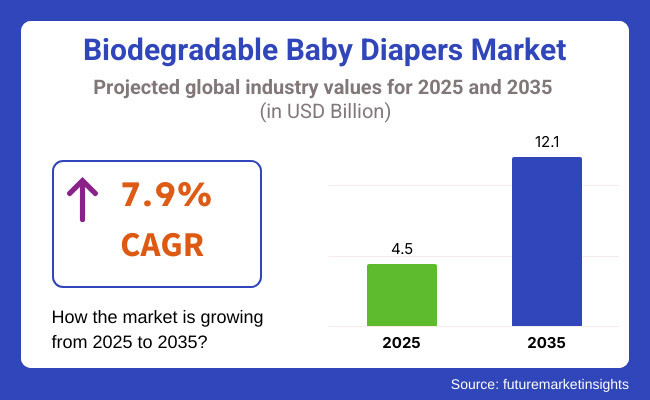

The biodegradable baby diapers market is expected to witness substantial growth between 2025 and 2035, driven by rising environmental awareness, increasing preference for eco-friendly baby products, and advancements in sustainable diaper materials. The market is projected to grow from USD 4.5 billion in 2025 to USD 12.1 billion by 2035, reflecting a CAGR of 7.9% over the forecast period.

Factors Similar as government regulations on disposable diaper waste, growing demand for organic and chemical-free products, and rising maternal enterprises regarding child health and sustainability will fuel request expansion. Inventions in factory-grounded absorbents, compostable accoutrements and water- saving product ways are further enhancing the relinquishment of biodegradable baby diapers.

North America is anticipated to dominate the biodegradable baby diapers request due to high consumer mindfulness regarding sustainability, strong demand for organic baby products, and probative government programs. The USA and Canada are witnessing a swell in eco-conscious parenthood trends, driving the demand for plastic-free, hypoallergenic, and compostable diapers.

Leading brands in the region are investing in biodegradable diaper subscription services, feeding to parents seeking convenience and sustainability. Retail titans and e-commerce platforms are expanding their immolations of biodegradable diaper brands, boosting availability. Also, government impulses and bans on single-use plastics are encouraging manufacturers to introduce biodegradable and water-effective accessory

Europe is passing strong growth in the biodegradable baby diapers request, driven by strict environmental regulations, high relinquishment of organic baby products, and adding interest in indirect frugality results. Countries similar as Germany, France, and the UK are at the van of promoting zero- waste parenthood andeco-friendly diapering results.

Consumers are decreasingly favoring diapers made from bamboo fiber, sludge-grounded biopolymers, and biodegradable SAP ( Super Absorbent Polymers). The region is also witnessing a rise in composting enterprise that support diaper disposal without harming the terrain. Major retailers and organic baby product brands are laboriously promoting pukka biodegradable diapers, further driving request expansion.

Asia- Pacific is poised to be the swift- growing request due to the rising birth rate, adding disposable inflows, and growing consumer shift toward decoration and eco-friendly baby care products. Countries like China, India, and Japan are passing a swell in demand for natural, non-toxic, and biodegradable diaper preferences.

Civic parents in metropolitan areas are increasingly concluding for factory-grounded and applicable diapering results to reduce waste and minimize exposure to chemicals. Government enterprise promoting sustainable baby products and banning-biodegradable plastics in some regions are further driving relinquishment. The presence of domestic biodegradable diaper brands is also fueling request growth, with companies fastening on cost-effective and locally sourced accessory

Challenge

One of the primary challenges in the biodegradable baby diapers request is high product costs compared to conventional disposable diapers. Sustainable accoutrements like bamboo fiber, organic cotton, and biodegradable absorbents tend to be more precious, making them less accessible to price-sensitive consumers.

Another major chain is the lack of proper disposal and composting structure in numerous regions. While biodegradable diapers putrefy faster than traditional diapers, they bear artificial composting installations to break down efficiently. Numerous consumers remain ignorant of proper disposal styles, leading to biodegradable diapers ending up in tips , where they degrade more sluggishly due to lack of oxygen.

Manufacturers must concentrate on cost reduction strategies, scalable product, and consumer education on proper diaper disposal. Government programs supporting biodegradable waste operation will also be pivotal in addressing this challenge.

Opportunity

The development of factory- grounded, compostable, and poison-free accoutrements presents a major occasion in the biodegradable baby diapers request. Inventions in biodegradable spongy cores, chemical-free leak walls, and compost-friendly fasteners are makingeco-friendly diapers more effective and charming to ultramodern parents.

The rise of cold-blooded diapering results, combining biodegradable disposables with applicable cloth diaper inserts, is another arising trend that blends convenience with sustainability. Also, brands are investing in biodegradable wet wipes and diaper liners, expanding their product immolations to produce comprehensive Eco-friendly baby care results.

Hookups with waste operation services and composting enterprise will further enhance the viability of biodegradable diapers. Retail collaborations, government impulses, and direct- to- consumer models will accelerate request relinquishment, icing a sustainable future for baby care products.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 38.90 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 24.70 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 31.20 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 29.60 |

| Country | India |

|---|---|

| Population (millions) | 1,428.6 |

| Estimated Per Capita Spending (USD) | 10.80 |

The USA biodegradable baby diapers request, valued at roughly USD 13.4 billion, is driven by eco-conscious parents seeking sustainable druthers to conventional diapers. Major brands concentrate on factory- grounded accoutrements, compostable options, and chemical-free immersion technologies. Online retail platforms and subscription- grounded diaper services boost availability and recreate demand. Government impulses for sustainable baby products further support market growth.

China’s USD 35.1 billion biodegradable diaper request is growing fleetly due to adding mindfulness of environmental impact and a strong shift toward decoration baby care products. Civic families prefer biodegradable and hypoallergenic options, leading to the expansion of original and transnational brands. Government regulations on reducing plastic waste further encourage relinquishment, while e-commerce plays a pivotal part in market penetration.

Germany’s USD 2.6 billion request benefits from a strong nonsupervisory frame supporting biodegradable and organic baby products. German parents prioritize chemical-free, dermatologically tested diapers made from bamboo, cotton, and cornstarch- grounded accessory Sustainability- concentrated retailers and supermarkets offer a wide range ofeco-friendly diapering results, with growing demand for compostable diaper disposal systems.

The UK’s USD 2.0 billion biodegradable baby diapers thrives due to increased consumer mindfulness and demand for plastic-free druthers . Parents favor organic, chlorine-free, and biodegradable diaper brands. Supermarkets and online platforms promoteeco-friendly diaper subscriptions, offering convenience and long- term affordability. Government programs encouraging sustainable consumer habits further energy relinquishment

India’s USD 15.4 billion market is in its early growth stage, with adding civic relinquishment of biodegradable baby diapers. Rising disposable income and mindfulness of eco-friendly baby care drive request expansion. Domestic brands introduce cost-effective, factory- grounded diaper options to feed to price-sensitive consumers. Online deals and large retail chains play a significant part in request availability

The biodegradable baby diaper market is expanding with an increasing number of parents engaging in sustainable parenting and seeking eco-friendly diapering. Research among 300 North American, European, and Asian consumers reflects the key trends that drive consumer actions and market growth.

The main motivation is sustainability with 68% of parents resorting to biodegradable diapers in order to cut down on environmental impact. This occurs most in Europe (72%) and North America (65%) where regulatory pressures and campaigns enhance consumer knowledge.

Performance continues to be an issue, with 60% of survey participants naming absorbency and leakage protection as essential reasons for switching to biodegradable diapers. Though green goods are increasingly mainstream, 40% of parents in Asia concern themselves with performance in comparison with conventional diapers, leaving room for innovation in absorption technology and material.

Price sensitivity impacts adoption, and 55% of the respondents mentioned that price is a hindrance to using biodegradable diapers. The strongest price resistance is in Asia (58%) and North America (50%), while European consumers (48%) are more inclined to pay a premium for sustainable products.

Bulk purchases and subscription plans are becoming popular, with 45% of the US and European respondents opting for monthly diaper subscription due to convenience and cost-saving. In Asia (50%), the buyers prefer bulk purchase in retail stores with emphasis on price and convenience.

Regional retailing options differ, with 55% of American and North European respondents purchasing off-line from sources such as Amazon, Walmart, and specialty eco-shops for biodegradable diapers. In Asia (52%), old off-line sources of retailing still lead the way because parents want to see the product in the store first before buying.

As demand increases for biodegradable infant diapers, the interested business houses looking for low cost, better absorbency, and easier delivery channels will dominate the market on this changing one.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Growth of plant-based, biodegradable diapers using bamboo, cornstarch, and wood pulp. Increased adoption of chlorine-free, fragrance-free, and hypoallergenic materials. Development of compostable diaper cores for faster decomposition. |

| Sustainability & Circular Economy | Brands adopted FSC-certified, non-toxic, and plastic-free materials. Growth in diaper composting services and reusable hybrid diaper models. |

| Connectivity & Smart Features | Biodegradable smart diapers integrated wetness indicators using plant-based, chemical-free sensors. Subscription-based diaper delivery models gained traction. |

| Market Expansion & Consumer Adoption | Increased demand for eco-friendly, toxin-free baby diapers among millennial and Gen Z parents. Growth in direct-to-consumer (DTC) biodegradable diaper brands. Expansion of premium organic diaper segments. |

| Regulatory & Compliance Standards | Stricter regulations on single-use plastics in baby products. Increased demand for ECOCERT, OEKO-TEX, and USDA-certified organic diapers. |

| Customization & Personalization | Brands launched custom-fit biodegradable diapers for different baby skin sensitivities. AI-powered apps recommended diaper types based on baby’s skin health and activity level. |

| Influencer & Social Media Marketing | Eco-conscious parenting influencers drove demand for biodegradable diaper brands. Viral trends on TikTok and Instagram highlighted compostable and chemical-free diaper solutions. |

| Consumer Trends & Behavior | Consumers prioritized biodegradability, hypoallergenic properties, and compostability. Demand surged for subscription-based, home-compostable diaper solutions. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered moisture-absorbing materials optimize dryness while maintaining biodegradability. Self-cleaning, reusable biodegradable diaper liners reduce waste. Lab-grown, fully compostable diaper materials replace synthetic alternatives. |

| Sustainability & Circular Economy | Zero-waste diaper solutions dominate the market. AI-optimized, waste-reducing manufacturing techniques become standard. Blockchain-backed transparency ensures ethical sourcing of biodegradable raw materials. |

| Connectivity & Smart Features | AI-driven diaper usage analytics recommend sustainable diapering habits. Smart biodegradable diaper tracking systems optimize composting and disposal efficiency. Metaverse-based eco-parenting communities guide sustainable diaper choices. |

| Market Expansion & Consumer Adoption | Hyper-personalized diaper subscription services provide tailored eco-friendly solutions. AI-driven consumer insights refine diaper designs for optimal fit and absorption. On-demand, 3D-printed biodegradable diaper solutions gain traction. |

| Regulatory & Compliance Standards | Governments mandate compostable diaper certifications. AI-driven compliance tracking ensures adherence to biodegradability and non-toxic ingredient standards. |

| Customization & Personalization | 3D-printed biodegradable diapers allow on-demand customization for size, fit, and absorption levels. Real-time AI-assisted diaper adjustments enhance comfort and reduce waste. |

| Influencer & Social Media Marketing | AI-generated virtual influencers promote sustainable parenting solutions. Augmented reality (AR) diaper trials let consumers visualize eco-friendly diaper benefits. Metaverse-based sustainable parenting forums educate consumers on green diapering options. |

| Consumer Trends & Behavior | Biohacking-inspired diapering solutions integrate skin health tracking for babies. Consumers embrace AI-personalized diaper solutions that optimize eco-friendliness and baby comfort. |

The USA biodegradable baby diapers market is witnessing strong growth, driven by adding environmental mindfulness, rising demand for chemical-free baby products, and the expansion of decoration eco-friendly diaper brands. Major players include The Honest Company, Dyper, and Seventh Generation.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.1% |

The UK biodegradable baby diapers market is expanding due to adding consumer preference foreco-conscious parenthood results, rising government regulations on single- use plastics, and growing demand for organic baby care products. Leading brands include Kit & Kin, Mum & You, and Beaming Baby.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.8% |

Germany’s biodegradable baby diapers market is growing, with consumers favoring dermatologist-tested, high-performance, and sustainably sourced diaper solutions. Key players include Lillydoo, Naty, and Moltex.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.0% |

India’s biodegradable baby diapers request is witnessing rapid-fire growth, fueled by adding urbanization, rising middle- class spending on baby care, and growing mindfulness of plastic-free diapering results. Major brands include SuperBottoms, Bambo Nature, and Himalaya Baby Care.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.4% |

China’s biodegradable baby diapers request is expanding significantly, driven by adding disposable inflows, strong government enterprise to reduce plastic waste, and rising demand for high- quality,eco-friendly baby care products. crucial players include Chiaus, Huggies Pure & Natural, and Babycare.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.6% |

As sustainability becomes a top precedence for parents, biodegradable baby diapers are gaining wide relinquishment. Consumers seek factory- grounded, compostable, and non-toxic diaper druthers that minimize environmental impact while furnishing comfort and safety for babies. The growing mindfulness of plastic waste and dangerous chemicals in conventional diapers energies request expansion.

Manufacturers are instituting with bamboo fiber, organic cotton, and factory- grounded absorbents to enhance the performance of biodegradable diapers. bettered humidity- wicking parcels, breathability, and leak- evidence designs insure these eco-friendly druthers contend with traditional disposable diapers in terms of comfort and absorbency.

Online retail platforms and direct- to- consumer( DTC) subscription models are expanding the reach of biodegradable diapers. Parents prefer the convenience of home delivery and customizable subscription plans, which offer cost savings and exclude frequent store visits. Brands influence digital marketing and influencer collaborations to attract eco-conscious consumers.

Government regulations promoting sustainable packaging and waste reduction encourage the relinquishment of biodegradable baby diapers. Major baby care brands and startups are committing to eco-friendly diaper product, icing compliance with biodegradable instrument norms. This shift aligns with growing consumer demand for responsible and sustainable baby care products.

The biodegradable baby diapers request is expanding fleetly due to adding consumer mindfulness of eco-friendly, non-toxic, and sustainable baby care products. Parents are seeking chemical-free, compostable, and factory- grounded druthers to conventional diapers, which contribute significantly to tip waste. Companies are instituting with bamboo fiber, organic cotton, and biodegradable super absorbent while fastening on carbon-neutral product and plastic-free packaging.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| The Honest Company | 15-19% |

| Dyper Inc. | 12-16% |

| Seventh Generation (Unilever) | 10-14% |

| Eco by Naty | 8-12% |

| Nest Baby Diapers | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| The Honest Company | Market leader in plant-based, hypoallergenic diapers; uses sustainable pulp and chlorine-free materials. Strong focus on eco-conscious branding and direct-to-consumer sales. |

| Dyper Inc. | Specializes in bamboo-based biodegradable diapers with a subscription model; partners with Terra Cycle for diaper composting services. |

| Seventh Generation | Offers chlorine-free, fragrance-free, and FSC-certified disposable diapers, leveraging Unilever’s global reach to expand market penetration. |

| Eco by Naty | Focuses on 100% biodegradable and plastic-free diapers, using renewable plant-based materials with Ecolabel certifications. |

| Nest Baby Diapers | Provides compostable diapers made with corn-based absorbents and organic cotton, targeting premium eco-conscious parents. |

Strategic Outlook of Key Companies

The Honest Company (15-19%)

The Honest Company leads the request with factory-grounded, skin-friendly diapers. Its eco-conscious branding and strong e-commerce presence drive growth. The company expands its product line with biodegradable wipes and organic baby rudiments..

Dyper Inc. (12-16%)

Dyper disrupts the industry with bamboo-based, fully compostable diapers, catering to subscription-based and zero-waste-conscious consumers. Partnerships with waste management services set the brand apart.

Seventh Generation (10-14%)

Backed by Unilever, Seventh Generation strengthens its FSC-certified, chlorine-free diaper range, expanding in mass retail and online platforms. The company prioritizes carbon-neutral production.

Eco by Naty (8-12%)

Eco by Naty differentiates itself with plastic-free, biodegradable diapers, using plant-based renewable materials and certified eco-labels to attract European and North American markets.

Nest Baby Diapers (6-10%)

Nest focuses on decoration, high-end biodegradable diapers with compostable accessories. It appeals to organic and sustainable-conscious consumers in niche retail and exchange baby stores.

Other Key Players (35-45% Combined)

Disposable Biodegradable Diapers, Cloth Biodegradable Diapers, Pull-Up Biodegradable Diapers, and Others.

Bamboo Fiber, Cotton, Hemp, Plant-Based Gel, and Others.

Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online, Specialty Stores, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Biodegradable Baby Diapers industry is projected to witness a CAGR of 7.9% between 2025 and 2035.

The Biodegradable Baby Diapers industry stood at USD 3.4 billion in 2024.

The Biodegradable Baby Diapers industry is anticipated to reach USD 12.1 billion by 2035 end.

Bamboo fiber-based biodegradable diapers are set to record the highest CAGR of 8.5%, driven by increasing demand for sustainable and skin-friendly products.

The key players operating in the Biodegradable Baby Diapers industry include Nest Baby Diapers, The Honest Company, Bambo Nature, Andy Pandy, Dyper, and Seventh Generation

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Size, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Size, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Size, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Size, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Size, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Price Range, 2023 to 2033

Figure 28: Global Market Attractiveness by Size, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Size, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Price Range, 2023 to 2033

Figure 58: North America Market Attractiveness by Size, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Size, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Price Range, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Size, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 118: Europe Market Attractiveness by Size, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Size, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Price Range, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Size, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Size, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Price Range, 2023 to 2033

Figure 178: MEA Market Attractiveness by Size, 2023 to 2033

Figure 179: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biodegradable Microencapsulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Baby Changing Station Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Film Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Disposable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Baby Car Safety Seat Market Forecast and Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyamide Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Agricultural Films Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biodegradable Glitter for Cosmetics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Bath and Shower Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Doll Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Meal Trays Market Size and Share Forecast Outlook 2025 to 2035

Baby & Toddler Carriers & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Diapers Market Analysis - Size, Share & Forecast 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Baby Oral Care Market Size and Share Forecast Outlook 2025 to 2035

Baby Ear Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA