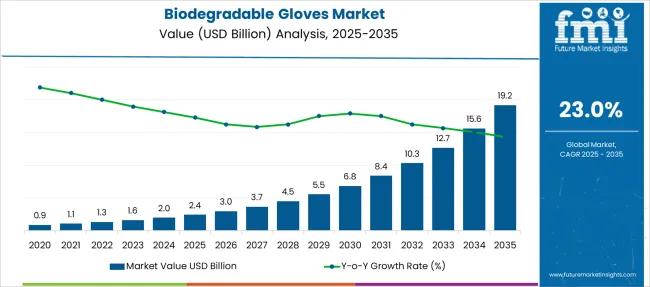

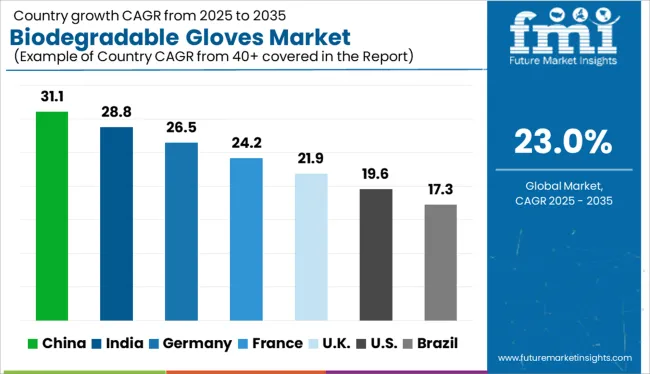

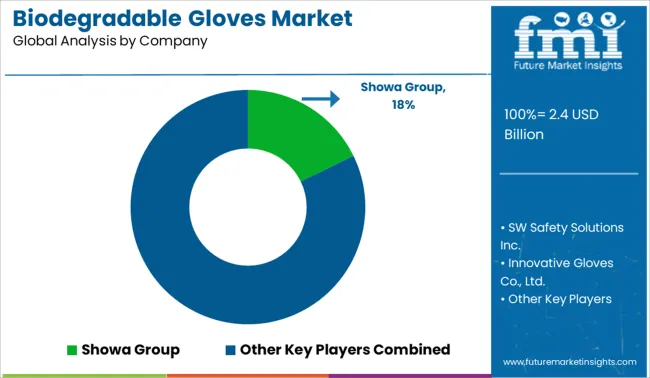

The Biodegradable Gloves Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 19.2 billion by 2035, registering a compound annual growth rate (CAGR) of 23.0% over the forecast period.

| Metric | Value |

|---|---|

| Biodegradable Gloves Market Estimated Value in (2025 E) | USD 2.4 billion |

| Biodegradable Gloves Market Forecast Value in (2035 F) | USD 19.2 billion |

| Forecast CAGR (2025 to 2035) | 23.0% |

The biodegradable gloves market is expanding rapidly as awareness around environmental sustainability and waste reduction increases. The shift away from traditional plastic gloves toward eco-friendly alternatives is supported by growing regulatory pressure and consumer demand for greener products.

Industries that require frequent glove use, such as healthcare, food processing, and manufacturing, are adopting biodegradable options to minimize their ecological footprint. Advances in material science have improved the durability and comfort of biodegradable gloves, making them more competitive with conventional products.

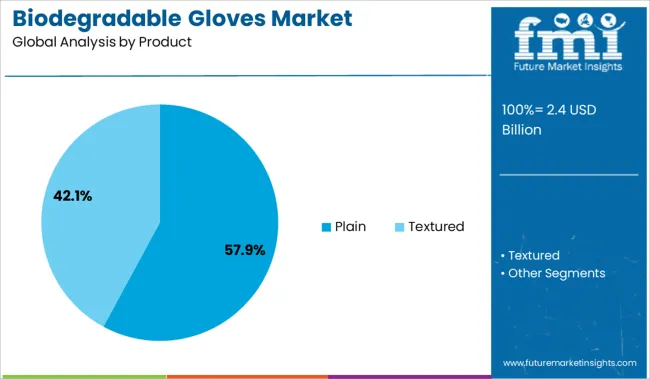

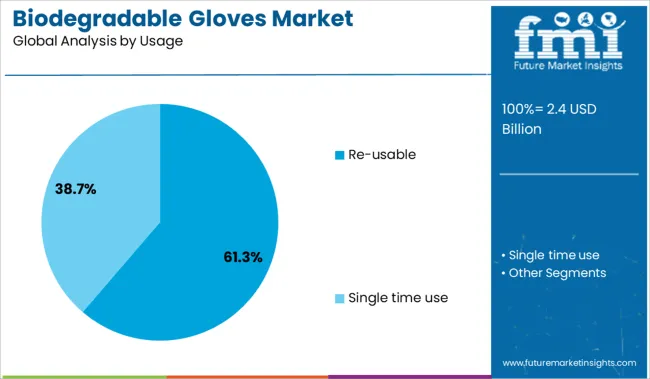

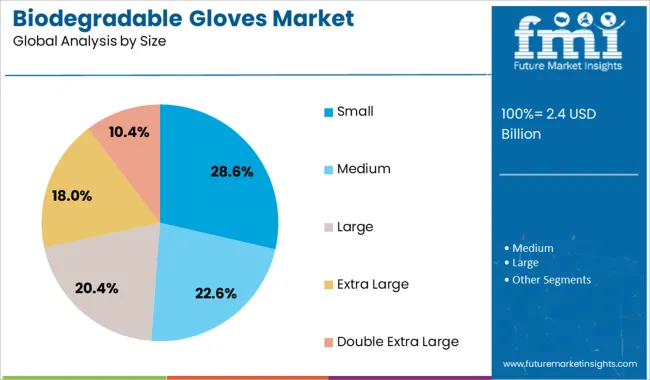

The rising preference for re-usable protective equipment and the need for effective yet sustainable solutions have further encouraged market growth. Retail availability through various distribution channels has improved accessibility to biodegradable gloves. The market’s future growth will be driven by continued innovation in bio-based materials and expanding applications across industries. Segmental leadership is expected to come from the Plain product type, Re-usable usage category, and Small size gloves preferred for specific task requirements.

The market is segmented by Product, Usage, Size, and End User and region. By Product, the market is divided into Plain and Textured. In terms of Usage, the market is classified into Re-usable and Single time use. Based on Size, the market is segmented into Small, Medium, Large, Extra Large, and Double Extra Large. By End User, the market is divided into Hospitals, Clinics, Ambulatory Surgical Centers, Academic and Research Institutes, Diagnostic Laboratories, and Home care settings. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Plain segment is projected to contribute 57.9% of the biodegradable gloves market revenue in 2025, holding the top position among product types. This segment’s growth is fueled by the demand for simple, versatile gloves that can be used in a wide range of applications without added textures or coatings.

Plain biodegradable gloves are often preferred in industries where sensitivity and dexterity are critical, providing comfort without compromising environmental benefits. The straightforward design makes manufacturing more cost-effective, enabling wider availability and competitive pricing.

Moreover, plain gloves are easier to recycle or compost, aligning with sustainability goals. As industries and consumers prioritize green alternatives, the Plain segment is expected to sustain its leading role.

The Re-usable segment is expected to account for 61.3% of the biodegradable gloves market revenue in 2025, establishing it as the dominant usage type. Growth in this segment reflects a shift toward products that offer longer life cycles and reduced waste generation compared to single-use gloves.

Re-usable biodegradable gloves provide economic and environmental advantages by minimizing the frequency of replacement and lowering the overall volume of disposed gloves. Organizations with sustainability targets have increasingly adopted re-usable gloves to meet environmental regulations and reduce procurement costs.

Technological advances in bio-material durability have made re-usable gloves more reliable and comfortable for extended use. As awareness of waste reduction increases, the Re-usable segment is expected to continue its upward trend.

The Small size segment is projected to hold 28.6% of the biodegradable gloves market revenue in 2025, securing its position as the leading size category. Demand for small-sized gloves is driven by industries requiring precision and dexterity, such as healthcare and electronics manufacturing.

Smaller gloves offer a better fit for users with smaller hands, improving comfort and reducing hand fatigue during prolonged use. The segment has been supported by ergonomic research and increasing customization of glove sizing to enhance user satisfaction.

Additionally, the growing presence of female workers in glove-intensive industries has contributed to the demand for smaller glove sizes. As more industries adopt biodegradable gloves with a focus on user comfort and environmental impact, the Small size segment is expected to maintain its market prominence.

The sales of biodegradable gloves grew at a CAGR of 20.5% from 2020 to 2024, owing to the advent of the COVID-19 pandemic.

The demand for nitrile gloves is expected to grow as these gloves do not affect human health, and are environment friendly. This is a key factor driving the production of biodegradable nitrile gloves.

Several healthcare facilities utilize latex-free gloves, owing to their affordability. The use of nitrile disposable gloves across the medical sector will grow in the forthcoming years owing to minimal drawbacks and positive features of the nitrile material.

The development of novel technologies to cater to the demand for high-quality gloves at low prices will drive the overall biodegradable gloves market.

Individuals may choose to continue wearing gloves even after the COVID-19 outbreak due to increased understanding of the necessity of gloves as a consequence of the pandemic.

This scenario exacerbated the issue of rubber solid waste management; consequently, the development of biodegradable gloves may be a viable solution. However, before commercialisation, it is critical to investigate the shelf life of biodegradable gloves.

Malaysia is the world's largest maker for rubber gloves, producing volumes of over 0.9 billion each year. Malaysia exported roughly 182 billion gloves in 2020, with the Malaysian Rubber Glove Manufacturers Association (MARGMA) estimating 2 billion pieces in 2024 due to the ongoing COVID-19 global pandemic.

It will substantially contribute to waste disposal issues, which is expected to boost the supply of single-use personal protective equipment. Biodegradation is thus a sustainable alternative which will aid in the waste disposal of these consumable products.

Demand for infection prevention and control utilities is projected remain high demand over the forecast period as the prevalence of epidemic diseases rises. Nitrile gloves are largely utilised in the medical field to protect caregivers and patients against infections. Nitrile gloves have higher strength and durability, and provide protection against blood borne diseases.

Thus, owing to the aforementioned factors, the global biodegradable gloves market is expected to grow at a CAGR of 23.0% during the forecast period.

Increasing demand for nitrile material gloves is expected to create opportunities for growth in the market over the forecast period amid growing concerns regarding the prevalence of latex allergy across the globe.

With stringent regulations imposed by the FDA and certain European regulatory authorities on powdered gloves, the demand for alternatives, such as biodegradable gloves and powder-free nitrile gloves is increasing worldwide.

Strict worker safety rules, as well as a high focus on hygiene across various end-use industries, are also driving up demand for nitrile gloves worldwide. These gloves have a stronger chemical and puncture resistance than latex gloves, which is driving demand in a wide range of industries.

During the forecast period, this is expected to provide lucrative opportunities for growth in the global biodegradable gloves market.

Medical gloves play an important role in keeping health care personnel, patients, and anyone in proximity safe.

However, the US Food and Drug Administration's Centre for Devices and Radiological Health has issued a ban on absorbable powder gloves, powdered surgeon gloves, and powdered patient examination gloves, citing a significant risk of injury and illness that cannot be eliminated or corrected by changing the label.

Granulomas, inflammation, and respiratory allergic reactions are some of the risks linked with using powdered gloves. This factor acts as a major impeding factor in the growth of the biodegradable gloves market.

Moreover, growth in the market is likely to be affected by the production costs and shelf-life assessment of biodegradable gloves. Numerous investigations have been published, with most studies focusing on different types of biodegradable fillers and distinct strategies towards enhancing non-rubber latex film compatibility, mechanical strength, and biodegradability.

However, little research has been done on the shelf life of biodegradable products. This is because of the high cost of measures employed for the assessment of the material integrity of biodegradable gloves. These factors are expected to limit sales in the market over the forecast period.

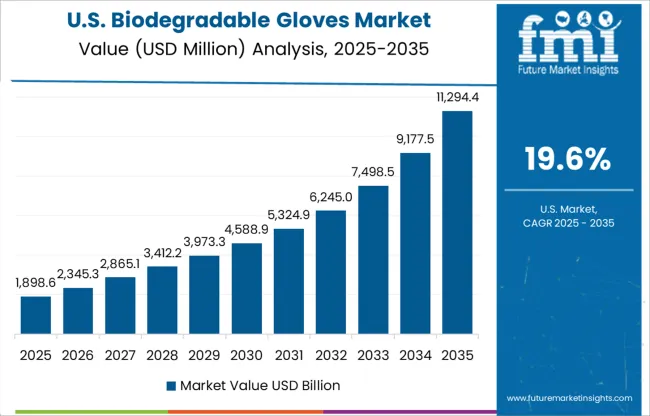

Surging Demand for Biodegradable Nitrile Gloves in the USA Will Boost Sales

The USA dominated the North America market, holding about 89.1% of the total market share in 2024. As per the report, the trend is expected to continue over the forecast period.

Expansion of the pharmaceutical sector and government laws prohibiting powdered and latex gloves in the USA will boost the market. Furthermore, the market is likely to benefit from growth in the food processing industry as well as the hygiene and personal care sectors.

Furthermore, the FDA recently imposed a ban on powdered medical gloves due to their negative side effects. Due to the powder, powdered medical gloves are easier to wear, however instead of aiding people with allergies, they have a negative impact. This is a prime driver for the design and production of biodegradable gloves within the country.

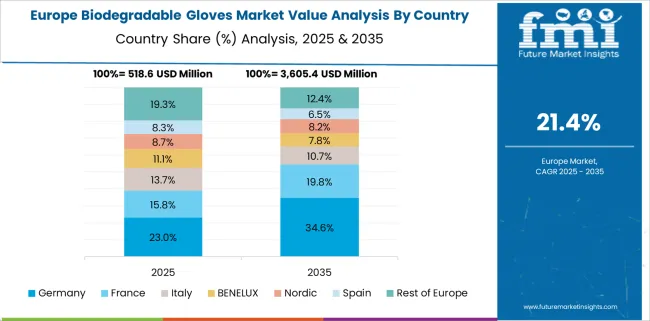

Rising Adoption of Biodegradable Disposable Gloves in Germany Will Spur Demand

Germany is set to exhibit grow at a CAGR of 2.3% in the European biodegradable gloves market during the forecast period. Germany is becoming an increasingly popular medical tourist hotspot. The country's attractiveness for healthcare stems from its high-quality care, strict ethical requirements, and quick access to specialists.

Additionally, in Germany, the cost-to-quality ratio of medical care is apparently low. It is not the cheapest medical destination in the world, but it is far less expensive than other industrialised nations such as the USA

Contributions fund the country's healthcare industry, guaranteeing that all residents have access to free healthcare. As a result of these advances in the medical industry, demand for disposable medical gloves is increasing, thereby fueling the growth in the market.

Expansion of the Healthcare Sector in Malaysia Will Drive Sales of Eco-friendly Disposable Gloves

Malaysia held approximately 17.8% of the South Asia share in 2024, and sales are projected to grow at a 2.5% CAGR during the forecast period. Malaysian rubber glove makers committed to contributing 2 million gloves to Wuhan city in early February 2024. The healthcare industry has been generating steady demand for protective medical supplies.

Medical gloves from China are now on the USD 200 billion list for Chinese goods, subjected to a 10% import tariff, which will hamstring rubber glove makers in China. To meet rising global demand, Malaysia's biggest producers have either boosted capacity or are gradually raising capacity over the next 1 to 3 years.

Top Glove, Hartalega, Kossan, CarePlus, and Riverstone are among Malaysia's top five companies, with a top growth streak in line with expanding global demand for gloves.

Demand for Plain Gloves to Remain High

Based on product type, sales of plain gloves are expected to increase at a 22% CAGR over the forecast period, accounting for about 75.1% of the total market share in 2035. Plain gloves, such as biodegradable nitrile gloves are enhanced for higher affinity to biodegradability with smooth and enhanced grip, as well as durability.

Adoption of Single Time Use Biodegradable Gloves Will Gain Traction

In terms of usage, the single time use gloves segment is projected to account for 93.1% of the total market share in 2035. With high demand for protective medical equipment, as well as rising cases of infectious diseases, the cost associated with the bulk purchase of single-use gloves is relatively lower than the reusable gloves, and are durable and cost-friendly.

Sales of Biodegradable Gloves Across Hospitals Will Continue Rising

By end use, the hospitals segment held 52.3% of the total market share in 2024. The growing prevalence of chronic and infectious diseases, as well as the associated increasing volumes of surgical procedures are expected to drive sales in this segment over the forecast period.

With various competitors in the biodegradable gloves market, the overall market is highly fragmented. To meet consumer demand and expand their customer base, leading companies are implementing methods such as mergers and acquisitions, partnerships and collaborations, and new product launches. For instance:

| Attributes | Details |

|---|---|

| Estimated Market Size (2025) | USD 2.4 billion |

| Projected Market Valuation (2035) | USD 19.2 billion |

| Value-based CAGR (2025 to 2035) | 23% |

| Forecast Period | 2020 to 2024 |

| Historical Data Available for | 2025 to 2035 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | The USA, Canada, Brazil, Mexico, Argentina, The UK, Germany, Italy, Russia, Spain, France, BENELUX, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Turkey, GCC, and South Africa |

| Key Market Segments Covered | Product, Usage, Size, End User, and Region |

| Key Companies Profiled | SHOWA GROUP; SW Safety Solutions Inc.; Innovative Gloves Co., Ltd.; Top Glove Corporation Bhd; Hourglass International, Inc.; Biogone; Worldchamp (Huizhou) Plastics Products Co., Ltd; SunEco Tech Ventures Private Limited; Traffi | Hand Protection Specialists; St. Marys Rubbers Pvt. Ltd.; INSINC Products Ltd |

The global biodegradable gloves market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the biodegradable gloves market is projected to reach USD 19.2 billion by 2035.

The biodegradable gloves market is expected to grow at a 23.0% CAGR between 2025 and 2035.

The key product types in biodegradable gloves market are plain and textured.

In terms of usage, re-usable segment to command 61.3% share in the biodegradable gloves market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biodegradable Film Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Disposable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyamide Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Agricultural Films Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biodegradable Glitter for Cosmetics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biodegradable Meal Trays Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Bone Graft Polymers Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Stretch Films Market - Analysis Size, Share, and Forecast 2025 to 2035

Biodegradable Food Packaging Market Size, Share & Forecast 2025 to 2035

Biodegradable Polymers Market Growth 2025 to 2035

Biodegradable Baby Diapers Market Analysis – Trends, Growth & Forecast 2025-2035

Biodegradable Microbeads Market Growth – Trends & Forecast 2025 to 2035

Competitive Breakdown of Biodegradable Lidding Films Providers

Competitive Landscape of Biodegradable Packaging Providers

Biodegradable Lids Market Analysis - Demand, Trends & Outlook 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA