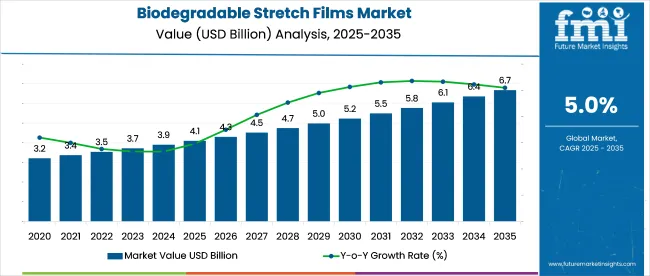

In 2025, the global biodegradable stretch films market is valued at USD 4.1 billion and is likely to reach USD 6.7 billion by 2035, growing at a CAGR of 5.0%.

| Attribute | Value |

|---|---|

| Market Size (2025) | USD 4.1 billion |

| Market Size (2035) | USD 6.7 billion |

| CAGR (2025 to 2035) | 5.0% |

Improved film strength, composting compatibility, and wider certification availability are helping expand adoption. Producers are scaling capacity and refining resin processing. Policy restrictions on conventional plastics and investment in composting infrastructure are encouraging uptake across both established and emerging markets.

Phil Stolz, Executive Vice President and General Manager for Flexibles at Berry Global Inc., stated that the transition to biodegradable stretch films extends beyond regulatory compliance, describing it as a fundamental redesign of supply chains aimed at reducing waste. He emphasized the company’s focus on material science innovations that maintain the performance standards of conventional films while enabling certified biodegradation, aligning with the environmental goals of their clients.

As of 2025, the biodegradable stretch films market accounts for approximately 1.8% of the global flexible packaging market, 3.9% of the bioplastics market, 4.6% of the stretch and shrink films market, 13.2% of the compostable packaging films market, and 2.7% of the food packaging materials market. These shares show the limited yet growing use of compostable stretch films within larger packaging segments dominated by conventional plastics.

Adoption remains concentrated in niche applications, especially food-grade and logistics wraps in regulated regions such as Western Europe and Canada. The highest integration is within compostable packaging, were regulatory alignment and substrate compatibility support deployment. Broader substitution in mainstream packaging remains constrained by pricing, film strength limitations, and composting infrastructure gaps across many high-volume markets

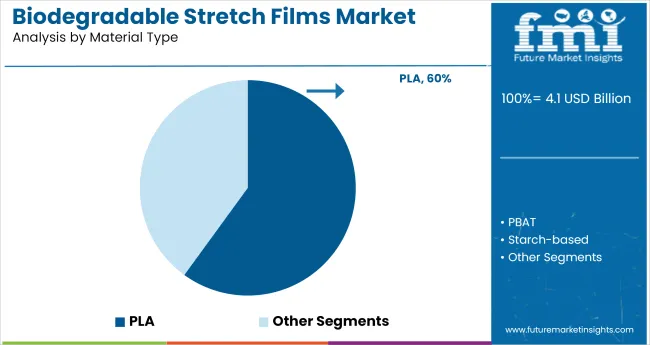

The market reflects material consolidation around PLA blends, end-use clustering in food-grade applications, and functional adaptation for manual and automated wrapping systems. Demand patterns are anchored in thickness precision, composability compliance, and shelf-life predictability across industries.

PLA-based blends hold a 60% share in material usage due to their adaptability in co-extrusion systems and compatibility with existing stretch film converters. Typical PLA content ranges from 45-70%, often combined with PBAT to balance tensile strength and elasticity.

Firms such as BASF, Futamura, and TIPA Corp produce PLA blend films targeting load retention values of 12-17 N/mm², which meet standard pallet unitization needs. These films can maintain elongation at break levels above 250%, enabling reliable stretch under both hand and machine wrap conditions. Optical clarity is another advantage, with haze values under 5%, supporting applications in retail-facing packaging.

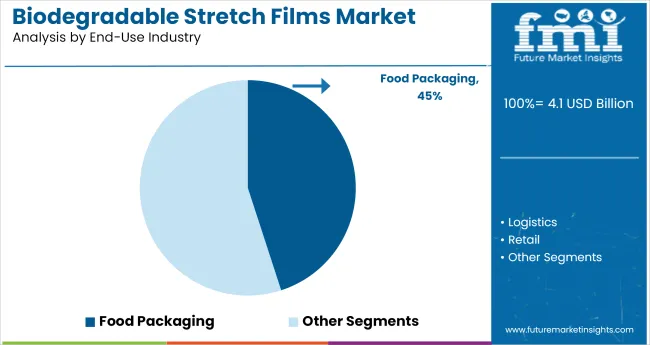

Food packaging represents 45% of end-use volume, favored for its compatibility with fresh produce, dairy, and meat categories. Key requirements include oxygen transmission rates (OTR) below 100 cc/m²/day and moisture vapor transmission rates (MVTR) under 20 g/m²/day, both achievable with PLA or PHA layers.

Players like NatureWorks, FKuR, and Novamont support chilled storage wrap solutions requiring high barrier retention and film uniformity. Common film widths range from 300-500 mm, with machine wrap films processed at speeds of 120-150 m/min. Biofilm variants also show good performance under intermittent temperature cycling (5°C to 25°C), required for cold chain logistics.

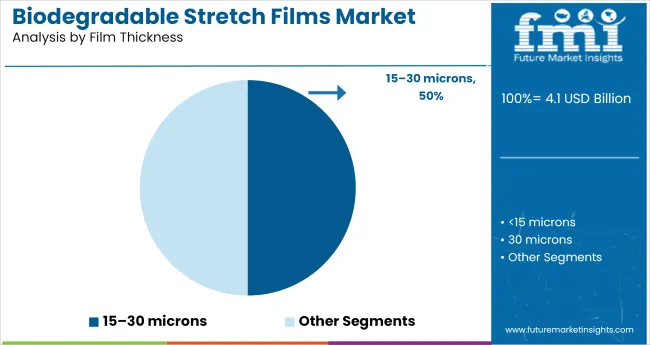

Films within the 15-30-micron range form the most commercially relevant segment, offering an optimal mix of strength, flexibility, and process economy. Average usage across pallet loads falls between 150-250 grams per pallet, translating to low material-to-load ratios.

Manufacturers such as Biogone, EcoCortec, and Polynova produce cast and blown variants tailored to meet puncture resistance thresholds above 1.5 N/mm for retail logistics. These films demonstrate minimal snapback and consistent unwind force of 0.5-1.2 kgf, making them adaptable for manual and semi-automatic wrappers. Gauge variability control and downgauging potential remain strategic levers for reducing operational costs.

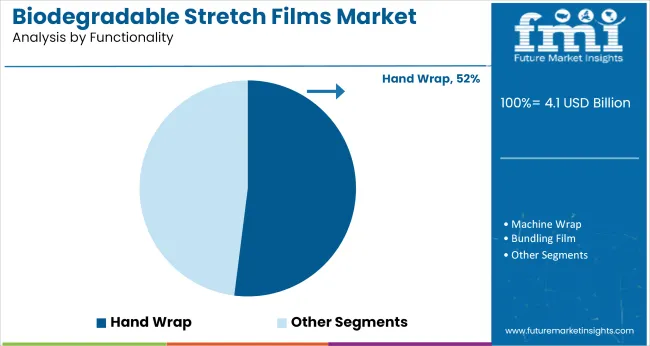

Hand wrap films are widely adopted across SME packaging units, accounting for an estimated 52% of total functional consumption. These films typically offer lower unwind noise (<80 dB) and better control over wrapping pressure, which is essential in uneven or fragile load configurations.

Players like Cortec Corporation, Bio4Pack, and Pack Natur supply rolls in coreless and extended core formats, with thicknesses usually between 17-23 microns. Load holding force of 9-12 N/mm² is sufficient for pallet weights under 400 kg. Color additives and printable surfaces are commonly integrated to aid in traceability and branding.

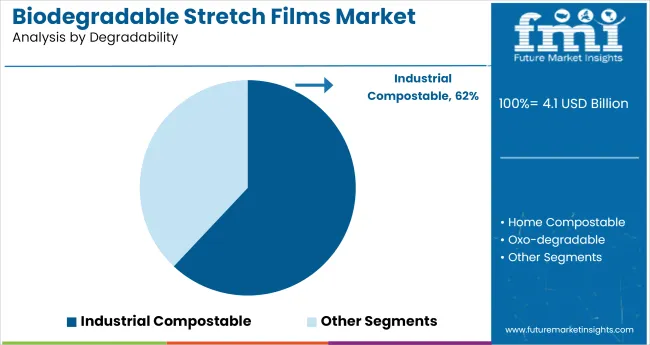

Films labeled as industrial compostable make up 62% of the degradability segment, preferred due to standardized degradation environments and broader certification acceptance. These films pass EN 13432 and ASTM D6400 testing with compost-to-carbon conversion rates exceeding 85% within 90 days.

Large-scale film processors such as Kingfa, Natur-Tec, and Green Dot Bioplastics prioritize this category for logistic scalability and minimal compliance overhead. Typical film densities range from 1.2-1.4 g/cm³, contributing to tighter wrapping with fewer passes. Resins can be pelletized for reuse or co-extruded with minor PBAT additions for enhanced mechanical flexibility.

Biodegradable stretch film suppliers adjusted inventory cycles, optimized machinery compatibility, and introduced compostable formats to meet evolving packaging demands. Retail trials boosted sales in premium produce, while resin and freight price fluctuations compressed converter margins.

Inventory Realignment & Machinery Compatibility Gains

Distributors in Germany and Italy shortened biodegradable stretch film inventory cycles from 73 to 49 days during Q1 2025 by calibrating roll dimensions with automated pallet wrappers. Retrofit kits allowed older equipment to handle PLA and PBAT blends with fewer tears, reducing unplanned stoppages by 27%.

Exporters across Southeast Asia introduced roll-width standards that cut average customs delays by 3.2 days. In Brazil, banana cooperatives moved to thinner 12 μm films from traditional 17 μm formats, lowering material use by 11% while maintaining required durability. These shifts enabled warehouse operators to trim buffer stock levels by 13%, improving turnover without raising supply risk.

Compostable Formats Gain Market Access in Premium Fresh Produce

Aldi Süd introduced home-compostable wraps for organic avocados across 180 locations in Q2 2025 and saw a 9% improvement in weekly sell-through compared to conventional formats. Film blends certified under EN 13432 with 62% renewable input were linked to stronger shelf appeal based on panel tests in France and Belgium.

Moroccan exporters of heirloom tomatoes adopted QR-coded film for tracking and disposal guidance, aligning with EU buyer preferences. Australian mango growers recorded a 23% rise in acceptance of certified compostable wraps among European importers, driven by packaging-linked emissions reporting.

Feedstock and Freight Volatility Weigh on Conversion Margins Fluctuations in input pricing pressured margins across the stretch film supply chain. Starch and PLA resin prices rose between 6-9% year-over-year by May 2025 due to supply issues in the US and ethanol constraints in Brazil.

PBAT cargoes entering China faced a 5.8% tariff adjustment, adding USD 180 per tonne to landed costs. Rising freight charges from Qingdao to EU ports, up 12%, added further strain. Gross margins for converters declined from 18.5% to 13.2% within six months. To absorb costs, some producers extended roll length by 15% through tighter core dimensions, reducing packaging waste per unit.

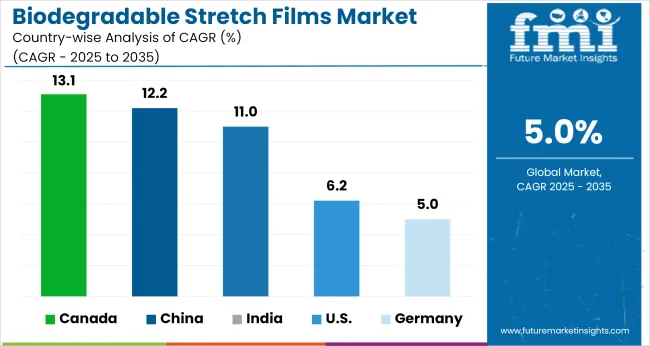

| Countries | CAGR (2025 to 2035) |

|---|---|

| Canada | 13.1% |

| China | 12.2% |

| India | 11.0% |

| USA | 6.2% |

| Germany | 5.0% |

Global demand for biodegradable stretch films is projected to grow at a 5.0% CAGR from 2025 to 2035. Among the five profiled countries out of 40 covered, Canada (OECD) leads with 13.1%, followed by China (BRICS) at 12.2%, India (BRICS) at 11.0%, the United States (OECD) at 6.2%, and Germany (OECD) at 5.0%. These translate to a performance premium of +162% for Canada, +144% for China, +120% for India, and +24% for the USA, while Germany matches the global baseline.

Demand in BRICS countries is driven by scaled packaging rollouts for food distribution and local initiatives to shift away from conventional polyethylene wraps. Among OECD members, Canada’s steep growth reflects strong alignment with national packaging reforms and public procurement shifts. The USA shows consistent industrial uptake, while Germany’s expansion is paced by selective use cases and manufacturing transitions within its industrial packaging sector.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

The USA market is projected to expand at a 6.2% CAGR, reaching 157,000 MT by 2035 from an estimated 86,000 MT in 2025. Demand is anchored in commercial freight operations, particularly across food and consumer packaged goods sectors. More than 12,000 logistics centers are expected to shift to biodegradable variants, and certified compostable film formats now account for over 7% of pallet-wrapping solutions in California and New York.

With a projected 13.1% CAGR, Canada’s biodegradable stretch film demand is expected to rise from 21,000 MT in 2025 to 72,000 MT by 2035. Growth is driven by zero-plastic directives adopted by seven provinces, covering over 75% of retail packaging operations. Adoption has surged in agricultural cold chains and eco-label retail formats, which now account for nearly 40% of total biofilm use.

The market in Germany is anticipated to rise at a 5.0% CAGR, with demand growing from 41,000 MT in 2025 to 67,000 MT in 2035. Over 110 logistics zones, including Hamburg and North Rhine-Westphalia, are seeing deployment of DIN-CERTCO certified stretch films. Over 150 SMEs are integrating biodegradable options into packaging lines, many of which now prefer multi-layer PBS-based films offering better cling properties under variable humidity.

The biodegradable stretch films market in China is set to grow at a 12.2% CAGR, from 59,000 MT in 2025 to 186,000 MT in 2035. More than 70 industrial parks across Jiangsu, Zhejiang, and Guangdong have introduced pilot mandates on biodegradable packaging. In 2024, over 23,000 MT of PBAT-based film was produced domestically. Volume buyers include cross-border fulfillment hubs, which are shifting toward PLA-PBAT hybrids rated for 6-month compost cycles.

The market in India is poised for an 11.0% CAGR, expanding from 38,000 MT in 2025 to 108,000 MT by 2035. Central Warehousing Corporation and state-run mandis account for 14,000 MT of projected 2030 demand. Bio-based film trials have been initiated in logistics corridors between Delhi, Mumbai, and Chennai. The market is also driven by an uptake in floriculture and agri-export packaging, where water-resistant biodegradable films are favored.

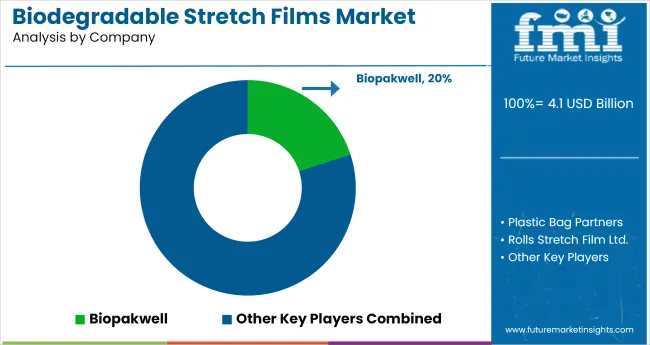

Leading Player - Sigma Stretch Film holding 12% Industry Share

Sigma Stretch Film, Alliance Plastics, and Rolls Stretch Film Ltd. are among the established producers expanding their reach through in-house film development and application-specific blends. Sigma’s PLA-PBAT wrap launched in 2024 targets temperature-sensitive freight, while Alliance Plastics invested in certified testing to improve buyer trust across Europe. These players focus on process refinement and reliable sourcing to maintain output consistency.

Emerging suppliers such as YITO ECO, Biopakwell, and Eternal Packaging Ltd. are gaining attention through regional partnerships and feedstock tie-ups. Biopakwell’s agreement with a starch supplier in Indonesia stabilized input costs, while Simply Polybags introduced smaller roll formats for independent packers. New entrants face barriers tied to raw material volatility, certification delays, and performance constraints in mechanized packing environments.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 4.1 billion |

| Projected Market Size (2035) | USD 6.7 billion |

| CAGR (2025 to 2035) | 5.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Material Types Analyzed (Segment 1) | PLA, PBAT, Starch-based, PHA, Cellulose-based |

| Film Thickness Range (Segment 2) | <15 microns, 15 - 30 microns, >30 microns |

| Functionality Categories (Segment 3) | Hand Wrap, Machine Wrap, Bundling Film |

| Degradability Types (Segment 4) | Industrial Compostable, Home Compostable, Oxo-degradable |

| End-Use Industries (Segment 5) | Food Packaging, Logistics, Retail, Agriculture |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, China, Japan, South Korea, India, Brazil, Australia |

| Key Companies Profiled | Biopakwell, Plastic Bag Partners, Rolls Stretch Film Ltd., Alliance Plastics, Soaraway Packaging, YITO ECO, Fibers of Kalamazoo, Simply Polybags, Sigma Stretch Film, Eternal Packaging Ltd |

| Additional Attributes | Dollar sales tracked across degradability type and film thickness, share by end-use sectors including logistics and agriculture, increasing demand from food packaging and bundling applications, adoption in zero-waste retail, produce wrap, and e-commerce shipping, regional production hubs in China and Western Europe fostering export volumes, film design evolution to meet composting norms across North America and EU markets. |

The industry is forecasted to reach USD 6.7 billion by 2035, growing from USD 4.1 billion in 2025.

The industry is expected to grow at a compound annual growth rate (CAGR) of 5.0% during the forecast period.

PLA blend films dominate with a 60% material share in 2025.

Food packaging accounts for approximately 45% of the total application share in 2025.

Sigma Stretch Film leads with a 12% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stretch Films Market Outlook - Size, Demand & Industry Trends 2025 to 2035

UVI Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

Cast Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

Stretch and Shrink Films Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Biodegradable Lidding Films Providers

Biodegradable Agricultural Films Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Blown Stretch Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Microencapsulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Film Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Disposable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyamide Market Size and Share Forecast Outlook 2025 to 2035

Stretch Film Industry Analysis in DACH Size and Share Forecast Outlook 2025 to 2035

Stretch Film Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Stretch Mark Prevention Creams Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA