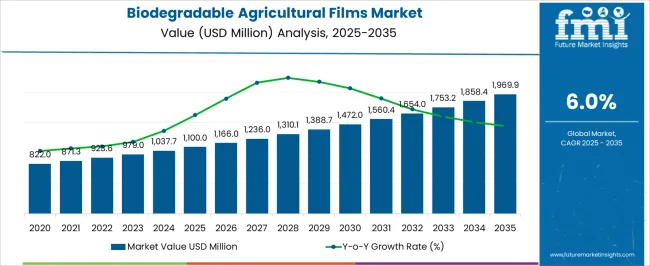

A valuation of USD 1,100.0 million is projected for the biodegradable agricultural films market in 2025, with expansion expected to reach USD 1,973.6 million by 2035. This growth reflects an absolute increase of USD 873.6 million across the decade, representing a compound annual growth rate (CAGR) of 6.0%. The trajectory signals nearly an 80% enlargement in overall market size within the forecast horizon.

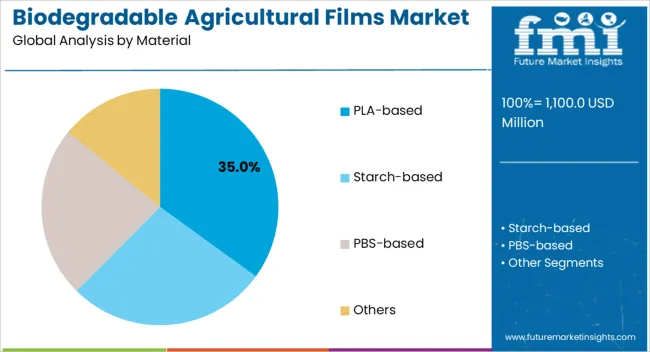

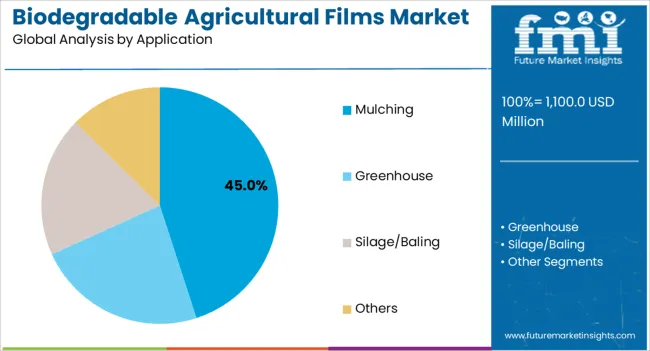

During the initial phase from 2025 to 2030, the market is forecast to advance from USD 1,100.0 million to USD 1,469.2 million, adding USD 369.2 million, equal to about 42% of the total decade expansion. This stage is anticipated to be shaped by greater adoption of sustainable farming practices and regulatory support for biodegradable materials in agriculture. PLA-based films, commanding a 35% share in 2025, are positioned to anchor growth momentum, while mulching applications are set to maintain their lead with a 45% share.

In the latter half from 2030 to 2035, acceleration is expected as valuations rise from USD 1,469.2 million to USD 1,973.6 million, adding USD 504.4 million or 58% of total growth. This period is projected to be reinforced by technological advancements in biodegradable materials and expanding adoption across greenhouse applications, where environmental benefits and soil health improvements drive premium positioning.

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,100.0 million |

| Market Forecast Value in (2035F) | USD 1,973.6 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

Between 2020 and 2024, the biodegradable agricultural films market expanded steadily from USD 897.2 million to USD 1,055.7 million, supported by farmers adopting sustainable alternatives to conventional plastic films. During this period, global suppliers dominated, controlling the majority of industry revenues by leveraging wide product portfolios and strong distribution networks. Differentiation was largely based on biodegradation rates, soil compatibility, and cost efficiency, while emerging applications in greenhouse cultivation remained in their growth phase.

Demand is forecast to reach USD 1,100.0 million in 2025, and the revenue structure is expected to shift as greenhouse and silage applications accelerate. Traditional film manufacturers are projected to face rising competition from specialized biodegradable material producers offering superior decomposition characteristics and environmental benefits.

Leading incumbents are anticipated to pivot toward hybrid models by integrating advanced polymer technologies, sustainability testing services, and digital agricultural platforms to retain their relevance. Emerging participants focusing on starch-based and PBS-based innovations are forecast to gain share, particularly in regions where regulatory frameworks support sustainable agriculture practices.

Growth in the Biodegradable Agricultural Films Market is being supported by increasing environmental regulations and farmer awareness regarding plastic pollution in agricultural soils. Rising consumer demand for sustainably grown food products has translated into higher adoption of biodegradable mulching films and greenhouse covers that decompose naturally without leaving harmful residues. Regulatory frameworks in key markets are increasingly restricting conventional plastic films, encouraging manufacturers to prioritize biodegradable alternatives.

Government incentives for eco-friendly agricultural inputs are reinforcing a shift toward sustainable farming practices, enabling farmers to invest in premium biodegradable solutions. Demand for organic food production is accelerating the adoption of certified biodegradable films that maintain soil health while providing effective crop protection. Technological advances in PLA, starch-based, and PBS polymer formulations are enabling better performance characteristics, ensuring long-term application viability.

The market is segmented by component, range, technology, type, and end-use industry. By component, the market is categorized into PLA-based, starch-based, PBS-based, and others. Based on range, the market is divided into mulching, greenhouse, silage/baling, and others. In terms of technology, the market is segmented into biodegradable polymer technology and film processing. By type, the market is classified into <20 µm, 20–50 µm, and >50 µm. By end-use industry, the market is categorized into cereals & grains, fruits & vegetables, and greenhouse. Regionally, the market is divided into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

PLA-based films are projected to dominate with a 35% share of the market in 2025, outpacing other biodegradable alternatives due to superior mechanical properties and consistent decomposition rates. Growth will be driven by their excellent compatibility with existing agricultural equipment and reliable performance across diverse climate conditions. Starch-based films, holding 28% share, are expected to maintain strong adoption in cost-sensitive applications where rapid biodegradation is prioritized over extended durability. PBS-based materials, with 22% share, are anticipated to grow moderately, supported by their balanced performance characteristics and expanding production capacity. As sustainability requirements intensify, PLA-based solutions are expected to solidify their role as the premium choice for demanding agricultural applications.

Mulching applications are forecast to maintain leadership with a 45% market share in 2025, favored for their direct impact on crop yield improvement and weed suppression. Their widespread adoption reflects proven benefits in moisture retention and soil temperature regulation across diverse farming systems. Greenhouse applications represent a 22% share and are projected to record stronger growth rates, driven by intensive cultivation methods requiring precise environmental control. Silage and baling applications, accounting for an 18% share, continue to serve specialized livestock farming needs. As precision agriculture expands, mulching applications will remain the most scalable solution while greenhouse formats offer higher value opportunities.

.webp)

The fruits and vegetables segment is anticipated to lead with a 28% share in 2025, supported by high-value crop cultivation where premium biodegradable films justify their cost through improved yields and quality.

Cereals and grains, representing a 25% share, maintain steady adoption across large-scale farming operations where soil health considerations drive sustainable input choices. Greenhouse and horticulture applications, with a 22% share, are expected to post faster growth as controlled environment agriculture expands globally. Plantation crops account for a 10% share, reflecting specialized applications in perennial crop systems where long-term soil health benefits are prioritized.

The market for biodegradable agricultural films is being supported by growing emphasis on sustainable farming practices, soil health preservation, and tightening environmental regulations on plastic waste. However, higher production costs and limited durability compared to conventional films continue to pose challenges for widespread adoption. Technology providers are focusing on developing next-generation polymer blends, enhancing UV and moisture resistance, and offering closed-loop recycling solutions to improve performance and strengthen farmer confidence.

The Biodegradable Agricultural Films Market is being accelerated by increasingly stringent environmental regulations targeting plastic waste reduction in agriculture. Government policies across key markets are implementing phase-out timelines for conventional plastic films, creating mandatory adoption scenarios for biodegradable alternatives. Regulatory frameworks are establishing biodegradation standards that ensure complete decomposition within specified timeframes, providing farmers with compliance certainty. This regulatory environment is expected to sustain long-term demand growth regardless of short-term cost considerations, positioning biodegradable films as necessary rather than optional agricultural inputs.

Market expansion is being constrained by the significant cost premium of biodegradable films compared to conventional plastic alternatives, particularly challenging adoption in price-sensitive agricultural segments. Production costs for advanced biodegradable polymers remain elevated due to specialized manufacturing processes and limited production scale, creating affordability barriers for smallholder farmers. This cost structure delays widespread adoption in developing markets where farming margins are constrained and immediate economic returns are prioritized over long-term environmental benefits.

| Countries | CAGR |

|---|---|

| China | 7.0 |

| Spain | 5.8 |

| Italy | 5.5 |

| USA | 5.2 |

| Germany | 4.9 |

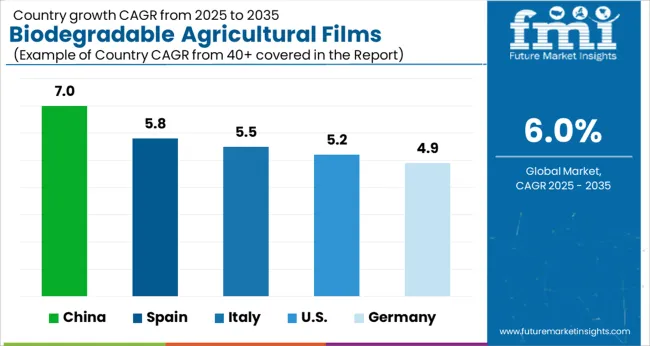

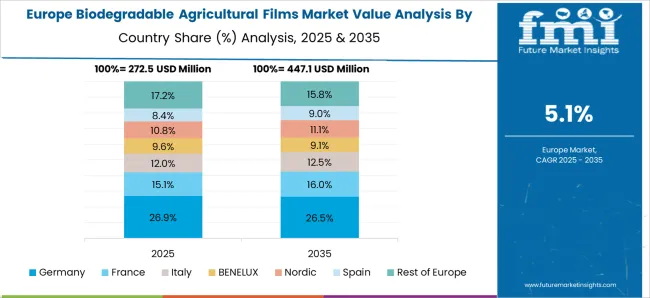

China leads global growth in the biodegradable agricultural films market with the highest CAGR of 7.0% from 2025 to 2035, supported by large-scale agricultural modernization, government-backed sustainability initiatives, and rising adoption of eco-friendly mulching films. Spain follows with a strong CAGR of 5.8%, driven by intensive horticulture, greenhouse cultivation, and EU regulations promoting biodegradable alternatives. Italy records a CAGR of 5.5%, benefiting from expanding organic farming, government subsidies for sustainable agriculture, and strong demand in fruit and vegetable production. The United States shows steady growth at 5.2%, supported by increasing focus on sustainable farming practices, rising demand for organic produce, and growing replacement of conventional plastics. Germany maintains consistent growth at 4.9%, reflecting its mature agricultural sector, stringent environmental regulations, and high adoption of advanced biodegradable solutions.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Demand for biodegradable agricultural films in China is projected to achieve the highest CAGR of 7.0% in the biodegradable agricultural films market, driven by aggressive government policies promoting sustainable agriculture and reducing plastic pollution. The country's massive agricultural sector and supportive regulatory framework create optimal conditions for rapid market expansion. Government subsidies for biodegradable agricultural inputs are accelerating farmer adoption, while domestic manufacturing capabilities ensure competitive pricing and supply security.

China's leadership in polymer technology development and large-scale production infrastructure positions the country to dominate both domestic consumption and global exports. The integration of biodegradable films into modern agricultural practices aligns with national sustainability goals and food security strategies, ensuring sustained policy support.

Revenue from biodegradable agricultural films in Spain is expected to expand at 5.8% CAGR, reflecting the country's position as a leading European agricultural producer with strong environmental consciousness. The Mediterranean climate and intensive horticulture sector create ideal conditions for biodegradable film adoption, particularly in greenhouse and fruit production applications. EU environmental regulations provide mandatory adoption drivers, while Spanish farmers demonstrate high receptivity to sustainable agricultural innovations.

The country's established agricultural export industry demands sustainable production methods to meet international market requirements. Spain's combination of favorable climate conditions, regulatory support, and export-oriented agriculture positions it as a key growth market for premium biodegradable film applications in European agriculture.

Sales of biodegradable agricultural films in Italy is projected to achieve 5.5% CAGR, supported by the country's leadership in sustainable agriculture practices and strong environmental awareness among farmers. The diverse agricultural landscape, ranging from Mediterranean crops to northern grain production, provides multiple application opportunities for biodegradable films. Italian farmers demonstrate high willingness to adopt premium agricultural inputs that enhance both productivity and environmental performance.

The country's position as a major food exporter creates market pressure for sustainable production methods, while consumer demand for environmentally responsible food products reinforces farmer adoption of biodegradable alternatives. Italy's agricultural sector increasingly views biodegradable films as essential inputs for maintaining market competitiveness and regulatory compliance.

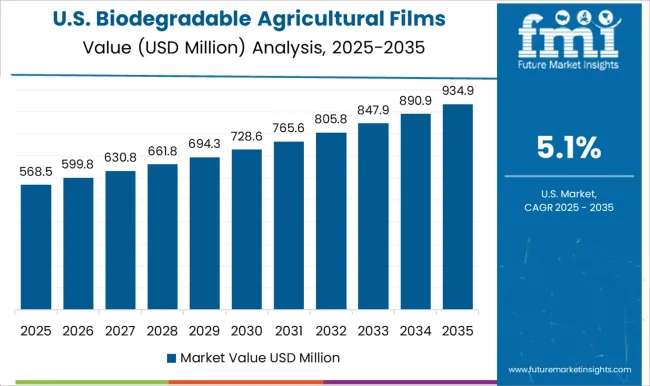

The United States biodegradable agricultural films market is expected to grow at 5.2% CAGR, driven by technological innovation in precision agriculture and increasing environmental regulations at state and federal levels. American farmers demonstrate high adoption rates for advanced agricultural technologies, creating favorable conditions for biodegradable film integration into existing farming systems. The country's large-scale agricultural operations provide significant volume potential for biodegradable film manufacturers.

Regional variations in environmental regulations create differential adoption patterns, with leading agricultural states implementing supportive policies for sustainable farming practices. The combination of technological sophistication, regulatory development, and environmental awareness positions the United States as a key market for advanced biodegradable film applications across diverse crop systems.

Demand for biodegradable agricultural films in Germany is forecast to expand at 4.9% CAGR, reflecting the country's role as a European innovation hub for sustainable agricultural technologies. German farmers demonstrate high adoption rates for environmentally responsible agricultural inputs, supported by comprehensive environmental regulations and consumer awareness. The country's advanced manufacturing capabilities in biodegradable polymers provide domestic supply security and technological leadership.

Germany's position as a major food producer within the EU creates significant market opportunities, while stringent environmental standards drive mandatory adoption in specific applications. The combination of technological innovation, regulatory compliance, and farmer environmental consciousness establishes Germany as a key European market for premium biodegradable film applications.

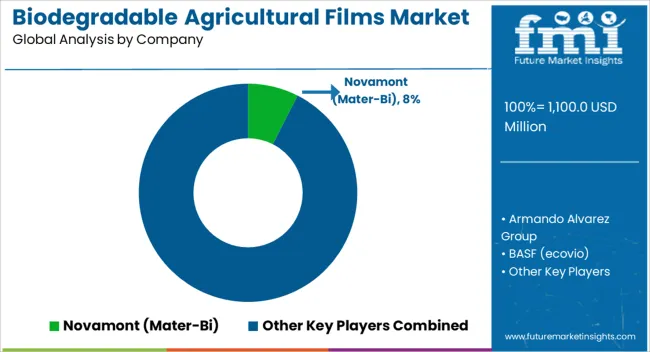

The biodegradable agricultural films market is moderately fragmented, with global chemical companies, specialized biodegradable material producers, and regional manufacturers competing across diverse application segments. Global leaders such as BASF, Novamont, and Berry Global hold significant market positions, supported by extensive research and development capabilities, integrated polymer production, and established agricultural distribution networks. Their strategies emphasize technological innovation, regulatory compliance, and partnerships with agricultural equipment manufacturers to secure market penetration.

Mid-sized innovators, including BioBag, Armando Alvarez Group, and Kingfa Biopolymer, are strengthening their positions through specialized biodegradable formulations, regional market focus, and cost-effective production methods. Their emphasis on application-specific solutions and local agricultural partnerships enables competitive positioning against global players while serving specialized market needs.

Regional manufacturers such as Iris Polymers, RKW Group, Sphere Group, and Trioplast focus on geographic advantages, local agricultural relationships, and cost optimization to compete effectively within their operational territories. Their strength lies in understanding local farming practices, regulatory requirements, and providing responsive technical support for agricultural customers. Competitive differentiation is shifting toward integrated sustainability solutions combining material performance, biodegradation reliability, and agricultural productivity benefits rather than cost competition alone.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,100.0 Million |

| Component | PLA-based, Starch-based, PBS-based, Others |

| Range | Mulching, Greenhouse, Silage/Baling, Others |

| Technology | Biodegradable Polymer Technology, Film Processing |

| Type | <20 µm, 20-50 µm, >50 µm |

| End-use Industry | Cereals & Grains, Fruits & Vegetables, Greenhouse |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | BASF, Novamont, Berry Global, BioBag, Armando Alvarez Group, Iris Polymers, Kingfa Biopolymer, RKW Group, Sphere Group, Trioplast |

| Additional Attributes | Dollar sales by material type and crop application, regional adoption trends, OEM competition, buyer preference for eco-friendly alternatives, integration with smart farming, innovations in compostable polymers, and sustainable cultivation practices |

The global biodegradable agricultural films market is estimated to be valued at USD 1,100.0 million in 2025.

The market size for the biodegradable agricultural films market is projected to reach USD 1,969.9 million by 2035.

The biodegradable agricultural films market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in biodegradable agricultural films market are pla-based, starch-based, pbs-based and others.

In terms of application, mulching segment to command 45.0% share in the biodegradable agricultural films market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biodegradable Film Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Disposable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyamide Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Glitter for Cosmetics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biodegradable Meal Trays Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Gloves Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Bone Graft Polymers Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Food Packaging Market Size, Share & Forecast 2025 to 2035

Biodegradable Polymers Market Growth 2025 to 2035

Biodegradable Baby Diapers Market Analysis – Trends, Growth & Forecast 2025-2035

Biodegradable Microbeads Market Growth – Trends & Forecast 2025 to 2035

Competitive Landscape of Biodegradable Packaging Providers

Biodegradable Lids Market Analysis - Demand, Trends & Outlook 2024 to 2034

Biodegradable Cutlery Market

Biodegradable water bottles Market

Biodegradable Packing Peanuts Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA