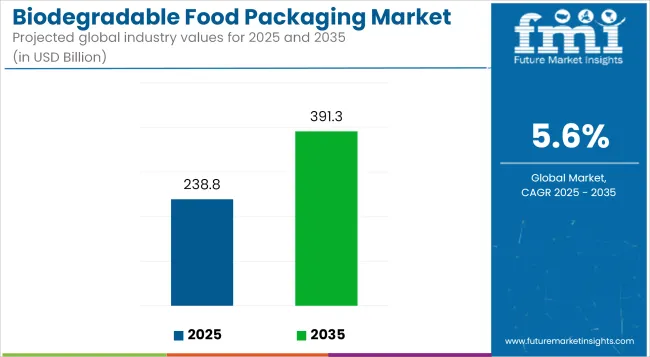

The biodegradable food packaging market is projected to grow from USD 238.8 billion in 2025 to USD 391.3 billion by 2035, registering a CAGR of 5.6% during the forecast period. Sales in 2024 reached USD 226.1 billion, indicating a steady demand trajectory.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 238.8 Billion |

| Projected Market Size in 2035 | USD 391.3 Billion |

| CAGR (2025 to 2035) | 5.6% |

This growth has been attributed to increasing consumer awareness of environmental issues and the rising demand for sustainable packaging solutions. Government regulations aimed at reducing plastic waste have further propelled the adoption of biodegradable packaging materials.

Innovations in material science, such as the development of compostable and recyclable materials, have played a significant role in shaping market dynamics, aligning with the growing emphasis on environmental responsibility among consumers and manufacturers alike.

In 2023, Mondi invests in Functional Barrier Paper Ultimate, an ultra-high barrier paper-based packaging solution. As a global leader in sustainable packaging solutions, we have been focused on the aluminum barrier challenge for some time.

We knew that with research, development and investment in new technologies, we would find an effective replacement that would provide the necessary protection for our customers’ food products. Functional Barrier Paper Ultimate helps our existing and new food producing customers to switch to a more sustainable packaging solution and thus contribute to their sustainability goals.

It is a tangible example of our Mondi Action Plan 2030 (MAP2030) commitment to making all our packaging solutions reusable, recyclable and compostable” says Dirk Gabriel, COO Consumer Flexibles, Mondi.

The biodegradable food packaging industry is poised for continued growth, driven by the ongoing expansion of the food and beverage sectors and the increasing emphasis on sustainable packaging solutions.

The market's trajectory suggests a steady rise in demand for innovative, eco-friendly biodegradable food packaging that caters to both consumer preferences and regulatory requirements. Companies investing in research and development to create durable, cost-effective, and environmentally friendly biodegradable food packaging are expected to gain a competitive edge. The integration of advanced materials and ergonomic designs will likely play a crucial role in shaping the future of the biodegradable food packaging market

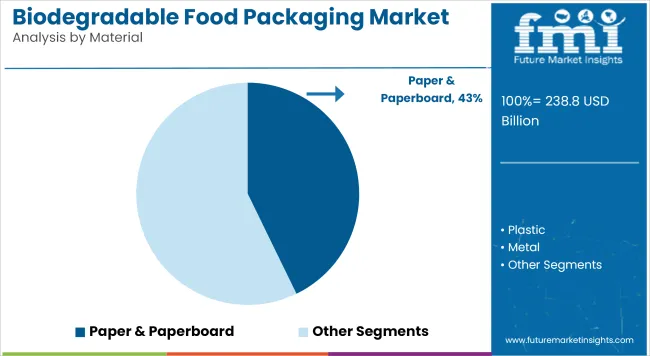

The market is segmented based on material, packaging format, end-use application, and region. By material, the market includes paper & paperboard, plastic, metal, glass, and other materials such as bamboo and cellulose. In terms of packaging format, the market is categorized into trays & clamshells, boxes & cartons, pouches & sachets, cups & lids, films & wraps, and bags & liners.

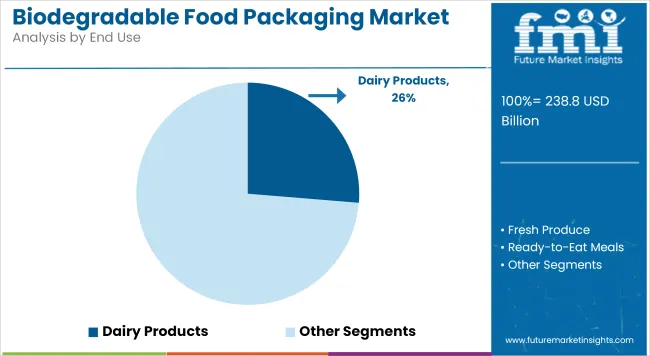

By end-use application, the market comprises fresh produce, ready-to-eat meals, bakery & confectionery, dairy products, meat, poultry & seafood, and foodservice & takeaway. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Paper & paperboard have been projected to account for 42.8% of the biodegradable food packaging market in 2025, owing to their ease of recyclability and natural biodegradability. Uncoated and coated variants have been widely adopted to package dry goods, bakery items, and foodservice products. Barrier coatings made from PLA, wax, or water-based emulsions have been applied to improve resistance to moisture and oil. Their lightweight construction and compatibility with flexographic and digital printing have been leveraged for brand differentiation and traceability.

Large-scale food manufacturers have adopted paper-based trays, wraps, and cartons to replace traditional plastic formats. Innovations in molded fiber and paper-laminate technologies have enabled improved structural strength and product visibility. Global regulatory policies favoring sustainable packaging have driven investments in recyclable and compostable paper formats. New capacities for FSC-certified and recycled-content board have been announced to meet rising food sector demand.

Dairy products have been estimated to hold a 26.3% market share in the biodegradable food packaging sector by 2025 due to strict freshness, barrier, and shelf-life requirements. Yogurt cups, cheese wraps, and milk cartons have been increasingly developed using biodegradable coatings and paper-based laminates. Compostable multilayer structures have been introduced to prevent spoilage while reducing environmental burden. Paper-lid solutions and molded pulp secondary packaging have also been implemented to replace conventional PET and PS formats.

Global dairy cooperatives and brands have introduced plant-based packaging for organic and premium dairy SKUs. PLA-coated paper and bio-HDPE containers have been employed to meet both functional and sustainability goals. Consumer demand for clean-label dairy products has aligned with expectations for eco-conscious packaging. Biodegradable formats have been preferred by health-focused and environmentally aware shoppers across retail and foodservice channels.

High Production Costs and Limited Infrastructure

Because of the high production cost of these materials, such as plant-based plastics, compostable paper, and biopolymers, the Biodegradable Food Packaging Market faces problems. Biodegradable alternatives require advanced production methods, specialized machinery, and sustainable sourcing of the raw materials - all of which are more expensive for producers and consumers compared to traditional plastic packaging. The environmental benefits, however, can only be realized with industrial composting, which is scarce, as well as adequate waste management infrastructure. To meet these challenges, they need to invest in cost-efficient production technologies, lobby for better composting and work with governments to broaden waste processing capacities.

Biodegradable food packaging manufacturers face challenges due to stringent environmental regulations in various countries, variability in sustainability standards across countries, and a myriad of certification requirements. Governments are so strict on labeling, biodegradability testing, and recycling guidelines because they don't want companies to make false green claims, and they want to protect their products.

Furthermore, biodegradable materials are generally less effective in prevention due to their shorter shelf lives, barrier properties, or heat resistance than conventional plastics, which concerns food safety and preservation. To address these challenges, businesses need to focus on R&D to improve material longevity, engage with regulatory bodies for compliance, and inform consumers about appropriate disposal methods to ensure the environmental benefits are realized.

The rise in consumer demand for sustainable packaging

Consumer awareness around plastic pollution, climate change, and sustainability is also driving demand for biodegradable food packaging. Consumers are also looking for solutions that explain how to reduce their carbon footprint and landfill waste and support circular economy efforts. From quick-service restaurants to grocery retailers and meal delivery services, the food industry is increasingly moving toward compostable and plant-based packaging alternatives, aligning with sustainability objectives. THE BOTTOM LINE - Companies that innovate new biodegradable materials, as well as co-develop new products with sustainable brands and gain eco-certification, will be in a strong position in this growing market.

Improvements in Technology and Use of New Materials

Algae-based films, mushroom packaging, and water-soluble bioplastics are some of the scientific breakthroughs in biodegradable material that are shaking this industry. Innovations within nanotechnology, smart coatings, and bio-based polymers are developing strength, moisture resistance, and compostability for these biodegradable packaging solutions. The addition of active packaging technologies, including antimicrobial films and oxygen-scavenging materials, maintains the sustainability of food shelf life. The industry will be primarily driven by the growth of companies investing in material research, sustainable supply chains, and high-performance biodegradable packaging solutions to attract environmentally conscious consumers.

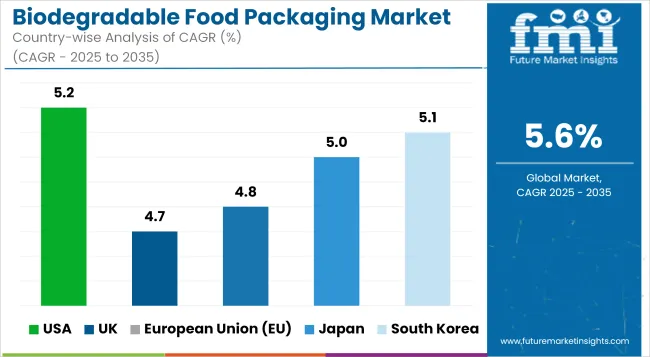

Underlying the USA's dominance of the biodegradable food packaging market is tightening environmental regulations, raising consumer awareness of sustainable packaging, and increasing the adoption of green alternatives in the food industry. Technological advancements are easing the right way for development.

The increasing need for compostable, plant-based, and recyclable food packaging solutions, as well as innovations in biodegradable polymers and fiber-based materials, are bolstering market growth. Moreover, innovations such as smart packaging technology, better barrier properties, and extended shelf-life solutions are driving the adoption of products in the food service and retail industries. In addition, companies are working to create cheaper biodegradable substitutes for conventional plastic packaging. In the United States, the increasing focus on circular economy practices and extended producer responsibility (EPR) programs are also contributing to the growth of the market

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

In the UK market, stringent government policies for reducing plastic waste, along with growing consumer preferences for eco-friendly packaging solutions, drive demand for biodegradable food packaging. The growing implementation of green packaging initiatives and corporate sustainability commitments is also boosting demand.

Plastic bans, extended producer responsibility initiatives, and government incentives for sustainable packaging innovations have improved the market growth. Additionally, the growth of edible packaging films, biodegradable coatings, and compostable bioplastics is witnessing. The concept focuses on food waste being a huge problem, so companies are putting their resources into new packaging formats, where food stays fresher for longer, but with little affect on the environment.

Furthermore, the growing consumer inclination toward plant-based, recyclable, and home-compostable food packaging is expected to drive market growth in the UK. Moreover, the growth of sustainable packaging certifications is building consumer confidence and driving greater adoption of biodegradable solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.7% |

Germany, France, and Italy dominate the European biodegradable food packaging sector, fueled by government backing, high consumer demand for sustainable alternatives, and a well-developed packaging industry.

The EU's ban on disposable plastics, coupled with bio-based and compostable material investments, enable rapid market growth. Biodegradable films with high barriers to oxygen (such as the new biodegradable nylon) and cellulose-based or algal films are also enhancing product innovation.

The increasing adoption of sustainable food delivery services, zero-waste grocery opportunities, and advanced recycling technologies are also driving demand for environmentally friendly packaging solutions. The growth of food-grade grade biodegradable inks and adhesives is also propelling the creation of fully compostable packaging solutions, especially in the EU market. Additionally, the introduction of stringent eco-labeling regulations and carbon footprint reduction targets are further propelling the growth of environmentally friendly packaging, including biodegradable packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

Demand for innovative packaging technologies, the growing emphasis on environmental sustainability, and the confluence of government-driven initiatives to limit plastic waste will all be fueling the growth of Japan's biodegradable food packaging market. Increasing requirements for high-performance biodegradable films and bio-based containers will stimulate the market for this product.

In the country, the market is driven by a focus on technological advancements, and integrates oriented materials with nano-cellulose packaging materials and water-soluble films. Moreover, stringent government policies controlling plastic waste management and the rise of awareness regarding packaging alternatives among consumers is compelling the companies to produce high-quality biodegradable solutions that are food safe.

Rising popularity of biodegradable bento boxes, compostable convenience food packaging, and seaweed-based wrappers are fueling the growth of the packaging sector in Japan. Another helpful trend for adoption of sustainable packaging is the move towards minimalistic and more functional packaging designs that require less material.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

So, there are opportunities for other countries to make eco-friendly packaging out of plant-based materials, especially when they can offer consumers something else, such as the packaging that Golovia makes, which is water-soluble and can help food stay fresh longer and can also be composted.

Increasing government regulations for the reduction of plastic and the focus of key players toward biodegradable & compostable materials for packaging solutions are other factors boosting the market growth.

Furthermore, the country’s efforts to boost the performance of its packaging through high-barrier biodegradable coatings, plant-based alternatives, and lighter and tougher designs is also bolstering competitiveness. The increasing implementation of biodegradable takeaway containers, sustainable food wraps, and recyclable packaging films further accelerates this demand.

Corporations are working on smart biodegradable packaging through temperature-sensitive indicators to bypass food wastage effectively. Driven by both eco-conscious consumer preferences and sustainable dining trends, demand for biodegradable packaging solutions is further bolstered by growing awareness about environmental issues among the South Korean customer base.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

Sustainable packaging Practices focus on the lifecycle of the product from the time it is produced to the end of its utility. With a target on food protection and shelf life, companies are turning to plant-based polymers, recyclable alternatives, and high-barrier biodegradable coatings. Some of the key trends in the biodegradable polymers market are the growing adoption of compostable packaging, bio-based plastics, and water-resistant biodegradable films.

Other Main Participants

The overall market size for Biodegradable food packaging market was USD 145.2 Billion in 2025.

The Biodegradable food packaging market expected to reach USD 233.5 Billion in 2035.

The demand for the biodegradable food packaging market will be driven by increasing environmental concerns, stringent government regulations on plastic usage, rising consumer preference for sustainable packaging, growth in the organic and natural food industry, and advancements in biodegradable materials for enhanced durability and functionality.

The top 5 countries which drives the development of Biodegradable food packaging market are USA, UK, Europe Union, Japan and South Korea.

Dairy and meat packaging growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyamide Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Agricultural Films Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biodegradable Glitter for Cosmetics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biodegradable Meal Trays Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Gloves Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Bone Graft Polymers Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Stretch Films Market - Analysis Size, Share, and Forecast 2025 to 2035

Biodegradable Polymers Market Growth 2025 to 2035

Biodegradable Baby Diapers Market Analysis – Trends, Growth & Forecast 2025-2035

Biodegradable Microbeads Market Growth – Trends & Forecast 2025 to 2035

Competitive Breakdown of Biodegradable Lidding Films Providers

Biodegradable Lids Market Analysis - Demand, Trends & Outlook 2024 to 2034

Biodegradable Film Market Insights – Growth & Forecast 2024-2034

Biodegradable Disposable Tableware Market Insights – Growth & Forecast 2024-2034

Biodegradable Cutlery Market

Biodegradable water bottles Market

Biodegradable Packing Peanuts Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA