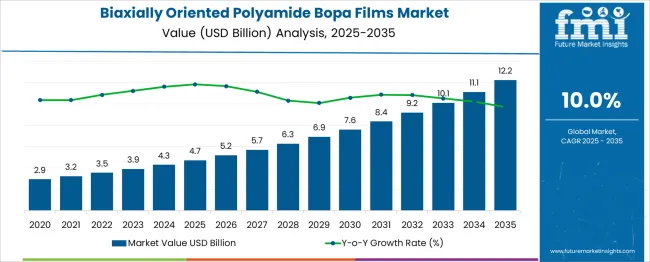

The Biaxially Oriented Polyamide BOPA Films Market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 12.2 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period. A peak-to-trough analysis shows distinct phases of acceleration and slowdowns. Between 2025 and 2030, the market increases from USD 4.7 billion to USD 6.9 billion, adding USD 2.2 billion with a CAGR of 9.3%. This period represents strong growth as demand for BOPA films rises in the packaging sector, driven by their superior barrier properties, lightweight nature, and increasing applications in food, pharmaceuticals, and electronics. The first peak occurs at USD 6.9 billion in 2030, followed by a brief slowdown between 2030 and 2032, where the market increases from USD 6.9 billion to USD 7.6 billion, demonstrating a CAGR of 5.0%. This deceleration phase reflects a slight plateau as market dynamics stabilize and adoption becomes more widespread. From 2032 to 2035, the market rebounds sharply, increasing from USD 7.6 billion to USD 12.2 billion, contributing USD 4.6 billion in growth, with a CAGR of 14.2%. This acceleration signals renewed growth driven by innovation in eco-friendly and high-performance BOPA films, particularly for packaging solutions. The overall analysis shows a strong market performance with periodic slowdowns, followed by significant rebounds.

| Metric | Value |

|---|---|

| Biaxially Oriented Polyamide BOPA Films Market Estimated Value in (2025 E) | USD 4.7 billion |

| Biaxially Oriented Polyamide BOPA Films Market Forecast Value in (2035 F) | USD 12.2 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The BOPA films market is witnessing sustained momentum driven by increasing demand for high-barrier, durable, and lightweight packaging materials across end-use industries. BOPA films are gaining preference due to their superior mechanical strength, puncture resistance, and oxygen barrier properties, making them ideal for packaging sensitive food products, pharmaceuticals, and industrial components.

Rising demand for flexible packaging formats, especially in emerging markets, is accelerating the adoption of BOPA films for shelf-life extension and visual clarity. Technological advancements in tenter frame and sequential processes have further enabled manufacturers to enhance thickness uniformity and film performance.

As sustainability becomes central to procurement decisions, recyclable BOPA film variants and mono-material laminates are being introduced to comply with evolving regulations and eco-labeling mandates. The market is expected to grow further with innovations in multilayer structures and expanding applications in vacuum packaging, medical pouches, and high-value electronics.

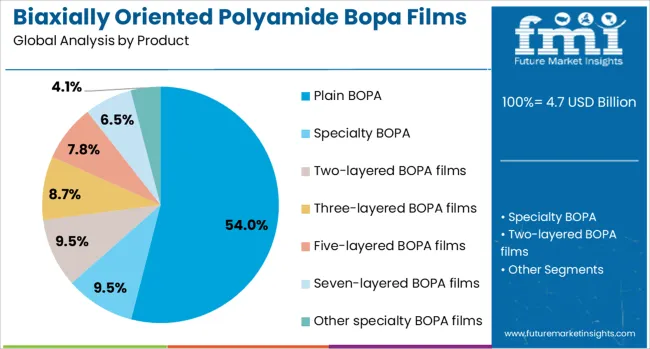

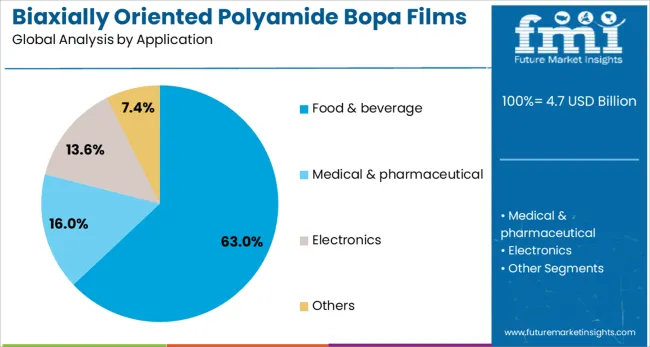

The biaxially oriented polyamide BOPA films market is segmented by product, application, and geographic regions. The product of the biaxially oriented polyamide BOPA films market is divided into Plain BOPA, Specialty BOPA, Two-layered BOPA films, Three-layered BOPA films, Five-layered BOPA films, Seven-layered BOPA films, and Other specialty BOPA films. In terms of application, the biaxially oriented polyamide BOPA films market is classified into Food & beverage, Medical & pharmaceutical, Electronics, and others. Regionally, the biaxially oriented polyamide BOPA films industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Plain BOPA is projected to account for 54.0% of total revenue in the BOPA films market by 2025, positioning it as the leading product segment. Its dominance stems from broad usability across flexible laminates, where clarity, tensile strength, and oxygen permeability resistance are essential.

Plain BOPA films are widely utilized for dry food, snacks, and retort pouches, offering excellent printability and lamination performance. Their compatibility with various packaging layers and ability to maintain seal integrity under thermal processing conditions makes them a versatile choice for converters.

With cost-effective production and wide substrate acceptance, plain BOPA continues to meet the performance and volume demands of both developed and developing packaging markets.

The food & beverage industry is expected to contribute 63.0% of total market share in 2025, emerging as the leading application segment in the BOPA films market. This growth is primarily driven by heightened demand for high-barrier packaging that extends product shelf life and enhances food safety.

BOPA films are extensively used in vacuum pouches, frozen food wraps, and liquid packaging due to their excellent aroma barrier, tensile strength, and chemical resistance. As global consumption of ready-to-eat meals, dairy products, and processed foods increases, BOPA films are being favored for their ability to withstand high-temperature sterilization and retain packaging aesthetics.

Their critical role in minimizing food waste and complying with food-grade standards positions this segment for continued expansion.

Demand for BOPA films is driven by their exceptional properties such as mechanical strength, high barrier performance, and resistance to moisture, making them ideal for packaging in industries like food, pharmaceuticals, and electronics. These films offer effective protection and extended shelf life for a wide range of products. The shift towards flexible packaging and consumer preference for convenience and durability further supports BOPA film adoption. Despite challenges like high production costs and the complexity of the manufacturing process, opportunities exist in emerging markets and through innovations in eco-friendly BOPA film solutions.

Rising consumer preference for flexible packaging solutions is a key driver in the adoption of BOPA films. These films provide superior protection against moisture, oxygen, and light, making them essential for maintaining product integrity in food and beverage packaging. The demand for longer shelf life and healthier, preservative-free products boosts BOPA film adoption in these sectors. BOPA films also serve industrial applications, where high mechanical strength, chemical resistance, and protection from external factors are critical. As industries strive for more functional packaging options, the shift towards flexible packaging offers manufacturers an opportunity to provide high-quality, durable, and versatile solutions across various sectors, meeting the needs of both consumer goods and industrial products.

BOPA film production comes with substantial costs, primarily due to the need for specialized raw materials like polyamide resins, which are more expensive than alternatives. The process of biaxial orientation, which imparts strength and flexibility to the films, adds to the overall production complexity and costs. Fluctuations in raw material prices can disrupt supply chains, impacting pricing stability and availability. Furthermore, while BOPA films offer high-performance benefits, competition from alternative packaging solutions such as polyethylene and polypropylene films adds pressure to reduce production costs without compromising on performance. This challenge is particularly difficult for smaller companies, who may lack the resources to scale production or invest in advanced manufacturing techniques.

Innovation in BOPA films is opening new opportunities, particularly in the development of eco-friendly and biodegradable alternatives. As consumer demand grows for products that minimize environmental impact, manufacturers are focusing on creating packaging that offers the same high-performance characteristics as traditional options, but with renewable and biodegradable materials. The increased focus on reducing plastic waste and providing more eco-conscious packaging solutions opens the door for BOPA films to lead the way in addressing these challenges. The food and beverage sector, in particular, represents a significant opportunity as companies are seeking ways to balance product preservation with eco-friendly alternatives. Emerging markets, with rising disposable incomes, further offer growth potential as demand for advanced packaging solutions increases.

A growing trend in the BOPA films sector is the integration of high-barrier properties into packaging for food and pharmaceuticals. These films are increasingly preferred due to their ability to protect against moisture, oxygen, and contaminants, which is crucial for maintaining product quality and safety. In food packaging, BOPA films are being used for products like snacks, beverages, and ready-to-eat meals, where extended shelf life and preservation of flavor are key. In the pharmaceutical industry, BOPA films ensure that sensitive drugs remain protected from environmental factors, ensuring efficacy and safety. As the demand for these high-performance packaging solutions rises, manufacturers are focused on improving the materials’ ability to offer reliable, efficient, and protective properties, ensuring the integrity of packaged products over time.

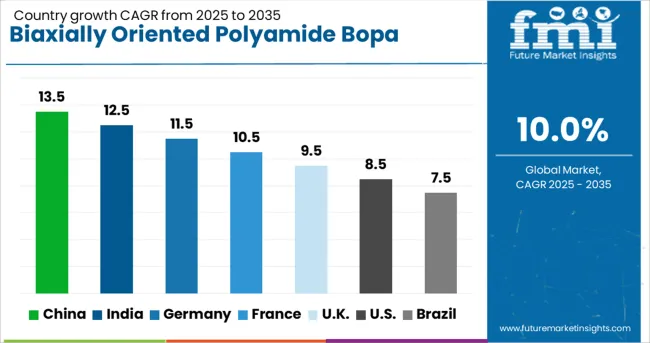

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

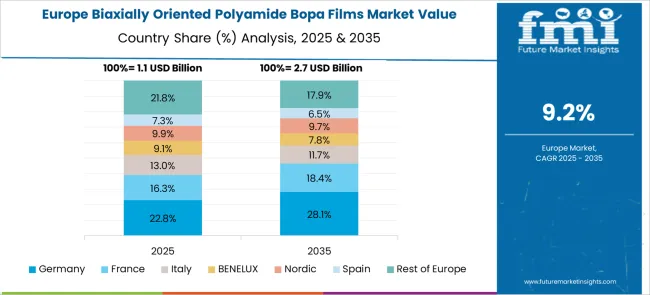

The biaxially oriented polyamide (BOPA) films market is projected to grow at a CAGR of 10% from 2025 to 2035. China leads at 13.5%, followed by India at 12.5%, Germany at 11.5%, the United Kingdom records 9.5%, and the United States stands at 8.5%. The strong growth in BRICS nations like China and India is driven by their rapidly expanding manufacturing sectors and growing demand for packaging solutions, particularly in food, beverages, and consumer goods. Developed economies like Germany, the UK, and the USA show steady growth, supported by the increasing adoption of BOPA films for high-performance packaging, industrial applications, and enhanced durability. The analysis spans over 40+ countries, with the top countries shown below.

China is expected to grow at a CAGR of 13.5% through 2035, driven by a robust manufacturing sector and the growing demand for advanced packaging solutions. As the largest producer and consumer of packaging materials globally, China is rapidly adopting BOPA films, which offer excellent barrier properties, strength, and durability. The food and beverage sector, along with the pharmaceutical and cosmetic industries, is are major driver for the market, particularly due to the growing consumer demand for longer shelf-life products. China’s expanding e-commerce sector, combined with urbanization, further supports the demand for advanced packaging solutions like BOPA films.

India is projected to grow at a CAGR of 12.5% through 2035, with rapid industrialization and increasing demand for high-performance packaging solutions in sectors such as food and beverages, pharmaceuticals, and consumer goods. The rise in disposable incomes, expanding retail infrastructure, and growing consumer preferences for quality, long-shelf-life products are key drivers for the market. India’s manufacturing industry is also increasingly adopting advanced packaging materials, including BOPA films, for their high strength, barrier properties, and versatility. As the demand for eco-friendly, sustainable packaging grows, BOPA films’ adoption for high-quality, recyclable packaging is expected to accelerate.

Germany is projected to grow at a CAGR of 11.5% through 2035, fueled by strong demand in the industrial and consumer packaging sectors. As one of Europe’s leading manufacturing hubs, Germany benefits from the increasing adoption of high-performance films for packaging solutions in food, beverages, and medical applications. The demand for BOPA films is driven by their superior properties, such as high tensile strength, gas barrier performance, and resistance to temperature extremes, which make them ideal for industrial use. Germany’s focus on eco-friendly and sustainable packaging is contributing to the increased use of BOPA films as a viable alternative to traditional materials.

The United Kingdom is expected to grow at a CAGR of 8.3% through 2035, with the food and beverage sector playing a significant role in the expansion of BOPA films. The increasing demand for packaged food, especially in the convenience food sector, drives the need for durable, high-performance packaging materials. The rise of online shopping and delivery services further accelerates the need for packaging solutions that maintain the freshness and quality of products. As the UK focuses on reducing its environmental impact, the adoption of BOPA films aligns with the growing demand for recyclable and eco-friendly packaging.

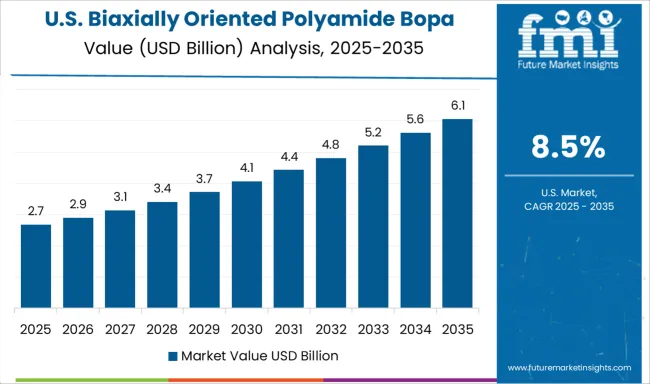

The United States is projected to grow at a CAGR of 8.5% through 2035, driven by increasing demand for food, beverage, and pharmaceutical packaging solutions. The USA market for BOPA films benefits from the growing consumer preference for convenient, long-shelf-life products. As the food and beverage sector increasingly focuses on sustainable packaging alternatives, BOPA films are becoming a preferred choice due to their excellent moisture resistance and protective properties. The pharmaceutical and medical industries are also adopting BOPA films for packaging sensitive products requiring high-quality protective measures. Innovations in flexible packaging and the rising demand for e-commerce have further contributed to the growth of the BOPA films market.

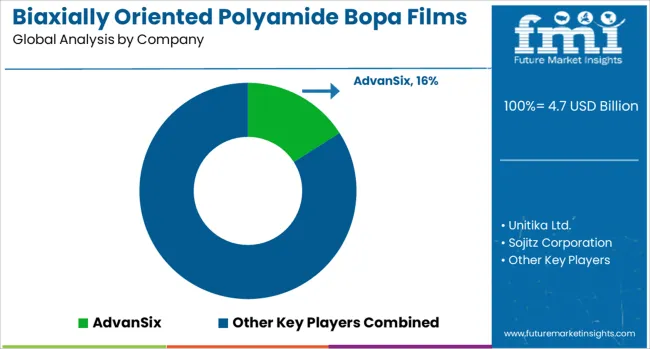

The biaxially oriented polyamide (BOPA) films market is led by key players providing high-performance films for a wide range of applications, including packaging, electronics, automotive, and textiles. AdvanSix and Mitsubishi Chemical Corporation are significant players, offering high-quality BOPA films known for their excellent barrier properties, strength, and flexibility, primarily serving the food packaging industry. Unitika Ltd. and Sojitz Corporation focus on producing BOPA films for specialized applications in packaging, medical, and electronic sectors, leveraging strong innovation capabilities in high-performance film technologies. Kunshan Yuncheng Plastic Industry Company and AMB Spa are major suppliers of BOPA films in the Asia-Pacific region, offering cost-competitive, high-quality films for a wide range of packaging applications. Oben Holding Group and A.J. Plast Public Company target flexible packaging, providing BOPA films with improved mechanical properties, tear resistance, and moisture barriers.

Cangzhou Mingzhu Plastic Company and Green Seal Holding Ltd. focus on manufacturing environmentally friendly BOPA films, aligning with growing sustainability trends in packaging. Triton International Enterprises and Kuraray Company are known for their specialized BOPA films, focusing on providing enhanced barrier protection for food packaging and high-strength films for industrial applications. Domo Group and Impak Films USA LLC. offer BOPA films for advanced packaging solutions, with an emphasis on product quality and customer-specific needs. NOW Plastics and GUNZE Limited are increasingly focusing on the production of ultra-thin BOPA films for high-tech applications in the electronics industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 Billion |

| Product | Plain BOPA, Specialty BOPA, Two-layered BOPA films, Three-layered BOPA films, Five-layered BOPA films, Seven-layered BOPA films, and Other specialty BOPA films |

| Application | Food & beverage, Medical & pharmaceutical, Electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AdvanSix, Unitika Ltd., Sojitz Corporation, Mitsubishi Chemical Corporation, Kunshan Yuncheng Plastic Industry Company, AMB Spa, Oben Holding Group, A.J. Plast Public Company, Cangzhou Mingzhu Plastic Company, Green Seal Holding Ltd., Triton International Enterprises, Kuraray Company, Domo Group, Impak Films USA LLC., NOW Plastics, GUNZE Limited, Thaipolyamide Company, AEC Group, Idemitsu Kosan Company, and Transparent Paper Ltd. |

| Additional Attributes | Dollar sales by film type (transparent, metallized, multi-layer) and end-use segments (food packaging, medical applications, electronics, textiles, automotive). Demand dynamics are influenced by growing consumer preference for high-barrier packaging materials, the rise of flexible packaging, and increasing use of BOPA films in the automotive and electronics sectors. Regional trends show North America and Europe leading the demand for high-quality BOPA films due to stringent packaging standards, while Asia-Pacific, particularly China, shows rapid growth in the production and consumption of BOPA films for packaging and industrial applications. |

The global biaxially oriented polyamide BOPA films market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the biaxially oriented polyamide BOPA films market is projected to reach USD 12.2 billion by 2035.

The biaxially oriented polyamide BOPA films market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in biaxially oriented polyamide BOPA films market are plain bopa, specialty bopa, two-layered BOPA films, three-layered BOPA films, five-layered BOPA films, seven-layered BOPA films and other specialty BOPA films.

In terms of application, food & beverage segment to command 63.0% share in the biaxially oriented polyamide BOPA films market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biaxially Oriented Polyamide Films Market Size and Share Forecast Outlook 2025 to 2035

Biaxially Oriented Polypropylene Market Size and Share Forecast Outlook 2025 to 2035

Oriented Perforating System Market Size and Share Forecast Outlook 2025 to 2035

Polyamide Intermediate Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Polyamide Resins Market Size and Share Forecast Outlook 2025 to 2035

BOPA Film Market Growth – Demand & Forecast 2025 to 2035

Market Positioning & Share in the Polyamide Industry

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

Bio-Polyamide, Specialty Polyamide & Precursors Market Growth – Trends & Forecast 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

LDPE Films Market

Card Films Market

Mulch Films Market Size and Share Forecast Outlook 2025 to 2035

Nylon Films for Liquid Packaging Market from 2024 to 2034

Vinyl Films Market

MDO-PE Films Market Analysis by Cast Films and Blown Films Through 2035

Edible Films and Coatings Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Edible Films and Coatings

Retort Films Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA