The Biodegradable Paper and Plastic Packaging Market is estimated to be valued at USD 15.4 billion in 2025 and is projected to reach USD 40.3 billion by 2035, registering a compound annual growth rate (CAGR) of 10.1% over the forecast period.

The biodegradable paper and plastic packaging market is advancing strongly, propelled by tightening environmental regulations, shifting consumer preferences toward sustainable products, and increased corporate focus on circular economy initiatives. Rising global concerns regarding plastic waste and carbon emissions have accelerated the transition toward biodegradable materials in both food and non-food packaging.

Continuous innovation in biopolymer technologies, improved barrier properties, and scalable production capabilities have enhanced the viability of biodegradable alternatives. The current market scenario reflects expanding applications across retail, food service, and e-commerce, where brand owners are aligning with sustainability goals.

Government support through incentives and bans on single-use plastics is further driving market penetration. With growing awareness of eco-friendly solutions and enhanced recyclability infrastructure, the biodegradable packaging market is positioned for strong, long-term growth.

| Metric | Value |

|---|---|

| Biodegradable Paper and Plastic Packaging Market Estimated Value in (2025 E) | USD 15.4 billion |

| Biodegradable Paper and Plastic Packaging Market Forecast Value in (2035 F) | USD 40.3 billion |

| Forecast CAGR (2025 to 2035) | 10.1% |

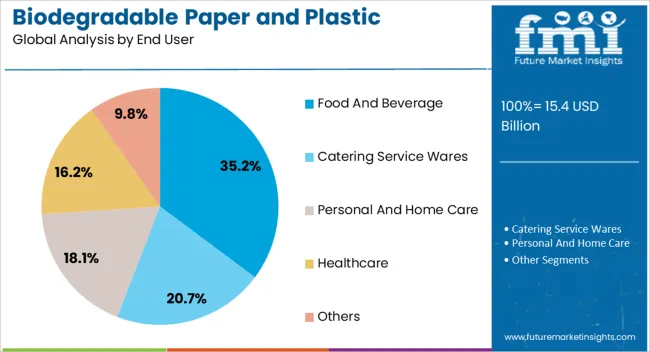

The market is segmented by Type, Material, and End User and region. By Type, the market is divided into Polylactic Acid, Starch Based Plastic, Cellulose Based Plastics, and Polyhydroxyalkanoates. In terms of Material, the market is classified into Plastic and Paper. Based on End User, the market is segmented into Food And Beverage, Catering Service Wares, Personal And Home Care, Healthcare, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polylactic acid segment leads the type category with approximately 22.50% share, driven by its versatility, biodegradability, and compatibility with existing manufacturing processes. Derived from renewable resources such as corn starch and sugarcane, PLA offers a sustainable alternative to conventional plastics without significant performance compromise.

The segment benefits from rising demand in food packaging, disposable cutlery, and agricultural films. Ongoing advancements in thermal resistance and processability have expanded PLA’s usability in diverse packaging formats.

With increasing production capacity and cost reduction through technological innovation, the segment is expected to maintain steady growth, supported by its balance between functionality and environmental compliance.

The plastic segment dominates the material category with approximately 57.40% share, reflecting its extensive use in packaging due to flexibility, durability, and lightweight properties. The focus has shifted toward biodegradable plastics that mimic conventional plastic performance while offering compostability and lower carbon footprint.

Growing regulatory enforcement against traditional plastics and increased adoption of eco-designed materials are supporting the segment’s expansion. The development of bio-based polyethylene and polybutylene succinate has further diversified material options.

With packaging manufacturers investing in sustainable alternatives to meet consumer and environmental demands, the biodegradable plastic segment is projected to maintain its dominant share in the global market.

The food and beverage segment accounts for approximately 35.20% share of the end-user category, underscoring its leading role in driving demand for biodegradable packaging. Increased consumption of packaged and ready-to-eat foods, combined with growing consumer preference for sustainable packaging formats, has strengthened the segment’s position.

Food manufacturers are transitioning to biodegradable paper and plastic solutions to comply with environmental standards and enhance brand image. The segment benefits from regulatory incentives promoting compostable packaging in the food service industry.

With rapid growth in convenience food consumption and e-commerce-based food delivery, the food and beverage segment is expected to remain the largest end-user, sustaining strong demand for biodegradable packaging solutions.

The scope for biodegradable paper and plastic packaging rose at a 13.6% CAGR between 2020 and 2025. The global market for biodegradable paper and plastic packaging is anticipated to grow at a moderate CAGR of 10.1% over the forecast period 2025 to 2035.

The market experienced steady growth during the historical period from 2020 to 2025. There was a significant increase in environmental awareness among consumers, businesses, and governments globally, during this period. Concerns about plastic pollution, marine debris, and landfill overflow prompted the adoption of biodegradable paper and plastic packaging as a more sustainable alternative.

Advancements in material science and packaging technology led to the development of innovative biodegradable materials with enhanced performance, durability, and shelf life. Improved manufacturing processes and scalable production methods made biodegradable packaging more cost effective and accessible to businesses across various industries.

Looking ahead to the forecast period from 2025 to 2035, the market is expected to witness significant growth. The concept of a circular economy, where resources are reused, recycled, or composted to minimize waste, will play a significant role in shaping the biodegradable packaging market.

Integration of biodegradable packaging into circular economy models will create opportunities for closed loop material flows, resource recovery, and sustainable waste management practices.

The growth of e-commerce and online retail will drive demand for biodegradable packaging solutions tailored for shipping, logistics, and last mile delivery. Biodegradable packaging options that offer protection, durability, and eco friendliness will be preferred by e-commerce companies seeking to reduce their environmental impact.

Governments worldwide are implementing stricter regulations aimed at reducing plastic waste and promoting sustainable packaging practices. The regulations often include bans on single use plastics and incentives for the use of biodegradable materials, creating opportunities for biodegradable packaging manufacturers.

Biodegradable packaging materials often come at a higher cost compared to traditional non biodegradable options. The initial investment required for research, development, and manufacturing of biodegradable materials may deter some businesses, especially smaller enterprises, from adopting these alternatives.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Korea and Japan. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 10.4% |

| China | 10.9% |

| The United Kingdom | 11.3% |

| Japan | 11.7% |

| Korea | 12.3% |

The biodegradable paper and plastic packaging market in the United States expected to expand at a CAGR of 10.4% through 2035. Growing concerns about plastic pollution and environmental degradation are driving demand for sustainable packaging solutions in the United States.

Consumers, businesses, and governments are seeking alternatives to traditional plastic packaging that have a lower environmental impact, spurring the adoption of biodegradable paper and plastic packaging materials.

The United States has implemented regulations and policies at the federal, state, and local levels aimed at reducing plastic waste and promoting sustainable packaging practices. Bans on single use plastics, restrictions on plastic bags, and mandates for recycled content in packaging create a favorable regulatory environment for biodegradable packaging alternatives.

The biodegradable paper and plastic packaging market in the United Kingdom is anticipated to expand at a CAGR of 11.3% through 2035. Consumers in the country are increasingly concerned about environmental issues and are actively seeking products packaged in sustainable materials.

Demand for biodegradable paper and plastic packaging is driven by consumer preferences for eco friendly options and brands that demonstrate a commitment to sustainability.

Many companies operating in the United Kingdom are integrating sustainability into their business strategies and supply chain practices. Adopting biodegradable packaging aligns with corporate sustainability goals, enhances brand reputation, and meets consumer expectations for environmentally responsible products.

Biodegradable paper and plastic packaging trends in China are taking a turn for the better. A 10.9% CAGR is forecast for the country from 2025 to 2035. Ongoing advancements in material science, biotechnology, and packaging technology drive innovation in biodegradable paper and plastic packaging materials.

Developments in bio based plastics, compostable polymers, and recyclable packaging designs expand the range of sustainable packaging options available to businesses and consumers in China.

The rapid growth of e-commerce and online retailing in China creates opportunities for sustainable packaging solutions tailored for shipping, logistics, and last mile delivery. Biodegradable packaging options that offer protection, durability, and eco friendliness are preferred by e-commerce companies seeking to reduce their environmental footprint and enhance customer experience.

The biodegradable paper and plastic packaging market in Japan is poised to expand at a CAGR of 11.7% through 2035. Collaboration between stakeholders across the packaging industry, including manufacturers, retailers, waste management companies, and policymakers, stimulates innovation and market expansion for biodegradable packaging materials in Japan.

Partnerships, joint ventures, and cross sector initiatives promote knowledge sharing, technology transfer, and collective action towards sustainability goals.

Japan offers significant market opportunities for biodegradable paper and plastic packaging across various industries, including food and beverage, personal care, healthcare, and consumer goods.

Emerging applications in flexible packaging, rigid containers, films, and pouches expand the market potential for biodegradable packaging materials in Japan.

The biodegradable paper and plastic packaging market in Korea is anticipated to expand at a CAGR of 12.3% through 2035. Korea is known for its culture of innovation and technological advancements. The packaging industry in the country continually develops innovative solutions to address environmental concerns and consumer demands.

The innovation includes new materials, designs, and packaging formats that enhance the appeal and functionality of biodegradable paper and plastic packaging.

Korea faces significant challenges related to plastic pollution. Increasing public awareness and concern about the environmental impact of plastic waste drive demand for sustainable packaging alternatives. Biodegradable paper and plastic packaging offer solutions to mitigate plastic pollution while meeting the packaging needs of various industries.

The below table highlights how starch based plastic segment is projected to lead the market in terms of type, and is expected to account for a CAGR of 9.8% through 2035.

Based on material, the plastic segment is expected to account for a CAGR of 9.6% through 2035.

| Category | CAGR through 2035 |

|---|---|

| Starch Based Plastic | 9.8% |

| Plastic | 9.6% |

Based on type, the starch based plastic segment is expected to continue dominating the biodegradable paper and plastic packaging market. Starch based plastics are derived from renewable and abundant sources such as corn, wheat, potatoes, and cassava. The availability of these raw materials makes starch based plastics an attractive option for biodegradable packaging, reducing dependence on finite fossil fuel resources and contributing to sustainability.

Starch based plastics are biodegradable and compostable, meaning they can break down naturally into non toxic components when exposed to environmental conditions such as moisture, heat, and microbial activity. Biodegradability reduces the environmental impact of packaging waste and supports waste management practices such as composting and organic recycling.

Starch based plastics offer versatility in terms of processing and applications. They can be processed using conventional plastic manufacturing techniques such as extrusion, injection molding, and thermoforming, making them suitable for a wide range of packaging formats including films, bags, containers, and trays.

In terms of material, the plastic segment is expected to continue dominating the biodegradable paper and plastic packaging market. Plastic materials offer a wide range of properties and characteristics that make them highly versatile for packaging applications. Biodegradable plastics can be engineered to meet specific packaging requirements such as flexibility, durability, transparency, and barrier properties, allowing for customization based on product needs.

Biodegradable plastics offer an alternative to conventional petroleum based plastics, which are a major contributor to environmental pollution and ecosystem degradation. Biodegradable plastics degrade naturally over time through biological processes, reducing the accumulation of plastic waste in landfills, oceans, and ecosystems.

Ongoing advancements in material science and polymer technology improve the performance, functionality, and biodegradability of biodegradable plastics. Innovations in biopolymer formulations, processing techniques, and additives enhance the properties of biodegradable plastics, making them more competitive with conventional plastics.

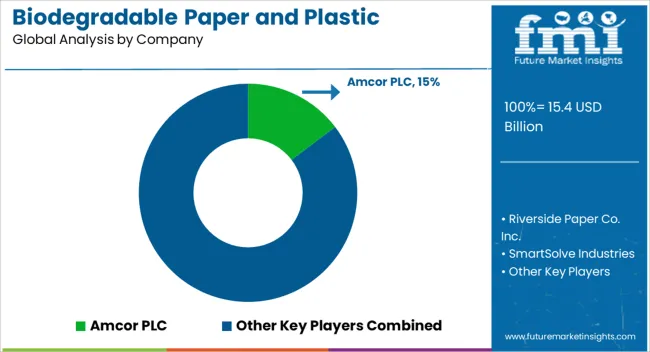

The biodegradable paper and plastic packaging market is characterized by a diverse array of players, including manufacturers, suppliers, distributors, and technology providers, all vying for market share and innovation leadership in the rapidly evolving field of sustainable packaging.

Recent Development

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 14.0 billion |

| Projected Market Valuation in 2035 | USD 36.8 billion |

| Value-based CAGR 2025 to 2035 | 10.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Type, Material, End User, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Riverside Paper Co. Inc.; SmartSolve Industries; Özsoy Plastik; Ultra Green Sustainable Packaging; Hosgör Plastik; Eurocell S.r.l; Tetra Pak International SA; Kruger Inc.; Amcor PLC; Mondi |

The global biodegradable paper and plastic packaging market is estimated to be valued at USD 15.4 billion in 2025.

The market size for the biodegradable paper and plastic packaging market is projected to reach USD 40.3 billion by 2035.

The biodegradable paper and plastic packaging market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types in biodegradable paper and plastic packaging market are polylactic acid, starch based plastic, cellulose based plastics and polyhydroxyalkanoates.

In terms of material, plastic segment to command 57.4% share in the biodegradable paper and plastic packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Market Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Paper Packaging Industry

Plastic Packaging For Food and Beverage Market Size and Share Forecast Outlook 2025 to 2035

Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Paper And Plastic Film Capacitors Market Trends - Growth & Forecast 2025 to 2035

Paperboard Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Competitive Overview of Plastic Jar Packaging Companies

Plastic-free Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bioplastic Packaging Bag Market Growth – Demand & Forecast 2025 to 2035

Competitive Landscape of Biodegradable Packaging Providers

PCR Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Aerosol Packaging Market

Waxed Paper Packaging Market

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA