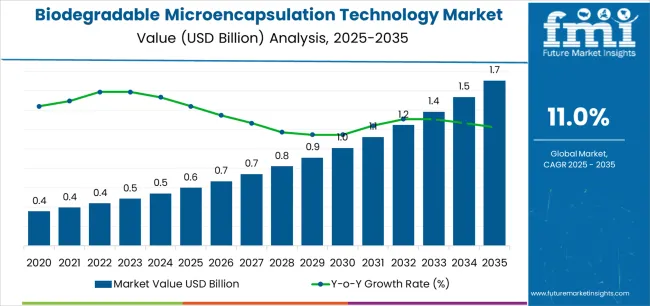

The biodegradable microencapsulation technology market is valued at USD 0.6 billion in 2025 and is expected to reach USD 1.6 billion by 2035, advancing at a CAGR of 11.0%. Growth is driven by increasing demand for controlled-release delivery systems across pharmaceuticals, food, and agrochemical sectors, alongside the global transition toward environmentally sustainable encapsulation materials. Rising regulatory focus on biodegradable polymers and the reduction of microplastic pollution further accelerate market adoption.

Solid-type microencapsulation dominates the market due to its stability, extended-release properties, and suitability for a wide range of bioactive compounds. These systems enable precise protection and timed release of active ingredients, improving product shelf life and reducing degradation from environmental exposure. Ongoing innovation in polymer matrix design, including the use of polylactic acid (PLA) and polycaprolactone (PCL), supports advancements in drug delivery, nutrient fortification, and pesticide formulation.

Asia Pacific leads market growth, supported by expanding pharmaceutical manufacturing capacity and agricultural modernization in China and India. Europe and North America maintain consistent demand through investments in green chemistry and green packaging solutions. Key market participants include BASF, 3M, Evonik, DSM, Balchem Corporation, and Microcaps, with a focus on material innovation, encapsulation precision, and regulatory compliance.

Peak-to-trough analysis suggests the market will experience high-growth peaks followed by short adjustment phases as industries adapt to new formulation standards. Between 2025 and 2028, growth will rise sharply as pharmaceutical, food, and agricultural sectors adopt biodegradable encapsulation materials to replace synthetic polymers. This early phase represents a strong upward peak driven by regulatory pressure for sustainable delivery systems and improved product stability.

A moderate trough is expected between 2029 and 2031 as manufacturers adjust production costs and optimize large-scale processing of biodegradable carriers. This phase will show temporary deceleration as supply chains stabilize and performance consistency improves. Post-2031, renewed acceleration will occur as innovations in biopolymer blends and controlled-release systems strengthen commercial viability across end-use industries. The cyclical movement between growth peaks and adjustment troughs indicates a dynamic yet resilient expansion pattern. Sustained technological development and compliance with global environmental standards will minimize long-term volatility, establishing the market as a key component of sustainable material innovation.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.6 billion |

| Market Forecast Value (2035) | USD 1.6 billion |

| Forecast CAGR (2025-2035) | 11.0% |

The biodegradable microencapsulation technology market is expanding as industries seek controlled-release systems that align with sustainability mandates and regulatory pressure on non-biodegradable materials. A heightened global focus on eco-friendly materials and circular-economy strategies drives demand for microcapsules constructed from biodegradable polymers such as polylactic acid (PLA) or polyhydroxyalkanoates (PHAs).

Technological advancements in encapsulation processes and active-ingredient stability enable broader adoption in agriculture (slow-release pesticides/fertilizers), pharmaceuticals (targeted drug delivery), and consumer goods (cosmetics, functional foods). The shift toward biodegradable carriers helps reduce the environmental impact of microcapsule waste and aligns with green-chemistry frameworks. Growth faces constraints: high production and R&D costs for specialized biodegradable microcapsule systems, potential trade-offs in shelf-life or performance versus synthetic shells, and supply-chain hurdles in scaling biodegradable polymer manufacture.

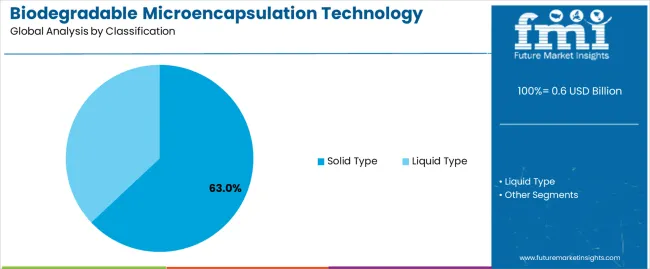

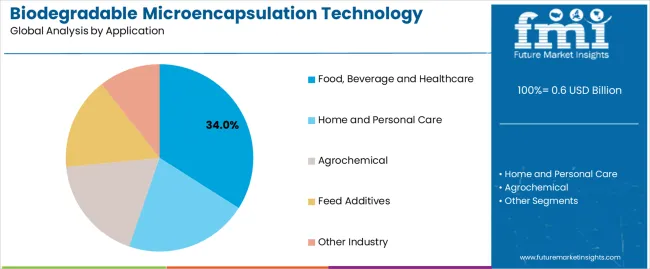

The biodegradable microencapsulation technology market is segmented by classification and application. By classification, the market is divided into solid type and liquid type microencapsulation systems. Based on application, it is categorized into food, beverage, and healthcare; home and personal care; agrochemical; feed additives; and other industrial applications. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The solid type segment holds the leading position in the biodegradable microencapsulation technology market, representing approximately 63.0% of total market share in 2025. Solid microencapsulation systems are widely used for controlled release, stability enhancement, and protection of active ingredients in formulations that require long-term performance and environmental compatibility. These encapsulates are typically produced through spray drying, coacervation, or extrusion techniques using biodegradable polymers such as polylactic acid (PLA), polycaprolactone (PCL), and starch derivatives.

The segment’s dominance is driven by its broad industrial usability, low degradation residue, and ability to maintain payload integrity under various storage and application conditions. Solid encapsulates are extensively applied in food fortification, pharmaceutical tablets, and agrochemical coatings, where precise release timing and protection against oxidation or moisture degradation are critical. The liquid type category, while smaller, is expanding in fields such as cosmetic emulsions and bioactive delivery systems due to ease of dispersion and fast-release properties.

Key factors supporting the solid type segment include:

The food, beverage, and healthcare segment accounts for approximately 34.0% of the biodegradable microencapsulation technology market in 2025. This leading share is attributed to increasing demand for encapsulated vitamins, probiotics, flavors, and pharmaceuticals requiring targeted release and protection from degradation. The technology enables improved bioavailability and controlled delivery of active ingredients while ensuring environmentally safe material disposal.

The segment benefits from the shift toward sustainable and biodegradable encapsulation materials that align with regulatory and consumer expectations for clean-label and eco-friendly products. The home and personal care segment follows, driven by microencapsulated fragrances, enzymes, and cosmetic actives designed for gradual release and reduced environmental impact. Agrochemical and feed additive applications are also gaining momentum, focusing on reducing toxicity and improving efficiency of bioactive compounds in soil and animal systems.

Primary dynamics driving demand from the food, beverage, and healthcare segment include:

The biodegradable microencapsulation technology market is driven by growing consumer and regulatory emphasis on sustainability, prompting companies to adopt biodegradable shell materials such as PLA (polylactic acid) and PHAs (polyhydroxyalkanoates) in encapsulation systems. Demand for functional ingredients in food, nutraceuticals, pharmaceuticals, agriculture and personal-care applications increases use of controlled release technologies that also require eco-friendly delivery systems. Multi-sector need for more stable, bio-compatible, and environmentally safe microcapsules reinforces investment in biodegradable encapsulation platforms, particularly in high-growth regions.

Biodegradable encapsulation systems often incur higher expense than conventional non-biodegradable capsules due to specialty polymers, formulation complexity and validation of controlled release profiles. Achieving equivalent mechanical strength, shelf life, release kinetics and compatibility with active ingredients poses technical hurdles that make some users reluctant to switch. Adoption in price-sensitive applications or emerging markets is slower as manufacturers balance cost, performance and eco-credentials.

Key trends include development of stimuli-responsive and multi-compartment biodegradable microcapsules combining controlled release, targeted delivery and biodegradability in one system. Fast-growing regions in Asia-Pacific and Latin America are seeing increased uptake as manufacturers localise ecofriendly technologies and regulatory focus on eco-certified products rises. Microencapsulation providers are integrating digital monitoring and bespoke formulation services, offering delivery platforms designed for specific active ingredients and end-use requirements, thus moving beyond simple encapsulation to integrated biodegradable delivery systems.

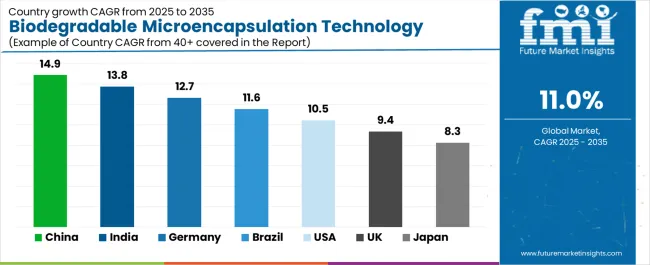

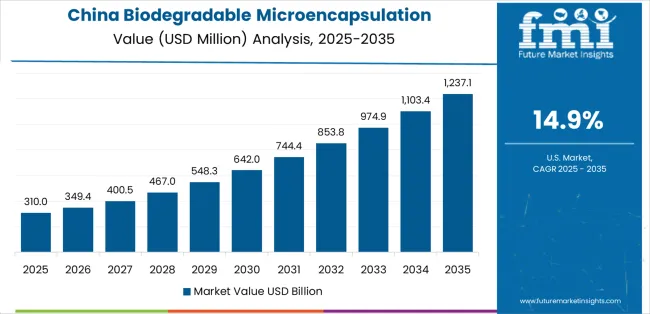

The global biodegradable microencapsulation technology market is growing rapidly through 2035, driven by rising demand for controlled-release systems, green packaging, and biocompatible materials across pharmaceutical, food, and agricultural sectors. China leads with a 14.9% CAGR, followed by India at 13.8%, supported by expanding biopolymer manufacturing and applied nanotechnology research. Germany grows at 12.7%, reflecting strong innovation in green chemistry and precision encapsulation. Brazil records 11.6%, driven by agricultural formulation development. The United States posts 10.5%, supported by advancements in drug delivery systems, while the United Kingdom (9.4%) and Japan (8.3%) maintain steady growth through technology-driven bioengineering and material optimization.

| Country | CAGR (%) |

|---|---|

| China | 14.9 |

| India | 13.8 |

| Germany | 12.7 |

| Brazil | 11.6 |

| USA | 10.5 |

| UK | 9.4 |

| Japan | 8.3 |

China’s market grows at 14.9% CAGR, supported by large-scale industrial adoption of biodegradable polymers and rapid expansion of pharmaceutical and agricultural encapsulation applications. National policies promoting sustainable chemical production and waste reduction are accelerating the development of eco-friendly encapsulants. Domestic manufacturers are integrating advanced techniques such as spray drying, coacervation, and solvent evaporation using polylactic acid (PLA) and polycaprolactone (PCL) matrices. Research collaborations between universities and biotech firms are improving encapsulation efficiency and release control. Demand is rising in pharmaceuticals, fertilizers, and cosmetics due to environmental compliance standards and consumer preference for biodegradable product formulations.

Key Market Factors:

India’s market grows at 13.8% CAGR, driven by the convergence of biotechnology, pharmaceutical, and agrochemical innovation. The government’s Make in India and Green Chemistry Initiative programs encourage the use of biodegradable polymers and bio-based materials. Indian firms are scaling production of controlled-release encapsulants for drug delivery, crop protection, and functional food applications. Academic–industry partnerships are strengthening pilot-scale manufacturing capabilities for polymeric microspheres and nanocapsules. The demand for biodegradable encapsulation systems is increasing in nutraceuticals and seed coating industries, supported by sustainability certification frameworks and export-oriented agricultural reforms.

Market Development Factors:

Germany’s market grows at 12.7% CAGR, driven by advanced R&D in green materials, pharmaceutical encapsulation, and controlled-release engineering. The country’s chemical industry emphasizes precision encapsulation using biodegradable polymers such as polyglycolic acid (PGA) and polyhydroxybutyrate (PHB). Research collaborations under EU sustainability programs promote innovation in bio-based carrier systems with tunable degradation profiles. Adoption of encapsulation technologies in food preservation, fragrance delivery, and drug formulation continues to expand. Germany’s strong intellectual property base and compliance with EU biodegradability standards position it as a key exporter of high-performance microencapsulation technologies.

Key Market Characteristics:

Brazil’s market grows at 11.6% CAGR, supported by expansion in agricultural biotechnology, pharmaceutical production, and food processing. Domestic chemical companies are developing biodegradable microcapsules for controlled nutrient and pesticide delivery. The government’s Agro+Sustentável initiative promotes environmentally responsible farming inputs, encouraging the use of bio-based encapsulants. Partnerships between universities and agritech firms are improving encapsulation efficiency using starch and cellulose derivatives. In pharmaceuticals, rising demand for biodegradable excipients supports production of controlled-release drug systems. Export opportunities in agricultural formulations are growing as global markets shift toward eco-friendly input technologies.

Market Development Factors:

The United States grows at 10.5% CAGR, supported by strong R&D in biomedical engineering, pharmaceuticals, and packaging technologies. Federal funding for green chemistry and advanced materials research drives innovation in biodegradable encapsulation. Companies are developing microcapsules using polylactic-co-glycolic acid (PLGA) and chitosan-based carriers for sustained drug delivery and active ingredient stabilization. The market benefits from growing demand in food fortification, personal care, and agrochemical applications. Collaborative programs between biotechnology firms, universities, and the USA Department of Energy are advancing scalable production processes. Strict environmental regulations encourage adoption of eco-compliant encapsulation technologies.

Key Market Factors:

The United Kingdom’s market grows at 9.4% CAGR, supported by bioengineering research, pharmaceutical innovation, and ecofriendly packaging initiatives. The country’s universities and start-ups are developing novel encapsulation systems using biodegradable polymers derived from renewable resources. Demand for bio-based microcapsules is growing in functional food and cosmetic applications. Government-funded programs under UK Research and Innovation (UKRI) promote low-impact material innovation and green manufacturing. The regulatory focus on reducing plastic waste supports expansion in packaging and personal care encapsulation. Collaboration with European research institutions enhances technological competitiveness and material diversity.

Market Development Factors:

Japan’s market grows at 8.3% CAGR, supported by its expertise in polymer science, biotechnology, and materials engineering. Domestic firms are developing precision microencapsulation systems for pharmaceuticals, agrochemicals, and functional coatings. Research in controlled-release delivery using biopolymers such as polylactide and alginate enhances product performance. The government’s Green Innovation Fund supports sustainable chemistry projects aimed at reducing petrochemical dependency. Collaboration between academic laboratories and industrial research centers is improving encapsulation uniformity and scalability. Japan’s emphasis on quality, process reliability, and environmental compliance sustains long-term growth in the biodegradable encapsulation sector.

Key Market Characteristics:

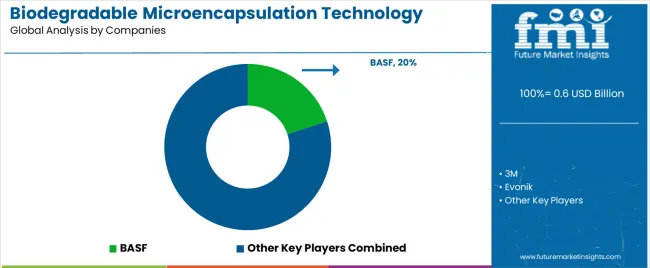

The biodegradable microencapsulation technology market is moderately consolidated, with approximately fifteen global players active across pharmaceuticals, food ingredients, personal care, and specialty chemicals. BASF leads the market with an estimated 20.0% global share, supported by its advanced polymer science, scalable encapsulation infrastructure, and consistent innovation in biodegradable coating materials. The company’s leadership is reinforced by cross-industry integration and strong R&D partnerships emphasizing controlled release, bio-compatibility, and environmental safety.

3M, Evonik, and DSM follow as major competitors, each leveraging expertise in polymer chemistry and formulation technologies. Their competitive strengths lie in microencapsulation platforms optimized for drug delivery, functional foods, and agricultural applications, with sustained investments in precision particle design and degradable carrier materials. Balchem Corporation, Microcaps, and Glanbia Nutritionals operate in mid-tier segments, focusing on encapsulated nutrients and flavor systems with extended stability and improved bioavailability.

Vantage Specialty Chemicals, Encapsys, and Cargill Delacon contribute to the market through innovation in natural-based encapsulants and application-specific performance in cosmetics, animal nutrition, and agritech. Emerging companies such as Iberchem, Lucta, Innobio, and Menon strengthen regional presence through custom formulation and green production processes.

Competition in this market is shaped by biodegradability performance, release control precision, and scalability, with market growth driven by increasing demand for eco-friendly encapsulation solutions across consumer, healthcare, and industrial applications.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Classification | Solid Type, Liquid Type |

| Application | Food, Beverage and Healthcare, Home and Personal Care, Agrochemical, Feed Additives, Other Industry |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | BASF, 3M, Evonik, DSM, Balchem Corporation, Microcaps, Glanbia Nutritionals, Vantage Specialty Chemicals, Encapsys, Cargill Delacon, Iberchem, Ashland, Lucta, Shenzhen Boton, Innobio, Menon |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of biodegradable encapsulation technology providers; advancements in polymer-based and natural coating materials; integration with sustainable packaging, food preservation, and controlled-release delivery systems. |

The global biodegradable microencapsulation technology market is estimated to be valued at USD 0.6 billion in 2025.

The market size for the biodegradable microencapsulation technology market is projected to reach USD 1.7 billion by 2035.

The biodegradable microencapsulation technology market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types in biodegradable microencapsulation technology market are solid type and liquid type.

In terms of application, food, beverage and healthcare segment to command 34.0% share in the biodegradable microencapsulation technology market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biodegradable Film Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Disposable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyamide Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Agricultural Films Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biodegradable Glitter for Cosmetics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biodegradable Meal Trays Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Gloves Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Bone Graft Polymers Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Stretch Films Market - Analysis Size, Share, and Forecast 2025 to 2035

Biodegradable Food Packaging Market Size, Share & Forecast 2025 to 2035

Biodegradable Polymers Market Growth 2025 to 2035

Biodegradable Baby Diapers Market Analysis – Trends, Growth & Forecast 2025-2035

Biodegradable Microbeads Market Growth – Trends & Forecast 2025 to 2035

Competitive Breakdown of Biodegradable Lidding Films Providers

Competitive Landscape of Biodegradable Packaging Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA