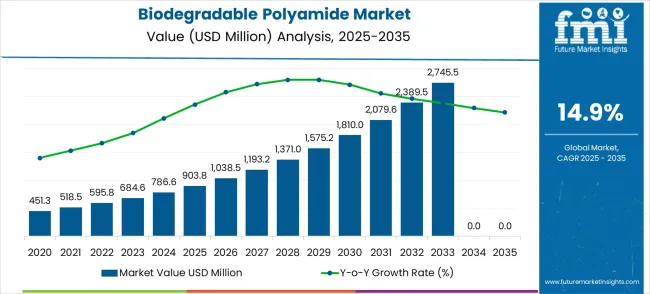

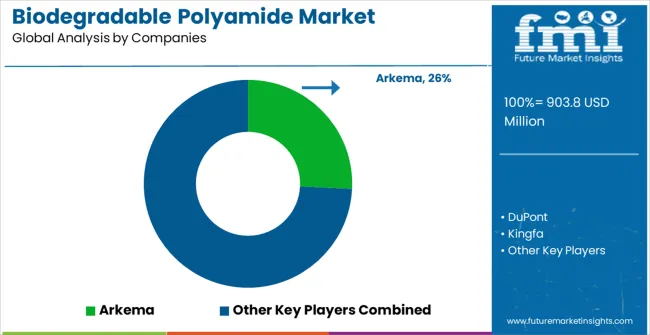

The biodegradable polyamide market is valued at USD 903.8 million in 2025 and is forecasted to reach USD 3,624.7 million by 2035, representing a substantial CAGR of 14.9%. This trajectory highlights strong growth driven by rising environmental concerns, regulatory pressures on non-biodegradable plastics, and increasing adoption in automotive, electronics, and packaging industries.

Historical year-on-year growth reflects consistent expansion, with the market reaching USD 1,038.5 million in 2026, marking a growth rate of approximately 14.9% from the base year. This pattern continues steadily throughout the decade, illustrating both robust demand and a clear upward trend in the adoption of biodegradable polyamides globally. The global biodegradable polyamide market is projected to grow from USD 903.8 million in 2025 to approximately USD 3,624.7 million by 2035, recording an absolute increase of USD 2,720.9 million over the forecast period.

This translates into a total growth of 301.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 14.9% between 2025 and 2035. The overall market size is expected to grow by nearly 4.01X during the same period, supported by increasing environmental consciousness, stringent plastic regulations, and growing demand for sustainable polymer solutions across various industrial applications.

Short-term forecasting for 2026–2028 suggests continued strong growth momentum. Based on the historical YoY trend, the market is expected to grow to USD 1,193.2 million in 2027 and USD 1,371.0 million in 2028, with annual growth rates slightly varying between 14–15%. This phase reflects early-stage adoption benefits, as manufacturers expand production capacities and develop cost-efficient processing technologies. Increased consumer preference for sustainable products in packaging and electronics will further accelerate near-term growth, supported by regulatory initiatives encouraging reduced plastic waste.

Between 2025 and 2030, the biodegradable polyamide market is projected to expand from USD 903.8 million to USD 1,810.0 million, resulting in a value increase of USD 906.2 million, which represents 33.3% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating environmental regulations across global markets, increasing adoption of sustainable materials in automotive manufacturing, and growing consumer awareness of eco-friendly products. Industrial manufacturers are investing in bio-based polyamide technologies to improve sustainability credentials and comply with circular economy initiatives.

From 2030 to 2035, the market is forecast to grow from USD 1,810.0 million to USD 3,624.7 million, adding another USD 1,814.7 million, which constitutes 66.7% of the overall ten-year expansion. This period is expected to be characterized by massive scale-up of bio-based production facilities, integration of advanced biotechnology in polymer synthesis, and widespread adoption across electronics, textile, and packaging applications. The growing focus on carbon neutrality will drive demand for plant-based and renewable feedstock polyamide solutions across multiple industrial sectors.

Between 2020 and 2025, the biodegradable polyamide market experienced accelerated expansion, driven by increasing environmental regulations in developed markets and growing corporate sustainability commitments. The market developed as manufacturers recognized the need for eco-friendly alternatives to conventional petroleum-based polymers. Climate change concerns and mandates to reduce plastic waste have begun influencing procurement decisions toward biodegradable polymer technologies.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 903.8 million |

| Market Forecast Value (2035) | USD 3,624.7 million |

| Forecast CAGR (2025–2035) | 14.9% |

Long-term forecasting combining CAGR and trend analysis projects the market to nearly quadruple by 2035, reaching USD 3,624.7 million. The compound growth effect is strongest after 2030, as cumulative adoption reaches maturity and cost efficiencies improve. By the latter half of the forecast period, growth increments will be the largest in absolute terms — for example, from USD 3,154.6 million in 2034 to USD 3,624.7 million in 2035, an annual increase of USD 470.1 million. This indicates a steepening growth curve driven by a broadening range of industrial applications and increasing regulatory mandates worldwide.

Scenario analysis suggests three possible pathways. In an optimistic scenario, rapid regulatory enforcement and technological breakthroughs could accelerate CAGR to around 17%, pushing the market beyond USD 4,000 million by 2035. The base case, reflected in current forecasts, holds CAGR at 14.9%, with steady growth across segments. A pessimistic outlook could result from slower adoption due to high costs or supply chain constraints, reducing CAGR to approximately 12%, with market value reaching around USD 3,150 million by 2035. The market shows strong resilience and expansion potential over the next decade.

Market expansion is being supported by the rapid implementation of environmental regulations across developed economies and the corresponding need for sustainable polymer alternatives in manufacturing industries. Modern industrial operations require high-performance materials that combine traditional polymer properties with end-of-life biodegradability to meet sustainability targets and regulatory compliance. The superior mechanical properties and biodegradation characteristics of advanced polyamides make them essential materials in demanding applications where environmental impact reduction is critical.

The growing emphasis focus on circular economy principles and carbon footprint reduction is driving demand for bio-based polymer technologies from certified manufacturers with proven track records of sustainability and performance. Industrial operators are increasingly investing in biodegradable polymer systems that offer comparable performance to conventional materials while providing reduced environmental impact over the complete product lifecycle. Regulatory requirements and sustainability standards are establishing performance benchmarks that favor precision-engineered biodegradable polyamide solutions with advanced processing capabilities.

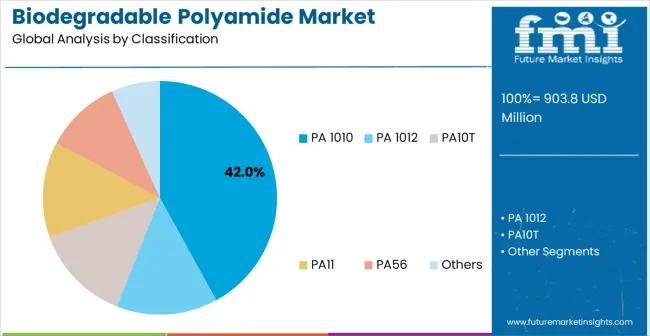

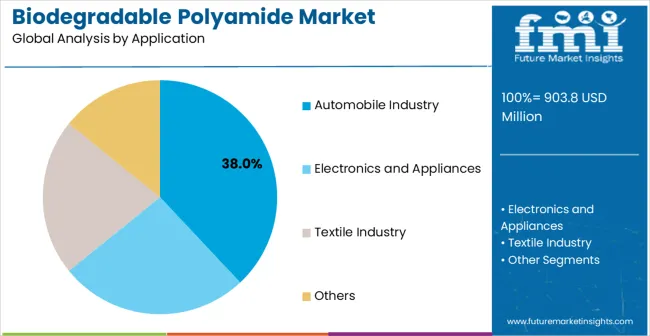

The market is segmented by product type, application, and region. By polyamide type, the market is divided into PA 1010, PA 1012, PA10T, PA11, PA56, and others configurations. Based on application, the market is categorized into automobile industry, electronics and appliances, textile industry, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

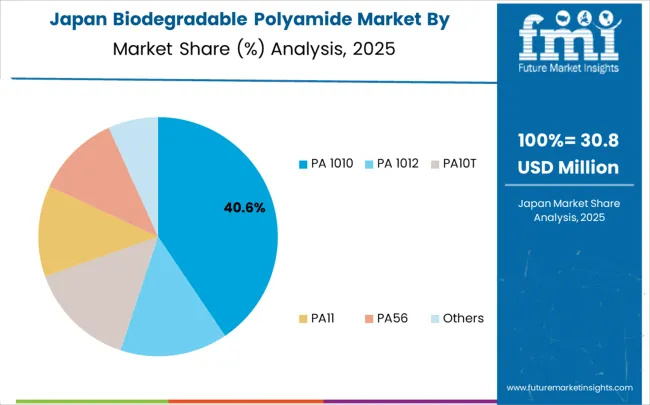

PA 1010 configurations are projected to account for 42% of the biodegradable polyamide market in 2025. This leading share is supported by the excellent balance of mechanical properties, processing characteristics, and biodegradability that PA 1010 offers for diverse industrial applications. PA 1010 provides superior chemical resistance, thermal stability, and mechanical strength while maintaining complete biodegradability under industrial composting conditions, making it the preferred choice for automotive components, electronic housings, and textile applications. The segment benefits from technological advancements that have improved the cost-effectiveness and scalability of bio-based production processes.

Modern PA 1010 polymers incorporate advanced molecular architectures, optimized catalyst systems, and sophisticated processing technologies that deliver performance characteristics comparable to conventional petroleum-based polyamides. These innovations have significantly improved mechanical properties while maintaining biodegradability and reducing production costs through improved manufacturing efficiency. The automotive sector particularly drives demand for PA 1010 solutions, as this industry requires materials that combine high performance with sustainability credentials to meet increasingly stringent environmental regulations.

Automobile industry applications are expected to represent 38% of biodegradable polyamide demand in 2025. This dominant share reflects the automotive sector's commitment to sustainability and the need for high-performance materials capable of meeting demanding automotive specifications while supporting end-of-life vehicle recyclability. Automotive manufacturers require lightweight and durable polyamides for interior components, under-hood applications, and structural parts. The segment benefits from ongoing electrification of automotive powertrains and increasing regulatory requirements for sustainable material usage in vehicle manufacturing.

Automotive applications demand exceptional polyamide performance to ensure adequate mechanical properties, thermal resistance, and chemical compatibility for critical vehicle components. These applications require materials capable of handling automotive operating conditions, including temperature cycling, chemical exposure, and mechanical stress, while maintaining biodegradability for end-of-life processing. The growing emphasis focus on automotive sustainability regulations, particularly in European and North American markets, drives consistent demand for high-performance biodegradable materials.

The biodegradable polyamide market is advancing rapidly due to increasing environmental regulations and growing recognition of sustainable polymer importance in industrial applications. However T, the market faces challenges including higher material costs compared to conventional polymers, need for specialized processing equipment, and varying biodegradation performance requirements across different applications. Standardization efforts and certification programs continue to influence material quality and market development patterns.

The growing deployment of biotechnology-enabled production systems and renewable feedstock processing is enabling cost-effective manufacturing and improved sustainability credentials in biodegradable polyamide production. Advanced fermentation technologies and enzymatic processing systems provide efficient conversion of plant-based feedstocks while optimizing material properties and reducing production costs. These technologies are particularly valuable for large-scale manufacturers that require consistent material quality and competitive pricing structures.

Modern polyamide manufacturers are incorporating advanced polymer chemistry and processing technologies that improve mechanical properties while maintaining biodegradability through specialized molecular architectures and additive systems. Integration of nanotechnology and advanced compounding techniques enables precise property optimization and significant performance improvements compared to first-generation biodegradable polymers. Advanced processing methods and quality control systems also support development of more consistent and reliable biodegradable polyamide grades for demanding industrial applications.

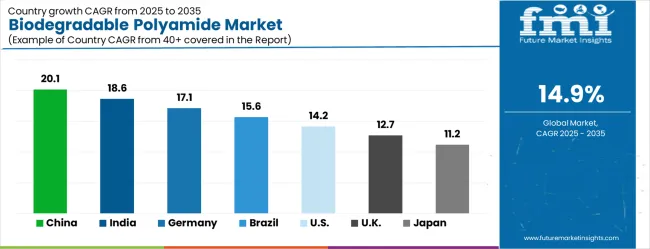

| Country | CAGR (2025–2035) |

|---|---|

| China | 20.1% |

| India | 18.6% |

| Germany | 17.1% |

| Brazil | 15.6% |

| United States | 14.2% |

| United Kingdom | 12.7% |

| Japan | 11.2% |

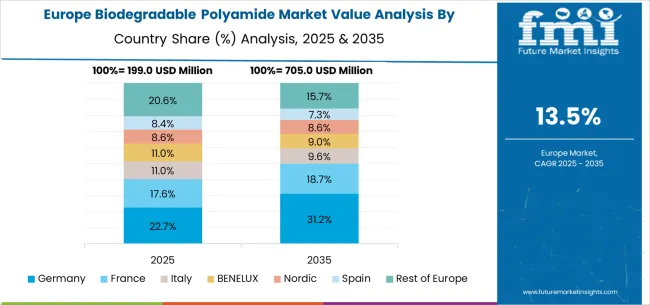

The biodegradable polyamide market is growing rapidly, with China leading at a 20.1% CAGR through 2035, driven by massive manufacturing sector expansion, government sustainability mandates, and growing environmental consciousness among consumers. India follows at 18.6%, supported by rising industrialization in automotive and textile sectors and increasing investments in sustainable manufacturing technologies. Germany records strong growth at 17.1%, emphasizing focusing precision engineering, sustainability leadership, and advanced polymer processing capabilities. Brazil grows steadily at 15.6%, integrating biodegradable polymers into expanding automotive production and textile manufacturing. The United States shows robust growth at 14.2%, focusing on regulatory compliance and corporate sustainability initiatives. The United Kingdom maintains strong expansion at 12.7%, supported by circular economy programs. Japan demonstrates steady growth at 11.2%, emphasizing focusing technological innovation and manufacturing excellence.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

China is forecasted to grow at a CAGR of 20.1% from 2025 to 2035, driven by increasing demand for eco-friendly polymers across packaging, automotive, textile, and electronics industries. Biodegradable polyamides are increasingly adopted due to their superior mechanical properties and environmental benefits. Local manufacturers are focusing on high-performance polymer blends, cost-efficient production, and large-scale commercialization. Government initiatives to reduce plastic waste and promote biodegradable materials are accelerating adoption. The expansion of the automotive sector, growth in green packaging solutions, and rising demand for biodegradable textile fibers further fuel market growth. Strategic collaborations between material manufacturers and research institutions are enhancing polymer performance and driving innovation. Export demand from European and Asian markets is also contributing significantly to market expansion.

India is expected to expand at a CAGR of 18.6% between 2025 and 2035, supported by rising adoption in packaging, textiles, and automotive components. Biodegradable polyamides are valued for their strength, flexibility, and eco-friendly characteristics. Indian manufacturers are investing in cost-effective polymer production, sustainable raw material sourcing, and blending technologies to meet growing demand. Government policies encouraging biodegradable materials and reducing plastic waste are reinforcing adoption. Growth is fueled by the textile sector, which increasingly integrates biodegradable polyamides for apparel and industrial fabrics. Packaging industry adoption is also on the rise due to regulatory compliance and consumer demand for sustainable alternatives. Export opportunities for biodegradable polymer products further strengthen market growth.

Germany is projected to grow at a CAGR of 17.1% from 2025 to 2035, driven by stringent EU regulations on plastic waste and high demand for sustainable polymers. Biodegradable polyamides are increasingly adopted in automotive interiors, industrial textiles, and eco-friendly packaging. German manufacturers focus on high-performance polymer blends, sustainable raw materials, and advanced extrusion technologies. Demand is supported by strong automotive production hubs and a commitment to circular economy practices. Research collaborations with European polymer institutes are accelerating innovation and improving biodegradability without compromising performance. Growing exports of sustainable packaging and industrial materials further drive demand, positioning Germany as a key leader in biodegradable polymer adoption in Europe.

Brazil is expected to grow at a CAGR of 15.6% from 2025 to 2035, supported by increasing adoption in packaging, automotive, and textiles. Biodegradable polyamides are valued for their environmental benefits, mechanical strength, and resistance to wear. Local manufacturers focus on cost-efficient production processes, renewable raw materials, and quality improvement. Growth is driven by packaging industry demand for compostable materials and the automotive sector’s increasing use of eco-friendly polymers for interior and exterior components. Government regulations promoting environmental protection and reducing plastic waste support adoption. International partnerships enable Brazil to access advanced polymer technologies, while exports of sustainable materials grow in importance, further enhancing market prospects.

The United States is projected to grow at a CAGR of 14.2% from 2025 to 2035, driven by demand in packaging, textiles, automotive, and electronics. Biodegradable polyamides are valued for their performance characteristics and eco-friendly nature. Manufacturers are investing in research to improve mechanical properties and expand industrial applications. Growth is supported by rising consumer awareness, stricter environmental regulations, and demand for sustainable alternatives to conventional polymers. The packaging sector is increasingly adopting biodegradable polyamides for single-use and flexible packaging solutions. Automotive manufacturers are incorporating biodegradable polymers into interiors and under-the-hood components to meet environmental targets. Collaborations with European and Asian polymer firms further strengthen the market.

The United Kingdom is expected to grow at a CAGR of 12.7% during 2025–2035, driven by adoption in packaging, automotive, and textile sectors. Biodegradable polyamides are preferred for their durability, environmental performance, and compliance with waste reduction regulations. UK manufacturers focus on polymer blends, renewable raw materials, and cost optimization for high-volume production. Growth is supported by increasing packaging demand for compostable solutions, expansion in automotive interiors, and textile applications in eco-fashion. Government initiatives promoting biodegradable materials and sustainability compliance further support adoption. Collaboration with global polymer technology companies ensures advanced product development. Rising exports of biodegradable polyamide-based materials contribute to overall market expansion.

Japan is projected to grow at a CAGR of 11.2% from 2025 to 2035, driven by adoption in automotive, electronics, packaging, and textile applications. Biodegradable polyamides are preferred for their strength, thermal stability, and environmental benefits. Japanese manufacturers emphasize high-performance polymer blends, advanced extrusion technologies, and precision molding for sustainable applications. Growth is supported by the automotive sector’s integration of biodegradable polymers in interiors and electronics housings, and increasing demand for eco-friendly packaging. Research and development collaborations with European and Asian firms further enhance product performance and biodegradability. Strict environmental standards and strong export demand reinforce Japan’s position in the global biodegradable polyamide market.

Revenue from biodegradable polyamide systems in China is projected to exhibit the highest growth rate with a CAGR of 20.1% through 2035, driven by rapid manufacturing sector expansion and comprehensive government sustainability programs across industrial sectors. The country's growing automotive industry and expanding electronics manufacturing facilities are creating significant demand for high-performance biodegradable polymer systems. Major industrial manufacturers are establishing comprehensive polymer processing installations to support large-scale production operations and meet stringent environmental compliance requirements.

Industrial modernization programs are supporting widespread adoption of advanced biodegradable polymer technologies across manufacturing facilities, driving demand for sustainable and high-performance material solutions.

Government sustainability mandates and environmental protection initiatives are creating substantial opportunities for biodegradable polymer applications in demanding industrial environments requiring regulatory compliance.

Revenue from biodegradable polyamide systems in India is expanding at a CAGR of 18.6%, supported by increasing industrialization across manufacturing sectors and growing investments in sustainable technology infrastructure. The country's expanding automotive and textile industries are driving demand for specialized biodegradable polymer systems capable of meeting demanding application requirements. Industrial facilities are investing in advanced polymer technologies to improve sustainability credentials and comply with emerging environmental regulations.

Manufacturing sector growth and textile industry expansion are creating opportunities for specialized biodegradable polymer applications across diverse industrial facilities requiring sustainable material solutions.

Infrastructure development programs and environmental compliance requirements are driving investments in advanced polymer systems for automotive, electronics, and textile applications throughout major industrial regions.

Demand for biodegradable polyamide systems in Germany is projected to grow at a CAGR of 17.1%, supported by the country's leadership in sustainability and advanced polymer processing capabilities. German industrial facilities are implementing high-performance biodegradable polymer systems that meet stringent environmental standards and operational reliability requirements. The market is characterized by focus on circular economy principles, advanced materials science, and compliance with comprehensive environmental regulations.

Manufacturing industry investments are prioritizing advanced biodegradable polymer technologies that demonstrate superior sustainability performance while meeting German industrial quality and environmental standards.

Sustainability leadership programs and circular economy initiatives are driving adoption of precision-engineered polymer systems that support optimal production conditions and reduced environmental impact.

Revenue from biodegradable polyamide systems in Brazil is growing at a CAGR of 15.6%, driven by expanding automotive production and increasing industrial development across manufacturing sectors. The country's established automotive industry is investing in advanced biodegradable polymer systems to improve sustainability credentials and meet international environmental standards. Industrial facilities are adopting modern polymer technologies to support growing production requirements and environmental compliance standards.

Automotive industry expansion and industrial development programs are facilitating adoption of sustainable polymer systems capable of meeting demanding application requirements in diverse industrial environments.

Industrial modernization initiatives and environmental compliance requirements are enhancing demand for biodegradable polymer solutions that meet evolving sustainability standards and regulatory requirements.

Demand for biodegradable polyamide systems in the United States is expanding at a CAGR of 14.2%, driven by increasing regulatory requirements and growing emphasis on corporate sustainability initiatives. Industrial facilities are adopting advanced biodegradable polymer technologies that provide improved environmental performance and compliance with emerging regulations. The market benefits from innovation in polymer chemistry and facility modernization programs across multiple industrial sectors.

Corporate sustainability initiatives and regulatory compliance programs are driving adoption of advanced biodegradable polymer systems that offer superior environmental performance and reduced carbon footprint.

Environmental regulations and sustainability mandates are supporting widespread adoption of modern polymer technologies that demonstrate compliance with operational standards and environmental requirements.

Demand for biodegradable polyamide systems in the United Kingdom is projected to grow at a CAGR of 12.7%, supported by comprehensive circular economy programs and industrial sustainability initiatives. Industrial operators are investing in biodegradable polymer systems that provide consistent performance and meet environmental compliance requirements. The market is characterized by focus on material sustainability, operational efficiency, and regulatory compliance across diverse industrial applications.

Circular economy initiatives and sustainability programs are supporting adoption of advanced biodegradable polymer systems that meet contemporary environmental and performance standards.

Industrial modernization programs and environmental regulations are creating demand for specialized polymer applications that provide sustainable operation and regulatory compliance.

Demand for biodegradable polyamide systems in Japan is expanding at a CAGR of 11.2%, driven by the country's emphasis on technological innovation and manufacturing excellence in polymer materials. Japanese manufacturers are developing advanced biodegradable polymer technologies that incorporate precision chemistry and sustainable design principles. The market benefits from focus on quality, performance, and continuous improvement in industrial material applications.

Manufacturing excellence programs and technological innovation initiatives are driving development of advanced biodegradable polymer systems that demonstrate superior performance and sustainability credentials.

Industrial automation and environmental efficiency programs are supporting adoption of precision-engineered polymer solutions that optimize operational conditions and reduce environmental impact.

The biodegradable polyamide market is defined by competition among established chemical companies, specialized polymer manufacturers, and emerging biotechnology firms. Companies are investing in advanced biotechnology, product innovation, sustainable production systems, and technical support capabilities to deliver high-performance, cost-effective, and environmentally-friendly polymer solutions. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

Arkema, operating globally, offers comprehensive biodegradable polyamide solutions with focus on high-performance applications, sustainability, and technical support services. DuPont, multinational, provides advanced polymer systems with emphasis focus on innovation and application-specific solutions. Kingfa, Asia-based, delivers specialized biodegradable polymer solutions for industrial applications with focus on cost-effectiveness and performance. EMS-GRIVORY offers comprehensive polymer technologies with standardized procedures and global technical support.

Evonik provides industrial polymer systems with emphasis focus on specialty applications and technical expertise. Wuxi Yinda Nylon delivers specialized polyamide equipment with focus on processing capabilities. DSM offers comprehensive polymer solutions for demanding industrial environments. Cathay Biotech Inc provides advanced biotechnology-based polymer systems with innovative production capabilities.

Shandong Yinglang Chemical, Shandong Dongchen, and BASF offer specialized polymer expertise, regional manufacturing capabilities, and technical support across global and regional networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 903.8 mMillion |

| Polyamide Type | PA 1010, PA 1012, PA10T, PA11, PA56, Others |

| Application | Automobile Industry, Electronics and Appliances, Textile Industry, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | Arkema, DuPont, Kingfa, EMS-GRIVORY, Evonik, Wuxi Yinda Nylon, DSM, Cathay Biotech Inc, Shandong Yinglang Chemical, Shandong Dongchen, BASF |

The global biodegradable polyamide market is estimated to be valued at USD 903.8 million in 2025.

The market size for the biodegradable polyamide market is projected to reach USD 3,624.7 million by 2035.

The biodegradable polyamide market is expected to grow at a 14.9% CAGR between 2025 and 2035.

The key product types in biodegradable polyamide market are pa 1010, pa 1012, pa10t, pa11, pa56 and others.

In terms of application, automobile industry segment to command 38.0% share in the biodegradable polyamide market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biodegradable Microencapsulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Film Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Disposable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Agricultural Films Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biodegradable Glitter for Cosmetics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biodegradable Meal Trays Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Gloves Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Bone Graft Polymers Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Stretch Films Market - Analysis Size, Share, and Forecast 2025 to 2035

Biodegradable Food Packaging Market Size, Share & Forecast 2025 to 2035

Biodegradable Polymers Market Growth 2025 to 2035

Biodegradable Baby Diapers Market Analysis – Trends, Growth & Forecast 2025-2035

Biodegradable Microbeads Market Growth – Trends & Forecast 2025 to 2035

Competitive Breakdown of Biodegradable Lidding Films Providers

Competitive Landscape of Biodegradable Packaging Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA