAGR of 5%, reflecting slower growth due to a mature packaging market. Demand is supported by flexible packaging, labeling, and industrial applications in consumer goods, pharmaceuticals, and food sectors. Domestic manufacturers focus on specialty films with enhanced barrier properties and heat resistance. Imports supplement domestic production to meet high-quality specifications. The steady adoption of metallized and coated films drives moderate growth across multiple industries.

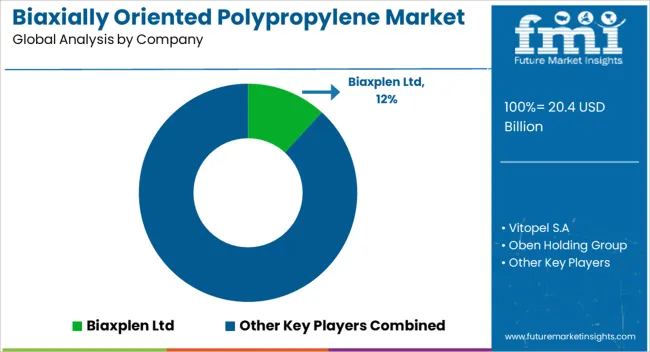

The biaxially oriented polypropylene market is shaped by global producers and specialized film manufacturers supplying solutions for packaging, labeling, lamination, and industrial applications. Polyplex Corporation Limited is assumed to be the leading player, supported by a broad range of barrier films, metallized films, and specialty coated films designed to provide strength, clarity, and moisture resistance. Biaxplen Ltd and SRF Limited maintain strong positions with high-quality films optimized for food, beverage, and consumer goods packaging. Vitopel S.A. and Oben Holding Group focus on decorative and protective films, emphasizing flexibility, printability, and surface uniformity. Xpro India Limited and Chemosvit A.S enhance market reach with industrial-grade films offering thermal stability and dimensional consistency.

Zubairi Plastic Bags Industry LLC, Rowad Global Packaging Co. Ltd, Kopafilm Elektrofolien GmbH, and Innovia Films deliver region-specific solutions with technical support and tailored specifications. Product brochures highlight transparent and metallized films, heat-sealable coatings, and lamination layers designed to improve product durability and shelf appeal. Features such as tensile strength, optical clarity, chemical resistance, and uniform thickness are emphasized. Dunmore, BIOFILM, Treofan Group, Uflex Ltd, Vibac Group S.p.a., Futamura Chemical Co, Manucor S.p.A., Cosmos Films Ltd, Poligal S.A., Jindal Poly Films, Taghleef Industries, and Tempo Group enhance market depth with specialized offerings and technical guidance.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.4 Billion |

| Application | Food, Tapes, Tobacco, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Biaxplen Ltd, Vitopel S.A, Oben Holding Group, SRF Limited, Xpro India Limited, Chemosvit A.S, Zubairi Plastic Bags Industry LLC, Rowad Global Packaging Co. Ltd, Kopafilm Elektrofolien GmbH, Polyplex Corporation Limited, Innovia Films, Dunmore, BIOFILM, Treofan Group, Uflex Ltd, Vibac Group S.p.a., Ltd, Futamura Chemical Co, Manucor S.p.A, Cosmos Films Ltd, Poligal S.A, Jindal Poly Films, Taghleef Industries, and Tempo Group. |

| Additional Attributes | Dollar sales by film type and end-use industry, demand dynamics across packaging, labeling, and industrial applications, regional trends across North America, Europe, and Asia-Pacific, innovation in high-clarity, heat-resistant, and barrier films, environmental impact of recyclability and production waste, and emerging use cases in flexible packaging, sustainable labels, and specialty industrial films. |

The global biaxially oriented polypropylene market is estimated to be valued at USD 20.4 billion in 2025.

The market size for the biaxially oriented polypropylene market is projected to reach USD 33.2 billion by 2035.

The biaxially oriented polypropylene market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in biaxially oriented polypropylene market are food, tapes, tobacco and others.

In terms of , segment to command 0.0% share in the biaxially oriented polypropylene market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biaxially Oriented Polyamide Films Market Size and Share Forecast Outlook 2025 to 2035

Biaxially Oriented Polyamide BOPA Films Market Size and Share Forecast Outlook 2025 to 2035

Oriented Perforating System Market Size and Share Forecast Outlook 2025 to 2035

High Magnetic Induction Grain-Oriented Silicon Steel Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Woven Bag and Sack Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Yarn Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Random Copolymers Market Growth – Trends & Forecast 2025 to 2035

Polypropylene Packaging Films Market Trends - Growth & Forecast 2025 to 2035

Market Share Distribution Among Polypropylene Woven Bag and Sack Manufacturers

Polypropylene Screw Caps Market

Polypropylene Film Market

Polypropylene Fibre Market

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Foamed Polypropylene Films Market Growth - Demand & Forecast 2025 to 2035

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

Expanded Polypropylene (EPP) Foam Market 2025 to 2035

Surgical Polypropylene Mesh Market

Demand for Polypropylene in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA