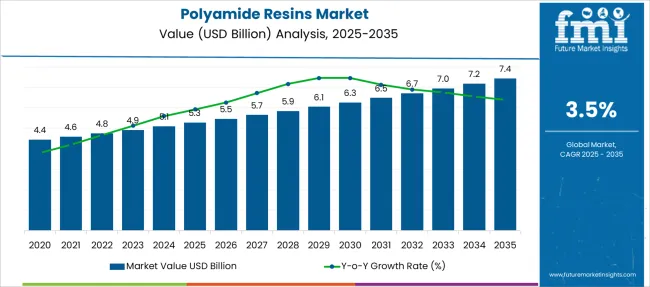

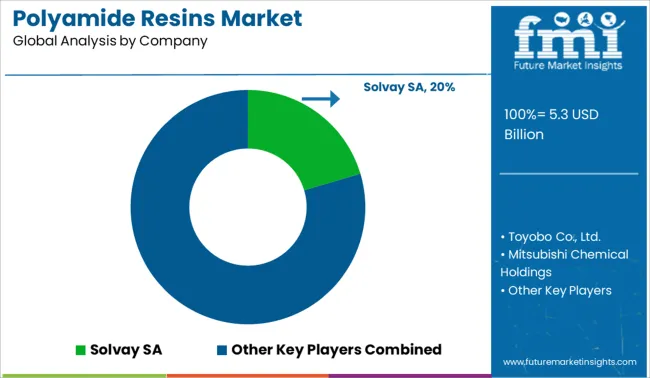

The Polyamide Resins Market is estimated to be valued at USD 5.3 billion in 2025 and is projected to reach USD 7.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

| Metric | Value |

|---|---|

| Polyamide Resins Market Estimated Value in (2025 E) | USD 5.3 billion |

| Polyamide Resins Market Forecast Value in (2035 F) | USD 7.4 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The polyamide resins market is advancing steadily, supported by the increasing demand for high-performance polymers in various industrial applications. Innovations in resin formulations and processing techniques have expanded the use of polyamides in sectors requiring durable, chemical-resistant, and flexible materials.

Growth in industries such as inks paints and coatings has fueled demand for polyamide resins that enhance adhesion, durability, and finish quality. The trend toward sustainable manufacturing and longer-lasting products has encouraged the adoption of specialty resins tailored to specific application needs.

Additionally, the versatility of polyamide resins in different product forms has enabled manufacturers to address diverse processing requirements. Market expansion is expected to be driven by rising investments in automotive electronics industrial equipment and consumer goods. Segmental growth is anticipated to be led by dimer acid–based polyamide resins as the preferred product type pellets as the dominant product form and inks paints and coatings as the leading end-use industry.

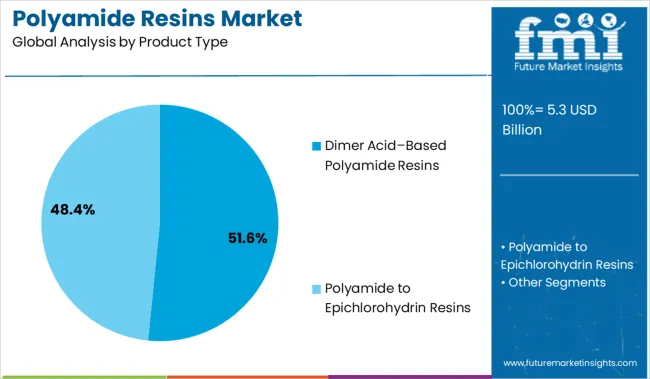

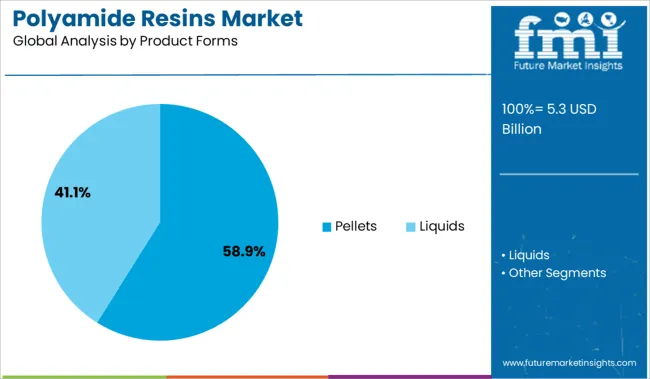

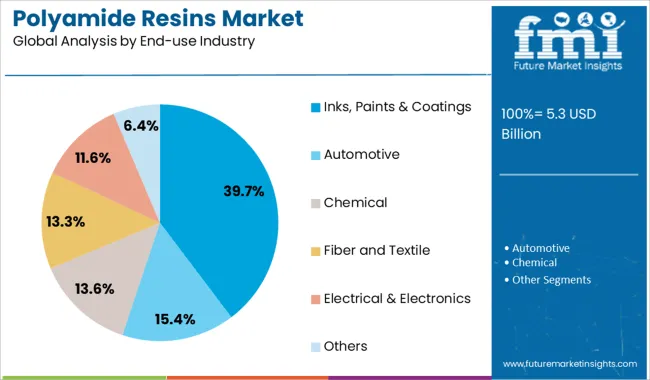

The market is segmented by Product Type, Product Forms, and End-use Industry and region. By Product Type, the market is divided into Dimer Acid–Based Polyamide Resins and Polyamide to Epichlorohydrin Resins. In terms of Product Forms, the market is classified into Pellets and Liquids. Based on End-use Industry, the market is segmented into Inks, Paints & Coatings, Automotive, Chemical, Fiber and Textile, Electrical & Electronics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dimer acid–based polyamide resins segment is projected to contribute 51.6% of the polyamide resins market revenue in 2025, securing its position as the leading product type. This segment has grown due to the superior flexibility chemical resistance and thermal stability offered by dimer acid–based resins.

Manufacturers have favored this type for coatings and adhesives where durability under harsh conditions is critical. The material’s ability to improve surface finish and enhance mechanical properties has made it popular in inks paints and coatings applications.

Additionally the adaptability of dimer acid–based polyamides to various formulations supports their widespread use. As industries continue to demand high-performance polymers the dimer acid–based segment is expected to maintain strong growth.

The pellets segment is projected to hold 58.9% of the polyamide resins market revenue in 2025, leading the product forms category. Pellets are preferred for their ease of handling efficient processing and compatibility with extrusion injection molding and other manufacturing methods.

Their consistent size and shape facilitate uniform melting and blending which improves production efficiency and product quality. The availability of pellets in various grades and customized formulations has supported their dominance.

Manufacturing facilities have increasingly adopted pelletized resins to streamline operations and reduce waste. With growing demand for versatile and process-friendly polymer forms the pellets segment is expected to retain its leading position.

The inks paints and coatings segment is projected to contribute 39.7% of the polyamide resins market revenue in 2025, establishing itself as the largest end-use industry segment. Growth in this segment has been driven by the need for resins that improve adhesion flexibility and durability of coatings.

The segment has benefited from the rising demand for high-performance inks and paints in automotive industrial and decorative applications. Manufacturers have increasingly incorporated polyamide resins to enhance scratch resistance chemical stability and environmental durability of coatings.

Additionally the growth of protective coatings in emerging markets has expanded opportunities. As product quality and performance continue to be prioritized the inks paints and coatings segment is expected to sustain strong demand.

The versatility of the flexographic printing market is a key factor fuelling the demand for polyamide resins, in turn, the growth of the global polyamide resins market.

In spite of e-books and internet having increased tremendously from last decade, the demand for magazines, newspapers, books, is also growing on a sound rate and the same is predicted to spur the sales of polyamide resins to an extent.

The demand from paper print sector, in turn, fuels the global polyamide resins market share.

Additionally, the demand for polyamide resins is also expected to augment form its use as a paper based packaging material whose end usage has rapidly grown in the recent times.

Polyamide resins have superior properties such as it provides the high clarity to the printing. Owing to this, sales of polyamide resins surges as it is mostly preferable in the flexographic printing inks.

Other advantages associated with polyamide resins considered to soar the demand for polyamide resins are-it enhances gel recovery, has effective anti-blocking properties, water resistance properties, ester resistance properties, etc.

However, the stringent environmental regulations on polyamide resins are projected to hamper the global demand for polyamide resins.

For instance, polyamide resins listed under the various regulations such as -Toxic Substances Control Act (USA), Domestic Substances List (Canada).

The Philippine Inventory of Chemicals and Chemical Substances (Philippine), Australian Inventory of Chemical Substances (Australia), Existing and New Chemical Substances (Japan), and China's chemical inventory of existing chemical substances, etc.

Geographically, Europe is to hold a major polyamide resins market share and is anticipated to be a significant platform for polyamide resins manufactures as it accounts around 60% market in term of label manufacturing which consumes ink in a huge volume.

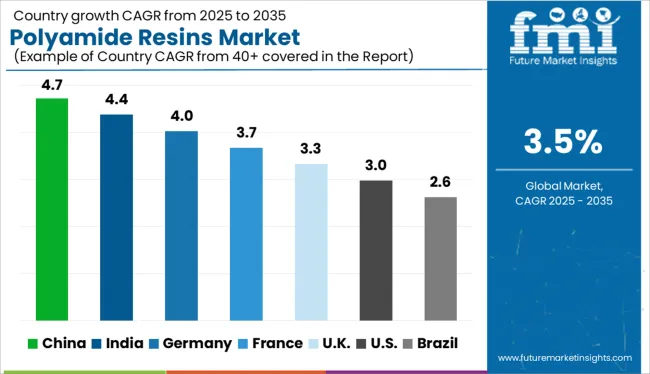

Further, Asia Pacific is expected to witness the maximum growth in term of polyamide resins primarily due to the growth in the automotive and chemical industry in the developing economies such as India and China.

The sales of polyamide resins expected to upsurge in developing economies due to increasing disposable incomes, changing lifestyle which has increased the usage of packed food in these countries, growing retail industry, etc.

Furthermore, North America and Middle East & Africa expected to grow at a moderate growth rate and hold only a minor polyamide resins market share towards the end of the forecast period.

The global polyamide resins market is a highly fragmented market owing to the presence of small as well as international market players at the regional level.

Few of them are identified across the value chain of polyamide resins market are – Solvay SA, Toyobo Co., Ltd., Mitsubishi Chemical holdings, The Ensinger Group, Merck KGaA, RI Chemical Corporation, Gabriel, MPD Industries Pvt. Limited.

Some other key players are Arizona Chemical, The Dow Chemical Company, AnqingHongyu Chemical Co., Ltd, Jinan Tongfa Resin Co., Ltd., RITEKS, Cytech Coatings Private Limited, Thomas Swan & Co. Ltd., and among others.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2014 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Product Type, Product Form, End Use, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Solvay SA; Toyobo Co., Ltd.; Mitsubishi Chemical holdings; The Ensinger Group; Merck KGaA; RI Chemical Corporation; Gabriel; MPD Industries Pvt. Limited.; Arizona Chemical; The Dow Chemical Company; AnqingHongyu Chemical Co. Ltd.; Jinan Tongfa Resin Co., Ltd.; RITEKS; Cytech Coatings Private Limited; Thomas Swan & Co. Ltd. |

| Customization | Available Upon Request |

The global polyamide resins market is estimated to be valued at USD 5.3 billion in 2025.

The market size for the polyamide resins market is projected to reach USD 7.4 billion by 2035.

The polyamide resins market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in polyamide resins market are dimer acid–based polyamide resins and polyamide to epichlorohydrin resins.

In terms of product forms, pellets segment to command 58.9% share in the polyamide resins market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyamide Intermediate Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in the Polyamide Industry

Bio-Polyamide, Specialty Polyamide & Precursors Market Growth – Trends & Forecast 2025 to 2035

Specialty Polyamides Market

Biodegradable Polyamide Market Size and Share Forecast Outlook 2025 to 2035

High Performance Polyamides Market Size and Share Forecast Outlook 2025 to 2035

Injection Molding Polyamide 6 Market Growth – Trends & Forecast 2024-2034

Biaxially Oriented Polyamide Films Market Size and Share Forecast Outlook 2025 to 2035

Biaxially Oriented Polyamide BOPA Films Market Size and Share Forecast Outlook 2025 to 2035

Dimer Acid-based (DABa) Polyamide Resin Market Size and Share Forecast Outlook 2025 to 2035

Biobased And Synthetic Polyamides Market Size and Share Forecast Outlook 2025 to 2035

High Heat Glass Reinforced Polyamide 66 Market Size and Share Forecast Outlook 2025 to 2035

PE Resins Market Size and Share Forecast Outlook 2025 to 2035

Barrier Resins Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Plastic Resins Market Size, Share & Forecast 2025 to 2035

Phenolic Resins Market Size and Share Forecast Outlook 2025 to 2035

Iodinated Resins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Protein A Resins Market Trends, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA