The biodegradable disposable tableware market is advancing strongly due to heightened environmental awareness and the growing adoption of sustainable food packaging solutions. Government regulations restricting single-use plastics have accelerated the shift toward biodegradable alternatives across hospitality, foodservice, and household sectors.

The market is characterized by expanding product availability, design innovation, and cost optimization in manufacturing processes using renewable materials. Increasing demand from quick-service restaurants, catering services, and large events continues to drive volume growth.

Consumer preference for eco-friendly lifestyles has further bolstered adoption. With technological progress in compostable materials and the expansion of distribution networks, the market outlook remains highly favorable over the forecast horizon.

| Metric | Value |

|---|---|

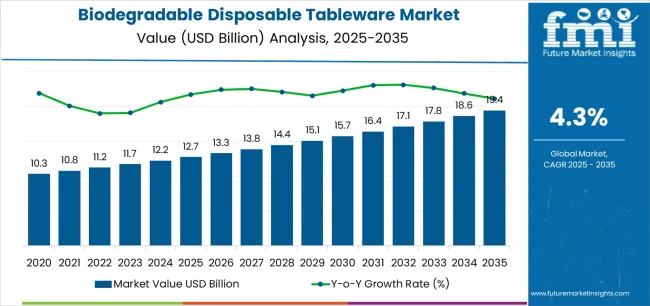

| Biodegradable Disposable Tableware Market Estimated Value in (2025 E) | USD 12.7 billion |

| Biodegradable Disposable Tableware Market Forecast Value in (2035 F) | USD 19.4 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The market is segmented by Product Type, Material, Packaging Application, and End-Use and region. By Product Type, the market is divided into Plates, Bowls, Cups, Trays, and Cutlery. In terms of Material, the market is classified into Pulp And Paper and Bioplastics. Based on Packaging Application, the market is segmented into Food and Beverages. By End-Use, the market is divided into Commercial Use, Institutional Use, and Household Use. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

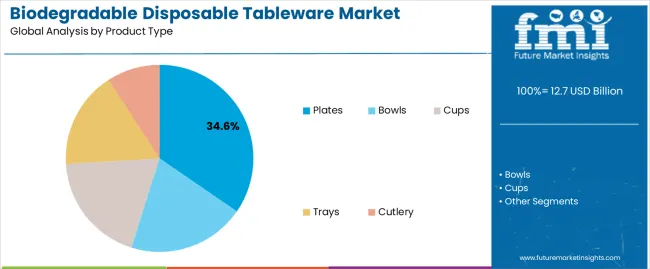

The plates segment leads the product type category, representing approximately 34.60% share of the biodegradable disposable tableware market. This dominance stems from their widespread use in catering, food delivery, and event services, where convenience and hygiene are key.

The growing shift toward sustainable dining practices has reinforced the adoption of biodegradable plates as a direct substitute for plastic variants. Lightweight design, ease of disposal, and compatibility with various food types contribute to their strong market position.

Continuous product development aimed at improving durability and moisture resistance supports long-term segment growth. As foodservice operations increasingly prioritize eco-conscious practices, the plates segment is set to maintain its leading share.

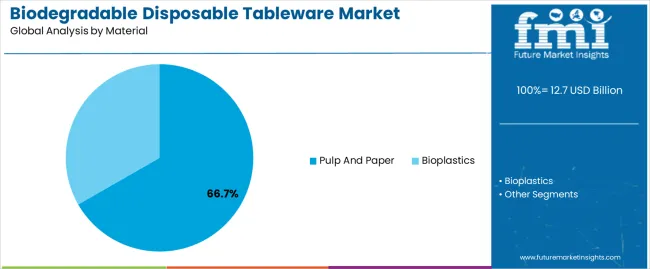

The pulp and paper segment dominates the material category with approximately 66.70% share, driven by its biodegradability, recyclability, and widespread availability. This material type offers favorable mechanical strength and aesthetic appeal, making it ideal for producing plates, cups, and trays.

Cost-effectiveness and compatibility with existing production infrastructure have accelerated its adoption among manufacturers. The segment also benefits from consumer trust in paper-based products as sustainable alternatives.

With increasing investment in sustainable forestry and the development of coated paper variants for better water and oil resistance, the pulp and paper segment is projected to maintain leadership throughout the forecast period.

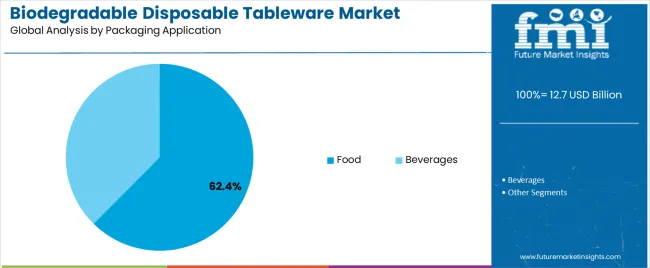

The food segment holds approximately 62.40% share in the packaging application category, underscoring its primary role in driving demand for biodegradable disposable tableware. The foodservice industry’s rapid expansion, especially in quick-service restaurants, catering, and delivery platforms, has intensified the need for sustainable packaging solutions.

Biodegradable tableware ensures compliance with environmental regulations while providing functionality and convenience. The segment benefits from growing consumer preference for eco-friendly dining experiences and increasing partnerships between food chains and sustainable packaging providers.

As awareness of waste reduction continues to rise, the food segment is expected to remain the largest application area in the market.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 9.3 billion |

| Market Value for 2025 | USD 11.5 billion |

| Market CAGR from 2020 to 2025 | 6.4% |

The segmented market analysis of biodegradable disposable tableware is included in the following subsection. Based on comprehensive studies, the trays sector is leading the product type category, and the commercial use segment is commanding the end use category.

| Attributes | Trays |

|---|---|

| Market Share (2025) | 46.6% |

| Attributes | Commercial Use |

|---|---|

| Market Share (2025) | 62.4% |

The biodegradable disposable tableware market can be observed in the subsequent tables, which focus on the leading regions in North America, Asia Pacific, and Europe. A comprehensive evaluation demonstrates that Asia Pacific has enormous opportunities.

Insights into the Biodegradable Disposable Tableware Market in Asia Pacific

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 7.1% |

| China | 6.7% |

| Thailand | 6.1% |

| South Korea | 5.8% |

| Japan | 5.6% |

Exploring the Shift to Biodegradable Disposable Tableware in North America

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

| Canada | 4.3% |

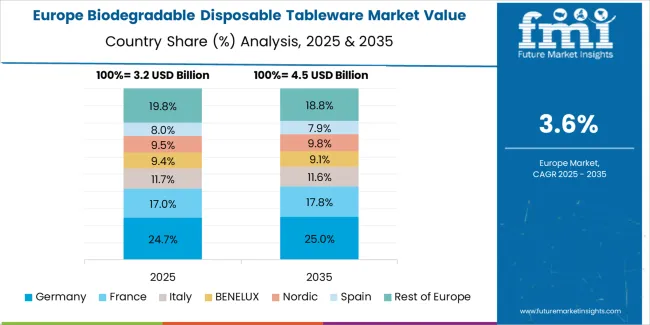

Mapping the Growth of Biodegradable Tableware in Europe

| Countries | CAGR (2025 to 2035) |

|---|---|

| Spain | 4.0% |

| Germany | 3.9% |

| United Kingdom | 3.7% |

| France | 3.5% |

| Italy | 3.3% |

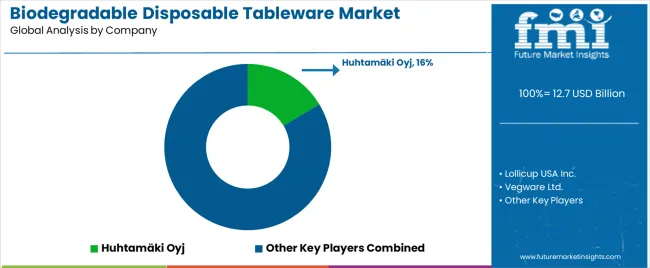

The biodegradable disposable tableware market is diversified, with a few major players spearheading sustainability and innovation. As a pioneer in environmentally friendly packaging, Huhtamäki Oyj uses its global reach to promote biodegradable cutlery. With its creative designs and emphasis on eco-friendly materials, Lollicup USA Inc. has carved out a niche for itself.

Vegware Ltd. is well-known for providing ecologically aware customers with compostable tableware solutions. Dart Container Corporation, one of the significant names in food service packaging, has come a long way in giving biodegradable options.

Hefty provides dependable and long-lasting solutions for various food service applications, whereas Solia, Inc. offers biodegradable dinnerware solutions that combine style and utility. In response to consumer demand for environmentally friendly alternatives, Dixie Consumer Products LLC has increased the number of biodegradable products in its lineup.

Due to its dedication to sustainability, Duni AB provides a selection of dinnerware options that are biodegradable for use by both consumers and businesses.

Other significant biodegradable disposable tableware providers with their unique strengths in production, distribution, and innovation Graphic Packaging International, LLC, Pacovis AG, Papstar GmbH, Dispo International, Genpak LLC, Natural Tableware, and Eco-Products, Inc. contribute to the competitive landscape. These biodegradable disposable tableware producers are well-positioned to spearhead expansion and innovation in the industry as long as consumer consciousness of environmental issues remains high.

Notable Breakthroughs

| Company | Details |

|---|---|

| Georgia Pacific | Leading tissue, pulp, packaging, and building supplies manufacturer, Georgia Pacific extended operations and business in Clarendon County in August 2025 to meet growing client demand and boost manufacturing capacity. |

| Blinkit | Blinkit and Chuk, a company specializing in compostable food service ware, joined in February 2025 to provide disposable dinnerware made of sustainable plant-based materials. Chuk would benefit from the partnership when it entered the B2C market. Additionally, it would allow Blinkit to expand its network of dark storefronts. |

| Defence Research and Development Organization (DRDO) | To replace single-use plastic, the Defence Research and Development Organization (DRDO), an Indian government agency, introduced biodegradable packaging goods in July 2025. These items are constructed of natural and plant-based food-grade ingredients. |

| International Paper | International Paper has plans to build a cutting-edge corrugated packaging facility in Atglen, Pennsylvania, in December 2025. The corporation will be able to increase its industrial packaging presence in the northeastern United States with the aid of this factory. The company anticipated that the factory would be completely operational in the first quarter of 2025, with construction scheduled to start in the first quarter of 2025. |

The global biodegradable disposable tableware market is estimated to be valued at USD 12.7 billion in 2025.

The market size for the biodegradable disposable tableware market is projected to reach USD 19.4 billion by 2035.

The biodegradable disposable tableware market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in biodegradable disposable tableware market are plates, bowls, cups, trays and cutlery.

In terms of material, pulp and paper segment to command 66.7% share in the biodegradable disposable tableware market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biodegradable Microencapsulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Film Market Size and Share Forecast Outlook 2025 to 2035

Disposable Medical Gowns Market Size and Share Forecast Outlook 2025 to 2035

Tableware Market Size and Share Forecast Outlook 2025 to 2035

Disposable Drills Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Disposable Food Containers Market Size and Share Forecast Outlook 2025 to 2035

Disposable Protective Apparel Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plates Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Disposable Hygiene Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Disposable Umbilical Cord Protection Bag Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyamide Market Size and Share Forecast Outlook 2025 to 2035

Disposable E-Cigarettes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Pen Injectors Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Agricultural Films Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Disposable Trocars Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biodegradable Glitter for Cosmetics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA