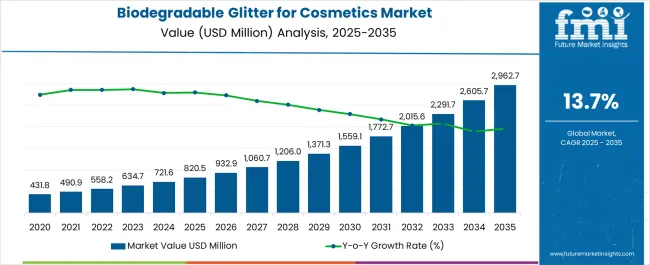

The global biodegradable glitter for cosmetics market is projected to grow from USD 820.5 million in 2025 to approximately USD 2,962.7 million by 2035, recording an absolute increase of USD 2,131.8 million over the forecast period. This translates into a total growth of 259.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 13.7% between 2025 and 2035. The overall market size is expected to grow by nearly 3.6X during the same period, supported by the rising demand for sustainable beauty products and increasing consumer awareness about environmental impact of traditional cosmetic ingredients.

Between 2025 and 2030, the Biodegradable Glitter for Cosmetics market is projected to expand from USD 820.5 million to USD 1,556.4 million, resulting in a value increase of USD 735.9 million, which represents 34.5% of the total forecast growth for the decade. This phase of growth will be shaped by rising awareness of environmental sustainability in beauty products, increasing regulatory pressure on plastic microparticles, and growing consumer preference for eco-friendly cosmetics alternatives.

From 2030 to 2035, the market is forecast to grow from USD 1,556.4 million to USD 2,962.7 million, adding another USD 1,395.9 million, which constitutes 65.5% of the overall ten-year expansion. This period is expected to be characterized by mainstream adoption of biodegradable alternatives, technological advancement in plant-based polymer manufacturing, and expansion of sustainable beauty product portfolios across major cosmetic brands.

Between 2020 and 2025, the Biodegradable Glitter for Cosmetics market experienced significant expansion, driven by growing environmental consciousness, regulatory bans on plastic microbeads in cosmetics, and technological innovations in biodegradable material development. The market developed as consumers became increasingly aware of the environmental impact of traditional glitter and beauty brands recognized the need for sustainable alternatives.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 820.5 million |

| Projected Value (2035F) | USD 2,962.7 million |

| CAGR (2025 to 2035) | 13.7% |

Market expansion is being supported by the increasing global focus on environmental sustainability and the cosmetics industry's transition toward eco-friendly formulations. Modern consumers are actively seeking products that align with their environmental values, moving away from traditional plastic-based glitters toward biodegradable alternatives that provide the same aesthetic appeal without environmental harm.

The growing implementation of plastic microparticle regulations across various regions and the rising awareness of ocean pollution caused by conventional glitter are driving demand for biodegradable alternatives. Beauty brands are increasingly investing in sustainable product development to meet consumer expectations and comply with evolving environmental regulations while maintaining product performance and visual appeal.

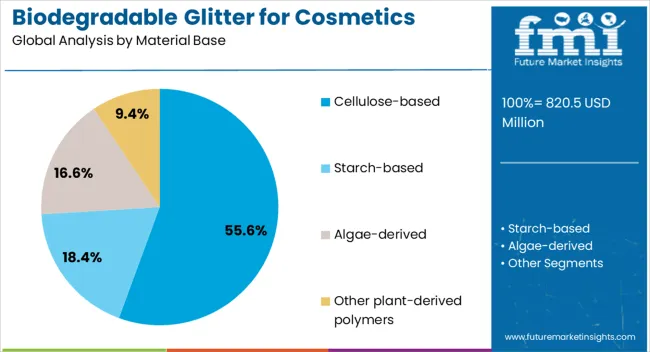

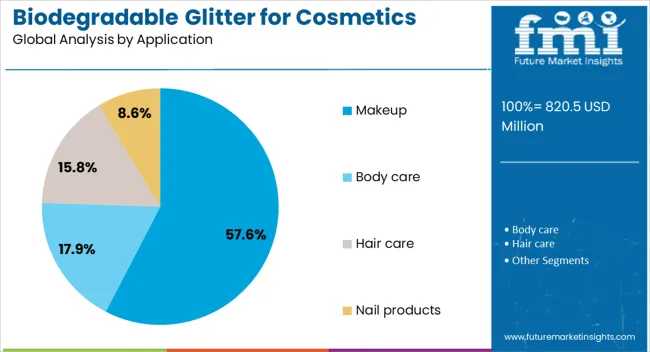

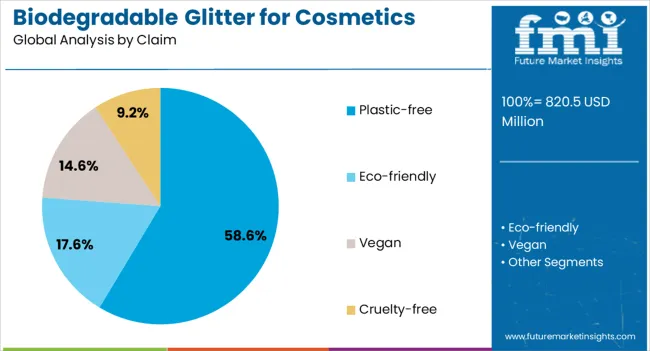

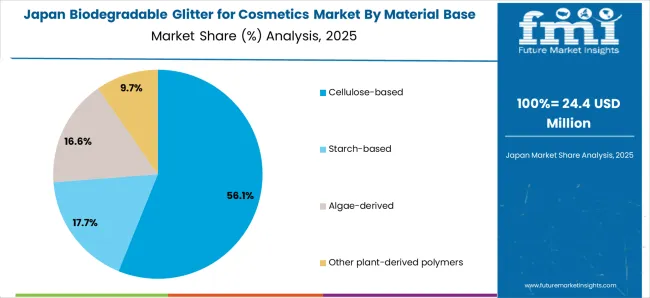

The market is segmented by material base, application, product form, channel, and claim. By material base, the market is divided into cellulose-based, starch-based, algae-derived, and other plant-derived polymers. Based on application, the market is categorized into makeup (eye, lips, face), body care, hair care, nail products, and others. In terms of product form, the market is segmented into loose glitter, gel-based glitter, pressed powders, and glitter sheets. By channel, the market is classified into e-commerce, mass retail, specialty beauty stores, and craft/cosmetic suppliers. By claim, the market includes eco-friendly, vegan, cruelty-free, and plastic-free segments. Regionally, the market spans across major countries including China, USA, India, UK, Germany, and Japan.

Cellulose-based biodegradable glitter is projected to account for 55.6% of the biodegradable glitter for cosmetics market in 2025, establishing its position as the leading material base in the global marketplace. This dominant market share is fundamentally supported by cellulose's excellent biodegradability properties, wide availability from renewable plant sources, and superior performance characteristics that closely match traditional plastic glitter in terms of sparkle and durability.

The preference for cellulose-based formulations stems from their proven safety profile for cosmetic applications, consistent degradation in various environmental conditions, and ability to be processed into various sizes and shapes required for different cosmetic applications. This material base offers excellent color retention, minimal skin irritation, and complete biodegradation within reasonable timeframes, making it ideal for cosmetic manufacturers seeking sustainable alternatives.

The market leadership of cellulose-based glitter is further reinforced by established manufacturing infrastructure, cost-effective production processes, and extensive research validating its environmental benefits. The segment benefits from continuous technological improvements in cellulose processing and treatment methods that enhance particle uniformity, color vibrancy, and shelf stability.

Makeup applications are expected to represent 57.6% of biodegradable glitter for cosmetics demand in 2025, establishing their dominance in the global market landscape. This commanding market position reflects the widespread use of glitter in eye makeup, lip products, and face cosmetics where sparkle and shimmer effects are highly valued by consumers across all age groups and demographics.

The makeup segment benefits from the versatility of biodegradable glitter in creating various aesthetic effects, from subtle highlighting to bold statement looks. Modern biodegradable glitters offer excellent adherence to skin, long-lasting wear, and compatibility with various cosmetic formulations including creams, powders, and liquid products, making them suitable for professional and consumer makeup applications.

The segment's growth is further supported by the influence of social media beauty trends, festival and party makeup culture, and the increasing availability of biodegradable glitter products through mainstream beauty retailers. Professional makeup artists and beauty influencers are increasingly advocating for sustainable alternatives, driving consumer awareness and adoption of biodegradable options in makeup applications.

Plastic-free biodegradable glitter is projected to contribute 58.6% of the biodegradable glitter for cosmetics market in 2025, representing the primary value proposition driving consumer adoption. This claim resonates strongly with environmentally conscious consumers who are actively seeking alternatives to traditional plastic-based cosmetic ingredients that contribute to microplastic pollution.

The competitive advantage of plastic-free positioning lies in its clear differentiation from conventional glitter products and alignment with growing regulatory requirements restricting plastic microparticles in cosmetics. This claim enables brands to communicate their environmental commitment while providing consumers with guilt-free beauty options that maintain aesthetic performance.

Plastic-free claims support brand positioning in the sustainable beauty segment and enable premium pricing for products that demonstrate genuine environmental benefits. The segment appeals to consumers who prioritize environmental impact in their purchasing decisions and are willing to pay premium prices for products that align with their values.

The market is advancing rapidly due to increasing environmental awareness, regulatory pressure on plastic microparticles, and growing consumer demand for sustainable beauty products. However, the market faces challenges including higher production costs compared to conventional glitter, limited color options in some biodegradable materials, and need for consumer education about performance characteristics. Quality standardization and supply chain development continue to influence market expansion patterns.

The increasing awareness of microplastic pollution and its environmental impact is driving demand for biodegradable alternatives to traditional plastic glitter. Regulatory initiatives banning plastic microbeads in cosmetics across various regions are accelerating market adoption, while consumer activism and environmental advocacy create pressure for brands to adopt sustainable formulations.

Innovation in plant-based polymer technology is enabling development of biodegradable glitters that match or exceed the performance characteristics of conventional alternatives. Advanced processing techniques are improving particle uniformity, color vibrancy, and shelf stability while maintaining complete biodegradability and environmental safety.

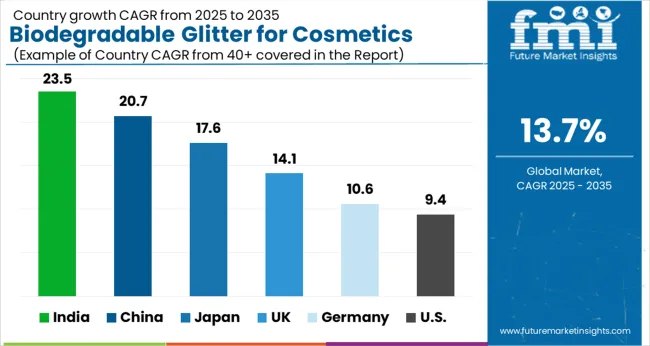

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 23.5% |

| China | 20.7% |

| Japan | 17.6% |

| UK | 14.1% |

| Germany | 10.6% |

| USA | 9.4% |

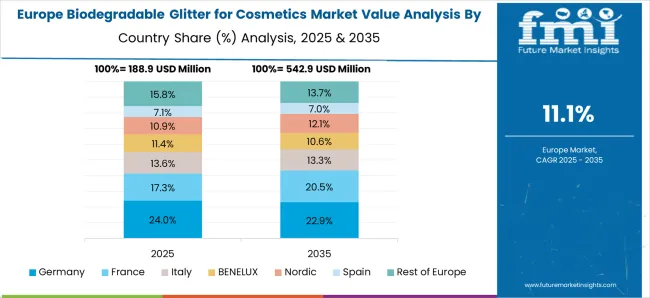

The biodegradable glitter for cosmetics market is growing rapidly across key regions, with India leading at a 23.5% CAGR through 2035, driven by expanding beauty industry, rising environmental consciousness, and growing adoption of sustainable cosmetic products. China follows at 20.7%, supported by strong manufacturing capabilities and increasing consumer preference for eco-friendly beauty solutions. Japan grows at 17.6%, emphasizing technological innovation and premium sustainable beauty products. The UK records 14.1% growth with strong regulatory support for plastic-free cosmetics. Germany shows 10.6% growth driven by established sustainability standards. The USA demonstrates steady 9.4% growth with mature market adoption and established distribution channels.

Revenue from biodegradable glitter for cosmetics in India is projected to exhibit the highest growth rate with a CAGR of 23.5% through 2035, driven by rapid expansion of the domestic beauty industry, increasing environmental awareness among consumers, and growing adoption of sustainable cosmetic products. The country's large and young demographic, combined with rising disposable income and beauty consciousness, creates significant opportunity for biodegradable glitter products across various price segments and application categories.

Revenue from biodegradable glitter for cosmetics in China is expanding at a CAGR of 20.7%, supported by advanced manufacturing capabilities, strong export potential, and increasing domestic consumer adoption of sustainable beauty products. The country's leadership in plant-based polymer technology and large-scale manufacturing infrastructure create competitive advantages in biodegradable glitter production, while growing environmental consciousness among consumers drives domestic market demand.

Revenue from biodegradable glitter for cosmetics in Japan is growing at a CAGR of 17.6%, driven by the country's technological leadership in sustainable materials, sophisticated consumer preferences for high-quality products, and strong cultural emphasis on environmental responsibility. Japanese consumers demonstrate willingness to invest in premium biodegradable alternatives that offer superior performance and aesthetic appeal while supporting environmental sustainability goals.

Demand for biodegradable glitter for cosmetics in the UK is projected to grow at a CAGR of 14.1%, supported by strong regulatory framework restricting plastic microparticles, established consumer awareness of environmental issues, and growing adoption of sustainable beauty products across mainstream retail channels. British consumers demonstrate high environmental consciousness and willingness to support brands that demonstrate genuine commitment to sustainability through product innovation.

Demand for biodegradable glitter for cosmetics in Germany is expanding at a CAGR of 10.6%, driven by stringent environmental standards, consumer preference for scientifically validated sustainable products, and established market infrastructure for premium eco-friendly cosmetics. German consumers value quality, efficacy, and environmental responsibility, creating strong demand for biodegradable glitter products that meet rigorous performance and sustainability standards.

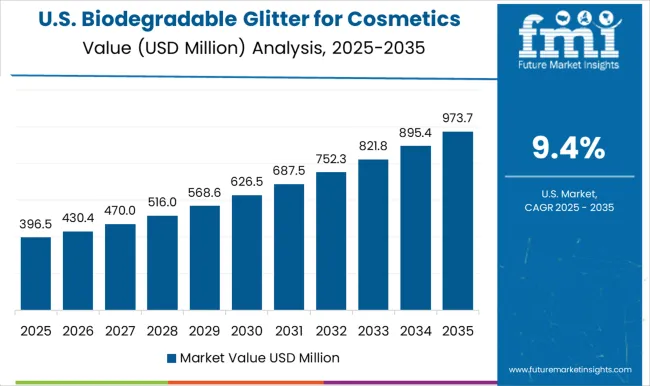

Demand for biodegradable glitter for cosmetics in the USA is growing at a CAGR of 9.4%, characterized by diverse consumer segments, established beauty industry infrastructure, and steady adoption of sustainable beauty products across mainstream and specialty retail channels. The American market demonstrates growing interest in environmentally responsible beauty solutions while maintaining focus on performance, accessibility, and value for money.

The biodegradable glitter for cosmetics market is characterized by competition among sustainable materials specialists, established cosmetic ingredient suppliers, and innovative startups focused on environmental alternatives. Companies are investing in advanced biodegradable material technologies, sustainable manufacturing processes, comprehensive product portfolios, and strategic partnerships with cosmetic brands to deliver high-performance, environmentally responsible glitter solutions. Technological innovation, sustainability credentials, and product quality are central to strengthening market presence and competitive positioning.

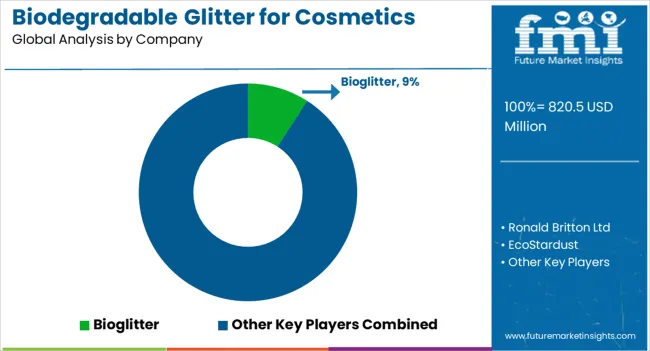

Bioglitter leads the market with a 9% global value share in 2025, focusing on cellulose-based biodegradable glitter with proven environmental credentials and comprehensive product range. Ronald Britton Ltd emphasizes premium quality and established market presence in specialty beauty applications. EcoStardust provides innovative biodegradable alternatives with strong brand recognition in sustainable beauty segments. Lush integrates biodegradable glitter into comprehensive sustainable beauty product lines.

Givaudan Active Beauty leverages advanced material science and established cosmetic industry relationships. Glitter Revolution focuses on festival and special occasion applications with vibrant biodegradable options. Eco Glitter Fun emphasizes craft and cosmetic applications with accessible pricing. Siway Glitter USA provides North American market focus with diverse product offerings. Glitterevolution offers innovative formulations and customization options. Mica Beauty combines traditional expertise with sustainable innovation.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 820.5 million |

| Material Base | Cellulose-based, Starch-based, Algae-derived, Other plant-derived polymers |

| Application | Makeup (eye, lips, face), Body care, Hair care, Nail products, Others |

| Product Form | Loose glitter, Gel-based glitter, Pressed powders, Glitter sheets |

| Channel | E-commerce, Mass retail, Specialty beauty stores, Craft/cosmetic suppliers |

| Claim | Eco-friendly, Vegan, Cruelty-free, Plastic-free |

| Countries Covered | China, United States, Japan, Germany, United Kingdom, India, and 40+ countries |

| Key Companies Profiled | Bioglitter, Ronald Britton Ltd, EcoStardust, Lush, Givaudan Active Beauty, Glitter Revolution, Eco Glitter Fun, Siway Glitter USA, Glitterevolution, Mica Beauty |

The global biodegradable glitter for cosmetics market is estimated to be valued at USD 820.5 million in 2025.

The market size for the biodegradable glitter for cosmetics market is projected to reach USD 2,962.7 million by 2035.

The biodegradable glitter for cosmetics market is expected to grow at a 13.7% CAGR between 2025 and 2035.

The key product types in biodegradable glitter for cosmetics market are cellulose-based, starch-based, algae-derived and other plant-derived polymers.

In terms of claim, plastic-free segment to command 58.6% share in the biodegradable glitter for cosmetics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyamide Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Agricultural Films Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biodegradable Meal Trays Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Gloves Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Bone Graft Polymers Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Stretch Films Market - Analysis Size, Share, and Forecast 2025 to 2035

Biodegradable Food Packaging Market Size, Share & Forecast 2025 to 2035

Biodegradable Polymers Market Growth 2025 to 2035

Biodegradable Baby Diapers Market Analysis – Trends, Growth & Forecast 2025-2035

Biodegradable Microbeads Market Growth – Trends & Forecast 2025 to 2035

Competitive Breakdown of Biodegradable Lidding Films Providers

Competitive Landscape of Biodegradable Packaging Providers

Biodegradable Lids Market Analysis - Demand, Trends & Outlook 2024 to 2034

Biodegradable Film Market Insights – Growth & Forecast 2024-2034

Biodegradable Disposable Tableware Market Insights – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA